There’s a whining at the threshold,

There’s a scratching at the floor,

To work! To work! In Heaven’s name!

The wolf is at the door!~ All Apple Analysts Everywhere ((No, seriously, it was written by Charlotte Perkins Gilman, In This Our World [1893]))

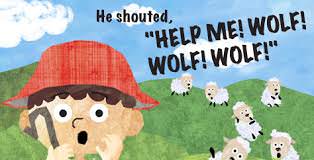

In “The Shepherd’s Boy”, Aesop provided us with a wonderful fable about a boy who repeatedly cried wolf because he wanted to draw attention to himself. The moral of the story was that an alarmist might be believed once, perhaps twice, but then they would never be trusted again.

Wow, was Aesop ever wrong. If you’re an Apple analyst, you can cry wolf time and time again and each and every time, Wall Street investors will react like a flock of frightened sheep.

iPhone Sales May Be Slowing

It was the best of times, it was the worst of times. Apple just had its best year ever so, by employing some sort of perverse logic, many Apple analysts have concluded it is only logical to assume Apple must now have its worst year ever.

Wait, what?

But hold on to your hat, there’s more logic where that came from! Not only is Apple going to have a bad quarter — which inevitably means they’re going to have a bad year — but…wait for it… it also means Apple is — dun, dun, dun — doomed!

No, seriously, an Apple analyst is literally predicting Apple is doomed.

The iPhone slowdown spells doom for Apple. ~ Jeff Reeves, MarketWatch, January 9, 2016

With all due respect, it’s pretty obvious Jeff Reeves doesn’t know how to spell.

Nature, not content with denying him the ability to think, has endowed him with the ability to write. ~ A. E. Housman

And what is triggering this coming Apple apocalypse? Why a single quarter of flat or decreasing iPhone sales, that’s what.

And what are all these gloom and doom predictions of lowered iPhone sales predicated upon?

“Channel checks.”

Seriously?

Year after year after year, channel checks have proven to be an unreliable way to gauge future sales of Apple products. But year after year after year, the cry of “channel checks” — like the cry of wolf — fills the hearts of Apple investors with dread.

I’ve been following tech for 15 years and am still startled how a random, flakey estimate can become accepted Truth in 24 hours.” ~ Benedict Evans on Twitter

Déjà Vu All Over Again ((Attributed to Yogi Berra.))

It’s not like this is anything new. People have been predicting doom for the iPhone since its inception.

Saturated

The market is already saturated with popular [phones] that are virtually free to consumers. … The old iPod magic doesn’t translate (to) the iPhone. ~ Ashok Kumar, Capital Group, 30 July 2007

Overstretched

There is no doubt, in my mind, that the whole (smartphone) sector is hugely overstretched. The whole sector is priced as if the average player would sustain 25 per cent margin in eternity. It’s bordering on absurdity. This will end in tears. ~ Per Lindberg, MF Global Ltd, Feb 2009

Tears, perhaps. But Apple cried all the way to the bank ((I cried all the way to the bank. ~ Liberace)) . Lindberg was right when he predicted Apple wouldn’t be able to sustain 25 per cent margins. It was more like 40 per cent.

No Growth

When the iPhone came out, it was so far beyond what was out there on the market, pretty much up until now, but with what’s coming out from competitors, that advantage is going away. For the first time, Apple’s going to be faced with a serious growth challenge. ~ Edward Zabitsky, ACI Research, 22 Apr 2009

Everything Has To Decline

If you look at any institution in history – look at the Roman Empire – anything in history, and what it looks like when it’s peaking. Look at Apple, and how can you say it’s not peaking? (H)ow much better can it really get? The thing is, it may take another year or two before it starts to decline, but it has to – everything does. ~ Trip Hawkins, Founder and CEO of Digital Chocolate, 3 Aug 2011

Peak

The last quarter slowdown could be foreshadowing bigger issue to come for iPhone sales and mark a peak in the growth rate of the iPhone. ~ Charlie Zhou, Seeking Alpha, 31 August 2012

Last Hurrah

With all things tech, fused products and commoditization are inevitable markers of the product cycle. The iPhone 5 will be Apple’s last hurrah as competitors increasingly gain ground. ~ Kofi Bofah, Onyx Investments, 29 August 2012

Shrinkage

Apple just reported that it sold more than 5 million iPhones over the iPhone 5′s opening weekend. This is a very disappointing number. It’s below top Apple analyst Gene Munster’s estimate of 6 million to 10 million. Worse, it indicates that growth may be slowing at Apple. Apple sold the iPhone 5 in nine countries over its opening weekend. It sold the iPhone 4S in seven. It actually sold fewer iPhones per country this year than the last. That’s not just deceleration, that’s shrinkage. ~ Nicholas Carlson, Business Insider, 24 Sep 2012

Winding Down

One thing Apple investors are waking up to, in other words, is that the iPhone’s amazing run is winding down. ~ Jay Yarow, Business Insider, 18 December 2012

Slowing Down

There’s no way around it: The iPhone business as currently constructed is slowing down significantly. ~ Jay Yarow, Business Insider, 23 April 2013

All-Time High

Apple’s struggles with the iPhone 5 appeared just shortly after the phone’s launch. That event coincided almost perfectly with Apple’s all-time high. Although the iPhone 5 has sold well (it’s the world’s single best selling phone), it failed to live up to the expectations of optimistic Wall Street analysts. ~ Salvatore “Sam” Mattera, The Motley Fool, 9 July 2013

Sales Growth Slowing

Looking at the yearly trajectory, one can see how the rate of iPhone sales growth is slowing down.” ~ Sam Gustin, Time , 28 October 2013

Slower Growth

Apple could be negatively impacted by slower growth in iPhone sales. In my opinion, the company cannot grow indefinitely in the smartphone market area and one day, it will materialize in its share price. ~ Gillian Mauyen, Seeking Alpha, 15 November 2013

Wow. Apple analysts cry wolf, wolf, wolf, wolf, wolf, wolf, wolf, wolf, wolf, wolf, wolf, wolf — with nary a wolf in sight. Yet now they expect us to take them seriously?

It is a mark of prudence never to trust wholly in those things which have once deceived us. ~ Descartes

Predictions

Let’s face it, predicting the future is not Wall Street’s forte.

Economist Alfred Cowles dug through forecasts of popular analysts who “had gained a reputation for successful forecasting” made in The Wall Street Journal in the early 1900s. Among 90 predictions made over a 30-year period, exactly 45 were right and 45 were wrong. This is more common than you think. ~ Motley Fool

Wall Street indexes predicted nine out of the last five recessions. ~ Paul A. Samuelson

The phrase “double-dip recession” was mentioned 10.8 million times in 2010 and 2011, according to Google. It never came. There were virtually no mentions of “financial collapse” in 2006 and 2007. It did come. A similar story can be told virtually every year. ~ The MoneyGeek Unplugged

Investment bank Dresdner Kleinwort looked at analysts’ predictions of interest rates, and compared that with what interest rates actually did in hindsight. It found an almost perfect lag. “Analysts are terribly good at telling us what has just happened but of little use in telling us what is going to happen in the future,” the bank wrote. It’s common to confuse the rearview mirror for the windshield. ~ The Motley Fool

Stocks have reached what looks like a permanently high plateau. ~ Irving Fisher, Professor of Economics, Yale University, October 17, 1929

To be fair, just because the pundits have been wrong in the past, doesn’t mean they will be wrong this time around. I honestly don’t know how many iPhones Apple sold this past quarter. But here’s the thing: The pundits don’t know either.

In the case of news, we should always wait for the sacrament of confirmation. ~ Voltaire

Much Ado About Nothing

Everyone acknowledges iPhone sales were unexpectedly high this time last year. That creates what analysts call a “tough compare”. In other words, Apple is being punished this year for doing so well last year.

If Apple doesn’t beat last year’s iPhone sales, it doesn’t portend an inexorable downward sales spiral. Apple is the world’s biggest company, as measured by market value, with around $525 billion market cap ((Market cap is a constantly changing number. Jay Yarrow listed it at $565 billion in his article but as of January 20, 2016 it is around $525 billion)). It has $206 billion cash on hand. It had $13.5 billion in cash flow last quarter. It is expected to do $77 billion in sales this quarter. (Via Jay Yarrow, Apple is going to have a tough year – Business Insider.) Apple remains — despite all the current kerfuffle — the most profitable company in the S&P 500.

A bad year for Apple would be a great year for almost any other company. So is Apple doomed? Not so much.

Cause And Effect

We’ve got to disabuse ourselves of this notion that short-term stock fluctuations accurately reflect the long-term health of a company.

(Wall Street) focuses on the waves and not of the currents. ~ Consuelo Mack

The breaking of a wave cannot explain the whole sea. ~ Vladimir Nabokov

Wall Street likes to focus on the short-term.

If you heat your company by burning the furniture, Wall Street will adore you and write glowing articles about you but you’ll be cold soon. ~ Farooq Butt (@fmbutt)

but a good company must focus on the long term instead.

If you’re long-term oriented, customer interests and shareholder interests are aligned. ~ Jeff Bezos

Wall Street has cause and effect reversed. You can’t tell how good or bad a company will do by looking at its stock. But you can tell how good or bad its stock will do by looking at the company. Believing the direction of AAPL stock determines the direction of Apple is like believing a weathervane controls the direction of the wind.

Buy Low, Sell High

I thought the goal was to buy low and sell high. If so, this might be a good time to buy Apple stock rather than to sell it.

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful. ~ Warren Buffett

But what do I know about stocks? Not very much. But that Warren Buffett guy, he seems to know a thing or two.

If a business does well, the stock eventually follows. ~ Warren Buffett

Apple owns the high end in smartwatches, smartphones, tablets, notebooks and desktops. Seems to me, that’s a pretty good place to be.

Total Apple device shipments (iOS, WatchOS, TV, Mac) 2015 about 330.5 million. ~ Horace Dediu (@asymco) 1/14/16

The End (Or Is This Never Ending?)

Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market. ~ Warren Buffett

If you can’t tolerate fear-mongering, then you shouldn’t be in the stock market to begin with. Invest in something safer and more stable — like Syrian real estate.

“Apple is screwed” – 1997, 1998, 1999, 2000, 2001, 2002, 2003, 2004, 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014, 2015 [2016, 2017…. ~ Sammy the Walrus IV ((Sammy the Walrus is Neil Cybart’s nom de plume)) (@SammyWalrusIV)

It seems as though this has become an annual ((Semiannual? Quarterly? Daily?)) ritual. The naysayers keep crying “Wolf” and I keep responding “Bull”.

It’s always been easier to explain how Apple will fail than it is to explain how the company will succeed. ~ Neil Cybart on Twitter

If the cries of Apple’s doomsayers unnerve you, then get the hell out of Apple stock, because the FUD ((Fear, Uncertainty and Doubt)) is never going to end. Analysts are going to keep on crying “Wolf” and scared investors are going to keep on acting like sheep. Do yourself and Apple a favor. Get the flock out. Apple doesn’t want you as an investor anyway.

If you’re in Apple for only a week… or two months, I would encourage you not to invest in Apple. We are here for the long term. ~ Tim Cook

Apple is run ‘for the investors who are going to stay, not the ones who are going to leave.’ ~ Warren Buffett

Post Script — Just For Fun

A MAN STOMPS INTO A BAR, obviously angry.

He growls at the bartender, ‘Gimme a beer,’ takes a slug and shouts, ‘All financial advisers are arseholes!’

A bloke at the other end of the bar retorts, ‘Take that back!’

The angry man snarls, ‘Why? Are you a financial advisor?’

The bloke replies, ‘No, I’m an arsehole.’

(Just in case you’ve never read my bio, I was once a lawyer, but I didn’t feel that I was hated enough, so I became a financial advisor just in time for the collapse of the technology bubble in the year 2000.)

I’ve said for years that I thought Apple would reach a billion active users and probably level out somewhere around there. I may have been wrong, Apple is getting close to selling one million computing devices per day (on average). Apple’s customer base could end up well north of a billion.

One thing that I didn’t mention in my article is that iPhones have an incredibly fast refresh rate. Many people buy new iPhones every two years and there is a large contingent that upgrades every year. This is a much, much faster refresh rate than previous tech items — such as desktop computers and Microsoft Windows — had.

But those old phones aren’t being fed into a shredder. Some of them languish in closets or desk drawers, but I suspect most of them get passed down to friends or sold. And the ones that get traded in are definitely going to be re-sold, so the install base keeps growing.

Only apple knows how many active IOS devices exist in the world, and they aren’t telling.

Benedict Evans, who I think has been fairly conservative on his estimates, recently pegged Apple’s active users at 800 million. Given that 2016 should see more than 300 million devices sold, that should put Apple over one billion. I suppose it depends what chunk of 2016 sales is to current users, so maybe that pushes it out to 2017. A billion active users is going to happen, the question is when.

There was a stat that came out a while ago that Apple had 800m or so credit cards on file. That does not exactly translate to 1:1 user. The number Benedict and I use is an active device number, meaning between Macs, iPhones, iPads, and iPod’s there are rouhgly 800-900m active devices. This again does not equate to unique users. Using the iPhone installed base of ~500m, then assuming some percentage of people have a Mac or iPad but not an iPhones, we can prob gret near ~600m unique users..

The part that is hard to model is how many brand new customers Apple is acquiring each year thus adding to their customer base. It is conceivable they get to around a billion but very difficult to know when. Unless of course they release some stat that helps us model it.

Perhaps Horace will turn out to be right, on Asymco a few years ago if memory serves he predicted 2018 would be the year Apple hits the one billion users mark. Evans did say in a Dec 18 blog post “Apple’s ecosystem has perhaps 800m active users”. So he must have meant devices. Obviously unique users would have to be lower than total active devices. If I’m remembering correctly, about a year ago Evans was saying 500 to 600 million users.

Do you think 2018 is still the target time-wise, or do you think it may happen sooner now? Or Apple might implode and never get to a billion?

It’s possible that Apple can get to a billion unique users but it will be a major challenge. It will have to focus hard on countries like India, Brazil, maybe Russia to drive extra growth, in addition to trying to get more Android switchers.

Unless something catastrophic derails Apple, they will reach a billion users, it’s just math at this point. The question is when. 2016 might be optimistic. Asymco predicts 2018, and Horace has been right about a lot of things.

Among enthusiasts that may definitely be the case but according to Ben’s iPhone subscriber post today, among late adopters / late market majority there’s good evidence that the replacement cycle may be getting longer. Around 50% of iPhone owners are still using an iPhone 5s or older. And that may become more true, with iPhones now having the performance of low-end laptops.

Apple is working on changing that with their iPhone upgrade program that to me was the big news of 2015 as not only will it allow more people to afford an iPhone increasing the market for iPhones and iOS devices and apps but in will get people on even faster upgrade cycles of every year having a new iPhone.

The problem with the plan as it stands now is that it is only available in Apple retail stores and the iPhones you can choose from have been limited. However I do suspect that will change as Apple expands it. This program is something that Apple will be working on for many years to come and the impact will take a while for Wall Street to see.

Plus, if the rumors are true, we eventually will see a refreshed smaller sized iPhone for the people who want a one handed iPhone experience. It is low hanging fruit that would be easy for Apple to pickup many sales from people who have not upgraded to the iPhone 6 or 6s because the size is too big for their needs.

Great. But, please, correct Apple’s market cap, it undermines the credibility of your rant. It is around 525B right at this moment.

Market cap is a moving target. The number I used came from the Jay Yarrow’s article I cited. However, based upon your suggestion, I lowered the number to 525 billion and added the following footnote:

“Market cap is a constantly changing number. Jay Yarrow listed it at $565 billion in his article but as of January 20, 2016 it is around $525 billion”

You really didn’t have to do anything. It’s the reader’s responsibility to digest and comprehend what they are reading.

It would be great to see these “analysts” have ratings like Yelp, so they have some accountability and we know who to believe and who to ignore.

Philip Elmer DeWitt does an excellent job of compiling and comparing analysts estimates.

“How Many iPhones Did Apple Sell Last Quarter”

http://fortune.com/2016/01/14/apple-iphone-q1-2016/

1. When I didn’t see a John Kirk article on the weekend, I thought, “oh right, holiday in the US, ah well, maybe there will be a column next weekend.” And now this unexpected mid-week present. Thanks.

2. The more I read these “apple is doomed” screeds that keep appearing, the more I wonder if all tech pundits are required to have learned English as a second language from a sadistic prankster who told them that “doomed” meant “will continue to do very well”

3. It’s becoming increasingly obvious that if you are running a publicly traded corporation and you want to reduce the stress in your life, the single best move you can make is to go private. And going public is only for the stupid or the greedy.

Once upon a time, investing in the stock market meant buying stocks in profitable companies and then enjoying receiving dividends… but a wave of stupid appears to have washed all that away and now it seems to mean buying stocks in profitable companies and then complaining bitterly that the companies are not doing enough self-destructive things to artificially inflate the value of their stocks.

What I am afraid of is Tim Cook may not be strong enough to tell to folks to shove it and fall victim to wall street short term mentality/gains at the expense of the companies future.

I am with you on that. I has seen way to many companies release products before they are ready to make Wall Street happy but end up pissing off their customers with half baked products. Wall Street should never drive a company as doing so will only lead to the downfall of company. Investors are way to fickle and most products have a much longer shelf life.

“What I am afraid of is Tim Cook may not be strong enough to tell to folks to shove it”

Well, it’s possible that Apple felt pressured to bring out the Apple Watch too soon. But they held off on the larger iPhones until they were good and ready. And then there is this quote:

“If you’re in Apple for only a week… or two months, I would encourage you not to invest in Apple. We are here for the long term.” ~ Tim Cook

The impressive thing about the above quote is that it was made spontaneously, during a shareholder meeting, directly to an angry, activist shareholder. That takes some moxey.

I, on the other hand, have no such fears about Tim Cook. He has shown nothing but steadfast resolve not to be swayed by the day to day hysterics emanating from the Chicken Little demographic of the investing public.

Agreed. As a customer (exclusively) I care about the tech, not about the money.

I agree. He should only be listening to customers and employees.

I don’t know about that. Stocks are about people and perception and there’s always been a lot of very smart and very dumb people participating in markets throughout history.

Sadly, I’ve lost the source of the following quote, but I add it here because I fully endorse its message.

“Study successful investors, and you’ll notice a common denominator: they are masters of psychology. They can’t control the market, but they have complete control over the gray matter between their ears.”

Woof

A dog goes into a newspaper to place an advertisement.

“What do you want your ad to say?” asks the newspaper clerk.

“Woof Woof Woof. Woof Woof Woof. Woof Woof Woof,” says the dog.

The newspaper clerk adds up the words and says, “Okay, that’s nine words. We charge the same for up to ten words. You could add another ‘woof’ for no extra money.”

The dog says, “But that wouldn’t make any sense.”

Sub doomed for woof, makes all the sense in the world.

I love that joke (and I think I may have used it in one of my articles long, long ago). 🙂

Of course it must have been Jobs’ dog. He knew what to leave out. The legend continues… 🙂

I’ve learned to tune out the Apple Doom chorus.

They pale in comparison to the incredible accuracy of Nostradamus’ predictions. Worse yet, there’s always the threats posed by the mole people…

http://weeklyworldnews.com/mutants/3389/mole-people-being-exploited/

Does he said / she said really matter ? We’ll see how things turn out. Those graphs are worth a million cherry-picked quotes:

A two thousand word post! tl;dr… 😉

Neither of those graphs have anything to do with the article. As a matter of fact, the second one is probably the result of what John is talking about. And market share? Haven’t you learned yet that market share has little meaning in this context?

Clearly you have grossly underestimated the value of a cherry-picked quote.

Meanwhile, the market share graph says nothing about profits, and the stock price graph is precisely what this article addresses.

So, you’ve managed to grossly overestimate the value of these graphs, as well.

“Does he said / she said really matter ?:

Never underestimate the power of words. ~ Martin Luther King, Jr.

“We’ll see how things turn out”

We’re already seeing it. Apple continues to be very successful in the high end segment of the markets they operate in, which naturally means a minority market share (when viewing the market as a monolithic whole, which is neither accurate nor smart, but we’ll forget about that for now). Your graph helps prove that actually.

And Apple’s stock market performance continues to be disconnected from their success because so many people (you included) don’t understand why Apple is successful. Your second graph helps prove that.

And there it is again. Didn’t we just discuss such a chart posted by you just a couple of articles ago? Hint: The arbitrary “Smartphone” category is growing to envelop all of Mobile, of which it was a part, etc. Either you have the memory of a goldfish, or you are trying to disingenuously worry new readers to this site, just like the analysts in the article.

I’ll take John Kirk’s cherry-picked quotes over your cherry-picked data any day.

You’ve got different stock and market share data ?

Yes. My stock data has a different start point, and a different end point.

Market share data is irrelevant to my goals as an investor and as a user. Show me a profit graph, or a user satisfaction graph, and we’ll talk.

there. Latest I could find. Apple is about average in satisfaction for flagships, and about twice as expensive.

Source? sample size? methodology? Sponsor?

Numbers out of context are essentially lies. You want to know real customer satisfaction? Look at repeat sales and brand loyalty. There is exactly ONE company whose flagship sales consistently grow. What does that tell you?

This is only hard if you need it to be. Perhaps you are trying to prop up your narrative?

An… Apple Insider article: http://appleinsider.com/articles/15/06/04/apple-samsung-tied-for-highest-smartphone-customer-satisfaction-iphone-falls-behind-galaxy-note

And.. it tells me that customer satisfaction is not the sole criteria when buying Apple ? That’s rather obvious ?

Apple Insider is not the source. The source is the American Customer Satisfaction Index, and if you bother to read the source the headline summary from their press release on this subject is as follows: “Apple and Samsung Tie”. The quick summary is that both Apple and Samsung are doing well when it comes to customer satisfaction. Another blurb from their press release: “With some of the strongest scores in the entire ACSI, the two largest smartphone manufacturers lead the way: Apple and Samsung Electronics. Apple advances 1 percent to 80, going head-to-head with Samsung (-1%).” Your source does not agree with your narrative.

Well, you need to think a bit: Samsung have low-end, midrange, and high-end model. The table nicely isolates the flagships, mostly. Sorry, facts, you gotta understand them….

You’re cute when you’re desperately clinging to your “Apple doom” narrative. As I suggested previously, you should look at your source in more detail, it doesn’t tell the story you wish it did.

I’ve looked very closely, and yes it does: The best “user satisfaction” phones are Android, and Apple is average amongst flagships.

You keep trying to insinuate it isn’t the case, but the chart is right up here.

Hmm, now you’re lying. I never said “Apple is worth paying 2x because user satisfaction”. It’s also very strange that when I look at my carrier the iPhone 6 Plus is $969 off contract, the 6S Plus is $1,054, and the Galaxy Note 5 is $849. Another carrier which does still have the Galaxy Note 4 has it for $800 off contract. More expensive? A bit, sure. Twice? Not even close. And when it comes to the reality of how people actually pay for phones (monthly) the difference is very small indeed. Now, it is true that there are Android phones available for half the price of some iPhones, but once again you tread into the logical fallacy of false equivalence.

Once again I invite you to look closely at the ACSI report. You’ve obviously missed the chart where they average scores by company, with Apple and Samsung tied at 80. That would be why the headline of their press release says “Apple and Samsung Tie”.

Note 4 is $500 unlocked from Amazon: http://www.amazon.com/s/ref=nb_sb_noss_2?url=search-alias%3Daps&field-keywords=unlocked+note+4 . Who’s lying, again ?

And yes, monthly payment hide that difference. That’s counting on people inability to do maths, which is justified, seeing how you can’t even find a price on the internet, but doesn’t change the actual reality and cost.

Again, I invite you to look at Apple’s and Samsung’s product ranges (hint: Samsung has about 20x more models and covers the entry and mi ranges too). Once you filter for flagships, or select the best Apple has to offer, Samsung has better satisfaction, for half the price.

Or you can continue to lie about prices and customer satisfaction.

Edit: edits

“Note 4 is $500 unlocked from Amazon… Who’s lying, again ?”

That would be you, again. You linked to an Amazon price, in US funds. I’m in Canada, and the prices I gave were from a carrier (more expensive than Amazon). That Galaxy Note 4 you linked to will actually cost me $700. The Galaxy Note 5, same deal from Amazon, is $850. An unlocked iPhone 6 through Amazon is $599. The 6 Plus is $725. Interesting, an iPhone 5S is $300 unlocked. All these prices are from Amazon, all in Canadian funds. See how that works when you compare in a fair manner?

The ACSI report also includes old model iPhones, the iPhone 4 is over five years old at this point. Lower cost purchases naturally will affect consumer surveys, as will aging devices, this is obvious. Do you really want to claim that four and five year old iPhones count as flagship phones today? That would be quite a compliment for Apple.

What devices do you want to filter? If we take the Note 4 and Note 3 we get an average score of 84. The iPhone 6 and 6 Plus averages 82. Again, if you’d bother to read the details of the index you’d know there’s more going on than simply “Ha ha! 84 beats 82!”

The actual story here is that both Samsung and Apple have very good consumer satisfaction ratings, and when you compare flagship devices they also have similar ratings. Unless you suddenly want to count the old models of iPhone as flagships, which seems odd, even for you.

Here’s something you’ve never actually provided details on. What devices exactly are you comparing that give a significant increase in the customer satisfaction rating AND at half the price of the Apple device? It can’t be either of the iPhone 6 models, since only one Samsung model beats them on the index and not by a significant amount. Plus there’s no way to manipulate the price data to get anywhere near your “half the price” claim. So, what are you comparing? Be specific.

So, to sum up:

1- the two devices with the highest user satisfaction aren’t from Apple

2- Apple devices have typical flagship satisfaction levels, no less, no more. Samsung, LG, Moto and Apple are all equivalent.

That puts paid to “Apple is worth it because it is the best of the best”: it is only average among the best, the best of the best is the GNote 4.

3- the only issue is whether Apple’s devices are 2x more expensive the say Samsung’s devices that offer similar satisfaction and broadly similar size. Let’s do Note3 vs 6+, using US prices.

iP6+ @64GB is US$750 on Apple’s site

GN3+64GB is $400+$20= $420 on amazon, unlocked US LTE version

iPhone is 80% more expensive than GN3. You’re right, it’s not 100%, only 80%.

The actual story is that Samsung offers the same satisfaction as Apple, but Apple is 80% more expensive. Apple is not better, just way more expensive.

PS: the $ sign is usually assumed to mean USD. You should make it clear when you’re using it for CAD.

PS2: the ACSI report also includes old Galaxy phones, so whatever you’re saying about iP4: Yep, and same for GS3.

And your lying continues. The Galaxy Note 3 was launched in 2013. The proper comparison would be the iPhone 5S, also from 2013. You also fail to use Amazon for both prices, which you could.

I’ll assume your Galaxy Note 3 price is actually correct (one can hope). The iPhone 5S 64GB is $499 on Amazon, US funds. Your Note 3 is $420.

Of course I already did the proper comparison for you with the iPhone 6 Plus and the Galaxy Note 4 (both from 2014). The iPhone was $725 while the Note 4 was $700, both prices from Amazon in Canadian funds. Even using your iPhone 6 price of $750 the difference isn’t huge.

Also, why do you keep putting quotes around things nobody said, such as “Apple is worth it because it is the best of the best”?

That faked quote actually proves that you don’t understand why people choose Apple. I get it, you’re mad at Apple. You come across like a jilted lover, lashing out with bad-mouthing and lies. Why not simply enjoy your own technology choice and stop trying to apply your own personal values to the choices of others?

But if you feel that you must continue to lie, please do so. No amount of lying is going to get you anywhere near your original claim of Apple being twice the price.

Still working hard for your Apple shares…

Again, to recap

1- Apple doesn’t lead in customer satisfaction, it is 3rd by model

2- and equal to all other OEMs’ flagships by brand.

So much for Apple offering higher customer satisfaction.

3- As for pricing

I don’t see how comparing the price of a 4″ iPhone with not even 720p resolution to a 5.7″ 1280p GNote 3 is more fair than my taking Apple’s highest ranked iPhone (in third place), and the closest phone to that ranking. Maybe take a a 4S ? they’re even cheaper, and fit in your “let’s compare bikes to cars” scheme.

In the US, The 64GB iP6+ is $750 from the aStore (a bit more on Amazon, so your paranoid accusations simply fall flat), and the GNote4+64GB is $500. So 50% more “only” for Apple, but now we’re comparing the best-in-class Samsung model to 2nd runner-up Apple model, which is a bit unfair.

the “quote” was not a quote (no attribution) but a way to “make the difference

between

a deeply cynical attitude,

and

a trite observation:” ( http://www.radford.edu/ibarland/Manifestoes/quote-mark-usage.shtml ). that’s a valid use, actually the first listed in the linked reference, so calm down and get some culture.

Your increasing hysteria and aggressiveness fail to obfuscate the bare fact that Apple’s customers are not more satisfied, and that Apple’s products are 50% to 150% more expensive than competitors ranked as high or higher. Sorry.

I don’t need to do any work for my Apple shares, the initial investment is now worth 8 times what we put in.

I think we can leave it here, I’ve exposed you for the liar you are, anyone reading this comment thread can see that your price comparisons are nonsense.

As for customer satisfaction, you’re the only one crying about Apple not leading. I’ve said all along that both Apple and Samsung have very good customer satisfaction ratings. Some models beat other models, but they’re all pretty good. I like my Samsung phone very much. I own other Samsung products as well (five in total I think), all have been great.

Again, you act like a jilted lover who has to prove that your ex really wasn’t any good anyway. Was Apple mean to your mom, or maybe Apple kicked your dog? At any rate please have the last word.

Also, there is ONE ecosystem with an overwhelming and growing share. What does that tell you ?

The “brand loyalty ” thing is a FUDdy red herring: of course Android users switch OEMs, the possibility of switching OEMs is a very important point of the Android value proposition. OEM loyalty has 0 meaning as a gauge of ecosystem health/satisfaction, ecosytem loyalty is the measure. Sorry I had to explain that.

Ecosystem loyalty, or cost to enter/leave as well.

And this “explains” why no other flagships are growing?

When you attempt to explain something, it is often helpful to actually offer an explanation.

not it doesn’t “explain”, it merely clarifies that it is *not* because of higher user satisfaction. I do have a few ideas of other reasons, but “higher satisfaction” is provedly not it.

Edit: also, yes, other flagships are growing. Just not Samsung.

A truly excellent article!

Thank you. Your compliment is much appreciated.

I am not sure “crying wolf” is a suitable analogy to use, because the boy actually ended up being right once, just that nobody would listen to him because he had lost all his credibility.

That said, even a broken clock is right twice a day, and there is no finesse involved in simply repeating the same old “Apple is doomed” refrain, wait for Apple to (eventually) slip up and then go “Ah hah, I told you so.” People will remember the one time he was right, and forget all the times he was wrong.

Which is irritating.

But a slow clock is never right!

I have no idea what I mean by that.

Joe

Either is a fast one? 🙂

These analysts are like movie critics; just a blabbering mouth with an opinion. And you know what they say: “if you can’t do, review”. This entire system is just another part of the “Wallstreet” zero-sum-scam with these parasites guessing as to what corporations have in the forecast. There should be a downside when analysts are wrong. Great article.

If I had a dollar for every ‘Apple is doomed” article I’ve read, I’d be well invested in Apple stock.

Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market. ~ Warren Buffett

Stocks go up, stocks go down. Probably the biggest joke in the stock market over the last fifty years has been the rise and then the fall of efficient market theory. Easily dis-proved with a simple thought experiment, it tried to make the case that all stocks were always fairly priced. This is so clearly not true that for it to have been taken seriously was ludicrous.

What surprises me is the level of hand-wringing by even long-term Apple shareholders when in one of these periods of low valuations. I try to make the case that low valuations are a good thing for investors: Apple can buy back its own stock at reduced prices, it can issue dividends at a higher yield, it has a higher earnings yield, you can buy additional shares at lower prices, and after all that, there is the promise of outsized future gains (whereas high valuations lead to under-sized future gains). People in the market should understand these things, and they should *fully* internalize Buffett’s above remark. They should experience no pain at a time like this, especially since gains over any reasonable period of time (2+ years) have been excellent.

It’s those who hold high-P/E stocks like Amazon and even MSFT/GOOG who should worry.

The second-biggest joke in the stock market over the last fifty years has got to be on those who have sold Apple at recent prices.

Yep, our family invested a reasonable chunk in Apple shortly after the iPhone launch. We’ve made about 8 times our initial investment so far. We’re not selling.

I recently tried CBD gummies because the from the word go [url=https://www.cornbreadhemp.com/products/cbd-balm]cbd balm for pain[/url] circumstance and they exceeded my expectations. The dash was charming, and they helped me unwind and relax. My uneasiness noticeably decreased, and I felt a sanity of whole well-being. These gummies are for the time being a staple in my self-care routine. Hugely propose for a talent and balsamic experience.

I recently embarked on a journey to increase autoflower weed seeds recompense the beginning in good time, and it was an incredibly [url=https://trilogeneseeds.com/collections/cheap-cannabis-seeds]cheap marijuana seeds for sale[/url] enriched experience. As a beginner, I was initially apprehensive, but the process turned out like a light to be surprisingly straightforward. Beginning off, the germination phase was mellow sailing. The seeds sprouted shortly, and their vigor was impressive. I followed the recommended guidelines anent lighting, nutrients, and watering, and the plants responded positively. Whole of the biggest advantages of autoflowering strains is their know-how to automatically transformation from vegetative development to flowering, regardless of light cycle.

I recently embarked on a pilgrimage to multiply autoflower weed seeds for the first time, and it was an incredibly enriched experience. As a beginner, I was initially apprehensive, but the alter https://trilogeneseeds.com/collections/cheap-cannabis-seeds turned out like a light to be surprisingly straightforward. Before all off, the germination configuration was velvety sailing. The seeds sprouted quickly, and their vigor was impressive. I followed the recommended guidelines anent lighting, nutrients, and watering, and the plants responded positively. A particular of the biggest advantages of autoflowering strains is their ability to automatically transformation from vegetative development to flowering, regardless of beat cycle.

I do not even understand how I ended up here, but I assumed this publish used to be great

Very nice blog post. I definitely love this site. Stick with it!

There is definately a lot to find out about this subject. I like all the points you made

I gave cbd oil a strive for the first patch, and I’m amazed! They tasted tremendous and provided a wisdom of calmness and relaxation. My urgency melted away, and I slept bigger too. These gummies are a game-changer someone is concerned me, and I extraordinarily recommend them to anyone seeking natural emphasis on assuagement and larger sleep.