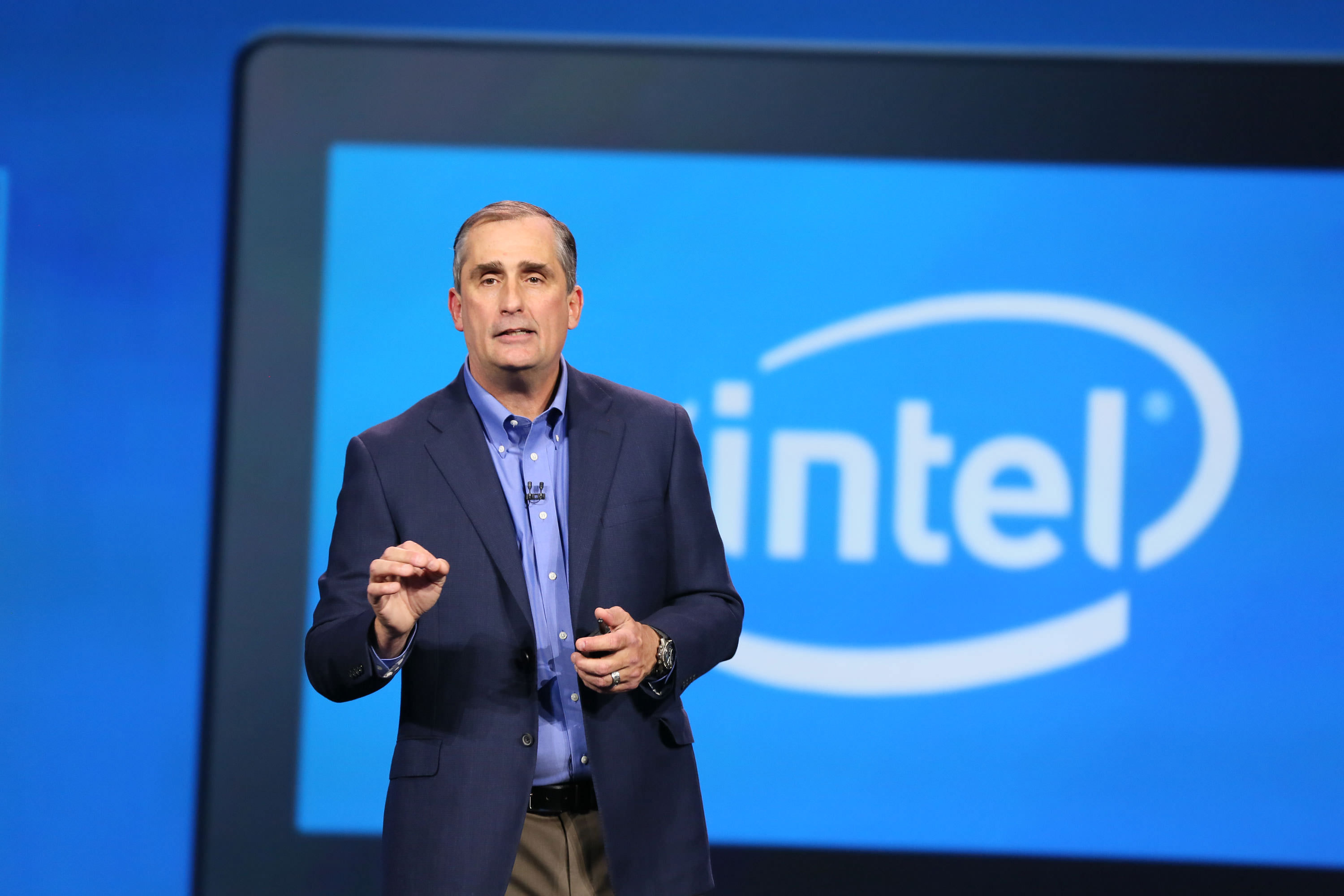

In an internal memo to employees that surfaced earlier this week, Intel CEO Brian Krzanich told staff that the company’s new, aggressive strategy for 2018 would involve taking more risks and expanding the areas in which Intel can impact technology. Citing change as the “new normal,” the leader often called simply “BK” is telling his engineers, marketers, product managers, and sales teams to prepare for a very different Intel in the coming months. This is a change that many analysts in the tech community have been asking for, and one that Intel finally seems to be publicly committing to.

For the better part of the 2010s, Intel has played an interesting role in the technology field. Though it dominated in the PC space, most pundits viewed the corporate direction as somewhat aimless and lacking a drive to push forward in any one particular space. That included the client compute and enterprise groups, both of which enjoyed a stranglehold in market share. The Xeon group was maintaining near 99% saturation in traditional server platforms and the Core-branded processors were the dominant player in PC gaming, mobility, and professional computer segments.

During that time certain sub-groups noticed a lack of innovation. PC gamers and enthusiasts are a small but vocal segment of the PC ecosystem. It is this group that is the canary in the coal mine; when it starts to recognize the lack of change and performance or feature improvement, it is a tell-tale sign that the rest of Intel’s business units will suffer the same fate as the technology roadmaps progress.

As a result, Intel allowed several key competitors to re-enter valuable PC and server segments, threatening to take over market share and decrease Intel’s margins. AMD was able to offer new products like Ryzen for the consumer desktop, Threadripper for enthusiasts and workstation users, and EPYC for the enterprise and cloud, all of which will reduce the dominance of Intel in those specific fields. Qualcomm is also entering the cloud computing space with its own Centriq 2400 server processors based on the Arm platform, circumventing traditional processor designs with a more power-efficient implementation.

Intel has fallen behind in the current race for dominance in the machine learning and artificial intelligence fields. Once considered the pinnacle for any compute workload, Intel processors have been overshadowed by the designs from NVIDIA (and AMD to some degree) that started as graphics and gaming chips but have migrated and evolved to focus on the massive amounts of data and parallel processing required to develop intelligent systems. As a result, NVIDIA stock has skyrocketed, and CEO Jensen Huang is cited as a leading mind in compute fields in countless media representations.

Even the crown jewel of Intel’s operation, the capabilities of Intel silicon chip fabrication technology, is starting to show signs of worry. Intel has been building processors on the 14nm process node for much longer than originally planned or expected based on roadmap projections from years back. This is a result of either a lack of desire to push forth to the next-generation option (10nm) or the inability to build this new process node to satisfactory status to maintain margins and yields. Companies like Samsung, TSMC, and Global Foundries continue to push new process node tweaks to customers despite Intel’s stationary position. Samsung has been producing and shipping 10nm chips for customers like Qualcomm for nearly a full year while Intel will only start doing so sometime in mid-2018.

The memo from BK weighs in on the cultural changes necessary to push Intel over this speed bump with surprising candor. Krzanich says that the future of Intel will be as a “50/50 company,” one that sees half of its revenue from the stalwart PC space and half from “new growth markets.” These will include memory, FPGA (programmable arrays for faster development of new products), the Internet of Things, artificial intelligence, and even autonomous driving. The memo states in many of these areas Intel will be the underdog in the fight and that it will require the use of “new, different muscles” in order for the company’s products to have the impact he sees coming.

Part of flexing these new muscles will mean taking more risks, something that Intel has been extremely hesitant to do in the last decade. For a blue-chip company that has been as successful as it has for the last 50 years, trying new things will mean an increase in R&D budget along with the expectation and acceptance of failure in some portion of these new ventures. Being able to “determine what works and moving forward” is a mentality that exists naturally at organizations like Google but must be grown and matured manually at Intel.

BK mentions a term called the “One Intel,” calling it an “aggressive company.” Part of that shift is being driven by stock holders that demand Intel move forward to address the market of opportunity before it. No other company in the world has a portfolio of product and minds like Intel can offer and though it may make more mistakes than successes at first, there is little doubt what it CAN DO if the management and leadership is truly committed to the changes put forth in this memo.

Intel believes that there is as much as $260 billion worth of addressable market for it to go after in 2018 and beyond. It’s a pot of gold that many other talented and driven organizations are going after. But if you believe Intel’s CEO, “the world will run on Intel silicon.”

Wonderful post! We will be linking to this great article on our site. Keep up the great writing

There is definately a lot to find out about this subject. I like all the points you made