This may be the exception that proves Betteridge’s Law. ((The law, named for Ian Betteridge, states that any headlong ending in a question mark can be answered no.)) It’s too soon to put a number on the days remaining to the once high flying BlackBerry, but the latest financial developments suggest that the sand is running out.

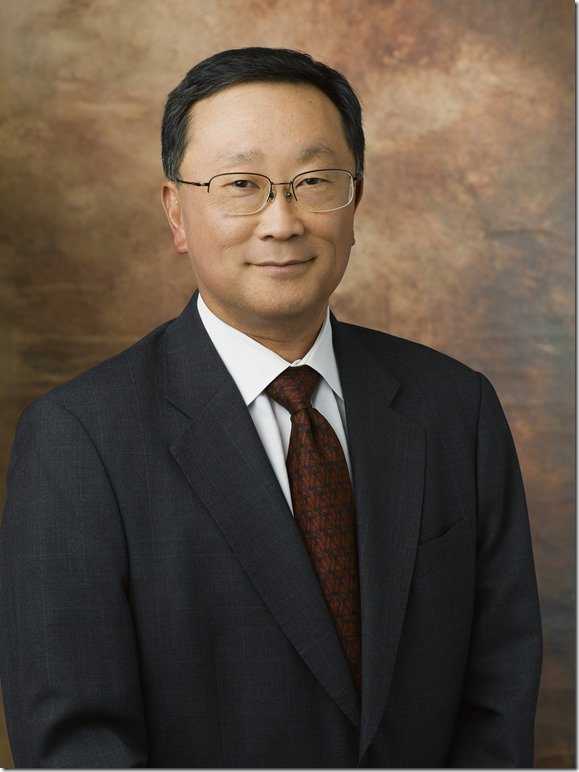

To recap: Back in September, a major shareholder, Fairfax Financial Holdings, offered to take BlackBerry private for $9 a share. That deal never got beyond a letter of intent and today it fell apart. Instead, BlackBerry is issuing $1 billion (U.S.) in convertible debt securities. Fairfax will take $250 million and plans to place the other $750 million privately. The securities have a 6% interest rate and a $10 conversion price, which becomes worth anything only if shares rise nearly 50% from their current price of $6.55. In addition, Thorsten Heins is out after a couple of miserable years as CEO. John S. Chen, former CEO of Sybase, will take over as executive chairman and interim CEO.

The big question is just what this deal does for BlackBerry. The company has been exploring “strategic options” for months, but doesn’t seem to have found any. BlackBerry doesn’t seem to need the cash urgently. It burned through $368 billion in cash in the quarter ended Aug. 31 but still had $1.2 billion is cash and equivalents on hand. The company’s plan to reduce operating costs by 50% by February should slow the hemorrhage, though we won’t know until year-end whether it suffered a big drain on cash from massive layoffs in the current quarter.[pullquote]If management had come up with a compelling turnaround plan, firing the CEO would be a very strange way to begin implementing it.[/pullquote]

It seems unlikely that this new financing can do more than delay the inevitable. The company has been trying to sell itself for months with no takers, at least not at a price that the board would accept. If management had come up with a compelling turnaround plan, firing the CEO would be a very strange way to begin implementing it. BlackBerry’s relevance to the smartphone market is trickling away, day by day.

The remaining question is what’s in this deal for Fairfax. Maybe it’s CEO, Prem Watsa, is a true believer who thinks BlackBerry is on the verge of a comeback. The financing is structured in such a way that Fairfax and whomever else it gets to take the BlackBerry debt stand to make a lot of money out of even a modest recovery, especially if the stack price tops $10. But there are less happy possibilities. Writing in the New York Times DealBook blog, Steven M. Davidoff speculates it may have more to do with Fairfax’s standing in an eventual BlackBerry bankruptcy:

One way to look at this investment is that it positions Fairfax and the other investors for a BlackBerry bankruptcy. BlackBerry has no long-term debt on its balance sheet, so this investment would now jump Fairfax ahead of the equity line for controlling BlackBerry in any bankruptcy proceeding. And remember that BlackBerry is a Canadian company, so the bankruptcy would be there. Canadian rules are different than those of the United States, but they do allow the creditors to have a substantial say in any restructuring plan, including approving it.

It’s been a long, strange trip for BlackBerry. But the end of the line is getting close.

But wanna say that this really is quite helpful , Thanks for taking your time to write this.