RECAP

We’re looking at the tablet business models of Apple, Amazon, Google, Samsung and Microsoft. Today we focus on the Google Nexus 7.

3.0 Google Nexus 7

3.1 WHERE DOES THE GOOGLE NEXUS 7 MAKE ITS MONEY?

When introducing the new Amazon tablets, Jeff Bezos said:

“We want to make money when people use our devices, not when they buy our devices.”

Interestingly, the Google Nexus 7 has the very same business model as do the new Amazon tablets. Google gives away the Nexus 7 hardware at cost and then seeks to make its money by selling content and advertising.

3.2 WHERE DOES THE GOOGLE NEXUS 7 PROVIDE VALUE?

The Google Nexus 7 has excellent hardware and it sports one the world’s premiere mobile operating systems in Android’s Jelly Bean. But where Google really brings value to their tablet customers is in the Nexus 7’s low tablet price.

Google is able to keep their tablet prices low because they don’t intend to make any (or much) money on the initial sale of their devices. They can give their customers more tablet for less because they are making it up in content and advertisement sales. Google wants to lure you into their store with their tablet and then have you buy content there.

Do the above two paragraphs sound familiar? If you read yesterday’s article on the Amazon Kindle Fire, they should because they are almost word for word the same. (Battle Of The Tablet Business Models: Amazon Kindle Fire, section 2.2.)

The Google Nexus 7 and the new Amazon tablet share the very same business model so they will naturally compete head-to-head with one another. Which one is likely to prevail over the other? Understanding their similarities and their differences should give us the answer to that question.

3.3 GOOGLE NEXUS 7 BUSINESS MODEL ADVANTAGES AND DISADVANTAGES

The Google Nexus 7 has received many fine reviews for both its hardware and its software but I think the reviewers are missing the larger picture. When I look at the Nexus 7 business model, there is little there to like. The Nexus 7 business model has all the downsides of the Amazon tablet business model and few of the upsides. Despite the almost universal praise the Nexus 7 has received from analysts and pundits, I predict that the Nexus 7 will fail to have any long lasting impact on the tablet markets other than to eliminate other Android manufacturers from contention.

The Google Nexus 7 and the Amazon Kindle Fire business models share many of the same issues:

— It’s hard to make a significant profit solely from the sale of low margin content and mobile advertising.

— Devices can only be sold in countries where content can be made available via the Google Play store. Sales of devices outside of those countries are counter-productive.

— Tablet sales must be carefully targeted at only those customers who voraciously consume (and are willing to pay for) content or who positively respond to advertising. Tablets sold to non-consumers are a waste of time, money and effort.

— Subsidized tablets draw exactly the wrong type of customer. Bargain hunters are less likely than others to consume content and respond well to advertising.

— A subsidy business model thrives on low cost hardware and long refresh cycles. However, we live in a world where Apple, Samsung and Microsoft are rapidly iterating their tablet hardware offerings and pushing the barriers of what it is technologically possible for a tablet to do. It will be difficult, if not impossible, to pursue the contradictory goals of spending as little as possible on the tablet hardware while still remaining competitive with the tablet offerings of competitors.

— A content focused, ad driven tablet will have little or no appeal to government, business or educational entities.

— Online only distribution will be difficult and other methods of distribution are sparse and immature.

(For a further discussion of the difficulties inherent in pursuing a subsidized tablet business model, please refer to section 2.3 of my earlier article: Battle Of The Tablet Business Models: Amazon Kindle Fire.)

In addition to the issues it shares with the Amazon tablets, the Nexus 7 has problems all its own:

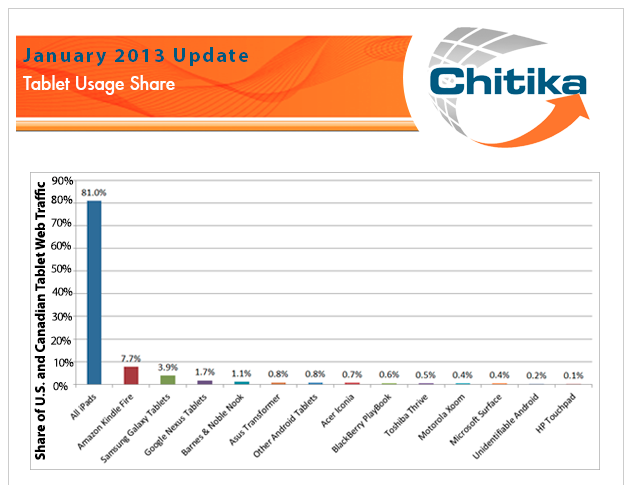

— The business model relies upon making a profit from content sales and content sales are not Google’s core strength. When it comes to online stores, Google Play is a distant third to Amazon and Apple.

— Open business models are good for many things, but the maintenance of a store is not one of them. While closed companies like Amazon and Apple run their stores with an iron fist, Google runs its store with abandon.

— Google is not known for its customer service. Its current customers are advertisers, carriers and manufacturers, not end users. The one time Google did sell directly to consumers with the Nexus, their efforts failed. Customer support is hard, Google has little experience in it and it would be a radical shift in their business model. There’s plenty of doubt about whether they can pull it off and until they prove otherwise, they don’t get the benefit of that doubt.

Google Nexus 7 v. Amazon Kindle Fire:

A head-to-head battle between the Nexus 7 and the Kindle Fire will not end well for the Nexus 7. The Nexus 7 probably has better hardware and software (although I know that Amazon would dispute that) and it also has a very strong and loyal user base. But the subsidy game is all about content and in content, Amazon shines.

The Google Nexus 7 business model is like a coach taking a great athlete and playing them out of position – like taking a superior skater and having them play baseball instead of hockey, or taking a great baseball hitter and having them play soccer instead of baseball. Amazon is playing to their strengths. Google is playing to their weakness. In the long run, Google’s putative superiority in hardware and software will come to naught. In the battle of the business models, when Amazon and Google go head-to-head in the sale of content, Amazon will win every single time.

Content v. Apps:

I think Google pursued the wrong strategy. They have focused on the sale of content when, in my opinion, they should have focused on apps and the creation of a stronger app platform. I wrote about their abandonment of tablet optimized apps in my article entitled: “With Apps, Size Matters.”

However, it’s too late to turn back now. Google’s failure to focus on tablet apps has all but doomed their already faltering tablet efforts.

Reversing The Business Model: Open v. Closed:

With the Nexus 7, Google abandoned their open business model and adopted a closed business model instead. Now they have none of the advantages of the open model yet they’ve gained few of the advantages of the closed model. Open allowed Google to focus solely on the operating system and to license that operating system to all comers which, in turn, led to the proliferation a wide variety of low cost, inexpensive hardware options. The Google Nexus 7 has none of those advantages. It is made by one manufacturer so its production numbers are limited. It is a single form factor. All of the things that make an open business model great – cost, choice, variety, distribution, ubiquity, etc. – are lost.

And what is gained in its stead? Not much.

— The original Android concept was to get Android everywhere in order to capture eyeballs in order to sell mobile advertising. As discussed above, a subsidized model LIMITS production to only those who are willing to buy content.

— The closed Nexus 7 business model will gut the tablet efforts of the remaining Android manufacturers. How are they supposed to compete with a for-cost Google tablet when they do not share in the profits that Google garners from the sale of content or advertising?

The change from an open model to the closed Nexus 7 business model will have dramatic long-term negative consequences for Google’s tablet efforts. For the reasons described above, the Nexus 7 will not sell well enough to garner large scale content and advertising profits but it will sell well enough to eviscerate the efforts of all other Android tablet manufacturers. For Google, it’s the worst of both worlds.

Summation

The Google Nexus 7 does not represent a coherent business strategy. It represents the abandonment of strategy. While others are singing the praises of the Google Nexus 7, I am singing a dirge.

I predict that we’ll continue to hear a lot about Android tablet activations but we’ll continue to hear little about content and advertising profits, which is all that matters in a subsidized business model.

I predict that the already moribund tablet efforts of the other Android manufacturers will simply give up the ghost altogether. (Caveat: I am not counting Amazon as an Android manufacturer since their operating system is so radically forked from Google’s version of Android.)

I predict that – unless Google makes a dramatic change – the Nexus 7 will all but fade from sight.

Bold predictions, I know. But they’re dictated, not be me but, by Google’s own flawed business model.

Next

We’ve now looked at the Apple, Amazon and Google tablet business models. Tomorrow, we look at Samsung and the Galaxy Tab.