Reports from Bloomberg suggest Apple is working on designing a new piece of silicon specifically for AI or more likely Machine Learning. Anyone tracking semiconductor trends could predict this since nearly every company working on AI/ML is using or designing a companion chip like a dedicated ASIC or FPGA for their AI efforts. At a fundamental level, these dedicated companion processors that are programmed for specific tasks are better suited for a range of tasks and AI is one of them.

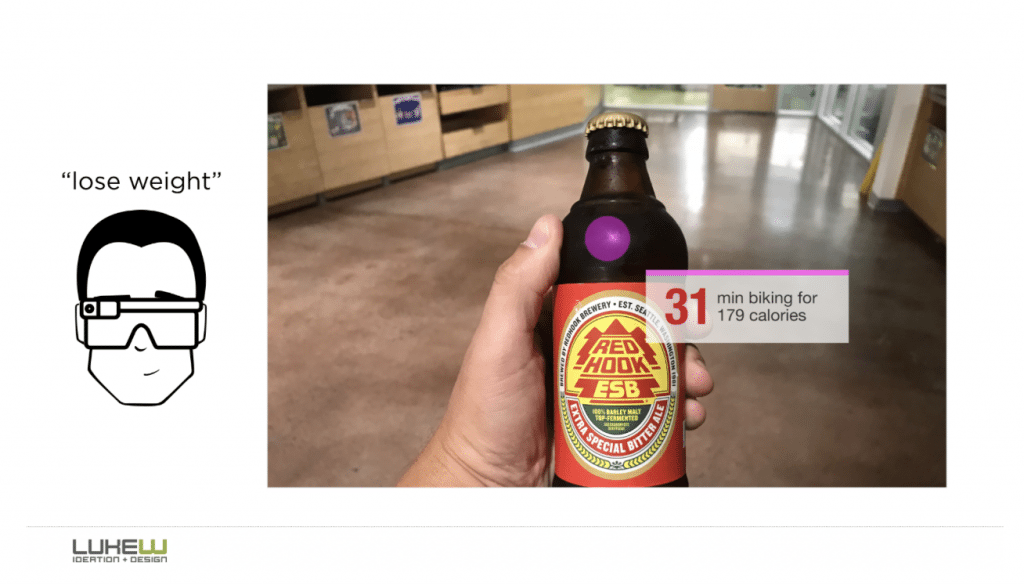

Most companies are using these companion processors for inference, which is what happens after the computer is trained and you ask it a question. The trend in machine learning is to use the CPU/GPU to teach the system and then use a dedicated co-processor to handle the inference. Nearly all benchmarks I’ve seen confirm this process speeds up the computers ability to answer a question dramatically. A practical example of something like computer vision is once you have trained a system (using the CPU/GPU) to recognize a dog the dedicated AI chip for inference is what is doing the work to identify the image is a dog. Experts in the AI/ML industry as well as some of the best silicon architects I know have concluded this heterogeneous architecture is the right path forward.

This is why it makes all the sense in the world for Apple, a company who looks to design every piece of silicon it can that will give their products a superior and differentiated experience, to develop a dedicated chip for their AI efforts. I suggested this very thing last year when we discovered the iPhone 7/7 Plus had an FPGA in it for the first time. This FPGA was being used for sensor fusion (to manage a number of the sensors more efficiently, but it signaled Apple understood these specially designed co-processors were optimal for efficiency and performance.

So What Might This New AI Chip Do?

A high-level point I’ll make is here is much of Apple’s machine learning applications are hiding in plain sight, and you wouldn’t recognize them if you didn’t know what you are looking for. For example, when you are at your office, or any location not your house, and you pick up your iPhone, and it says it will take you X number of minutes to get home. That is Apple’s machine learning at work looking at your location, looking up the traffic/routes, and letting you know its estimate of your time to get home. Or when a get a phone call from a number you don’t recognize, and under the number, there is text saying “maybe John Smith.” This is Apple’s machine learning at work looking on your device for this phone number in case it is associated with this contact (like in an email) even if you didn’t add the number to your contacts. Or when you pull up Apple Maps to look for directions and start searching for an address for an upcoming meeting, and below the search box the address pops up automatically because it saw this address in your email. That is Apple’s machine learning working indexing address data in your email and date/time information, and it anticipated you might look for this address at some point. All of this happens behind the scenes and it is a complex series of algorithms which accomplish these feats, and they are all tactics in machine learning.

One of the things a casual iPhone owners may not recognize is that iOS is always learning about them, and to a degree, becoming customized uniquely for them. iOS is a learning operating system that conforms to its owner. While this is still very early in how it is done, this is essentially how Apple is designing their operating systems and apps, and this AI chip will likely move this ambition forward in leaps and bounds.

Another way we may see the benefits of this chip right off the bat is with Apple’s rumored new facial recognition system. This solution will undoubtedly have extremely sophisticated software working behind the scenes for what is being called FaceID. The system will need to recognize your face in the dark, from all angles, be secure and not fooled by a picture of you so will require 3D mapping, as a few examples. But some new recent leaks even suggest the front facing camera sensors may indeed gain some intelligence as well. This feature in particular, suggested the iPhone will know when you are looking at it and add some intelligent context to things like notifications in this case.

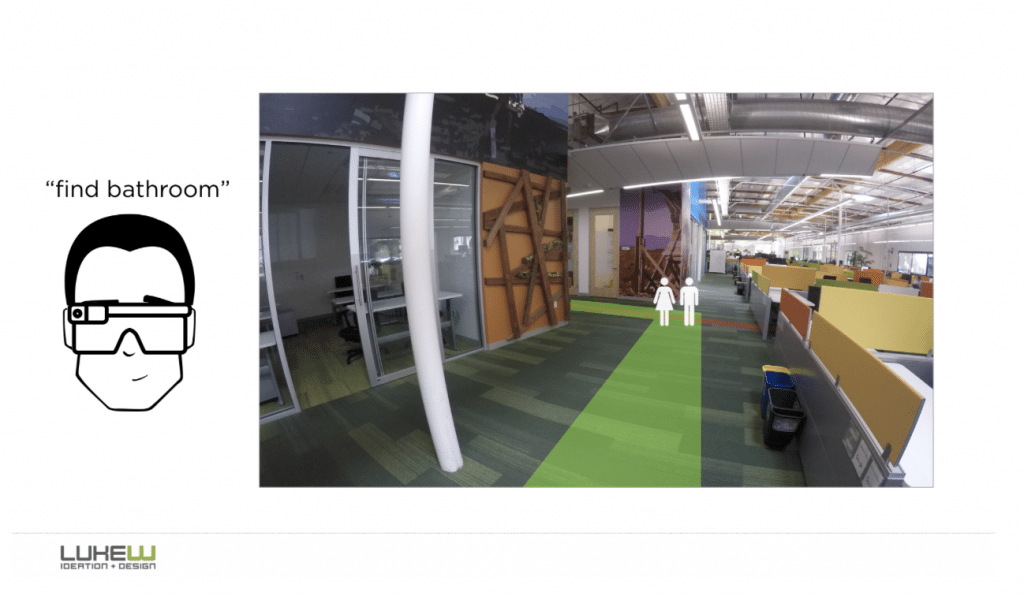

Given computer vision is one of the most computationally intense use cases out there, I suspect a range of intelligent features to come to the iPhone camera app as well. This can expand beyond simple effects to even identifying people in real time, not taking a picture if everyone is not smiling, and even using Siri more specifically for things like a selfie. While I appreciate Apple’s Siri promos with the Rock when you ask Siri to take a selfie all it does is launch the camera but not take a selfie. I hope this evolves so when I say “hey Siri take a selfie” the app opens and Siri then says “let me know when you are ready.” Then I say “ready, ” and it waits until I’m smiling and the picture is the best it can then take the picture. Just one example of others I can think up.

The bottom line is, a dedicated and specifically designed piece of silicon from Apple’s world class design team makes all the sense in the world. Apple is uniquely positioned to do this and provide a superior AI experience at the core of their learning operating system. The competition will try, but it will be extremely difficult to match the on device learning from Apple.

There is a quote that has been bounced around, with some debate to who said it, that says “a computer should not ask you a question it knows the answer to.” This has been a notoriously difficult but I suspect Apple’s custom effots in silicon and tuning that software specifically toward more intelligence and adaptive OS/apps we will start to get closer to this vision. We have talked about Apple designing an anticipation engine and I’m certain this AI chip will help greatly in this effort.