Kantar Worldpanel released the latest installment of its always interesting public data set on smartphone buying behavior this past week and, as usual, I added it to my spreadsheet that tracks these things over time. One of the things that jumped out at me as I crunched some of the numbers from the last few months was Android’s share seems to be stagnating or falling in the five European markets Kantar tracks.

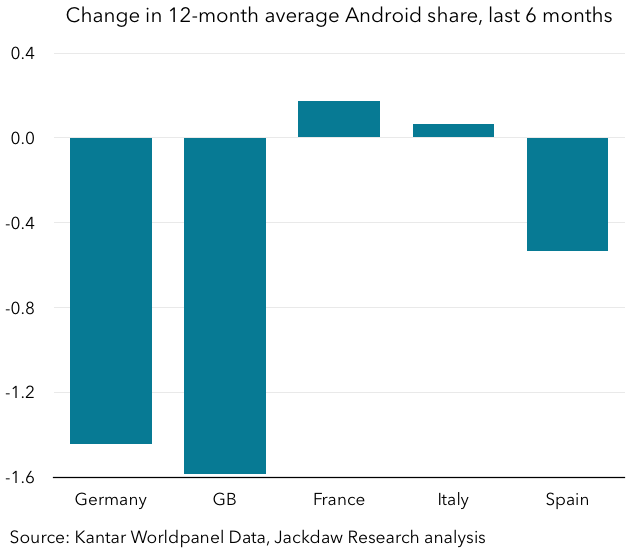

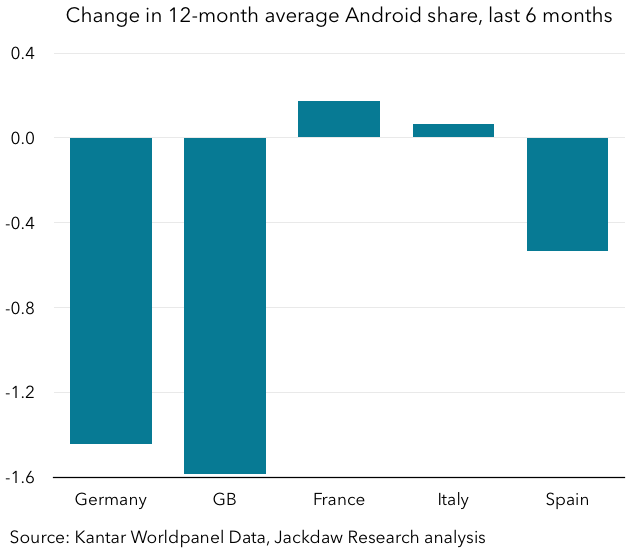

Because Kantar reports smartphone sales and not installed base, you have to be careful to avoid making assumptions based on short term trends, since this market is highly cyclical. One thing you can do is take a 12 month average of the reported numbers, which should ideally allow the cyclical trends to cancel each other out. What I’ve done here is shown the change in that 12 month average view over the last six months for each of the five European countries Kantar reports data for. That’s shown here:

What you can see is Android’s share dropped in Germany, Great Britain, and Spain; it grew, but only very slightly, in France and Italy. This is in marked contrast to the last several years, when Android share in these markets increased significantly (10-20% over the last three years) by the same measure. It appears as though Android has hit some kind of tipping point in these markets over the last six months in particular – there’s a marked change in the trajectory in the last few months in several of these markets. So what’s happening?

The resurgence of iPhone at the high end

Even as Android’s share has been rising in these markets over time, iPhone’s share tends to have been slowly falling, as Android mops up many of the later adopters who either can’t afford to or don’t want to spend what it takes to buy an iPhone. But over the last few months, iPhone’s share has risen even on this 12 month basis (i.e. adjusted for the fact iPhone sales are always higher at this time of year, after new iPhones are launched but before the big Android flagship models come out). This is likely happening mostly at the high end of the market, as the new iPhone 6 models take share from larger Android phones such as the Galaxy S and Note series. The chart below shows the change in the same period in iPhone share over the last six months (also on a 12 month average basis):

As you can see, the iPhone gained share in each of these markets, whereas in Italy, France, and Germany, the share of iPhones in sales has been stagnant or falling for the last couple of years. Again, something has changed in the last few months. As you can also see, the gains in share for the iPhone in some countries is bigger than the losses for Android, as the iPhone is also eating into other bases, including legacy BlackBerry and Symbian bases in some markets, but also Windows in others.

Windows Phone also nibbling at the low end

For comparability’s sake, I’m pasting the same chart for Windows Phone below, and you can see that in a couple of markets (Germany and France), Windows Phone actually made gains in the same period, eating partly into Android share and partly into legacy platforms’ share:

However, Windows Phone is in a bit of a lull at present, and so its effect here isn’t as pronounced as it is in some earlier periods. I’m showing below a longer term view of Windows Phone performance in the same markets, which shows both the significant gains made in earlier periods and the fairly respectable share Windows Phone has captured in some of these countries:

In France and Italy, Windows Phone share of sales was in the teens in February this year, up significantly in France from the previous year though down slightly year on year in Italy. Windows Phone is, I would guess, nibbling at the low end of Android just as iPhone is making gains at the premium end, and I would expect this trend to accelerate as both more low end Windows Phones are launched and as Windows 10 arrives later in the year. AdDuplex data for Windows Phone installed bases in these various countries suggests that here, as elsewhere, it’s primarily the very cost-effective 500 and 600 series that’s proven so popular in these markets. This is Windows Phone’s big success story at the moment, although also a potential liability as the platform attracts almost entirely the lowest spending users in each market. But capturing such a significant share in certain markets at least provides some indication Windows Phone might be successful more broadly when Windows 10 launches in these countries, if not more broadly overall (its share in the US continues to languish at under 5%).

There’s a bit of a timing issue: Dec-Jan-Feb means fresh iPhones, while the Android camp releases flagships March-June (S6, M9, G4)

I think the YoY iOS share reflects Apple entering the phablet segment. I expected hat impact to be bigger actually. The changes also vary widely per country, it would be interesting to know with what that correlates. I’m betting on subsidies, but can’t find confirmation.

Windows Phone is in a weird place, I think it’s selling more on the Nokia heritage still, both the brand and the design language. On the other hand, if you want something fancier… The few users around me are still having mighty app issues; public transport apps for example are just missing.

See my second paragraph – this is precisely why I used trailing 12-month averages, to avoid the cyclicality.

I think the way you present “change in 12-month average” is quite unconventional, and I think that is what was confusing for @obarthelemy. Normally you would have a line graph with time as the x-axis, and show the 12-month moving average for each quarter. That way, you could confirm whether averaging over 12-months has truly cancelled out seasonal effects or not. Because of variations in lauch date, etc., there is no guarantee that a 12-month window will cancel out timing issues.

I would also prefer the conventional presentation, if there are enough data-points to make it feasible.

Understood, and I do have that chart too – it’s just hard to see exactly how much the line has moved over a relatively short period of time, hence showing change rather than the underlying numbers.

Yes, I understand that it would be hard to see a few percentage points or less.

Spotting early trends is hard 🙂

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated