We are winning with our products in all the ways that are most important to us, in customer satisfaction, in product usage and in customer loyalty. ~ Tim Cook, Apple earnings call

Customer satisfaction. Product usage. Customer loyalty.

Is Tim Cook right? Is Apple really winning in those areas? And is that really what’s most important?

Customer Satisfaction

Based on their most recently published research, ChangeWave measured a 96% customer satisfaction rate among iPhone users and a 99% customer satisfaction rate among those who owned iPads. Impressive, to say the least.

Product Usage

Experian reported that iPhone users spend an average of 53% more time each day on their phones than Android phone users. Nearly two-thirds of iOS devices are already running iOS 7. The App Store now has over 60 billion downloads. And Apple has nearly doubled its total payout to app developers this year — now at $13 billion, up from $7 billion in January.

“Regardless of what you might hear or read about how many are bought or sold or activated, iPad is used more than any of the rest. And not just a little more, a lot more. The iPad is used more than four times more than all of those other tablets put together.” ~ Tim Cook

Now before your read on, stop and think about that for a moment. The iPad is used four times more than all other tablets put together. Astounding.

Industry analyst, Alexander, noted that “In an increasingly bifurcated tablet market, Apple has yet to experience any serious competition for the premier customer, particularly those users wanting to do more with a tablet than watch videos, surf the Web, and do email….”

If usage is the defining criterion, then there are actually very few tablets that are directly competing with the iPad.

Customer Loyalty

Based on the most recently published research, Kantar measured a 92% customer loyalty rate among Apple customers, significantly higher than that of the competition.

Summary

Based on the above, I think it’s fair to conclude that Apple is “winning” in Customer Satisfaction, Product Usage, and Customer Loyalty. But is that what matters? What about things like profits, growth, innovation, and market share? Aren’t they what really matter?

But, Apple Is Not Growing…

True enough. Apple has not released any significant new products over the past year and, consequently, they have not grown over they past year either. But they have remained extremely profitable.

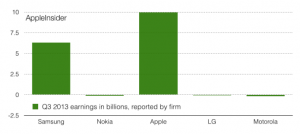

For example, Apple’s sales of 33.8 million iPhones earned more than the combined sales of 211.2 million phones sold by the rest of the world’s top 5 phone makers.

For example, Apple’s sales of 33.8 million iPhones earned more than the combined sales of 211.2 million phones sold by the rest of the world’s top 5 phone makers.

Still, profit without growth is like sex without love. It’s an empty experience…

…but, as empty experiences go, it’s one of the very best.

Eventually, Apple will have to grow or die. But in the meantime. Apple, can take solace in the fact that they’re making money hand over fist, while simultaneously screwing the competition, to boot.

But, But, Lack Of Innovation…

Many analysts covering Apple are bearish, citing ‘dwindling catalysts.’ But seriously, who are they to judge? Those self-same analysts missed every catalyst that Apple ever caught on their ride from last to first.

They are ill discoverers that think there is no land, when they can see nothing but sea.” ~ Francis Bacon

Apple naysayers act like small children who think that if something is out of sight, it ceases to exist. Just because THEY can’t see what’s coming down the pike doesn’t mean that Apple and others can’t see it. As always, it’s a question of vision. And I’d put Apple’s vision up against the analysts’ any day of the week.

But, But, But, Growth Should Be Constant, Continuous, Ever Upward…

Really? Show me an example of something healthy, where growth was constant and ever upward and I’ll show you the exception to the rule.

A child of five would understand this. Send someone to fetch a child of five. ~ Groucho Marx

NO ONE is always at their best. Well, I take that back…

Only the mediocre are always at their best.” ~ Jean Giraudoux

Sun Tzu said that “Energy may be likened to the bending of a crossbow; decision, to the releasing of a trigger.” A bowman needs to pull the bow before releasing the arrow. The arrow won’t go very far if he doesn’t take the time and effort to do so. Similarly, a company needs to do the preparation before releasing a new product.

I means, seriously, do I really need to cite Sun Tzu in order to make this point? New products take time to prepare. Duh.

There Is A Season For Everything

You’d be a pretty poor farmer if you planted the seed and then walked away before the harvest. And you’d be a pretty poor investor if you thought that every season was harvest season and no season was to be set aside for the planting.

Don’t judge each day by the harvest you reap, but by the seeds you plant. ~ Robert Louis Stevenson

Apples critics deny the realities of life. They want rain without thunder and lightning. They want crops without plowing the ground. ((Inspired by Frederick Douglass))

When clouds form in the skies we know that rain will follow but we must not wait for it. Nothing will be achieved by attempting to interfere with the future before the time is ripe. Patience is needed. ~ I Ching

I mean, are you prepared to argue with the freakin’ I Ching?

I didn’t think so.

When you walk through a farm, some see the (beauty), some only observe the manure. ~ Henri Matisse

Manure is often used to fertilize crops. If you can’t stand the sight of manure and you can’t patiently wait for the seed to ripen, don’t become a farmer. And if you can’t stand the turmoil of the market and you can’t patiently wait for an investment to mature, don’t become an investor.

Warren Buffett said Apple is run ‘for the investors who are going to stay, not the ones who are going to leave.’ Which are you? Do you walk away in the Spring or do you wait for the Autumn to arrive?

But, But, But, But, market share, Market Share, MARKET SHARE!!!

If you see the world in black and white, you’re missing important grey matter.” ~ Jack Fyock

Apple regularly fires some of its customers for the sake of empowering its target market. News Flash: Apple has been “ignoring” a large portion of its potential customer base since 1996. They could have done worse.

For example since Google’s IPO, Google is up 833.8%. On the other hand, since Google’s IPO, Apple is up 3200.2%. Not bad for a company that doesn’t cow-tow to market share.

What the heck do you think the phrase “target market” means anyway? If you “target” everyone, you target no one. Seems to me that Apple is aiming for the premium market and their aim, so far, has been spot on.

And remember, just because YOU’RE not the target market doesn’t mean there is no target market.

The Critics Have Big Buts

“Critics? I love every bone in their heads.” ~ Eugene O’Neill

There seems to be a law in human nature which draws us to passionately condemn the preeminently successful. For every action there is an equal and opposite critical reaction.

The critics are always ready to give Apple the full benefit of their inexperience and are never without multiple ways for how Apple should spend its wealth. Some critics even think that they are more powerful than God. After all, Jesus was only able to turn water into a wine but critics are able to turn anything they focus upon into a whine.

Look, everyone has the right to be stupid. But some of Apple’s critics are abusing the privilege.

Watch Carefully What Apple’s Competitors Are Complaining About

Companies like Samsung and Microsoft spend their time criticizing those very aspects of Apple that they would most like to emulate. Samsung mocks Apple’s customer’s for standing in line? Microsoft mocks Apple’s tablets for their inability to do “real” work? Don’t kid yourself. They’d both cut off your right arm to have what Apple has.

Watch what people are cynical about, and one can often discover what they lack. ~ George S. Patton

Turns out that copying products is easy. Copying the culture that produced those products is hard.

Investors

The eight most terrifying words for any CEO must be: “I’m Carl Icahn and I’m here to help.”

Sheesh, thanks but no thanks.

And as if Carl Icahn weren’t bad enough, other investors are demanding that Apple lower its prices in order to capture more market share. Market share sounds great and all, but what they’re really talking about is a price war. As Pliny the Younger put it, “An object in possession seldom retains the same charm that it had in pursuit.” A price war is a delightful thing to those who don’t have to participate in it, but a rather frightful thing for those who have to pay for it.

When the gods wish to punish us, they answer our prayers. ~ Oscar Wilde

Sadly, A CEO must always be prepared to defend his company against his investors.

The right to be heard does not automatically include the right to be taken seriously. ~ Hubert H. Humphrey

Lessons To Unlearn

We should be careful to get out of an experience only the wisdom that is in it—and stop there; lest we be like the cat that sits down on a hot stove-lid. She will never sit down on a hot stove-lid again—and that is well; but also she will never sit down on a cold one anymore. ~ Mark Twain

I think that most critics are like a cat that sat on a hot stove-lid. They got burned when Apple fell in the nineties, misdiagnosed the cause of that failure as missing market share, and they haven’t stopped lecturing Apple on the wrong lesson ever since.

Memory is the greatest of artists… ~ Maurice Baring

Meanwhile, the very actions that the critics are begging Apple to stop taking are also the very actions that have made Apple successful for the past 13 years. It’s like telling a football coach that wins Super Bowl, after Super Bowl, After Super Bowl, that he’s doing it all wrong.

New Facts Demand New Conclusions

Logic?” Jim says. “What’s that?” The professor says, “I’ll give you an example. Do you own a weed eater?” “Yeah.” “Then logically speaking, because you own a weed eater, I presume you have a yard.” “That’s true, I do have a yard.” “I’m not done,” the professor says. “Because you have a yard, I think that logically speaking, you have a house.” “Yes, I do have a house.” “And because you have a house, I think that you might logically have a family.” “Yes, I have a family.” “So, because you have a family, then logically you must have a wife. And because you have a wife, then logic tells me you must be a heterosexual.” “I am a heterosexual. That’s amazing! You were able to find out all of that just because I have a weed eater.”

Excited to take the class, Jim shakes the professor’s hand and leaves to go meet Bob at the bar. He tells Bob about how he is signed up for Logic. “Logic?” Bob says, “What’s that?” “I’ll give you an example,” says Jim. “Do you have a weed eater?” “No.” “Then you’re gay.”

Apple’s critics seem to rely upon a similar chain of “logic” to predict Apple’s future. Apple doesn’t have majority market share (a weed eater) so they must be doomed.

We should all be so lucky as to be as “doomed” as Apple is.

After a battle in the War of the Spanish Succession (1701–14) Villars, the defeated commander of the French forces, was justified in writing to King Louis, “If God gives us another defeat like this, your Majesty’s enemies will be destroyed.” His judgment was prophetic in so far as the battle proved to have cost the allies their hopes of victory in the war.

Apple could rightfully claim nearly the same as Villars. Should Apple “suffer” another “disastrous” year like 2013, their competitors will be utterly destroyed.

Look, maybe Apple is doomed, maybe they’re not. But Apple’s critics have got to start coming up with better reasons for predicting Apple’s demise ’cause the same tired old reasons they keep trotting out and using over and over again just ain’t cutting it.

Attention, Attention! The naysayers have been predicting Apple’s demise since 1997 – and for the very same reasons. All the while Apple, by ignoring their critics, has merely grown to become the richest company in the free world.

Criticize Apple all you want, but please, come up with something that hasn’t been proven wrong year after year after year for the past 13 years.

“We’ve clearly never seen a tech company like this before. Perhaps it’s time to stop using tired PC tech company metaphors to predict their future.” ~ Ben Thompson

Listening For Genius

The principle mark of genius is not perfection but originality, the opening of new frontiers.” ~ Arthur Koestler

If a company values its profits more than its vision, it will first forfeit its vision and subsequently forfeit its profits, too.

Talent hits a target no one else can hit. Genius hits a target no one else can see.” ~ Arthur Schopenhauer

Look, there’s risk in everything. But Apple has proven itself successful by doing things their way.

I’d rather be a failure in something that I love than a success in something that I hate. ~ George Burns

The Stoic Philosopher, Thales, when asked “What is difficult?” replied “To know oneself.” When asked “What is easy?” he said “To give another advice.”

Critics shout boldly, but genius speaks in a whisper. Perhaps, in lieu of shouting instructions at Apple, we should be quietly listening and learning from them, instead.