As a primer for this analysis of Amazon, I recommending reading the Insider report on Smart Devices and E-Commerce. Amazon’s imminent smartphone entry is a puzzle. It feels as though the mobile landscape in places like the US, UK, and other regions where Amazon has a play are mostly settled. Apple and Samsung are the dominant brands, with the dominant ecosystems. So how can anyone break through? This is the puzzle and the question is, does Amazon have a piece that fits into the broader mobile landscape?

It would be easier to speculate, and be optimistic, about Amazon’s plans if most the markets (the US primarily) where Amazon has a foothold were not subsidy markets for mobile devices. The cost of a premium device to end consumers is relatively low, making price less of an issue. Speculating price to be a perceived advantage for an Amazon smartphone entry may not be the right angle, however. What are the possible value propositions then?

Sponsored Data

Part of the picture became more clear as news broke that a key feature may be called “Prime Data.” Amazon is making a push for Prime lately, running commercials promoting the service and even looking to invest in more exclusive content deals like adding HBO Go. The concept around sponsored data is that the cost of the data tiers goes down in exchange for consumer seeing sponsored or advertising content. While this seems like it would not be the greatest consumer experience, the bottom line is if a consumer can get an all you can eat plan for voice, text, and data, at a very low cost or even free, this could be an interesting value proposition.

Another thing to watch with regards to the Amazon phone, or any smartphone coming soon, is Broadcast LTE. No one has been more skeptical of the idea of getting broadcast TV signals on a mobile device than we are. It really only works for things like news or sports. However, Broadcast LTE can use the existing infrastructure. This was an issue with things like Digital Video Broadcast and other live mobile broadcast technologies. Those took not only new technology in many cell towers but also dedicated chips in the handsets. Broadcast LTE is different and when you think about it being free thanks to sponsored data, things could get pretty interesting from a services standpoint. While I still have some big questions about Broadcast LTE, it is something to keep an eye on.

What has become clear to me over the past few months is many carriers in Amazon’s battleground countries are complicating their plans to the point consumers are getting extremely confused. This smells like an opportunity for someone to simplify plans and give consumers value in a way they can understand. While I don’t expect Amazon to become their own mobile operator, I would look for them to do something creative with a carrier like T-Mobile or possibly AT&T.

Mobile Commerce

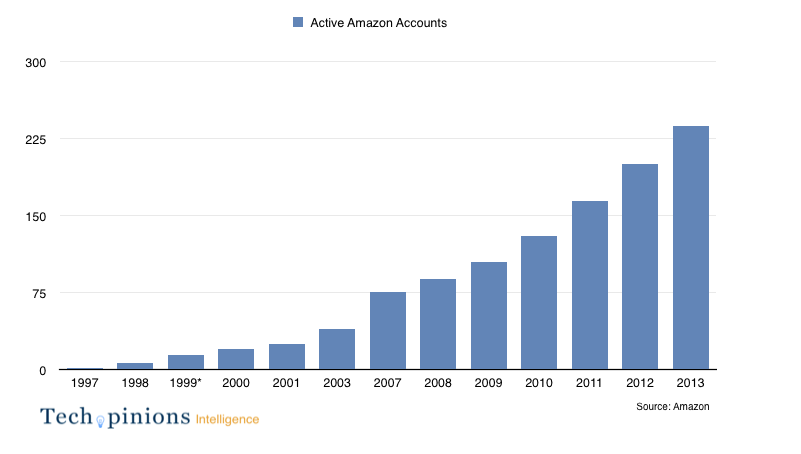

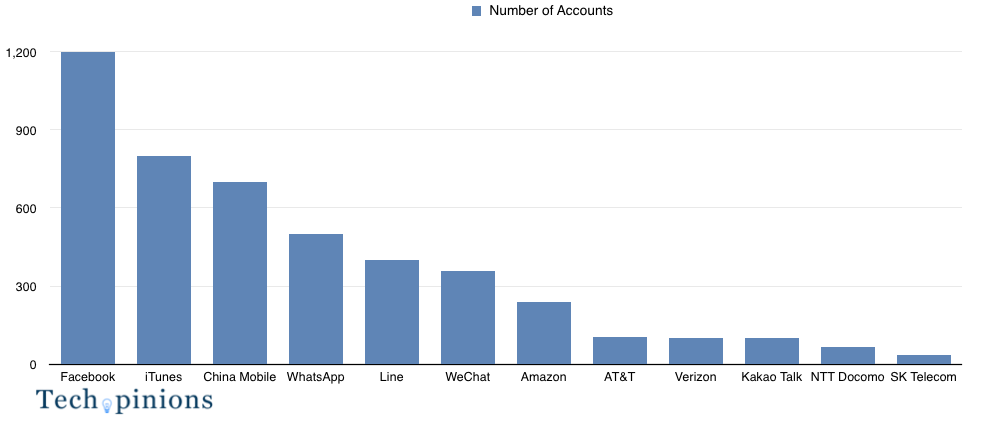

One of the other points to speculate on is the degree Amazon’s play has anything to do with mobile commerce. At the end of 2013, Amazon stated they had 237 accounts. While it pales in comparison to Apple’s 800, Amazon’s are active where Apple’s are just registered. I would estimate Apple’s active iTunes account base to be in the high 600m range, with a decent degree of confidence from our data. With that in mind, the speculation around Amazon’s mobile play is around the concept of “showrooming.” The idea behind this is consumers go to retail stores, look at the products, make a decision, and then go home and buy it online. Recent data we have highlights that 68% of mobile users surveyed said they have “showroomed” in the past month. During the Q4 2013 time frame 27% indicated they purchased the product they showroomed via their mobile device. The same research we have said the top categories for “showrooming” are: clothes (33%), shoes (26%), books (23%) and gifts (22%).

Not surprisingly in the regions where Amazon has a presence, they were the preferred retailer for someone who was showrooming. Whether from a PC, tablet, or smartphone, 48% indicated they purchased the product they showroomed through Amazon. The corresponding figure for eBay is 38%. Perhaps Amazon knows this and believes their smartphone can help drive more sales from showroomers through their portal.

Amazon is well positioned when it comes to show rooming; however this can be done through their app on any smartphone. It is hard to see how Amazon can make it any better or easier on their platform versus someone else’s.

Fighting Against Webrooming

One interesting trend where we are specifically getting data now is around “webrooming.” This is where a consumer researches online and then goes and buys the product at retail. In the above category of showrooming where 68% have done so, 74% who say they have used the internet to search for a product or service to buy offline. Clearly both are happening, with one slightly more frequently than the other, but the majority of the online population is participating in both showrooming and webrooming. However, webrooming does not benefit Amazon. They would prefer to drive the sale back through their portal. We can speculate any entry from Amazon may be designed to bring the masses, and more frequent shoppers, to do more showrooming than webrooming.

What is left to be stated is, in developed markets, the PC is the dominant e-commerce device by a healthy margin. Over 90% of online shopper indicate they shop through the PC regularly with just under 50% indicating they do so frequently from mobile, and 19% indicating they do so frequently through a tablet. Knowing this calls into question the degree Amazon’s value proposition in a smartphone hinges on the point of mobile commerce.

Beacons Play a Role

In general, beacons like iBeacon and other devices based on Bluetooth LE, will play a significant role in mobile commerce. A transformative role one might even say. For an excellent read on the promise of beacons check out this excellent piece by Steve Cheney, who works for one of the leading beacon companies.

These beacons in retail have the potential to give deeper context to a shopper through their mobile device. What’s fascinating is, beacons don’t necessarily have to drive e-commerce to dramatically change the retail experience. Instead, a shopper can walk down the cereal aisle, trigger a beacon, and be presented with coupons or promotional offerings on cereal. Beacon’s will bring proximity to retail and it stands to change the game entirely. More importantly, it will give retailers a chance to compete more fully against the Amazons of the world.

Challenges for Amazon’s Smartphone

In mobile, no company shipping a forked version of Android has attempted to succeed in mature markets. This is because Google and Apple have all the apps, the map services, and a host of other things considered essential for a mobile device. Amazon has a much weaker app ecosystem in mobile on their Android fork. They have no mapping solution, and will need to use someone else’s most likely. They will need to use a search engine like Bing as they do on the Kindle Fire tablets. Knowing what their options are, it is extremely difficult to have optimistic projections for their smartphone entry against the likes of Apple and other Android vendors like Samsung.

That being said, Amazon seems to be playing a very different game than others. So perhaps we need to shape our expectations of what success looks like for Amazon different than others in the smartphone market. Whatever the case, it will be nice to see some new competition enter mobile. And if Amazon can prove that a fork can compete against the incumbents, it could open the flood gates of others driving hardware as a service in multiple segments related to PCs, tablets, and smartphones.

Amazon’s hardware play, in any category, is their attempt to acquire valuable data and integrate their experience. These are two things they will have trouble accomplishing if they are simply a software stack on someone else’s platform. But whether they can pull it off, or whether their platform is even the right one, remains to be seen. In terms of mobile eyeballs, payment opportunity, and overall share of mobile engagement time, I again leave this slide as food for thought.

“Amazon’s imminent smartphone entry is a puzzle.”

I read an interesting explanation of it: Amazon, with their strategy of near-zero profit margin, will simply sell their phone for less than the competition.

It could be effective.

I do not even understand how I ended up here, but I assumed this publish used to be great

As I website owner I believe the content material here is really good , appreciate it for your efforts.