Apple has been taking a real beating on Wall Street and in the press lately. But are we losing our long-term perspective by focusing so intently on quarterly results?

Stock Market

The Stock Market is a predictor of future growth, but it is hardly infallible. Seven months ago the market was predicting spectacular growth for Apple. Today it’s predicting almost no growth at all, worse than Dell and HP. Was the market wrong seven months ago or is it wrong today? Or both?

Growing Markets

Take a broader look at the computing markets. We are transitioning from notebook and desktop computers to mobile phones and tablets. No one is in a better position to benefit from this changeover than Apple. They were first-movers in both phones and tablets and they continue to devour the bulk of those sector’s profits. Apple’s path is not unimpeded, but they still have the inside track.

iPhone & iPad Sales

Last quarter, Apple sold 37.4 million iPhones for 7% growth and 19.5 million iPads for 65% growth.

Remember all that talk about suppliers cutting orders and how it meant that Apple wasn’t selling as many phones and tablets as before? Yeah, not so very much.

China

“iPad experienced very strong year-over-year growth in every operating segment, particularly in Greater China and Japan where sales more than doubled year over year.”

The highlights for the quarter in China were that iPads grew 138% year-on-year, and we set new records for sell-through both for iPhone and iPad during the quarter.” ~ Peter Oppenheimer

Remember all that talk about Apple not doing well in China? Yeah, not so very much.

Business

“…the Good Technology’s data that says that iOS accounted for 77% of all their activations by their corporate customers. Now that would not include BlackBerry, but it would include all the other guys. and so we seem to be doing really well and honestly, I don’t see the recent announcements changing that at all. I’ve seen more and more people developing more and more custom apps for their businesses on iOS to be used on iPad and we’re very, very bullish on it. As a matter of fact, just to quote you some numbers, iPad now is being used in 95% of the Fortune 500 and what’s even more impressive probably is on the global 500 companies, we’re now in 89%.” ~ Peter Oppenheimer

Remember all that talk about Apple’s iPhone and iPad not doing well in business? Yeah, not so very much.

Unique Advantages

Critics dismiss Apple as un-innovative, passé and niche. But Apple retains distinctive differences that give it unique advantages in the the newly emerging mobile markets:

— App Stores in 155 countries

— iTunes in 119 countries

“Today, our iTunes store offer the broadest combination of geographic reach in content depth in the industry, and they surpassed quarterly billings of $4 billion for the first time ever in the March quarter, that’s a $16 billion annual run rate making our digital content stores the largest in the world. The quarter’s iTunes billings translated to record quarterly iTunes revenue of $2.4 billion, up 28% from the year ago March quarter with new quarterly revenue records for music, movies, and apps. ~ Peter Oppenheimer

— 300 million iCloud users

— Highest loyalty and customers satisfaction rates in the business

“A recent study by Kantar measured 95% loyalty rate among iPhone owners, substantially higher than the competition, and iPhone remains top in customer experience. Last month, we were very pleased to receive the number one ranking in smartphone customer satisfaction from J.D. Power and Associates for the ninth consecutive time.” ~ Peter Oppenheimer

“The most recent survey published by ChangeWave indicated a 96% satisfaction rate among iPad customers.” ~ Peter Oppenheimer

— Developers

…(W)ith App Stores in 155 countries that encompass almost 90% of the world’s population, our developers have created more than 850,000 iOS apps, including 350,000 apps made for iPad.”

“Cumulative app downloads have surpassed 45 billion and app developers have made over $9 billion for their sales through the App Store, including $4.5 billion in the most recent four quarters alone. Canalys estimate the sales from our App Store accounted for 74% of all app sales worldwide in the March quarter.”

“…(W)e are now paying very happily our developers more than $1 billion every quarter.” ~ Peter Oppenheimer

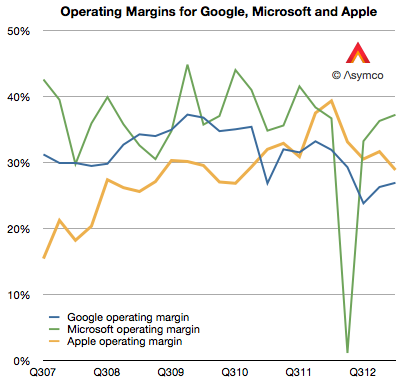

Revenues, Profits And Margins

Apple had $43.6 billion in revenue. What other company had comparable revenues?

Apple had $9.5 billion in profits. What other company had comparable profits?

Apple had 37.5% margins which is astonishing for a hardware company and compares quite favorably to the margins of both Google and Microsoft, which are primarily software shops.

Courtesy of Asymco

It seems that Apple compares favorably to every other company in the world other than the Apple of 12 months ago.

iPhone 4

“Now, that said, we see an enormous number of first time smartphone buyers coming to market, particularly, in certain countries around the world. And so what we’ve done with that is and we started last quarter is we’ve made the iPhone 4 even more affordable and which has made it more attractive to first time buyers and we caught up on the – our supply – demand towards the late in the quarter last quarter and we are continuing to do that in other markets. And we believe that the phone or the price point that we are offering is an incredible value for people, that allows them to get into the ecosystem with a really, really, phenomenal product.”

One thing that hasn’t been getting enough attention, or rather hasn’t been getting the right kind of attention, is the continued sales of the iPhone 4. The iPhone 4 is now over two and a half years old but it continues to sell well in developed markets like the United States and Europe and in developing markets like China, India and Brazil. How can this be? Is there any other phone manufacturer who could successfully sell a phone that is two generations and two years out of vogue?

The iPhone 4 is proof that buyers are buying Apple’s ecosystem, not just their hardware. So long as Apple maintains a lead in integrating hardware, software and services, they will maintain an edge in mobile computing.

And as an added bonus, while the iPhone 4 may be bring the iPhone’s average sale price down, the sale of this older technology should be bringing the iPhone’s margins up.

Apple’s Long-Term Outlook

“We are managing the business for the long-term and are willing to trade off short-term profit where we see long-term potential. The iPod is a great example of this. When we launched it in 2001, its margins were significantly below the margins of Apple at that time.

Four years later, the iPod and the iTunes Music Store comprised half of Apple’s revenues and inspired us to build the iPhone. The iPad mini is another great example. We have priced it aggressively and its margins are significantly below the corporate average. However, we believe deeply in the long-term potential of the tablet market and think that we’ve made a great strategic decision. We’ll only make great products and this precludes us from making cheap products that don’t deliver a great experience.”

If you look at Apple’s numbers for this quarter and the next, you might think you see a company in decline. But if you look at Apple’s numbers over the fiscal or annual year, you see anything but decline. Let’s put this in perspective: Would you rather have Apple’s profits or those of Google, Amazon, Microsoft or Samsung? Once you put it that way, the answer as to how Apple is doing becomes clear.

Apple dominates the most dominant tech sectors of our times. And unless I’m gravely mistaken, that’s a good thing. A very good thing.

Crikey, if all the media was this rational, who knows what could happen!

Macabella & Polimon, well said. I don’t remember a time when Apple’s P/E ratio was high, not like the crazy highs of the likes of Amazon. I don’t know if this is bias, confused views or befuddlement by economic forecasters and analysts. I see the holes in the arguments of the Naysayers, but haven’t found one in any of JK’s analyses; but I’m open to any possibilities, and waiting. 🙂 What I’d like to hear about is an analysis (an detailed one) on the problems with iTunes and possibly solutions. I do find each update seems to be a little more confusing but since I have grown up with iTunes, the learning curve has never been too steep a climb.

1

We live in times when the obvious needs to be underlined and overstated to compete with the barrage of anti Apple FUD, including paid (by Samsung) FUD. Thanks to Mr. Kirk for this article. Yes, obviously Apple rules the tech sphere, and no amount of hot air is going to change this fact.

John Kirk had written, as usual, a terrific piece of journalism: clear, objective and well documented. I have no problem to say I’m an Apple lover, but I am not an Apple fan boy; I’m not blind, there are things I don’t like from Apple like the way it manages the product updates. I’d like this process was shorter, with more added value, but it seems to be working well for Apple.

I think Apple is already posed to be the Number One company in the tech world, it has, as John Kirk had pointed, unique and strategics advantages over its competency. Google is making all the possible mistakes related with Android, Google has no idea about what to do with Android and the online ad may have more than one real player, remember that Yahoo! is in the very capable hands of Marissa Mayer, who is reviving the company. In the other hand, Microsoft is doing its best to sink the company, every move they make is in that sense. Steve Ballmer will achieve what Steve Jobs never imagined: ending Microsoft. And related to Samsung, mmh… well, Samsung is a simple copycat (a very good one, by the way) with a lot of money, but with a very few ideas. In the very moment Samsung tries something, it will try the bitter taste of defeat, because it will never be the same thing steal to invent.

Congrats John, well done.

While i agree with most of your assessment i would argue that with the latest samsung s4 they have put some innovation to there device which include the air view and air gesture…Samsung will continue to be apple’s main competition in the coming years…Apple however will need to be more innovative in their ecosystem than in the hardware as the hardware is almost at its limit i think!….how much thinner/faster are we really going to get? What’s the next step?

Yeah, you’re right. I have read a little about the S4, especially about those technologies you mention, I read it here in an article by Tim Bajarin a couple of days ago. My point with Samsung is that 90% –or more– of what they sell, are mere copies of products or technologies developed by other companies, whether Apple, Sony, RIM, etc. Samsung needs to take a lot more risk in R&D if really wants to be considered as an innovator. Meanwhile, it will be no more than a mere copycat. Thank you so much for your comment.

Throwing new technologies into a device is not in and of itself innovative, at least not in the consumer market, as much as the companies that do so try to make it sound like it is. Making the new technologies important and usable, that’s innovative, assuming the new technologies are even consistent and reliable, which so far is not the case from what I’ve read.

That is what made and makes Apple innovative over all the other handset makers and most of the rest of the consumer tech companies. Not just new technologies, but things people will find important and usable. Oh and actually _find_. If you have to throw in an “Easy mode” on your device (and I include Apple’s Mac OS in this), that is automatic “lose”, IMHO.

Oddly enough, Google knows this, too, as they keep working on new technologies to improve their search results. Now if they could translate this to Android, they and their OEMs might have something other than an Apple/iOS chaser.

Joe

It’s amazing to me that Apple (making it’s money primarily from hardware sales) has margins essentially as good as software and internet services companies, who have no “cost of sale” to speak of. It’s mind-blowing.

Agreed. Instead of bemoaning the fact that Apple’s margins have fallen, we should be astonished at how high they yet remain.

In one way, a company’s stock is another commodity from the company. If people really want the stock the price goes up, if they don’t then it goes down — regardless of the financials. Amazon has many investors who would rather hold their stock even though the financials say it is way over priced. Apple apparently has many stockholders who want to sell even though the business and financials say it is a great investment. If I had the money I would buy in based on what you have written.

Overall a well written piece, but I have just a mild disagreement with the initial setup’s premise. The stock market is not a predictor of anything. While you can monitor stock market data to identify trends that may be useful for some things, financial analysts always disclaim that past (and I’d add current performance) is no guarantee of future performance.

The only things predicting anything in the financial industry are financial analysts, whose motivations are not always in the interests of investors, and whose opinions can often be purchased, for both well-intended and unscrupulous purposes. Those analyses provided by these financial analysts are often no better than a witch doctor tossing bones when it comes to predicting future events. And there are so many institutions who desire a certain amount of market volatility to make money, and creating analytically sound fictions can serve to create or manage that kind of volatility. This also does not take into account the many algorithmically managed transactions handled by software trading systems that can affect the market positively or negatively, as the recent nano-crash that occurred as a result of the fake AP wire story regarding the white house bombing.

For some reason Apple seems to be a magnet for much of the industry’s negative financial analytical fiction, even when the facts, as you so eloquently pointed out, do not support their suppositions. I would cynically state that the financial industry appears to not let facts get in the way of making money.

Thanks for the article. Great logical piece of journalism.

Now if you could just explain the Amazon situation to all of us, that would be great. i.e.

Apple Profit $9,500,000,000 – Market Cap $383 Billion

Amazon Profit $85,000,000 – Market Cap $124 Billion???

John, thinking more about what you wrote and the discussion I do think one element needs to be added to your analysis. Who owns large blocks of stock and how their investment strategy impacts the price. I think it was Philip Elmer-Dewitt who noted how much AAPL the major brokerage houses were selling in the recent downturn.

The top ten holders of AAPL: Vanguard, FMR. State Street, Jupiter, Barclays, T Rowe Price, Susquehanna, JP Morgan Chase, Northern Trust, Invesco. Lots more detail, including who is buying and who is selling, here.

Great article. Makes a lot of sense. With all the money they spend on R&D, Apple will again amaze us wth some new product or gizmo that we didn’t even think could exist a few years ago! Then the “herd” mentality in Wall St. will flock back and the stock will go up again. No company stays on top forever (smasung, amazon and google be warned!), but a solid company like Apple doesn’t stay down for long either!

It is not that there is something fatally wrong with Apple. It has, however, become dull. The excitement premium is what made customers pay such a premium and queue up overnight to be the “first on their block” to have the latest and greatest product.

Compare a visit to an Apple Store now vs. a year ago. Far fewer events, less energy and no special experience.

60 billion for share repurchase and dividend increase: how about putting more of that into R&D?

“Compare a visit to an Apple Store now vs. a year ago. Far fewer events, less energy and no special experience.” – 4ourth

The facts respectfully disagree with your assessment:

“With an average of 401 stores open in the March quarter, average revenue per store was $13.1 million, compared to $12.2 million in the year ago quarter. Retail segment income was $1.1 billion.” … “We hosted 91 million visitors to our stores during the quarter compared to 85 million in the year-ago quarter. That translates the 17,500 visitors per store per week.” – Peter Oppenheimer

Considering you can now pre-order an iPhone online versus waiting in the cold dark mornings for a _chance_ to get one, I was surprised that there were _any_ lines for the iPhone 5 and iPad mini last year, never mind how long the lines endured. One would think that after two weeks it would have become clear, just place the order online.

Anyway. “Excitement” is a subjective qualifier. “Experience” and “energy” are a bit more quantifiable if you simply look at the stores themselves and how regularly they are PACKED and how well Apple has refined the physical shopping experience (for which they do not get enough coverage or credit. Maybe the fine folks here at Techpinions could help that deficit).

But I intuitively agree with “fewer events”. I don’t have numbers, but it does seem like that is one area where Jobs and Cook are differing. Michael Kaiser’s advice for arts organizations in his book _The Art of the Turnaround_ is to find some way to engage the public at least once a month to once a quarter (depending on the organization size) and I think that is a valid point.

Joe

“The iPhone 4 is proof that buyers are buying Apple’s ecosystem, not just their hardware.”

Right. At Verizon, 2 million customers preferred an older iPhone to new Android. Tell me again who has a problem?

Joe

Bravo.

It would help if people understood the context in which Apple’s stock price ballooned to 700. It was a time when every other stock seemed to be struggling, and AAPL was the only stock defying the gravity of the economic crisis. Every cent that could go into Apple’s stock did go, until no one was left with room in their budget for more. Meanwhile the economy regained its footing, and smart investors took their (massive) profits and diversified into recovering sectors. The decline is an unwinding of a very unusual situation, and not a verdict on Apple in a vacuum.

One part, but an important part, of the context, to be sure, IMHO. A lot of people who were always more bear (and that is being generous) than bull on Apple got real giddy. If anything, after that, most analysis has returned to the Apple view from pre-iPod era, even a major portion of that era. I remember many profitable quarters and ERs and the stock dropping like a lead brick right after. No one had faith Apple could continue things going forward, never mind Apple did so quarter after quarter.

Is Apple worth over $700 a share, even if the run was based on emotion than fundamentals? Absolutely, because the fundamentals are real. But a share holder has to be patient and wait it out because most investors don’t get Apple and frankly, as a shareholder, I’m glad many of them are gone.

Joe

Thank you for great content. I look forward to the continuation.

As a Newbie, I am always searching online for articles that can help me. Thank you

My website: изнасилование девочек

A lot of blog writers nowadays yet just a few have blog posts worth spending time on reviewing.

My website: порно на руском

Muchos Gracias for your article.Really thank you! Cool.

My website: порно с русскими студентками

I gotta favorite this site it seems very beneficial handy

My website: порно препод

Definitely, what a great blog and revealing posts, I definitely will bookmark your site. Best Regards!

My website: секс с учителями на русском

As a Newbie, I am always searching online for articles that can help me. Thank you

My website: секс порно

As a Newbie, I am continuously exploring online for articles that can be of assistance to me.

My website: порно по категориям на русском

Definitely, what a great blog and revealing posts, I definitely will bookmark your site. Best Regards!

My website: секс с училкой

I gotta favorite this site it seems very beneficial handy

My website: порно изнасиловали

I am incessantly thought about this, thanks for posting.

My website: домашнее порно зрелых с разговорами

Very good post.Really looking forward to read more. Great.

My website: порно отлизал пизду

I got what you intend,bookmarked, very decent website.

My website: В сперме

As a Newbie, I am always searching online for articles that can help me. Thank you

My website: жесткое двойное проникновение

I got what you intend,bookmarked, very decent website.

My website: порно с девушкой с упругой грудью

A lot of blog writers nowadays yet just a few have blog posts worth spending time on reviewing.

My website: Отчим и падчерица

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: жена в порно

A round of applause for your article. Much thanks again.

My website: девочки глотают сперму

As a Newbie, I am always searching online for articles that can help me. Thank you

My website: sex cumshot

Thanks-a-mundo for the post.Really thank you! Awesome.

My website: секс с мамой по русски

I got what you intend,bookmarked, very decent website.

My website: Секс пары

Definitely, what a great blog and revealing posts, I definitely will bookmark your site. Best Regards!

My website: порнуха с толстыми

Wohh precisely what I was searching for, regards for putting up.

My website: секс подростков видео

A lot of blog writers nowadays yet just a few have blog posts worth spending time on reviewing.

My website: порно русских гимнасток

Thanks-a-mundo for the post.Really thank you! Awesome.

My website: трах невесты

http://medicinefromindia.store/# pharmacy website india

india pharmacy

Definitely, what a great blog and revealing posts, I definitely will bookmark your site. Best Regards!

My website: смотреть домашний минет

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: порно русских бабушек

This site definitely has all of the information I needed about this subject

My website: порно сосет

purple pharmacy mexico price list mexico drug stores pharmacies mexico drug stores pharmacies

A lot of blog writers nowadays yet just a few have blog posts worth spending time on reviewing.

My website: порно русских мамаш

mexico drug stores pharmacies reputable mexican pharmacies online mexico pharmacy

mexican online pharmacies prescription drugs buying from online mexican pharmacy medicine in mexico pharmacies

https://mexicanph.com/# reputable mexican pharmacies online

mexican rx online

mexico drug stores pharmacies mexican mail order pharmacies mexico drug stores pharmacies

http://mexicanph.shop/# mexican mail order pharmacies

mexico drug stores pharmacies

pharmacies in mexico that ship to usa mexican border pharmacies shipping to usa mexican border pharmacies shipping to usa

mexico pharmacy mexico pharmacies prescription drugs mexico drug stores pharmacies

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: трахнул сочную жопу

pharmacies in mexico that ship to usa mexican drugstore online buying prescription drugs in mexico online

Ponto IPTV a melhor programacao de canais IPTV do Brasil, filmes, series, futebol

My website: бесплатное порно пухлые

http://mexicanph.com/# medication from mexico pharmacy

buying prescription drugs in mexico

mexico pharmacies prescription drugs purple pharmacy mexico price list purple pharmacy mexico price list

mexican pharmaceuticals online buying prescription drugs in mexico reputable mexican pharmacies online

best mexican online pharmacies buying prescription drugs in mexico online mexican online pharmacies prescription drugs

best online pharmacies in mexico mexican drugstore online mexico drug stores pharmacies

mexico pharmacy mexican rx online mexican online pharmacies prescription drugs

purple pharmacy mexico price list medication from mexico pharmacy medication from mexico pharmacy

mexico pharmacy best online pharmacies in mexico best online pharmacies in mexico

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: Мама и сын

mexico pharmacies prescription drugs medicine in mexico pharmacies medicine in mexico pharmacies

medicine in mexico pharmacies mexican border pharmacies shipping to usa mexico drug stores pharmacies

http://mexicanph.com/# mexican rx online

mexican rx online

reputable mexican pharmacies online mexican mail order pharmacies buying prescription drugs in mexico online

A lot of blog writers nowadays yet just a few have blog posts worth spending time on reviewing.

My website: порно красавицы

mexico pharmacy mexican pharmacy mexico pharmacies prescription drugs

mexican online pharmacies prescription drugs best online pharmacies in mexico buying prescription drugs in mexico

best online pharmacies in mexico medicine in mexico pharmacies mexican pharmaceuticals online

purple pharmacy mexico price list buying prescription drugs in mexico online medicine in mexico pharmacies

best online pharmacies in mexico mexican pharmaceuticals online mexican online pharmacies prescription drugs

buying from online mexican pharmacy mexican online pharmacies prescription drugs mexican pharmaceuticals online

mexican online pharmacies prescription drugs buying prescription drugs in mexico buying from online mexican pharmacy

mexico pharmacy mexico drug stores pharmacies mexico pharmacies prescription drugs

Major thanks for the article post. Much thanks again.

My website: Первый анал

mexico drug stores pharmacies mexican rx online buying prescription drugs in mexico online

buying prescription drugs in mexico online medication from mexico pharmacy buying prescription drugs in mexico

https://mexicanph.com/# mexico pharmacies prescription drugs

medicine in mexico pharmacies

buying from online mexican pharmacy mexican drugstore online mexico drug stores pharmacies

Ponto IPTV a melhor programacao de canais IPTV do Brasil, filmes, series, futebol

My website: arabcha seks

mexican mail order pharmacies mexican drugstore online mexican pharmaceuticals online

buying prescription drugs in mexico online reputable mexican pharmacies online buying prescription drugs in mexico online

mexican pharmaceuticals online mexican mail order pharmacies best online pharmacies in mexico

mexico pharmacies prescription drugs mexico pharmacy п»їbest mexican online pharmacies

mexican pharmaceuticals online mexican pharmaceuticals online buying prescription drugs in mexico online

medicine in mexico pharmacies medication from mexico pharmacy mexican rx online

mexico pharmacy mexico drug stores pharmacies pharmacies in mexico that ship to usa

buying prescription drugs in mexico online medicine in mexico pharmacies buying prescription drugs in mexico

purple pharmacy mexico price list buying prescription drugs in mexico best online pharmacies in mexico

https://mexicanph.shop/# mexican border pharmacies shipping to usa

mexican mail order pharmacies

mexican rx online pharmacies in mexico that ship to usa reputable mexican pharmacies online

pharmacies in mexico that ship to usa mexican pharmacy mexican pharmaceuticals online

As a Newbie, I am continuously exploring online for articles that can be of assistance to me.

My website: русская ебля с разговорами

medicine in mexico pharmacies mexican mail order pharmacies mexican mail order pharmacies

mexican pharmaceuticals online mexico drug stores pharmacies mexican online pharmacies prescription drugs

buying prescription drugs in mexico mexican rx online reputable mexican pharmacies online

My website: трахнул красивую жену

mexican rx online purple pharmacy mexico price list mexican mail order pharmacies

purple pharmacy mexico price list mexican pharmacy mexican border pharmacies shipping to usa

best online pharmacies in mexico mexican online pharmacies prescription drugs buying from online mexican pharmacy

buying prescription drugs in mexico online mexico drug stores pharmacies buying from online mexican pharmacy

pharmacies in mexico that ship to usa best online pharmacies in mexico medication from mexico pharmacy

mexican mail order pharmacies buying prescription drugs in mexico pharmacies in mexico that ship to usa

http://mexicanph.shop/# buying prescription drugs in mexico

purple pharmacy mexico price list

mexican border pharmacies shipping to usa mexican drugstore online mexican border pharmacies shipping to usa

mexico pharmacy mexico drug stores pharmacies buying prescription drugs in mexico

best online pharmacies in mexico purple pharmacy mexico price list mexican online pharmacies prescription drugs

buying from online mexican pharmacy mexico drug stores pharmacies buying prescription drugs in mexico

This site definitely has all of the information I needed about this subject

My website: порно соло сквирт

mexican drugstore online medication from mexico pharmacy reputable mexican pharmacies online

medicine in mexico pharmacies reputable mexican pharmacies online best online pharmacies in mexico

mexican mail order pharmacies medicine in mexico pharmacies medicine in mexico pharmacies

buying prescription drugs in mexico medicine in mexico pharmacies reputable mexican pharmacies online

As a Newbie, I am always searching online for articles that can help me. Thank you

My website: глубокая глотка

mexican online pharmacies prescription drugs best online pharmacies in mexico п»їbest mexican online pharmacies

medicine in mexico pharmacies best mexican online pharmacies purple pharmacy mexico price list

5 prednisone in mexico: prednisone generic cost – prednisone for cheap

http://furosemide.guru/# lasix 100mg

can i buy prednisone online without prescription: 20 mg prednisone – buying prednisone

https://buyprednisone.store/# cost of prednisone 5mg tablets

amoxicillin cost australia: how to buy amoxicillin online – amoxicillin online no prescription

https://lisinopril.top/# buy cheap lisinopril

http://amoxil.cheap/# how to buy amoxicillin online

lasix: Buy Lasix – buy lasix online

lasix generic name: Buy Furosemide – lasix uses

https://lisinopril.top/# zestoretic 20-25 mg

lisinopril 40 mg: how much is lisinopril 5 mg – buy lisinopril 20 mg online usa

https://furosemide.guru/# lasix dosage

I reckon something truly special in this website.

My website: госпожа страпонит

lasix for sale: Buy Furosemide – lasix side effects

http://furosemide.guru/# furosemide 40 mg

amoxicillin 500 coupon: buy amoxicillin from canada – amoxicillin script

http://furosemide.guru/# lasix dosage

http://lisinopril.top/# zestoretic 10 12.5

zestril tab 10mg: lisinopril 100mcg – lisinopril in usa

https://stromectol.fun/# stromectol order

where can i get amoxicillin: amoxicillin 500 mg where to buy – amoxicillin no prescipion

furosemide 40 mg: Buy Furosemide – lasix side effects

http://furosemide.guru/# lasix 20 mg

purchase prednisone no prescription: prednisone 10 mg over the counter – prednisone 20mg cheap

https://amoxil.cheap/# amoxicillin 500mg buy online uk

stromectol tablets uk: ivermectin tablet price – stromectol ireland

https://furosemide.guru/# lasix 20 mg

http://stromectol.fun/# ivermectin 1 topical cream

buy lasix online: Buy Lasix – lasix 40 mg

http://stromectol.fun/# ivermectin 10 mg

furosemide 100mg: Over The Counter Lasix – furosemide 100mg

amoxicillin online no prescription: amoxicillin 500 mg cost – amoxicillin discount

http://furosemide.guru/# lasix generic name

lisinopril 10 best price: lisinopril 2.5 mg for sale – price of zestril

https://stromectol.fun/# buy ivermectin cream for humans

amoxicillin where to get: amoxicillin 500mg without prescription – medicine amoxicillin 500

amoxicillin 500mg capsules: where to buy amoxicillin pharmacy – cheap amoxicillin 500mg

http://stromectol.fun/# stromectol covid

http://stromectol.fun/# ivermectin where to buy

https://amoxil.cheap/# generic for amoxicillin

stromectol covid 19: ivermectin oral 0 8 – buy stromectol uk

http://lisinopril.top/# zestril price in india

furosemide 40 mg: Over The Counter Lasix – furosemide 40 mg

prednisone coupon: prednisone medicine – prednisone price australia

http://amoxil.cheap/# amoxicillin 500 mg brand name

lisinopril 5 mg buy: lisinopril medication – zestril 40

http://buyprednisone.store/# buying prednisone without prescription

lisinopril 30 mg cost: buy lisinopril 20 mg online uk – 20 mg lisinopril without a prescription

https://stromectol.fun/# minocycline 100mg capsule

https://stromectol.fun/# stromectol price uk

furosemide: Over The Counter Lasix – lasix 40 mg

https://furosemide.guru/# lasix 20 mg

lisinopril 420 1g http://lisinoprilpharm.com/%5Dlisinopril lisinopril tab 100mg

lisinopril 20 mg cost: prinivil 25mg – lisinopril tabs 4mg

https://stromectol.fun/# ivermectin 1 topical cream

ivermectin 0.5: where can i buy oral ivermectin – stromectol medication

ivermectin topical: purchase stromectol – ivermectin 8000 mcg

http://lisinopril.top/# buy zestoretic online

https://buyprednisone.store/# prednisone 10mg canada

stromectol 3 mg tablet: price of ivermectin liquid – ivermectin pills human

https://amoxil.cheap/# amoxicillin pills 500 mg

http://lisinopril.top/# lisinopril 2.5 pill

lasix dosage: Over The Counter Lasix – lasix uses

http://amoxil.cheap/# amoxicillin 500mg capsules

lasix for sale: Buy Furosemide – buy lasix online

https://furosemide.guru/# lasix generic

buy lisinopril 20 mg no prescription: can i buy lisinopril over the counter – 20 mg lisinopril without a prescription

http://furosemide.guru/# lasix side effects

http://amoxil.cheap/# amoxicillin buy no prescription

lasix 100 mg tablet: Buy Lasix – lasix dosage

https://amoxil.cheap/# amoxicillin 500

where can i buy oral ivermectin ivermectin stromectol cost of ivermectin pill

http://lisinopril.top/# lisinopril canada

where to buy amoxicillin pharmacy: how to get amoxicillin – generic amoxil 500 mg

https://stromectol.fun/# ivermectin 5ml

http://indianph.xyz/# top 10 online pharmacy in india

top online pharmacy india

top 10 online pharmacy in india Online medicine order reputable indian pharmacies

https://indianph.xyz/# buy prescription drugs from india

online shopping pharmacy india

http://indianph.com/# Online medicine home delivery

http://indianph.xyz/# india pharmacy

india pharmacy mail order

http://indianph.xyz/# indianpharmacy com

indianpharmacy com

http://indianph.xyz/# india pharmacy mail order

india pharmacy

online pharmacy india buy prescription drugs from india best india pharmacy

http://indianph.xyz/# buy medicines online in india

best india pharmacy

https://indianph.xyz/# buy prescription drugs from india

top 10 pharmacies in india

top 10 online pharmacy in india п»їlegitimate online pharmacies india india online pharmacy

https://indianph.com/# top 10 pharmacies in india

Online medicine home delivery

https://indianph.com/# top 10 pharmacies in india

https://cytotec24.shop/# cytotec online

antibiotics cipro: purchase cipro – purchase cipro

https://cytotec24.com/# buy misoprostol over the counter

pct nolvadex: tamoxifen reviews – nolvadex pct

https://cytotec24.shop/# cytotec online

diflucan price south africa: diflucan 100mg – diflucan online no prescription

https://cipro.guru/# ciprofloxacin 500 mg tablet price

https://cipro.guru/# buy cipro online

https://nolvadex.guru/# aromatase inhibitor tamoxifen

low dose tamoxifen: cost of tamoxifen – is nolvadex legal

diflucan otc australia can i buy diflucan over the counter in australia diflucan online australia

http://cipro.guru/# ciprofloxacin 500mg buy online

https://cipro.guru/# antibiotics cipro

diflucan 150 cost diflucan online canada cost of diflucan tablet

ciprofloxacin 500mg buy online: ciprofloxacin 500mg buy online – ciprofloxacin order online

https://nolvadex.guru/# tamoxifen

http://diflucan.pro/# how to get diflucan

https://doxycycline.auction/# generic doxycycline

https://diflucan.pro/# can you purchase diflucan over the counter

https://diflucan.pro/# diflucan without get a prescription online

http://doxycycline.auction/# doxycycline without prescription

doxycycline hydrochloride 100mg doxycycline without prescription price of doxycycline

https://nolvadex.guru/# tamoxifen and antidepressants

http://cipro.guru/# buy ciprofloxacin over the counter

http://nolvadex.guru/# nolvadex 10mg

https://evaelfie.pro/# eva elfie filmleri

Sweetie Fox filmleri: Sweetie Fox izle – Sweetie Fox

https://abelladanger.online/# abella danger izle

Angela Beyaz modeli: Angela White filmleri – Angela White filmleri

http://sweetiefox.online/# Sweetie Fox modeli

https://evaelfie.pro/# eva elfie

lana rhoades video: lana rhoades – lana rhoades izle

http://lanarhoades.fun/# lana rhoades

https://lanarhoades.fun/# lana rhoades filmleri

Angela White izle: Abella Danger – Abella Danger

http://abelladanger.online/# abella danger filmleri

https://angelawhite.pro/# Angela White video

?????? ????: abella danger filmleri – abella danger video

https://angelawhite.pro/# Angela White izle

Angela White video: Angela White filmleri – Angela White

http://abelladanger.online/# abella danger izle

http://lanarhoades.fun/# lana rhoades video

https://evaelfie.pro/# eva elfie izle

Sweetie Fox video: Sweetie Fox – Sweetie Fox filmleri

https://angelawhite.pro/# Angela White izle

sweety fox: Sweetie Fox filmleri – Sweetie Fox

https://sweetiefox.online/# sweety fox

https://angelawhite.pro/# Angela White filmleri

eva elfie: eva elfie – eva elfie izle

https://lanarhoades.fun/# lana rhoades izle

Sweetie Fox filmleri: Sweetie Fox video – Sweetie Fox modeli

https://sweetiefox.online/# Sweetie Fox

https://lanarhoades.fun/# lana rhoades izle

http://angelawhite.pro/# Angela White video

Angela White video: abella danger filmleri – Abella Danger

http://angelawhite.pro/# Angela White

eva elfie izle: eva elfie filmleri – eva elfie izle

Angela White video: Angela White izle – Angela White

http://abelladanger.online/# Abella Danger

https://lanarhoades.pro/# lana rhoades

lana rhoades boyfriend: lana rhoades unleashed – lana rhoades unleashed

tinder dating: https://evaelfie.site/# eva elfie videos

https://lanarhoades.pro/# lana rhoades hot

lana rhoades unleashed: lana rhoades unleashed – lana rhoades videos

https://lanarhoades.pro/# lana rhoades videos

sweetie fox full: sweetie fox cosplay – fox sweetie

eva elfie hd: eva elfie new videos – eva elfie photo

sz dating seiten: http://sweetiefox.pro/# sweetie fox

http://miamalkova.life/# mia malkova videos

mia malkova full video: mia malkova videos – mia malkova full video

fox sweetie: sweetie fox – sweetie fox

http://evaelfie.site/# eva elfie photo

mia malkova girl: mia malkova full video – mia malkova full video

adult-daiting site: http://evaelfie.site/# eva elfie full video

https://miamalkova.life/# mia malkova

mia malkova only fans: mia malkova girl – mia malkova full video

sweetie fox full video: sweetie fox – sweetie fox full

ph sweetie fox: sweetie fox cosplay – sweetie fox full

http://miamalkova.life/# mia malkova new video

sweetie fox full: sweetie fox video – sweetie fox full video

http://miamalkova.life/# mia malkova movie

eva elfie hd: eva elfie full video – eva elfie hd

sweetie fox video: sweetie fox full – fox sweetie

senior dating sites: https://miamalkova.life/# mia malkova videos

lana rhoades: lana rhoades hot – lana rhoades hot

https://evaelfie.site/# eva elfie hd

mia malkova hd: mia malkova girl – mia malkova hd

http://evaelfie.site/# eva elfie new video

lana rhoades unleashed: lana rhoades – lana rhoades unleashed

https://miamalkova.life/# mia malkova videos

lana rhoades full video: lana rhoades pics – lana rhoades videos

skip the games dating site free: https://sweetiefox.pro/# sweetie fox full video

https://aviatormalawi.online/# aviator bet malawi login

ganhar dinheiro jogando: aplicativo de aposta – jogo de aposta

https://aviatoroyunu.pro/# aviator hilesi

pin up casino: pin up bet – pin up bet

https://aviatorjogar.online/# jogar aviator online

pin up: pin up cassino online – pin-up casino login

https://aviatoroyunu.pro/# pin up aviator

pin up: pin up casino – pin-up casino

aviator bet malawi: aviator malawi – aviator betting game

https://jogodeaposta.fun/# jogo de aposta

https://aviatormocambique.site/# aviator bet

aviator ghana: aviator – aviator game

https://aviatorjogar.online/# jogar aviator online

aviator oyunu: aviator hilesi – aviator sinyal hilesi

http://aviatorjogar.online/# pin up aviator

pin up casino: pin up cassino online – pin-up

como jogar aviator: aviator mz – como jogar aviator em moçambique

http://aviatormocambique.site/# como jogar aviator em mocambique

jogar aviator: aviator bet – como jogar aviator

aviator sinyal hilesi: aviator sinyal hilesi – aviator bahis

play aviator: aviator game – aviator game

aviator bet: aviator bet malawi login – aviator bet

estrela bet aviator: jogar aviator online – aviator betano

aviator pin up: aviator game – aviator bet

generic zithromax azithromycin – https://azithromycin.pro/zithromax-is-used-for.html can you buy zithromax over the counter in mexico

aviator jogo de aposta: aviator jogo de aposta – aplicativo de aposta

aviator malawi: aviator bet malawi login – aviator game online

zithromax 600 mg tablets: where to get zithromax – purchase zithromax online

aviator: play aviator – aviator malawi

jogar aviator online: jogar aviator online – estrela bet aviator

zithromax over the counter uk: can zithromax treat strep throat zithromax canadian pharmacy

mexican rx online: Mexico pharmacy online – mexican border pharmacies shipping to usa mexicanpharm.shop

best mail order pharmacy canada My Canadian pharmacy canada pharmacy reviews canadianpharm.store

mexican online pharmacies prescription drugs: order online from a Mexican pharmacy – mexican pharmaceuticals online mexicanpharm.shop

http://indianpharm24.com/# pharmacy website india indianpharm.store

https://indianpharm24.shop/# top 10 pharmacies in india indianpharm.store

https://indianpharm24.shop/# world pharmacy india indianpharm.store

https://canadianpharmlk.com/# canada rx pharmacy world canadianpharm.store

buying from online mexican pharmacy: Medicines Mexico – mexico drug stores pharmacies mexicanpharm.shop

canadian pharmacies that deliver to the us Canada pharmacy online canada rx pharmacy world canadianpharm.store

https://canadianpharmlk.shop/# canadian world pharmacy canadianpharm.store

best online canadian pharmacy: Pharmacies in Canada that ship to the US – canadian pharmacy antibiotics canadianpharm.store

http://indianpharm24.com/# top 10 pharmacies in india indianpharm.store

https://mexicanpharm24.com/# mexico pharmacy mexicanpharm.shop

http://canadianpharmlk.shop/# canadian pharmacy 24 canadianpharm.store

http://canadianpharmlk.shop/# best canadian pharmacy online canadianpharm.store

https://canadianpharmlk.com/# online canadian pharmacy reviews canadianpharm.store

http://canadianpharmlk.com/# my canadian pharmacy canadianpharm.store

http://indianpharm24.com/# Online medicine order indianpharm.store

legitimate canadian pharmacies: Cheapest drug prices Canada – online pharmacy canada canadianpharm.store

http://mexicanpharm24.shop/# mexican pharmacy mexicanpharm.shop

http://mexicanpharm24.shop/# mexico drug stores pharmacies mexicanpharm.shop

http://canadianpharmlk.shop/# canadian pharmacy world canadianpharm.store

https://mexicanpharm24.com/# mexican pharmaceuticals online mexicanpharm.shop

prednisone online australia: 5 mg prednisone tablets – prednisone acetate

prednisone 250 mg online order prednisone 10mg prednisone tablets 2.5 mg

http://amoxilst.pro/# buy amoxicillin 500mg uk

cost of cheap clomid tablets: clomid constipation – can you buy generic clomid price

prednisone 30 mg daily: generic over the counter prednisone – prednisone buy

where can i buy generic clomid pill: where can i get generic clomid no prescription – buy generic clomid without dr prescription

https://prednisonest.pro/# prednisone 0.5 mg

over the counter prednisone cream: how to take prednisone – prednisone cost in india

amoxicillin online purchase amoxicillin price without insurance amoxicillin in india

http://clomidst.pro/# cost of clomid now

order generic clomid prices: taking clomid – how to buy cheap clomid now

https://prednisonest.pro/# prednisone 10 mg daily

54 prednisone: buy prednisone online india – buy prednisone online without a prescription

can i get clomid pill: get generic clomid price – how to get generic clomid online

prednisone 2.5 mg tab: does prednisone make you tired – canadian online pharmacy prednisone

https://clomidst.pro/# how to get clomid without prescription

can i buy generic clomid without rx how to buy generic clomid without prescription how to buy generic clomid without rx

buy amoxicillin without prescription: how to get amoxicillin – amoxicillin buy canada

where to get clomid prices: cost cheap clomid without prescription – clomid sale

http://amoxilst.pro/# amoxil pharmacy

cost of clomid: clomid cheap – can you buy generic clomid pill

where can i get clomid pill: can you get generic clomid – where to buy generic clomid no prescription

https://edpills.guru/# ed treatments online

best ed pills online: ed medicine online – online ed treatments

order prescription drugs online without doctor: canada mail order prescription – canadian mail order prescriptions

https://onlinepharmacy.cheap/# cheapest prescription pharmacy

ed prescription online: erectile dysfunction drugs online – ed medicines

canadian pharmacy online no prescription needed pills no prescription buying prescription drugs online from canada

canada drugs no prescription: no prescription on line pharmacies – online pharmacy no prescriptions

https://pharmnoprescription.pro/# best online pharmacy no prescription

discount prescription drugs canada: online pharmacy without a prescription – no prescription drugs online

cheap ed medication: erectile dysfunction pills online – ed pills cheap

https://pharmnoprescription.pro/# online drugstore no prescription

prescription drugs from canada: online pharmacy india – rx pharmacy coupons

canadian pharmacy world coupon code: canadian pharmacy online – cheapest pharmacy to get prescriptions filled

http://edpills.guru/# ed meds cheap

ed online pharmacy: buying erectile dysfunction pills online – cost of ed meds

canada pharmacy not requiring prescription Cheapest online pharmacy online pharmacy without prescription

http://pharmnoprescription.pro/# prescription canada

prescription drugs from canada: canada pharmacy online – canadian online pharmacy no prescription

rxpharmacycoupons: Online pharmacy USA – rxpharmacycoupons

reputable canadian pharmacy: best canadian pharmacy to order from – the canadian drugstore

mexico pharmacies prescription drugs mexican drugstore online mexico drug stores pharmacies

https://indianpharm.shop/# online shopping pharmacy india

https://canadianpharm.guru/# canada drugs online review

reputable indian online pharmacy cheapest online pharmacy india pharmacy website india

canadianpharmacyworld com: canadian pharmacy online ship to usa – canadian pharmacy

canadian pharmacy prescription: canadian prescription – canadian pharmacy prescription

http://pharmacynoprescription.pro/# buying prescription drugs from canada online

Online medicine home delivery: indian pharmacies safe – indian pharmacy online

https://mexicanpharm.online/# purple pharmacy mexico price list

best online pharmacy without prescription: online pharmacy with prescription – no prescription drugs

https://indianpharm.shop/# india online pharmacy

indian pharmacy no prescription: medicine with no prescription – canada online prescription

canadian pharmacy victoza: best canadian pharmacy online – canada drugs online reviews

buying prescription drugs in mexico mexico pharmacies prescription drugs mexican border pharmacies shipping to usa

http://indianpharm.shop/# best online pharmacy india

best online pharmacy india: Online medicine order – cheapest online pharmacy india

legitimate online pharmacies india: world pharmacy india – top 10 pharmacies in india

buying prescription drugs in mexico: buying prescription drugs in mexico online – purple pharmacy mexico price list

indian pharmacies safe: indian pharmacies safe – cheapest online pharmacy india

buying prescription drugs in mexico online: mexico pharmacy – mexico pharmacies prescription drugs

https://indianpharm.shop/# cheapest online pharmacy india

northwest canadian pharmacy: canadian pharmacy 24 com – drugs from canada

http://mexicanpharm.online/# buying prescription drugs in mexico online

canadian pharmacy no prescription: canadian pharmacy non prescription – best no prescription online pharmacy

http://indianpharm.shop/# indianpharmacy com

buy medicines online in india: indianpharmacy com – buy prescription drugs from india

http://canadianpharm.guru/# safe canadian pharmacies

top 10 online pharmacy in india: top 10 online pharmacy in india – Online medicine home delivery

canadian pharmacy victoza: canadian pharmacy ltd – canadapharmacyonline

http://pharmacynoprescription.pro/# can you buy prescription drugs in canada

indian pharmacies safe: reputable indian pharmacies – india pharmacy

mexican mail order pharmacies best online pharmacies in mexico buying prescription drugs in mexico online

top 10 online pharmacy in india: reputable indian pharmacies – world pharmacy india

https://pharmacynoprescription.pro/# canada pharmacy without prescription

reputable mexican pharmacies online: mexico drug stores pharmacies – best online pharmacies in mexico

http://mexicanpharm.online/# mexico pharmacies prescription drugs

legal to buy prescription drugs from canada: canada drugs online reviews – maple leaf pharmacy in canada

no prescription medicine: buy medications online no prescription – buying prescription drugs online from canada

northwest canadian pharmacy: canada drugs online reviews – canada drugs online review

best online pharmacy india: world pharmacy india – india pharmacy

https://mexicanpharm.online/# best online pharmacies in mexico

indian pharmacies safe india pharmacy indian pharmacies safe

india pharmacy mail order: pharmacy website india – Online medicine order

real canadian pharmacy: reputable canadian online pharmacy – ed drugs online from canada

mail order pharmacy india: indian pharmacies safe – top online pharmacy india

https://pharmacynoprescription.pro/# prescription from canada

https://indianpharm.shop/# pharmacy website india

best india pharmacy: Online medicine order – buy prescription drugs from india

onlinecanadianpharmacy: canadian compounding pharmacy – canadian drug

http://indianpharm.shop/# pharmacy website india

medication from mexico pharmacy: buying prescription drugs in mexico – mexican pharmaceuticals online

aviator bahis: aviator mostbet – aviator hile

http://slotsiteleri.guru/# en iyi slot siteleri

en yeni slot siteleri: guvenilir slot siteleri – oyun siteleri slot

https://gatesofolympus.auction/# gates of olympus demo free spin

https://aviatoroyna.bid/# aviator hile

http://slotsiteleri.guru/# bonus veren casino slot siteleri

http://slotsiteleri.guru/# canli slot siteleri

https://slotsiteleri.guru/# casino slot siteleri

sweet bonanza 100 tl: sweet bonanza yorumlar – sweet bonanza siteleri

pin up giris: pin up casino – pin up casino guncel giris

https://sweetbonanza.bid/# sweet bonanza indir

http://slotsiteleri.guru/# güvenilir slot siteleri

http://sweetbonanza.bid/# sweet bonanza giris

http://pinupgiris.fun/# pin up indir

https://gatesofolympus.auction/# gates of olympus nasil para kazanilir

sweet bonanza yasal site: sweet bonanza slot demo – sweet bonanza demo oyna

aviator mostbet: aviator oyna 100 tl – aviator oyunu 20 tl

https://sweetbonanza.bid/# sweet bonanza slot demo

http://slotsiteleri.guru/# slot siteleri

http://aviatoroyna.bid/# aviator hilesi

https://pinupgiris.fun/# pin up giris

http://slotsiteleri.guru/# bonus veren slot siteleri

guvenilir slot siteleri: en yeni slot siteleri – deneme veren slot siteleri

gates of olympus: gates of olympus oyna – gates of olympus demo free spin

http://aviatoroyna.bid/# aviator sinyal hilesi

aviator: aviator – aviator oyna 100 tl

https://aviatoroyna.bid/# aviator oyunu giris

aviator oyunu: aviator oyunu 50 tl – aviator ucak oyunu

http://sweetbonanza.bid/# sweet bonanza demo

pin up: pin-up online – pin up guncel giris

https://sweetbonanza.bid/# sweet bonanza nas?l oynan?r

https://gatesofolympus.auction/# gates of olympus giris

slot siteleri bonus veren: deneme bonusu veren siteler – slot siteleri 2024

india pharmacy mail order: india online pharmacy – indian pharmacy online

https://canadianpharmacy24.store/# rate canadian pharmacies

buy prescription drugs from india online pharmacy india best online pharmacy india

online pharmacy india: indian pharmacy – pharmacy website india

canadian pharmacy no scripts: onlinecanadianpharmacy 24 – canadian pharmacy no scripts

http://indianpharmacy.icu/# indian pharmacy paypal

п»їlegitimate online pharmacies india Cheapest online pharmacy top 10 pharmacies in india

canadian mail order pharmacy: canadian pharmacy ltd – canada pharmacy world

canadian pharmacy online reviews: pills now even cheaper – best canadian online pharmacy

canadian family pharmacy: canadian pharmacy 24 – canadian online pharmacy

medication from mexico pharmacy: mexican pharmacy – medication from mexico pharmacy

cheapest online pharmacy india: indian pharmacy delivery – top 10 pharmacies in india

ed meds online canada: pills now even cheaper – canadian pharmacy

cheapest pharmacy canada: Certified Canadian Pharmacy – best canadian pharmacy

mexican drugstore online: Mexican Pharmacy Online – pharmacies in mexico that ship to usa

https://canadianpharmacy24.store/# canadian pharmacy india

maple leaf pharmacy in canada: Prescription Drugs from Canada – best canadian pharmacy online

best canadian pharmacy online: Large Selection of Medications – canadian pharmacy ltd

mexican online pharmacies prescription drugs: Mexican Pharmacy Online – pharmacies in mexico that ship to usa

online pharmacy india Healthcare and medicines from India mail order pharmacy india

mexico pharmacy: Online Pharmacies in Mexico – best mexican online pharmacies

cheapest online pharmacy india: indian pharmacy – Online medicine home delivery

http://indianpharmacy.icu/# mail order pharmacy india

best mexican online pharmacies: Online Pharmacies in Mexico – purple pharmacy mexico price list

online pharmacy canada: Certified Canadian Pharmacy – reputable canadian online pharmacies

http://prednisoneall.com/# prednisone 10 mg online

zithromax over the counter uk: zithromax online paypal – where can i purchase zithromax online

https://clomidall.com/# how to get generic clomid price

https://clomidall.shop/# where to get generic clomid pills

https://zithromaxall.shop/# zithromax 500mg

cost cheap clomid no prescription: where can i get cheap clomid pill – where to buy cheap clomid no prescription

http://zithromaxall.com/# can i buy zithromax online

http://zithromaxall.com/# zithromax capsules australia

https://prednisoneall.com/# where can i buy prednisone without prescription

where can you buy prednisone: buy prednisone mexico – prednisone 5 mg cheapest

https://zithromaxall.shop/# zithromax 600 mg tablets

http://prednisoneall.shop/# 10 mg prednisone

amoxicillin 500 mg cost: buy amoxicillin – amoxicillin online no prescription

https://kamagraiq.com/# Kamagra Oral Jelly

Buy Tadalafil 10mg: Generic Tadalafil 20mg price – Tadalafil Tablet

Cialis over the counter: Generic Tadalafil 20mg price – cheapest cialis

http://sildenafiliq.com/# Generic Viagra online

sildenafil oral jelly 100mg kamagra: kamagra best price – sildenafil oral jelly 100mg kamagra

http://sildenafiliq.xyz/# Cheap Viagra 100mg

Generic Cialis without a doctor prescription: Buy Cialis online – Generic Cialis price

kamagra: kamagra best price – buy Kamagra

buy kamagra online usa: Sildenafil Oral Jelly – Kamagra 100mg price

Cheap Viagra 100mg: cheapest viagra – generic sildenafil

http://sildenafiliq.com/# buy Viagra online

Viagra tablet online: best price on viagra – Cheap Sildenafil 100mg

cheap kamagra: kamagra best price – Kamagra tablets

Cialis over the counter: cheapest cialis – Cialis 20mg price

https://kamagraiq.shop/# п»їkamagra

Buy Tadalafil 10mg: Buy Cialis online – Buy Tadalafil 5mg

Kamagra 100mg price: Kamagra gel – Kamagra tablets

Kamagra 100mg: Kamagra Oral Jelly Price – Kamagra tablets

http://sildenafiliq.xyz/# generic sildenafil

buy Kamagra: Sildenafil Oral Jelly – buy kamagra online usa

cialis for sale: tadalafil iq – Cheap Cialis

http://tadalafiliq.com/# Buy Tadalafil 20mg

kamagra: kamagra best price – Kamagra Oral Jelly

Kamagra tablets: kamagra best price – buy Kamagra

https://sildenafiliq.com/# Sildenafil Citrate Tablets 100mg

buy viagra here: cheapest viagra – Cheap Viagra 100mg

indian pharmacies safe: indian pharmacy – pharmacy website india

https://indianpharmgrx.shop/# world pharmacy india

http://indianpharmgrx.com/# indian pharmacies safe

best online pharmacies in mexico: Pills from Mexican Pharmacy – mexican rx online

http://mexicanpharmgrx.com/# medication from mexico pharmacy

http://canadianpharmgrx.com/# ed drugs online from canada

canada drugs online: List of Canadian pharmacies – recommended canadian pharmacies

http://mexicanpharmgrx.com/# mexico pharmacies prescription drugs

http://indianpharmgrx.com/# best india pharmacy

northwest canadian pharmacy CIPA approved pharmacies canadianpharmacyworld com

reputable indian online pharmacy: indian pharmacy – п»їlegitimate online pharmacies india

http://canadianpharmgrx.xyz/# canadian discount pharmacy

https://indianpharmgrx.com/# top online pharmacy india

online pharmacy india: indian pharmacy delivery – indian pharmacies safe

http://indianpharmgrx.com/# world pharmacy india

http://indianpharmgrx.com/# india pharmacy mail order

http://indianpharmgrx.shop/# reputable indian online pharmacy

indian pharmacies safe: indian pharmacy delivery – india pharmacy mail order

mexican online pharmacies prescription drugs: mexican pharmacy – mexican drugstore online

http://canadianpharmgrx.xyz/# thecanadianpharmacy

indian pharmacy: indian pharmacy – Online medicine order

top 10 online pharmacy in india indian pharmacy online indianpharmacy com

buying prescription drugs in mexico online mexican pharmacy best online pharmacies in mexico

where to buy diflucan online: diflucan best price – diflucan canada

buy cipro cheap: cipro pharmacy – cipro ciprofloxacin

https://misoprostol.top/# Cytotec 200mcg price

tamoxifen 20 mg tablet: nolvadex during cycle – tamoxifen for men

clomid nolvadex: nolvadex pills – tamoxifen warning

cipro pharmacy: ciprofloxacin – antibiotics cipro

generic tamoxifen: tamoxifen menopause – tamoxifen alternatives

cipro: purchase cipro – buy ciprofloxacin over the counter

http://diflucan.icu/# diflucan rx coupon

diflucan 1 pill: diflucan tablets price – diflucan 1 pill

cipro online no prescription in the usa: ciprofloxacin – buy ciprofloxacin

cipro for sale: buy cipro cheap – where can i buy cipro online

buy misoprostol over the counter: buy cytotec online – buy cytotec pills online cheap

buy cipro: ciprofloxacin 500 mg tablet price – purchase cipro

diflucan 100mg: over the counter diflucan pill – buy diflucan canada

http://ciprofloxacin.guru/# purchase cipro

buy doxycycline online uk: doxycycline 100mg tablets – buy doxycycline cheap

doxycycline prices: doxycycline 200 mg – purchase doxycycline online

order doxycycline: buy generic doxycycline – order doxycycline 100mg without prescription

effexor and tamoxifen: tamoxifen joint pain – tamoxifen premenopausal

cipro online no prescription in the usa: cipro – antibiotics cipro

Cytotec 200mcg price: Abortion pills online – Misoprostol 200 mg buy online

ciprofloxacin generic price: cipro 500mg best prices – antibiotics cipro

http://nolvadex.icu/# nolvadex generic

diflucan coupon canada: where to buy diflucan 1 – diflucan 200 mg price south africa

diflucan 150 tablet: diflucan tablet 100 mg – where can you buy diflucan over the counter

tamoxifen vs raloxifene: raloxifene vs tamoxifen – nolvadex half life

how to buy zithromax online: zithromax online paypal – can you buy zithromax over the counter

stromectol australia: ivermectin 5 mg – stromectol where to buy

order prednisone on line: prednisone – prednisone online australia

http://stromectola.top/# stromectol price usa

can i order generic clomid: cost clomid without rx – can i get cheap clomid prices

https://prednisonea.store/# prednisone for dogs

prednisone 20mg online pharmacy: how to get prednisone without a prescription – prednisone 60 mg daily

zithromax 500mg price in india: zithromax 500mg price in india – zithromax 500mg over the counter

stromectol drug: stromectol ireland – ivermectin buy nz

prednisone 500 mg tablet: prednisone oral – prednisone where can i buy

can you buy amoxicillin over the counter in canada: amoxicillin capsule 500mg price – buy amoxicillin online mexico

how to buy clomid price: cheap clomid without prescription – cost of clomid pills

https://prednisonea.store/# prednisone for sale in canada

prednisone 15 mg daily: prednisone for cheap – buy prednisone online no script

online pharmacy with prescription: medicine with no prescription – canadian pharmacy no prescription

buying prescription drugs online from canada online pharmacies no prescription usa online pharmacies no prescription usa

https://onlinepharmacyworld.shop/# online pharmacy without prescription

http://onlinepharmacyworld.shop/# international pharmacy no prescription

http://onlinepharmacyworld.shop/# drugstore com online pharmacy prescription drugs

https://medicationnoprescription.pro/# mexican pharmacies no prescription

https://medicationnoprescription.pro/# online pharmacy without a prescription