There are over a billion active users of Google’s version of Android. Add AOSP and we are probably in the 1.6 to 1.7 billion range of users on Android. Both will grow — however, I believe Google’s version of Android will grow at a more rapid pace than AOSP. This is largely thanks to big and fast growing markets where smartphone penetration is still relatively low — India, Brazil, Indonesia, and other surrounding regions in Latin America and SE Asia. While AOSP works in China, most vendors I speak to plan on using Google’s services outside of China. This is what Google recognizes and why they are releasing their Android One Program.

This concept is nothing new. Every main SoC provider — Qualcomm, MediaTek, and others — already offer reference design platforms designed to provide turnkey solutions for low-end players to go to market extremely fast. Months in some cases. The next billion new smartphone users will enter the market with a product that costs less than $200 and a large percentage of this next billion will buy devices costing below $100-$150. Based on what Google just shared with us on developer payouts this is an extremely significant point.

Google announced they have paid out five billion dollars to developers over the past 12 months. Not bad since the year before they paid out two billion dollars to developers. However, Apple has likely paid out near $10 billion to developers in the same time frame (Benedict Evans estimates). The key distinction here, which Benedict Evans points out in this post, is Apple has paid out approximately double the amount of Google to developers with less than half the active install base. Android has over 1b and iOS with just less than 500m (trailing 24mo..likely around 350m of those are iPhones—my estimates). This last point of revenue payout to developers relative to ecosystem size brings up the significant point I am talking about. Developers make more money with iOS than Android (even though the installed base is larger). A large percentage of the current Android installed base is not on the absolute cheapest device in the world. To put it succinctly, Google–Android–likely has the most profitable customers they are going to get. So what does this mean for developer revenue opportunities when the next billion new Android users will come from devices on the extreme low end?

It is extremely important Google is active in getting new customers online, empowered with a pocket computer, in every region of the world. The problem however, is this group is likely not profitable to anyone but Google and even that may be debatable. Connecting the next billion is massively important but is it profitable? Who will be the hardware OEM, chipset providers, screen manufacturer, willing to chase pennies to serve this market? Certainly Samsung will not. Will it require a new business model like Xiaomi’s where the service is where the money is and not in the hardware? This is an important and overlooked question in my mind with no clear answer yet.

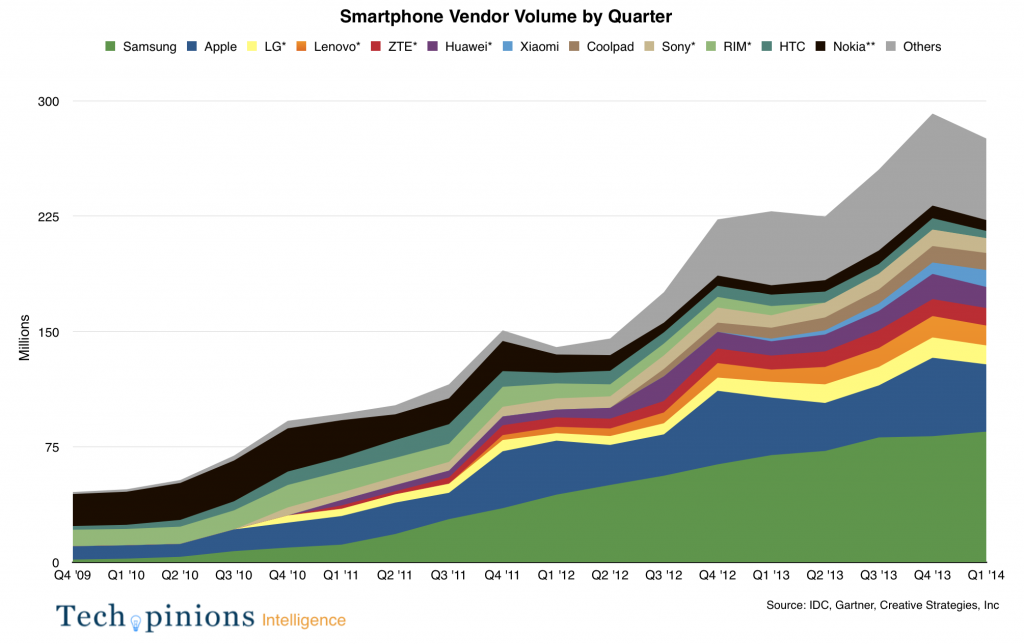

What is exciting, and also scary for many, is when money is no longer in hardware (which is about to the case in the growth markets for smartphones) it opens the door to business model innovation. That is why I’m certain this chart will look dramatically different in three years.

This chart originated from a Tech.pinions Insiders article on my updated Smartphone Installed Base and Vendor shipments.

Will there be an equilibrium at the end of a vicious cycle? The value of an Android user to 3rd party developers is going to drop. Will it get so low that many developers decide it’s no longer worth doing development on Android? This could result in the reduction of consumer desire for Android devices due to the lack of those 3rd party apps. That could then result in growth of the Android platform flatlining.

Are Google’s plans to blur the distinctions between apps and web pages in part a recognition of and reaction to this? It could be an acknowledgement that the value proposition to 3rd parties for native apps on Android is only going to get worse, so they might as well try to encourage mobile web development by bringing it more to the forefront to try to compensate.

No money in hardware and less in software. That leaves sales and services. No?

Where’s that leave Google?

Snooping on users and selling that information to the highest bidders.

I love how you put on a positive attitude to a dire situation.

As much as software, services and advertisements seem to be the new business model that can replace the hardware centric model, I am concerned that these might only be applicable to developed countries, especially the US. At least, for the time being, App Store (Google Play) revenue skews heavily to wealthy nations and advertising in general skews to the US. I am not sure how applicable these business models will be to emerging countries.

We might need something really new.

I just listened to the June 28th Tech.pinions podcast and it was fantastic! I didn’t fully understand what you meant by “business model innovation” in this post, but your combined explanation of Android One, Cherry Mobile, and the not-so-good Google Play revenue in the podcast really, really made sense.

One example that I can give, that may or may not be relevant, is a relatively new service from KDDI (au) in Japan. It’s called “AU Smart Pass” ( http://www.au.kddi.com/content/smartpass/ ). For 372 yen (about 3.7 USD) per month, they give you access to a selection of paid Apps, video/book content, KDDI’s cloud storage, access to paid websites, special offers from restaurants and retail. I’ve heard that it’s quite popular.

If I understand his post correctly Ben Evans estimates roughly half a billion iOS users on a trailing 24 month basis. So does that mean he’s only counting devices sold in the last 24 months as active users? If so I’d say that’s a mistake. My family actively uses 8 iOS devices, all but one are older than 24 months.

He is doing trailing 12 months but the actual number of install base is not terribly much higher. That is why I used the 500m number since I believe it is around that number. I have a scenario where it could be closer to 600m but not much confidence in that scenario given data point I see. There is fluctuation in data points around grey market usage of iPhones and iPads so hard to be exact.

My gut tells me the market for iOS devices older than 24 months is very large. I would have thought there would be a way to do a reasonable estimate of those users.

very satisfying in terms of information thank you very much.

Good article with great ideas! Thank you for this important article. Thank you very much for this wonderful information.

Some really excellent info, Sword lily I detected this.

Somebody essentially assist to make severely posts I might state. This is the very first time I frequented your website page and so far? I surprised with the analysis you made to create this actual submit amazing. Fantastic process!

I am constantly browsing online for articles that can benefit me. Thanks!

Wow! Thank you! I permanently wanted to write on my website something like that. Can I include a portion of your post to my blog?

I have recently started a site, the info you provide on this website has helped me tremendously. Thank you for all of your time & work.

I really like your writing style, superb info , appreciate it for putting up : D.

I was just searching for this info for a while. After six hours of continuous Googleing, at last I got it in your site. I wonder what is the lack of Google strategy that don’t rank this type of informative web sites in top of the list. Normally the top sites are full of garbage.

Greetings from Ohio! I’m bored at work so I decided to browse your site on my iphone during lunch break. I really like the information you provide here and can’t wait to take a look when I get home. I’m surprised at how quick your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyhow, awesome blog!

This is really interesting, You are a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I have shared your site in my social networks!

I?¦ve recently started a website, the information you offer on this web site has helped me tremendously. Thank you for all of your time & work.

It?¦s actually a nice and helpful piece of information. I?¦m satisfied that you shared this helpful information with us. Please keep us informed like this. Thanks for sharing.

Great – I should definitely pronounce, impressed with your web site. I had no trouble navigating through all the tabs as well as related information ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or anything, web site theme . a tones way for your client to communicate. Excellent task..

I have been surfing online more than three hours as of late, but I by no means discovered any fascinating article like yours. It is pretty value enough for me. In my view, if all webmasters and bloggers made excellent content material as you probably did, the net will be a lot more helpful than ever before. “Learn to see in another’s calamity the ills which you should avoid.” by Publilius Syrus.

I have recently started a web site, the info you offer on this site has helped me tremendously. Thanks for all of your time & work.

It¦s actually a nice and useful piece of information. I am glad that you shared this useful information with us. Please keep us up to date like this. Thank you for sharing.

Dead written subject matter, thanks for selective information.

It¦s really a great and helpful piece of info. I am satisfied that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

I was just seeking this info for a while. After six hours of continuous Googleing, at last I got it in your web site. I wonder what’s the lack of Google strategy that do not rank this kind of informative sites in top of the list. Usually the top sites are full of garbage.

I like your writing style truly loving this site.

I will immediately clutch your rss as I can not in finding your email subscription hyperlink or newsletter service. Do you have any? Please permit me know in order that I could subscribe. Thanks.

Only a smiling visitor here to share the love (:, btw outstanding design. “Make the most of your regrets… . To regret deeply is to live afresh.” by Henry David Thoreau.

Pretty! This was a really wonderful post. Thank you for your provided information.

I do not even know how I ended up here, but I thought this post was great. I don’t know who you are but definitely you are going to a famous blogger if you are not already 😉 Cheers!

We’re a group of volunteers and opening a new scheme in our community. Your website provided us with valuable information to work on. You have done a formidable job and our whole community will be thankful to you.

Hello there, I found your blog via Google while looking for a related topic, your site came up, it looks good. I’ve bookmarked it in my google bookmarks.

What i don’t understood is actually how you’re now not really much more neatly-favored than you might be now. You are so intelligent. You recognize therefore considerably in relation to this subject, produced me for my part imagine it from so many various angles. Its like women and men don’t seem to be interested unless it?¦s one thing to do with Woman gaga! Your personal stuffs nice. All the time handle it up!

Regards for this tremendous post, I am glad I discovered this internet site on yahoo.

Just wanna remark on few general things, The website design and style is perfect, the content material is very great. “Art for art’s sake makes no more sense than gin for gin’s sake.” by W. Somerset Maugham.

Thanks for the good writeup. It actually was a entertainment account it. Look complicated to more introduced agreeable from you! By the way, how can we communicate?

Hey there I am so happy I found your blog, I really found you by accident, while I was looking on Google for something else, Anyways I am here now and would just like to say kudos for a marvelous post and a all round interesting blog (I also love the theme/design), I don’t have time to read it all at the minute but I have saved it and also added your RSS feeds, so when I have time I will be back to read much more, Please do keep up the fantastic work.

There are definitely lots of details like that to take into consideration. That may be a great point to convey up. I offer the thoughts above as general inspiration however clearly there are questions just like the one you carry up the place crucial factor might be working in sincere good faith. I don?t know if finest practices have emerged round things like that, but I’m sure that your job is clearly recognized as a good game. Both boys and girls really feel the impression of just a moment’s pleasure, for the remainder of their lives.

I really enjoy looking at on this website, it holds superb posts. “Never fight an inanimate object.” by P. J. O’Rourke.

I’ve been surfing online greater than three hours nowadays, but I never discovered any fascinating article like yours. It is beautiful value enough for me. In my opinion, if all site owners and bloggers made excellent content as you did, the internet will likely be a lot more helpful than ever before.

You made certain nice points there. I did a search on the subject matter and found the majority of folks will consent with your blog.

The crux of your writing while appearing agreeable at first, did not work perfectly with me after some time. Somewhere within the sentences you were able to make me a believer but just for a while. I nevertheless have a problem with your jumps in logic and one might do nicely to fill in those gaps. In the event that you can accomplish that, I would surely end up being fascinated.

Wohh just what I was searching for, regards for posting.

Your home is valueble for me. Thanks!…

We are a group of volunteers and starting a new scheme in our community. Your site offered us with valuable information to work on. You’ve done a formidable job and our entire community will be thankful to you.

Hiya, I am really glad I’ve found this information. Today bloggers publish only about gossips and web and this is actually annoying. A good site with exciting content, this is what I need. Thank you for keeping this web site, I will be visiting it. Do you do newsletters? Cant find it.

Hello just wanted to give you a quick heads up and let you know a few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same results.

Hey there, You’ve done a great job. I’ll definitely digg it and personally suggest to my friends. I’m confident they’ll be benefited from this site.

I have read several good stuff here. Certainly worth bookmarking for revisiting. I wonder how much effort you put to make such a excellent informative website.

I have been surfing online greater than 3 hours today, yet I by no means found any fascinating article like yours. It is beautiful price enough for me. Personally, if all site owners and bloggers made good content material as you did, the net can be much more useful than ever before.

Thanks for some other informative blog. Where else may I am getting that kind of information written in such an ideal way? I’ve a project that I am simply now running on, and I have been at the glance out for such info.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your weblog when you could be giving us something informative to read?

I like this post, enjoyed this one regards for putting up. “What is a thousand years Time is short for one who thinks, endless for one who yearns.” by Alain.

I’ve been exploring for a little bit for any high quality articles or blog posts in this kind of house . Exploring in Yahoo I eventually stumbled upon this website. Studying this information So i am happy to express that I’ve an incredibly just right uncanny feeling I discovered exactly what I needed. I most indisputably will make sure to don’t put out of your mind this web site and provides it a glance on a constant basis.

Hi there! I know this is kinda off topic but I’d figured I’d ask. Would you be interested in exchanging links or maybe guest writing a blog post or vice-versa? My site goes over a lot of the same subjects as yours and I think we could greatly benefit from each other. If you might be interested feel free to shoot me an e-mail. I look forward to hearing from you! Great blog by the way!

Very good written article. It will be beneficial to anyone who utilizes it, as well as me. Keep doing what you are doing – can’r wait to read more posts.

Very interesting info!Perfect just what I was looking for!

I really like your writing style, wonderful information, thanks for putting up :D. “If a cluttered desk is the sign of a cluttered mind, what is the significance of a clean desk” by Laurence J. Peter.

Have you ever thought about creating an ebook or guest authoring on other blogs? I have a blog centered on the same topics you discuss and would really like to have you share some stories/information. I know my visitors would value your work. If you’re even remotely interested, feel free to send me an email.

Pretty! This was a really wonderful post. Thank you for your provided information.

I besides believe so , perfectly written post! .

Just want to say your article is as amazing. The clearness to your submit is simply great and i can think you’re an expert in this subject. Fine together with your permission allow me to snatch your RSS feed to stay up to date with drawing close post. Thanks one million and please carry on the rewarding work.

Really excellent info can be found on website. “Society produces rogues, and education makes one rogue more clever than another.” by Oscar Fingall O’Flahertie Wills Wilde.

Keep up the superb work, I read few articles on this site and I believe that your weblog is real interesting and has got lots of wonderful info .

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Keep up the fantastic piece of work, I read few content on this website and I believe that your weblog is very interesting and has circles of superb information.

Heya ich bin zum ersten Mal hier. Ich bin auf dieses Board gestoßen und ich finde es wirklich hilfreich und es hat mir viel geholfen. ich hoffe bereitstellen eine Sache zurück und helfen anderen wie dir hast mir geholfen.

I was just looking for this information for some time. After 6 hours of continuous Googleing, finally I got it in your website. I wonder what is the lack of Google strategy that don’t rank this type of informative websites in top of the list. Usually the top web sites are full of garbage.

Thanks for this terrific post, I am glad I detected this site on yahoo.

I discovered your blog site on google and check a couple of of your early posts. Proceed to keep up the excellent operate. I simply additional up your RSS feed to my MSN Information Reader. Looking for forward to studying more from you later on!…

What i don’t understood is in reality how you are now not really a lot more smartly-favored than you might be now. You are so intelligent. You know thus significantly in the case of this subject, made me in my opinion believe it from a lot of various angles. Its like men and women are not fascinated except it is something to do with Woman gaga! Your own stuffs nice. Always maintain it up!

This website is mostly a walk-by for all of the information you needed about this and didn’t know who to ask. Glimpse right here, and also you’ll definitely discover it.

Does your site have a contact page? I’m having problems locating it but, I’d like to shoot you an email. I’ve got some creative ideas for your blog you might be interested in hearing. Either way, great website and I look forward to seeing it grow over time.

I very glad to find this internet site on bing, just what I was searching for : D besides saved to fav.

Some really interesting details you have written.Aided me a lot, just what I was looking for : D.

I truly appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again

We absolutely love your blog and find a lot of your post’s to be what precisely I’m looking for. can you offer guest writers to write content for yourself? I wouldn’t mind producing a post or elaborating on most of the subjects you write in relation to here. Again, awesome weblog!

Its fantastic as your other blog posts : D, thankyou for putting up.

Keep functioning ,splendid job!

Hi there! I just wanted to ask if you ever have any problems with hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no back up. Do you have any solutions to protect against hackers?

You could certainly see your enthusiasm within the work you write. The world hopes for even more passionate writers such as you who are not afraid to mention how they believe. Always follow your heart.

Very nice post. I just stumbled upon your weblog and wished to say that I have really enjoyed surfing around your blog posts. After all I will be subscribing to your rss feed and I hope you write again soon!

Have you ever thought about including a little bit more than just your articles? I mean, what you say is valuable and all. But just imagine if you added some great images or videos to give your posts more, “pop”! Your content is excellent but with pics and clips, this website could definitely be one of the very best in its niche. Excellent blog!

There are some interesting cut-off dates on this article however I don’t know if I see all of them middle to heart. There’s some validity however I’ll take maintain opinion till I look into it further. Good article , thanks and we want extra! Added to FeedBurner as well

Wonderful beat ! I would like to apprentice while you amend your web site, how can i subscribe for a blog website? The account aided me a acceptable deal. I had been a little bit acquainted of this your broadcast offered bright clear idea

I’ve been exploring for a bit for any high-quality articles or blog posts on this kind of area . Exploring in Yahoo I at last stumbled upon this web site. Reading this information So i am happy to convey that I have a very good uncanny feeling I discovered just what I needed. I most certainly will make certain to do not forget this website and give it a look on a constant basis.

Attractive component to content. I just stumbled upon your web site and in accession capital to say that I get in fact enjoyed account your blog posts. Anyway I’ll be subscribing in your augment and even I fulfillment you get admission to persistently fast.

I’m really enjoying the design and layout of your website. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a developer to create your theme? Outstanding work!

Loving the information on this internet site, you have done great job on the blog posts.

Keep working ,impressive job!

I’d forever want to be update on new articles on this internet site, saved to favorites! .

Great post. I am facing a couple of these problems.

I am now not sure where you are getting your info, however good topic. I must spend some time finding out more or understanding more. Thanks for great info I was in search of this info for my mission.

Outstanding post, I conceive website owners should learn a lot from this web blog its rattling user pleasant.

Good info. Lucky me I reach on your website by accident, I bookmarked it.

You have brought up a very fantastic points, thankyou for the post.

Hello my friend! I want to say that this article is amazing, great written and include almost all significant infos. I would like to peer extra posts like this .

Hiya very cool website!! Guy .. Beautiful .. Wonderful .. I will bookmark your website and take the feeds also…I’m satisfied to find a lot of helpful information right here in the publish, we want develop extra strategies on this regard, thanks for sharing. . . . . .

Merely a smiling visitant here to share the love (:, btw great layout. “Individuals may form communities, but it is institutions alone that can create a nation.” by Benjamin Disraeli.

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.

I rattling delighted to find this website on bing, just what I was looking for : D also saved to favorites.

I have been absent for some time, but now I remember why I used to love this blog. Thanks , I’ll try and check back more often. How frequently you update your web site?

As I web-site possessor I believe the content material here is rattling fantastic , appreciate it for your hard work. You should keep it up forever! Best of luck.

I really like what you guys are usually up too. This sort of clever work and reporting! Keep up the amazing works guys I’ve you guys to blogroll.

Hi! This is my first comment here so I just wanted to give a quick shout out and say I genuinely enjoy reading your posts. Can you suggest any other blogs/websites/forums that cover the same subjects? Thanks for your time!

Частный дом престарелых в Тульской области. Также мы принимаем пожилых людей с Брянской, Орловской, Липецкой, Рязанской, Калужской и Московской областей. Наш пансионат для пожилых людей является…

Very nice layout and fantastic subject matter, absolutely nothing else we require : D.

F*ckin¦ awesome issues here. I¦m very happy to see your post. Thanks a lot and i’m having a look ahead to touch you. Will you kindly drop me a e-mail?

hey there and thank you for your info – I’ve definitely picked up anything new from right here. I did however expertise several technical issues using this website, as I experienced to reload the web site a lot of times previous to I could get it to load properly. I had been wondering if your hosting is OK? Not that I am complaining, but slow loading instances times will often affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your respective fascinating content. Ensure that you update this again very soon..

Magnificent beat ! I would like to apprentice whilst you amend your web site, how can i subscribe for a blog website? The account aided me a appropriate deal. I were a little bit familiar of this your broadcast provided bright transparent idea

Outstanding post, you have pointed out some fantastic points, I also believe this s a very great website.

I used to be recommended this website by means of my cousin. I’m now not positive whether or not this publish is written by way of him as no one else recognize such detailed about my difficulty. You are wonderful! Thank you!

Wow! Thank you! I always needed to write on my site something like that. Can I include a portion of your post to my site?

I am often to blogging and i actually respect your content. The article has really peaks my interest. I’m going to bookmark your website and keep checking for brand new information.

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

Good day! I know this is kinda off topic nevertheless I’d figured I’d ask. Would you be interested in trading links or maybe guest authoring a blog post or vice-versa? My site goes over a lot of the same topics as yours and I believe we could greatly benefit from each other. If you are interested feel free to send me an email. I look forward to hearing from you! Great blog by the way!

Thank you for the sensible critique. Me and my neighbor were just preparing to do a little research about this. We got a grab a book from our local library but I think I learned more clear from this post. I am very glad to see such magnificent information being shared freely out there.

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

I like what you guys are up also. Such intelligent work and reporting! Keep up the superb works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my site 🙂

Does your site have a contact page? I’m having a tough time locating it but, I’d like to shoot you an email. I’ve got some creative ideas for your blog you might be interested in hearing. Either way, great blog and I look forward to seeing it improve over time.

We are a group of volunteers and opening a new scheme in our community. Your web site offered us with valuable information to work on. You’ve done a formidable job and our entire community will be grateful to you.

Do you have a spam problem on this blog; I also am a blogger, and I was wondering your situation; we have developed some nice procedures and we are looking to trade techniques with others, please shoot me an email if interested.

Outstanding post, you have pointed out some fantastic points, I besides think this s a very superb website.

It is truly a great and useful piece of information. I¦m glad that you simply shared this helpful info with us. Please stay us up to date like this. Thanks for sharing.

I regard something genuinely special in this web site.

Hi there very cool web site!! Man .. Excellent .. Superb .. I will bookmark your web site and take the feeds also…I am happy to seek out a lot of useful information here in the submit, we want develop more strategies on this regard, thanks for sharing.

I was recommended this web site by my cousin. I’m not sure whether this post is written by him as nobody else know such detailed about my problem. You’re amazing! Thanks!

I’m so happy to read this. This is the kind of manual that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this greatest doc.

Usually I don’t read post on blogs, but I would like to say that this write-up very pressured me to check out and do it! Your writing style has been surprised me. Thank you, quite nice post.

Very interesting points you have remarked, thankyou for posting. “Nothing ever goes away.” by Barry Commoner.

I enjoy the efforts you have put in this, regards for all the great content.

I think other site proprietors should take this web site as an model, very clean and fantastic user friendly style and design, as well as the content. You’re an expert in this topic!

whoah this weblog is magnificent i love reading your posts. Stay up the good work! You recognize, lots of individuals are searching round for this info, you can aid them greatly.

Hi this is somewhat of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding knowledge so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

I think other web site proprietors should take this web site as an model, very clean and great user genial style and design, as well as the content. You are an expert in this topic!

I am really loving the theme/design of your weblog. Do you ever run into any web browser compatibility issues? A couple of my blog visitors have complained about my website not operating correctly in Explorer but looks great in Opera. Do you have any ideas to help fix this issue?

Saved as a favorite, I really like your blog!

I conceive this web site holds some rattling great information for everyone. “The best friend is the man who in wishing me well wishes it for my sake.” by Aristotle.

Its such as you read my thoughts! You seem to know a lot about this, like you wrote the guide in it or something. I feel that you could do with a few to drive the message house a little bit, however other than that, this is great blog. A fantastic read. I’ll certainly be back.

Outstanding post, you have pointed out some fantastic points, I as well conceive this s a very good website.

It’s actually a cool and helpful piece of info. I’m glad that you shared this helpful information with us. Please keep us up to date like this. Thanks for sharing.

Glad to be one of the visitors on this awing web site : D.

As I site possessor I believe the content material here is rattling magnificent , appreciate it for your hard work. You should keep it up forever! Best of luck.

Very interesting subject, appreciate it for putting up. “Ok. Sex is fine. Sex is good. Sex is GREAT Okay, okay, we need men for sex… Do we need so many” by Sybil Adelman.

I admire your piece of work, thankyou for all the interesting articles.

Very good written post. It will be valuable to anyone who employess it, including yours truly :). Keep up the good work – for sure i will check out more posts.

Sight Care is a daily supplement proven in clinical trials and conclusive science to improve vision by nourishing the body from within. The Sight Care formula claims to reverse issues in eyesight, and every ingredient is completely natural.

I have recently started a website, the information you provide on this website has helped me greatly. Thank you for all of your time & work.

Good day I am so excited I found your site, I really found you by mistake, while I was browsing on Google for something else, Regardless I am here now and would just like to say kudos for a remarkable post and a all round enjoyable blog (I also love the theme/design), I don’t have time to read it all at the moment but I have book-marked it and also included your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the fantastic job.

ProDentim is a nutritional dental health supplement that is formulated to reverse serious dental issues and to help maintain good dental health.

Gorilla Flow is a non-toxic supplement that was developed by experts to boost prostate health for men. It’s a blend of all-natural nutrients, including Pumpkin Seed Extract Stinging Nettle Extract, Gorilla Cherry and Saw Palmetto, Boron, and Lycopene.

Dentitox Pro is a liquid dietary solution created as a serum to support healthy gums and teeth. Dentitox Pro formula is made in the best natural way with unique, powerful botanical ingredients that can support healthy teeth.

GlucoBerry is one of the biggest all-natural dietary and biggest scientific breakthrough formulas ever in the health industry today. This is all because of its amazing high-quality cutting-edge formula that helps treat high blood sugar levels very naturally and effectively.

BioFit is an all-natural supplement that is known to enhance and balance good bacteria in the gut area. To lose weight, you need to have a balanced hormones and body processes. Many times, people struggle with weight loss because their gut health has issues.

TerraCalm is an antifungal mineral clay that may support the health of your toenails. It is for those who struggle with brittle, weak, and discoloured nails. It has a unique blend of natural ingredients that may work to nourish and strengthen your toenails.

Great – I should definitely pronounce, impressed with your web site. I had no trouble navigating through all the tabs as well as related info ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or something, website theme . a tones way for your client to communicate. Nice task..

Boostaro increases blood flow to the reproductive organs, leading to stronger and more vibrant erections. It provides a powerful boost that can make you feel like you’ve unlocked the secret to firm erections

GlucoTrust is a revolutionary blood sugar support solution that eliminates the underlying causes of type 2 diabetes and associated health risks.

The Quietum Plus supplement promotes healthy ears, enables clearer hearing, and combats tinnitus by utilizing only the purest natural ingredients. Supplements are widely used for various reasons, including boosting energy, lowering blood pressure, and boosting metabolism.

EyeFortin is a natural vision support formula crafted with a blend of plant-based compounds and essential minerals. It aims to enhance vision clarity, focus, and moisture balance.

Puravive introduced an innovative approach to weight loss and management that set it apart from other supplements. It enhances the production and storage of brown fat in the body, a stark contrast to the unhealthy white fat that contributes to obesity.

With its all-natural ingredients and impressive results, Aizen Power supplement is quickly becoming a popular choice for anyone looking for an effective solution for improve sexual health with this revolutionary treatment.

I am glad to be one of several visitants on this great web site (:, thanks for putting up.

t’s Time To Say Goodbye To All Your Bedroom Troubles And Enjoy The Ultimate Satisfaction And Give Her The Leg-shaking Orgasms. The Endopeak Is Your True Partner To Build Those Monster Powers In Your Manhood You Ever Craved For..

Prostadine is a dietary supplement meticulously formulated to support prostate health, enhance bladder function, and promote overall urinary system well-being. Crafted from a blend of entirely natural ingredients, Prostadine draws upon a recent groundbreaking discovery by Harvard scientists.

Neurodrine is a fantastic dietary supplement that protects your mind and improves memory performance. It can help you improve your focus and concentration.

HoneyBurn is a 100% natural honey mixture formula that can support both your digestive health and fat-burning mechanism. Since it is formulated using 11 natural plant ingredients, it is clinically proven to be safe and free of toxins, chemicals, or additives.

Amiclear is a dietary supplement designed to support healthy blood sugar levels and assist with glucose metabolism. It contains eight proprietary blends of ingredients that have been clinically proven to be effective.

Glucofort Blood Sugar Support is an all-natural dietary formula that works to support healthy blood sugar levels. It also supports glucose metabolism. According to the manufacturer, this supplement can help users keep their blood sugar levels healthy and within a normal range with herbs, vitamins, plant extracts, and other natural ingredients.

GlucoCare is a natural and safe supplement for blood sugar support and weight management. It fixes your metabolism and detoxifies your body.

Introducing FlowForce Max, a solution designed with a single purpose: to provide men with an affordable and safe way to address BPH and other prostate concerns. Unlike many costly supplements or those with risky stimulants, we’ve crafted FlowForce Max with your well-being in mind. Don’t compromise your health or budget – choose FlowForce Max for effective prostate support today!

Metabo Flex is a nutritional formula that enhances metabolic flexibility by awakening the calorie-burning switch in the body. The supplement is designed to target the underlying causes of stubborn weight gain utilizing a special “miracle plant” from Cambodia that can melt fat 24/7.

SynoGut is an all-natural dietary supplement that is designed to support the health of your digestive system, keeping you energized and active.

TropiSlim is a unique dietary supplement designed to address specific health concerns, primarily focusing on weight management and related issues in women, particularly those over the age of 40.

GlucoFlush™ is an all-natural supplement that uses potent ingredients to control your blood sugar.

Nervogen Pro, A Cutting-Edge Supplement Dedicated To Enhancing Nerve Health And Providing Natural Relief From Discomfort. Our Mission Is To Empower You To Lead A Life Free From The Limitations Of Nerve-Related Challenges. With A Focus On Premium Ingredients And Scientific Expertise.

Claritox Pro™ is a natural dietary supplement that is formulated to support brain health and promote a healthy balance system to prevent dizziness, risk injuries, and disability. This formulation is made using naturally sourced and effective ingredients that are mixed in the right way and in the right amounts to deliver effective results.

InchaGrow is an advanced male enhancement supplement. Discover the natural way to boost your sexual health. Increase desire, improve erections, and experience more intense orgasms.

I’m still learning from you, while I’m improving myself. I certainly enjoy reading everything that is written on your website.Keep the stories coming. I liked it!

Great write-up, I am regular visitor of one’s web site, maintain up the nice operate, and It’s going to be a regular visitor for a lengthy time.

Was ich nicht merke ist eigentlich, dass du nicht eigentlich viel beliebter bist als du jetzt. Du bist so intelligent. Sie wissen daher erheblich in Bezug auf dieses Thema, produziert, dass ich es persönlich aus so vielen verschiedenen Blickwinkeln betrachte. Es ist, als ob Männer und Frauen nicht fasziniert sind, es sei denn, es ist eine Sache, die man mit Lady Gaga erreichen kann! Deine eigenen Sachen ausgezeichnet. Halte es immer aufrecht!

Oh my goodness! a tremendous article dude. Thank you However I am experiencing challenge with ur rss . Don’t know why Unable to subscribe to it. Is there anybody getting similar rss problem? Anyone who is aware of kindly respond. Thnkx

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

I’ve been surfing online more than 3 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all site owners and bloggers made good content as you did, the web will be much more useful than ever before.

Regards for helping out, excellent info .

My brother suggested I would possibly like this website. He used to be totally right. This submit actually made my day. You can not consider simply how a lot time I had spent for this information! Thank you!

Sight Care is a natural supplement designed to improve eyesight and reduce dark blindness. With its potent blend of ingredients. https://sightcarebuynow.us/

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.

SightCare supports overall eye health, enhances vision, and protects against oxidative stress. Take control of your eye health and enjoy the benefits of clear and vibrant eyesight with Sight Care. https://sightcarebuynow.us/

Please let me know if you’re looking for a article writer for your weblog. You have some really great posts and I feel I would be a good asset. If you ever want to take some of the load off, I’d love to write some articles for your blog in exchange for a link back to mine. Please blast me an e-mail if interested. Kudos!

Boostaro is a dietary supplement designed specifically for men who suffer from health issues. https://boostarobuynow.us/

Hi, Neat post. There is a problem along with your website in internet explorer, could check this… IE still is the market leader and a large component to other folks will omit your fantastic writing due to this problem.

BioVanish a weight management solution that’s transforming the approach to healthy living. In a world where weight loss often feels like an uphill battle, BioVanish offers a refreshing and effective alternative. This innovative supplement harnesses the power of natural ingredients to support optimal weight management. https://biovanishbuynow.us/

Aizen Power is an all-natural supplement designed to improve male health. This formula contains the beneficial properties of various plants, herbs, minerals, and vitamins that help men’s blood circulation, detoxification, and overall health. https://aizenpowerbuynow.us/

Claritox Pro™ – The Natural Supplement for Optimal Brain Health and Balance to Prevent Dizziness, Injuries and Disability https://claritoxprobuynow.us/

AquaPeace is an all-natural nutritional formula that uses a proprietary and potent blend of ingredients and nutrients to improve overall ear and hearing health and alleviate the symptoms of tinnitus. https://aquapeacebuynow.us/

GlucoTrust is a revolutionary blood sugar support solution that eliminates the underlying causes of type 2 diabetes and associated health risks. https://glucotrustbuynow.us/

DentaTonic is a breakthrough solution that would ultimately free you from the pain and humiliation of tooth decay, bleeding gums, and bad breath. It protects your teeth and gums from decay, cavities, and pain. https://dentatonicbuynow.us/

GlucoFlush is an advanced formula specially designed for pancreas support that will let you promote healthy weight by effectively maintaining the blood sugar level and cleansing and strengthening your gut. https://glucoflushbuynow.us/

100% Natural Formula Expressly Designed to Support Healthy Hearing and Mental Sharpness Well Into Your Golden Years. https://cortexibuynow.us/

Glucofort Blood Sugar Support is an all-natural dietary formula that works to support healthy blood sugar levels. It also supports glucose metabolism. According to the manufacturer, this supplement can help users keep their blood sugar levels healthy and within a normal range with herbs, vitamins, plant extracts, and other natural ingredients. https://glucofortbuynow.us/

Digestyl™ is natural, potent and effective mixture, in the form of a powerful pill that would detoxify the gut and rejuvenate the whole organism in order to properly digest and get rid of the Clostridium Perfringens. https://digestylbuynow.us/

EyeFortin is an all-natural eye-health supplement that helps to keep your eyes healthy even as you age. It prevents infections and detoxifies your eyes while also being stimulant-free. This makes it a great choice for those who are looking for a natural way to improve their eye health. https://eyefortinbuynow.us/

Herpagreens is a dietary supplement formulated to combat symptoms of herpes by providing the body with high levels of super antioxidants, vitamins

Gorilla Flow prostate is an all-natural dietary supplement for men which aims to decrease inflammation in the prostate to decrease common urinary tract issues such as frequent and night-time urination, leakage, or blocked urine stream. https://gorillaflowbuynow.us/

Fast Lean Pro is a herbal supplement that tricks your brain into imagining that you’re fasting and helps you maintain a healthy weight no matter when or what you eat. It offers a novel approach to reducing fat accumulation and promoting long-term weight management. https://fastleanprobuynow.us/

Illuderma is a serum designed to deeply nourish, clear, and hydrate the skin. The goal of this solution began with dark spots, which were previously thought to be a natural symptom of ageing. The creators of Illuderma were certain that blue modern radiation is the source of dark spots after conducting extensive research. https://illudermabuynow.us/

HoneyBurn is a revolutionary liquid weight loss formula that stands as the epitome of excellence in the industry. https://honeyburnbuynow.us/

FlowForce Max is an innovative, natural and effective way to address your prostate problems, while addressing your energy, libido, and vitality. https://flowforcemaxbuynow.us/

Neurodrine is a nootropic supplement that helps maintain memory and a healthy brain. It increases the brain’s sharpness, focus, memory, and concentration. https://neurodrinebuynow.us/

Folixine is a enhancement that regrows hair from the follicles by nourishing the scalp. It helps in strengthening hairs from roots. https://folixinebuynow.us/

Nervogen Pro is an effective dietary supplement designed to help patients with neuropathic pain. When you combine exotic herbs, spices, and other organic substances, your immune system will be strengthened. https://nervogenprobuynow.us/

PowerBite is an innovative dental candy that promotes healthy teeth and gums. It’s a powerful formula that supports a strong and vibrant smile. https://powerbitebuynow.us/

ProstateFlux is a dietary supplement specifically designed to promote and maintain a healthy prostate. It is formulated with a blend of natural ingredients known for their potential benefits for prostate health. https://prostatefluxbuynow.us/

LeanBiome is designed to support healthy weight loss. Formulated through the latest Ivy League research and backed by real-world results, it’s your partner on the path to a healthier you. https://leanbiomebuynow.us/

ProDentim is a nutritional dental health supplement that is formulated to reverse serious dental issues and to help maintain good dental health. https://prodentimbuynow.us/

Prostadine is a dietary supplement meticulously formulated to support prostate health, enhance bladder function, and promote overall urinary system well-being. Crafted from a blend of entirely natural ingredients, Prostadine draws upon a recent groundbreaking discovery by Harvard scientists. This discovery identified toxic minerals present in hard water as a key contributor to prostate issues. https://prostadinebuynow.us/

Protoflow is a prostate health supplement featuring a blend of plant extracts, vitamins, minerals, fruit extracts, and more. https://protoflowbuynow.us/

Are you tired of looking in the mirror and noticing saggy skin? Is saggy skin making you feel like you are trapped in a losing battle against aging? Do you still long for the days when your complexion radiated youth and confidence? https://refirmancebuynow.us/

Serolean, a revolutionary weight loss supplement, zeroes in on serotonin—the key neurotransmitter governing mood, appetite, and fat storage. https://seroleanbuynow.us/

Unlock the incredible potential of Puravive! Supercharge your metabolism and incinerate calories like never before with our unique fusion of 8 exotic components. Bid farewell to those stubborn pounds and welcome a reinvigorated metabolism and boundless vitality. Grab your bottle today and seize this golden opportunity! https://puravivebuynow.us/

Quietum Plus supplement promotes healthy ears, enables clearer hearing, and combats tinnitus by utilizing only the purest natural ingredients. Supplements are widely used for various reasons, including boosting energy, lowering blood pressure, and boosting metabolism. https://quietumplusbuynow.us/

Red Boost is a male-specific natural dietary supplement. Nitric oxide is naturally increased by it, which enhances blood circulation all throughout the body. This may improve your general well-being. Red Boost is an excellent option if you’re trying to assist your circulatory system. https://redboostbuynow.us/

Sonovive™ is an all-natural supplement made to address the root cause of tinnitus and other inflammatory effects on the brain and promises to reduce tinnitus, improve hearing, and provide peace of mind. https://sonovivebuynow.us/

TropiSlim is the world’s first 100% natural solution to support healthy weight loss by using a blend of carefully selected ingredients. https://tropislimbuynow.us/

Sugar Defender is the #1 rated blood sugar formula with an advanced blend of 24 proven ingredients that support healthy glucose levels and natural weight loss. https://sugardefenderbuynow.us/

VidaCalm is an all-natural blend of herbs and plant extracts that treat tinnitus and help you live a peaceful life. https://vidacalmbuynow.us/

Wild Stallion Pro, a natural male enhancement supplement, promises noticeable improvements in penis size and sexual performance within weeks. Crafted with a blend of carefully selected natural ingredients, it offers a holistic approach for a more satisfying and confident sexual experience. https://wildstallionprobuynow.us/

Mass News is the leading source of breaking news, local news, sports, business, entertainment, lifestyle and opinion for Silicon Valley, San Francisco Bay Area and beyond https://massnews.us/

overing the latest beauty and fashion trends, relationship advice, wellness tips and more. https://gliz.us/

I really enjoy looking at on this site, it has fantastic posts.

Wow, blog ini seperti roket meluncurkan ke alam semesta dari kegembiraan! Konten yang mengagumkan di sini adalah perjalanan rollercoaster yang mendebarkan bagi imajinasi, memicu ketertarikan setiap saat. Baik itu gayahidup, blog ini adalah sumber wawasan yang menarik! ke dalam perjalanan kosmik ini dari penemuan dan biarkan pemikiran Anda berkelana! Jangan hanya mengeksplorasi, alami kegembiraan ini! #BahanBakarPikiran Pikiran Anda akan berterima kasih untuk perjalanan menyenangkan ini melalui ranah keajaiban yang menakjubkan!

You are my breathing in, I have few blogs and sometimes run out from to post .

Aizen Power is an all-natural supplement designed to improve male health. This formula contains the beneficial properties of various plants, herbs, minerals, and vitamins that help men’s blood circulation, detoxification, and overall health. https://aizenpowerbuynow.us/

BioFit is an all-natural supplement that is known to enhance and balance good bacteria in the gut area. To lose weight, you need to have a balanced hormones and body processes. Many times, people struggle with weight loss because their gut health has issues. https://biofitbuynow.us/

Abdomax is a nutritional supplement using an 8-second Nordic cleanse to eliminate gut issues, support gut health, and optimize pepsinogen levels. https://abdomaxbuynow.us/

Alpha Tonic is a powder-based supplement that uses multiple natural herbs and essential vitamins and minerals to helpoptimize your body’s natural testosterone levels. https://alphatonicbuynow.us/

Amiclear is a dietary supplement designed to support healthy blood sugar levels and assist with glucose metabolism. It contains eight proprietary blends of ingredients that have been clinically proven to be effective. https://amiclearbuynow.us/

The most talked about weight loss product is finally here! FitSpresso is a powerful supplement that supports healthy weight loss the natural way. Clinically studied ingredients work synergistically to support healthy fat burning, increase metabolism and maintain long lasting weight loss. https://fitspressobuynow.us/

Claritox Pro™ is a natural dietary supplement that is formulated to support brain health and promote a healthy balance system to prevent dizziness, risk injuries, and disability. This formulation is made using naturally sourced and effective ingredients that are mixed in the right way and in the right amounts to deliver effective results. https://claritoxprobuynow.us/

Nervogen Pro is an effective dietary supplement designed to help patients with neuropathic pain. When you combine exotic herbs, spices, and other organic substances, your immune system will be strengthened. https://nervogenprobuynow.us/

Cortexi is a completely natural product that promotes healthy hearing, improves memory, and sharpens mental clarity. Cortexi hearing support formula is a combination of high-quality natural components that work together to offer you with a variety of health advantages, particularly for persons in their middle and late years. https://cortexibuynow.us/

BioVanish a weight management solution that’s transforming the approach to healthy living. In a world where weight loss often feels like an uphill battle, BioVanish offers a refreshing and effective alternative. This innovative supplement harnesses the power of natural ingredients to support optimal weight management. https://biovanishbuynow.us/

https://gutvitabuynow.us/

Endopeak is a natural energy-boosting formula designed to improve men’s stamina, energy levels, and overall health. The supplement is made up of eight high-quality ingredients that address the underlying cause of declining energy and vitality. https://endopeakbuynow.us/

GlucoTrust is a revolutionary blood sugar support solution that eliminates the underlying causes of type 2 diabetes and associated health risks. https://glucotrustbuynow.us/

Hey very cool blog!! Man .. Excellent .. Amazing .. I’ll bookmark your blog and take the feeds also…I’m happy to find so many useful information here in the post, we need work out more strategies in this regard, thanks for sharing. . . . . .

Kerassentials are natural skin care products with ingredients such as vitamins and plants that help support good health and prevent the appearance of aging skin. They’re also 100% natural and safe to use. The manufacturer states that the product has no negative side effects and is safe to take on a daily basis. Kerassentials is a convenient, easy-to-use formula. https://kerassentialsbuynow.us/

SynoGut is an all-natural dietary supplement that is designed to support the health of your digestive system, keeping you energized and active. https://synogutbuynow.us/

LeanFlux is a revolutionary dietary formula specially crafted for individuals dealing with obesity and those on a weight loss journey. https://leanfluxbuynow.us/

Fast Lean Pro is a herbal supplement that tricks your brain into imagining that you’re fasting and helps you maintain a healthy weight no matter when or what you eat. It offers a novel approach to reducing fat accumulation and promoting long-term weight management. https://fastleanprobuynow.us/

DentaTonic is a breakthrough solution that would ultimately free you from the pain and humiliation of tooth decay, bleeding gums, and bad breath. It protects your teeth and gums from decay, cavities, and pain. https://dentatonicbuynow.us/

VidaCalm is an all-natural blend of herbs and plant extracts that treat tinnitus and help you live a peaceful life. https://vidacalmbuynow.us/

Java Burn is a proprietary blend of metabolism-boosting ingredients that work together to promote weight loss in your body. https://javaburnbuynow.us/

LeanBiome is designed to support healthy weight loss. Formulated through the latest Ivy League research and backed by real-world results, it’s your partner on the path to a healthier you. https://leanbiomebuynow.us/

ProstateFlux is a dietary supplement specifically designed to promote and maintain a healthy prostate. It is formulated with a blend of natural ingredients known for their potential benefits for prostate health. https://prostatefluxbuynow.us/

Serolean, a revolutionary weight loss supplement, zeroes in on serotonin—the key neurotransmitter governing mood, appetite, and fat storage. https://seroleanbuynow.us/

Metabo Flex is a nutritional formula that enhances metabolic flexibility by awakening the calorie-burning switch in the body. The supplement is designed to target the underlying causes of stubborn weight gain utilizing a special “miracle plant” from Cambodia that can melt fat 24/7. https://metaboflexbuynow.us/

https://zoracelbuynow.us/

Neurozoom crafted in the United States, is a cognitive support formula designed to enhance memory retention and promote overall cognitive well-being. https://neurozoombuynow.us/

Dentitox Pro is a liquid dietary solution created as a serum to support healthy gums and teeth. Dentitox Pro formula is made in the best natural way with unique, powerful botanical ingredients that can support healthy teeth. https://dentitoxbuynow.us/

Researchers consider obesity a world crisis affecting over half a billion people worldwide. Vid Labs provides an effective solution that helps combat obesity and overweight without exercise or dieting. https://leanotoxbuynow.us/

GlucoBerry is one of the biggest all-natural dietary and biggest scientific breakthrough formulas ever in the health industry today. This is all because of its amazing high-quality cutting-edge formula that helps treat high blood sugar levels very naturally and effectively. https://glucoberrybuynow.us/

Keratone addresses the real root cause of your toenail fungus in an extremely safe and natural way and nourishes your nails and skin so you can stay protected against infectious related diseases. https://keratonebuynow.us/

EyeFortin is an all-natural eye-health supplement that helps to keep your eyes healthy even as you age. It prevents infections and detoxifies your eyes while also being stimulant-free. This makes it a great choice for those who are looking for a natural way to improve their eye health. https://eyefortinbuynow.us/

Gorilla Flow prostate is an all-natural dietary supplement for men which aims to decrease inflammation in the prostate to decrease common urinary tract issues such as frequent and night-time urination, leakage, or blocked urine stream. https://gorillaflowbuynow.us/

Neurodrine is a nootropic supplement that helps maintain memory and a healthy brain. It increases the brain’s sharpness, focus, memory, and concentration. https://neurodrinebuynow.us/

Prostadine is a dietary supplement meticulously formulated to support prostate health, enhance bladder function, and promote overall urinary system well-being. Crafted from a blend of entirely natural ingredients, Prostadine draws upon a recent groundbreaking discovery by Harvard scientists. This discovery identified toxic minerals present in hard water as a key contributor to prostate issues. https://prostadinebuynow.us/

Puralean incorporates blends of Mediterranean plant-based nutrients, specifically formulated to support healthy liver function. These blends aid in naturally detoxifying your body, promoting efficient fat burning and facilitating weight loss. https://puraleanbuynow.us/

Illuderma is a serum designed to deeply nourish, clear, and hydrate the skin. The goal of this solution began with dark spots, which were previously thought to be a natural symptom of ageing. The creators of Illuderma were certain that blue modern radiation is the source of dark spots after conducting extensive research. https://illudermabuynow.us/

Reliver Pro is a dietary supplement formulated with a blend of natural ingredients aimed at supporting liver health

Hey there! I know this is somewhat off topic but I was wondering if you knew where I could get a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having difficulty finding one? Thanks a lot!

As a Newbie, I am always searching online for articles that can benefit me. Thank you

you’re really a good webmaster. The web site loading speed is incredible. It seems that you are doing any unique trick. Also, The contents are masterwork. you’ve done a magnificent job on this topic!

Well I definitely enjoyed studying it. This subject procured by you is very useful for accurate planning.

Very valuable information was given. Pretty nice article.

Some genuinely nice and useful information on this website, too I conceive the style and design has superb features.

My brother suggested I might like this web site. He was entirely right. This post truly made my day. You cann’t imagine simply how much time I had spent for this information! Thanks!

View the latest from the world of psychology: from behavioral research to practical guidance on relationships, mental health and addiction. Find help from our directory of therapists, psychologists and counselors. https://therapisttoday.us/

Virginia News: Your source for Virginia breaking news, sports, business, entertainment, weather and traffic https://virginiapost.us/

The latest film and TV news, movie trailers, exclusive interviews, reviews, as well as informed opinions on everything Hollywood has to offer. https://xoop.us/

Find healthy, delicious recipes and meal plan ideas from our test kitchen cooks and nutrition experts at SweetApple. Learn how to make healthier food choices every day. https://sweetapple.site/

RVVR is website dedicated to advancing physical and mental health through scientific research and proven interventions. Learn about our evidence-based health promotion programs. https://rvvr.us/

Breaking US news, local New York news coverage, sports, entertainment news, celebrity gossip, autos, videos and photos at nybreakingnews.us https://nybreakingnews.us/

The best tips, guides, and inspiration on home improvement, decor, DIY projects, and interviews with celebrities from your favorite renovation shows. https://houseblog.us/

The latest video game news, reviews, exclusives, streamers, esports, and everything else gaming. https://zaaz.us/

Colorado breaking news, sports, business, weather, entertainment. https://denver-news.us/

Covering the latest beauty and fashion trends, relationship advice, wellness tips and more. https://gliz.us/

Breaking food industry news, cooking tips, recipes, reviews, rankings, and interviews https://tastingcorner.us/

Latest Denver news, top Colorado news and local breaking news from Denver News, including sports, weather, traffic, business, politics, photos and video. https://denver-news.us/

OCNews.us covers local news in Orange County, CA, California and national news, sports, things to do and the best places to eat, business and the Orange County housing market. https://ocnews.us/

BioPharma Blog provides news and analysis for biotech and biopharmaceutical executives. We cover topics like clinical trials, drug discovery and development, pharma marketing, FDA approvals and regulations, and more. https://biopharmablog.us/

Miami Post: Your source for South Florida breaking news, sports, business, entertainment, weather and traffic https://miamipost.us/

Fresh, flavorful and (mostly) healthy recipes made for real, actual, every day life. Helping you celebrate the joy of food in a totally non-intimidating way. https://skillfulcook.us/

Island Post is the website for a chain of six weekly newspapers that serve the North Shore of Nassau County, Long Island published by Alb Media. The newspapers are comprised of the Great Neck News, Manhasset Times, Roslyn Times, Port Washington Times, New Hyde Park Herald Courier and the Williston Times. Their coverage includes village governments, the towns of Hempstead and North Hempstead, schools, business, entertainment and lifestyle. https://islandpost.us/

I am continually browsing online for posts that can benefit me. Thanks!

Healthcare Blog provides news, trends, jobs and resources for health industry professionals. We cover topics like healthcare IT, hospital administration, polcy

Looking for quick and easy dinner ideas? Browse 100

The one-stop destination for vacation guides, travel tips, and planning advice – all from local experts and tourism specialists. https://travelerblog.us/

Outdoor Blog will help you live your best life outside – from wildlife guides, to safety information, gardening tips, and more. https://outdoorblog.us/

Stri is the leading entrepreneurs and innovation magazine devoted to shed light on the booming stri ecosystem worldwide. https://stri.us/

Valley News covers local news from Pomona to Ontario including, California news, sports, things to do, and business in the Inland Empire. https://valleynews.us/

The latest health news, wellness advice, and exclusives backed by trusted medical authorities. https://healthmap.us/

Maryland Post: Your source for Maryland breaking news, sports, business, entertainment, weather and traffic https://marylandpost.us/

Baltimore Post: Your source for Baltimore breaking news, sports, business, entertainment, weather and traffic https://baltimorepost.us/

Food

The Boston Post is the leading source of breaking news, local news, sports, politics, entertainment, opinion and weather in Boston, Massachusetts. https://bostonpost.us/

Pilot News: Your source for Virginia breaking news, sports, business, entertainment, weather and traffic https://pilotnews.us/

Santa Cruz Sentinel: Local News, Local Sports and more for Santa Cruz https://santacruznews.us/

Supplement Reviews – Get unbiased ratings and reviews for 1000 products from Consumer Reports, plus trusted advice and in-depth reporting on what matters most. https://supplementreviews.us/

Evidence-based resource on weight loss, nutrition, low-carb meal planning, gut health, diet reviews and weight-loss plans. We offer in-depth reviews on diet supplements, products and programs. https://healthpress.us/

Get Lehigh Valley news, Allentown news, Bethlehem news, Easton news, Quakertown news, Poconos news and Pennsylvania news from Morning Post. https://morningpost.us/

The latest food news: celebrity chefs, grocery chains, and fast food plus reviews, rankings, recipes, interviews, and more. https://todaymeal.us/

Foodie Blog is the destination for living a delicious life – from kitchen tips to culinary history, celebrity chefs, restaurant recommendations, and much more. https://foodieblog.us/

Exclusive Best Offer is one of the most trusted sources available online. Get detailed facts about products, real customer reviews, articles

The latest movie and television news, reviews, film trailers, exclusive interviews, and opinions. https://slashnews.us/

East Bay News is the leading source of breaking news, local news, sports, entertainment, lifestyle and opinion for Contra Costa County, Alameda County, Oakland and beyond https://eastbaynews.us/

Macomb County, MI News, Breaking News, Sports, Weather, Things to Do https://macombnews.us/

Have you ever considered writing an ebook or guest authoring on other websites? I have a blog based on the same topics you discuss and would love to have you share some stories/information. I know my audience would enjoy your work. If you’re even remotely interested, feel free to send me an e-mail.

Orlando News: Your source for Orlando breaking news, sports, business, entertainment, weather and traffic https://orlandonews.us/

Guun specializes in informative deep dives – from history and crime to science and everything strange. https://guun.us/

Do whatever you want. Steal cars, drive tanks and helicopters, defeat gangs. It’s your city! https://play.google.com/store/apps/details?id=com.gangster.city.open.world

Outstanding post, I think blog owners should larn a lot from this site its very user pleasant.

The LB News is the local news source for Long Beach and the surrounding area providing breaking news, sports, business, entertainment, things to do, opinion, photos, videos and more https://lbnews.us/

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

There are certainly lots of details like that to take into consideration. That is a nice point to bring up. I supply the thoughts above as general inspiration however clearly there are questions like the one you carry up the place a very powerful factor shall be working in sincere good faith. I don?t know if best practices have emerged round things like that, however I am sure that your job is clearly identified as a fair game. Each girls and boys really feel the affect of only a moment’s pleasure, for the remainder of their lives.

indiaherald.us provides latest news from India , India News and around the world. Get breaking news alerts from India and follow today’s live news updates in field of politics, business, sports, defence, entertainment and more. https://indiaherald.us

I like the valuable info you provide in your articles. I’ll bookmark your weblog and check again here frequently. I am quite certain I’ll learn many new stuff right here! Good luck for the next!

Kingston News – Kingston, NY News, Breaking News, Sports, Weather https://kingstonnews.us/

Definitely, what a great blog and revealing posts, I definitely will bookmark your site. Best Regards!

My website: бесплатное порно

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: порно пьяные русские

Marin Breaking News, Sports, Business, Entertainment https://marinnews.us/

So excited to share my thoughts here! This content is a breath of fresh air, merging creativity with insight in a way that’s both engaging and enlightening. Every detail seems carefully put together, demonstrating a deep grasp and passion for the subject. It’s rare to find such a perfect blend of information and entertainment! Major applause to everyone involved in creating this masterpiece. Your hard work and dedication shine brightly, and it’s an absolute joy to witness. Looking forward to seeing more of this amazing work in the future! Keep amazing us all! #Inspired #CreativityAtItsBest

Humboldt News: Local News, Local Sports and more for Humboldt County https://humboldtnews.us/

Boulder News

very informative articles or reviews at this time.

I got good info from your blog

Excellent web site. A lot of useful info here. I am sending it to a few friends ans also sharing in delicious. And naturally, thanks on your effort!

Oakland County, MI News, Sports, Weather, Things to Do https://oaklandpost.us/

Longmont News – Longmont, Colorado breaking news, sports, business, entertainment, real estate, jobs and classifieds https://longmontnews.us/

Greetings from Carolina! I’m bored to tears at work so I decided to check out your site on my iphone during lunch break. I really like the knowledge you provide here and can’t wait to take a look when I get home. I’m shocked at how fast your blog loaded on my cell phone .. I’m not even using WIFI, just 3G .. Anyways, wonderful blog!

Reading, PA News, Sports, Weather, Things to Do http://readingnews.us/

Hi my friend! I wish to say that this article is awesome, nice written and come with approximately all important infos. I would like to see extra posts like this.

Thanks-a-mundo for the post.Really thank you! Awesome.

My website: порно русское онлайн

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: смотреть русское порно онлайн

Respect to post author, some fantastic information

My website: порно студентки

No question, I’ve been a fan of this author for a while now – always delivering exceptional posts!

This site definitely has all of the information I needed about this subject

My website: русский порно массаж

This really answered my downside, thank you!

netovideo.com

그는 휘장을 내리고 사람들에게 가마를 일으키라고 명령하고 단정한 옷을 입은 관리들과 경비병들을 이끌고 떠났습니다.

digiapk.com

오늘은 심부름을 좀 하러 나갔다가 늦게 들어와서 너무 졸려서 잠깐 자고 일어나서 글을 쓰게 되었습니다.

Valuable information. Lucky me I found your site by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.

Vacavillenews.us covers local news in Vacaville, California. Keep up with all business, local sports, outdoors, local columnists and more. https://vacavillenews.us/

Trenton News – Trenton, NJ News, Sports, Weather and Things to Do https://trentonnews.us/

Fashion More provides in-depth journalism and insight into the news and trends impacting the fashion

Have you ever thought about publishing an ebook or guest authoring on other websites? I have a blog based on the same subjects you discuss and would really like to have you share some stories/information. I know my visitors would value your work. If you’re even remotely interested, feel free to send me an e-mail.

Your ideas and insights are unique and thought-provoking I appreciate how you challenge your readers to see things from a different perspective

Great wordpress blog here.. It’s hard to find quality writing like yours these days. I really appreciate people like you! take care

Hello, Neat post. There is a problem with your website in internet explorer, could test this?K IE still is the market leader and a large section of other folks will pass over your great writing due to this problem.

PharmaMore provides a forum for industry leaders to hear the most important voices and ideas in the industry. https://pharmamore.us/

Medical More provides medical technology news and analysis for industry professionals. We cover medical devices, diagnostics, digital health, FDA regulation and compliance, imaging, and more. https://medicalmore.us

Your ability to simplify complex topics is remarkable. Thanks for making learning easier!

Your post today was exactly what I needed to read. Thank you for the timely insights!

Local news from Redlands, CA, California news, sports, things to do, and business in the Inland Empire. https://redlandsnews.us

San Gabriel Valley News is the local news source for Los Angeles County

restaurant-lenvol.net

갑자기 이 견습생과 손자 무리는 어우양 스승님에 의해 새로운 문을 여는 것 같았습니다.

This piece was a bit different from your usual content, but I liked it!

NewsBreak provides latest and breaking Renton, WA local news, weather forecast, crime and safety reports, traffic updates, event notices, sports https://rentonnews.us

Give a round of applause in the comments to show your appreciation!

Very interesting information!Perfect just what I was searching for! “We are shaped and fashioned by what we love.” by Johann von Goethe.

I haven’t checked in here for a while as I thought it was getting boring, but the last few posts are great quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂