There have been some interesting data points over the past few quarters that I’ve been following. Most of them are related to some specific interplays between the tablet market and the PC market. As many of our readers know, I divide the tablet category into two categories–for now. One is the market for more capable tablets like the iPad, Surface fits into this category now as well, and a slew of other new tablets called 2-in-1s (I dislike the term) coming in 2014 will as well. Then there are tablets which are purely more media consumption products. Now what is interesting from a data point is that the US, who is one of the largest regions for notebooks and desktops, also happens to be one of the largest regions for tablets as well of both categories. But perhaps more importantly, the US is one of the largest markets for iPads. The rest of the worlds big markets are higher consumers of less expensive, commodity tablets, which is actually where much of the tablet growth has come from the past 6 months. So with these observations in mind let’s look at a few charts.

What this chart is showing is that it appears the PC market is stabilizing in the US. Meaning that quarterly negative growth is lessening. What it also shows is that tablet growth is also slowing in the US. I believe there are several explanations for this.

While I believe a certain class of tablets will suffice for the masses as a PC replacement, the majority of the installed base is still using them in conjunction with their PCs. It is important to remember that over 90% of tablets sold are sold to EXISTING PC owners. Many PC owners find that owning a capable tablet allows them to delay their purchase or need for a new PC. Most are still using their tablet and keeping but using their current PC less. This would explain many data points we see from comScore and others showing PC usage high during the day and tablet usage high during the evening.

The question now becomes: Are many of those tablet (mostly iPad) owners finally ready to start upgrading their PCs? This is the theory the PC industry hopes is true. I do believe there is some merit to this theory. However, it is going to take at least another six month’s for us to have a clearer picture. My hunch is that the tablet slow down picks back up this holiday Q4 and notebook and desktop sales remain negative. In fact the Consumer Electronics Association Black Friday and Cyber Monday survey’s indicated that tablets were the second most frequently purchased product at 36% to the notebook which was 23%.

How negative notebooks and desktops are in Q4 is a key point. If it is around -4 to -5 or better then this is actually good news as it would add to the theory that the market is stabilizing. I fear it may be off more than that, but this scenario may also be interpreted as a good sign for PC refresh in 2014.

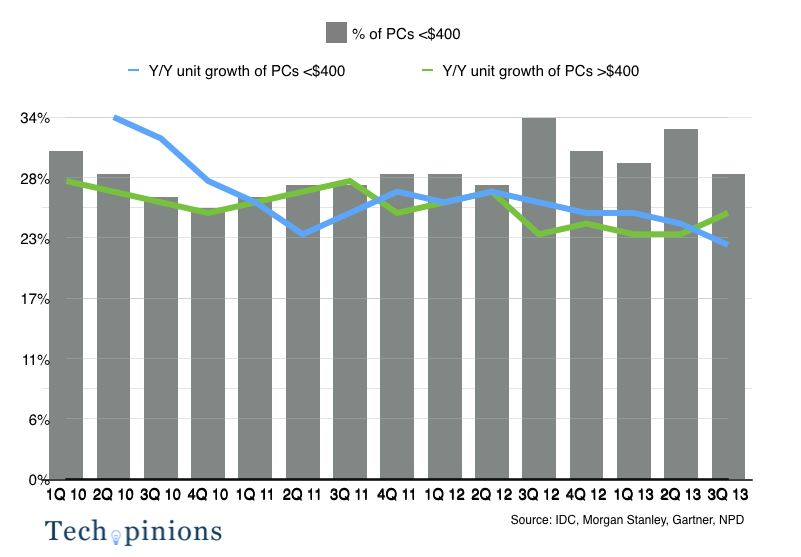

The other bit of good news is that the higher-tiered price bands of PCs are doing better than lower tiers.

As you can see the chart shows the greater than $400 segment as doing better than the less than $400 segment. Even the premium segment of PCs is holding steady mostly thanks to Apple.

Looking forward, if the PC market is stabilizing this is good news. We could very well be looking at a pendulum swing in the industry where PC slowdown and tablet slowdown off-set each other in particular years. PCs may be slow during tablet refresh cycles and tablet refresh cycles may be slow during PC refresh cycles. The key point in this scenario is that tablet refresh cycles will be more frequent that PC refresh cycles.

2014 will be an interesting one to observe these trends and the interplay between tablets and PC. I feel that by the end of 2014 we will have a much clearer picture of this somewhat symbiotic relationship.