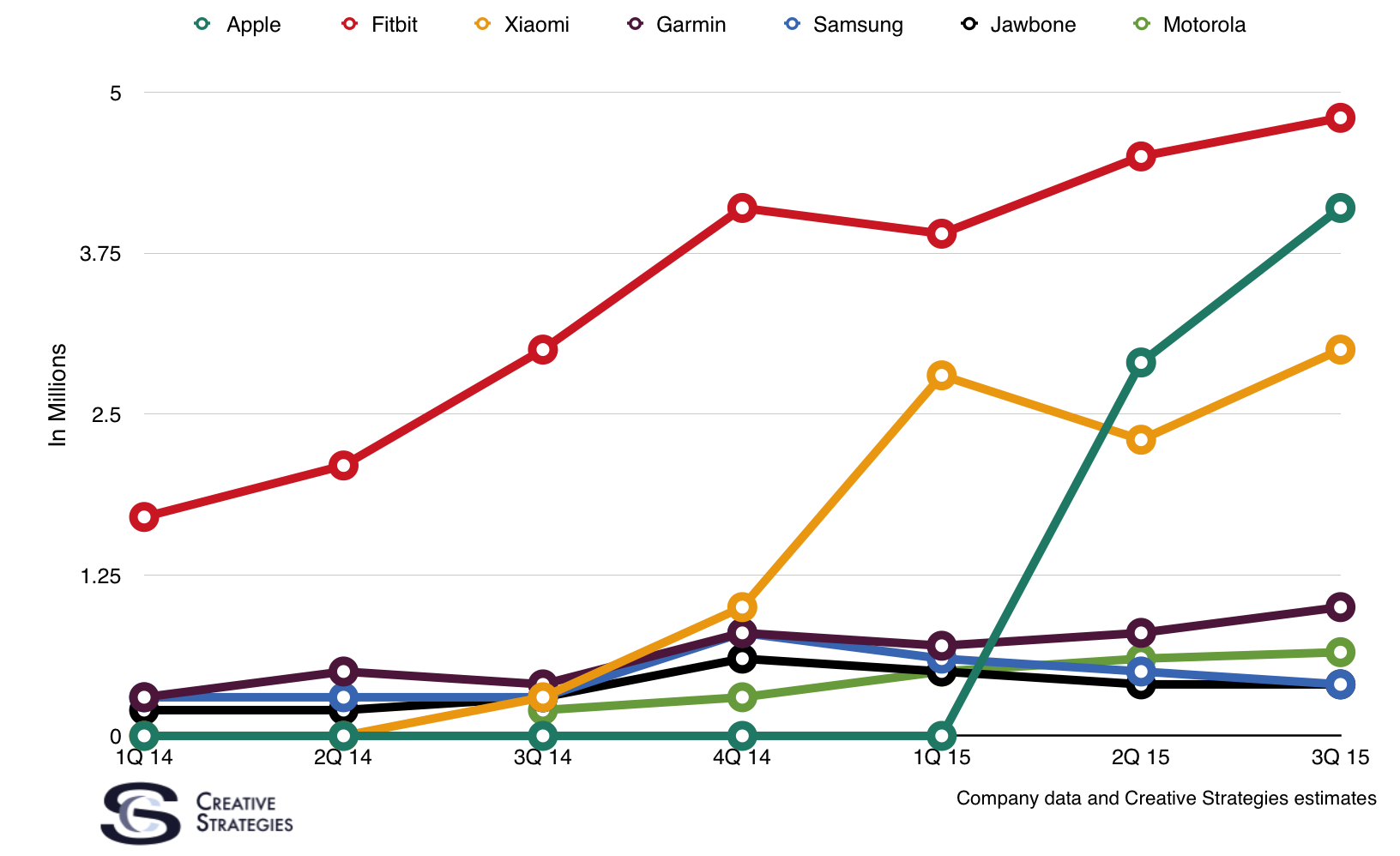

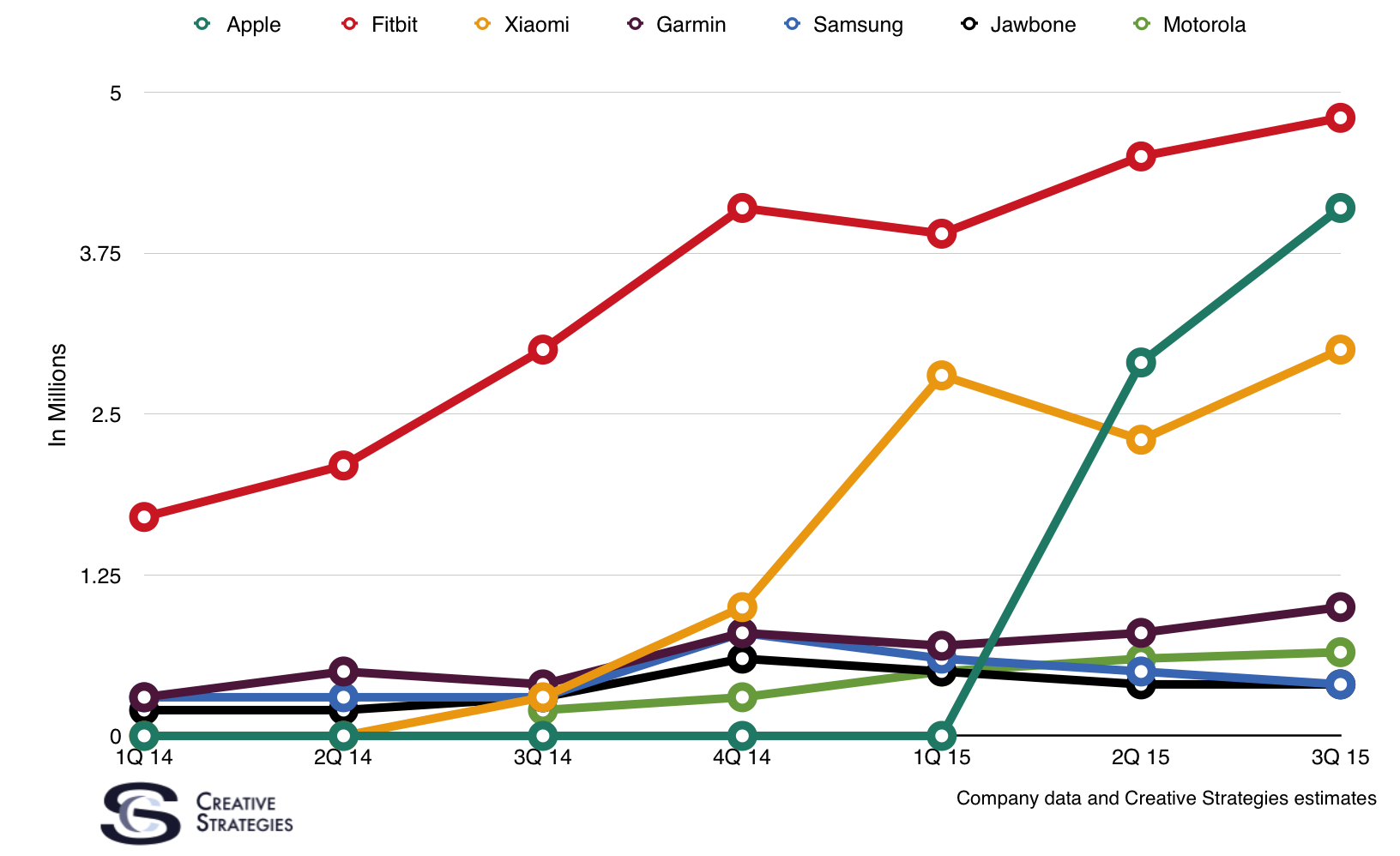

The last few quarters, I’ve been talking about how the vast majority of quarterly wearable sales have been made up by two players–Apple and Fitbit. This was entirely predictable given the immaturity of the wearable market. The early players tend to dominate. In terms of health and fitness bands, Fitbit’s market share is 36%, the highest of any brand. Apple’s share of the smartwatch segment is 82%. Here is the wearable market breakdown by vendor to date.

From my own primary research, both these brands also have over 80% of the mindshare and purchase consideration over the next six months of all brands currently in the market, either a fitness tracker or a smartwatch. The duopoly between Apple and Fitbit does not appear to be ending anytime soon.

My recent retail checks from the Black Friday weekend and Cyber Monday sales revealed similar trends with these two brands making up most of the volume. The market data confirms it’s a duopoly — so where do we go from here?

The big question in my mind is the sustainability of Fitbit. In fact, it is the key question I get from many big investment firms with a bet on Fitbit. As you can see from the chart above, Fitbit could be under pressure from the low-end by Xiaomi and the high-end by Apple. Fitbit likely knows there is an upside to their ASP. While they will do everything they can to raise it slightly, they are ultimately a company with an ASP between $90-$120 and will strive to maintain that against competitive threats from the low-end.

The concern about Xiaomi is valid, but only in some markets. To be frank, a company that sells in wealthy regions in China where a sub-$20 wearable is pocket change yet, they are only selling 2-3 million a quarter is very telling about both the broader wearable category in China and the perception of the Xiaomi brand. In fact, I find it incredibly interesting that the best selling phone, in the one of the largest and wealthiest cities in China, is Xiaomi’s cheapest Android smartphone, the Redmi 1S.

Attentive eyes will be watching Fitbit closely over the next year as they balance the growth of their ecosystem and try to make sure they are the best fitness tracker on the market and the first one people buy to enter the market. Their ecosystem is sticky and engaging, and they are the only brand their customers stick with over time.

Again referencing my quarterly wearable vendor chart, the rapid rise of Apple sales as a percentage should be a focus. It is both a testament to the Apple brand, the quality of the product for a version 1, and the total Apple ecosystem. At the pace we are seeing both interest and adoption, Apple may likely displace Fitbit in quarterly volume (obviously they do already in revenue) by Q2 2016.

Our conviction remains that the Apple Watch has potential to penetrate more of the iPhone base than the iPad and potentially cross the 50% penetration rate of the iPhone base. By our current estimates, we believe the Apple Watch installed base could be well over 100m sometime in or by the end of 2017.

One of the most interesting things we saw over the Black Friday weekend was discounts being given on the Apple Watch and Best Buy. This had a huge impact on sales and a Target promo was sold out quickly. Most people in our Apple Watch surveys who don’t own one yet refer to the price as still being too expensive. These deals seem to indicate $249 was a price that moved significant volume. While I don’t see Apple lowering the price quite yet, it is interesting to see how this will impact the competitive landscape. Even though we are not all the way through the holidays, this is shaping up to be a big quarter for the Apple Watch and early indication is its success has impacted Fitbit sales to a degree.

Thinking about price, one thing I am watching closely is the continued roll out of corporate wellness plans where companies will buy a product like Fitbit to give to their employees as a part of a health and wellness plan. Or they will be giving a credit for employees to purchase the product of their choice to help them be more healthy. All indications are the duopoly continues here with Apple and Fitbit benefiting. One can argue a Fitbit being free is better than a $100 subsidy and still paying over $200 for an Apple Watch. But here I refer to the point of $249 being a price that moves in volume. I can see the Apple Watch benefiting quite a bit here with a ~$100 corporate subsidy.

The real question is whether there is much space for other competitors. To have two companies controlling more than half a market leaving other competitors small slices makes for a tough environment to justify investment in the category. There may be an opportunity once the market matures for competitors to start picking off segments but we are quite a few years away from that level of maturity.

Tim,

Given March 1 rumors, do you think the unusual (for Apple products) Watch discounting is supported by an Apple giveback to discounters? Thinking of Target and Best Buy.

I haven’t met anyone who is a bigger AW fan or believer than me, but your 100M install base within 2 years made me sit up and notice. Assuming sales of 15M in 2015 (only 8 months) that means sales more than double in 2016 and 2017. Really?

I can’t go into the full logic and details of the assumption publically, but as you can imagine we are making some bets on what we are seeing as retail momentum, future features, etc. But considering a similar timeline for iPad was 117m units, if we believe the ramp is on pace, or potentially faster then it lines up.

Not expecting full details of assumptions. Being more explicit that it’s rooted in the ipad ramp is helpful. As big user of AW and ipad I’m not entirely convinced. But, you are a lot more knowledgeable than I am, so good to know the high level reasoning.

A pity, I’m very curious about it, especially with the numerous differences:

– iWatch restricted to iPhone owners; not iPad

– pre-existing competitors for iWatch; not for iPAd

– narrower use cases

The numerous discounts this holiday season seem to point at below expectations sales, in any case.

Superb post however I was wanting to know if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit more.

Greetings! Very helpful advice in this particular article! It is the little changes which will make the most important changes. Thanks a lot for sharing!

You have noted very interesting details! ps decent web site.