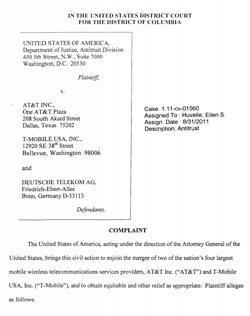

We now know what the U.S. wireless landscape will not look like in a couple of years. The filing of U.S. v. AT&T effectively ends AT&T’s dream, tacitly shared by Verizon Wireless, of a wireless duopoly with a troubled Sprint maybe hanging on.

Of course, AT&T made the obligatory noises about fighting on to win approval of its acquisition of T-Mobile USA, but this deal is as good as dead. It is possible for an acquisition to go through over government objections–Oracle-PeopleSoft is an example, but it is very rare. The deal has to be kept on ice for months or years while the legal battles are fought out. The Justice Dept. complaint makes it clear that it would be very difficult to modify the deal in a way that made it acceptable to the government. And even if it were to prevail over the Justice Dept., AT&T would still have to win approval, on the basis of different laws and criteria, from a very skeptical Federal Communications Commission.

Of course, AT&T made the obligatory noises about fighting on to win approval of its acquisition of T-Mobile USA, but this deal is as good as dead. It is possible for an acquisition to go through over government objections–Oracle-PeopleSoft is an example, but it is very rare. The deal has to be kept on ice for months or years while the legal battles are fought out. The Justice Dept. complaint makes it clear that it would be very difficult to modify the deal in a way that made it acceptable to the government. And even if it were to prevail over the Justice Dept., AT&T would still have to win approval, on the basis of different laws and criteria, from a very skeptical Federal Communications Commission.

That leaves us with the status quo: Two national mega-carriers in Verizon and AT&T, two much smaller national carriers in T-Mobile and Sprint, and an assortment of much, much smaller regional wireless companies.

T-Mobile and Sprint, however, have exactly the same problems that threatened their viability before the AT&T deal was announced. T-Mobile has been a feisty competitor, a fact that helped persuade Justice to move to block the merger. But T-Mo’s coverage is spotty in many parts of the country, it’s 3G service is incompatible with anyone else’s (that why an unlocked iPhone can only get EDGE service on the T-Mo network), and it lacks any clear path to 4G.

Sprint has big problems of its own. After six years, it still hasn’t fully digested the purchase of Nextel and faces challenges in migrating the remaining Nextel iDEN customers to CDMA/EV-DO technology. Sprint’s 4G strategy is also murky. It owns a majority interest in Clearwire, which owns a big swath of national 4G spectrum, but which made a bad technology bet on WiMax. Sprint currently provides 4G service over the Clearwire network and is expected announce its strategy at an event in early October. The government move against AT&T probably makes it more likely that Sprint will buy the rest of Clearwire and accelerate its migration of 4G technology from WiMax to the LTE standard used by Verizon and AT&T (and most other carriers in the industrialized world.)

Would a combination of Sprint and T-Mobile be better equipped to challenge Verizon and AT&T than two relatively weak competitors? Superficially, this makes sense, but there are tremendous difficulties in the way of such a deal happening, or succeeding if it were to happen. Sprint has relatively little cash, a lot of debt, and is deeply entangled in Clearwire.

Sprint would probably have to raise the financing to buy T-Mobile outright. Because it is a subsidiary of Deutsche Telekom, there is no possibility of a merger of equals. In theory, a merged company could be operated as a partnership between Sprint Nextel and DT (as Verizon Wireless is a partnership between Verizon Communications and Vodafone) but T-Mo’s German parent has shown no interest in doubling down in the U.S. market.

A T-mo-Sprint combination would also be a technological nightmare. Sprint operates a CDMA network with EV-DO 3G data, all at 1900 MHz and Clearwire 4G at 2500 MHz. T-Mo provides GSM and EDGE service at 1900 Mhz and 3G UMTS at 1700 and 2100 MHz. There’s no compatibility anywhere and no existing devices that will run properly on both networks. Given its painful technology integration experience with Nextel, Sprint may be particularly reluctant to wade into another swamp.

So it looks like the status quo will be with us for a while. Let’s hope that the Justice Dept.’s belief that this competitive landscape will be better for consumers than a T-Mobile-AT&T merger turns out to be correct.