The hundred meter dash, archery, weightlifting and the long jump are four very different Olympic sports with four very different methods of keeping score. The hundred meter dash is scored on speed. Archery is scored on accuracy. Weightlifting is scored on strength. The long jump is scored on distance. You don’t judge the participants in the hundred yard dash by how much weight they can lift. That would be the wrong way to measure them.

“…looking at ‘smartphone share’ or ‘profit share’ or ‘platform share’ all tell you something about the industry, but all three metrics mislead you if you try to treat them as a way to see who’s ‘winning’, because ‘winning’ means different things for Apple, Samsung or Google. After all, Google may well still make more money from searches on iOS than it does from searches on Android.” ~ Ben Evans, On market share

Hardware manufacturing, advertising, “razors-and-blades” content sales, and platforms are four very different business models and they have four very different methods of keeping score too.

You don’t take the metrics used to measure one business model and apply them to another business model. That would be the wrong way to measure them.

Each business model demands its own specific forms of scoring. The goal should be to devise, discover, or discern a form of measurement that properly and accurately reflects how a business is performing in the business model in which it is participating.

Biathlons, Triathlons and Decathlons are all unusual Olympic events in that they group together several disparate sports and then determine an overall winner. Think of Apple, Google, Samsung, and Amazon as Olympic teams that compete with one another in the four interrelated mobile business models – hardware manufacturing, advertising, “razors-and-blades” content sales, and platforms – a sort of Quadrathlon. Each team has its strengths and its weaknesses, each team wants to win the events that they’re best at and maximize their score in the other events in order to win the overall Quadrathlon.

Let the games begin!

Hardware Manufacturing

Last week I tried to explain how using only market share to analyze mobile hardware manufacturing was not only the wrong way to keep score of that business model but that it was actually obscuring the real score.

“The truth is that focusing on market share as the primary metric is the only way to paint the iPhone as anything other than a roaring success.” ~ John Gruber

I suggested an alternative measurement known as the “Fair share profit analysis,” in order to generate some perspective but, truth be told, the only real way to accurately “score” who’s winning in hardware manufacturing is with net hardware profits. When it comes to selling mobile hardware, do Apple, Samsung, HTC, Motorola, etc. really care what their market share is? No they do not. That’s the top line, a means to an end. The only thing that matters when they are selling mobile hardware is profit. That’s the bottom line, the end for which the means were made. Market share is all well and good but only if it brings home the profits. Keep your eyes on the prize – and profits are the prize.

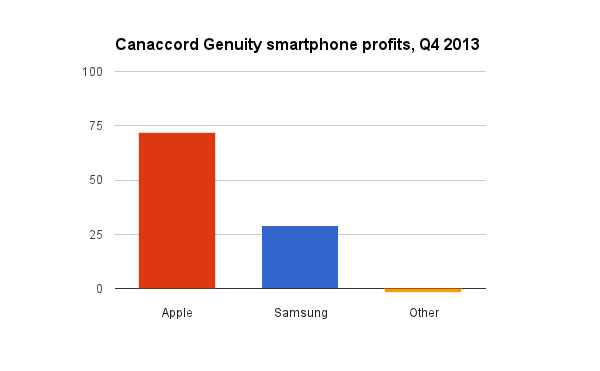

So who’s winning the medals in the olympic sport of mobile hardware manufacturing?

Source: “Who’s Winning, iOS or Android? All the Numbers, All in One Place”

Awards Ceremony: Apple walks away with the Gold (both figuratively and almost literally), Samsung takes the Silver and no one else even medals. The Bronze podium stands empty.

Advertising

The only proper way to score advertising is net advertising profits retained. Market share and platform may be used to garner advertising revenue but they are only the means and they should never be confused with profit, which is the end.

Today, there are three great truths in mobile advertising:

1) Google is killing it in mobile advertising.

2) Google is killing it in mobile advertising…but mobile advertising is still relatively small; and

3) The vast majority of Google’s mobile advertising revenue is generated on the iOS platform, not the Android platform.

1) Google is killing it in mobile advertising.

Google dominates the mobile search market with 93% of US mobile search advertising dollars, according to eMarketer. Facebook is at No. 2.

2) Mobile advertising is still relatively small.

The mobile ad market alone stood at roughly $4.1 billion at the end of last year, up from $1.5 billion at the end of 2011. Google, currently has more than half the mobile ads market with annual revenues of around $2.2 billion.

Just to keep things in perspective, mobile ad revenue only accounted for 9% of all online ad revenue last year, although the percentage of mobile ads vis-a-vis other online ads is rapidly growing. And mobile ad revenues paled in comparison with mobile hardware sales. While it took an entire year for ALL mobile ad revenue to reach $4.1 billion, Apple alone, and in 90 days, and in what many considered a down quarter, brought in revenues of approximately $31.4 billion just from iPhone and iPad sales.

3) Google is making its advertising money on iOS, not Android

“(I)t’s Android’s large market share that is the winner for Google. The more Android devices being used, the more Google services with Google ads are being used.” – Virtual Pants

Actually, not so very much. Most of Google’s advertising dollars are generated by iOS’s relatively smaller market share, not by Android’s massive market share.

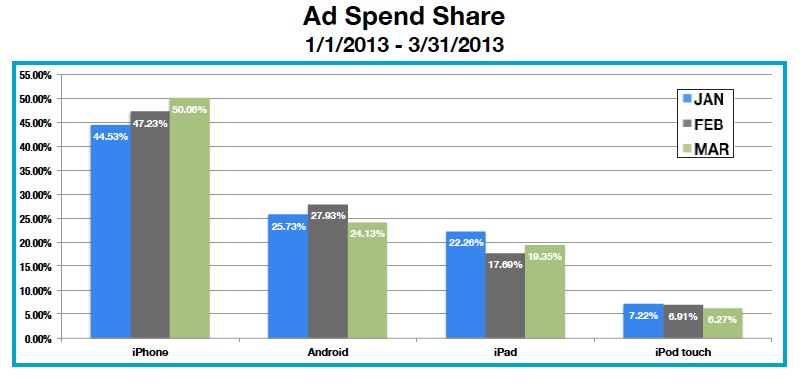

Source: MoPub

Take a good hard look at the chart, above. The iPhone ad spend doubles the ad spend share of ALL of Android. The iPad almost matches ALL of Android BY ITSELF. And even the lowly iPod has one-quarter of the ad spend that ALL of Android does. Market share is all that matters? I don’t think so. That’s like arguing that acreage is all that matters in real estate. The size of the lot does matter in real estate but location, location, location matters more, more, more. And market share does matter in mobile advertising but it is the location of the market share that matters even more.

— Apple’s iOS Mobile Ad Metrics Dominates Android

— Why 75 cents of every dollar spent on mobile advertising is spent on iPhone and iPad

— iOS leads Android in mobile ad revenue

— Apple’s iPad dominates online shopping traffic & revenue generation

— iPad Still Dominates Tablet Ads With iPad Mini Gaining, Velti Finds

“My belief, though, is that what Google is winning with Android is a booby prize — overwhelming majority share of the unprofitable segment of the market.” – John Gruber

When it comes to ad revenues and profits, we shouldn’t be counting Android as a single entity anyway. Ad revenues don’t help Android, the platform. They help specific digital stores. Ads going to Amazon, Google, and the various stores in China and elsewhere need to be broken out separately, not lumped together.

Awards Ceremony: Google wins the Gold and they win it going away. But they receive their Gold medal standing on the Apple iOS platform, not the Android platform.

Silver and Bronze? I’ll let you decide if it’s Facebook, Yahoo, Microsoft’s Bing or someone else. They’re all so far back that it doesn’t much matter now anyway. That may change over time but we’ll have to wait and see how this market develops.

“Razors-And-Blades” Content Sales

“(T)he razor and blades business model, is a business model wherein one item is sold at a low price (or given away for free) in order to increase sales of a complementary good, such as supplies…” ~ Wikipedia

The “razors-and-blades” business model is tricky to score.

— Hardware revenues and profits mean NOTHING in the “razors-and-blades” model. In fact, it’s not unusual to LOSE money from hardware (razor) sales.

— Market share means both nothing and everything in the “razors-and-blades” model. It means nothing because it doesn’t actually generate any profits but it means everything because it is a prerequisite to generating profits. In fact, the only reason you’re giving away your hardware in the first place is to acquire massive market share which, in turn, will hopefully lead to massive profits.

— Ultimately, the only way to measure the success of the “razors-and-blades” model is on the net profits generated by the sale of the complementary goods (razors). In mobile, the complementary goods are content such as music, video, books, etc. and apps. Amazon also has the added advantage of being able to sell everything from their sprawling retail catalog.

As I tried to explain in my tersely titled article: “Selling The Amazon Kindle Fire and Google Nexus 7 Is As Silly As Selling Razor Blades To Men Who Love Beards“, the “razors-and-blades” model makes no sense in this market space. At least it makes no sense to me. In the “razors-and-blades” model, the complementary sales – whether it be blades for razors, or ink for inkjet printers or games for gaming consoles – must be proprietary and must command a premium price. That’s the whole point. Give away the razor, make it back – and more – by selling the blades at a premium.

If you’re selling content, you want to be platform agnostic so that you can sell as much content as possible. This, in my opinion, should be Amazon’s strategy.

If you’re giving away hardware in order to sell content, then you want that content to be tied to your hardware product so that you can monopolize the sale of the complementary product and command a premium price.

In the mobile space, the complementary sales ARE NOT proprietary, they ARE subject to competition and they DO NOT command a premium price. Amazon and Google don’t sell content that is any different or superior to that being sold by Apple and other content providers and their content isn’t being sold at a premium. In fact, Amazon often sells their merchandise at a DISCOUNT which – in the “razors-and-blades” business model – is completely bat-manure crazy. ((Then again, we all know that Jeff Bezos is crazy like a fox.))

So who’s winning in the “razors-and-blades” business model? Why, surprisingly, it’s Apple and it’s Apple in a runaway.

— Google Play now at 90% of iOS app store downloads; iOS still holds a 2.6X revenue lead

Despite growing competition from other tablets, Apple’s iPad still accounts for a whopping 89.28 percent of e-commerce website traffic, and also rakes in more money on a per-user basis than any other platform. ~ Monetate

Distimo reports that iOS App Store revenues were 430% larger than Android during 2012. ~ Apple F2Q13 Earnings Call

“…iTunes inclusive of Apple’s own Software generates as much as 15% operating margin on gross revenues. That’s over $2 billion a year.” ~ Asymco, So long, break-even

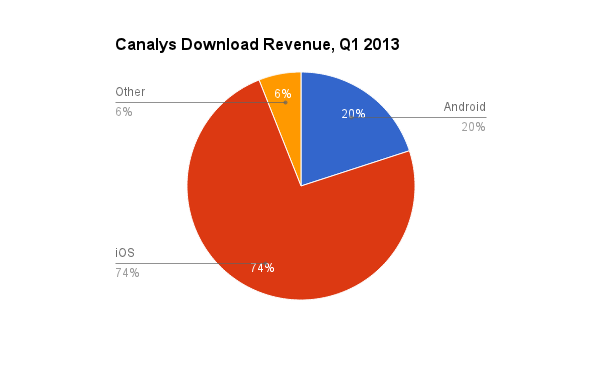

Source: Canalys

Apple sells their content, not in order to make money but, in order to make their hardware more attractive so that they can sell ever more hardware and make ever more profits. With regard to tablets, Apple is playing the OPPOSITE game that the Amazon Fire and the Google Nexus are playing. While Amazon and Google subsidize their tablets (razors) in order to make money on the sale of their content (blades), Apple should be subsidizing the sale of their content (blades) in order to make money on the sale of their hardware (razors). But that’s not how Apple rolls. Instead, Apple sells their hardware at a premium AND they sell their content at a premium. That’s not supposed to happen but that’s just how good the Apple ecosystem is.

It’s like a walk-on winning the Olympic marathon while everyone else is stuck in the starting blocks.

You can say that it’s elitist or arrogant to argue that iOS users are better customers than Android users. But you can also say that it’s the truth. ~ John Gruber, Church of market share

One last thing. If Amazon and Google have an incentive to sell discounted hardware and premium content and Apple has an incentive to sell premium hardware and discounted content, one of those business models is going to fail and it’s going to fail hard. Since Apple is, so far, successfully selling premium hardware AND premium content, I’ll let you be the judge of how this is going to play out.

Awards Ceremony: I’m tempted to award all three medals to Apple just for having the sheer audacity to win a game that they didn’t even enter. But I guess Apple will have to console themselves with just winning the Gold.

And the Amazon Fire and the Google Nexus tablets? Disqualified for not understanding the rules of the game that they were playing.

Remember, Amazon and Google sell their hardware at cost. They don’t make a penny off those sales and they might even be taking a loss.

Market share? Yes, they have taken some minor market share…in a market where they are GIVING AWAY THEIR MERCHANDISE. And market share is not how you score in the “razors-and-blades” game. While the press and the pundits fawn over the market share of the Amazon Fire and the Google Nexus, what they’re entirely missing is that in the “razors-and-blades” business model, market share should be a GIVEN. I mean, honestly, if you can’t obtain overwhelming market share when you’re giving away your product at cost, then you should be ashamed, embarrassed, abashed, chagrined, humiliated and mortified ’cause you’re doing something terribly, terribly wrong.

You win the “razors-and-blades” game by scoring the most content profits. All those Amazon Fire and Google Nexus market share numbers that the analysts are always going gaga over? Meaningless. They should be removed from the count. They’re probably not hurting the sales of the other available tablets and they’re not helping the bottom lines of their makers either. There is zero proof that Amazon and Google’s hardware giveaways have led to increased retail sales which, after all, in the “razors-and-blades” model, IS the point.

And if you’re going to prophesy that market share alone gives Google data that will someday, somehow, be worth something to someone, then you need to go back and re-read how the “razor-and-blades” business model is scored.

What we desperately need in analyzing mobile computing is far more attention paid to profits and far less attention paid to prophets.

Next Time

Next time I will finish with the “mother” of all business models – platforms – and do the medal count.

Google’s Android Activations Are A Lot Less Cash Cow And A Lot More Bull. And That’s OK.

Read Part One of John’s column entitled: Android’s Market Share Is Literally A Joke

Read Part Three of John’s column entitled: Google’s Android Activations Are A Lot Less Cash Cow And A Lot More Bull. And That’s OK.

The author would like to gratefully acknowledge the contributions of Ben Bajarin and Steve Wildstrom. All the great ideas, that you agree with, were theirs. All the bad ideas, that you disagree with, were mine.