This week’s Techpinions podcast features Carolina Milanesi and Bob O’Donnell discussing the news from the Facebook-owned Oculus press event on their new VR headset and plans for AR glasses, chatting about the release details of Sony’s forthcoming gaming console, and analyzing the news from Apple’s event, including new Apple Watches, iPads and its Apple One bundle of services.

Category: The Daily Techpinion

Facebook Doubles Down on VR with Oculus Quest 2

At its annual Virtual and Augmented Reality-focused event, now named Facebook Connect, Facebook announced that the Oculus Quest 2 would begin shipping in October with preorders open now. In addition to announcing the Quest 2 at the virtual event, the company also took the opportunity to talk about upcoming VR software (including an early-stage desktop experience), its research projects around AR, and its plans to ship a pair of smart glasses in partnership with Ray-Ban next year. Today I will focus on the Quest 2, its technical specs, its price, and its potential ramifications for the VR market.

Standalone VR

Today’s VR market offers three headset types: screenless viewers that use your smartphone screen (such as Samsung’s discontinued Gear VR); tethered headsets that connect to a PC to leverage its processing and graphics capabilities (such as the Rift S); and standalone products that are self-contained units. Since the launch of the original standalone Quest and competitive products from a growing list of other vendors, we’ve seen the standalone market explode in popularity with Facebook leading the charge and products a wide range of other vendors gaining momentum.

Standalone VR cannot push as many pixels as a tethered headset that can leverage a PC with a powerful CPU and GPU. But I find that standalone products help drive a more immersive experience because you are not dealing with the physical cable connection to the PC, which is constantly yanking you back out of the immersive experience. And last year, Facebook launched a beta version of Oculus Link that lets you use a USB cable to connect the -first generation Quest to a PC to achieve tethered-like performance for apps that only run on the PC.

Throughout the pandemic, as my family and I have sheltered and worked from home, my kids and I have been using the original Quest to play a growing list of games. I have also been enjoying the fitness app Supernatural. What I have not really done is use it for anything related to work. The fact is, if VR as a technology and a platform had been further along at the start of 2020 (and headsets had been more widely available), the pandemic could have been the catalyst for a significant shift to VR for virtual meetings, training, collaboration, events, and more. To be sure, all these things are happening, but not at scale. However, the shifts set in motion by COVID-19 will be a major catalyst for both consumer and commercial adoption; it will just take some time. The Quest 2 positions Facebook to drive much of that next wave of adoption.

Evolutionary Updates

As noted, I have used the original Quest extensively, and it is a very good product that Facebook has made better with regular updates. With Quest 2, Facebook clearly focused on iterative improvements rather than a radical rethink. Perhaps the most notable specification changes are the processor and the screen. Quest 2 features Qualcomm’s new XR2 processor supported by 6GB of RAM and a single, fast-switching LCD rated at 1832 x 1920 per eye, versus the Quest’s dual OLED panels. Facebook says the display can support a 90Hz refresh rate (but it won’t at launch). Facebook also tweaked the Touch controllers and says the new ones will be more ergonomic than the current ones.

These evolutionary changes should drive a better experience when it comes to both consumer uses cases such as gaming, as well as commercial use cases such as training and collaboration. Facebook clearly believes the Quest 2 has enough horsepower to be its primary VR product, as it announced that it would discontinue its tethered Rift S hardware in 2021.

Perhaps the most important news around the Quest, though, is its price. Facebook chopped $100 off the price of the new headset versus the original Quest, which means the entry-level version with 64GB of storage starts at $299 versus $399. A version with 256GB of storage sells for $399. The company is taking orders now, and the product will ship in late October.

I have yet to test the new Quest 2, but initial tech press reviews are mostly positive. However, not everyone is enamored with some of the changes Facebook has made to the physical design of the headset or the new touch controllers. Some complain that to hit the new price point Facebook had to cut too many corners in the design.

Too Much Social?

Facebook has worked hard since the launch of Quest to drive VR adoption and has stood up its Oculus for Business group to focus on commercial use cases. However, in the end, it is still Facebook, and at its core, it is a social networking company. As such, it has recently decided that in October, all new Oculus headsets must log in using a Facebook account, versus using a new or existing separate Oculus account. This will allow Facebook to serve up personalized content and ads inside the Oculus experience.

As you might imagine, many Oculus users are not happy about this move. It is not clear if this will impact Oculus for Business users, but I know from talking to many organizations looking at VR for commercial use cases that they find any ties to social problematic at best. I also have mixed feelings about the Facebook account requirement but will reserve judgment until I see the implementation.

Based on the information we are seeing from our supply-side analysts, Facebook expects to ship a huge number of the Quest 2s in the second half of this year. I expect that to be a mix of consumer and commercial shipments, as the company leans into its Oculus for Business offering. I’ll be watching closely to see how the market reacts to this new offering, and how Facebook’s competitors respond as we close out 2020 and head into a new year.

Takeaways from CBRS Auction and Implications for the C-Band

The 3.5 GHz CBRS PAL auctions were concluded on August 26, and the winners were announced a week later. Overall, the auction raised $4.4 billion, which was slightly above what many analysts had expected. The big winners: Verizon, DISH, Comcast, and Charter. Also interestingly, a number of enterprises also won licenses, which demonstrates the interest to deploy private wireless networks as a complement to/replacement for Wi-Fi and for certain specialized applications.

Here’s my take on the winners and losers in the auction, what it means for 5G and the competitive structure of the wireless industry, and the implications on the even more consequential C-Band auction, which is scheduled to start on December 8.

As a quick backgrounder, the FCC has made 150 MHz of spectrum available in the 3550-3700 MHz band, or the 3.5 GHz CBRS ‘mid-band’. This band, incidentally, is also being used for 5G in many other countries. The initial phase of the CBRS auction, called the GAA layer, consists of 80 MHz of shared spectrum, meaning that it can be used by anyone (i.e. not auctioned) as long as it’s available, through a regime managed by four spectrum database administrators (SASs). The GAA layer became commercially available in late 2019, and so far has been used for mainly corporate or venue type deployments.

The second phase was the 70 MHz PAL auction (called Auction 105), for 10 year licenses, in 10 MHz channels, on a county-by-county basis. A provider could bid for up to 40 MHz in a particular geographic region. That auction concluded on August 26. Of the $4.4 billion spent on the auction, Verizon was the big winner, spending $1.9 billion. DISH spent $913 million, Comcast spent $458 million, and Charter spent $212 million. T-Mobile only won a handful of licenses, and AT&T did not win any licenses at all.

The auction was especially critical for Verizon, which is in the weakest spectrum position of all the major operators, especially in the mid-band. I expect its 3.5 GHz efforts are a precursor to what will be a more significant spend in the C-band auction, where 280 MHz of spectrum in the 3.7-4.2 GHz band will be made available.

The magnitude of DISH’s spend was a bit of a surprise, given DISH’s already strong spectrum position and its rather precarious cash situation, as the company bleeds pay TV subscribers. But it’s an important signal of DISH’s commitment to being in the wireless business. In addition to its treasure trove of low-band spectrum, DISH reaped the spoils of the T-Mobile-Sprint merger, getting some of the excess spectrum, Boost Mobile from Sprint, and an MVNO relationship with T-Mobile. So DISH is now a bona fide retail player in the prepaid wireless space, with 9 million Boost subscribers (and 270,000 from the recently acquired Ting), with plans to build a nationwide 5G network in what is likely to be a hybrid of retail/wholesale strategy.

The cable companies were the other notable winners in the auction. Cable — mainly Comcast (Xfinity Mobile), Charter (Spectrum Mobile), and Altice — have been steadily growing their wireless business, counting some 4 million wireless subscribers between them. However, their mobile business relies on the several million Wi-Fi hotspots and an MVNO relationship with Verizon (Altice’s is through T-Mobile). Their participation in the PAL auction is the first time the cable companies have acquired a meaningful amount of wireless spectrum, enabling them to add some physical cellular infrastructure to complement their Wi-Fi/MVNO strategy. It demonstrates their commitment to being in the mobile space, and their desire to be less dependent on the MVNO structure, given the rather unfavorable economics.

T-Mobile’s relative lack of participation in the 3.5 GHz auction was no big surprise, given its strong mid-band position by virtue of the 150 MHz of 2.5 GHz spectrum it got from Sprint. AT&T was conspicuously absent from the CBRS auction. We suspect they’re saving their powder for the C-band auction.

Outside of the major operators, this was also a successful auction in bringing in some new, innovative players. Among the winners were:

- Several Wireless Internet Service Providers (WISPs), some of them already using the GAA spectrum, who will use it to provide rural broadband using fixed wireless access (FWA). They’re also counting on additional funds being made available for rural broadband initiatives, an idea that’s gained steam in the wake of Covid and the need to narrow the digital divide.

- Numerous private companies. A 10 MHz license is sufficient bandwidth for a company to deploy a private LTE or 5G network. Among the auction winners were Deere & Company and Chevron, who could use their licenses to provide connectivity to manufacturing and other facilities that are harder to reach with Wi-Fi. Several real-estate companies also won licenses, the idea being that building or campus-wide networks could be deployed. Power companies also spent more than $50 million, collectively, on licenses, to power smart grid and IoT applications, or to use wireless as a connectivity backup.

Implications for the C-Band Auction

Given that the CBRS auction is in the mid-band, it’s viewed as somewhat of a warm-up act for the upcoming C-Band auction. This will be the largest auction in U.S. wireless history, with 280 MHz being made available in the attractive 3.7-4.2 GHz band. We expect all the major players to be there. Wall Street analysts expect this auction could raise $50 billion or more.

The auction is probably most consequential for Verizon, which still needs additional mid-band spectrum to meet 5G coverage and capacity needs. I also expect AT&T to spend big, especially since it sat out CBRS. And even though DISH and T-Mobile are in a pretty good spot spectrum-wise, it’s almost certain they’ll be active in the auction, given the attractiveness of the C-band, the seemingly insatiable need for additional capacity…and a defensive strategy to ensure that major competitors don’t end up in an overly advantageous position.

Financing will be a big story over the next three months, as the C-band auction looms. I don’t think it’s a coincidence that there have been recent rumors about AT&T potentially shedding some of its media assets, particularly DirecTV and possibly Xandr. AT&T’s balance sheet isn’t pretty. Wall Street and Elliott Management aren’t going to let AT&T go wild at the C-band auction without the means to pay for it.

DISH also needs to come up with some source of funding if it’s going to both be active in the C-band auction and spend the $10 billion (or more) required to build its 5G network. I believe that DISH’s strategy is to offer a retail wireless operation (like Verizon, AT&T, etc.) but also to run an active wholesale business, given its favorable capacity position. In fact, DISH really needs a major anchor tenant to sign a long-term deal, which would provide DISH with the resources needed to execute its wireless strategy. My bet is that it will be one of the major Internet players, such as Amazon. The cable companies are also possible candidates, as they look for more favorable MVNO terms than they currently have with Verizon. Given that DISH is a major competitor in the pay TV space, this would be among the frenemiest relationships in telecom.

Between the mmWave auctions completed earlier this year, the recently completed CBRS auction, the upcoming C-band auction, and the FCC’s announcement a few weeks ago that it would auction off another 100 MHz of spectrum in the 3.45-3.55 GHz band in 2021, we’re seeing an unprecedented expansion of capacity being made available for commercial wireless use. This will alter the competitive landscape and will be a catalyst for the sorts of innovative new use cases envisioned for 5G. Ensuring adequate spectrum resources for 5G is also the ante needed for being competitive on the global 5G stage.

Apple “Time Flies” Event Lets the Spotlight Shine on Apple Watch and iPad

The rumors went back and forth on whether Apple would unveil the iPhone 12 at this event. I argued that, with the events now being digital, Apple did not have to cram everything together in one event, especially given they had said the iPhone 12 would be shipping a little later than usual.

All being business as usual, Apple might have announced everything into one event, but given the circumstances making lemonade out of lemons meant that the iPad and the Apple Watch got some undivided attention for a change. The new iPad Air was even the showcase for the new A14 Bionic chip. This is usually something the iPhone gets to do, as the iPad adopts it in the cycle immediately following the latest iPhone release.

These two devices share one common trait: in one way or another, they have been playing an important role during the pandemic. Whether it’s using Apple Watch to keep active and balanced or using the iPad to do distance learning, gaming or binge-watch Netflix, many have been turning to these devices daily, and some of the announcements from the event will add to their appeal. Apple also referred in a couple of occasions to Apple Card Financing, which had been introduced already for iPad, Mac, and AirPods and now can be used for Apple Watch as well, with monthly payments as low as $12.

Apple Watch Widens Appeal with Family Setup and Lower Price Points

There was a lot of news on Apple Watch, starting with the new affordable Apple Watch SE, the new high-end model Apple Watch Series 6 with its blood oxygen measure and Family Setup, to connect an Apple Watch to someone else’s iPhone.

Family Setup had been rumored for a while, I was actually expecting it to launch with the Apple Watch 5, but it turned out we had to wait a little longer. I am sure Apple would have launched Family Setup even without the pandemic. Still, with kids returning to school and many families caring for older relatives, it certainly seems like this feature is very timely. Family Setup will be available for cellular models only, from Series 4 and later. I do wonder how much cellular connectivity will be a hindering factor for potential buyers, given the extra monthly cost. Of course, if you see these devices as emergency devices, being always connected is a must. Unfortunately, carriers in the US still seem to be profiting way too much from a connected watch, which in most cases uses very little data.

The choices Apple made in what kids are allowed to do right on the watch vs. what the parent or guardian can do on the phone connected to the Apple Watch are quite interesting. Apple offers some thoughtful options like being able to set up which contacts can be called and messaged, or the ability to set up automatic location notifications, and a “Do Not Disturb” mode for school time. Kids can create their own memoji for messages, and they can track their move goal. I appreciate that Apple took a more kid-friendly approach to the rings by focusing activity on minutes of movement rather than calories. Kids who are still growing should not concern themselves with calories, but how active they are, associating physical activity with good health.

Apple is doubling down on Fitness, with the new Fitness + service that ties Apple Watch to fitness videos one can follow along on an Apple device to deliver an integrated work out at a time when most people still cannot go to the gym. Apple also continues to pursue medical research with the new blood oxygen level readings linked to three new studies.

Keeping the Apple Watch Series 3 in the lineup for $199 and adding an Apple Watch SE at $279 offers some new entry points into the ecosystem for new users or multi-device users as Apple makes Watch an integral part of the new Fitness + service.

At $9.99 a month or $79.99 for an annual subscription for a family up to six people, Fitness + is priced quite aggressively compared to subscription such as Peloton, which is currently $39.99 a month. Furthermore, with the new Apple, One service bundle for many users who already subscribe to multiple services, Fitness + might end up being free. For instance, if you are paying for Apple Music Family ($15), Apple Arcade ($4.99), Apple TV+ ($4.99), 2T iCloud ($ 9.99), and Apple News+ ($9.99), you would see a savings of $25 and a free Fitness+ subscription if you signed up to the Premier tier. The Premier tier will only be offered in selected markets, depending on service availability, which keeps things easier than adjusting pricing by market. It will be very interesting to see how Apple will let current subscription holders know pricing is changing.

The iPad Air is Back

iPad Air used to be Apple’s most popular iPad, and then came the iPad 7th generation. Apple surprised most by refreshing the iPad Air to a design and specifications that positioned it right below the iPad Pro, making it an appealing option for users who want a high-end experience for both creation and consumption but don’t need cutting edge features like a Lidar scanner.

The portfolio before the Apple Air was leaving a gap in the middle. If you want to think about it in terms of iPhone, Apple was missing an iPhone 11 iPad equivalent. We will see if Apple retains the smaller iPad Pro model in the future, especially as there will be an ARM-based Apple Mac that could play as a continuation of the iPad portfolio.

With the iPhone/iPad launch out of cycle, I am sure many were reading the tea leaves of what features we saw on the iPad will be in the iPhone aside from the A14 Bionic. I would guess the colors are one, as it would be strange that Apple went for different colors for the two product lines. The second feature would be TouchID integrated on the power button. Considering wearing masks will stay with us for longer than first anticipated making unlocking with FaceID more challenging, adding a fingerprint reader would be very useful. Samsung already offers that option on the Galaxy Z Fold.

Apple continues to widen its reach by strategically lowering the barrier of entry for those products that have the potential to delight the user and create a level of engagement that will make it difficult for them to leave the ecosystem especially now that it is not just about hardware and software but services too.

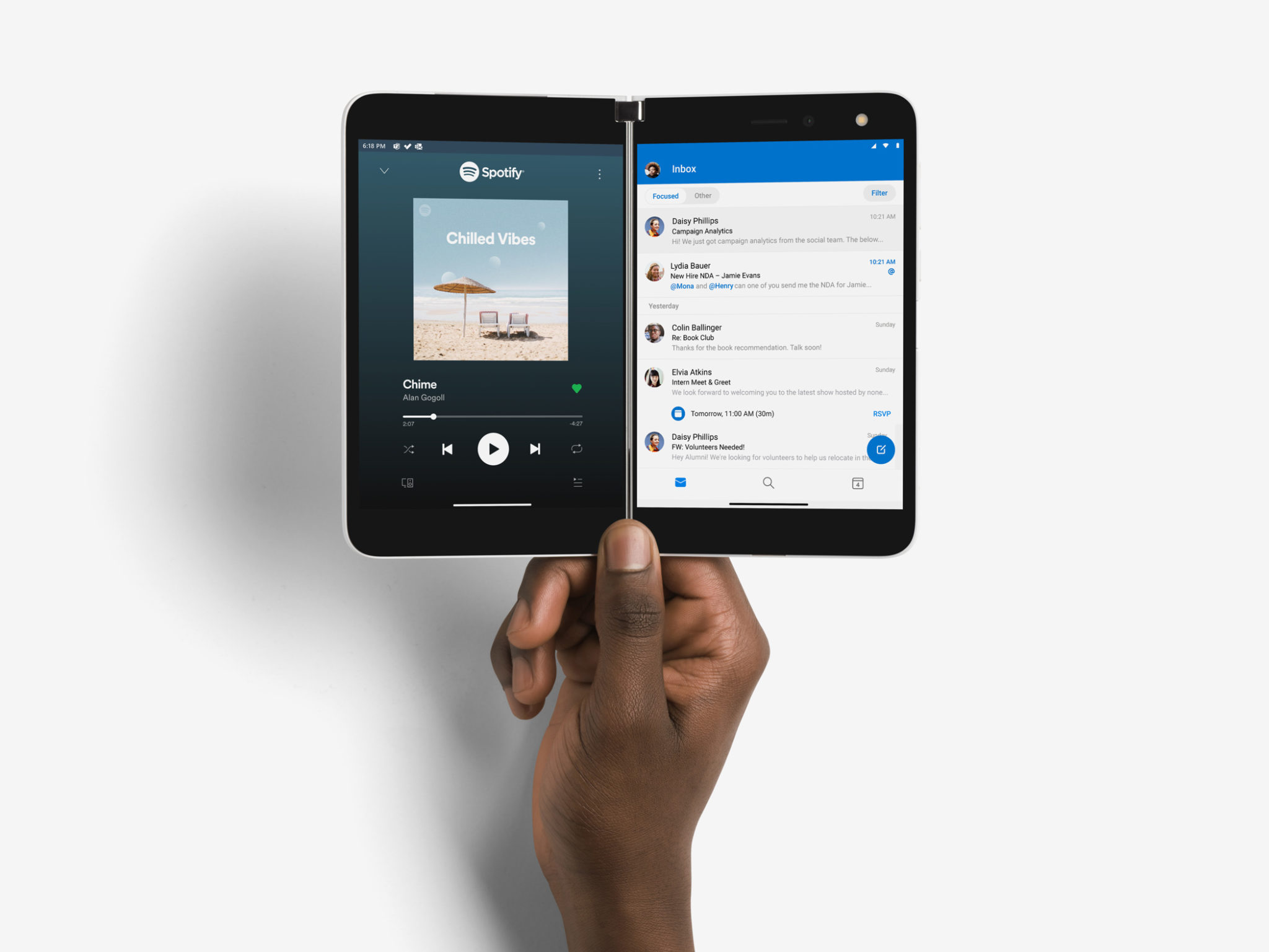

Surface Duo and Two Screens vs. One

I have had the opportunity to spend time with the Surface Duo. A product that certainly has room for improvement, but which I think signals something about the future of mobile computers.

The emphasis from Microsoft was on a true two-screen experience with Duo, which is where the differentiation with this product and it’s most interesting use cases reside. As always, when I use a tech product that brings something new to the table, my exploration focuses on what I can do with this device that I could not do before. With Surface Duo, this was evident from the start where the side by side screens allowed to run two apps together side by side. What immediately hit me about this experience was how it was a mobile experience of my favorite way of working on iPad by using two apps side by side at the same time.

The bigger the screen, the more customers can do with their devices. This is why the notebook/desktop has always been positioned as the ultimate productivity computing devices. But also why the debate with iPad got blurry since it allowed for much better multitasking but on a more mobile device than a laptop and desktop. To that end, those of us who have always study consumer behavior has always been fascinated by just how much traditional computing tasks most consumers do with their smartphones, which has continually led me to conclude that what consumers really want is the most mobile device form factor that they can get the most done with. This is why the Surface Duo is so intriguing to me because it enables a dramatic amount of productivity in a pocketable/pursuable form factor. Which, as I mentioned, I have concluded, is exactly what consumers will continue to gravitate toward and exactly why I’m convinced folding pocketable devices have a bright future.

One of the more difficult parts of testing the Surface Duo was getting ample opportunities to stress test the productivity angle while out and about due to COVID-19 and the reality that many of us are not leaving the house. But I did take it out into the world every chance I got and intentionally took some video calls/meetings while out in the world which, given the work from home moment we are in, actually proved to be one of the more interesting use cases.

We can all relate to the painful amount of video calls/meetings we are all experiencing lately, and to be honest, before using Surface Duo, this is not something I would have considered doing with my smartphone due to my need to be present and on camera as well as take notes. This use case, in particular, is where the side by side apps and increased multitasking function of Surface Duo stood out to me as quite compelling. This use case is also made more functional due to the size of the side by side screens on the Duo, compared to something like the Samsung Galaxy Fold. While the Fold can run apps side by side, the Duo allows a little more real-estate for those essential productivity apps, which was quite empowering and gave me quite a bit of confidence to do more while I was on the go.

Going back to my point about how the Duo brought the most empowering productivity angle of iPad in side by side apps to a more mobile device causes makes me think it is better to think of Surface Duo as a pocketable tablet than a smartphone. The more time I got to use Surface Duo out in the wild, the more this became clear that using it feels more like using a pocketable tablet than a smartphone.

V1 and Software

There was a great deal of conversation around the software with Surface Duo. There were many fair criticisms of the Surface Duo hardware specs, and the greatest challenge for the platform and Microsoft, and Google is to get more apps optimized for the folding mobile device experience. Yes, Duo is a V1 product, but the broad commentary about the hardware was spot on. From a design standpoint, the hardware is amazing. The biggest hardware knock being the camera, which is also fair. But again, if we think of Duo more like a tablet than a smartphone, both the potential customer for this and the broader future of mobile devices becomes clear.

For all the criticism the Duo has taken in software, I think it is worth pointing out that getting the hardware right for this is an equally important task and arguably the first important task. The software can update over time, but hardware can not. In fact, even with the shortcomings in the camera specs on Duo, if this product was running the Google camera that powers Google’s Pixel phones, I don’t think the Duo camera criticisms would have been as negative.

I think Microsoft nailing the hardware design in many regards was the most critical first step on their journey. They are collaborating deeply with Google, which is an interesting side point. And given the bent on the productivity potential of Surface Duo and the fact that most of Microsoft’s productivity suite was highly optimized for Duo, being productive with Office was quite effective.

For Microsoft, this is a marathon, not a sprint. And for Surface, the goal of the Microsoft hardware line was never to be the market share leader in terms of sales but to be a catalyst for innovation and push the Microsoft ecosystem of software and hardware forward. While I am certain Microsoft has more Surface mobile hardware coming, if this product and their collaboration with Google causes the mobile ecosystem to move forward and support more sid by side app usage, then everyone wins. Especially Microsoft, as the more we can all get done in more places for our day jobs the better positioned Microsoft software and services solutions are on all devices.

Workflows

I found the flexibility of folding the Duo over for one screen usage quite compelling when I went to triage email or to enter long text. My biggest complaint was the keyboard for text entry when the device was opened to two screens. A challenge I think, will need to be solved for us to take folding devices more seriously. But that was solved by flipping Duo over into single-screen mode when I could use it more in a context like my iPhone for inputting and feeling comfortable inputting long text.

One very interesting thing I found, was because of some of the challenges inputting text I found myself using voice input more often. It caused me to wonder if this two-screen/folding screen mobile solution may cause more usage of voice as a computing interface and the role of smart assistants whenever it becomes mainstream.

Microsoft also did something with the software that I wish Apple would with iPad. Which was group different apps together so you could launch specific pairings of apps you pre-determine. Essentially I created several dual-screen workspaces with the most common pairings together. I did things like pair Teams and OneNote or Twitter and Edge, Facebook, and Instagram, etc. This way whenever you clicked the app grouping they both launched together side by side.

Ultimately, I land on the same point many reviews did with Surface Duo. It’s not perfect. It will get better (both hardware and software), but by using it, we get a chance to use a bit of the future today.

Podcast: Microsoft Surface Duo, Motorola Razr, Microsoft XBox Series X, Apple Event Preview

This week’s Techpinions podcast features Carolina Milanesi and Bob O’Donnell discussing their experiences with Microsoft’s Surface Duo device, analyzing the launch of the second generation Motorola Razr foldable 5G phone, chatting about the details of the next generation XBox gaming console and previewing Apple’s Event for next week.

Motorola Updates Its Foldable razr

These past few weeks sure feel like foldable heaven. In the span of a few days, we have seen the Microsoft Surface Duo, the updated Samsung Galaxy Z Flip now with 5G, the Galaxy Z Fold2, the LG Velvet and now the new Motorola razr.

In an exclusive online event, Motorola introduced the new device, which stays true to its predecessor in form but adds some improvements to the foldable display technology, the processor (going from Snapdragon 725 to the 765G), the camera (from 16MP to 48MP for the primary camera and from 5MP to 20MP for the selfie one) and drops the price by $100 to $1399.

The event was nothing like a phone launch, similar to the launch of the first foldable razr about seven months ago when Motorola held a party in Los Angeles for the big unveil. In the era of COVID-19, this event was digital and focused around a short movie directed by Luke Gilford and starring Julia Garner. While, to be honest, the film itself felt more like a glorified commercial, the experience that was meant to be shared over a PC and a phone screen was quite intriguing. I would say the same about the choice of words to describe elements of the movie, which also reflected the razr positioning: “evoke confidence and spark excitement,” “sexy, nostalgic sleekness.”

In an interview with Bloomberg, Motorola’s President Sergio Buniac shared some interesting data points. Twenty percent of buyers of the first foldable razr was iPhone or iPad owners. Also, Motorola accounted for 50% of foldable sales in North America. While, of course, we are talking about a small number of sales as a whole and a minimal number of brands, the results must be encouraging for Motorola.

Part of Lenovo and under Buniac’s leadership, Motorola has been focused on profitability and creating a solid foundation in some key markets like China, the US, Brazil, Mexico, and India. Such a foundation was built, mostly on more affordable products like their Motorola G, Motorola E and Motorola One series. The razr was the product that opened the door for Motorola to re-enter the high-end segment. The razr brand, as well as the foldable design, created an aspirational product that will work as a halo on the rest of the portfolio. Given this intent, Motorola was smart in focusing on marketing and positioning around life-style rather than tech. The foldable design of the razr, similarly to the Samsung Galaxy Z Flip, is certainly more about design and individuality than productivity. This is not necessarily a bad thing, it just addresses a different market to the one the Galaxy Fold and the Surface Duo (yes, I know this is a dual-screen, not a foldable) are targeting.

This round two of foldables from both Motorola and Samsung has two things in common: first, it adds 5G and second, it strengthens the durability of the screen. The two brands take a different approach to it, but the goal is the same: limit damage from wear and tear, or in this case, fold and unfold, and limit damage from debris entering underneath the screen itself. Motorola reduced the moving parts within the hinge itself and added a metal plate underneath the screen to give it more support.

The Quick View Display is, for me, the biggest differentiator against the Galaxy Z Flip. From some of the video footage, there are a few new apps that are supported by the external display like Google Maps, which could come in handy for pedestrian navigation. I compare the Quick View screen to the screen of a smartwatch. A small screen that helps you view and take quick actions on notifications, control your music and even allow you to take a selfie using the more capable external camera system while using the display as a viewfinder. The familiarity of the main screen centered around a one-hand operation and the comparable experience to a smartwatch of the external screen considerably lower the learning curve on the razr. Considering Samsung moved to a larger external display for the Fold, I expect the next Galaxy Z Flip to also sport a larger external screen.

I know there has been a lot of talk about nostalgia with the razr brand and design, but I do believe it would be a disservice to the foldable razr to think of it as riding on nostalgia alone. The younger generations are likely to have never heard of the name or seen the form factor. And older consumers will remember that the original razr had this super cool design but delivered a terrible experience because of poor software. This is precisely where the foldable razr is very different. While the design is most likely the biggest purchase driver, users will not be disappointed by the razr’s performance and how it addressed essential needs like camera, fast charging and battery life. As far as durability, Motorola says that “the razr is designed to withstand up to 200,000 flips, which would take a power user more than five years to reach this level of use.” Of course, all foldables today should be considered as more delicate than the traditional smartphones we have been using and this is not a flaw of these devices, but a reality of the new foldable displays that are used and the hinge mechanism wrapped around them.

Looking at Motorola’s website, the first razr remains in the lineup, at least for now, at the reduced price of $999, which is not a bad price if you are interested in trying out for size the foldable experience.

There are more foldable products coming with less traditional form factors like the upcoming LG Wing that has two screens folding open like a T. Hard to know which one will win. Still, one thing is sure there is a limit to how much sexy alone will sell, especially with a price tag of a couple of thousand dollars. Brand experimenting with designs should always ask themselves what the benefit is and whether the unique design will never come to life because the lack of apps will limit what users can do. Ultimately a phone is our most precious device because we do so much with it and we cannot allow for it to let us down.

How WFH Could Spur Always-Connected PC Adoption

As the fall semester begins with many k-12 and college students still learning from home, while many parents are still working from home, a technical issue looms for many households: slow broadband. Many home Internet connections are not up to the task of supporting multiple concurrent Zoom and Teams calls, along with the other broadband-taxing software and services a family utilizes when everyone is connecting from home. I believe this could drive interest in always-connected PCs. But this will only happen if all the requisite players—including PC vendors, carriers, and platform owners—take some necessary actions.

Slow Adoption of Connected PCs

I’ve written in the past about the value of always-connected PCs, and in the past much of the value I attributed to the category was predicated upon the user being highly mobile. Pre-COVID-19, I traveled a great deal, and the ability to stay connected in hotels, airports, taxis, Lyfts, client offices, and in the minutes leading up to the plane door closing drove immense productivity value for me personally. Add to this the security benefits of not dealing with sketchy, slow WiFi connections, plus the cost savings of not having to pay for WiFi, and for me, the connected PC became more than a luxury; it became a necessity.

Despite all of this, attach rates for LTE modems in traditional notebooks remains stubbornly low as a percentage of overall notebook shipments (it is notably higher in commercial versus consumer segments). Obviously, not everyone wants or needs an always-connected PC, but I do believe the volumes there could be much higher.

There are several reasons for this slow adoption, the most important being the most obvious: Cost. Both the cost of adding the modem to the notebook itself, plus the ongoing cost of service. Other inhibitors include hardware vendors who have been unwilling to deal with the challenges of offering modems across more of their product lines, carriers who have been disinclined to put in the work to drive better onboarding experiences, and platform owners that have been slow to evolve the always-connected experience for users.

As we barrel toward 2021, I am convinced we’ll see the industry begin to deal with these inhibitors, which could lead to a sizeable increase in connected PC shipments in the coming years.

IT Interest Plus 5G Rollout

When companies first started closing offices, the first and immediate need for many was simply acquiring notebook PCs to make sure all employees could continue to work and be productive from home. Now, as organizations move from triage to thinking about the long-term ramifications of some larger percentage of their workforce working from home some or all the time, IT is exploring the best ways to support these workers. One way many companies have helped support their employees is by offering to cover some or all their broadband costs, typically through expense reimbursement.

This is a wildly inefficient and costly way to provide connectivity for employees. Looking ahead, I expect many organizations will take a closer look at the cost of a connected PC, and the ongoing cost of providing connectivity to that PC through corporate bulk purchases and will find much to like. When you add on top of this the potential collaboration and productivity benefits of disconnecting from the overtaxed home broadband connection, the option becomes even more attractive.

In a recent IDC survey of U.S. IT decision-makers, we asked about interest in connected PCs before COVID and now, and the spike in interest was dramatic. And several of the major OEMs I’ve talked to say they also see a spike in interest from IT buyers. Note that I said there was a spike in interest. So far, there hasn’t been a comparable spike in orders. Yet.

Another big potential driver in the coming year is the rollout of 5G networks. There are two factors at play here: that 5G will eventually bring faster, lower latency performance, and the fact that the carriers have spent a fortune building out these networks, and they need paying customers to utilize them. I think these two things could drive more interest from both consumer and commercial notebook buyers.

I’ve been using Lenovo’s new Flex 5G, which is based on Qualcomm’s Snapdragon 8cx processor, with good results. During Intel’s big 11th-gen processor event this week, we saw a glimpse of Samsung’s upcoming Samsung Galaxy Book Flex 5G. Intel has said more products from vendors such as HP and Dell will ship in early 2021 using a combined Intel and MediaTek 5G solution.

What I’d like to happen over the next 12-18 months is for more hardware vendors to begin the challenging process of revamping more existing notebook designs to accommodate 5G modems. That is no small task, I know, but it is one of the critical things that need to happen if adoption is to grow. Concurrently, we need the carriers to work with the vendors and the platform owners (Microsoft, Google, and Apple) to find better, more frictionless ways to let users and companies sign up for, connect to, and utilize fast and affordable connections. Finally, we need the platform owners themselves to evolve their products to better leverage the capabilities that such a connection can bring.

The next few years are going to be very interesting in terms of the technologies that help drive both work and school from home. Even as we look forward to things eventually returning to some sense of normal, many things will have changed for good. One thing will not have changed: The need for a good Internet connection to get work done. I’m hopeful we’ll see some significant strides in making the always-connected PC more common in the future.

Podcast: Samsung Galaxy Z Fold 2, Nvidia Gaming GPUs, Intel CPUs and Branding, Qualcomm IFA Announcements

This week’s Techpinions podcast features Carolina Milanesi and Bob O’Donnell discussing their experiences with Samsung’s second generation foldable device, analyzing the GeForce RTX 3000 series GPU announcements from Nvidia, talking about Intel’s new 11th Generation Core CPUs and the company’s new Evo platform brand, and chatting about the many different announcements from Qualcomm’s IFA keynote speech.

Podcast: TikTok, Apple Facebook, HP and Dell Earnings, Fall Product Preview

This week’s Techpinions podcast features Ben Bajarin and Bob O’Donnell discussing the latest developments and challenges around the potential sale of social media app TikTok, the controversies between Apple and Facebook on activity tracking, the latest quarterly earnings from PC industry leaders HP and Dell, and the potential impact of a range of tech products expected to be released this fall.

The Long-Term ‘Work From Home’ Trend is Overstated

The transition to ‘work from home’ for many types of white collar jobs was a swift and quite remarkable mobilization. With the coronavirus still extant, many companies are encouraging their employees to work from home through the end of 2020, with some intimating that working remotely will be an option on a more permanent basis.This has led to all sorts of forecasts of a permanent, dramatic shift in workplace patterns, away from the office and toward remote/home-based work. I think it’s awfully premature to make such bold prognostications about the longer term. And, I believe these forecasts will turn out to be overstated.

Certainly, the current pattern will continue until there is a vaccine, which could take us well into 2021. The tools to be able to work remotely are available, and companies and employees have adapted commendably. I’ve thought quite a bit over these past several months about how work and learning might have been significantly more disrupted had the pandemic occurred 15 or 20 years ago, before collaboration tools were enabled by broadband, mobile, and cloud. Working from home will be the default option for many as long as the virus in our midst, and will need to be an option for many working parents until day care centers and schools are fully open and in-person. But on a longer term basis, once Coronavirus has waned? I believe the vast majority of people who were going ‘into the office’ prior to the pandemic will choose to do so once again. And, employers will start changing their tune somewhat on how pervasive and permanent they’ll want WFH to be.

While WFH was feasible out of necessity, it’s a suboptimal solution for many — capital ‘S’ for some, small ‘S’ for others. The situation varies by individual, but it could be the combination of any number of factors, such as the type of work they do might be harder to perform remotely, or their home environment is challenging in some way, be it space issues or the inability to work effectively with kids, spouse, etc. in the picture. Sitting at a computer all day and Zooming all day worked OK as a temporary phenomenon. Some companies have even said that some employees have become more productive in a WFH environment. Long-term, I can see this being the case for some workers, but I think the majority of people will become increasingly fatigued with the WFH experience.

I also believe the social aspect of working in an office environment is an under-recognized need for many individuals. This is especially true, I think, for younger workers. Imagine you’re in your mid-20s, having just graduated college or come out of grad school. You’ve had (2020 excepted) an entire community — work, social, activities — at your disposal during college (and in school before). Many social networks, of the analog variety, are formed in those first ten years of work, before marriage, kids, etc. It’s in those first couple of jobs that many people in their 20s and early 30s form their networks, meet their partners, engage with the community, and so on. Going straight to a ‘work from your one-bedroom apartment’ on a permanent basis would be terrible for the mental health of many young people. Zoom is OK for meetings. But it’s not how you meet people, form friendships, and form a life outside of work.

There’s another, less measurable benefit of working in an office: serendipity. Zoom, Teams, Slack, and so on all have their place. But there’s something to be said for the nuances of an in-person conversation that can’t be fully captured remotely, no matter how effective the tool. And then there are the spontaneous, informal types of conversations that just happen when you’re in a physical milieu with other people — the knock on someone’s door to bat around an idea, the side meeting, the drinks after work. All that.

It’s sort of like the difference between online shopping and bricks-and-mortar. Buying something from Amazon or some other online retailer is a largely transactional experience. Usually you’ve done the research and pretty much know what you want. Whereas with physical stores, there can be a browsing/serendipitous/pleasurable aspect.

There are also the nuances of in-person conversations that just can’t be captured in a remote environment. It’s sort of like comparing a phone conversation to text or email. There’s nuance, emotion, empathy, and privacy that happens when people just talk to each other: when you hear someone’s voice, look into their eyes, capture some sort of other facial expression…or just wait a beat and think before responding to something. Plus, there’s a certain informality that happens in the workplace, where not every interaction is witnessed, recorded, or memorialized with digital breadcrumbs.

Sure, there are the pollyannish aspects of WFH. No commute! Less office politics! Cut the clothing budget! Live wherever you want! There are merits to all of these. But I believe that both employers and employees will come to realize that the benefits of working at a place, with people, have come to be somewhat under-appreciated. More people will work remotely post-pandemic than pre-pandemic, and there will be a trend toward more flexible/hybrid models. Patterns will be significantly altered. There are still wonderful opportunities to develop tools to further enable and improve remote work.

But ultimately, we’ll come to realize the palpable benefits of congregating with others at a physical office. Even the elements that are fraught and frustrating are key to learning how to navigate professional relationships. Office buildings might be ghost towns right now. But I think that over time, they will largely be filled and the buzz will be back.

Podcast: 5G, Radio Frequency Spectrum and What it All Means

This week’s Techpinions podcast features Mark Lowenstein and Bob O’Donnell explaining many of the details of how 5G works, what radio frequency (RF) spectrum is, why it’s critically important and what the latest developments are, how how all of this impacts telco carriers and device makers, and more.

Podcast: Microsoft Surface Duo, Qualcomm Court Decision, Fortnite Battle with Apple and Google

This week’s Techpinions podcast features Carolina Milanesi and Bob O’Donnell analyzing the news around Microsoft’s Surface Duo mobile device, discusses the positive legal outcome for Qualcomm’s IP licensing business, and debates the issues around Epic’s Games’ Fortnite-driven battle with Apple and Google’s app store policies.

Wireless Industry Poised for Major Change

Wireless is poised for its fourth cycle of major change in the industry’s 30+ year history. Three major new factors will drive this change. The most important catalyst is the gargantuan amount of new spectrum that will become available over the next several years. The second factor is an industry realignment caused by all this new spectrum, resulting in the emergence of some new players, and an evolving new framework for how networks are built are deployed. Third is the emergence of 5G, whose adoption and new use cases will be tepid initially but will start accelerating in 2-3 years. The rest of this column delves into these three megatrends in greater detail.

The history of the wireless industry actually fits quite neatly into decade-long cycles. The ‘cellular industry’ was born in the mid-1980s, but was not really seen as a major consumer mobility market until the advent of the portable phone in the early 1990s. The 1990s was really about expanding coverage, greater capacity due to digital, and the gradual displacement of voice landlines. The 2000s witnessed the advent of wireless data, beginning with SMS (text messaging), and, later, mobile e-mail services and the first real smartphones, initially led by Blackberry. During this decade, the mobile operators held most of the power, deciding which ring tones and games would be on the carrier ‘deck’. The 2010s was the smartphone decade, defined by a succession of continually improving devices, the emergence of native apps (and the App Store) as the new business framework, and the introduction of true mobile broadband networks in the shape of LTE.

True to form, the wireless industry is poised for major change as it enters its fourth decade. Three interrelated factors will drive this change.

From Spectrum Scarcity to Spectrum Abundance

Earlier this year, I wrote a Techpinions column titled Spectrum-Palooza, whose key theme is that after 30 years of ‘spectrum scarcity’ in wireless, we will be moving to one of ‘spectrum abundance’. This will drive an industry realignment, a different business framework, and exciting new uses, with 5G at the center.

Six months into the year, this theme is coming dramatically into focus: More spectrum will become available for commercial wireless use in the next 3-4 than the cumulative total that’s in use today. The first of four major ‘spectrum events’, the mmWave auctions, were completed earlier this year. All of the [now] Big Three operators emerged with strong mmWave holdings in the major markets. mmWave will act as a sort of ‘Super Wi-Fi’, offering very fast speeds but over short distances.

The next swath of spectrum to become available is in the very important mid-band. We’re two weeks into the first of these auctions, the CBRS PAL auctions at 3.5 GHz. Some 70 MHz of spectrum is being auctioned, on top of the 80 MHz already made available late last year through the GAA ‘spectrum sharing’ layer. So far, the auction is exceeding expectations, with $3 billion raised and all of the major players participating (so far). On the heels of the 3.5 GHz auction is the critical C-band auction, scheduled to start December 8, where 280 MHz of spectrum (not a typo) will be auctioned in the 3.7-4.2 GHz band, raising potentially $100+ billion, according to some Wall Street analysts. This auction is especially critical for AT&T and Verizon, who both need more mid-band spectrum in order to remain competitive. Finally, the FCC added icing to the spectrum cake with the announcement earlier this week that 100 MHz of spectrum in the 3.1-3.55 GHz band, historically used by the military, will be made available for commercial wireless use. That auction could be held in late 2021.

There are two areas of impact from this spectrum-palooza. First, since so much spectrum is being made available, any dramatic imbalance in operators’ post-auction spectrum position will cause major share shifts and potential M&A. Second, the capacity increase will result in significant drops in the price of providing wireless data, which will lead to price changes, new use cases, and new business models, including a more vibrant wholesale market. This is also pivotal to the types of network performance improvements and new market opportunities envisioned for 5G.

Industry Realignment

In addition to a raft of spectrum activity, 2020 also began with a change in the competitive landscape, with the approval of the T-Mobile/Sprint deal. In fact, as of the second quarter, T-Mobile overtook AT&T in terms of the number of branded wireless subscribers. The New T-Mobile is in a particularly strong position compared to AT&T and especially Verizon in terms of spectrum capacity per subscriber, particularly in the mid-band, where T-Mobile inherited 150 MHz of 2.5 GHz spectrum from Sprint. If T-Mobile puts this spectrum to work quickly, it could gain a substantial early lead in 5G performance, while AT&T and Verizon need to spend big in the other mid-band auctions to catch up. The chink in T-Mobile’s armor is the enterprise space, where T-Mobile’s capabilities, and share, lag significantly behind AT&T and Verizon.

The other major new factor in the industry is DISH. The company has been amassing, and sitting on, a treasure trove of spectrum for years, which it is finally putting to use by promising (and being required) to build a greenfield 5G network. DISH is already getting its retail wireless training wheels by virtue of the 9 million Boost Mobile prepaid subscribers the company inherited as spoils from the T-Mobile/Sprint deal. On the heels of that, DISH recently acquired 271,000 Ting Mobile subscribers, and is likely to shake up some of the prepaid industry’s more antiquated practices. DISH is active in the CBRS auction, and is likely to participate in the C-band auction as well. DISH could be an innovator and industry disruptor. For example, DISH is embracing a Rakuten-like approach of building a wireless network using an Open RAN approach, employing a new breed of vendors rather than the usual wireless network equipment troika. I also believe that DISH will establish a substantial wholesale business, perhaps with Amazon or some other Big Tech player as anchor tenants.

And what about Cable and Big Tech? Cable companies, mainly Comcast and Charter, have quietly grown to 4+ million mobile subscribers between them. They’re participating in the mid-band spectrum auctions, but might get priced out by the big guys. Even so, they will have more palatable wholesale options — potentially ironically from DISH — with all the new spectrum becoming available. As for Big Tech, they’re likelier to take advantage of wholesale opportunities than spend big on spectrum.

5G

The third big theme of the 2020s for wireless will, of course, be 5G. My one word of advice: be patient. We are in the very early innings of 5G and it’s likely to get off to a slow start. Even though AT&T and T-Mobile both boast ‘nationwide 5G’ availability, this is 5G of the ‘4G+’ variety, not of the ‘game-changing’ speeds/latency variety. Really fast 5G (mmWave, or T-Mobile’s 2.5 GHz) is only available in parts of certain markets. That, combined with a challenging economy and the lack of compelling use cases for 5G other than faster speeds, are likely to depress 5G adoption, at least initially.

It will be 2022-23 before 5G, in terms of the hyped performance improvements and the incremental opportunities driven by new types of uses in the enterprise, really kick into gear. For that, we need the combination of new spectrum to be commercially deployed, 3GPP Release 16 enhancements such as Ultra Low Latency (URLLC) to become available, a new generation of devices, and new business models — especially for enterprise 5G deployments. We also need to see enterprises shift some of their spending toward mobile for the operators to realize some of the incremental revenue potential from 5G that will justify the heavy spectrum auction and capex spend. The pandemic will be a factor here. On the one hand, some of the 5G catalysts such as remote work and new frameworks in health care and education have accelerated. On the other hand, enterprise budgets will be tight, so any spending on 5G ‘experiments’ will have to be justified.

For most of the past 2-3 years, most developments in mobile were of the internecine variety, with hype about the ‘5G Future’ and endless discussions about industry structure. But the deals are done, the spectrum auctions are in full force, and 5G networks are being deployed. Time to strap on your seatbelts.

Surface Duo: Windowing Is The New Lapability

Yesterday I participated in a press and analyst briefing during which Panos Panay, Chief Product Officer, Windows + Devices and the Surface team spent about an hour going over the Surface Duo, its specs, some key features, but most importantly, in my mind, the thought process that brought the team to this device. We first saw the Surface Duo back in October 2019 during the annual Fall Surface event. At the time, we also saw Surface Neo and together, these two products were clearly positioned as the future of productivity.

The big difference between the two devices, aside from size, is that they run two different operating systems: Duo runs Android while Neo, once it ships in 2021, will be running Windows 10X. Panay positioned Surface Duo as the combination of the “Microsoft you love and the Android, you know.” Users might not be quite thinking about Microsoft in terms of love. Still, there is no question that when it comes to productivity, the Microsoft + Android combo is what the vast majority of US users consider their reality.

The Journey

Panay took us on a Surface journey to remind us of what the team set out to achieve when they brought to market the first Surface and the journey that they have been on since then. This was not about nostalgia; it was an essential reminder of the drivers behind a product that came to inspire a long list of devices both in the Windows and Apple camps. I genuinely believe Surface Duo is the start of a new journey, or maybe it is the next leg of the same journey.

The original Surface was about creating a more dynamic device that brought together a PC and a tablet so that a more stationary workflow could seamlessly blend into a more mobile one and vice versa. With Surface Duo, we have a product that empowers new workflows on the go thanks to the different posture the hardware allows for, but also thanks to the software. Surface Duo does this while having a strong dotted line to the PC that sits on your desk or, at the moment, more likely, on your kitchen table. The more I listened to Panay talk about Surface Duo, the more it was clear to me that, much like our smartphones do, the power this device has is not limited to when we are on the go. The additional benefit of Surface Duo is that it bridges two ecosystems by bringing together the apps that you depend on your phone and the apps that you use every day on your PC. From what I saw from the demos, the team made a real effort in staying true to the Android experience as much as they possibly could while anchoring some core Microsoft experiences.

The Phone

I was struck by one sentence in the blog published by Panos Panay: “So, with Surface Duo, we did not focus our energy on the places the industry is already advancing – processors and networks will get faster, and cameras will get better with or without us.” This makes it quite clear to me that Panay did not set out to launch the best smartphone in the market. Had he done so, clearly, networks, cameras and processors would have been the main focus as these, and maybe screen size and battery, are the battlefields of smartphone innovation.

As I wrote back in October, it would be a real shame if we just measured Surface Duo against traditional smartphones and decided that it wasn’t worth the investment because of what might be perceived like hardware shortcomings such as the camera system, or the lack of 5G support. The team set out to launch the best productivity device for users who spend most of their day in Microsoft 365 apps. Also, users who want a Surface product because they stand for high-quality hardware and attention to detail. A product with a design centered around enabling you to do your best work by freeing you from hardware constraint.

Staying true to the mission of delivering the best hardware for the best workflow, not just the best hardware, requires a certain degree of discipline in deciding what you add and you don’t. With Surface Duo, I am sure most people will concentrate on why Microsoft opted for a dual-screen rather than a foldable one. This question was one of the most asked after the unveiling last year and it has probably become more top of mind after Samsung’s sneak peek of the Galaxy Z Fold 2 last week. Microsoft reiterated the neurological benefits that come from using two windows compare to one larger screen. You can buy into this argument or not. Still, the reality is that a foldable form factor wouldn’t have allowed for the slim design the Surface Duo sports, nor would users have been able to use a pen, a key ingredient in many Surface users’ workflows.

I also wonder if windowing will drive users to discover new workflows rather than adapting how they do things on their phone or their PCs. Having a larger screen usually just makes people think about doing things in the same way but using more space to do so. Some of the ‘enlightened” apps the Surface Teams showed during the briefing from Outlook to Kindle, to the options of “grouping” two apps that you usually use together, are really trying to push new workflows or turning some analog ones into a digital one, like reading a book on one window while taking notes on the other, something that apparently CEO Satya Nadella loves to do on his Surface Duo.

The Cornerstone

I pointed out who I believe will be the most obvious addressable market for Surface Duo. I also can tell you that Surface Duo will disappoint anyone who is not willing to invest some time in figuring out what the device can do for them. As it is often the case with a new category of devices, you need to have an exploration period. Maybe you think it is just semantics, but I consider this different to a learning curve. With Surface Duo, there is nothing to learn per se. It is the software and the apps you know and hardware that, at times, behaves like a phone and others like a compact PC. What you need to figure out is how you bring together all those things you know and make them work for you. This is not a process that everybody wants to go through, especially when it comes with a price tag of $1399.

Whether the Surface Duo is for you or not, what matters most is the opportunity it brings to reinvigorate the Android app ecosystem thanks to the work that the Surface and the Android team will continue to do. This work will benefit Android smartphone players like Samsung and Motorola, who are already foldable segment. It will also benefit PC OEMs and Microsoft first-party apps that will benefit from the tighter connection between phone and computer, possibly what many PC users envy Mac and iPhone users the most. Ironically, even Chromebooks could end up benefitting from this effort. The Surface Team brings a deep understanding of the synergies between hardware and software more so than even a company like Samsung can bring and this is ultimately what is exciting about this collaboration.

For the Surface team, Duo will test what users will be willing to do with the form factor and give a good indication of what can be done for Neo and other products with dual screens and eventually folding screens.

I look forward to exploring how Surface Duo will transform my workflows and rest assured, I will share that in a column soon.

Don’t expect any serious action on Tech Antitrust legislation until 2022.

Last week’s earnings reports from Alphabet, Facebook, Apple, and Amazon were amazing. Although Alphabet showed some losses in ad revenue, it still showed resilience. The other three just blew past market expectations.

As I tracked the earnings of these four, I was also looking at their market capitalizations. If you had told me even five years about that three of these companies would have trillion-dollar market caps by 2020, I would have scoffed and said you were crazy. Five years ago nobody saw this coming and only 18 months ago did it even seem possible that even one of these, Apple, could even hit that trillion-dollar market cap.

Axios created a chart that showed clearly the actual market caps of these four over the last four years.

If you look at this chart closely, you will see that the combined market caps of these four companies are close to $5 trillion.

Earlier this week, due to Apple earnings and a rise in share price, Apple hit a valuation of almost $1.9 trillion Monday Morning, Aug 3, 2020.

Even during a pandemic, with the economy contracting over 30 %, the four of them reported $773 billion combined revenue annualized to date.

Axios also put these annual earnings in perspective to other countries GDP:

- Facebook: $70.7 billion, in the same ballpark as Venezuela’s gross domestic product.

- Alphabet: $161.9 billion, a bit north of Ukraine’s GDP.

- Apple: $260.2 billion, close to Vietnam’s GDP.

- Amazon: $280.5 billion, around Pakistan’s GDP.

Together, revenue for all four adds up to roughly the GDP of Saudi Arabia.

And all four are cash-rich:

The combined cash pile of all four, taken from their last reports, is $420 billion.

$420 billion: the combined total cash pile of the four firms (per data from FactSet, from when they last reported earnings). That breaks down to about:

- $49.6 billion for Amazon

- $60.3 billion for Facebook

- $117.2 billion for Alphabet

- $192.8 billion for Apple

With this type of financial position, these companies have become increasingly powerful in their own right. They now have the scrutiny of governments around the world in terms of antitrust regulations and competition.

In the US, where last week’s hearings brought this antitrust issue to the forefront, it became clear that these major tech companies will have to deal with this antitrust threat for years to come.

Some of these congressional leaders asked good questions but left the hearing not giving any calls to action that had any teeth to it.

As I listened to these hearings, I became convinced that much of it was election posturing, and in the short term, meaning probably the next 18 months, not much will be done to challenge these firms in terms of trying to break them up or change much of their current business practices.

I have two reasons for this view. The first is that current Antitrust laws were not written for the digital age. They were written mostly for the Industrial Age. For any real changes to happen in an antitrust action, it needs new, well thought out laws written specifically for our digital times and make these actions meaningful and applicable to all digital properties in the future.

I have dealt with Washington for decades, and, from my experience, getting everyone on the same page for any real digital antitrust regulations will take time.

The second reason why I don’t see anything happening for at least 18 months, is tied to the Covid-19 Pandemic and the election and possible change in leadership.

Should Trump be reelected, he tends to side with business, even if they get too big. His focus, as we know from the attempt to ban TikTok, is focused on China and products that could feed info to the Chinese in any way, shape, or form. Also, he loves social media for what it allows him to do via its platforms. I have no faith that a Trump administration would force any new and meaningful antitrust laws against any tech company, at least in the first half of a reelected presidency.

If Biden is elected, he would have higher priorities, even if his Democratic colleagues would like to keep the fires lit on big tech and antitrust laws. His first 18 months would most likely be working on correcting the mistakes he feels were made in the past four years. I just don’t see him putting a lot of energy in meaningful tech anti-trust legislation until he and his team feel they have corrected other structural issues much more important to the US than breaking up big tech.

All of this leads me to believe that these four and others will not only weather the Covid-19 Pandemic well but, as they have proven so far, become even bigger. Yes, they will have to be looking over their shoulders at potential government action, but I doubt anything meaningful will happen until late 2021 or early 2022 at the earliest.

Podcast: Samsung Unpacked, T-Mobile 5G, Apple App Store, Microsoft-TikTok

This week’s Techpinions podcast features Carolina Milanesi and Bob O’Donnell discussing the announcements from the Samsung Unpacked event, including their new Note 20 and Galaxy Z Fold 2 smartphones as well as their partnership with Microsoft on software and gaming services, chatting about T-Mobile’s launch of the world’s first 5G SA (Standalone) network, controversies around Apple’s App Store policy and cloud-based gaming services like Microsoft’s upcoming xCloud, and analyzing the potential purchase of TikTok by Microsoft.

Chromebooks and Macs Enjoy Huge Quarantine Quarter in the U.S.

The entire PC industry experienced a very good second quarter. And here in the United States, we saw exceptionally strong results with a year-over-year growth rate of 18.8% in the traditional PC market comprised of desktops, notebooks, and workstations, according to IDC’s latest data. Inside that monster quarter, all the major platforms—Windows, ChromeOS, and macOS—saw growth, but the latter two saw massive expansion during the quarter that is worth exploring in more detail.

ChromeOS Growth

During the second quarter, Chrome OS saw 29.7% year-over-year growth, with shipments well north of 6 million units, which represented 27.3% of the U.S. market. What is notable about that number is that it spread across segments, including consumers, education, and business.

The success of Chromebooks in U.S. education is well documented. Google and its OEM partners have seen steady growth in the education segment over the years, thanks to a combination of low-cost devices, easy-to-use device manageability, and strong security. In the second quarter, as schools around the country shifted to school from home, many school districts began accelerating their purchase of Chromebooks. As a result, the education segment saw substantial year-over-year growth, and it continues to represent more than 75% of Chromebook shipments in the United States.

Based on my ongoing conversations with both OEMs and component vendors, there is strong reason to believe that Chromebooks will also enjoy a strong third quarter in education. Schools continue to buy devices in anticipation of a challenging fall semester that is likely to include at least some school-from-home elements. In fact, many inside the supply chain believe that we could see strong education shipments well into the fourth quarter, well beyond normal seasonality, as schools build out their fleets for ongoing 1-to-1 device requirements looking ahead to 2021 and beyond.

While the strength of Chrome OS in education may not be too surprising, the other area where we saw strong shipment growth was in consumer. That segment grew even faster than education, although from a much smaller base, to represent more than 15% of shipments. While some percentage of these purchases was undoubtedly consumers purchasing Chromebooks for personal use, I believe a sizeable chunk of these purchases through consumer-focused channels is for work purposes. That’s because as companies shut down and sent employees to work from home, many weren’t able to acquire the PCs they needed through their normal channels, and so they had to ask employees to go out and buy their own, to be reimbursed later.

I’ve long argued that I see a role for Chromebooks in business, and this current shift to work from home could be an inflection point. We’ve seen a wide range of enterprises test out Chromebooks, and even deploy them to a subset of their employee installed base. Many companies jumped into the Chrome OS pool in the second quarter and found the water just fine. I expect many to swim deeper in during the coming months and years.

macOS Growth

During the second quarter, MacOS saw a whopping 70% year-over-year growth, with shipments of more than 3.2 million units, which represented 14.5% of the U.S. market. In early May, Apple updated the 13-inch MacBook Pro with its new Magic Keyboard and more storage.

In the U.S., macOS enjoyed strong growth across all of the segments IDC covers, including all sizes of business. As you might expect, the consumer segment was the strongest of all, representing 80.1% year-over-year growth and more than half of total shipments. Apple also saw a nice education bump during the quarter, but nothing near the size of Chrome OS. That said, as we head into the third quarter and higher-education students and their families begin to prepare for what promises to be an interesting fall college semester, Apple is likely to see strong volumes. It’s worth noting that when an individual purchases a Macbook through retail, for use at college, it shows up as a consumer unit in our data. If a college makes the purchase and distributes it to students, it shows up as an education unit.

One interesting aspect to watch: During WWDC, Apple announced that the first Macs running Apple Silicon would ship in the fourth quarter. It is unclear yet if this announcement will cause some buyers to hold off on new Macs during the third quarter in anticipation of the new products. However, with Apple continuing to announce new Intel-based Mac products—including an updated 27-inch iMac this week—I suspect many Mac buyers won’t let the pending new product(s) slow their current purchases.

Outlook for 2H20

It is worth noting that while Chrome OS and macOS both had excellent quarters, Windows also saw good growth in the U.S. during the quarter. And Windows-based PCs still represent more than 58% of all units shipped in 2Q20.

Looking ahead, and based on ODM data, the third quarter is off to a strong start. The big question is whether that growth is sustainable through the quarter and into the final quarter of the year. At some point, the economic reality will set in. As companies downsize and consumers face steep unemployment, buying will drop off. It is too soon to say precisely when that will be, and even if buying remains strong through this year, it does set the market up for a challenging 2021.

Podcast Special: Marta Karczewicz of Qualcomm Discussing Video Compression Technology

This is a special Techpinions podcast with Carolina Milanesi and Bob O’Donnell along with special guest Marta Karczewicz, VP of Technology at Qualcomm, discussing the evolution of video compression technology and standards and how they impact our ability to watch streaming videos from services like Netflix on our smartphones and TVs. In addition, they discuss the role of women in engineering roles and the importance of diversity in technology research and development.

Samsung #Unpacked2020: Strong High-End Portfolio & Deeper Collaboration with Microsoft

The Samsung Galaxy Unpacked part one, back in February, was the last live event I attended. Hence, as we approached this week’s Unpacked, I was as curious about the products to be announced as I was to see how Samsung would pull off their first digital launch.

Overall, I thought Samsung did a good job mixing content videos, technical and informational videos and time on the virtual stage. Personally, I was not a fan of the virtual audience, but I think it did fit the feeling that the live venues over the past couple of times created, with the big floor to ceiling screens that displayed both content and the audience in the room.

I appreciated having the opportunity to see new faces from the engineering and design teams. I suppose it is the silver lining of having a digital event and recording in Korea. This setup also brought more women on stage, which is always a good thing!

There was a lot to cover product-wise, but Samsung kept a fast pace and, for the first time, brought all the products together, demonstrating the value of having more than one Samsung product. Samsung has been trying to paint that “better together” picture, but what was missing was the software portion that would bring the products together. This time, both thanks to Samsung’s software and a renewed partnership with Microsoft, that the dotted line between products was much more obvious and natural.

Products that Do More At a Time When We All Do More

With August-Unpacked being the Galaxy Note reveal show, we have been accustomed to focusing on the latest and greatest tech and so the very high-end of the Samsung portfolio. Over the past year, there have been some questions on whether the Note line continued to fulfill the initial promise of being the best of what Samsung has to offer in mobile, especially as the market moves into Foldables. I think the Galaxy Note20 Ultra took care of those concerns by embracing quite a few technology firsts from the 5G Snapdragon 865+ chipset to Gorilla Glass Victus and UWB.

What was interesting this year is that Samsung announced a whole portfolio of high-end devices around the Galaxy Note line. Galaxy Z Fold 2 teaser aside, we saw the Galaxy TabS7, the Galaxy Watch 3 and the Galaxy Buds Live. While it might seem strange to bring to market high-end products in the current economic environment, we need to consider that this is not Samsung’s only offering. Earlier in the summer, Samsung launched a whole range of mid-tier phones that added to its Galaxy S line to give smartphone buyers an ample choice of features, designs and price points.

Together with a lot of economic uncertainty, the pandemic also brought a stronger need for technology and reliable devices, whether it is for working from home, distance learning, keeping healthy, or just trying to stay sane. While being stuck at home might have increased the time we spend on larger screens, it has not taken away how much we rely on our phones. Phones also remain the tech device that you can more easily plan for financially thanks to installment plans that limit the impact that a one-off purchase would have.

Samsung’s strong carrier channel and 5G integration might also make the Galaxy TabS7 line to be as easy to purchase as a phone at a time when many consumers are re-evaluating their computing needs as well as their broadband constraints!

The one product that I find harder to justify, although it fits into the portfolio, is the Galaxy Watch 3, where the price point reflects more design choices than technology ones. I would have liked Samsung to double down on its Galaxy Watch Active line maybe with a new color variant to fit with the new Galaxy Buds Live. The good news is that many of the features and capabilities announced for the Watch 3 are software-driven, which might mean we will see them trickle down to the Watch Active line at some point.