On December 4, 2014, Techpinions’ own Jan Dawson wrote a 33 page report on Windows Phone. While it sounds long, for those interested in the topic, it is easy reading and I highly recommend it to you.

Jan’s report answered the “What” questions — What’s gone wrong with Windows Phone and What should Microsoft do about it. His answers are compelling. But I am far more interested in the “Why” than the “What.” Why is Microsoft doing phones at all?

Why?

Why Windows Phone? Does it help sell more Window’s licenses? No it does not. ((Microsoft launched Office for iPad in March and says it’s seen 40 million downloads of the three apps since then. But the full functionality of the apps has only been available to Office 365 subscribers, and it’s added less than three million Home and Personal subscribers since then, at roughly the same pace as it added subscribers earlier. People have been very interested in the apps, but most haven’t been willing to pay for the full functionality (or already had access to it through existing Home or Business subscriptions ~ Jan Dawson)) Microsoft is now giving away Windows on any device smaller than 9 inches. Microsoft Windows phone is not necessary to pursue that strategy.

Why Windows Phone? Does it help sell more Office licenses? No it does not. Microsoft is now giving away Office on all mobile devices under 9 inches. Microsoft Windows phone is not necessary to pursue that strategy.

Why Windows Phone? Does it help entice more people to upgrade to Windows 365? There is no evidence that it does.

Why Windows Phone. Does it make money from the sale of hardware. Not it does not. Windows phone is a money loser.

Estimated share of Q3 handset industry profits: Microsoft: -4%, Motorola: -2%, HTC, BB: 0%, LG: 2%, Samsung: 18%, Apple: 86%. ~ Kontra (@counternotions) 11/4/14

Further, if is far more likely that Microsoft is making far more money from licensing its patents to Android manufacturers than it is from selling its own phone hardware.

Strategy Tax/Conflict Of Interest

Why Windows Phone? Does it complement Microsoft’s licensing model? No it does not. If fact, it does just the opposite.

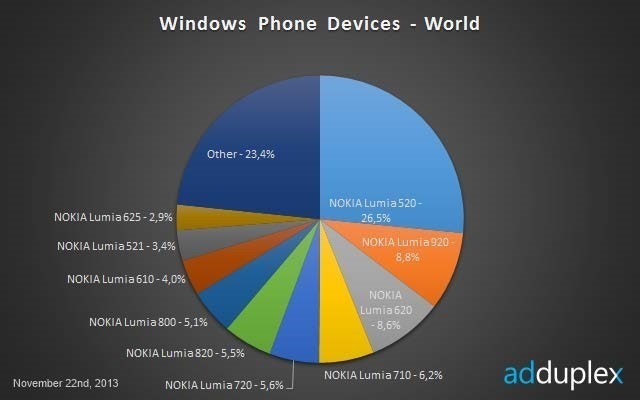

Microsoft’s Windows Phone directly competes with its own manufacturing partners. ((With the Lumia line, now manufactured by Microsoft Mobile following its acquisition from Nokia, Microsoft is now playing Windows Phone from both sides, as the only licensor and by far the largest licensee. It’s competing with its other licensees in the most direct and dominant fashion, even as it seeks to increase the number of OEMs using Windows Phone. ~ Jan Dawson)) And if you think those manufacturers haven’t noticed, then you haven’t been watching as they one-by-one flee the market.

In what is yet another blow to Microsoft’s mobile efforts, Huawei — a top-5 smartphone maker in 2014 — confirmed to The Seattle Times that for the time being, it is done with Windows Phone. What’s more, the company’s head of international media affairs said that Huawei has not made any money with Windows Phone… and neither have any other Microsoft partners. ~ Zach Epstein, BGR

Where Is Microsoft Headed?

Microsoft is doing a great job of moving towards services. Its Windows, Office and on-premise Server businesses are throwing off cash, while Office 365 and Azure are rapidly growing.

Windows hardware is not only doing poorly, it is antithetical to Microsoft’s services business model. Consider the following four quotes from Satya Nadella:

— (Microsoft’s core question is) How do we harmonize the interests across end users, developers, and IT?

— Microsoft wants to be a player everywhere.

— I definitely don’t want to compete with our OEMs.

— We are a software company at the end of the day. ~ Satya Nadella

You cannot harmonize those quotes with the sale of Windows Phone. And, in fact, I don’t think that Nadella actually wants to be in the hardware business. It was forced on him by his predecessor and he is slowly backing away from it.

I’ll make a bold prediction. Microsoft will eventually drop Windows Phone. Unfortunately, based upon what we’ve seen of Satya Nadella’s cautious style, I think it will be later rather than sooner.

Conclusion

Windows Phone is probably a lost cause…

When a lot of remedies are suggested for a disease, that means it can’t be cured. ~ Anton Chekhov

…but so what? That’s not the problem. The problem is that Windows Phone doesn’t advance Microsoft’s strategic interests. Yet Microsoft is pursuing it anyway. That’s bad strategy…

Endurance is frequently a form of indecision. ~ Elizabeth Bibesco

…and it needs to stop.

It is better to run back than run the wrong way. ~ Proverbs

Microsoft needs to stop doing what others are doing just because others are doing it.

Once a problem is solved, you compete by rethinking the problem, not making a slightly better version of the current solution. ~ Benedict Evans (@BenedictEvans)

Instead, Microsoft needs to focus its efforts on those areas where it has a competitive advantage.

It’s not about doing what you can, it’s about doing what others can’t. ~ C. Michel ((Excerpt From: C. Michel. “Life Quotes.” C. Michel, 2012. iBooks. https://itun.es/us/AyIDI.l))

I fully understand that this is easy for me to say and hard for Microsoft to do…but that doesn’t make my advice any less valid. What I’m suggesting is the hard path but its also the smart path and the courageous path.

The right thing and the easy thing are never the same. ~ Kami Garcia

Microsoft’s future is in services and that future can be great. But that future does not need hardware and, in fact, hardware is impeding Microsoft’s progress. And I’m not the only one to say so:

Abandon devices. The devices business is only worthwhile if you are able to sell at a high margin; while this does not offer the margin percentage of software licensing, the absolute monetary value of a high margin device is significant ($300+ for an iPhone, for example). However, Lumia’s are simply not competitive at the high end; all volume to date is that the very low end (<$150), and is being sold at a loss. Moreover, Lumia volume is too low to be supply chain competitive, at least once the former Nokia feature phone business is spun off. ~ Ben Thompson

Microsoft should embrace their future and let go of everything that ties them to their unsuccessful past. And that especially includes Windows Phone.

Post Script

Jean-Louis Gassée has a very different, yet very compatible, take on Microsoft’s hardware future. Highly recommended.

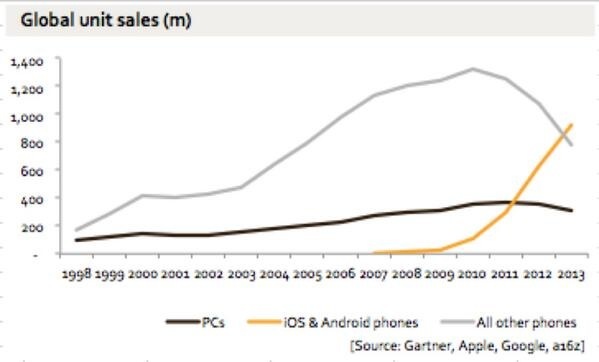

Microsoft – like World War II Japanese soldiers stranded on deserted islands – continued to pretend the war was ongoing while everyone else went about the business of post-war reconstruction. Not only had Microsoft lost the post-PC wars, but their insistence the world was still fighting the PC wars jeopardized their possibilities in the post-post-PC world, as well.

Microsoft – like World War II Japanese soldiers stranded on deserted islands – continued to pretend the war was ongoing while everyone else went about the business of post-war reconstruction. Not only had Microsoft lost the post-PC wars, but their insistence the world was still fighting the PC wars jeopardized their possibilities in the post-post-PC world, as well.

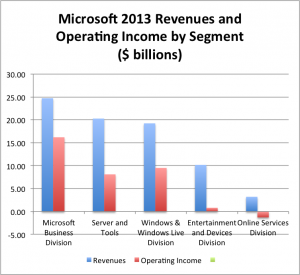

At a time when it should be thinking about the strategic direction of a new CEO, Steve Ballmer in his remaining months and his now probable successor, Nokia CEO Stephen Elop, who will become a Microsoft executive vice president, will instead be devoting a lot of time and effort to integrating Nokia. The money-losing device business had about $15 billion in revenues last year, which would make it Microsoft’s fourth largest division (see chart.) But its 32,000 employees will increase Microsoft’s worldwide employment by nearly a third. A Finnish hardware unit and Microsoft, the quintessential software company have cultures that likely will resist easy integration.

At a time when it should be thinking about the strategic direction of a new CEO, Steve Ballmer in his remaining months and his now probable successor, Nokia CEO Stephen Elop, who will become a Microsoft executive vice president, will instead be devoting a lot of time and effort to integrating Nokia. The money-losing device business had about $15 billion in revenues last year, which would make it Microsoft’s fourth largest division (see chart.) But its 32,000 employees will increase Microsoft’s worldwide employment by nearly a third. A Finnish hardware unit and Microsoft, the quintessential software company have cultures that likely will resist easy integration.