I found it hard to take Bitcoin seriously for a long time. What were you really supposed to say about a payment system and monetary alternative that was the combined delight of extreme libertarians and folks looking for a way to get away buying drugs and who-knows-what at Silk Road? How could you do ostensibly serious business at Mt. Gox, an online exchange named for Magic: The Gathering?

But somehow Bitcoin is moving toward a legitimate life following the the allegedly criminal implosion of the Silk Road and now the bankruptcy of Mt. Gox after the theft of between $400 and $500 million in assets. In spite of itself, Bitcoin may be becoming for real, and it just might matter.

It’s certainly time for some major changes in how our payment systems are handled. Our systems seem to exist mostly for the benefit of legacy banks and transaction systems. As treasurer of a non-profit organization, I am deeply annoyed by how much it costs to process credit card fees for tuition, donations, and merchandize sales. It is even crazier that electronic processing costs more than than bank checks that involve moving stupid slips of paper around the country. I was furious being kept at a Capital One Bank for more than two hours for a meeting at which all the officer could do was call someone else on the phone, who then placed the call on hold to call someone else–and absolutely nothing was resolved.

The system is nothing but archaic and fossilized. So its past time that we started giving some serious attention to innovation. Ben Thompson of Stratechery still has some doubts about Bitcoin, but he asks the right question:

Bitcoin and the breakthrough it represents, broadly speaking, changes all that. For the first time something can be both digital and unique, without any real world representation. The particulars of Bitcoin and its hotly-debated value as a currency I think cloud this fact for many observers; the breakthrough I’m talking about in fact has nothing to do with currency, and could in theory be applied to all kinds of objects that can’t be duplicated, from stock certificates to property deeds to wills and more.

Of course, there are some disturbing elements things about it Bitcoin. The fact that its inventor, Satoshi Nakamoto, is totally anonymous and perhaps non-existent, is a bit discouraging. (UPDATE: A significant scoop by Newsweek has found that Satoshi Nakamoto turns out to be a quiet Japanese-Californian named–Satoshi Nakamoto.) Although the fundamental cryptographic principles that drive Bitcoin seem sound, many potential users find such things as the blockchain more than a bit mysterious. And although the crypto may be safe, too many people have found too many ways to steal Bitcoins from wallets.

There are also some historical questions about just what money is. Traditionally, Adam Smith and other economists assign money with three principle characteristics:

- A medium of exchange, that is, a source of value that can be used to buy and sell goods and services.

- A unit of account, which can measure the relative prices of goods.

- A store of value, which gives a way to store money not immediately needed for future use.

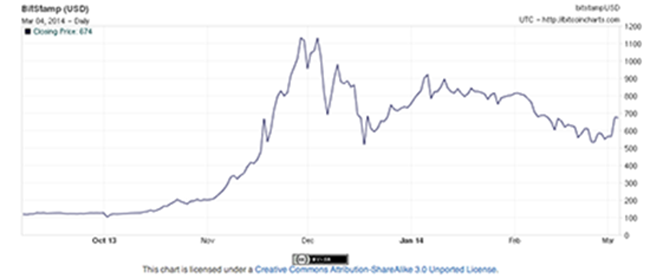

Clearly, one of the problems with Bitcoin has been sometimes insane variation of value, with the value per Bitcoin falling from US$1,150 to just about US$500 in February before recovering to just under US$700:

Exactly what establishes the value of any fiat currency, whether dollars, Swiss francs, Euros, or even Chinese rinminbi can be strange. And some of the looser currencies, say Argentine pesos, can be mighty shaky. But it’s hard to find anything that compares to Bitcoin at its craziest, and that makes it hard to meet the basic requirements of a means of payment. It has gotten better, but clearly some greater stabilization is needed over time.

The U.S. Treasury and other regulators are also putting a hand into the Bitcoin business and subjecting it to greater regulatory controls. Currency transfers are going to are going to come under rules (the U.S., for example, requires that all cash transactions of $10,000 or more must be reported to the Treasury) as will general distribution procedures. Bitcoin payments may not become exactly banking–let’s at least hope that the hidebound overpriced banks don’t get a hold of it–but it will also become a bit less wild.

Maybe the best outcome for the time being is the use of Bitcoin is as a means of payment, available for experimental use by those who want an alternative to cash, checks, or traditional card payments. This could allow a new method mature slowly and usefully and let those willing to take some chances, hopefully relatively small now that some of the odder aspects are out of the way.

We certainly could use a new system. And we should offer some gratitude to those working to make a new method work.

Really interesting article. I’m as far from being an economist as I am to being the Pope. Without meaning to diminish it’s value, economics is that uninteresting to me. Yet, you’ve kept me engaged.

By the time I got to the third paragraph, you already had me thinking “The international banking system is really going to hate this”. And there you were! Right on cue. The real value of fiat currency, of course (I think) is the country behind it. Or in the case of the US, the corporation behind it (Federal Reserve). While acknowledging a healthy level of paranoia, it does not surprise me at all that the inventor(s) of bitcoin are anonymous.

I am ignorant of bit coin but it smells of a very insecure way of transferring and holding onto money in any form. Security and accountability in money terms is something I am more than willing to “pay” for. Annonimous is just a guy/girl with a mask waiting to take it, POOF. Free comes with its risks of which I am not going to pay. Trust is earned and from what I have witnessed of Bitcoin it looks like another rocket to Poofdom.

btw, I too grumble and grip about the arcaicness of banks, try to get a VA loan for a house thru Chase and you will know what it is like to die by a billion cuts. s/

principal not principle

and a lot of extraneous/duplicated words

needs a good human editor/proofreading

otherwise ok but not really insightful

1) BitCoin transactions is as safe as any known transaction.

2) The future value of BitCoins is highly uncertain. BitCoins has no intrinsic non-monetary value as a commodity or consumption good. Nor can it be used to pay taxes. One suspects the future exchange-rate of BitCoins to flactuate wildly before it plummets to zero.

3) I fail to see how authorities can hope to regulate BitCoin.

Libertarians are fools who don’t understand how things work. These people will all cry for gov to help when their money is worthless.

Since there’s no paper trail or digital trail allowing one to trace transactions in Bitcoins, who’s to stop some crook from setting up a Bitcoin bank or exchange, pilfer money from his customers, and after accumulating a generous pile, start squawking “We wuz robbed!” and then file for bankruptcy and shut down his operations and move on to a comfortable retirement?

As I website owner I believe the content material here is really good appreciate it for your efforts.

Thank you for great article. I look forward to the continuation.

Wonderful post! We will be linking to this great article on our site. Keep up the great writing