Introduction

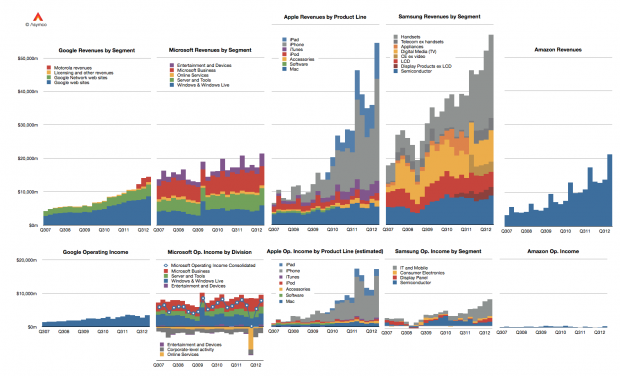

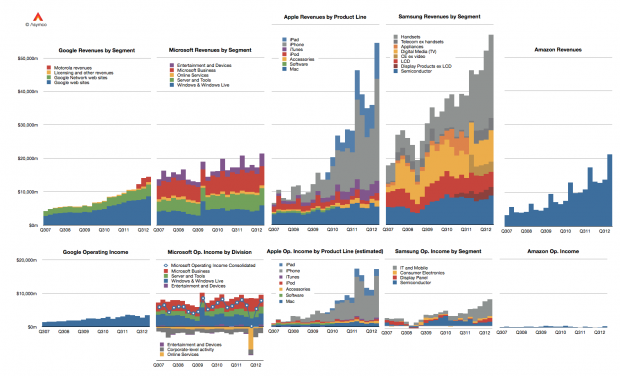

Today’s five Titans of personal computing are Google, Microsoft, Apple, Samsung and Amazon. Horace Dediu of ASYMCO has created a side-by-side comparison of their respective revenues and profits.

Google is a money making machine, but I think that many overestimate its profitability. As the graph clearly shows, Google doesn’t make nearly as much profit as does Microsoft, Apple or Samsung.

Further, we know that the vast majority of Google’s profits are still derived from its desktop advertising business. Android, for all its success in the marketplace, has not yet proven to be profitable to Google.

In a reversal of Microsoft’s business model over the past twenty years, all of the Android profits currently reside with the hardware makers rather than the software provider. Perhaps this is why Google is moving more and more towards making their own hardware. (Google currently owns Motorola and makes Nexus phones, Nexus tablets, Chromebooks and the newly minted Google Chromebook Pixel.)

Microsoft

Microsoft has been making ungodly profits for almost two decades. Microsoft’s problem isn’t profitability, it’s growth. Despite making money hand over fist, Microsoft has been unable to grow its base for much of the past ten years.

And Microsoft is facing serious challenges to even maintain the profits that it now has. In the above graph, the red portion of Microsoft’s profits come from Microsoft Office and the blue portion comes from Microsoft Windows. Both currently reside primarily on desktop and notebook machines. With those devices declining in sales and with phones and tablets rapidly growing in sales, Microsoft needs to make the transition to mobile and they need to make it fast or their two cash cows are going to be isolated and start to dry up.

Apple

As you can see from looking at the graph, Apple’s profits are not just good, they’re spectacular. They far outdistance the other four titans of tech. At yesterday’s shareholder meeting, Tim Cook reputedly said that Apple grew revenue by about $48 billion, more than Google, Microsoft, Dell, HP, RIM, and Nokia combined.

Apple’s problem is the perception that they are the next Microsoft – that they will continue to make great profits but that their growth will stagnate. The graph, above, does not seem to support that view, but past performance is not a guarantee of future profitability.

Samsung

Samsung is an amazing story in oh so many ways. By all rights, Samsung shouldn’t even be on this list of Tech Titans. For the past two decades, the PC manufacturers – the Dells, HPs, Lenovos, Samsungs, etc – were at the bottom of the tech totem pole. Always trapped in a race to the bottom, Microsoft and Intel took all the profits while the hardware manufacturers were relegated to fighting for the scraps.

No more. Samsung has turned that business model on its head. Android – like all licensed operating systems – was supposed to encourage a wide variety of hardware providers. But Samsung has swallowed the Android market share and the Android profit share whole.

Amazon

What can one saying about the amazing Amazon. Their revenues go up but their profits do not. And the less profit they make, the more successful they are perceived to be.

John Gruber once described Amazon as the crazy guy at the poker game. You simply don’t know how to play your cards against Amazon because they don’t play by any of the known rules. And you sure as shooting don’t want Amazon to come after you because they will sacrifice profits in order to win your market. And they are relentless.

Summary

So long as Apple is profitable and their ecosystem healthy, they’re not going anywhere. Microsoft is in it for the long run too. They have the money to sustain their efforts and they well know that they need to be in mobile or they will be locked out of the future of computing. Amazon appears determined to be part of the mix too.

The two titans that seem the most unstable to me are Google and Samsung. Google controls the Android operating system and the ecosystem but they make little profit from either. Samsung makes almost all the profit from Android, but they have little control over the operating system and they make little to no money from the sale of advertising, apps or content sales. That seems like an unsustainable relationship to me. Something has got to give and it’s clear that each side is weighing their options. Google is moving more and more towards making their own hardware and Samsung is flirting with a variety of different operating systems. The future is always uncertain but it seems clear that the relationship between Google and Samsung is certain to change.

It’s written in the stars: Steve Ballmer will remain CEO of Microsoft for another year and the company will continue to lose clout in the consumer market.

To me what stands out is that Smartphones are an anomaly in a world where hardware is largely a commodity business. This is because in this one instance, corporations have largely convinced buyers (AKA suckers) to buy hardware with a rent-to-own like model where monthly payments mix HW subsidy with service costs, to hide the true cost of HW, and huge margins buried within.

What would happen if that subsidy bubble burst? It would mainly affect the two main beneficiaries: Apple and Samsung.

I don’t think Google is chasing HW margins, I think they want to kill HW margins (and SW margins FWIW). They disrupt by choking the competitor air supply. Similar to Amazon.

Google is willing to be the zero margin HW/SW provider to ensure it gets it’s services everywhere. Amazon in a similar position so it can be the Walmart of the online world.

Amazon is definitely the Walmart of the online world and they’re even scaring Walmart in the offline world.

The challenge to Google’s and Amazon’s type of strategy is to build a deep enough moat for a class of business that you’ll be able to prosper with for many years.

Both are throwing everything into growth, sapping opportunities of competitors but taking little home. Trouble with this sort of a strategy is that they are JUST as susceptible to a disruption as Microsoft, whose biggest problem in the ’90s was carrying their bags of money to the bank. Smartphones — which are more pocket post-PCs than phones — should be a good reminder that a different paradigm could pop out of left field any day.*

The trick is staying at the sweet spot on the wave of innovation—not on the bleeding edge, but close enough that you can define new technologies in ways that match up with YOUR unique capabilities and style.

* No, Google Glass is not that paradigm.

John, Google is the important outlier in the gang of five. Unlike the others, its product is NOT sold to consumers; Android, Search, Mail… those are all, as you’ve heard Dediu say, merely cost centers for collecting info on people to maximize the aptness of Google’s ad placement.

Android et al aren’t MEANT to be profitable; it would only be so accidentally. Charging money would limit the number of people they touch, and thereby harm the actual corporate goal of being the premier ad broker.

I’ve pondered how a bright startup team could compete asymmetrically against Google (as I imagine somebody in Mountain View does regularly). Facebook’s approach is slightly different, but it still depends on getting web sites to run ads that Facebook places smartly (or at least, in sufficient volume).

My best tack so far would be a company that built a micropayments system for page views. I pay about $1000 a year for various online news and entertainment services (NYT, WSJ, FT, New Yorker, …) and that’s a non-starter for anybody not a news junkie. But most people would like to read a hot story in the NYT for a penny or so; my understanding is that’s MORE than they get for the ads that clutter up so many sites.

A company like Twitter or Facebook could act as an intermediary for pay-per-view, collecting a commission every time one of my tweeps points me (thru a “1.1¢”-labeled link) to an ad-free page; Apple could revise their store policies to encourage, rather than discourage in-app purchases of content. That keeps up the referral business and trusted references, and for many sites could be MORE profitable. (At the likely purchase rate on those dumb testosterone, insurance and belly fat ads, it could be a huge win.) Especially over mobile, where ads are disruptive and burn up valuable bandwidth.

Too bad it’s such an uphill battle to have a streamlined, ad-free experience online, in exchange for a few dollars a month, paid only for the authors and/or organizations you want to follow.

I can tell that you could be acting myopic in your entry just to cause discord.

Magnificent beat ! I wish to apprentice while youamend your site, how can i subscribe for a blog site? Theaccount aided me a acceptable deal. I had been a little bit acquainted ofthis your broadcast provided bright clear concept

Great post Thank you. I look forward to the continuation.

But wanna say that this really is quite helpful Thanks for taking your time to write this.

Thank you for great information. I look forward to the continuation.

Wow, fantastic blog layout! How long have you

ever been running a blog for? you make blogging look easy.

The whole glance of your site is excellent, as well as the content!

You can see similar here sklep internetowy