Why Apple dominates smartphone revenues but may need some lower priced models to keep growing their services business.

Not long after Steve Jobs came back to Apple in 1997, I had a couple of talks with him that ranged from how he was going to save Apple to what some of his guiding principles would be when it came to bringing Apple back from the brink of bankruptcy.

At the time he re-joined Apple, I had been spending time with current Apple CEO, Bill Amelio looking at ways he could keep Apple afloat and get it out of its downward spiral.

In my first meeting with Jobs, which took place the second day he was in the role of CEO or interim CEO as he liked to say, he told me that one of the guiding principles for making Apple relevant again was to focus on industrial design. At the time I questioned this focus, but as history has shown, industrial design has indeed played a key role in bringing Apple back from the brink of disaster.

A few weeks later, when I bumped into him at the Apple Campus, I asked a follow-up question to that first meeting and asked his view about margins. I had had this discussion with him before he left Apple in 1985 where his goal was to price any product Apple brought to market in the 22% and above range. Interestingly, that seemed low at the time as these were the early days of the PC and margins were closer to 35%-40% in those days. If I remember correctly, Mac’s margins were in these same ranges at that time too.

By the time Jobs returned to Apple in 1997, PC margins had shrunk to under 20%, and today, in some cases, those margins are closer to 5%. Apple’s margins on Mac’s, smartphones and most hardware products continue to be in the 35-37% range continuously.

I attribute this to two main factors-

1-Jobs’ initial goal of having margins of at least 22% and that being engrained into their leadership rules that guide Apple’s current management team. To their credit, Apple’s CEO and his team probably look at that 22% as lowest margin rate they would ever have on any product they ship.

2-Apple has always aimed to be the premium provider of any product they bring to market in any category. This is not news to anyone who follows Apple since this has been in their DNA since the Mac was introduced in 1984. With a premium focus on anything they make, premium pricing comes along with that and Apple makes no apologies for creating and delivering the best of breed on everything they ship. The new HomePod is an excellent example of this strategy.

Unlike other home speakers whose focus is on providing an assistant in low-end speaker designs, Apple went with a DNA based product in which the quality of the speaker was critical to their premium design thinking. Yes, they have a lot of work to do to get SIRI up to par with some of the voice assistants from others, but the AI engine is getting smarter, and with the dedicated specialty microphones tied to SIRI, Apple’s HomePod will get better over time.

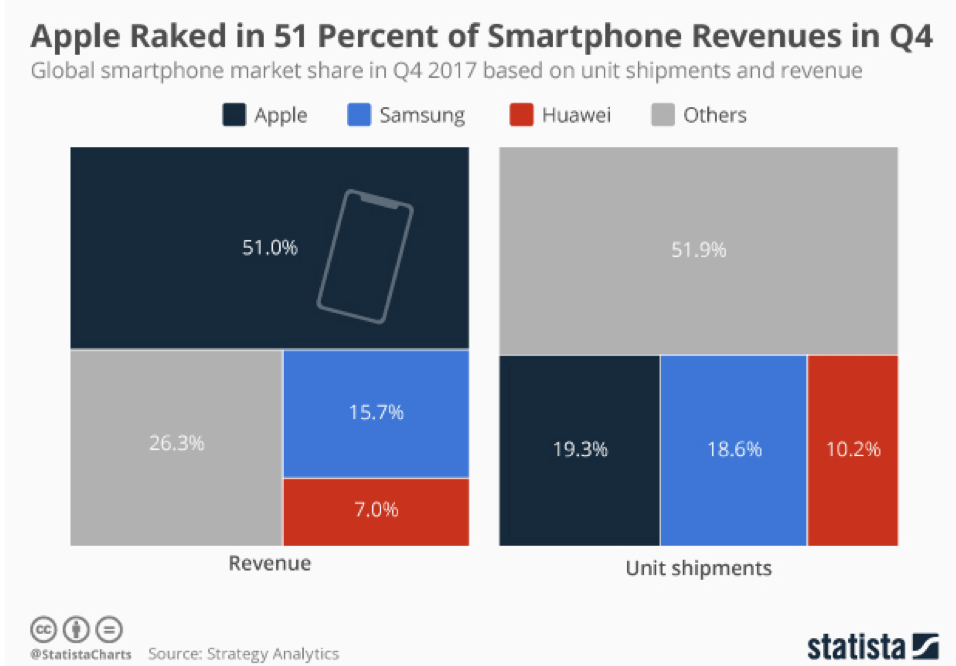

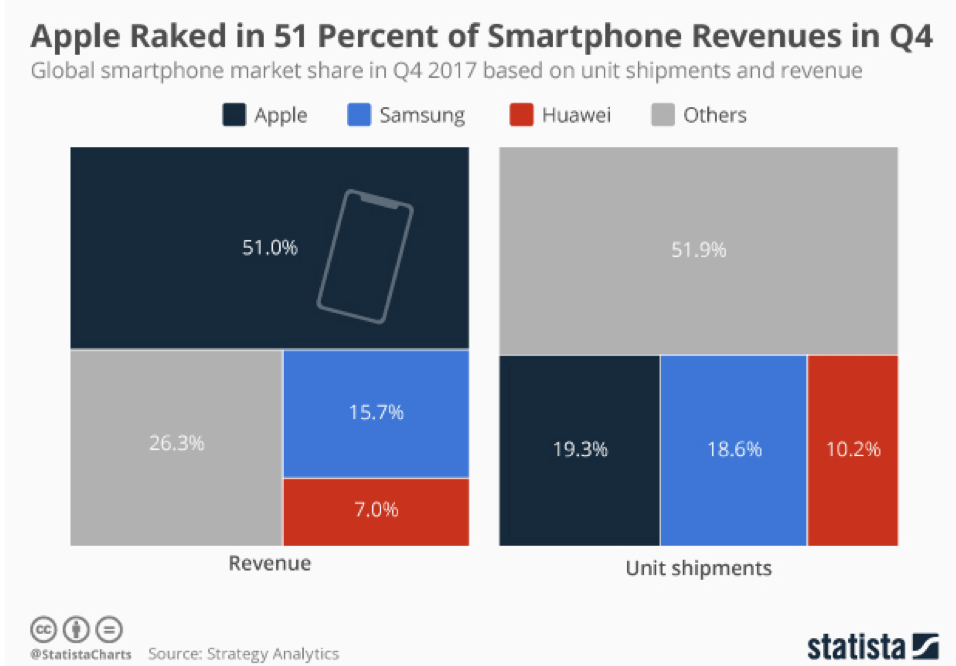

The chart below emphasizes how Apple’s focus on premium and commitment to healthy margins impact their market position regarding smartphone revenue. Apple had the lions share of smartphone revenues in the last reported quarter. Samsung was #2 with 15.7 % of all smartphone revenue in the same quarter. Even the other category, which represents hundreds of millions of smartphones but with much lower ASP’s, were only 26.3% of this category.

Apple’s total revenue growth is also impressive. Apple’s Q1 (Sept to Dec 2017) broke records again in almost all categories. This reflects Apples focus on premium products with higher margins.

While I don’t believe Apple will deviate much from their premium products and high margin strategy that has served them well for decades, I have lately been wondering if we could see a bit of a shift in pricing over the next few years. If you look at the services category in the chart above, this segment of their business is one that is multiplying. Services brought in $8.5. Billion in revenue last quarter and continues to grow.

However, it is growing because it is tied to hundreds of millions of iOS devices, which include iPhones, iPads, iPods and Macs of all flavors. For services to continue to grow, Apple needs to continue to see hundreds of millions of new iOS devices sold year after year.

Today’s premium pricing serves Apple well today, but I believe there will be a time when Apple will need to rethink pricing for future smartphones and perhaps even iPads and Mac’s that have lower ASP’s and thus lower margins if they want to keep their services business growing. If and when that will happen is anybody’s guess, but Apple and Wall Street understand that their services business is a critical part of Apple’s future growth and for it to keep growing it will need to be connected to more and more iOS devices in the future.

Premium products and premium pricing can always drive the lions to share of profits, but I believe Apple may have to create a range of products that have lower ASP’s and slightly lower margins if they want to keep seeing their services business expand and grow and remain a big contributor to their bottom line.