Last week, Microsoft CEO Satya Nadella laid bare his vision for the tech giant. It is borderline revolutionary.

From its early days, Microsoft has focused on using software and computing to empower people and businesses around the world. Nadella still clings to this laudable vision. However, he has now fundamentally flipped the seat of power, even as he fears to let go of all Microsoft has amassed over the decades.

Just as America’s Constitution enumerated inalienable rights all its people are endowed with, forever empowering even a single individual against the full force of the government, in a similar manner Nadella has positioned the user above all else.

This is radical. For Microsoft, it’s nearly unthinkable.

Nadella does not simply place emphasis on users instead of PCs, on productivity instead of Windows. He changes the equation of the software behemoth going forward. This could set Microsoft apart from all others.

The most user-friendly tech company in the world, Apple, emphasizes ecosystem over device, lock-in over empowerment. Google takes from its own users when they are not looking. Amazon confounds its customers with Prime service, making it nearly impossible to ever fully know the actual price — or value — of any single item.

Nadella is positioning Microsoft on the side of the user. Security, privacy, productivity, empowerment. I believe this will have a profound and lasting impact on the company and its customers forever. This call to great and permanent and never ending change is buried inside Nadella’s 3,500 word memo to Microsoft staff. I understand if you choose not to read (any/all of) it.

My analysis of his manifesto is below, in bold italic.

Satya

From: Satya Nadella

To: All Employees

Date: July 10, 2014 at 6:00 a.m. PT

Subject: Starting FY15 – Bold Ambition & Our Core

Team,

As we start FY15, I want to thank you for all of your contributions this past year. I’m proud of what we collectively achieved even as we drove significant changes in our business and organization. It’s energizing to feel the momentum and enthusiasm building.

This is all wrong. Platitudes, corporate management speak and 3,500 words are absolutely the wrong way to begin a discussion about “significant changes” and “enthusiasm building.” That within the first paragraph we are twice reminded FY15 has commenced, all I can think is Nadella is too steeped in the pre-existing conditions of Microsoft to achieve anything great, let alone revolutionary.

The day I took on my new role I said that our industry does not respect tradition – it only respects innovation. I also said that in order to accelerate our innovation, we must rediscover our soul – our unique core. We must all understand and embrace what only Microsoft can contribute to the world and how we can once again change the world. I consider the job before us to be bolder and more ambitious than anything we have ever done.

“What only Microsoft” can do should be plastered across every meeting room in Redmond. Nadella mimics Tim Cook’s penchant for “change the world” pablum but to be fair, very few companies really can. Microsoft is one. Kudos to Nadella for not shying away from this.

We’ll use the month of July to have a dialogue about this bold ambition and our core focus.

The very corporate nonsense-speak that turned me into a freelancer.

Today I want to synthesize the strategic direction and massive opportunity I’ve been discussing for the past few months and the fundamental cultural changes required to deliver on it.

Means nothing.

On July 22, we’ll announce our earnings results for the past quarter and I’ll say more then on what we are doing in FY15 to focus on our core. Over the course of July, the Senior Leadership Team and I will share more on the engineering and organization changes we believe are needed. Then, at MGX and //oneweek, we’ll come together to build on all of this, learn from each other and put our ideas into action.

Rigid, bureaucratic and enslaved to artificial dates.

We live in a mobile-first and cloud-first world. Computing is ubiquitous and experiences span devices and exhibit ambient intelligence. Billions of sensors, screens and devices – in conference rooms, living rooms, cities, cars, phones, PCs – are forming a vast network and streams of data that simply disappear into the background of our lives. This computing power will digitize nearly everything around us and will derive insights from all of the data being generated by interactions among people and between people and machines. We are moving from a world where computing power was scarce to a place where it now is almost limitless, and where the true scarce commodity is increasingly human attention.

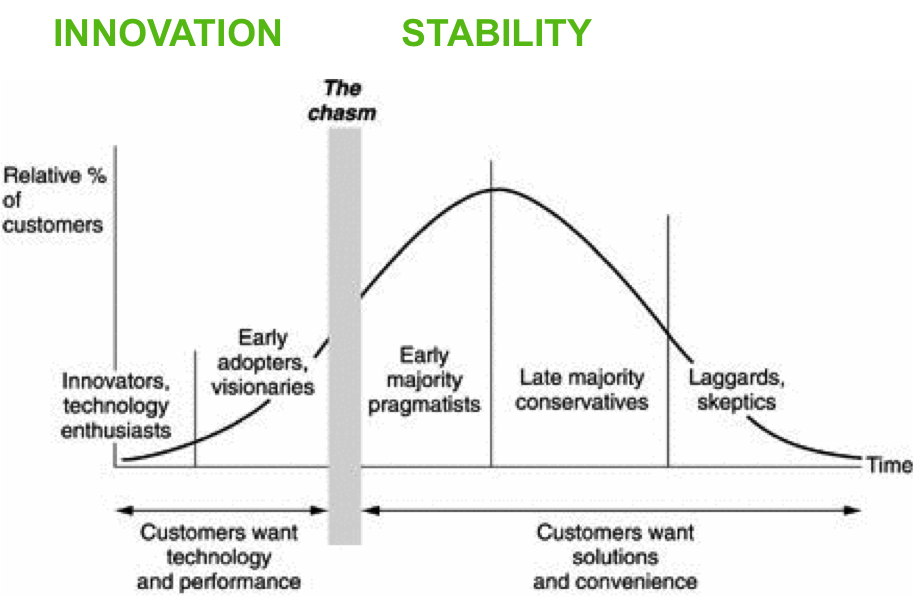

This is brilliant. Better, it launches the long, painful slog of fully re-positioning Microsoft away from PCs, away from Windows, away from Office, away from its past, which now binds it, and onto a future of screens, data and insight.

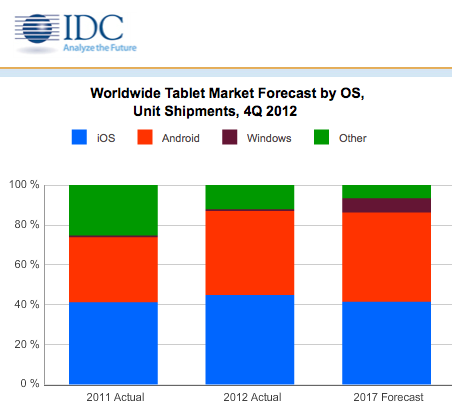

The only company at present that can challenge a fully engaged Microsoft in this is Google.

In this new world, there will soon be more than 3 billion people with Internet-connected devices – from a farmer in a remote part of the world with a smartphone, to a professional power user with multiple devices powered by cloud service-based apps spanning work and life.

Microsoft will be the anti-Apple, delivering services and value to all, not just the world’s 10%.

The combination of many devices and cloud services used for generating and consuming data creates a unique opportunity for us. Our customers and society expect us to maximize the value of technology while also preserving the values that are timeless.

Means nothing. Wasting employee’s time.

We will create more natural human-computing interfaces that empower all individuals. We will develop and deploy secure platforms and infrastructure that enable all industries. And we will strike the right balance between using data to create intelligent, personal experiences, while maintaining security and privacy. By doing all of this, we will have the broadest impact.

Preach! Only Google can challenge Microsoft in delivering services to all. But, only Microsoft can deliver these services and effectively protect individual privacy.

Mobile First Cloud First

Microsoft was founded on the belief that technology creates opportunities for people and organizations to express and achieve their dreams by putting a PC on every desk and in every home.

Microsoft’s business practices rightly angered many of us. But their efforts also helped deliver us directly to this future. We should be thankful for that.

More recently, we have described ourselves as a “devices and services” company. While the devices and services description was helpful in starting our transformation, we now need to hone in on our unique strategy.

I am not Steve Ballmer.

At our core, Microsoft is the productivity and platform company for the mobile-first and cloud-first world. We will reinvent productivity to empower every person and every organization on the planet to do more and achieve more.

Wow. This is a truly revolutionary message and within Microsoft’s skill set to make happen. I will be happy if Microsoft simply comes close to this vision, as it is glorious: “empower every person and every organization on the planet to do more and achieve more.”

We think about productivity for people, teams and the business processes of entire organizations as one interconnected digital substrate. We also think about interconnected platforms for individuals, IT and developers. This comprehensive view enables us to solve the more complex, nuanced and real-world day-to-day challenges in an increasingly digital world. It also opens the door to massive growth opportunity – technology spend as a total percentage of GDP will grow with the digitization of nearly everything in life and work.

I think this is wrong. Backwards, in fact. It’s not about an “interconnected digital substrate,” a nonsense phrase, but about building a product that truly empowers that one person. If it empowers one, it will empower millions. Apple has taught us this. Microsoft has yet to learn this.

We have a rich heritage and a unique capability around building productivity experiences and platforms. We help people get stuff done. Stuff like term papers, recipes and budgets. Stuff like chatting with friends and family across the world. Stuff like painting, writing poetry and expressing ideas. Stuff like running a Formula 1 racing team or keeping an entire city running. Stuff like building a game with a spark of your imagination and remixing it with the world. And stuff like helping build a vaccine for HIV, and giving a voice to the voiceless. This is an incredible foundation from which to grow.

Nice reminder for the troops and the public.

At our core, Microsoft is the productivity and platform company for the mobile-first and cloud-first world. We will reinvent productivity to empower every person and every organization on the planet to do more and achieve more.

Repeating this is not productive.

Microsoft has a unique ability to harmonize the world’s devices, apps, docs, data and social networks in digital work and life experiences so that people are at the center and are empowered to do more and achieve more with what is becoming an increasingly scarce commodity – time!

It took far too much time to get here, but Nadella has shrewdly set in motion not only Microsoft’s mission, but its marketing message as well, which is almost as important.

Microsoft will save us time.

Productivity for us goes well beyond documents, spreadsheets and slides. We will reinvent productivity for people who are swimming in a growing sea of devices, apps, data and social networks. We will build the solutions that address the productivity needs of groups and entire organizations as well as individuals by putting them at the center of their computing experiences. We will shift the meaning of productivity beyond solely producing something to include empowering people with new insights. We will build tools to be more predictive, personal and helpful.

The deconstruction of Word, Excel et al shall commence starting now.

We will enable organizations to move from automated business processes to intelligent business processes. Every experience Microsoft builds will understand the rich context of an individual at work and in life to help them organize and accomplish things with ease.

This will be tricky. Even in a data driven, always-on world, people vigilantly maintain different lives: work, home, and those known only between the person and her browser history. Nadella wants to create a whole where I believe people want to maintain separate, if porous, fiefdoms.

Productive people and organizations are the primary drivers of individual fulfilment and economic growth and we need to do everything to make the experiences and platforms that enable this ubiquitous.

I love how Nadella and Microsoft are the anti-Apple. Steve Jobs was famous for talking about computers and creativity whereas Microsoft is now focused on computers and productivity. Both are worthy visions: Apple is more likely to garner passionate adherents, Microsoft is more likely to lift up all boats.

Users Not Consumers

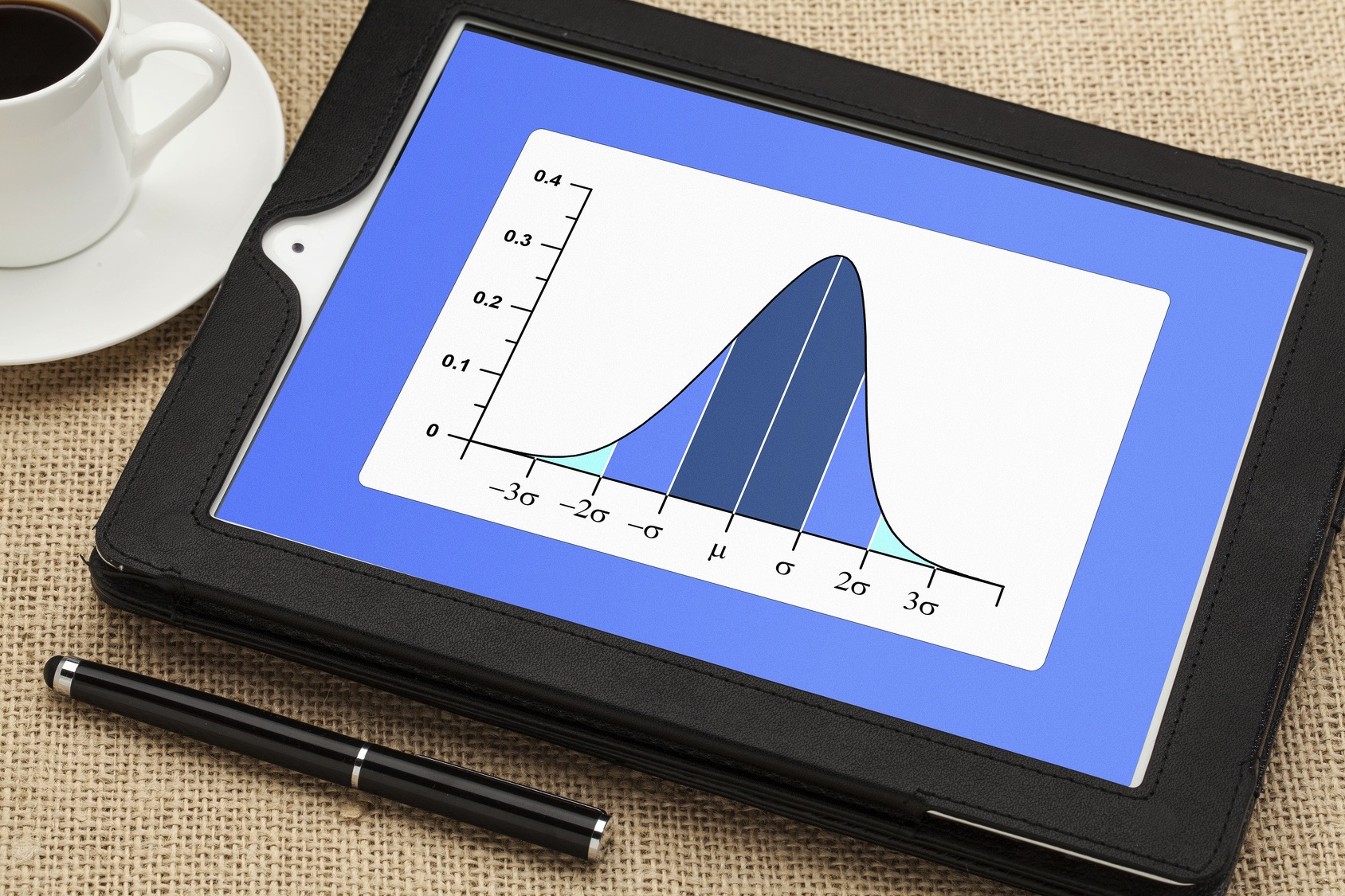

We will think of every user as a potential “dual user” – people who will use technology for their work or school and also deeply use it in their personal digital life. They strive to get stuff done with technology, demanding new cloud-powered applications, extensively using time and calendar management, advanced expression, collaboration, meeting, search and research services, all with better security and privacy control.

Privacy, privacy, security.

Wise of Microsoft to attack Google’s Achilles Heel. Obviously, we embrace the many benefits that accrue as our data, all of it, flows between many clouds and many screens.

We will want to know, however, that some data will remain forever cordoned off to all but exactly whom we wish and when. Only Microsoft can deliver this — Google’s business model is almost in direct opposition to it and Apple refuses to embrace Microsoft scale.

Warning, Mr. Nadella: do not abdicate user privacy. Do not screw this up.

Microsoft will push into all corners of the globe to empower every individual as a dual user – starting with the soon to be 3 billion people with Internet-connected devices. And we will do so with a platform mindset. Developers and partners will thrive by creatively extending Microsoft experiences for every individual and business on the planet.

None of this sounds even remotely appealing. Platforms empower the maker, not the user. That’s why every company in tech talks platforms.

“Microsoft experiences” sounds no better than, say, a visit to the dentist.

Across Microsoft, we will obsess over reinventing productivity and platforms. We will relentlessly focus on and build great digital work and life experiences with specific focus on dual use.

Nadella has hitched his future to a belief in “dual use.” That is, our work and home lives meld into one interconnected digital sphere. I think this is wrong and will be his undoing.

Microsoft Everywhere

Our cloud OS infrastructure, device OS and first-party hardware will all build around this core focus and enable broad ecosystems. Microsoft will light up digital work and life experiences in the most personal, intelligent, open and empowering ways.

Key words: “first-party hardware.” Surface, Lumia, Xbox — these are only the start of Nadella’s hardware ambitions. Ballmer must be pleased.

Developers and partners will thrive by creatively extending Microsoft experiences for every individual and business on the planet.

Requisite acknowledgement of developers and partners now out of the way…

We will deliver digital work and life experiences that are reinvented for the mobile-first and cloud-first world. First and foremost, these experiences will shine for productivity. As a result, people will meet and collaborate more easily and effectively. They will express ideas in new ways. They will experience the magic of ambient intelligence with Delve and Cortana.

This is the future we expect and I am looking forward to Microsoft’s implementation of “ambient intelligence.”

It’s easy to believe Microsoft will be unable to match Google Now and other iterations of Google’s ambient intelligence capabilities. It’s nearly as easy to believe Microsoft won’t be able to deliver a service as simple to use as Apple’s Siri. These are legitimate concerns. That said, Bing, Yammer, Office, Exchange, Skype, Lumia, and the reach of Microsoft’s cloud infrastructure are critical resources to be tapped, and will help guide users in all facets of their digital life.

Moreover, for the shareholders, ambient intelligence will be a business revolution, and in this, Microsoft is far ahead of the pack.

They will ask questions naturally and have them answered with insight from Power Q&A. They will conquer language barriers and change the world with Skype translator. Apps will be designed as dual use with the intelligence to partition data between work and life and with the respect for each person’s privacy choices. All of these apps will be explicitly engineered so anybody can find, try and then buy them in friction-free ways. They will be built for other ecosystems so as people move from device to device, so will their content and the richness of their services – it’s one way we keep people, not devices, at the center.

I hope you succeed at this. Right now, these remain mere words.

This transformation is well underway as we moved Office from the desktop to a service with Office 365 and our solutions from individual productivity to group productivity tools – both to the delight of our customers.

Please ban the use of the word ‘delight’.

We’ll push forward and evolve the world-class productivity, collaboration and business process tools people know and love today, including Skype, OneDrive, OneNote, Outlook, Word, Excel, PowerPoint, Bing and Dynamics.

The next revolution will be in the office, not in the home. In this, new Microsoft still acts like old Microsoft.

Increasingly, all of these experiences will become more connected to each other, more contextual and more personal. For example, today the Cortana app on my Windows Phone merges data from highway sensors and my own calendar and simply reminds me to leave work to make it to my daughter’s recital on time. In the future, it will be even more intelligent as a personal assistant who takes notes, books meetings and understands if my question about the weather is to determine my clothes for the day or is intended to start a complex task like booking a family vacation. Microsoft experiences will be unique as they will reason over information from work and life and keep a user in control of their privacy.

Dear tech bloggers: the ‘Microsoft is doomed’ stories are just stupid.

The Cloud Everywhere

Our cloud OS represents the largest opportunity given we are working from a position of strength. With Azure, we are one of very few cloud vendors that runs at hyper-scale. The combination of Azure and Windows Server makes us the only company with a public, private and hybrid cloud platform that can power modern business. We will transform the return on IT investment by enabling enterprises to combine their existing datacenters and our public cloud into one cohesive infrastructure backplane. We will enable our customers to use our Cloud OS to accelerate their businesses and power all of their data and application needs.

The cloud will be where nearly all our data and all the intelligence connected to that data resides. But not all. We will use our mobile devices to store and share data and content which we dare not send via the cloud.

That said, the cloud will be paramount, and Mr. Nadella is wise to focus so much attention upon Microsoft’s capabilities here.

His statement also reminds us Nadella is a techie and he understands how to fully leverage the breadth of Microsoft’s infrastructure. I wish his statement, however, wasn’t so buried underneath enterprise-speak. How will this cloud benefit me — not me at work, not me doing work. Simply, me.

Beyond back-end cloud infrastructure, our cloud will also enable richer employee experiences. For example, with our new Enterprise Mobility Suite, we now enable IT organizations to manage and secure the Windows, iOS and Android devices that their employees use, while keeping their companies secure. We are also making it easy for organizations to securely adopt SaaS applications (both our own and third-party apps) and seamlessly integrate them with their existing security and management infrastructure. We will continue to innovate with higher level services like identity and directory services, rich data storage and analytics services, machine learning services, media services, web and mobile backend services, developer productivity services, and many more.

Nadella may talk of “dual use” and of the merging of work and home. Microsoft remains, however, a work company.

Our cloud OS will also run all of Microsoft’s digital work and life experiences, and we will continue to grow our datacenter footprint globally. Every Microsoft digital work and life experience will also provide third-party extensibility and enable a rich developer ecosystem around our cloud OS. This will enable customers and partners to further customize and extend our solutions, achieving even more value.

Cloud “APIs,” essentially, could revolutionize how we create, manipulate and benefit from data. Microsoft should be a leader in this, and it will propel tremendous business value.

Hardware Everywhere

Our Windows device OS and first-party hardware will set the bar for productivity experiences.

Again, that phrase “first-party hardware.”

Microsoft is (now) a hardware company. But a good one? Can an applications, services and infrastructure company also do great hardware? I have my doubts. I welcome being proven wrong.

Windows will deliver the most rich and consistent user experience for digital work and life scenarios on screens of all sizes – from phones, tablets and laptops to TVs and giant 82 inch PPI boards.

Does anyone believe this will ever be so?

We will invest so that Windows is the most secure, manageable and capable OS for the needs of a modern workforce and IT.

Nadella will not cede one organization to Google Docs and not allow a single corporation to let iPhone, iPad or BYOD to loosen its grip on the enterprise. This will be a bloody fight. I can’t wait.

Windows will create a broad developer opportunity by enabling Universal Windows Applications to run across all device targets. Windows will evolve to include new input/output methods like speech, pen and gesture and ultimately power more personal computing experiences.

Multi-mode inputs will absolutely create more personal computing experiences. The burden of proof that these should — or even can — be offered by Microsoft is quite high, however.

Very, very few humans use speech, pen or gestures to interact with Microsoft products or applications. Microsoft has repeatedly failed to lead the world in this.

Our first-party devices will light up digital work and life. Surface Pro 3 is a great example – it is the world’s best productivity tablet.

No.

In addition, we will build first-party hardware to stimulate more demand for the entire Windows ecosystem. That means at times we’ll develop new categories like we did with Surface. It also means we will responsibly make the market for Windows Phone, which is our goal with the Nokia devices and services acquisition.

Being deliberately inexplicable is not productive, Mr. Nadella. What exactly is “responsibly make the market?” You intend to be a hardware company, in direct competition with many of your very best partners. Say so.

I also want to share some additional thoughts on Xbox and its importance to Microsoft. As a large company, I think it’s critical to define the core, but it’s important to make smart choices on other businesses in which we can have fundamental impact and success. The single biggest digital life category, measured in both time and money spent, in a mobile-first world is gaming. We are fortunate to have Xbox in our family to go after this opportunity with unique and bold innovation. Microsoft will continue to vigorously innovate and delight gamers with Xbox. Xbox is one of the most-revered consumer brands, with a growing online community and service, and a raving fan base. We also benefit from many technologies flowing from our gaming efforts into our productivity efforts – core graphics and NUI in Windows, speech recognition in Skype, camera technology in Kinect for Windows, Azure cloud enhancements for GPU simulation and many more. Bottom line, we will continue to innovate and grow our fan base with Xbox while also creating additive business value for Microsoft.

Brilliant. Nadella has scuttled all rumors about Microsoft abandoning Xbox. He has reminded analysts gaming is a primary driver behind mobile and while Microsoft lags in mobile it is a leader in gaming. Nadella also reminds us in our new age of data, collaboration and ideas, “gaming” will become a crucial component of productivity.

While today many people define mobile by devices, Microsoft defines it by experiences. We’re really in the infant stages of the mobile-first world. In the next few years we will see many more new categories evolve and experiences emerge that span a variety of devices of all screen sizes. Microsoft will be on the forefront of this innovation with a particular focus on dual users and their needs across work and life.

Microsoft will continue to vigorously innovate and delight gamers with Xbox.

My take: Microsoft to acquire Zynga. That’s just for starters.

Our ambitions are bold and so must be our desire to change and evolve our culture.

I truly believe that we spend far too much time at work for it not to drive personal meaning and satisfaction. Together we have the opportunity to create technology that impacts the planet.

Good, lord, this memo is just ridiculously long.

I’ve Seen All Good People

Nothing is off the table in how we think about shifting our culture to deliver on this core strategy. Organizations will change. Mergers and acquisitions will occur. Job responsibilities will evolve. New partnerships will be formed. Tired traditions will be questioned. Our priorities will be adjusted. New skills will be built. New ideas will be heard. New hires will be made. Processes will be simplified. And if you want to thrive at Microsoft and make a world impact, you and your team must add numerous more changes to this list that you will be enthusiastic about driving.

If you are not a star, I strongly advise you to get to work on your resume.

I am committed to making Microsoft the best place for smart, curious, ambitious people to do their best work.

If you are a star, I strongly advise you to get to work on your resume.

First, we will obsess over our customers. Obsessing over our customers is everybody’s job. I’m looking to the engineering teams to build the experiences our customers love. I’m looking to the sales and marketing organizations to showcase our unique value propositions and drive customer usage first and foremost.

In order to deliver the experiences our customers need for the mobile-first and cloud-first world, we will modernize our engineering processes to be customer-obsessed, data-driven, speed-oriented and quality-focused. We will be more effective in predicting and understanding what our customers need and more nimble in adjusting to information we get from the market. We will streamline the engineering process and reduce the amount of time and energy it takes to get things done. You can expect to have fewer processes but more focused and measurable outcomes. You will see fewer people get involved in decisions and more emphasis on accountability. Further, you will see investments in two new or combined functions: Data and Applied Science and Software Engineering. Each engineering group will have Data and Applied Science resources that will focus on measurable outcomes for our products and predictive analysis of market trends, which will allow us to innovate more effectively. Software Engineering will evolve so that information can travel more quickly, with fewer breakpoints between the envisioning of a product or service and a quality delivery to customers. In making these changes we are getting closer to the customer and pushing more accountability throughout the organization.

We should not be surprised when thousands of Microsoft staff are shown the door.

Second, we know the changes above will bring on the need for new training, learning and experimentation.

That’s you, old, middle management gatekeepers.

Over the next six months you will see new investments in our workforce, such as enhanced training and development and more opportunities to test new ideas and incubate new projects.

Big layoffs by Christmas.

I have also heard from many of you that changing jobs is challenging. We will change the process and mindset so you can more seamlessly move around the company to roles where you can have the most impact and personal growth. All of this, too, comes with accountability and the need to deliver great work for customers, but it is clear that investing in future learning and growth has great benefit for everyone.

I suspect Microsoft will soon become the GE of personal computing. Massive, always in flux, possessing an agile bureaucracy, driven less by product or business model and more by shrewdly financing initiatives which it can dominate.

I am committed to making Microsoft the best place for smart, curious, ambitious people to do their best work.

Why hasn’t it been?

Finally

Yes!

every team across Microsoft must find ways to simplify and move faster, more efficiently. We will increase the fluidity of information and ideas by taking actions to flatten the organization and develop leaner business processes.

See note above re: resumes.

Culture change means we will do things differently. Often people think that means everyone other than them. In reality, it means all of us taking a new approach and working together to make Microsoft better. To this end, I’ve asked each member of the Senior Leadership Team to evaluate opportunities to advance their innovation processes and simplify their operations and how they work. We will share more on this throughout July.

Big layoffs by Thanksgiving.

A few months ago on a call with investors I quoted Nietzsche and said that we must have “courage in the face of reality.” Even more important, we must have courage in the face of opportunity.

+1 for quoting Nietzsche. -2 for quoting Nietzsche 3,000 words in.

We have clarity in purpose to empower every individual and organization to do more and achieve more. We have the right capabilities to reinvent productivity and platforms for the mobile-first and cloud-first world. Now, we must build the right culture to take advantage of our huge opportunity. And culture change starts with one individual at a time.

Validate why you, ye lowly programmer, should continue to be employed by Microsoft.

Rainer Maria Rilke’s words say it best: “The future enters into us, in order to transform itself in us, long before it happens.”

Want to get on Nadella’s good side? He obviously has a penchant for early 20th century German writers.

We must each have the courage to transform as individuals. We must ask ourselves, what idea can I bring to life? What insight can I illuminate? What individual life could I change? What customer can I delight? What new skill could I learn? What team could I help build? What orthodoxy should I question?

Big layoffs by Labor Day.

With the courage to transform individually, we will collectively transform this company and seize the great opportunity ahead.

I wish you well, Mr. Nadella, and all of you (still) at Microsoft.