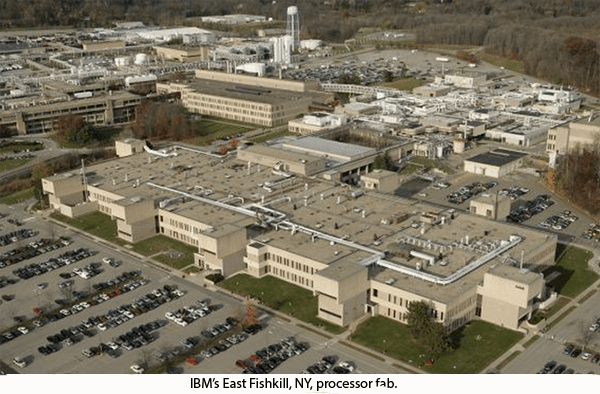

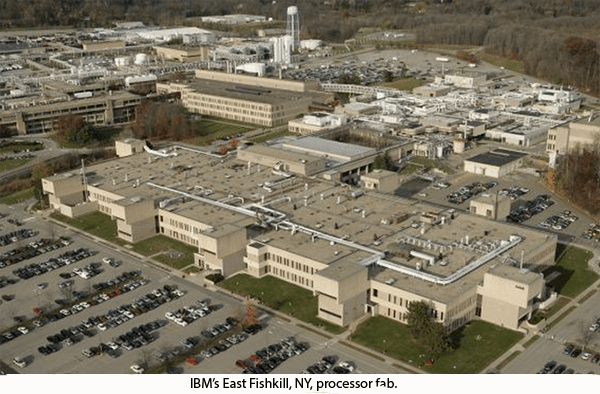

In case you wondered about IBM completing the restructuring of its business, the company’s quiet announcement this week tells the tale. It unloaded a long critical part of the company, including its semiconductor factories in East Fishkill, N.Y., and outside Burlington, Vt., by paying GLOBALFOUNDRIES to take it off its hands for $1.5 billion.

Dumping the semiconductor is the latest step in IBM’s unloading its manufacturing activity in favor of a new world of cloud support. At this point, it is limited to manufacturing its Power systems and its Z-series mainframes — and it will no longer be manufacturing its own processors for them.

Once upon a time, the IBM microelectronics business changed the world by inventing chip-based memory that eliminated vastly expensive core memories. The impact was stunning. Paul Castrucci, one of the leaders of the development, said he once gave IBM CEO Thomas J. Watson Jr. the cost outlook: “You know, cores are 80 cents a bit. Maybe we’ll get this down to a penny a bit.” At that price, memory would cost $80 million a gigabit, while the going cost for a gigabit today is less than $2. No wonder the capacity of memory could quickly move from kilobytes to megabytes, gigabytes, and even terabytes.

IBM also created large storage capacity by creating the first disk drive, RAMAC (1958, with 5 mb of storage for $160,000). It also played a critical role in inventing the “Winchester” drive, the desktop and laptop hard drive. Like so many other inventions, IBM’s creations ended up as unprofitable players in commodity markets; IBM sold its drive business to Hitachi in 2002.

IBM has been a technology leader of processors, but the industry is dominated by the likes of Intel, Samsung, GLOBALFOUNDARIES, and TSMC, companies whose business depends on big volumes. IBM made an early stab at ruling the business through a partnership with Motorola and Apple in the PowerPC. It might have worked if Apple had beaten Microsoft, but instead Intel ended up with most of the market. Motorola dropped out and IBM, which was clearly losing interest, finally got out of 2005 when Apple moved the Mac to Intel. IBM went on making the Power processor for its own mid-range and up business computer.[pullquote]The death of IBM’s semiconductor effort is a sad event, but one long overdue. [/pullquote]

IBM also partnered with Sony and Toshiba to make the Cell processor, best known as the processor for the PS3 game console. But the PS4 was introduced in 2013 with a processor based on the x86 and designed by AMD. A chip similar to the Cell, the PowerXCell, continues with some specialized use, mainly in supercomputers, but it is a small market.

The death of IBM’s semiconductor effort is a sad event, but one long overdue. What can you say about the prospect for a business that is so bad you have to pay a competitor to take it off your hands? IBM continues to get out of commodity businesses, of which there aren’t many left, to focus efforts on high end services.

Some of IBM traditions go on. The company still is the dominant player in top end business computers and it makes many of the world’s supercomputers. IBM Research continues to be the world’s leading industrial scientific center. And while its efforts include support for many of the services that dominate IBM business, it still does basic work in scientific fields such as physics and materials research.

But the future of IBM’s business is services. The competition is hot, but so is the potential for growth and profits.

I’m glad somebody in this country is still doing basic research. We can’t let China do all of that!

“What can you say about the prospect for a business that is so bad you have to pay a competitor to take it off your hands?”

To be fair, the payment to GF was an advance — in return for ownership of the fabs plus a down payment plus more payments every year for the duration of the contract, GF will now make IBM’s Power cpus for them.

I do not even understand how I ended up here, but I assumed this publish used to be great

There is some nice and utilitarian information on this site.

This was beautiful Admin. Thank you for your reflections.