On October 27th, 2014, Techpinion’s very own, Brian S. Hall, wrote an article entitled “Microsoft Is Doomed. Doomed!”

Brian was, of course, being facetious. Far from predicting doom for Microsoft, he was mocking the Microsoft doomsayers. Let’s take a look at a few of his article’s choicer bits:

I have to believe Microsoft’s latest earnings has finally obliterated all the silly “Microsoft is doomed!” discussion that’s been so bien pensant across the blogosphere these many years. This is a company that generated $23 billion in revenues and is clearly poised for growth.

Repeatedly, the analysts trotted out “jobs to be done” and “the innovators dilemma” and “the smartphone is the computer” to explain why Microsoft was so obviously doomed. How could they all have been so utterly wrong?

Microsoft is welcome to serve up a bowl of tasty claim chowder.

That sound you hear now? That’s Satya Nadella, laughing from his CEO chair in Redmond.

Hmm. With all due respect to Brian, Microsoft is not poised for growth, the critics aren’t wrong yet, there’s no claim chowder to be had here, and I very much doubt that Satya Nadella is laughing about the challenges facing Microsoft.

Truth springs from argument amongst friends. ~ David Hume

The difference between Brian’s view and mine reminds me of a joke:

-

Holmes and Watson are on a camping trip. In the middle of the night Holmes wakes up and gives Dr. Watson a nudge. “Watson,” he says, “look up in the sky and tell me what you see.”

“I see millions of stars, Holmes,” says Watson.

“And what do you conclude from that, Watson?”

Watson thinks for a moment. “Well,” he says, “astronomically, it tells me that “there are millions of galaxies and potentially billions of planets. Astrologically, I observe that Saturn is in Leo. Horologically, I deduce that the time is approximately a quarter past three. Meteorologically, I suspect that we will have a beautiful day tomorrow. Theologically, I see that God is all-powerful, and we are small and insignificant. Uh, what does it tell you, Holmes?”

“Watson, you idiot! Someone has stolen our tent!”

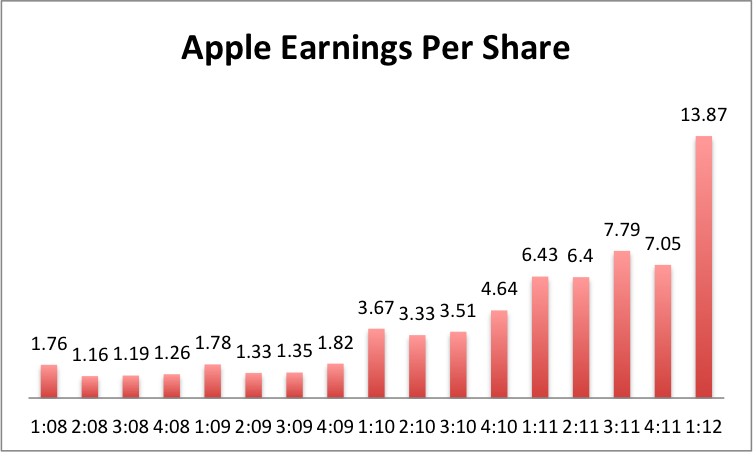

Brian, like Watson, is very observant but he’s overlooking the problems that are closest at hand. Just because Microsoft made lots and lots of money last quarter does not mean that all is well. Profits are great, profits are swell, but they do not, the future foretell. For example, Nokia outsold the iPhone for four years after the iPhone’s launch…and we all know how that story ended.

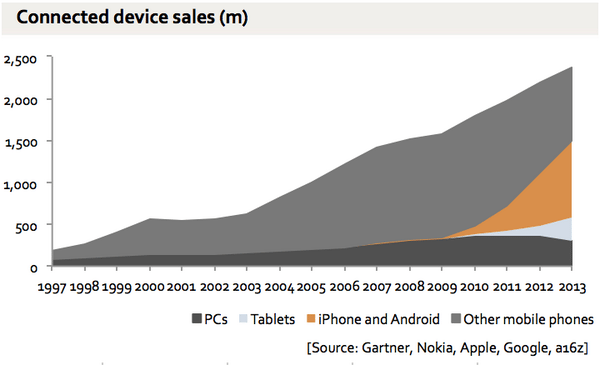

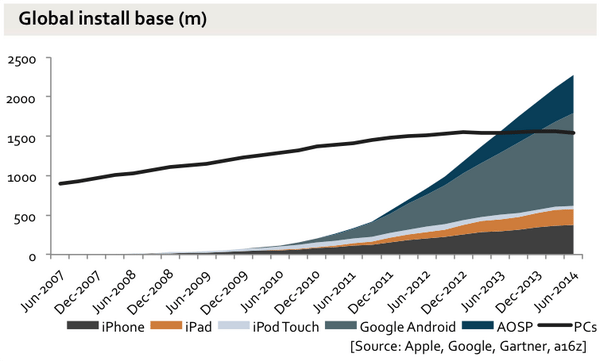

The Microsoft that just brought in record quarterly income, is the same Microsoft that faces severe challenges going forward. First, Mobile is the fastest growing segment in tech and Microsoft has no prospects there. Second, Microsoft’s business model is dependent upon licensing its Windows Operating System to manufacturers and that business model has been disrupted and is no longer viable. Third, approximately seventy percent of Microsoft’s income is generated by its Windows Operating System and its Office productivity suite but all of that income is coming from PCs (notebook and desktop personal computers) and PC sales are flat or declining.

Let’s examine each those issues in one by one.

Mobile

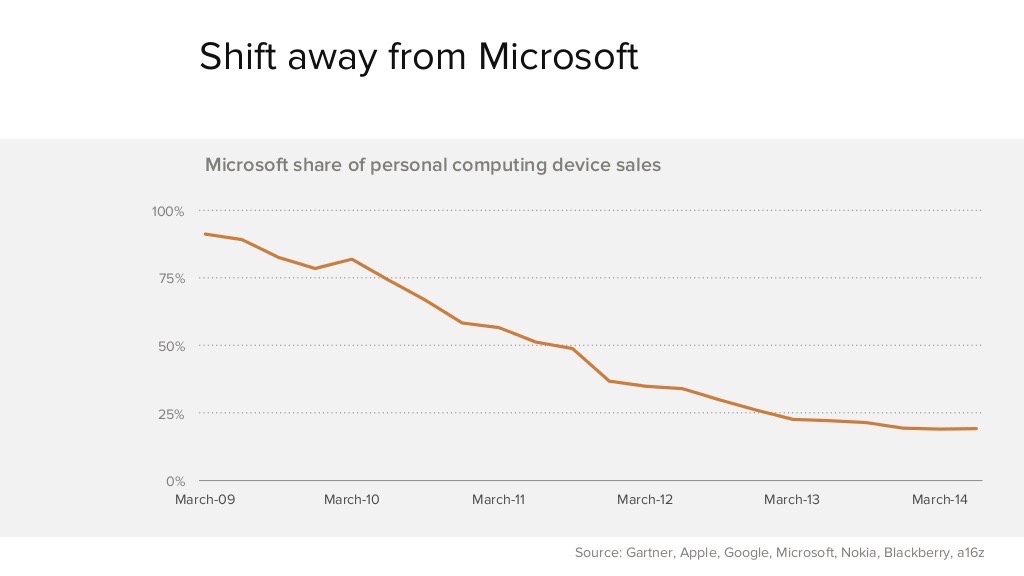

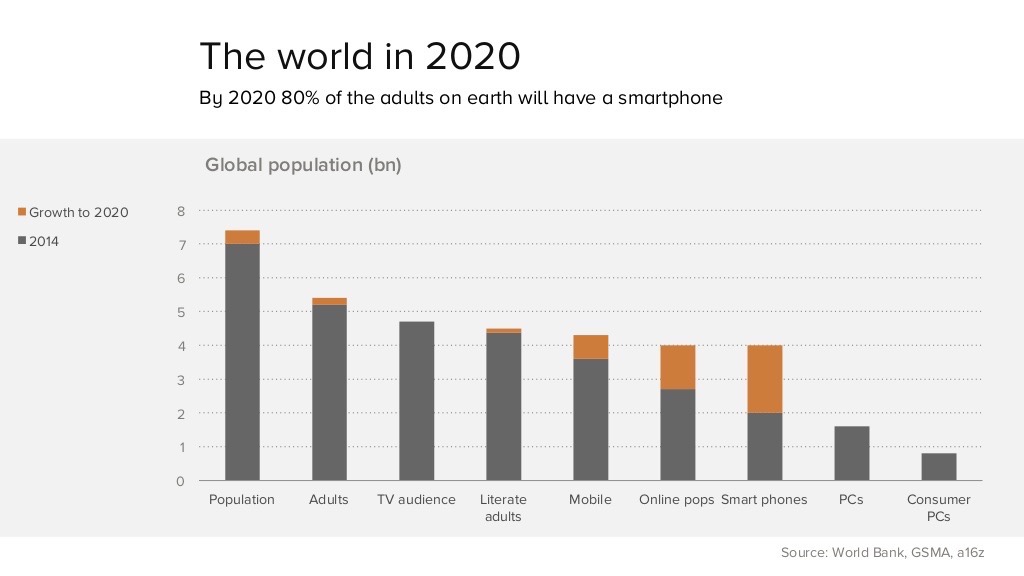

In 2006, Microsoft Windows ran on about 95% of all personal computing devices in existence.

Today, that number is well south of twenty-five percent and Microsoft itself estimates that number to be around fourteen percent. ((MS COO Turner: We have 14% share of all devices (including our 90% PC share).”~ @maryjofoley) 7/14/14))

In 2010, Microsoft saw that it was nowhere in Mobile and they tried to turn things around with the introduction of Windows 8 and Windows RT. Microsoft was going to use its Windows Operating System as leverage to drive sales of Windows 8 tablets and it was going to use its Office productivity suite as leverage to drive sales of Windows RT.

Four years later, Windows tablet sales are nonexistent, Windows RT is gone, and both Windows and Office are being given away to mobile users for free.

We’re seeing the consumer valuation for those [Offce] start to approach zero,” said Wes Miller, an analyst at Directions on Microsoft, a research firm that tracks the company.

“Lots of consumers don’t need a PC,” said Rick Sherlund, an analyst at Nomura Securities. “They just need an Internet connection. They don’t need Office as much.”

In other words, free Windows and Office on Mobile devices are now being used by Microsoft to 1) mollify their existing user base; and 2) as a freemium product designed to entice mobile users to try, and then potentially buy, the full product. Mollifying Microsoft’s existing base is, in my opinion, a good move. Microsoft needs to milk Windows and Office for all they are worth, for as long as they’re worth something.

However, using freemium to attract new users has proven to be a losing proposition.

Microsoft launched Office for iPad in March and says it’s seen 40 million downloads of the three apps since then. But the full functionality of the apps has only been available to Office 365 subscribers, and it’s added less than three million Home and Personal subscribers since then, at roughly the same pace as it added subscribers earlier. People have been very interested in the apps, but most haven’t been willing to pay for the full functionality (or already had access to it through existing Home or Business subscriptions). ~ Jan Dawson

[pullquote]Neither Windows nor Office have any significant value on mobile devices[/pullquote]

This is the reality facing Microsoft today: Neither Windows nor Office have any significant value on mobile devices.

The problem with MS Office isn’t the price. Jordan Cooper (@blenderhd)

Exactly right.

User behavior isn’t the same on phones as it is on PCs. ~ Jared Newman

[pullquote]User behavior isn’t the same on Mobile as it is on PCs[/pullquote]

Let me repeat that, because this is the part the many people are still not getting. User behavior isn’t the same on phones (and tablets) as it is on PCs. In other words, operating systems like Windows and productivity suites like Office, have great value on PCs but have little or no value on phones and tablets. Accept that as a fact and your entire understanding of what is happening to Microsoft dramatically changes.

One’s destination is never a place, but a new way of seeing things. ~ Henry Miller

Microsoft is GIVING AWAY both Office and Windows for free…and the move is being met, not with applause but, with apathy:

Was poised to download MS Word, Excel for mobile. Then thought: what do I need them for again exactly? Charles Arthur (@charlesarthur) 11/7/14

Notice how long the web cared about free Microsoft Office for iOS. Times have indeed changed. Sammy the Walrus IV (@SammyWalrusIV) 11/7/14

Mobile is where it is at and Microsoft is nowhere in Mobile.

The high-growth parts of the tech industry, smartphones and tablets, are not built on Microsoft software. Microsoft applications have very little presence on those devices. Meanwhile, on the Internet it continues to be an also-ran to giants like Google and Facebook. ~ Ben Thompson, Stretechery

But perhaps you think that Microsoft is going to make their money in Mobile by selling hardware.

Please.

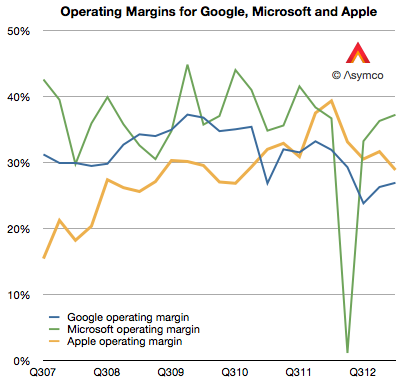

Estimated share of Q3 handset industry profits: Microsoft: -4%, Motorola: -2%, HTC, BB: 0%, LG: 2%, Samsung: 18%, Apple: 86%. ~ Kontra (@counternotions) 11/4/14

Microsoft’s hardware has done nothing but bleed red ink. For an excellent discussion of Microsoft’s hardware woes, check out the Mark Rogowsky’s article entitled: “Amazon, Microsoft And The Quixotic Quest To Sell Mobile Devices“.

CAPTION: Microsoft is never going to make any money off of any of these mobile devices.

If you think Microsoft’s short-term earnings makes their long-term problems in Mobile go away, then you’ve got another think coming.

Business Model

Business models are the best crystal ball technology ever invented. ~ @andreascon

Microsoft makes its money from Windows by licensing the operating system to manufacturers and consumers. Google killed that business model by giving their operating system away for free. Apple piled on by bundling their operating system for free with the purchase of their hardware.

Incumbents are rarely disrupted by new technologies they can’t catch up to, but instead by new business models they can’t match. ~ Aaron Levie (@levie)

Operating systems are losing all of their value. Their price is rapidly moving to zero. Yet Microsoft still makes approximately thirty percent of its income from this dying business model.

Moving from one technology to another is difficult. Moving from one business model to another is one of the hardest transitions there is. But that’s exactly what Microsoft now has to do.

If you think Microsoft’s short-term earnings makes their long-term problems in licensing Windows go away, then you’ve got another think coming.

PCs (Notebook and Desktop Computers)

This is what Windows sales looked like in 1995:

We’ve come a long way since then and yet, in some ways, it would be apt to say that Microsoft is still partying like it’s 1995.

- Approximately seventy percent of Microsoft’s income comes from Windows and Office.

- Almost all of that Windows and Office income is generated from sales to PC manufacturers and owners.

This presents Microsoft with two problems.

First, PC sales are flat or diminishing. Second, Microsoft’s portion of that diminishing market share is also rapidly diminishing.

PCs ARE FLAT OR DIMINISHING

The challenge staring Microsoft in the face is the 1.5 billion copies of Windows being used is not increasing and is, in fact, decreasing. … Desktops and notebooks are not growing in sales and not attracting first time buyers in any meaningful numbers. ~ Ben Bajarin

GOOGLE CHROMEBOOKS

Here are four recent headlines regarding Google Chromebooks.

Chromebook sales increase 67%, Acer holds the market lead

Chromebooks may grab 5% of PC market

Chromebook sales set to nearly triple by 2017, Gartner says

Microsoft’s next big headache: The Google Chromebook

Chromebooks are eating away at Microsoft’s PC sales from the low-end. And Macs are eating away at Microsoft’s PC sales from the high-end.

APPLE MACS

Apple’s Mac hits record market share in U.S., says latest IDC research. ~ Walt Mossberg (@waltmossberg) 11/6/14

Apple Grabs Record US PC Market Share On Strong Mac Sales in Q3 2014 ~ AppleTree

26.8% of the PCs sold in the U.S. between July 4th and September 1st were Macs. ~ Horace Dediu (@asymco) 9/24/14

Mac reached the highest PC market share since Windows 95 launched. ~ Horace Dediu (@asymco) 10/20/14

The Apple Mac, by itself, easily generates more revenue than does Microsoft’s Windows.

Mac ~$6bn/quarter, Windows ~$4bn. ~ Jan Dawson (@jandawson) 10/24/14

MICROSOFT IS LOSING EDUCATION

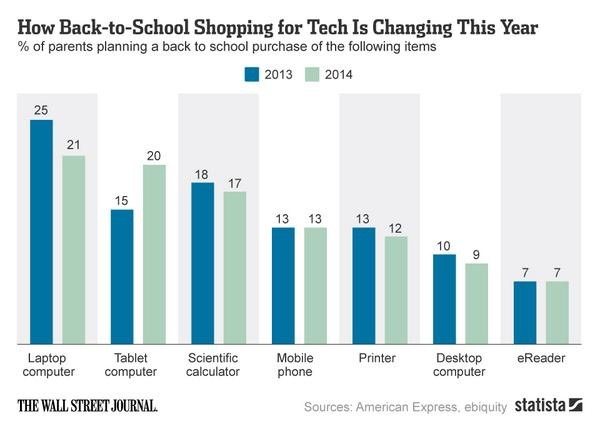

In the third quarter of 2014, Macs took in more than 25% of the back-to-school sales. And at Harvard University, an astonishing 71% of new students owned a Mac computer.

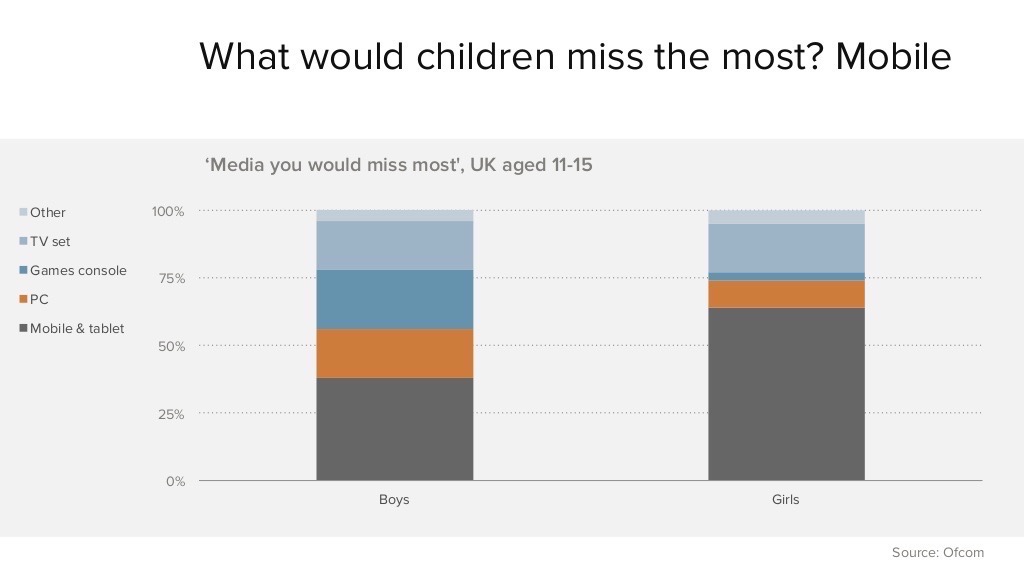

Further, the trend in education is towards tablets and away from laptops.

This is bad news for Microsoft since their presence in tablets is practically non-existent. Meanwhile, the iPad is capturing 90 percent tablet share in U.S education.

The back-to-school season voted and the Mac won… ~ Tim Cook

MICROSOFT IS LOSING THE ENTERPRISE

Good Technology released the latest iteration of its Mobility Index Report, in which it found iOS holds 69 per cent of the enterprise market — that’s nearly seventy times larger than the 1 percent share held by Microsoft. ~ Jonny Evans

Windows Phone activations remain consistent with the six previous quarters: flat at 1 percent. ~ Venturebeat

The iPad took 89 percent of activations during the third quarter, while Android tablets claimed the remaining 11 percent. Windows tablets are yet to make a dent. ~ Jonny Evans

(O)verall, the trends in the enterprise remain unchanged. Businesses prefer iOS, sometimes choose Android, and essentially ignore Windows Phone. ~ Venturebeat

Custom business apps showed a 107 percent quarter-over-quarter growth and 731 percent growth over the same time period last year. And Windows developers are getting virtually none of that business.

If you think Microsoft’s short-term earnings makes their long-term dependency on an ever shrinking PC base go away, then you’ve got another think coming.

Transition

(Wall Street) focuses on the waves and not of the currents. ~ Consuelo Mack

Microsoft’s most recent earnings statement was a wave and an impressive wave at that. But if we want to foresee Microsoft’s future, we need to focus on the currents, not the waves, and the tech currents are flowing against, not with, Microsoft.

Wisdom consists of the anticipation of consequences. ~ Norman Cousins

Windows will continue to make money for some time to come, but it is not a growth sector.

Windows has taken Microsoft as far as it could. ~ Ben Bajarin (@BenBajarin) 10/31/14

And Windows is not Microsoft’s future.

Microsoft has many very interesting things going for them and none of them have to do with Windows. ~ Ben Bajarin (@BenBajarin) 10/30/14

Office is transitioning from a monopoly software suite, running on a monopoly platform, to a cloud service, that is just one of many competing cloud services.

Seventy percent of Microsoft’s income is in flux and is either going to go away or is going to transition to something entirely new. And these sorts of things happen “gradually, then suddenly.” ((“How did you go bankrupt?” Two ways. Gradually, then suddenly.” ~ Ernest Hemingway, The Sun Also Rises))

So no, Microsoft is not “Doomed.” But neither is its future assured.

Realizing Windows is not a hegemony will unleash market forces nobody can predict. ~ Jean-Louis Gassée (@gassee)

Ridiculous to say Microsoft is doomed. But entirely sensible to wonder whether (and how much) it will shrink in the next few years. ~ Jan Dawson (@jandawson) 10/23/14

In fact, the one thing we know for certain is that the Microsoft of tomorrow is going to be radically different from the Microsoft of today. So, in a way, the monopoly Windows and Office supported Microsoft that we know is — sorta — doomed as it makes way to the unknown Microsoft of tomorrow.

The Promised Land always lies on the other side of a Wilderness. ~ Havelock Ellis

And if you think the magnificent earnings of a single quarter are going to change the fact that today’s Microsoft is a Microsoft in transition — not just from one or product to another, but from one business model to another — then you’ve got another think coming.