We have known for a while Disney planned on launching a new digital subscription plan around Disney’s strongest brands. Already have a digital subscription offering for ESPN (ESPN+), and owning a majority stake in Hulu, Disney+ will round out Disney’s subscription offering and give them an extremely strong position as the way we pay for entertainment content changes. Before looking at what strategic advantages Disney has in this race, and the impact on the competitive market, it’s important to know that cord cutting (in the US) is accelerating at rates faster than previously assumed.

Consumers Want TV in New Ways

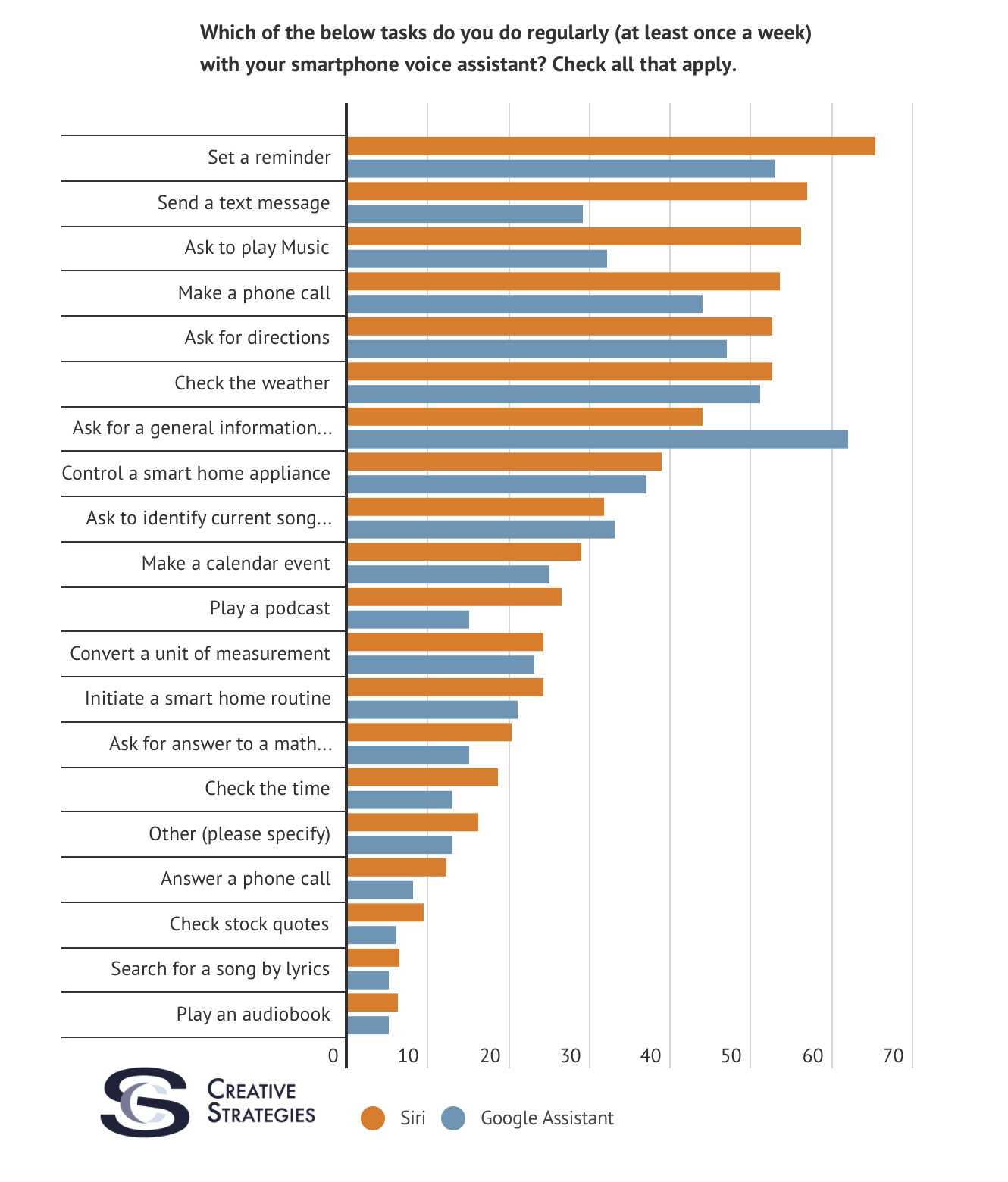

There are undoubtedly many factors to why cord cutting is accelerating. Luckily, I have multiple independent studies that all confirm the same accelerating trend of US consumers moving quickly to new services like Hulu and YouTubeTV, both making up the most popular new TV services on the market.

From a recent study on services we ran at Creative Strategies, 24% of respondents indicated they already canceled their cable subscription and are using streaming-only services for their TV/entertainment content. According to another research study run by UBS Bank, 33% of respondents in their study indicated their interest and consideration to cut the cord and go all in with streaming services. Notably, that 33% number is up from a similar study they ran in May of last year where it was 18%. Similarly, in our research study, 17% are actively researching switching from cable to streaming only. Interestingly, only 19% of consumers in our study said they are happy with their current cable bundle. Many of them indicated the only reason they are not changing at the moment is because of a bundle deal with the Internet.

One juicy nugget of insight I found in the UBS research study, was in the past few years consumers were doubling up on their cable subscription and a subscription to streaming TV service. Their most recent study found that number dramatically declined and those consumers were mostly streaming only now. What that tells is was people were not sure they could get all the channels and content they wanted in a streaming service, so they kept their cable as a backup plan just in case. The newest data suggesting they dumped cable and went streaming only is a big indication those services like Hulu and YouTubeTV do indeed deliver the same experience as cable and satisfy the needs of most of the market. This should be the most worrying stat for cable companies.

Traditional cable TV subscriptions have already been trending downward, and most forecasts for 2019 have traditional cable subscriptions declining 5-8% during the year. Consumers are waking up to the idea that streaming services actually give them more value for the money than their traditional cable providers and by the end of 2019 we are very likely to see north of 30% of the US market moved to a streaming TV package.

One last point here. Almost universally, in our study and others, younger demographics have no intention of signing up for traditional cable packages and are starting their adult lives all in with streaming. Which tells you the cable monopolies only have the older demographics as customers, and that won’t last forever.

Disney’s Global Brand

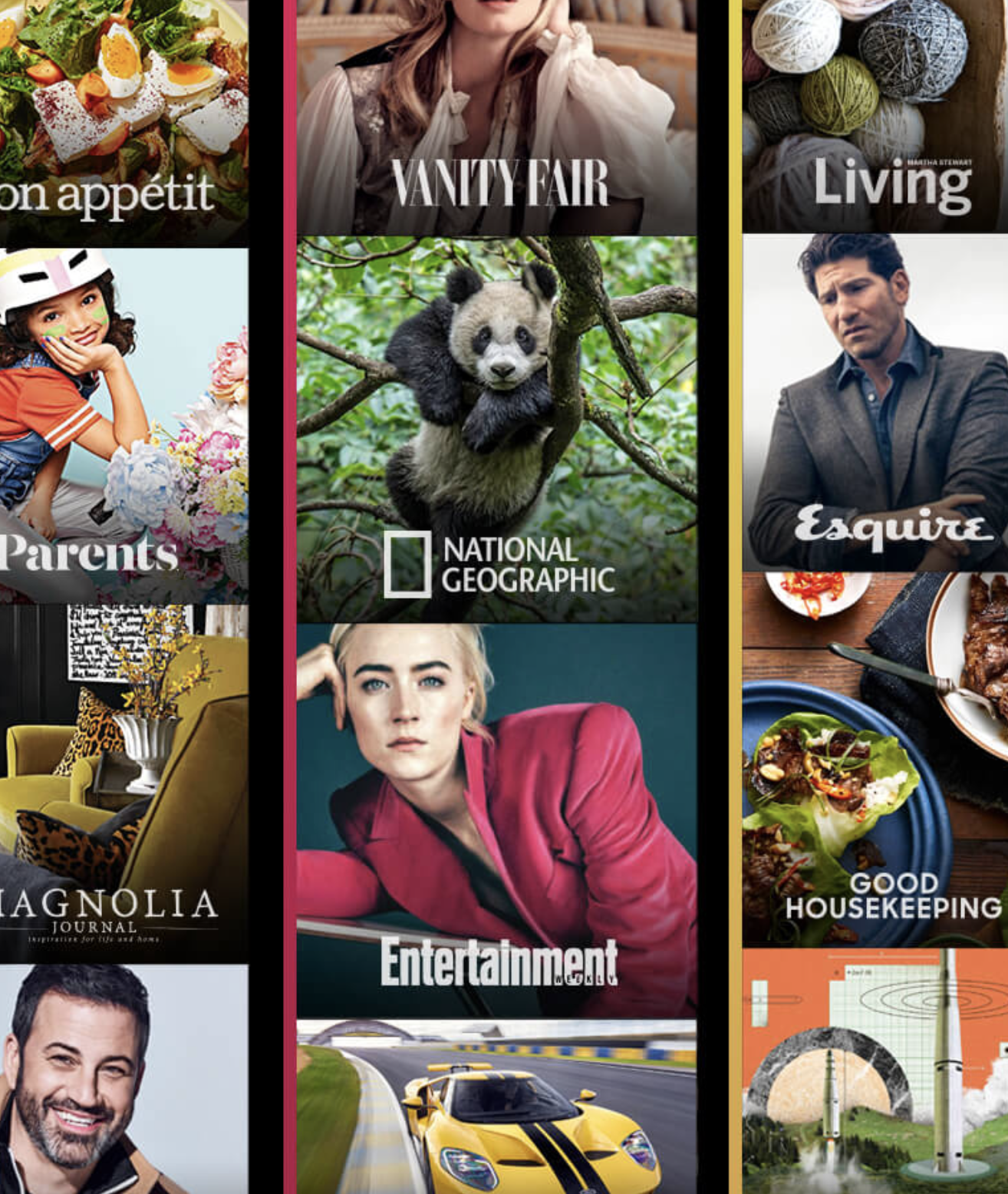

There is an equation which did not get enough attention when talking about Disney’s upside and that is their brand. Of all the streaming/online entertainment options on the market or coming, only Disney and Apple have a truly global brand. While you can assume many global markets know of Amazon or Netflix, the reality is they are not nearly as globally strong as Disney or Apple. Both companies abilities to attract a global audience and bring their services/content to more markets than the competition should be something to keep in mind.

Another factor that did not get enough attention is the retail footprint to Disney. Disney parks see over 150 million people every year, and their parks are going to be a big part of the strategy to market Disney+. Similarly, Apple has over 500 million retail visitors each year, and Apple is already aggressively pushing Apple News+ at their retail stores, and when Arcade and AppleTV+ come out, you can be certain they will promote those heavily in store.

Disney+ Impact on the Market

Competitively, I’m not sure people are correctly interpreting Disney’s subscription packages impact on the market. Disney+, in particular, feels like it will make it challenging for everyone outside of Netflix, Amazon, and Apple. The main reasoning for this is Disney+ price. For example, CBS all access is $5.99 a month and feels quite limited now next to Disney+ at $6.99. Disney’s price may hurt the competition the most making it very hard for them to price near Disney and thus will only see uptake at a price much lower than they want to charge in order to make a profit.

Rumors from within Hollywood circles is most networks, and even some studies, want in on the streaming services, but I think Disney will make it very hard for many of them to succeed.

It is also interesting to think about what Disney can do with Hulu. Conceivably, Disney is in the strongest position now to offer a holistic service offering including premium content, live and network TV access. I would fully expect Disney to offer a bundle with Hulu and Disney+, and possibly even some excessive experiences from ESPN+ and create quite a compelling service.

From the recent research reports I mentioned, Hulu remains the most dominant current streaming TV service by market share AND has the most mindshare in terms of intent to subscribe from those looking to cut the cord. Aligning the trends I outlined here, Disney’s presence behind these offering will only accelerate cord cutting, and likely drive Hulu to a commanding position in the market from a content distribution standpoint.