Ben Bajarin and NPD’s Steve Baker get together to discuss what tech products were hot at holiday and what the broader US retail holiday trends were.

Author: Ben Bajarin

The Smartphone Market’s Plight and the Mature Market Mindset

The once often discussed smartphone market has certainly lost its luster in the recent months. There aren’t too many interesting observations to make at the moment, but there is still one major theme I think is worth letting sink in as we may see this same movie play out again in the future.

As an analyst, one of the things I constantly watch for is consistent patterns in business, a market, or within an industry. The observable and repeatable pattern of a market shift from hardware, to software, then to services (which I’ve written about before) remains a baseline understanding. Related to the smartphone market, I think another set of fundamental observations have emerged that are likely going to keep repeating for the foreseeable future.

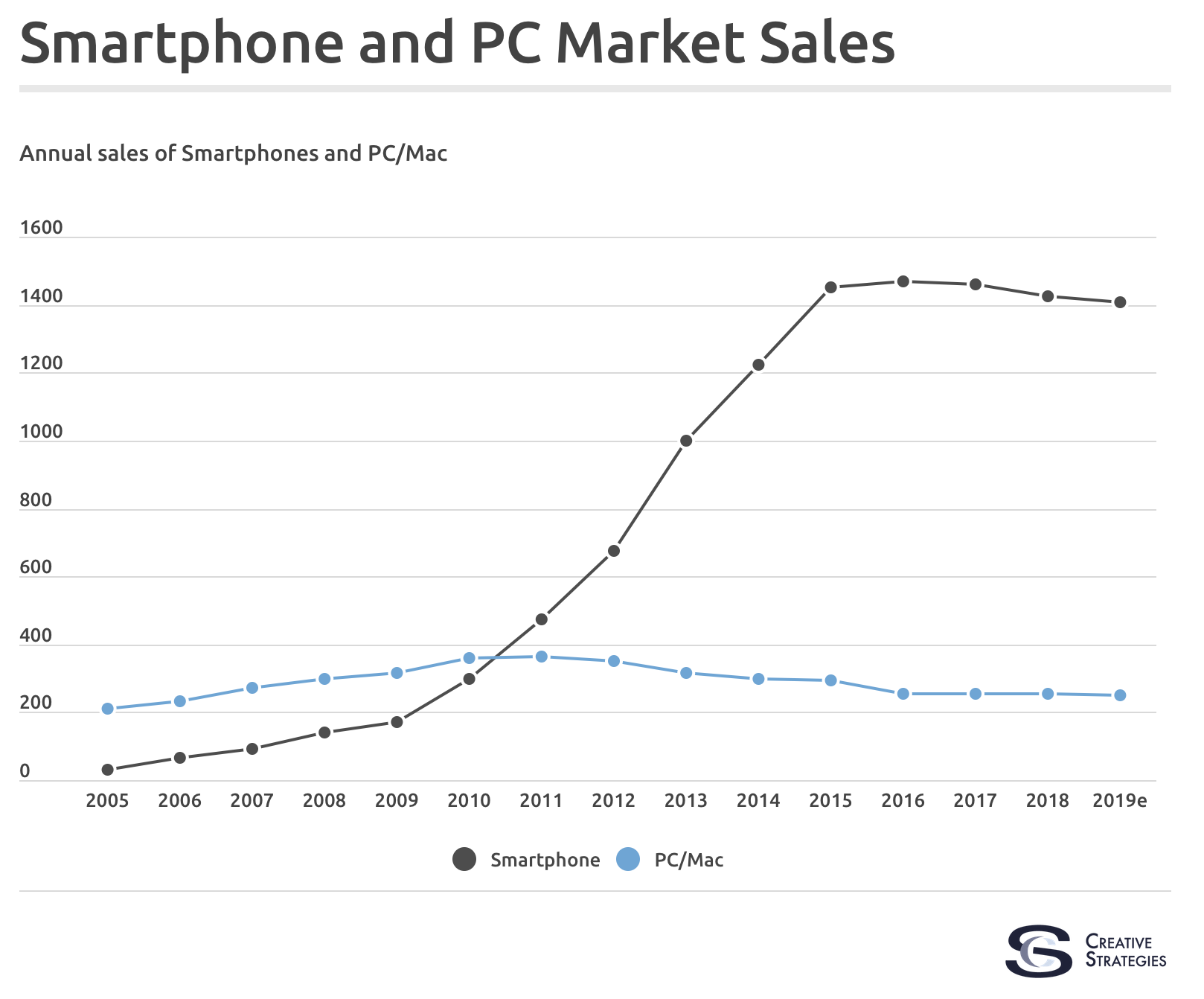

Thanks to the PC/Mac market, we have been able to observe the patterns from that categories maturity and now see similar patterns in the smartphone market. One of the patterns we hypothesized was the smartphone would follow a similar pattern as the PC market primarily, that the smartphone market would see a bit of a slowdown just after its peak year. As you can see from the chart below, the patterns were quite similar, and both markets had a slight dip after their peak and then began to stabilize.

What was predictable in both markets, was when the hardware reached a certain point and innovation slowed down, refresh cycles began to elongate. That is the sole reason for the decline as it shows up in the trend lines once consumers en masse start upgrading their devices more slowly. Some refer to this as the good enough phase of a product cycle which merely means the product is perceived as good enough and the newest features are not as much of a draw. We are entirely in this phase with both PCs and smartphones.

Another observation, I found particularly interesting, is in both the case of the PC and the smartphone markets ASPs began to rise at about the same time they both peaked and then stabilized. Meaning, an ASP rise is an early predictor that a category is near its peak. Having studied markets in their mature and post-mature phases this ASP rise coinciding with the maturity of a market makes a great deal of sense. In mature markets, consumers become acutely aware of their needs and wants, and this mindset is the basis for their decision making filter.

This refining of their needs and wants causes them to be much more aware of what draws them to a new product. This is the primary reason why when we survey consumers on what causes them to start to look to upgrade a PC or Smartphone the dominant response is “when it is old and/or slow.” The mature consumer mindset becomes harder to attract to the newest innovations because what they currently own is good enough for their needs.

Innovations Slowdown

In the case of both PCs and Smartphones, it took a good many years for the mature market mindset to set in. In the early phase of the market’s growth, new innovations remain highly attractive to new and existing customers. The ramp in said categories growth is due to both more frequent replacement of devices and the acquisition of new users.

This cycle can be long or short depending on competition and the pace of innovation, but the inevitability of predicting the category slowdown comes when the observable pace of innovation slows down and becomes more incremental. One of my favorite sayings, when I explain this in presentations on the market, is the purpose of innovation is to shake off the crust of contentment in the eyes of consumers. Consumers easily fall into a content mindset which puts the burden on the innovator to keep pushing limits if they want to maintain a growth cycle and acquire as many customers as possible.

In both the PC and Smartphone markets innovation has become incremental. The PC market stabilized after the initial decline, and it’s reasonable to assume the smartphone market will do the same. Even as we come to the cusp of things like foldable displays, and other new form factors, I don’t believe we will see the market turn to growth overall. There will be pockets of growth, but the market itself will remain likely flat.

My advice to device makers in this phase is always to focus on pain points. It is much easier to keep solving pain points than try to focus on pure innovation/invention. The latter may happen as a result of solving a pain point, and in that case, it will make rapid adoption much easier.

I call out these observations to both make points about these two markets, the PC and the smartphone, but also to lay a foundation for a set of observations that help us become more knowledgeable about whatever next new thing may come to market. For example, let’s say augmented reality glasses become a thing. If so, we can expect the market cycle to be similar to both what we observed in PCs and smartphones and will, therefore, be more aware of the opportunities and traps related to the market. We will also be on the lookout for the different developmental phases of the market and be much more informed about what to watch for as it reaches maturity.

The nature of competition changes dramatically at these different market phases, which is why the observations become important from a strategic perspective. While we can’t predict the future, we can see the patterns in history that give us the blueprint for future market directions.

5G and the Next Cycle of Software Innovation

I find the 5G debate interesting. There is always a good reason to be skeptical when on the cusp of new technologies, but there is also a great deal of misunderstanding around 5G that many of the authors here at Tech.pinions have tried to address. As we transition to 5G, we inevitably get many benefits. The most obvious one is more bandwidth capacity. Not only will we get faster internet connections wirelessly, but the wireless networks themselves will also be able to sustain high-speed bandwidth for their customers at a concurrent point in time. Meaning, the more people on a particular cell tower at a time won’t slow the network.

The benefits to this go beyond the quality of service as we all like to play games, or stream movies to our devices and we want both high quality and low-latency when we do so. The more people on the network doing this at the same time the worse the experience has been historically. 5G looks to change this, but it won’t be an overnight fix.

While I have no doubt the foundation to bring 5G will be worked out, it is the broader benefits of that foundation I’m most interested in.

New Richer and Immersive Media

In some ways, the Fortnite phenomenon will likely open the floodgates to a new wave of innovation, for which 5G is essential. Fortnite is best understood as not just a game but also a hangout to the Gen Y and Z masses who spend the most time on it. This experience may become the new bar that software and service providers must hit to compete. The idea that millions of people, and someday hundreds of millions of people, can simultaneously experience and interact in real time in a rich digital environment is both compelling and uncharted territory.

This uncharted territory is where I think the most interesting innovations, which 5G will enable, will spring up. If we look back at 3G, then 4G, we see how each network evolution led to new software and services. Notably, each tended to enable a much more visual experience. This is true looking back historically at the Internet’s evolution as a whole. Each time we saw a speed bump in Internet speeds the web experience itself became more visual and media rich. Which stands to reason, the shift to 5G will bring even more immersive, interactive and visually rich software and services.

For a glimpse of where this trend I like to call “be together even when apart” may be heading check out this app called Squad that is targeting teens and allows them so screen share from their mobile device and interact with apps together on one device.

This app has been exciting to watch my daughters use with their friends since I told them about it. The first thing they did was work on homework together. Notably, it was to share notes and go over specific answers to homework together. But the compelling part of this that catches my eye builds upon how much I notice my girls FaceTime with each other while doing homework. This app has allowed them to continue to FaceTime but also add screen sharing into the equation on their iPad’s. Essentially, this is an integrated approach to collaboration with a consumer-friendly spin. And it requires a significant amount of bandwidth even to be usable, which adds to the 5G story as enablement for innovation around this space.

Using just Fortnite, and Squad as an example, a clear picture emerges as the kinds of new apps and visual/immersive experiences 5G will enable. But it will also start to set the stage for a broader augmented reality future.

5G and Augmented Reality

We can debate the merits of virtual reality, but it seems a foregone conclusion that augmented reality will bring more tangible and real-world value to the mass consumer market. This is an area of software design where 5G will help the most due to the demands on both the device and the network.

Augmented reality is an area where I don’t think we have yet to scratch the surface. We have seen signposts of where this market may be headed, but I can confidently say I don’t think we have begun to see the most interesting augmented reality apps and experiences that will generate demand among mainstream consumers.

What makes all these related points most interesting is when we understand how historically each leap in broadband led to a software innovation cycle. We can include, for the first time I think, the element that in the 5G cycle we will see more innovation in services than ever before. In part, some software experiences will transition to services models, and in some cases, we will see new services models and businesses emerge.

While I’m keenly aware of people not wanting to get caught up in the hype of 5G, I do think it bears remembering that it will likely lead to an innovation cycle in software and services and being on the lookout for these trends will benefit the industry observer.

The Netflix Effect

Netflix is causing profound changes to happen within the entertainment industry. While my opinion, I believe Netflix is the gold standard for a streaming service, sans any live TV option. We can debate how crucial live content is to Netflix’s service, I’m still not convinced it is that important, but where Netflix is causing the most turbulence is in original series.

I outlined why in a post a wrote a few years ago, where I called Netflix’s actual business model stories as a service. If I were to give the edge to any volume producer of episodic based stories I give it to Netflix. Netflix produces a consistent stream of quality episodic content and stories, and in many ways, their model is more aligned with a book than a TV show.

Observationally, the big networks like CBS, ABC, NBC, etc., do a good job with hit shows which are well produced single episodes. Their goal is more the story of the individual episode than the story of the entire series. The networks deliver most of their shows to be stand-alone productions, with a mild continuing narrative, but the emphasis is on a single entertaining hour than a story that plays itself out over a dozen episodes. Netflix’s focus, and Amazon’s in this regard is more on the story arc than the encapsulated single episode. This is where their content model is much more like a book than their competition. I’d argue the latter is more compelling, entertaining, and essentially more in line with what drives customer engagement. This is also the underlying psychology driving binge watching. It is extremely common to binge read more than one chapter in a sitting of a great book, and thus the behavior follows for episodic content when there is a continuing compelling narrative.

I’d also argue, that the model Netflix is betting on, which Amazon follows, is much more aligned with their customer-centric business model of direct customer subscription. The model the networks use which is more focused on the story in a single episode than over the series is more aligned with the network business model of advertising supported.

The latter point convinces me the network attempts to go directly to a consumer like CBS has done and NBC has announced is likely to fail. To be successful here, they would need to entirely change their content production strategy to be more narrative than single episodic. While these networks have had success doing this before, shows like Lost, for example, were highly narrative based, it is not something they do as consistently or repeatedly as Netflix or Amazon have demonstrated.

The wholesale shift to subscription-based streaming of entertainment content is upon us, and it is an era where I’m not sure what the traditional cable networks play. At the moment, I don’t feel they are well positioned. However, there may still be a role in a broader bundle, perhaps with Amazon Prime, or another kind of light service like Apple may offer. But I can say with a relatively high degree of certainty their ambitions to go directly to the consumer are likely to fail.

Disney the Only Other Competitor

While Apple remains a wild card, it seems that Netflix, Amazon, and Disney are the three who have the best track record for a direct to consumer media and entertainment subscription. Regarding overall budget, only Disney outspends Netflix, and a good portion of Disney’s budget goes to live sports. For example, Disney’s sports rights made up just under $8 billion of their total ~ $13 billion content spend in 2018 alone. The rest they spent on original content. Netflix, in contrary, spent just over $12 billion on original content in 2018 greatly surpassing how much story based original media Disney spent. While Disney’s subscription cost is a bit lower than Netflix’s, one does wonder how much more Disney has to increase on original content to drive their new subscription service.

Disney’s brand is powerful, and they have super-power infused branded content to market and drive the subscription. Initial forecasts I’ve seen project Disney acquire approximately 3-5 million subscribers to this new service in 2018. To put that into context, Netflix has consistently added 5 million new users in the US every year. Given Disney’s brand, marketing power, lower price, and unique content, it seems reasonable 5 million subscribers in the first year is achievable and may even be conservative.

Overall, it is clear this shift is happening, and Netflix has had an effect on the entire industry causing forms of turbulence and even some disruption among the traditional entertainment industry players. Netflix is not without its challenges. Their recent price increase validates many observers concerns that unless they see significant S-curve growth cycle, they will have to keep raising their prices to existing customers to justify the massive annual content spend.

The big concern that still lingers is the overall tolerance to pay for a variety of content services from consumers. The worry is consumers will eventually suffer from subscription burnout paying $X to Netflix, $X to Disney, $X to Apple, $X to Amazon, and so on. This is uncharted territory since historically consumers have gotten value and become accustomed to the bundle model for media and entertainment. A la carte subscriptions change the nature of competition, and in a way, competition for share of wallet among these services becomes more fierce than in a bundled world. At this point, it is tough to say which model is better for consumers in the end.

Apple’s Services Playbook

It’s hard to have a conversation around Apple that does not include Apple’s services business. Rightly so, as the services revenue for Apple is likely to be one of the largest contributions to their overall company growth as well as one of the more predictable revenue streams. In Dec of last year, I wrote an article called Apple’s Services Challenge for our subscribers to our Think.tank industry analysis service. In that article, I point out how Apple’s services business is certainly an opportunity, but it will also be a new challenge for the company.

The challenge can be summed up as Apple being required to think beyond their own hardware for services support. In Apple’s Service Challenge I wrote the following:

A point about services I think is important to make is how a consumer will often separate the money they shell out for a service from the brand that offers it. To say it another way, services are neutral. The nature of subscribing to a service has historically assumed that service is widely available where the consumer wants it. The caveat being things like cable TV service (until late) or something like satellite radio, but neither of those models has ever yielded significant scale in the wider consumer market. Services that do scale take a more horizontal/modular approach and benefit from being as widely available on all shapes of hardware. This will be true of Apple’s first-party services as well. The consumer mindset is one of “If I subscribe to Apple Music, I feel I should not be limited to just Apple hardware to get the most out of my monthly subscription.” Or said another way, consumers will find subscribing to a service a harder sell if it is not more widely available. It is simply the new expectation in the digital age and wanting content anytime, anywhere.

Services growth will require a new playbook from Apple. One that incentivizes them to embrace the hardware, like Apple Music in the case of Sonos and Amazon Echo device. Hardware + platforms like the case of Samsung, LG, and Vizio TVs (more to come I’m sure). And platforms, like the case of Android, Windows, and any other platforms that may emerge and grow to take enough share for Apple to prioritize. Apple’s embracing of third-party hardware and, in some cases, competing hardware was entirely predictable, yet it seemed to catch many off guard. This is simply the services playbook, and Apple is now required to play by some new rules to grow their business.

Where Apple’s Playbook is Unique and Differentiated

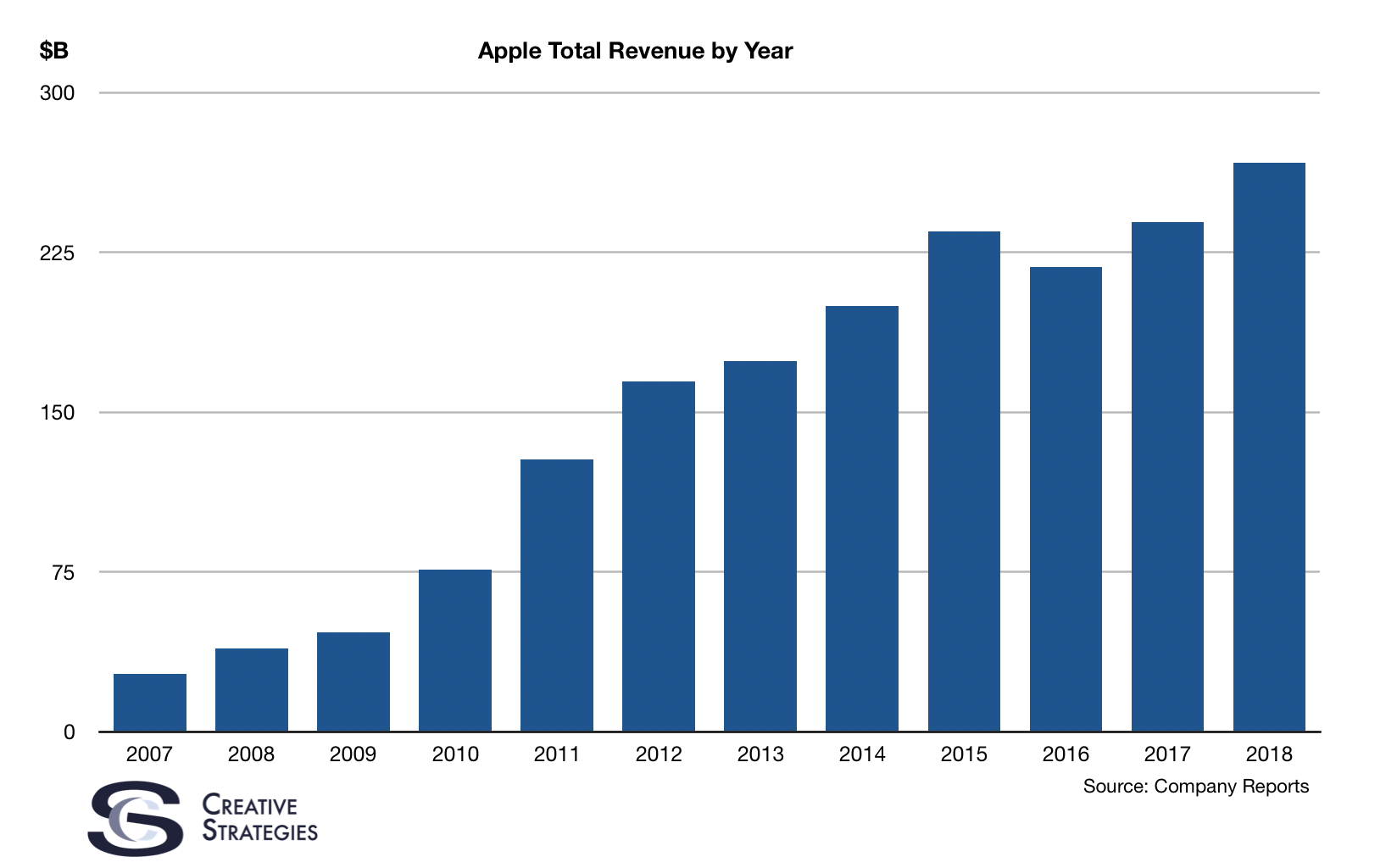

Apple has accomplished many industry firsts. No other company in the history of consumer electronics has sold, at scale, a premium computing experience. Apple sells north of ~200 million iPhones every year, at an average ASP above $700 and Apple stands alone in this feat. Apple set financial records, App Store records, and the list goes on. But ultimately, what makes all these achievements possible is Apple’s monolithic vertical integration.

While it is true, some part of their services strategy will require them to break slightly from their vertical strategy, and it will not change the overarching strategic imperative to bundle hardware, software, and services together tightly. Apple has set the bar when it comes to hardware and software integration, and if they can bring services into this equation and things like Apple Music, a future TV/video service, Siri, and other new core experiences and out-integrate the third parties then it gives their hardware and software strategy even more strength in differentiation.

Looking back at a hindsight view of Apple, most of the focus on analyzing Apple as a hardware company. While I’ve always more strongly argued Apple is a software company the reality is they are equally a hardware and a software company. Now that the services business gets a great deal of attention, people like to wonder if Apple is, or should turn into, a services company. Such logic falls into the either/or fallacy that so often plagues Apple analysis. Ultimately, Apple is not a hardware company or a software company or a services company. Their future depends on them being hardware, software, and services company with each pillar deeply intertwined and integrated together.

In this equation, Apple’s first-party services a consumer subscribes to will be available on third-party hardware and competing platforms because it is unreasonable for Apple to assume every one of their customers will ONLY own their hardware. As I outlined, consumers will separate a service like Apple Music, or an Apple TV/video solution from Apple’s total hardware and if they pay $10,$20, or even $30 for an Apple content service they will expect that on any hardware they choose such as a smart speaker or TV. But that does not mean Apple does not care about a product like HomePod or Apple TV. What it means, in simple terms, is Apple will make those products the best endpoint to consume their first party services because those services will be more deeply integrated into Apple hardware and, therefore, will be the best of the Apple experience overall. This does not mean Apple’s services won’t work well on third-party hardware, just that Apple’s goal is to make their services the best on their hardware. Ultimately, this may end up being a catalyst to make Apple’s hardware and services even better.

Where this gets quite interesting is how Apple will be competing with companies they have not directly competed with before. In content, for example, they are now competing or will be competing with Amazon, Netflix, Disney, TV networks and even movie studios. While these companies and others which will enter the fold as new competition for Apple will excel is that they are first and foremost services companies and, for the moment, said services focused companies will do this better than Apple. Apple will do hardware better than most, if not all pure-play services companies, and they will likely meet in the middle in software. Each company brings a unique element to the equation but looking forward I find many fall into the temptation to emphasize the value of services and weight them more heavily than hardware. When the reality is, consumer electronics has always been a hardware-focused business and consumers are drawn to hardware objects of desire.

For Apple, and specifically, the management team and company culture are entering a period of testing as the historically unprecedented cash machine of iPhone begins to decline slightly and quickly stabilize as a revenue stream. Apple needs to find new growth engines, and while that can certainly come in the form of new hardware products, management needs to establish a clear playbook for the services business and challenge their people to bring the Apple process to new territory.

FTC vs. Qualcomm: My Analysis of the Case Up To This Point

You don’t have to look hard, or far, to find the most high-profile legal battle going on at the moment. The case with the most industry implications and perhaps one of the most important wireless/telecom related legal dispute of our time is the FTC bringing anti-trust allegations against Qualcomm.

There is a vast array of fascinating dynamics about this case which has already had extremely high-level executive testimony thus far. I’ve never attended a court case, and since this one is in my backyard, a San Jose district court with the Honorable Judge Judy Koh presiding, I wanted to see the action for myself.

The legal chess match is something I find interesting at an intellectual level. I greatly enjoyed this part of what I witnessed on Friday. Part of this is their legal team’s strategy to bring out specific points or counterpoints in evidence, including witness testimony, and some of it is what each sides legal team fights to have sealed or unsealed in evidence, which means, what the public can see vs. what only the Judge can see. Overall, I think I fully understand what the FTC has built their case around and how Qualcomm intends to defend themselves against that narrative. While the case is still a few weeks away from being concluded, I’ll cover what I think is happening up to this point.

What the FTC Wants To Prove

The FTC has a few bullets in their gun. They firstly continued to seek to prove that Qualcomm’s business model is unique to Qualcomm. They essentially brought evidence and witnesses in an attempt to demonstrate that Qualcomm’s business is unique in the industry. The business model in question is not licensing of IP or selling of chips, and it is what their legal team calls “no license, no chips.” Essentially, and this is true, Qualcomm does not sell chips, meaning Snapdragon SoC chips, modems, and other core computing bits of silicon to any vendor who does not also sign a broader license with them. It is important to note there are chips Qualcomm sells that do not require a license but the most important ones that are also key innovations from Qualcomm are the chips which require a license.

While all these license agreements are 100% negotiable, the FTC lawyers went to lengths to prove in evidence and witness testimony that only Qualcomm has a no license, no chips business model. This is tactic number one for the FTC.

The second strategy of the FTC is to prove that the business model unique to Qualcomm leads to higher costs due to licensing, royalties, etc., and the effect is less competition. This is particularly important when it comes to licensing technology to a rival chip maker like Intel, Samsung, HiSilicon, etc. Qualcomm owns nearly all the patents for CDMA; therefore any competing modem maker would need to acquire those patents to make a CDMA modem and sell it to the broader market. I find this particular dynamic interesting because Qualcomm started as a licensing company and essentially created the standard, and underlying technology for CDMA. Those licensing standards fall under FRAND (Fair Reasonable and Non-Discriminatory) pricing. But the irony is, at least from the case of the FTC, that competitors to Qualcomm are complaining about unfair business practices from Qualcomm when in fact they would not be able to compete at all in the market if it was not for Qualcomm’s technology IP around CDMA.

As a result, the FTC expert witnesses are chiming in about Qualcomm’s monopoly power around CDMA due to the massive investment in IP and technology around CDMA Qualcomm spent billions in R&D to achieve. Qualcomm had the dominant position from an IP and technology standpoint concerning CDMA/LTE and possibly even 5G. But the FTC needs to prove that dominant position leads to not just monopoly pricing, meaning outside of FRAND, but also that it led to harm in the industry and for competition.

The Burden of Proof

With the fundamentals tactics of the FTC clear, the question is are they making strides in proving not just an abuse of market pricing but also the said practice led to market harm. So let’s explore a few of the points.

Qualcomm’s unique business model. While the FTC did a good job proving Qualcomm’s business model is mostly unique to them, there was some scrutiny of this point. When Apple’s head of procurement Jim Blevins was asked if any other chip maker required a license to buy chips he noted that only NXP came back to him with such a requirement. But he went on to say that when he balked at that request NXP quickly reorganized the terms and dropped that requirement.

What the FTC did a good job of proving was that Qualcomm’s business model, while not entirely exclusive, is much more demanding or rigid. Testimonies from key witnesses outlined how not only would Qualcomm not drop the requirement for a license to buy chips, but that the license from Qualcomm included a cross license of said companies IP. This was one of the areas that Apple, rightly so, had a huge problem with. The FTC proved that Qualcomm not willing to budge on key terms, as NXP did, meant that they felt they had more leverage and thus the power to dictate terms.

Interestingly, I learned Apple never signed a license with Qualcomm despite Qualcomm’s push for them to sign a license. Apple got around this because their suppliers had signed a license with Qualcomm and thus the two companies put together a series of agreements to bridge some of the gaps. Two key parts of this agreement that came out were Apple’s agreeing to exclusivity with Qualcomm for a period three years. During that agreement, if Apple remained exclusive to Qualcomm, Apple would receive incentives to the tune of one billion dollars. Interestingly, the FTC wanted these incentive payments to come across as Qualcomm incentivizing Apple to not buy from competitors, namely Intel. But the Qualcomm defense, with Qualcomm CEO Steve Mollenkopf, brought out that it was Apple that demanded the one billion from Qualcomm partly because of the engineering costs associated with a modem change. Mollenkopf said that such an ask from a customer is not uncommon, but the amount Apple asked for was more substantial than any customer asks previously. The conclusion here is while those incentive payments were worth it to both parties, in the end, the FTC’s attempt to make it look like these payments forced Apple not to choose a competitor was not a strong part of this particular tactic.

One other point worth mentioning is the FTC spent a few days, and are still hitting this angle with expert witnesses today, that Qualcomm’s threat of not providing chips any longer to any licensee, not in good standing is an enormous threat. However, when Qualcomm’s lawyers pressed Steve Mollenkopf, on this issue, he acknowledged that while they have the right to stop providing chips they have never exercised this right. Two cases in point. One was a similar situation to Apple with Sony where Sony raised a dispute and stopped selling paying Qualcomm. Qualcomm continued to supply chips to Sony while they worked out the issues. Second, since Apple’s suppliers have stopped paying Qualcomm, Qualcomm has continued to provide chips to Apple for devices like the iPhone 7 during the time that royalties are not being paid to Qualcomm. Here again, the FTC’s attempt to prove this as monopoly leverage fell short because there was not an example where Qualcomm actually enforced this issue and thus pulled the rug out from a customer.

Note, there is some confusion in the media over this point with comments from Apple’s COO Jeff Williams yesterday that they were interested in dual-sourcing Qualcomm and Intel in new model iPhones, but Qualcomm refused to provide them chips. This is specific to new devices going forward, where the point about Qualcomm not providing chips only matters about older devices. Qualcomm, in this case, choose to honor their agreement with Apple and Apple supplies for older models already in market but not provide chips for new models. So these are entirely different things.

Lastly, on the point of market harm. This I think is still the hardest thing for the FTC to prove and I say that for a few specific reasons. First, as a part of the FTC’s attempt to prove monopoly tactics via Qualcomm’s business model they tried to establish that Qualcomm had no competition in premium chipsets. Premium defined here as devices costing over $400 which is where Qualcomm’s royalty cap is set. An interesting tidbit came out today that before 2014 Qualcomm had 100% share of premium LTE/CDMA chipsets and that declined to 63% in 2016, and obviously quite a bit lower today given Apple is 100% Intel modems. What has to be established here, however, is that Qualcomm’s business model made it so that others could not compete in the premium tier. Proving lack of competition in the premium tier is the only angle since there are, and have been, many competitors not in the premium tier of modem chipsets.

From what I heard on Friday, I heard more evidence supporting that Qualcomm had superior technology than I did that their business model made it, so companies like MediaTek, Intel, HiSilicon, or Samsung were prohibited from making compelling solutions for the premium tier. This was made clear by Apple, LG, Motorola, and a few other suppliers when they essentially confirmed there was no compelling alternative to Qualcomm in premium and their decision to choose Qualcomm was based on the superior performance. My read on that was Qualcomm was the best option, not the only option. It seems reasonable that you could argue the possibility that said competitors simply weren’t good at making superior modems because that is Qualcomm’s bread and butter and that is the reason, not their tactics, their modems were not competitive.

Lastly, and I’m sorry this is long but this is a meaty issue, with the clear but pricing details which were revealed in the case, I’m more convinced that establishing Qualcomm’s pricing is outside of FRAND will be a challenge. While the FTC is focusing on discriminatory pricing, I’m not sure they can argue it isn’t far. Case in point, the price Apple has paid for access to Qualcomm’s patent portfolio, and their chipsets in their hardware is less than $20 broadly. Some specific clarity showed the price they pay for the modem, and Qualcomm’s is benchmarkable better than Intel’s, is $7.50 after incentive payments. Given how important cellular connectivity is to the device itself and the spur of innovation that has led to in software development, which has benefitted Apple as much as any company, it is hard to argue costs less than $20 and specifically less than $10 is not fair for the overall value added to the smartphone.

The next week or so will be Qualcomm presenting their defense. I’d love to have another summary, and I hope to attend the closing sessions as well to get some more informed perspective. While this analysis is not exhaustive, I tried to include the key nuances that stood out to me this far in the case — lots more to come.

Industry Shaping Trends That Emerged from CES

CES generally takes a beating from the pundits as they see it as a place where lots of technology is exhibited that often never sees the light of day. CES is, undoubtedly, an exhibition of engineering and there is a reason companies display feats of engineering that may never see the light of day. Sometimes that is to demonstrate leadership; sometimes, it is to help them challenge their engineers to commercialize an invention or innovation that may serve the company sometime later down the road. And, yes, there are often many wild ideas that money should never have been spent developing. All things considered, if you spend the time to look above that noise on the things that may shape the industry, CES is a great place to get a 1000 ft view of the industry and draw some conclusions. That is generally what I do, and I’d like to share a few of my thoughts.

Auto Manufacturers Remain Clueless

CES has had automobiles on the show floor for as long as I’ve been going since the early 2000s. Those auto manufacturers were showing innovation in audio, and all these cars and exhibits were in a dedicated audio section of the convention. Now, nearly every car manufacturer is at CES showing not just concept cars, but how entertainment, connectivity, autonomy, and more will make it to their vehicles. The problem? The user experience, user interface, and overall implementation of many of these manufacturers continue to be some of the least consumer-friendly experiences in the world.

While it is clear that electric vehicles are a massive investment from auto-makers and along with that they are committed to autonomous solutions, it is crystal clear to me now that unless an entire people and process change don’t happen within traditional car manufacturers that they will all be disrupted by Tesla and new entrants.

The reality, and from my brief conversations with automotive industry insiders confirms, what auto manufacturers are completely failing to grasp is that cars are becoming computers. Car manufacturers have no idea how to make computers, and they are not computer companies yet that is what they have to become if they want to be successful.

For all the negative press Tesla seems to get, I heard it confirmed to me several times from people inside automotive companies that Tesla has them all spooked. The only thing holding Tesla back from knocking out some of the biggest car brands in the world is how crappy they are at manufacturing. If Tesla ever figures out how to mass manufacture with industry-leading quality and detail then watch out.

This point about manufacturing is why Detroit car companies and others around the world believe they have an advantage. Mass manufacturing quality cars is hard! But becoming turning your car into a computer and becoming a computer company is also hard! So both have a ways to go. If I’m making a few predictions at this point, I will offer that US car companies are in the most trouble. If anyone can figure out how to evolve and compete with Tesla is it likely more the Japanese and other Asian car companies.

This will be an interesting space to watch for a long time, and some of the most interesting inventions and innovation in automotive are still to come.

Peak Smart Home/ Smart Assistant

Well, we have hit it. It is inevitable everything will be connected, and everything will connect to the smart assistant of your choice, and that should no longer surprise us. We have hit peak smart home. Which is great because we can move past the initial work of connecting everything and start to focus on making all these things work together.

The biggest hurdle standing in the way of the smart home was connectivity standards. In that equation, the interface was still a challenge because each brand/appliance had its app and to control a smart home appliance was still several clicks deep in your smartphone. Voice assistants brought that to a single voice command away, and now we are off in the running. While some underlying connected standards have emerged, the most important standard how being supported by all smart home products is Alexa, Google Assistant, and Siri/HomeKit.

I have no doubt in my mind the smart assistant market is not a winner take all market. And after talking with Google, Amazon, and Apple about this as well, all three seem to agree. The belief is consumers have the intelligence to interact with each assistant for what they do best, and will use each accordingly. This is relevant because it seems that supporting all three assistants will be table stakes to compete for any company looking to make “smart” products. I put smart in quotes because none of these are smart yet. Hopefully, AI will be the component that takes all this technology from just being connected to smart, but even the AI being used now is rudimentary. We still have a long way to go.

The Future of Display are On.. Display

Attendees always marvel at the TVs at CES. For years it was simply HDTV on display. Then it was how big can I make my HDTV. Then we saw OLED show up and it was incredible to see for the first time, but it was a screen about 6 inches large. Then each year it was about how big can we make OLED screens. The last few years, foldable and foldable TVs emerged, and this year we saw huge rollable and foldable TVs. The reality, however, is what was important to grasp hidden in plain sight with these TV innovations is what was truly happening was the future of display technology was being shown.

Displays will be everywhere. Not just on our pockets, in our cars, all over our homes, in mirrors, in glass in our homes and office buildings, retail, etc. We are a visual species, and the Cambrian explosion of displays has not yet happened. But what we see as a technology showcase around displays at CES is an easy way to predict what the Cambrian explosion of displays is going to look like when it happens.

Robots, Drones, Autonomy, and AI are Closely Linked

Lastly, it is clear that drones, autonomy, robots, and AI are much more closely linked than previously realized. Innovation happening in all three has still not yet merged into a coherent product, but all these technologies are the foundation of the future of robotics. It is relevant to see the advances made in each category since nuggets of insight will come and give us clarity on the broader picture.

Drones are coming in all shapes and sizes now with underwater drones being the recent big showing at CES. Fascinating space to watch, with implications which may only be evident in hindsight.

What is key to all of this is an innovation cycle in components, being fueled by the sheer size of the consumer electronics industry which is evident at the size CES and the truly global movement of electronics. I’ve said for many years that the tech industry best times are still ahead and every year this show gives me confidence this is true.

Short term economics may consume the news cycle, and bring the appearance of technological slowdowns in pockets of the industry. But do not be fooled, in the future technology will deeply touch every single business industry in the world and every single business industry in the world will be a technology industry.

Apple’s AirPlay/HomeKit/Siri Ecosystem Growth; Battle of the Assistants in Smart Home

Last year, I wrote a post that generated some noise among other media and news outlets called Apple’s Indirect Presence from CES Fades. If you haven’t read it, I encourage you to, but this section is what I want to bring up again.

It is easy to say that because Apple was never present at CES that the show didn’t mean something to them or their ecosystem. It is easy, and correct to say that CES was not, or never was, a measure of the health of Apple’s products. It is, however, incorrect and dangerous to miss that CES had been, for some time, a barometer for the health of Apple’s ecosystem.

As I mentioned, our ability to measure any platforms ecosystem from what we observe at CES, is the main reason so many are paying attention to what is happening with Amazon’s Alexa platform. Google Assistant is certainly more present than it was last year, however, when you look at how third parties are talking about-and marketing-their support of these assistants they are putting significantly more effort into talking about Alexa than Google Assistant. Which is a telling signal. Again, to reiterate this point, third parties used to market, and spend energy talking about their integration with iOS or support of iPhone/iPad with the same rigor they are now talking about Amazon’s Alexa. This can not be ignored.

First, I want to revisit some heat I took from many saying CES is irrelevant when it comes to Apple. If anything, Apple’s collaboration with now the three largest TV companies to bring Airplay 2 (which brings some Siri support, and HomeKit to their TVs, as evidence Apple does care about the ecosystem shown here at CES. The announcement from Samsung, LG, and Vizio was a key part of the keynote where they announced and highlighted this feature during the presentation. Apple knows full well that if a broader ecosystem of appliances makers and brands starts talking more about their competitors in Google Assistant and Amazon Echo it puts them into a position of weakness from a third party ecosystem standpoint.

Now, up to this point, the most important third-party ecosystem to Apple is software developers. To a lesser degree, more so at the beginning of the iPhone era, was the ecosystem of accessory makers for iPhone. What we see now is the new important battleground of third-party support of other major brands in consumer electronics, and Apple is on new ground having to work with a much broader hardware ecosystem and fitting into another brands strategy than before.

What’s unique about this new scenario for Apple is Apple is not the central brand in the equation, per se, Apple is actually an ingredient brand to a Samsung TV, or an LG TV. The model for Apple to move their services like Siri (which is a service), iTunes movies, or Apple Music, or a future news and TV service requires a new strategy. One where Apple plays nicely with brands and products of a whole new class.

I outlined in Apple’s Service Challenge, growing their services business will require a new strategy that plays nicely with other people’s platforms and hardware. That is simply the reality.

The question was raised to me on Twitter, and even in some recent press articles on what this says about Apple TV. Well if you love Apple TV and are a loyal user fear not because Apple TV is not going away and I fully expect Apple to keep it on the roadmap. Why? Because Apple TV, like HomePod, will remain the purest experience of Apple’s integration and hardware/software/services. To put it plainly, Apple hardware will always be the best way to experience the Apple ecosystem. This is why people who value that will still buy an Apple TV or a HomePod. Apple doesn’t need to be the market leader in either category, but it just needs to exist to be the best of Apple’s integration.

An interesting point to mention is how Apple is embracing other brands platforms and hardware with core services the result may lead to making products like Apple TV and HomePod even better. Essentially, it increases competition for Apple to make the experience of Apple TV and HomePod better than other hardware integrating their services. Ultimately, this is all good for Apple customers.

Battle of the Assistants in Smart Home

While the short time I’ve already been at CES, it is already clear Apple’s ecosystem is more supported this year than last year. Which means it is safe to assume next year, even more brands and products will support HomeKit, AirPlay, and Siri. This is important for a variety of reasons.

Firstly, Siri is active on over a billion devices. Most of those are smartphones, but the smartphone is the one product consumers will have with them at all times. Being able to use the Siri in your pocket, on your wrist, or in your ears and control other products in your home is the most likely way consumers will use ambient computing. It is convenient to have products like smart speakers in rooms of the house, but I’ll argue at the end of the day those products roles are simply speakers. The best place for your ambient computing assistant is on devices you have with you all the time. This puts Siri in a potentially winning situation, so long as Apple continues to improve Siri and keep it on par with Echo and Google Assistant.

Just as Samsung, LG, and Vizio are demonstrating, that AirPlay 2 and HomeKit is now coming into its own as the standard to connect to the iPhone ecosystem, I’m sure more brands in consumer electronics will follow suit and support HomeKit as well. What I’m not sure is what happens with Alexa when Apple’s third-party support ecosystem is as robust as the Alexa ecosystem (which is inevitable). This will take time, but it will be interesting to watch how Amazon’s lead fares over the next few years.

Podcast: Apple’s Guidance Revision and CES Expectations

Ben Bajarin and Carolina Milanesi discuss the big news of the week about Apple’s rare revision of guidance. To cap it off, they look at what to expect from CES next week in Las Vegas.

Apple’s Inflection Point

While Apple’s decline and slow down in iPhone sales was inevitable, what made it surprising was that it was a holiday quarter which has historically always been Apple’s biggest quarter. Now, Apple’s December quarter is still going to be a monster quarter revenue-wise, but, it is notable that they missed their revenue projections when they have historically been very accurate in projecting their guidance range.

Earlier in December I wrote about iPhone unit sales peaking. The challenge Apple’s December quarter iPhone sales had validates the iPhone has peaked and will likely stay flat, or stabilize in 2019. Which means Apple is in a position to reassess how they project unit sales and revenue going forward.

Apple’s Potentially Turbulent 2019

While the end market, or Apple’s customer, doesn’t give much thought to what is happening to Apple at a financial, stock, or business level it is something worth analyzing for those of us in the industry observing Apple from all angles. From a business standpoint, it will be interesting to see how Apple’s management handles issues that could arise in 2019.

One of the main things Apple’s management may have to address is a potential for a year over year decline in iPhone sales. While Apple is not disclosing iPhone unit sales any longer, a drop in iPhone sales year over year will reflect in overall quarterly and annual revenue. What is unclear is if the growth in services, or products like Apple Watch and iPad, can offset any revenue shortfalls from a drop in iPhone sales. If iPhone unit sales see a double-digit decline quarter over quarter or year over year it would be unlikely growth from other areas would offset the revenue loss from iPhones and could make 2019 Apple’s first year over year revenue decline in more than a decade.

Apple Can Use a Crisis

This may not be a popular statement, but I think a good old fashioned crisis is good for Apple. While Apple makes industry-leading hardware, that alone can not continue their growth streak any longer. Apple needs to go beyond hardware even more than they have in the past and further into software, and more importantly first party services. As I articulated in Apple’s Services Challenge this will stretch Apple in ways, and test them in ways they have not yet been tested:

Lastly, I’d like to touch on the most interesting part of Apple’s services strategy. Growing a services business will stretch Apple in ways I’m not even sure they can comprehend yet. Apple is not a services company, the same way that companies they are about to try to compete with are services companies.

Apple still has not perfected their cloud services strategy with a range of first-party experiences like iMessage, continuity, Siri and a host of other things that still break and remain inconsistent at best. To compete in services, Apple is going to battle on ground where they don’t have the advantage and are up against companies who spend more, control more of the cloud platform, and have built teams and decades of core expertise building services companies.

Apple is going up against new competitors they have not yet faced as they look to expand beyond hardware and operating system software. There is something to be appreciated about industry competition and how great it is for consumers, innovation, and the tech industry as a whole.

What a crisis can do for Apple, is make them better, stronger, and even better positioned for the future if they tackle it head on and challenge and inspire their employees to take it on.

This is why I titled the piece as I did stating this is an opportunity for Apple to step back and look at their business, their potential growth levers, the new face of market competition, the new market reality with their customer hardware cycles, and more, and reflect and then strategize on where they need to go from here.

A fresh market test is good for Apple and will be good for the industry and customers, but I also don’t gloss over the challenge it will be for Apple and moving forward strategically in the post-iPhone era will by no means be easy.

This inflection point will be something we look back on in a decade or more and see how Apple handled the task and may also reveal the things underlying fundamentals that set the stage for the next few decades of Apple’s future. There is no guarantee Apple will lead the next big tech revolution the way they led with the iPhone. We can game theory the fundamentals of Apple’s culture, process, people, and more that they have what it takes to lead the next era but that can never mean a guarantee. Whether this inflection point is the beginning of Apple’s fade from leadership or the very thing that catapults them to lead the next era is what I’m most interested in observing.

Big Questions for Tech in 2019

Rather than write a predictions column, I’d instead look at what I think some of the more prominent narratives to keep an eye on in 2019 because they will be trends or events that will set the stage for the upcoming years.

Before digging in, I think it is important to echo something I wrote about last year about where we are in the tech industry cycle. I often get calls from journalists who call me wanting to talk about what the next big tech product or thing will be in the coming years. I have to explain to them that we likely won’t see whatever is next for quite some time. We are in a period of maturity, or postmaturity, which means tech products are mostly past their most innovative cycles and future products will continue to see much more revision and refinement than pure new invention.

This is relevant background context as it helps us look at 2019, not as a year where we will likely see the invention that leads to the next big thing but rather fundamental evolution that will set the stage and further bring us closer to what comes next. Let’s get to the big questions and things to watch. Note, these are in no particular order.

Apple,Component Manufactures, and the FTC vs. Qualcomm

I’m not sure how well understood the ramifications of legal battles that will ensure between Qualcomm and their suit with the FTC and with the component manufacturing supply chain. At an underlying level, Qualcomm provides a great many inventions and innovations that enable hardware brands, telecom, and telecom-related services to be competitive. Qualcomm’s licensing business model, or as it may better be understood as a technology transfer license, enables companies who have little to no intellectual property to enter a market and compete. While their licensing part of their business model is not the focus of these lawsuits (the extra fees or royalties associated are) if a result of this lawsuit has some impact to how their licensing and technology transfer works it could have significant impact to Qualcomm, and in some cases hurt competition making it easier for those conglomerates who do own and create a lot of intellectual property to keep new market entrants or competitors from entering a market successfully.

The dynamics of this case could change the shape and set precedents for more licensing centric business models that exist in the market in ways we may not yet perceive. The entire case will bring out fascinating debates around market power for companies who own a significant patent portfolio, which there are many, and how those companies will be able to monetize those patents fairly in the future. This will be an industry shaping event that will take place in 2019.

Where Does Computational Photography Go?

From a consumer-facing perspective, computational photography is one of the most interesting trends happening. It also appears to be a key battleground smartphone companies are focusing in on and using as a way to lure customers. But what stands out to me as particularly interesting about this trend is how it is more of a software trend than a hardware one. To make this point, it is worth highlighting a recent experience I’ve had as I’ve used a few recent Android smartphones alongside my iPhone XS Max.

I wanted to see what Google’s has done, in software, with older Pixel hardware and recent software updates. To my surprise, the Pixel 2 takes photos that can go toe-to-toe in side by side comparisons with Apple’s latest iPhones. While photography contains a lot of subjective elements with lighting and color accentuation, etc., some pictures in a variety of lighting scenarios had the older Google Pixel hold up against the iPhone XS Max. Notably, that was not the case prior to some recent software updates to the camera app on the Pixel. What brings up an interesting observation about Google’s capabilities in computational photography and the role software can play for them in this market.

Second, Qualcomm’s newest Snapdragon 855 will enable some powerful new features both in hardware and software around computational photography. The 855 will bring impressive capabilities in computer vision processing and image signal processing to growing competitors on the global front like OnePlus, Xiaomi, Oppo, Vivo, and others that will make for exciting battles around photography features.

Something I’m curious about, which relates to the observation most of this is taking place in software, is whether or not those software capabilities will ever make it cross-platform. Particularly with Google looking to own the camera app on iPhone. Most of the things Google is doing that are truly impressive like night sight, for example, as well as their advanced noise reduction, are all done in software and can technically be done with a Google made camera app for iPhone. As more and more of computational photography is executed in software or as a cloud service, this will create some interesting competition in the years to come.

The US-China Trade War

The continued trade battle between China and the US will be hard to ignore in 2019. It is already creating challenges in the global supply chain but with both these markets, the US and China, being two of the most important when it comes to consumer electronics, I expect it to be a fierce fight with unknown implications still looming.

ODMs and other key suppliers are already making plans to move supply and manufacturing of certain things out of China as a backup plan. Countries looking to grow these capabilities like Vietnam, for example, will welcome these companies with open arms. From a competitive standpoint, this creates some interesting challenges for China, if not resolved soon, as they could lose some of their manufacturing competitiveness as other countries scale their skillsets with the influx of business. Watching how other parts of South East Asia capitalize on this opportunity will be fascinating.

Politically, there will be implications to watch as well, but that may be a story for 2020 more than 2019.

Will Voice, Smart Assistants, or Augmented Reality Meaningfully Move Forward?

The last few years, voice interfaces, smart assistants, and Augmented Reality have been talked about as playing a role in the next big thing in tech. The reality is, none have moved forward meaningfully in the past two years. We have seen some moderate evolution, but the way consumers use and engage with these technologies has not changed much. Voice remains just a simple way to automate tasks, smart assistants are still not smart at all, and augmented reality has not yet landed its value proposition with the mainstream.

While I expect to see a lot of all these technologies at CES next week, what is unclear is whether or not any of these technologies take more than a minor evolutionary step in 2019. I believe all three of these technologies I mentioned have transformational potential, but it still feels like we are a long way off from realizing that potential.

The Fall of Social Media?

Social media was the darling of growth stories in the tech industry. It touches nearly every online consumer on every continent in the world. But, the events of the last year, around Facebook, in particular, have no raised bigger questions at an economic and political level around social media. Is it good? Bad? Should it be regulated? All these questions and more have risen, and the result appears to be fatigue around these services and consumers becoming more skeptical and burnt out than ever before.

This is leading to a potential decline in social media from a usage standpoint and at the very least a regulation of time spent or how the services are used by a growing number of consumers. Watching what happens around the narrative, political element, and user behavior around social media will be a fascinating storyline to watch in 2019.

Those are a few of the more significant narratives I will be keeping an eye on that all have the potential to shape the next decade of the tech industry. I’m sure I’ll add update this list throughout the year.

Facebook and Our Data, Public Spaces and Fair Use, Business Model and Jobs to be Done

Facebook, and their data harvesting tactics are again coming under scrutiny. It’s essentially the topic that will not go away of 2018. In fact, I think we can declare 2018 the year a spotlight focused in on companies who harvest data on users as a fundamental part of their business model.

This is a challenging topic, because of the lack of clarity on how much personal data Facebook and their APIs have allowed third parties to access. Each report seems to insinuate Facebook’s platform tactics allowed third parties with access to more data than consumers might be comfortable with. The reality, as I see it, is whether or not Facebook does indeed allow third parties more data than they should, the overall public perception is what is at stake. If consumers feel their privacy has been violated, regardless of whether it has or not, then Facebook has broken consumer trust. Trust takes years to gain and a minute to break.

That being said, there are a few specific points to flesh out related to this topic. First, I want to focus on what our research revealed about the way consumers think about this topic of privacy.

Privacy Definition as a Baseline

In a series of research studies we conducted, one goal was to establish a baseline of how consumers define privacy. Below is a chart from one of our presentations on the subject.

As you can see, the distinct understanding of consumers related to when a company says they keep their data private is that said company does not give their data to third parties. The privacy understanding has everything to do with a comfort level that the company will keep, and use, any personal data given solely for first party purposes. While a key part of this debate is whether or not Facebook SOLD that data, the truth of the recent reports is that the Facebook platform APIs allowed third parties more access to Facebook users personal data. This by definition of how consumers understand and expect a level of privacy, means that Facebook has violated their privacy in the eyes of the consumer.

We can see this playing out in public sentiment. Consumers feel their privacy has been violated and are making behavioral changes with how they use social media. I think this point is the one that warrants more thought. Facebook is not at risk of a mass exodus of users. They are, however, at risk of having a sweeping change in their user’s behavior that does not necessarily help theirs or their advertisers business model objectives.

Should Consumers Even Have Expected Privacy From Facebook?

Here we move to an interesting part of the debate around Facebook and privacy. What should consumers have expected from Facebook? Should they even expect privacy or in their mind is Facebook something else? Here we have a few additional insights from our research that are helpful.

We asked consumers in what areas of their digital lives privacy matters to them. Only 20% said privacy mattered to them when it comes to social media. Things like email and a range of cloud services all were much higher in terms of areas where consumers prioritize privacy. What’s more, is we asked consumers to rank all the big tech companies in order of those they trust most and those they trust least with their privacy. Social media companies like Facebook, Twitter, and Snapchat heavily weighted the scale of distrust. Which tells us consumers did not have much faith in Facebook from a privacy standpoint, to begin with.

In light of that distrust, and in light of their understanding that Facebook is free and they will see ads, most still continue to use the service. Granted there is an emergence of a behavior change but, given consumers view social media services differently, and may not expect as much privacy from them, they will continue to use Facebook and other services.

Where the conversation starts to get interesting to me is when we dig into how consumers think about social media services, and thus, how that understanding could lead to some personal rights around personal data.

Social Media as Public Forum

A key insight derived from our research on this topic is that consumers view social media, and Facebook in particular, as a public forum. Essentially they think about their actions on these platforms in the same way they think about their actions if they were to go out in public. Granted, in the early days of Facebook, I don’t think this was always the case. People would post things, share thing, say things, they may not in a physically public forum. However, it became apparent quickly that anything you post online can be viewed by anyone and thus we saw some distinct changes in how people present themselves publicly on social media.

Given this is how consumers view social media, it is a fair question to ask what personal data Facebook and even third parties should be able to access. I’d argue there could/should be a hard line between things done publicly and things done privately. For example, if I post that I like a certain product or brand, or even click a like of a product or brand, then I’m knowingly doing so in a public forum, and thus that information is fair game. Something I say in a private message, or private group, or even search for, is not and should not be considered public domain and therefore should be off limits from data harvesting. This would at least follow consumers logic of public vs. private behavior in the digital domain and could limit the viewpoint that their privacy is being invaded.

When consumers say something in private, like in a message, or email, or even search for something, they don’t consider this public domain. Therefore when they see an ad or brand message that is eerily related to something they said or did in private, this is when they get weirded out and tend to feel creeped out by the service.

Lastly, and I throw this out as food for thought as I do want to research this specific point more. I get the question a lot about why consumers seem to have an issue with Facebook, or other social media, but not Google. I think this is a great question and part of the answer may be in line with jobs to be done theory. At the root, I think Google’s business model of ads, both relevant and targeted, are actually very much aligned with the reason consumers hire Google. Therefore, I submit, it feels less weird and in some ways much more valuable when you search for something on Google and discover highly relevant and targeted brands, services, products because that is what you want and were hoping for when doing a Google search.

Facebook, on the other hand, has a business model that has nothing to do with the reason consumers hire the service. In our Facebook study, we gave consumers a range of options to why they use Facebook, and the overwhelmingly dominant reason was to keep in touch with friends and family. In Facebook’s case, the business model is not aligned with the job-to-be-done and therefore creates a source of conflict instead of one of value or convenience which is the case with Google.

A Recession Would Hurt Tech More This Time Around

A US economic recession, I fear, may be becoming more and more likely. While the economy seems sturdy, sometimes these things become self-fulfilling prophecies. The media seems to be talking more about a recession. It is in investors minds as a looming possibility thanks to many influential economists. Trump’s wild-card actions during trade disputes, and increasing hostility with the US from a foreign policy standpoint, all lay the bedrock for a potential recession. For the tech industry, there is good news and bad news if the US does move into a recession time period.

The Bad News

First, the bad news. The last US recession began in 2008. I remember the beginning of it as I was speaking at a tech conference that happened to have a large number of investment bankers in attendance. During one of the late morning sessions, panic ensued, and I witnessed half the room get up and walk out while talking on the phone. It was that moment the Dow dropped more than 800 points in a matter of minutes, and all of them were getting calls from clients, and partners trying to make sense of what was happening.

The tech industry was in a unique time period in 2008. The industry was just settling as primary computers (PCs) had peaked and were no longer in a growth period. But we were on the cusp of the smartphone era with Apple in its early days with the iPhone. I’m convinced that had the smartphone era not been just kicking off as the last big US recession hit, most tech companies would have been impacted much more significant than they were.

While many PC OEMs like Dell, HP, Lenovo, etc., were impacted as they say one of their primary businesses almost completely dry up, they made strategic decisions during that time period which set them up for where they are today. Apple, was a unique outlier in the last recession as the downturn hardly hurt them at all as people were falling in love with iPhone, then with iPad, and Apple remarkably outperformed nearly everyone in the midst of a broad US economic recession. This time around, if a recession hits, I think it will hurt, and Apple will not be excluded this time.

We have no big growth driver on the horizon, as we did with smartphones last time. We are in a bit of a long pause before the next big thing comes around. The smartphone boom served as a cushion that offset much of the potential pain during the last economic recession, and the industry has no such buffer at the moment.

If a recession hits, Apple may actually be one of the most impacted companies. A recession would be the worst thing to hit Apple as they are already suffering from an iPhone peak/decline narrative. Their increasing costs in hardware plus an economic recession would set up the making of a very tough season of hardware sales for Apple. They were insulated from the last downturn but would be significantly impacted should another one hit.

The cloud/data center is also driven by consumer trends like e-commerce, and the shift to streaming entertainment. This area may not be as impacted by a recession, at least the entertainment side. Since even during times of recession people still tend to spend money on entertainment. Which, could still help Apple’s services business should a recession hit, but that won’t be enough to offset a harsh decline in hardware sales which is likely in a recession.

The Good News

I said there was good news as well. The tech industry is not recession-proof, but it is the closest industry to recession-proof. The tech sector has historically been the fastest to recovery and the industry least impacted by recession overall. Which means, even if the US market does go into recession, the tech industry should recover the fastest.

The other bit of good news overall is that most economists reports I’ve read do not believe any US recession would be very deep or very long. This is not to say there won’t be an impact but only it is likely not to be as severe as the one from 2008 and likely won’t span many years.

The wild card in all of this remains Donald Trump and his actions with other countries on both trade, and foreign relations. For talk of a recession to even be in the mind of economists and investors, there have to be some underlying fundamentals that point in that potential direction. With the issues facing social media, which indirectly will impact advertising and then indirectly consumer spending, along with rising prices in consumer hardware, and no immediate growth curve in front of us, a recession would be a bit more painful this time around.

Data Center/Cloud Platform TAM Expansion is Bigger Than You Thought

Through a series of industry events, I spent some time digging deeper into the data center and cloud platform market. Mostly, at a technical/semiconductor and component level, but the deeper I went into the markets that drive growth, the more I realized how much I previously had underestimated the TAM growth ahead for companies which supply components to the data center and the cloud platforms themselves.

At this point, I think even the most bullish TAM growth forecasts may be conservative as the world may be moving faster than analyst forecasts are assuming. Most forecasts peg the data center market at a sizable $200 billion market by 2020. But nearly every company from Intel, Nvidia, Microsoft, Google, AMD, and Amazon are seeing faster than forecasted growth from the data center business each year. This is a signal of a snowball effect that doesn’t seem like it will slow down. The dependence on cloud platforms and thus data centers is growing so quickly thanks to a few trends like machine learning/AI and e-commerce to name a few. There are other markets to discuss, but in this analysis, I want to show how just these two markets alone are likely to drive faster than anticipated growth in data center and cloud.

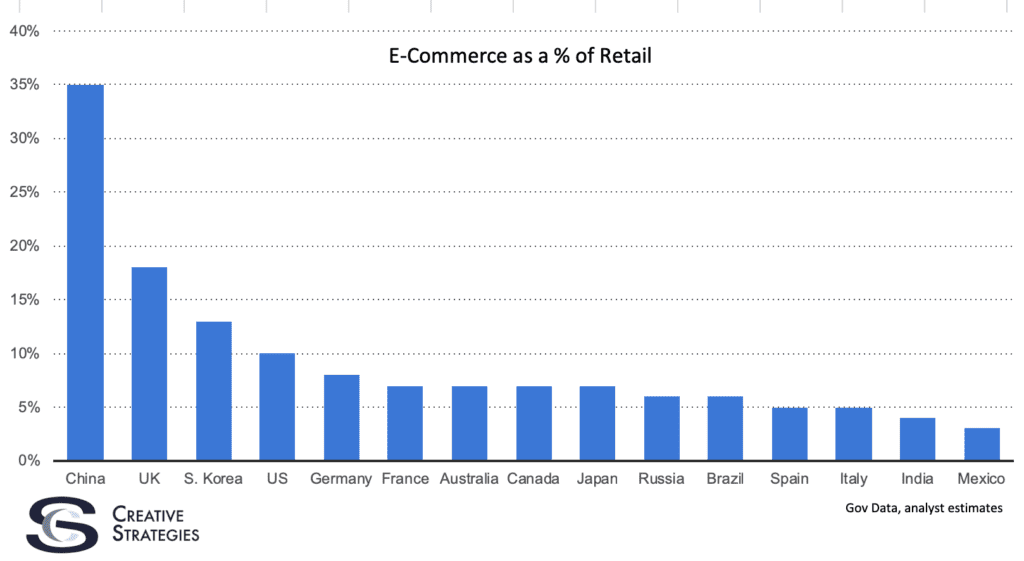

E-Commerce

One of my previous underestimations of cloud/data center TAM growth was not realizing the tremendous demand on the data center of e-commerce. Some companies do this vastly better than others, and they are ones who truly come at this problem with cloud-first expertise. Take Alibaba for example. When it comes to e-commerce scale, Alibaba may be at the top of the pyramid. To date, no company drives more e-commerce transactions in 24 hours than Alibaba on Singles Day. No company drives more e-commerce transactions than Alibaba does in their first hour of Singles Day. In their last Singles Day, 11/11/2018, Alibaba drove $10b in the first hour alone and set a new Singles Day record at $42 billion for the full 24 hour period.

To put that into contrast, Black Friday revenues in total are around ~$10 billion for the 24 hours. While those statistics are interesting, the observation that stands out to me is how Alibaba can generate about the total of US Black Friday 24-hour sales in just one hour and have no issues or delays in transactions. Where many US retailers had their websites go to a crawl or even go down during their online sales event. Even Apple has a record of trouble with their online store during iPhone pre-order days, and in all these cases the transaction volume is lower than what Alibaba does on Singles Day. It just goes to show how much demand there will be for data center/cloud platforms as e-commerce continues to grow and become a primary way consumers shop.

To this last point about the growth TAM. If e-commerce is growing faster than people believe, and it is, and we know that e-commerce drives tremendous demands on the data center, then consider that global e-commerce is still less than 20% of total retail sales on a yearly basis. In the US, e-commerce is around 10% of annual retail sales. In China, it is still just less than 50%, and in the UK it is about 18%. There is significant headroom to grow the data center and cloud platform TAM on the massive growth still to come from e-commerce alone. And like I said, it is happening faster than many forecasts assume.

ML/AI

Outside of e-commerce, machine learning and how that translates into AI is easily the biggest evergreen growth area for cloud platforms and data center needs. There is a machine learning/AI element to retail and e-commerce as well as retailers look to include more personalization and anticipation of purchases for the individual consumers, but this extends much more deeply into the relationship between device specific (edge processing) and cloud processing.

As the explosion of data being created by end users continues the demands on the cloud will only continue to increase. This explosion of data creation is enabled by the increase in capabilities of the devices we use day in and day out. For example, as Apple continues to increase the capabilities of their smartphones, by innovation at the silicon level for things like imaging/computer vision, AR and maybe VR, consuming more rich and interactive games, etc., the demand on backend data center and cloud platforms will only grow. Similarly, every smartphone and PC maker is increasing what is possible for software and services with innovations in hardware that grow the demand in data centers and cloud platforms exponentially.

Give developers more computing/graphics/computer vision capabilities, and they will create more rich and immersive software and services to take advantage of those capabilities. And give consumers the option to consume more of these rich experiences at engagement levels we can not yet predict.

The capabilities to create, and consume data and experiences is increasing faster than people assumed as the competition in hardware increases during a period of flat to declining smartphones. All of this will inevitably create even more demand and growth in data center and cloud platforms.

These two areas alone are enough to be extremely bullish on all companies who play in the data center and cloud markets and not to underestimate the growth ramp ahead which will be significant and likely larger than what is currently forecasted.

A New Challenge for Consumer Startups

When it comes to a breaking report of a consumer app or service having a breach leading to an invasion of customer privacy, not a week seems to go by without some news. This constant barrage of bad press for consumer services, that use a business model that hinges on advertising, has deep impacts I’m yet to see anyone fully grasp. So in this analysis, I’d like to offer some food for thought about how these events will lead to a new challenge for consumer startups.

The Heightened Awareness of Consumers Over Privacy

The adage that consumers don’t care about privacy is no longer a new truth. It may have been true at one point, I like to debate this, but it is no longer true. Consumers have awoken to a heightened awareness over the privacy issues with many of the apps and services they use which cost them nothing but their personal data.

Just yesterday, an report in the NY Times uncovered a story on how many apps which have been abusing consumer location sharing data. From a consumer standpoint, this kind of stuff is very scary. These stories begin to erode away consumer trust and could lead to a much more steeper wall for consumer startups to have to climb to get any kind of scale. Before I dig into that, consider these statistics I found from a recent study fielded by behavioral analysis firm UE Group.

- 72% of consumers polled said they are more aware now than they were 12 months ago about how companies collect and use their data