The Plot

The Good, the Bad and the Ugly is a 1966 Italian epic Spaghetti western film directed by Sergio Leone, starring Clint Eastwood, Lee Van Cleef, and Eli Wallach in the title roles. ~ paraphrased from Wikipedia

Apple, Microsoft and Google are engaged in an epic tablet war starring the iPad, the Surface and the Nexus 7 in the title roles.

In the Good, the Bad and the Ugly, the plot revolves around three gunslingers competing to find a fortune in hidden Confederate gold.

In the tablet wars, the plot revolves around three tablet gunslingers competing to find a fortune in hidden tablet profits.

Clint Eastwood as “Blondie”: The Good. A subdued, cocksure, bounty hunter who both works with and works against Angel Eyes, and Tuco in shifting alliances to find the hidden gold.

Apple as “iPad”: The Goliath. An implacable, cocksure, bounty hunter who both works with and works against Microsoft and Google in shifting alliances to find the hidden profits.

Lee Van Cleef as “Angel Eyes”: The Bad. A ruthless, unfeeling and sociopathic mercenary who always finishes the job.

Microsoft as “Surface”: The Bad (ass). A ruthlessly efficient, relentlessly effective, money making machine who knows how to close.

Eli Wallach as “Tuco”: The Ugly. A comical, oafish fast talking bandit who proves to be a crafty and surprisingly dangerous opponent.

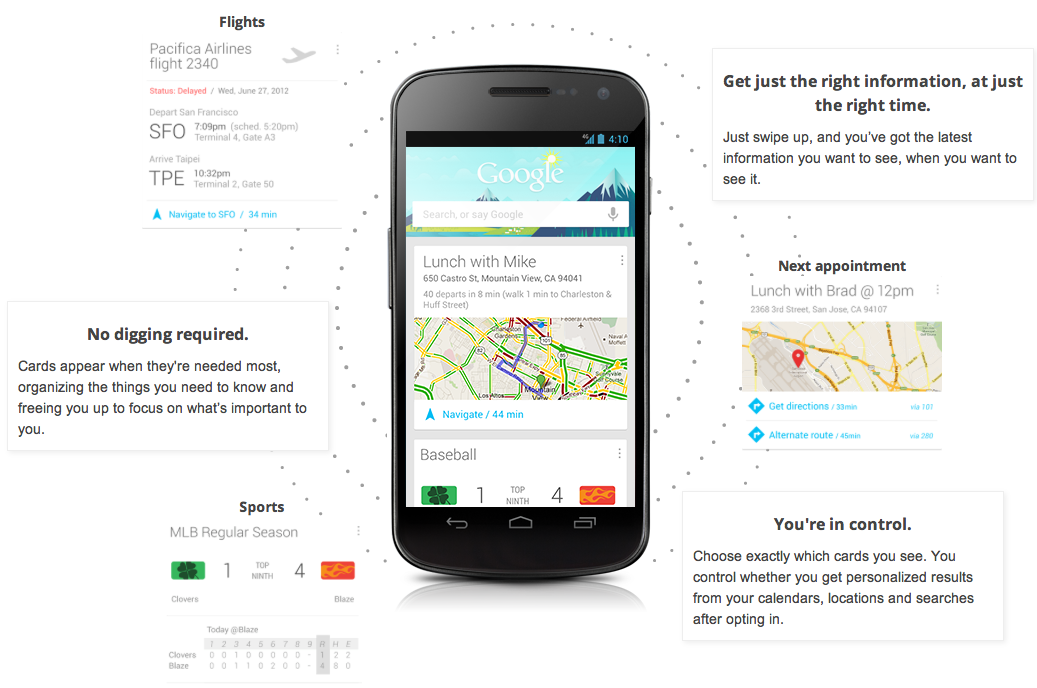

Google as “Nexus 7”: The Geeky. A nerdy, engineering and advertising company whose “don’t be evil” exterior masks a surprisingly powerful and unexpectedly ominous corporate bandit.

The Truel

In the movie’s climatic final scene, Blondie, Angel Eyes and Tuco face off against one another in a Truel.

In the climatic autumn of 2012, Apple, Microsoft and Google face off against one another in a truel.

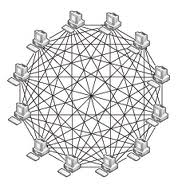

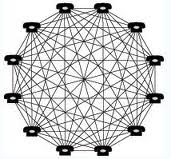

A truel is: “a neologism for a duel among three opponents, in which players can fire at one another in an attempt to eliminate them while surviving themselves. ~ via Wikipedia

Each party jockeys for position, each itching to fire first, each wary of what the other two fighters will choose to do.

In tech, Apple, Microsoft and Google are involved in a great tablet truel. Each party jockeys for position, each itching to eliminate the other, each wary of what the other two competitors will choose to do.

The three stare each other down in the circular center of the cemetery, calculating alliances and dangers in a Mexican standoff.

The Apple iPad stands alone at the center of the tablet world. Then the Google Nexus 7 joins in the fray. And finally, on October 26, 2012, the Microsoft Surface steps into the ring. The three stare each other down, calculating alliances and dangers in a Mexican standoff.

The parties position themselves, the tension grows, the Ennio Morricone film score swells until suddenly, they draw and…

The Treasure

Remember the pundits who laughed off the tablet form factor and called them toys? No? Neither does anyone else. They were as wrong as wrong could be.

Tablets are the second coming of the personal computer. Apple knows it. Microsoft knew it long ago but they were unable to successfully seize the moment and capture the treasure for themselves. Google is only just now realizing the importance of tablets. The company or companies that win the tablet wars win the future of computing. The fight is only just begun but like a gunfight, the battle may soon – and very suddenly – be over.

The Gunfighters

Apple iPad

Apple is like Blondie. Confident. Cock-sure. Perhaps a bit too cock-sure. Apple insists on doing things their own way. Google is counting on Apple’s insistance on having a closed shop to be their undoing. Microsoft is counting on Apple’s unwavering insistance on seperating their touch and desktop devices to be their undoing.

However, Apple has an advantage. Like Blondie, they know where the gold (profits) is hidden. The key to unlocking the tablet treasure is tablet optimized Apps. And using our gunfight analogy, when it comes to tablet apps, if Google and Microsoft have six shooters, Apple has an Uzi. Or a bazooka. Or a tank…

Microsoft Surface

If Apple is the cocky newcomer – the up and coming gunslinger – Microsoft, like Angel Eyes, is the consummate professional – the grizzled vertern who has the experience, knows all the tricks in the book and is extremely confident in their ability to win in a shootout.

If Apple is cocky because they think they’re good, Microsoft is confident because they know they’re good. Microsoft has not only been through the wars, they’ve won the wars and they’ve won them convincingly.

However, Microsoft’s secret weapon in the PC wars was compatibility and familiarity. In gunfighter terms, it would be like shooting with the sun at your back. And getting in five shots before your opponent even drew their weapon. And shooting from behind a wall. It was that devastating an advantage.

When it comes to a gunfight – or a platform war – Microsoft is the best there ever was. But this isn’t yesterday and this is a whole new fight. In mobile, Microsoft’s monopoly advantage is no where to be found. If Microsoft is going to win this gunfight, they’re going to have to do it on merit.

And Microsoft is very, very late to the fight…

…and it’s never good for a gunfighter to be late.

Why is Microsoft’s Surface obsessed with Keyboards?

The Apple iPad Tablet vs. the Microsoft Surface Anti-Tablet

Battle Of The Tablet Business Models: Windows 8 And The Microsoft Surface

Google Nexus 7

Google, like Tuco, is in good position. Microsoft and Apple know that each is the greatest danger to the other. They will almost certainly fire all their weapons at one another leaving Google (Tuco) free to gain from the exchange.

Only Google, like Tuco, has a problem.

It was just last week that Google initiated a program to encourage the creation of tablet optimized apps for Android.

Last week.

Tuco doesn’t know it, but he doesn’t have any bullets. Google didn’t know it was important, so they don’t have many tablet optimized apps. And in a truel, being unarmed is a big, big problem to have.

Google Android Tablet Optimized Apps — Two Years Too Late

Battle Of The Tablet Business Models: Google Nexus 7

The Denouement

The gunfighters move into place. The eyes narrow, the hands twitch, the music swells, the tension mounts, the guns are drawn and then…

…a single shot is fired…

…Blondie shoots Angel Eyes. Tuco also tries to shoot, but discovers that his gun is unloaded.

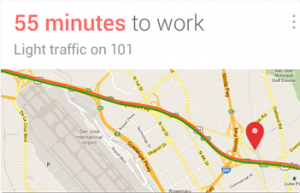

The mobile wars are a fascinating watch. Apple dominates tablets. Microsoft dominates desktops. Google dominates smartphones. Each knows that the future – the elusive treasure – is in mobile. They can’t all win this truel. One, perhaps two, will be left for dead. Which will it be? Which will it be?

“You see, in this world there’s two kinds of people, my friend: Those with loaded guns and those who dig. You dig.” ~ Blondie (Clint Eastwood)

Unlike The Good, the Bad and the Ugly, no one has seen how this movie ends. Microsoft hopes that this will be a sequel: How Microsoft Won The PC Wars, Part II. Google thinks that this is an entirely new genre of film, the kind where open always outguns closed. Apple thinks that there are two kinds of personal computing companies: Those with platforms loaded with apps.. and those who don’t much matter.

Me? I think it’s advantage Apple. You don’t grow from nothing in tablets to a world shaker in two and a half years unless you got it right. The essence of tablets is touch. Not keyboards. Touch.

Microsoft is desperately hoping that Apple got it wrong. Microsoft NEEDS tablets to simultaneously run both touch and desktop operating systems and Microsoft needs both to run well together.

Google? When it comes to tablets, they’re still digging.

It’s clear to me that Apple’s iPad is going to remain on top. The rumored iPad mini only makes this more likely.

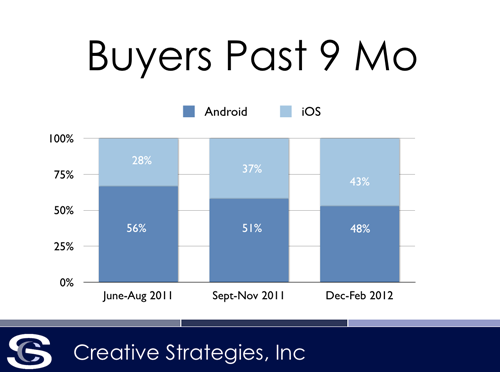

Normally, I’d say that – as in phones – Microsoft would have little chance of having their tablets jump past Google and into second place. But circumstances are far from normal. Despite Google’s overwhelming success in phones, they’ve done next to nothing in tablets. And I have little respect for their newly minted subsidized tablet business model and their ever shifting business strategies. And Microsoft has powerful advantages in their ability to leverage a large desktop customer base and utilize their extensive business connections. Microsoft could quite quickly vault Google in tablets and land in second place…

…and wouldn’t that be interesting. In phones it would be Google-Apple-Microsoft. In desktops it would be Microsoft-Apple-Google. In tablets it would be Apple-Microsoft-Google.

That can’t possibly last. This is about to get very real, very fast.

The world of personal computing is in flux. It’s a “truel” world and for some tablet maker – and possibly for several tablet makers – it’s about to go bad and get ugly.