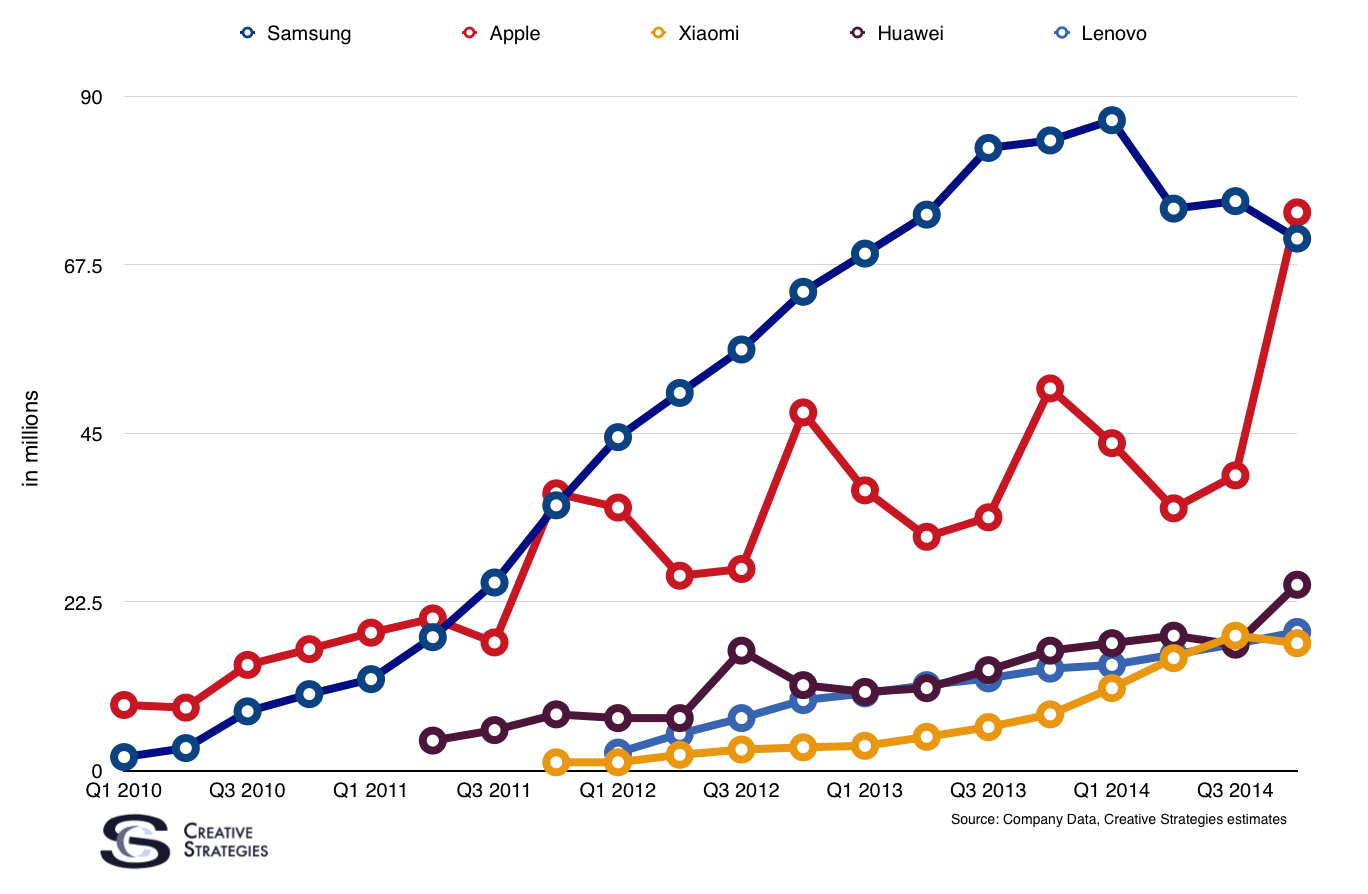

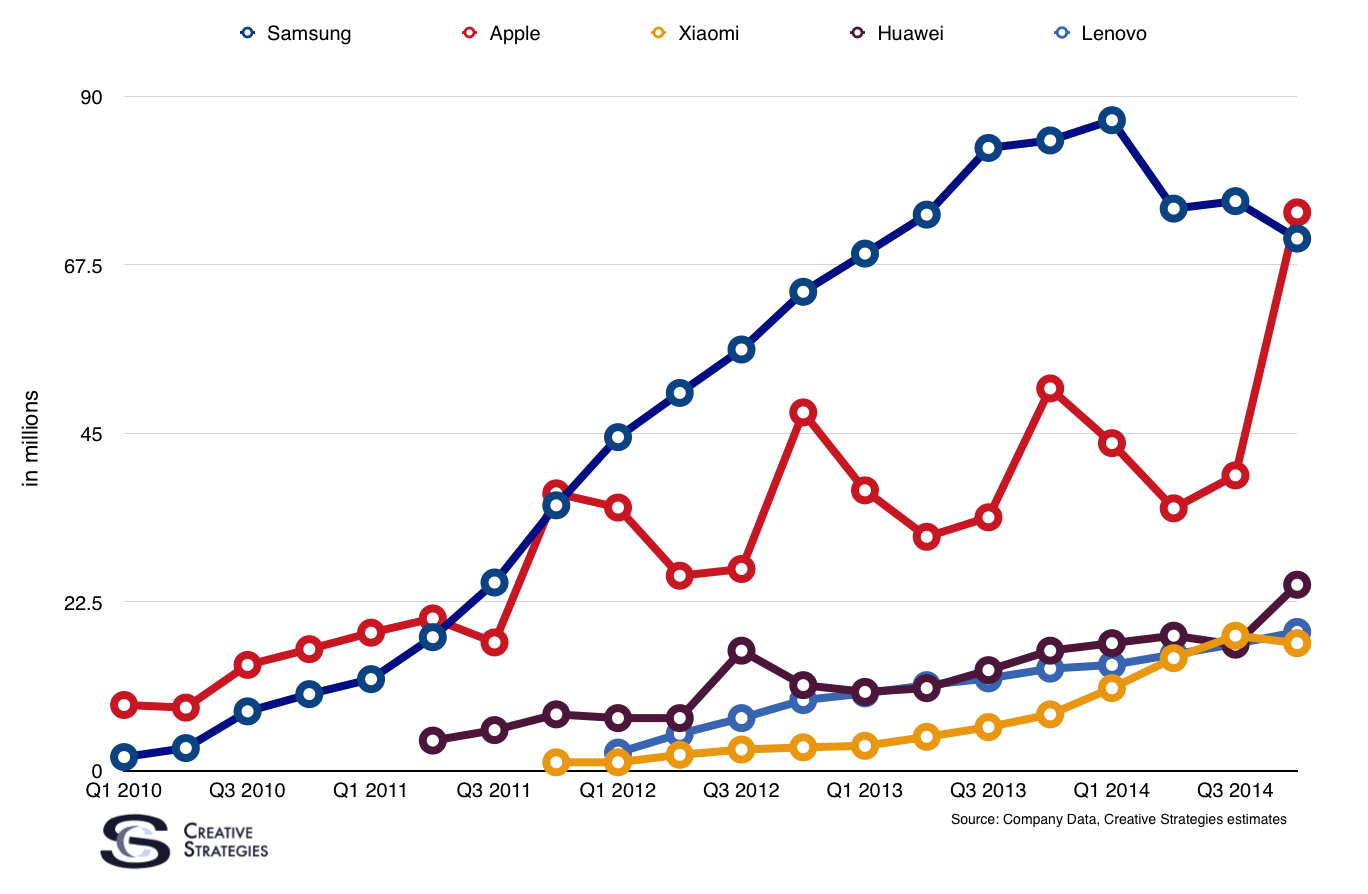

In the December quarter, Apple became the largest seller of smart phones in the world for the first time. Here is my tweet from September 4th.

So I can’t say I’m shocked. Yet, with a number of analyst firms reporting or about to report we are getting confirmation Apple did indeed pass Samsung in sales last quarter.

You can expect some mild disagreement with this claim. Counterpoint has come in and given the lead spot to Apple. While Strategy Analytics has called it a “shipment” tie. Granted, the Strategy Analytics headline acknowledges Apple as the top vendor, since Apple sold through their number and Samsung did not. I also expect Gartner and IDC to come in around this range for Samsung shipments. The takeaway is it was close. However, one thing no one at any of the firms will deny is Apple did, in fact, sell more smart phones than Samsung.

I prefer to base my models attempting to track sell through. I have access to live device data which helps me put parts of this puzzle together. From all the sources I have, and trying to get closer to sell through by the vendors, this is where I landed.

For Tech.pinions subscribers next week, I’ll do a deep dive on the December quarter smart phone data and detail the implications pointed out in my global model as well as look at some updated installed base estimates.

While an impressive feat, last quarter’s iPhone numbers are further evidence Apple defies conventional wisdom. Certainly, Samsung will be number one again next quarter. There are also certain questions circulating around Apple sustaining this growth as Bob O’Donnell goes into here for our subscribers. What we have to recognize is the trend lines. Trend lines, followed by sound study of global markets, is what gives us insight into not just current trajectories but future ones as well. Ultimately, that is what matters in this analysis. A good analysis is not just a snapshot in time but sheds insight into where things may go. This is where the focus will lie as we analyze the key story lines for 2015. Luckily, using sound data models, we can develop more educated insights about what lies ahead.

Apple’s success may be good for the company but not for its customers. For quite awhile now, when you call their Support line you’re always told “There’s currently an extended wait time to speak to an Advisor.” They used to say “15 minutes” but now they don’t even give a number, which means it could be more than 15 minutes! Their formerly wonderful customer service has deteriorated and that’s not a good trend.

This is a very good point. Had to have an issue fixed with my wife’s iPhone. Clicked to make an appointment and it was two days away. Pretty crazy.

Of course. You get much better results calling your android manufacturer with a problem.

This is as much, if not more so, a Samsung story. Their sales began declining well before the launch of the iPhone 6 which suggests they are losing a lot of ground in the lower end of the market. Is there any data to suggest Samsung’s sales will improve any time soon?

It really depends on the moves Samsung makes. However, one thing I am having to lean toward as a conclusion, is that Samsung essentially has no choice but to forfeit the premium sector. Which means they will start doing things to move volume, thus shipments could return but ASP will be way down. I don’t think the ASP or margins are maintainable at this point.

Samsung’s trajectory is steeper downward that Apple’s is upward. SO they will meet in the middle sometime this year. But it is an interesting question to tease out, but it is possible Apple could sell more smartphones than Samsung in 2015.

Fascinating story to watch.

If Samsung has no choice to forfeit the premium sector, what about HTC and LG? Will they forfeit that sector too?

Things are starting to look a bit crazy.

My thesis is modular companies can’t compete in premium. There may be some caveats I can develop, but I don’t feel it applies here.

I vote “Yes!”

They can all still go after it. And they can all still offer premium smartphones. But to “forfeit the sector” you have to “have” it first. So, some of the players already forfeit it major shares of it to Samsung. And, contrary to conventional “wisdom”, Samsung is showing that it isn’t able to hang onto it, either.

Why is it “that Samsung essentially has no choice but to forfeit the premium sector”? Is it largely because they have no ecosystem or control over/differentiation due to software?

Could be both.

If you recall this thing I wrote, it gives the basics. http://techpinions.com/samsungs-cautionary-tale/35415

My favorite line, is when you ship someone else’s software,(which your competitors use) you are only as good as your lowest priced competitor.

“..Samsung essentially has no choice but to forfeit the premium sector.”

And yet as you write this, Huawei has decided to focus on the premium sector in smartphones.

And Huawei will fail. Just like all the Windows PC manufacturers who tried to sell premium priced PCs failed. It’s the race to the bottom among manufacturers who offer the same OS –the other guy can always grab market share from you by pricing their widget just a little less than yours.

“Just like all the Windows PC manufacturers who tried to sell premium priced PCs failed.”

Can’t say if Huawei will fail or not, but Lenovo sells premium-priced PC’s and they’re growing at a healthy rate with decent profit.

Premium for Windows PCs but not really in the Mac’s neighborhood. I don’t think their margins come close at all to Apple’s Mac margins. Correct me if I’m wrong.

Agree that Lenovo sells very nice and well thought out Thinkpads. I’m not sure how well they’re selling, but I think that it’s doing ok.

As for Sony, they also used to do quite well with their Vaio line. Hence I don’t think it’s as simple as “If you don’t own the software, you’re always screwed”. It is much more nuanced.

What I think is different is that Windows was much more dominant and essentially unchallenged. Unlike Android, Windows was also strong with the most profitable customers. The Windows platform had customers who valued premium products. Therefore it was possible to sell premium product to them.

The problem in smartphones is that customers who value premium experiences do not seem to choose Android in the first place. That’s why Android OEMs can’t charge premium prices, whatever they try.

In other words, when Windows was dominant and thriving, Windows OEMs were differentiating among themselves. Companies that made premium hardware offerings could command premium prices (of course not as high as Apple’s margins, but substantial nonetheless).

In the Android world, to be a premium brand, it is no longer enough to offer the best Android hardware. You have to compete with Apple, and Google has not provided you with enough ammunition to do that. Competing with Apple is a battle that Android OEMs cannot win. The only thing left is to battle it out in the less profitable mid- to low-end tiers.

With PCs, OEMs competed among themselves. With smartphones, they have to compete with Apple for the premium segment.

What this perspective tells us is that if Android was better, dominant and was more popular in the premium segments, then there would be room for Android OEMs to differentiate and profit from these customers. Thus if Apple for some reason suddenly falls back to the Sculley/Gassee dark ages, then Android OEMs will regain profitability, despite using the same OS.

Yes my friend. You’re correct. Because the real, the substantial, value added of any tool…is the user and what THEY can do with it. THEIR creativity and resourcefulness.

The race to the bottom has put powerful computer’s everywhere, not just in the “best customers” hands.

Eh, I’m not going to be drawn into this

the-best-computer-is-the-one-you-can-meticulously-customize-to-fit-your-most-idiosyncratic-user-requirements

versus

the-best-computer-is-the-one-that-just-let’s-you-plunge-into-your-work-without-need-for-very-fine-tweaking-and-tinkering.

As did Sony. It doesn’t seem to have worked out for them. At least not yet.

I think it is important to underscore how Apple fired on at least two fronts–Innovation with #iPhone6 and 6 plus. More important is that they managed the supply chain brilliantly on a global basis and execute that Tim Cook is famous for. Many companies introduce products but the real question is becomes if they can execute at scale. Clearly Samsung could manage it volume (but not so much profits). Can Microsoft execute its Surface Pro at scale? The unsung part of Apple is its flawless execution that it has clearly improved from iPhone 4 to 5 and now 6 and 6 Plus. @NVenkatraman

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

Superb post however I was wanting to know if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit more.

http://withoutprescription.guru/# buy prescription drugs online without

https://mexicopharm.shop/# buying prescription drugs in mexico

mexico pharmacies prescription drugs: п»їbest mexican online pharmacies – mexico pharmacies prescription drugs

cheap propecia: buying propecia without prescription – get cheap propecia pill

http://canadapharm.top/# canada discount pharmacy

buy ed pills: cures for ed – ed dysfunction treatment

viagra without doctor prescription amazon: viagra without a doctor prescription – ed meds online without doctor prescription

https://canadapharm.top/# canadian pharmacies compare

over the counter erectile dysfunction pills: mens ed pills – ed drugs

can i order clomid online: can you get cheap clomid without insurance – can i buy clomid without insurance

https://sildenafil.win/# 100 mg sildenafil cost

new ed pills: cheapest ed pills online – pills erectile dysfunction

tadalafil online no prescription buy cheap tadalafil online tadalafil soft

http://kamagra.team/# Kamagra 100mg price

ed treatment pills: ed drugs compared – medicine for impotence

Kamagra tablets sildenafil oral jelly 100mg kamagra Kamagra Oral Jelly

tadalafil online prescription: tadalafil online cost – tadalafil tablets 10 mg online

http://kamagra.team/# super kamagra

http://kamagra.team/# Kamagra 100mg price

tadalafil 2.5 mg tablets india tadalafil 2.5 mg price 20 mg tadalafil cost

Kamagra tablets: Kamagra 100mg price – Kamagra tablets

best non prescription ed pills: ed pills otc – ed medication

tadalafil 2.5 mg tablets tadalafil price comparison tadalafil tablets price in india

https://edpills.monster/# best ed medications

https://tadalafil.trade/# tadalafil 2.5 mg cost

top erection pills best treatment for ed best erection pills

amoxicillin over the counter in canada purchase amoxicillin online buy amoxil

amoxicillin buy canada: buy amoxil – amoxicillin 500mg for sale uk

doxycycline pills price in south africa Buy doxycycline hyclate doxycycline cost united states

buy cipro online: buy ciprofloxacin online – ciprofloxacin generic price

https://azithromycin.bar/# where can i buy zithromax in canada

canadian pharmacy doxycycline: buy doxycycline over the counter – cheap doxy

zithromax online paypal: zithromax z-pak – generic zithromax 500mg india

http://lisinopril.auction/# prinivil 10 mg tab

how to buy amoxycillin buy amoxil amoxicillin 500 mg capsule

discount zestril: Lisinopril 10 mg Tablet buy online – lisinopril uk

http://ciprofloxacin.men/# buy cipro without rx

zithromax buy online no prescription: buy zithromax canada – zithromax antibiotic

generic amoxicillin online purchase amoxicillin online amoxicillin price without insurance

https://amoxicillin.best/# amoxicillin generic brand

doxycycline hyc: Buy Doxycycline for acne – where to get doxycycline in singapore

where can i buy cipro online: ciprofloxacin without insurance – cipro

https://amoxicillin.best/# amoxicillin 500 mg tablets

online pharmacy india: Online medicine order – buy medicines online in india

http://canadiandrugs.store/# canadian pharmacy 24

buying prescription drugs in mexico: mexico pharmacy – purple pharmacy mexico price list

pharmacy: buy drugs online – medication without prior prescription

mexican rx online: mexican pharmacy – purple pharmacy mexico price list

top 10 pharmacies in india pharmacy website india Online medicine home delivery

https://canadiandrugs.store/# buy canadian drugs

my canadian pharmacy: certified canadian pharmacy – online pharmacy canada

https://canadiandrugs.store/# is canadian pharmacy legit

http://clomid.club/# clomid without a prescription

buy ventolin over the counter with paypal: Ventolin inhaler online – can i buy ventolin over the counter uk

https://clomid.club/# how to buy generic clomid without prescription

wellbutrin adhd: Wellbutrin prescription – 150 mg wellbutrin

http://claritin.icu/# ventolin 4mg tab

Paxlovid buy online: Paxlovid buy online – paxlovid india

paxlovid price http://paxlovid.club/# paxlovid india

https://wellbutrin.rest/# buy wellbutrin australia

ventolin capsule: buy ventolin over the counter australia – can you buy ventolin over the counter in uk

http://wellbutrin.rest/# wellbutrin 150 mg generic

paxlovid pharmacy: Paxlovid buy online – paxlovid cost without insurance

https://claritin.icu/# ventolin australia prescription

п»їpaxlovid: paxlovid club – Paxlovid buy online

https://clomid.club/# can i purchase clomid now

farmacie online autorizzate elenco: kamagra gel prezzo – farmacia online miglior prezzo

acquisto farmaci con ricetta farmacia online piu conveniente п»їfarmacia online migliore

farmacia online: avanafil – comprare farmaci online all’estero

farmacia online miglior prezzo Farmacie a roma che vendono cialis senza ricetta comprare farmaci online con ricetta

comprare farmaci online all’estero: Cialis senza ricetta – acquisto farmaci con ricetta

https://kamagrait.club/# farmacia online migliore

esiste il viagra generico in farmacia alternativa al viagra senza ricetta in farmacia viagra originale in 24 ore contrassegno

farmacie online sicure: avanafil spedra – п»їfarmacia online migliore

https://tadalafilit.store/# п»їfarmacia online migliore

farmacia online piГ№ conveniente acquistare farmaci senza ricetta п»їfarmacia online migliore

https://tadalafilit.store/# farmacia online piГ№ conveniente

farmacia online miglior prezzo: cialis prezzo – migliori farmacie online 2023

https://tadalafilit.store/# farmacie on line spedizione gratuita

farmaci senza ricetta elenco avanafil spedra farmacia online

farmacia online madrid vardenafilo farmacia online internacional

https://farmacia.best/# п»їfarmacia online

п»їfarmacia online mejores farmacias online farmacia barata

sildenafilo 100mg precio farmacia: sildenafilo precio – viagra online cerca de toledo

https://farmacia.best/# farmacia online 24 horas

farmacia envГos internacionales: comprar cialis online sin receta – farmacias baratas online envГo gratis

http://vardenafilo.icu/# farmacia barata

farmacias baratas online envГo gratis: Comprar Cialis sin receta – farmacia online 24 horas

http://kamagraes.site/# farmacia online barata

http://kamagraes.site/# farmacia online

farmacias online seguras: vardenafilo – farmacia online internacional

https://sildenafilo.store/# viagra para hombre venta libre

farmacia online madrid se puede comprar kamagra en farmacias farmacias online seguras

http://kamagraes.site/# farmacia online madrid

http://tadalafilo.pro/# farmacia online

farmacias baratas online envГo gratis: Comprar Cialis sin receta – farmacia online envГo gratis

п»їfarmacia online gran farmacia online farmacia online madrid

farmacia 24h: farmacias online seguras – farmacia online barata

https://farmacia.best/# farmacias online seguras en españa

https://farmacia.best/# п»їfarmacia online

farmacias baratas online envГo gratis: Levitra sin receta – farmacia 24h

viagra para hombre precio farmacias comprar viagra viagra para hombre precio farmacias

SildГ©nafil Teva 100 mg acheter Meilleur Viagra sans ordonnance 24h Acheter viagra en ligne livraison 24h

farmacias baratas online envГo gratis: cialis 20 mg precio farmacia – farmacias online seguras

acheter mГ©dicaments Г l’Г©tranger: levitra generique – Pharmacie en ligne livraison gratuite

Viagra prix pharmacie paris Viagra generique en pharmacie SildГ©nafil Teva 100 mg acheter

farmacias baratas online envГo gratis: mejores farmacias online – farmacias online seguras

Pharmacies en ligne certifiГ©es: acheter medicament a l etranger sans ordonnance – Acheter mГ©dicaments sans ordonnance sur internet

Pharmacie en ligne livraison rapide Levitra 20mg prix en pharmacie п»їpharmacie en ligne

farmacia 24h: farmacia online barata y fiable – farmacia 24h

Pharmacie en ligne sans ordonnance: kamagra en ligne – Pharmacie en ligne pas cher

farmacia 24h: Comprar Levitra Sin Receta En Espana – farmacias baratas online envГo gratis

Viagra sans ordonnance 24h Amazon Quand une femme prend du Viagra homme Quand une femme prend du Viagra homme

Pharmacie en ligne pas cher: pharmacie en ligne sans ordonnance – acheter mГ©dicaments Г l’Г©tranger

https://kamagrafr.icu/# Pharmacie en ligne fiable

pharmacie ouverte Levitra 20mg prix en pharmacie Pharmacie en ligne livraison 24h

https://cialiskaufen.pro/# online apotheke gГјnstig

online apotheke preisvergleich Potenzmittel fur Manner п»їonline apotheke

http://cialiskaufen.pro/# online apotheke versandkostenfrei

https://viagrakaufen.store/# Viagra kaufen ohne Rezept legal

online apotheke preisvergleich cialis kaufen п»їonline apotheke

http://apotheke.company/# online apotheke preisvergleich

http://potenzmittel.men/# online apotheke gГјnstig

online apotheke preisvergleich versandapotheke versandapotheke deutschland

https://viagrakaufen.store/# Viagra online kaufen legal in Deutschland

versandapotheke versandkostenfrei: potenzmittel ohne rezept – versandapotheke

versandapotheke deutschland Online Apotheke Deutschland online apotheke versandkostenfrei

https://viagrakaufen.store/# Viagra Tabletten für Männer

https://cialiskaufen.pro/# online apotheke preisvergleich

п»їonline apotheke kamagra oral jelly online apotheke preisvergleich

https://cialiskaufen.pro/# online apotheke gГјnstig

http://apotheke.company/# online apotheke deutschland

https://mexicanpharmacy.cheap/# mexican border pharmacies shipping to usa

https://mexicanpharmacy.cheap/# buying from online mexican pharmacy

buying prescription drugs in mexico online best online pharmacies in mexico mexican mail order pharmacies

http://mexicanpharmacy.cheap/# best online pharmacies in mexico

best online pharmacies in mexico mexican drugstore online mexican pharmaceuticals online

http://mexicanpharmacy.cheap/# buying from online mexican pharmacy

https://mexicanpharmacy.cheap/# п»їbest mexican online pharmacies

buying from online mexican pharmacy mexican mail order pharmacies mexico pharmacies prescription drugs

http://mexicanpharmacy.cheap/# reputable mexican pharmacies online

mexican border pharmacies shipping to usa best online pharmacies in mexico mexican border pharmacies shipping to usa

http://mexicanpharmacy.cheap/# buying from online mexican pharmacy

http://mexicanpharmacy.cheap/# mexican rx online

mexican pharmaceuticals online buying prescription drugs in mexico pharmacies in mexico that ship to usa

safe reliable canadian pharmacy best canadian online pharmacy – canada pharmacy canadiandrugs.tech

http://mexicanpharmacy.company/# buying prescription drugs in mexico online mexicanpharmacy.company

canada pharmacy online legit canadian pharmacy in canada – online canadian drugstore canadiandrugs.tech

canadian drugs canadian drug stores canada pharmacy canadiandrugs.tech

top 10 pharmacies in india best india pharmacy – india pharmacy mail order indiapharmacy.guru

https://canadiandrugs.tech/# pharmacy rx world canada canadiandrugs.tech

http://canadiandrugs.tech/# canadian discount pharmacy canadiandrugs.tech

canadian pharmacy 24 canada pharmacy online legit – canadian pharmacy sarasota canadiandrugs.tech

buy medicines online in india best online pharmacy india indian pharmacy online indiapharmacy.guru

https://indiapharmacy.pro/# indian pharmacies safe indiapharmacy.pro

ed pills cheap erection pills online – new ed treatments edpills.tech

http://indiapharmacy.guru/# india pharmacy mail order indiapharmacy.guru

online pharmacy india online shopping pharmacy india buy medicines online in india indiapharmacy.guru

canadian online drugs canadian pharmacy 24 com – best canadian pharmacy canadiandrugs.tech

canadian 24 hour pharmacy pharmacy wholesalers canada – buying from canadian pharmacies canadiandrugs.tech

legit canadian pharmacy online canadian pharmacy online canadian pharmacy 24 canadiandrugs.tech

https://edpills.tech/# non prescription ed pills edpills.tech

non prescription ed drugs cheapest ed pills – ed drugs list edpills.tech

https://canadiandrugs.tech/# canadian pharmacy 24h com safe canadiandrugs.tech

http://edpills.tech/# ed drugs list edpills.tech

best online pharmacy india indian pharmacy online indian pharmacy online indiapharmacy.guru

pharmacy website india mail order pharmacy india – best online pharmacy india indiapharmacy.guru

http://mexicanpharmacy.company/# pharmacies in mexico that ship to usa mexicanpharmacy.company

https://canadiandrugs.tech/# canadian pharmacy 24 canadiandrugs.tech

canadian pharmacies canadian pharmacy meds review canadian pharmacy world reviews canadiandrugs.tech

indian pharmacy best online pharmacy india – п»їlegitimate online pharmacies india indiapharmacy.guru

http://canadiandrugs.tech/# legit canadian online pharmacy canadiandrugs.tech

https://paxlovid.win/# paxlovid buy

clomid without prescription buy generic clomid no prescription how to get clomid price

prednisone 10 tablet: how can i get prednisone online without a prescription – prednisone 40 mg tablet

https://amoxil.icu/# amoxicillin order online

where to get generic clomid without rx: how to buy cheap clomid prices – how can i get cheap clomid without insurance

http://ciprofloxacin.life/# buy cipro online canada

can i get clomid online where to buy cheap clomid where can i buy generic clomid without a prescription

buy cipro online canada: buy cipro online canada – buy cipro online canada

where can i buy clomid no prescription can i purchase generic clomid clomid for sale

https://clomid.site/# order clomid without a prescription

prednisone uk: prednisone 20mg price in india – prednisone tablets 2.5 mg

order cheap clomid without rx: clomid without insurance – cost generic clomid without a prescription

paxlovid pill: paxlovid price – paxlovid generic

amoxicillin 775 mg amoxicillin 250 mg price in india buy cheap amoxicillin online

where can i get generic clomid without a prescription: can i buy cheap clomid without prescription – order clomid without rx

http://ciprofloxacin.life/# ciprofloxacin generic price

can we buy amoxcillin 500mg on ebay without prescription: buy cheap amoxicillin – amoxicillin 500mg for sale uk

where to buy cheap clomid pill: how can i get cheap clomid without insurance – can you buy cheap clomid for sale

https://ciprofloxacin.life/# buy cipro online canada

where can you buy prednisone prednisone canada prednisone 30 mg tablet

Paxlovid over the counter: Paxlovid over the counter – Paxlovid buy online

buy cipro online usa buy cipro online canada where can i buy cipro online

http://clomid.site/# where can i get clomid without rx

buy cipro without rx buy ciprofloxacin over the counter ciprofloxacin generic

https://clomid.site/# where can i buy generic clomid pills

amoxicillin buy online canada generic for amoxicillin buy amoxicillin 500mg capsules uk

http://amoxil.icu/# buy amoxicillin from canada

cost generic clomid how to get cheap clomid tablets – get generic clomid now

prednisone 300mg: prednisone 5 mg tablet cost – buy prednisone no prescription

where to get clomid price: cost of cheap clomid without a prescription – cost clomid tablets

http://amoxil.icu/# rexall pharmacy amoxicillin 500mg

https://ciprofloxacin.life/# buy cipro

http://zithromaxbestprice.icu/# zithromax 250 mg australia

http://doxycyclinebestprice.pro/# doxycycline 100mg

generic doxycycline: buy doxycycline online – doxycycline mono

tamoxifen brand name nolvadex for sale amazon common side effects of tamoxifen

Misoprostol 200 mg buy online: buy cytotec in usa – Cytotec 200mcg price

zithromax online no prescription: zithromax online no prescription – zithromax 500 mg for sale

http://doxycyclinebestprice.pro/# doxycycline 50 mg

zithromax tablets: buy zithromax online with mastercard – order zithromax without prescription

https://lisinoprilbestprice.store/# cost of generic lisinopril 10 mg

can you buy zithromax over the counter in mexico: average cost of generic zithromax – cheap zithromax pills

https://doxycyclinebestprice.pro/# doxycycline hydrochloride 100mg

lisinopril online uk buy lisinopril online canada buy lisinopril 10 mg online

lisinopril pill 20mg: 40 mg lisinopril – price lisinopril 20 mg

cytotec online: Misoprostol 200 mg buy online – cytotec pills buy online

https://lisinoprilbestprice.store/# lisinopril 20 mg discount

https://doxycyclinebestprice.pro/# doxylin

zestoretic medication: lisinopril 2016 – lisinopril 10 mg pill

https://doxycyclinebestprice.pro/# order doxycycline

2 lisinopril lisinopril without an rx cost of lisinopril 30 mg

tamoxifen joint pain: tamoxifen cancer – tamoxifen hip pain

tamoxifen and ovarian cancer: nolvadex only pct – nolvadex for pct

zithromax: where can i get zithromax over the counter – buy zithromax without prescription online

http://zithromaxbestprice.icu/# zithromax 250

doxycycline pills: doxycycline 50mg – purchase doxycycline online

https://cytotec.icu/# buy cytotec pills

purple pharmacy mexico price list: mexican pharmacy – buying from online mexican pharmacy mexicopharm.com

canadian pharmacy 365: Canada Drugs Direct – onlinepharmaciescanada com canadapharm.life

http://mexicopharm.com/# mexican drugstore online mexicopharm.com

Online medicine order: indian pharmacies safe – top 10 online pharmacy in india indiapharm.llc

п»їlegitimate online pharmacies india Online India pharmacy india online pharmacy indiapharm.llc

best canadian online pharmacy: onlinecanadianpharmacy – canadian pharmacy service canadapharm.life

https://indiapharm.llc/# india online pharmacy indiapharm.llc

canadian family pharmacy: Canada Drugs Direct – canadian pharmacy world canadapharm.life

https://indiapharm.llc/# india online pharmacy indiapharm.llc

mexican border pharmacies shipping to usa: Best pharmacy in Mexico – mexican pharmacy mexicopharm.com

mexico drug stores pharmacies: Medicines Mexico – mexican mail order pharmacies mexicopharm.com

http://mexicopharm.com/# medicine in mexico pharmacies mexicopharm.com

mexican rx online: Medicines Mexico – mexican drugstore online mexicopharm.com

reputable indian online pharmacy India Post sending medicines to USA reputable indian pharmacies indiapharm.llc

п»їlegitimate online pharmacies india: India Post sending medicines to USA – top online pharmacy india indiapharm.llc

online shopping pharmacy india: India Post sending medicines to USA – п»їlegitimate online pharmacies india indiapharm.llc

https://mexicopharm.com/# mexico drug stores pharmacies mexicopharm.com

my canadian pharmacy: Canada pharmacy online – best online canadian pharmacy canadapharm.life

http://mexicopharm.com/# mexico pharmacies prescription drugs mexicopharm.com

pharmacies in mexico that ship to usa: Purple Pharmacy online ordering – purple pharmacy mexico price list mexicopharm.com

mexican border pharmacies shipping to usa: Best pharmacy in Mexico – pharmacies in mexico that ship to usa mexicopharm.com

canadian pharmacy world: Canadian pharmacy best prices – adderall canadian pharmacy canadapharm.life

canadian pharmacies compare Canada Drugs Direct canadian pharmacy com canadapharm.life

https://canadapharm.life/# my canadian pharmacy reviews canadapharm.life

п»їlegitimate online pharmacies india: Online India pharmacy – Online medicine home delivery indiapharm.llc

http://kamagradelivery.pro/# cheap kamagra

cheap 10 mg tadalafil: tadalafil without a doctor prescription – tadalafil tablets 20 mg online

purchase tadalafil online: cheap tadalafil canada – buy tadalafil cialis

best ed treatment pills ed pills online ed pills online

http://levitradelivery.pro/# Cheap Levitra online

buy generic tadalafil online cheap: Tadalafil 20mg price in Canada – tadalafil 5mg canada

http://levitradelivery.pro/# Buy Vardenafil 20mg

http://levitradelivery.pro/# Levitra online pharmacy

Vardenafil online prescription: Buy Levitra 20mg online – Buy Levitra 20mg online

http://edpillsdelivery.pro/# best ed drugs

Kamagra 100mg price: kamagra oral jelly – Kamagra 100mg price

Cheap Levitra online: Generic Levitra 20mg – Levitra online pharmacy

buy tadalafil 5mg online Tadalafil 20mg price in Canada 80 mg tadalafil

https://levitradelivery.pro/# Cheap Levitra online

Buy Vardenafil 20mg: Levitra best price – Levitra online pharmacy

Levitra online USA fast: Levitra 20 mg for sale – Buy Vardenafil 20mg

http://kamagradelivery.pro/# Kamagra 100mg

https://sildenafildelivery.pro/# sildenafil purchase

Generic Levitra 20mg: Levitra best price – Buy Vardenafil 20mg

Generic Levitra 20mg: Buy Levitra 20mg online – Levitra 20 mg for sale

http://tadalafildelivery.pro/# tadalafil pills 20mg

paxlovid india paxlovid covid paxlovid generic

minocycline hydrochloride: cheapest stromectol – ivermectin buy canada

https://prednisone.auction/# where to buy prednisone 20mg

https://prednisone.auction/# 54 prednisone

https://paxlovid.guru/# Paxlovid buy online

https://amoxil.guru/# can you buy amoxicillin over the counter in canada

paxlovid pharmacy Buy Paxlovid privately п»їpaxlovid

Paxlovid over the counter: Buy Paxlovid privately – paxlovid cost without insurance

http://clomid.auction/# where to buy cheap clomid no prescription

http://prednisone.auction/# order prednisone with mastercard debit

https://prednisone.auction/# prednisone without prescription

https://prednisone.auction/# otc prednisone cream

generic amoxil 500 mg: amoxicillin 750 mg price – where to buy amoxicillin 500mg

https://clomid.auction/# buy generic clomid without insurance

Paxlovid buy online paxlovid best price paxlovid buy

https://paxlovid.guru/# paxlovid

paxlovid cost without insurance: paxlovid price without insurance – п»їpaxlovid

http://paxlovid.guru/# paxlovid india

https://stromectol.guru/# stromectol xl

https://finasteride.men/# buying generic propecia without prescription

https://lisinopril.fun/# lisinopril medication generic

zithromax online pharmacy canada: zithromax best price – generic zithromax 500mg

propecia tablets: cheap propecia online – propecia pills

http://finasteride.men/# cost of cheap propecia without rx

propecia tablets Cheapest finasteride online cost of propecia no prescription

where can i purchase zithromax online: cheapest azithromycin – where to get zithromax over the counter

http://furosemide.pro/# lasix 100 mg

http://finasteride.men/# buy cheap propecia prices

http://lisinopril.fun/# buy cheap lisinopril 40mg

zestril 20 mg tab: High Blood Pressure – lisinopril 10mg tablet

https://misoprostol.shop/# purchase cytotec

lisinopril pills 10 mg: buy lisinopril online – buy lisinopril 20 mg online

how to buy zithromax online buy zithromax over the counter generic zithromax online paypal

prinivil price: buy lisinopril online – lisinopril pill

https://lisinopril.fun/# zestril price in india

buy cytotec pills online cheap: buy misoprostol – п»їcytotec pills online

https://azithromycin.store/# zithromax online usa

http://furosemide.pro/# furosemide

cost cheap propecia buy propecia cost propecia without rx

cytotec buy online usa: cheap cytotec – order cytotec online

prinivil drug: buy lisinopril online – lisinopril 20 25 mg

lisinopril discount: over the counter lisinopril – lisinopril 10 india

http://misoprostol.shop/# buy cytotec

price of zestril: buy lisinopril canada – 50mg lisinopril

https://misoprostol.shop/# Abortion pills online

propecia pill buying cheap propecia without dr prescription buy generic propecia without prescription

get propecia tablets: Buy Finasteride 5mg – cost of cheap propecia now

lisinopril online canada: buy lisinopril canada – 10 mg lisinopril tablets

http://misoprostol.shop/# buy cytotec pills

https://misoprostol.shop/# buy cytotec in usa

buy cytotec over the counter: Misoprostol best price in pharmacy – buy misoprostol over the counter

http://misoprostol.shop/# buy cytotec

lasix 100 mg tablet Buy Furosemide lasix for sale

https://finasteride.men/# propecia sale

lisinopril 40 mg mexico: over the counter lisinopril – lisinopril without an rx

https://finasteride.men/# cost of propecia

get generic propecia pills: Buy Finasteride 5mg – buy generic propecia

lisinopril tabs 20mg: cheapest lisinopril – buy lisinopril without prescription

esiste il viagra generico in farmacia viagra prezzo farmacia le migliori pillole per l’erezione

farmacia online miglior prezzo: kamagra gold – п»їfarmacia online migliore

http://sildenafilitalia.men/# siti sicuri per comprare viagra online

farmacia online miglior prezzo: farmacia online – comprare farmaci online con ricetta

http://avanafilitalia.online/# comprare farmaci online all’estero

alternativa al viagra senza ricetta in farmacia: viagra online siti sicuri – viagra online consegna rapida

https://sildenafilitalia.men/# viagra naturale in farmacia senza ricetta

http://kamagraitalia.shop/# farmacia online migliore

farmacia online senza ricetta: avanafil generico – farmacia online miglior prezzo

comprare farmaci online all’estero kamagra gold п»їfarmacia online migliore

http://sildenafilitalia.men/# esiste il viagra generico in farmacia

farmacie online sicure: Tadalafil generico – farmacia online piГ№ conveniente

viagra online spedizione gratuita: viagra generico – alternativa al viagra senza ricetta in farmacia

farmacia online senza ricetta: kamagra oral jelly consegna 24 ore – farmacie online affidabili

viagra naturale viagra prezzo kamagra senza ricetta in farmacia

acquistare farmaci senza ricetta: kamagra gel prezzo – farmacie online autorizzate elenco

https://tadalafilitalia.pro/# farmacie on line spedizione gratuita

https://tadalafilitalia.pro/# farmacie on line spedizione gratuita

acquistare farmaci senza ricetta kamagra oral jelly acquistare farmaci senza ricetta

https://sildenafilitalia.men/# farmacia senza ricetta recensioni

http://sildenafilitalia.men/# dove acquistare viagra in modo sicuro

farmacia online migliore: avanafil spedra – п»їfarmacia online migliore

viagra online spedizione gratuita: sildenafil 100mg prezzo – viagra originale recensioni

https://indiapharm.life/# Online medicine order

mexican border pharmacies shipping to usa: mexican drugstore online – п»їbest mexican online pharmacies

onlinepharmaciescanada com: canadian pharmacy ed medications – canadian online drugstore

reputable canadian pharmacy: canadian pharmacy – reliable canadian pharmacy reviews

https://mexicanpharm.store/# mexican rx online

northwest pharmacy canada legitimate canadian pharmacies reputable canadian pharmacy

http://canadapharm.shop/# canadian pharmacy meds

mexican pharmaceuticals online: buying prescription drugs in mexico – mexican drugstore online

mexican border pharmacies shipping to usa: buying from online mexican pharmacy – mexico pharmacies prescription drugs

http://indiapharm.life/# top online pharmacy india

canadian online pharmacy: canadian pharmacy victoza – canada ed drugs

canada drugs: canada online pharmacy – safe canadian pharmacy

https://indiapharm.life/# reputable indian online pharmacy

medication canadian pharmacy: canada pharmacy online – canadapharmacyonline com

http://mexicanpharm.store/# best mexican online pharmacies

mexican online pharmacies prescription drugs purple pharmacy mexico price list medicine in mexico pharmacies

buy medicines online in india: п»їlegitimate online pharmacies india – online pharmacy india

https://canadapharm.shop/# canadian pharmacy phone number

india online pharmacy: reputable indian pharmacies – pharmacy website india

best online pharmacy india: mail order pharmacy india – best india pharmacy

п»їbest mexican online pharmacies: purple pharmacy mexico price list – mexican pharmaceuticals online

http://indiapharm.life/# indian pharmacy

rate canadian pharmacies: vipps approved canadian online pharmacy – canadian pharmacy antibiotics

http://canadapharm.shop/# online canadian pharmacy reviews

Online medicine order: best india pharmacy – indian pharmacy online

http://indiapharm.life/# indianpharmacy com

buying prescription drugs in mexico online: mexico drug stores pharmacies – mexico pharmacies prescription drugs

top 10 pharmacies in india buy medicines online in india indian pharmacy paypal

buying prescription drugs in mexico online: buying from online mexican pharmacy – mexican pharmacy

https://indiapharm.life/# buy medicines online in india

medication from mexico pharmacy: mexico drug stores pharmacies – reputable mexican pharmacies online

reliable canadian pharmacy reviews: is canadian pharmacy legit – canadian pharmacy meds review

https://mexicanpharm.store/# mexico drug stores pharmacies

mexican drugstore online: medication from mexico pharmacy – mexico pharmacies prescription drugs

http://mexicanpharm.store/# mexican border pharmacies shipping to usa

https://mexicanpharm.store/# pharmacies in mexico that ship to usa

http://prednisonepharm.store/# prednisone over the counter australia

pct nolvadex: tamoxifen for men – how does tamoxifen work

http://prednisonepharm.store/# prednisone 5 tablets

get cheap clomid: can i get cheap clomid tablets – how can i get clomid for sale

where can i buy clomid without rx get cheap clomid pills cost of generic clomid no prescription

https://clomidpharm.shop/# where can i get generic clomid

by prednisone w not prescription: prednisone 20 mg – buy 10 mg prednisone

http://prednisonepharm.store/# 5 mg prednisone daily

tamoxifen rash pictures: tamoxifen and antidepressants – where to get nolvadex

https://nolvadex.pro/# tamoxifen blood clots

Misoprostol 200 mg buy online Cytotec 200mcg price buy cytotec online

where can i buy nolvadex: tamoxifen and uterine thickening – tamoxifen chemo

http://prednisonepharm.store/# can you buy prednisone online uk

https://clomidpharm.shop/# how to buy generic clomid online

http://prednisonepharm.store/# prednisone 20

where can i get zithromax over the counter: zithromax online – buy zithromax without presc

https://prednisonepharm.store/# prednisone 20mg cheap

prednisone over the counter australia: prednisone purchase canada – buy prednisone no prescription

online order prednisone prednisone 50 mg buy prednisone 5 mg cheapest

https://prednisonepharm.store/# prednisone over the counter uk

best ed pills: online ed medications – erectile dysfunction drugs

order prescriptions http://reputablepharmacies.online/# online pharmacies reviews

canadian pharmacy prices

https://edwithoutdoctorprescription.store/# non prescription erection pills

https://edwithoutdoctorprescription.store/# best non prescription ed pills

canadian pharmacy ship to us: prescription meds without the prescription – pharmacy drug store online no rx

http://edpills.bid/# non prescription ed drugs

canadian pharmacy drug prices: canadian pharmacy no rx needed – reliable canadian pharmacy

online pharmacy canada: aarp approved canadian pharmacies – on line pharmacy with no prescriptions

http://edwithoutdoctorprescription.store/# prescription drugs

http://edwithoutdoctorprescription.store/# real cialis without a doctor’s prescription

prescription drugs online without doctor: cialis without doctor prescription – viagra without doctor prescription amazon

https://edpills.bid/# best ed treatment pills

prescription drugs online: buy cheap prescription drugs online – prescription meds without the prescriptions

viagra without doctor prescription: non prescription erection pills – buy prescription drugs

http://edwithoutdoctorprescription.store/# non prescription ed pills

п»їprescription drugs: non prescription erection pills – levitra without a doctor prescription

https://edwithoutdoctorprescription.store/# buy prescription drugs online

prescription drugs without doctor approval: legal to buy prescription drugs without prescription – non prescription ed pills

http://edpills.bid/# best pills for ed

http://mexicanpharmacy.win/# medicine in mexico pharmacies mexicanpharmacy.win

online pharmacy india: Best Indian pharmacy – cheapest online pharmacy india indianpharmacy.shop

http://canadianpharmacy.pro/# pharmacy canadian canadianpharmacy.pro

https://canadianpharmacy.pro/# canadian pharmacy com canadianpharmacy.pro

prescription drug prices comparison

canadian 24 hour pharmacy Canadian pharmacy online canadian medications canadianpharmacy.pro

canadian pharmacy review: Pharmacies in Canada that ship to the US – vipps canadian pharmacy canadianpharmacy.pro

https://canadianpharmacy.pro/# my canadian pharmacy reviews canadianpharmacy.pro

reputable indian online pharmacy: Cheapest online pharmacy – india online pharmacy indianpharmacy.shop

https://mexicanpharmacy.win/# mexican mail order pharmacies mexicanpharmacy.win

https://canadianpharmacy.pro/# canadian valley pharmacy canadianpharmacy.pro

http://indianpharmacy.shop/# buy medicines online in india

cheapest online pharmacy india

https://indianpharmacy.shop/# india pharmacy indianpharmacy.shop

canadian pharmacy prices Pharmacies in Canada that ship to the US canadianpharmacyworld com canadianpharmacy.pro

http://indianpharmacy.shop/# top 10 online pharmacy in india indianpharmacy.shop

nabp canadian pharmacy

mexico drug stores pharmacies: mexican pharmacy online – mexican pharmacy

http://indianpharmacy.shop/# best india pharmacy indianpharmacy.shop

https://canadianpharmacy.pro/# canadapharmacyonline com canadianpharmacy.pro

https://canadianpharmacy.pro/# ordering drugs from canada canadianpharmacy.pro

http://indianpharmacy.shop/# best india pharmacy indianpharmacy.shop

http://indianpharmacy.shop/# best india pharmacy indianpharmacy.shop

drugs without a prescription

https://canadianpharmacy.pro/# my canadian pharmacy review canadianpharmacy.pro

online pharmacy india

http://canadianpharmacy.pro/# canadian pharmacy near me canadianpharmacy.pro

http://indianpharmacy.shop/# indian pharmacy paypal indianpharmacy.shop

http://canadianpharmacy.pro/# legitimate canadian pharmacies canadianpharmacy.pro

best online canadian pharmacies

http://viagrasansordonnance.pro/# Viagra homme prix en pharmacie

http://pharmadoc.pro/# Pharmacie en ligne France

pharmacie ouverte

Pharmacie en ligne sans ordonnance: acheterkamagra.pro – Pharmacie en ligne pas cher

Viagra sans ordonnance pharmacie France: Acheter du Viagra sans ordonnance – Viagra homme sans prescription

https://viagrasansordonnance.pro/# Viagra sans ordonnance pharmacie France

pharmacie ouverte 24/24

Viagra Pfizer sans ordonnance Meilleur Viagra sans ordonnance 24h Viagra sans ordonnance 24h

https://levitrasansordonnance.pro/# Pharmacie en ligne sans ordonnance

http://viagrasansordonnance.pro/# Viagra pas cher livraison rapide france

Pharmacie en ligne sans ordonnance: kamagra en ligne – Pharmacies en ligne certifiГ©es

http://pharmadoc.pro/# pharmacie ouverte

https://cialissansordonnance.shop/# Pharmacie en ligne fiable

pharmacie ouverte 24/24

http://pharmadoc.pro/# Pharmacie en ligne livraison 24h

https://prednisonetablets.shop/# 50 mg prednisone tablet

stromectol 3mg: stromectol cvs – stromectol cost

where buy clomid no prescription: can i buy clomid prices – cost cheap clomid now

https://azithromycin.bid/# zithromax 1000 mg pills

https://prednisonetablets.shop/# prednisone sale

order clomid price: where to get clomid without rx – where to buy clomid no prescription

where to buy clomid tablets: can i purchase generic clomid tablets – can you get clomid without insurance

https://clomiphene.icu/# can you get generic clomid without dr prescription

prednisone 10 mg brand name: prednisone uk – generic prednisone online

https://amoxicillin.bid/# amoxicillin medicine

https://prednisonetablets.shop/# order prednisone with mastercard debit

https://clomiphene.icu/# cost of clomid pills

prednisone 1 mg for sale: buy prednisone 5mg canada – prednisone 50 mg tablet cost

http://clomiphene.icu/# cheap clomid prices

amoxicillin order online no prescription buy amoxicillin 500mg 875 mg amoxicillin cost

where to get generic clomid pill: can you get cheap clomid online – where to buy generic clomid without rx

https://clomiphene.icu/# order cheap clomid no prescription

https://mexicanpharm.shop/# medicine in mexico pharmacies mexicanpharm.shop

best online pharmacies in mexico: Online Mexican pharmacy – mexican rx online mexicanpharm.shop

reputable indian pharmacies: international medicine delivery from india – mail order pharmacy india indianpharm.store

http://indianpharm.store/# reputable indian pharmacies indianpharm.store

https://canadianpharm.store/# vipps canadian pharmacy canadianpharm.store

http://canadianpharm.store/# canadian pharmacy 1 internet online drugstore canadianpharm.store

canadian online pharmacy: Best Canadian online pharmacy – canadian world pharmacy canadianpharm.store

https://indianpharm.store/# best online pharmacy india indianpharm.store

http://canadianpharm.store/# online canadian drugstore canadianpharm.store

indian pharmacy: Indian pharmacy to USA – indian pharmacies safe indianpharm.store

online pharmacy india: international medicine delivery from india – indian pharmacy paypal indianpharm.store

https://canadianpharm.store/# legitimate canadian online pharmacies canadianpharm.store

http://canadianpharm.store/# canadian pharmacies that deliver to the us canadianpharm.store

http://indianpharm.store/# best india pharmacy indianpharm.store

mexico pharmacies prescription drugs Certified Pharmacy from Mexico pharmacies in mexico that ship to usa mexicanpharm.shop

mexico pharmacies prescription drugs: best online pharmacies in mexico – best online pharmacies in mexico mexicanpharm.shop

http://mexicanpharm.shop/# buying prescription drugs in mexico mexicanpharm.shop

https://canadianpharm.store/# my canadian pharmacy review canadianpharm.store

http://indianpharm.store/# indian pharmacy indianpharm.store

canadianpharmacyworld com reputable canadian online pharmacies canadian 24 hour pharmacy canadianpharm.store

https://canadianpharm.store/# canadian pharmacy canadianpharm.store

mexican pharmacy: trusted canadian pharmacies – online drug

https://canadadrugs.pro/# canadian pharmacies shipping to usa

https://canadadrugs.pro/# viagra 100mg canadian pharmacy

reputable canadian pharmacy online: canada drug stores – canada drug prices

cheap prescriptions: pharmacy in canada – pharmacy drug store

http://canadadrugs.pro/# canadian mail order pharmacies

the canadian pharmacy: no prescription pharmacy – on line pharmacy with no prescriptions

best online pharmacies canada: pharmacy world – online canadian pharmacy no prescription needed

reliable mexican pharmacies canada pharmacy online orders the best canadian pharmacy

offshore online pharmacies: list of canada online pharmacies – canadian online pharmacies

https://canadadrugs.pro/# world pharmacy

onlinepharmaciescanada com: online pharmacy without a prescription – canada medications online

https://canadadrugs.pro/# medications with no prescription

https://canadadrugs.pro/# online pharmacy with no prescription

canadian pharmacy in canada: canadian mail order drugs – fda approved pharmacies in canada

https://canadadrugs.pro/# online pharmacy review

http://medicinefromindia.store/# world pharmacy india

generic ed pills: ed drugs list – new ed drugs

http://edwithoutdoctorprescription.pro/# meds online without doctor prescription

https://edpill.cheap/# the best ed pills

pills for ed: best ed medication – ed pills online

https://edwithoutdoctorprescription.pro/# levitra without a doctor prescription

india pharmacy mail order: indianpharmacy com – indian pharmacy online

http://edpill.cheap/# erection pills that work

canadian drugs online ed meds online canada canadian pharmacy prices

canada pharmacy online legit: 77 canadian pharmacy – www canadianonlinepharmacy

top 10 online pharmacy in india: п»їlegitimate online pharmacies india – online pharmacy india

medication for ed dysfunction ed pills comparison best erectile dysfunction pills

reputable indian online pharmacy: best india pharmacy – india pharmacy

https://canadianinternationalpharmacy.pro/# best canadian online pharmacy

https://mexicanph.shop/# mexico pharmacies prescription drugs

mexican pharmaceuticals online

mexico pharmacy mexico drug stores pharmacies best online pharmacies in mexico

https://mexicanph.com/# п»їbest mexican online pharmacies

pharmacies in mexico that ship to usa

mexico drug stores pharmacies п»їbest mexican online pharmacies mexican border pharmacies shipping to usa

pharmacies in mexico that ship to usa pharmacies in mexico that ship to usa medicine in mexico pharmacies

http://mexicanph.com/# medication from mexico pharmacy

п»їbest mexican online pharmacies

best online pharmacies in mexico mexican pharmaceuticals online mexican pharmaceuticals online

mexican rx online mexican mail order pharmacies mexico pharmacies prescription drugs

https://mexicanph.shop/# buying prescription drugs in mexico

п»їbest mexican online pharmacies

mexican pharmaceuticals online mexican pharmacy best online pharmacies in mexico

mexican pharmacy mexican online pharmacies prescription drugs buying prescription drugs in mexico

best online pharmacies in mexico mexican border pharmacies shipping to usa buying prescription drugs in mexico

http://mexicanph.com/# pharmacies in mexico that ship to usa

mexican drugstore online

best online pharmacies in mexico mexican border pharmacies shipping to usa purple pharmacy mexico price list

medicine in mexico pharmacies mexican pharmaceuticals online buying prescription drugs in mexico online

buying prescription drugs in mexico online mexican online pharmacies prescription drugs mexican border pharmacies shipping to usa

buying prescription drugs in mexico mexico drug stores pharmacies mexican pharmaceuticals online

mexico pharmacy mexican online pharmacies prescription drugs mexican drugstore online

mexican border pharmacies shipping to usa mexico drug stores pharmacies medication from mexico pharmacy

buying prescription drugs in mexico mexico drug stores pharmacies pharmacies in mexico that ship to usa

mexican online pharmacies prescription drugs mexico pharmacy mexican border pharmacies shipping to usa

mexico pharmacies prescription drugs mexican mail order pharmacies mexican drugstore online

buying from online mexican pharmacy buying prescription drugs in mexico online medication from mexico pharmacy

buying from online mexican pharmacy mexico drug stores pharmacies mexico pharmacy

reputable mexican pharmacies online mexican pharmaceuticals online mexican drugstore online

http://mexicanph.shop/# mexican rx online

mexican border pharmacies shipping to usa

mexican online pharmacies prescription drugs purple pharmacy mexico price list mexico pharmacy

medicine in mexico pharmacies best online pharmacies in mexico mexican border pharmacies shipping to usa

best mexican online pharmacies mexican pharmaceuticals online mexican drugstore online

mexico drug stores pharmacies best online pharmacies in mexico mexican rx online

purple pharmacy mexico price list best online pharmacies in mexico buying from online mexican pharmacy

mexican online pharmacies prescription drugs mexican online pharmacies prescription drugs buying prescription drugs in mexico

mexico drug stores pharmacies medicine in mexico pharmacies mexican pharmacy

medicine in mexico pharmacies mexican rx online medicine in mexico pharmacies

mexican mail order pharmacies best mexican online pharmacies reputable mexican pharmacies online

mexican drugstore online buying from online mexican pharmacy mexican drugstore online

buying from online mexican pharmacy medication from mexico pharmacy buying from online mexican pharmacy

pharmacies in mexico that ship to usa mexico pharmacy purple pharmacy mexico price list

mexico pharmacy buying prescription drugs in mexico mexican online pharmacies prescription drugs

mexican pharmaceuticals online mexico drug stores pharmacies best mexican online pharmacies

mexican drugstore online medicine in mexico pharmacies mexican border pharmacies shipping to usa

reputable mexican pharmacies online purple pharmacy mexico price list mexico drug stores pharmacies

mexican border pharmacies shipping to usa buying from online mexican pharmacy medicine in mexico pharmacies

mexico drug stores pharmacies medication from mexico pharmacy mexico pharmacy

buying prescription drugs in mexico online reputable mexican pharmacies online mexican rx online

medication from mexico pharmacy pharmacies in mexico that ship to usa medication from mexico pharmacy

mexican mail order pharmacies buying from online mexican pharmacy п»їbest mexican online pharmacies

https://buyprednisone.store/# generic prednisone tablets

lasix side effects Over The Counter Lasix furosemide 40mg

amoxicillin 500mg capsules: can i buy amoxicillin over the counter in australia – amoxicillin without prescription

http://furosemide.guru/# lasix online

https://lisinopril.top/# lisinopril 10 mg canada

buy amoxicillin online without prescription: amoxicillin without rx – buy amoxicillin 500mg canada

http://furosemide.guru/# lasix 100 mg

http://amoxil.cheap/# amoxicillin cephalexin

lisinopril average cost: generic prinivil – lisinopril 20 mg coupon

https://buyprednisone.store/# 5 mg prednisone tablets

https://stromectol.fun/# ivermectin tablet 1mg

http://buyprednisone.store/# best pharmacy prednisone

ivermectin 5 mg price: ivermectin 12 mg – ivermectin for sale

https://furosemide.guru/# lasix generic

https://amoxil.cheap/# where can you get amoxicillin

prednisone generic cost buy prednisone online canada prednisone 50 mg tablet cost

ivermectin 250ml: ivermectin 0.2mg – stromectol buy

http://furosemide.guru/# furosemida

https://amoxil.cheap/# buy amoxicillin 500mg capsules uk

stromectol uk buy stromectol 0.5 mg generic name for ivermectin

lisinopril tablets: buy prinivil – lisinopril 20 mg tablet

https://buyprednisone.store/# can i buy prednisone online without prescription

https://buyprednisone.store/# online prednisone 5mg

lisinopril medication generic: lisinopril 5mg prices – lisinopril pharmacy online

https://stromectol.fun/# ivermectin 500mg

https://furosemide.guru/# lasix 100mg

furosemide 100mg: Buy Furosemide – buy lasix online

http://lisinopril.top/# order lisinopril online from canada

buy lisinopril without a prescription average cost of lisinopril lisinopril 10 mg online no prescription

https://furosemide.guru/# lasix medication

ivermectin brand name: ivermectin pills human – buy ivermectin cream

https://buyprednisone.store/# prednisone 50 mg tablet canada

http://buyprednisone.store/# can i buy prednisone online without a prescription

https://lisinopril.top/# generic prinivil

price of lisinopril 30 mg: order cheap lisinopril – prinivil 25 mg

https://stromectol.fun/# ivermectin 6 tablet

generic lasix furosemide 40 mg lasix generic

http://buyprednisone.store/# cheap prednisone 20 mg

http://buyprednisone.store/# prednisone 10 mg canada

http://furosemide.guru/# furosemide 100 mg

http://buyprednisone.store/# can you buy prednisone over the counter in usa

https://furosemide.guru/# lasix medication

ivermectin 0.5% lotion ivermectin 9mg stromectol tablets for humans

medication lisinopril 10 mg: zestoretic 10 12.5 – zestril brand

http://buyprednisone.store/# average cost of generic prednisone

ivermectin 3mg tablets price: ivermectin otc – buy ivermectin stromectol

http://amoxil.cheap/# amoxicillin in india

lasix online Buy Lasix No Prescription lasix generic

http://buyprednisone.store/# buy prednisone 10mg

ivermectin buy online: stromectol generic name – ivermectin 1

http://furosemide.guru/# generic lasix

http://buyprednisone.store/# buy prednisone online without a script

ivermectin 0.5% lotion ivermectin price stromectol nz

https://buyprednisone.store/# prednisone prescription online

buy ivermectin canada: ivermectin topical – where can i buy oral ivermectin

http://lisinopril.top/# lisinopril 2 5 mg tablets

http://furosemide.guru/# buy lasix online

lasix for sale: Buy Furosemide – generic lasix

http://furosemide.guru/# buy lasix online

buy lasix online lasix dosage lasix medication

https://indianph.com/# india pharmacy

best india pharmacy

top 10 online pharmacy in india reputable indian online pharmacy п»їlegitimate online pharmacies india

https://indianph.xyz/# top 10 online pharmacy in india

legitimate online pharmacies india

http://indianph.com/# best online pharmacy india

best india pharmacy

http://indianph.com/# top 10 online pharmacy in india

top 10 pharmacies in india

online pharmacy india п»їlegitimate online pharmacies india mail order pharmacy india

https://indianph.com/# top 10 pharmacies in india

indianpharmacy com

http://indianph.xyz/# india pharmacy mail order

Online medicine home delivery

https://indianph.xyz/# indian pharmacy online

mail order pharmacy india

http://indianph.xyz/# Online medicine order

reputable indian online pharmacy indianpharmacy com reputable indian pharmacies

https://doxycycline.auction/# cheap doxycycline online

diflucan fluconazole diflucan no prescription diflucan price in india

https://nolvadex.guru/# nolvadex generic

https://diflucan.pro/# over the counter diflucan

ciprofloxacin over the counter cipro ciprofloxacin buy cipro online canada

https://doxycycline.auction/# odering doxycycline

https://doxycycline.auction/# doxycycline hyclate 100 mg cap

https://cipro.guru/# ciprofloxacin

https://cytotec24.com/# cytotec abortion pill

https://diflucan.pro/# diflucan cost uk

https://nolvadex.guru/# is nolvadex legal

http://nolvadex.guru/# nolvadex for sale amazon

п»їcytotec pills online: buy cytotec over the counter – п»їcytotec pills online

http://nolvadex.guru/# nolvadex d

http://diflucan.pro/# diflucan 150 mg fluconazole

http://cipro.guru/# cipro online no prescription in the usa

https://cytotec24.shop/# cytotec pills buy online

https://nolvadex.guru/# tamoxifen mechanism of action

https://nolvadex.guru/# how to lose weight on tamoxifen

http://nolvadex.guru/# liquid tamoxifen

http://cipro.guru/# ciprofloxacin generic price

http://lanarhoades.fun/# lana rhoades modeli

https://evaelfie.pro/# eva elfie modeli

https://angelawhite.pro/# Angela White video

http://lanarhoades.fun/# lana rhodes

https://sweetiefox.online/# Sweetie Fox

http://angelawhite.pro/# Angela Beyaz modeli

https://lanarhoades.fun/# lana rhoades filmleri

http://abelladanger.online/# abella danger izle

https://sweetiefox.online/# Sweetie Fox video

http://sweetiefox.online/# swetie fox

https://lanarhoades.fun/# lana rhoades video

https://angelawhite.pro/# Angela White

https://evaelfie.pro/# eva elfie

https://lanarhoades.fun/# lana rhoades modeli

https://angelawhite.pro/# ?????? ????

https://lanarhoades.fun/# lana rhodes

https://angelawhite.pro/# ?????? ????

https://abelladanger.online/# abella danger filmleri

http://angelawhite.pro/# ?????? ????

https://evaelfie.pro/# eva elfie video

http://abelladanger.online/# abella danger video

http://abelladanger.online/# abella danger izle

http://angelawhite.pro/# ?????? ????

Angela Beyaz modeli: ?????? ???? – Angela Beyaz modeli

https://abelladanger.online/# abella danger filmleri

http://evaelfie.pro/# eva elfie filmleri

mia malkova girl: mia malkova videos – mia malkova movie

sweetie fox: sweetie fox video – sweetie fox cosplay

mia malkova photos: mia malkova – mia malkova only fans

lana rhoades pics: lana rhoades pics – lana rhoades boyfriend

mia malkova new video: mia malkova girl – mia malkova only fans

https://evaelfie.site/# eva elfie

sweetie fox new: sweetie fox full – sweetie fox new

sweetie fox full: sweetie fox full video – sweetie fox new

https://miamalkova.life/# mia malkova photos

dating sites into trampling: https://miamalkova.life/# mia malkova full video

mia malkova girl: mia malkova only fans – mia malkova hd

http://evaelfie.site/# eva elfie full videos

mia malkova: mia malkova movie – mia malkova only fans

sweetie fox video: sweetie fox new – sweetie fox full

http://sweetiefox.pro/# sweetie fox new

lana rhoades full video: lana rhoades hot – lana rhoades hot

mia malkova hd: mia malkova photos – mia malkova movie

mia malkova: mia malkova movie – mia malkova videos

http://evaelfie.site/# eva elfie

eva elfie hot: eva elfie photo – eva elfie

http://lanarhoades.pro/# lana rhoades boyfriend

http://miamalkova.life/# mia malkova photos

eva elfie full videos: eva elfie new videos – eva elfie videos

http://sweetiefox.pro/# sweetie fox full

sweetie fox full: sweetie fox full – sweetie fox

https://sweetiefox.pro/# sweetie fox cosplay

lana rhoades: lana rhoades – lana rhoades pics

https://pinupcassino.pro/# pin-up cassino

melhor jogo de aposta: ganhar dinheiro jogando – aplicativo de aposta

https://aviatorghana.pro/# play aviator

aviator: aviator game bet – aviator game bet

https://aviatormalawi.online/# aviator malawi

https://aviatorjogar.online/# estrela bet aviator

melhor jogo de aposta: jogo de aposta – melhor jogo de aposta

https://aviatorjogar.online/# aviator jogar

aviator pin up: jogar aviator Brasil – aviator bet

https://aviatormalawi.online/# play aviator

aviator jogar: aviator bet – aviator game

aviator oyna: aviator – pin up aviator

melhor jogo de aposta para ganhar dinheiro: melhor jogo de aposta – aviator jogo de aposta

play aviator: aviator game online – aviator

aviator: pin up aviator – aviator hilesi

http://aviatormocambique.site/# como jogar aviator em mocambique

jogo de aposta: depósito mínimo 1 real – aviator jogo de aposta

pin up aviator: aviator bet – aviator jogo

https://pinupcassino.pro/# pin up cassino online

aviator oyna slot: aviator sinyal hilesi – aviator bahis

cassino pin up: aviator pin up casino – pin-up casino

http://aviatorghana.pro/# play aviator

http://mexicanpharm24.com/# mexican pharmaceuticals online mexicanpharm.shop

п»їlegitimate online pharmacies india india pharmacy indianpharmacy com indianpharm.store

http://mexicanpharm24.com/# п»їbest mexican online pharmacies mexicanpharm.shop

canadian pharmacy no scripts Canada pharmacy online canadian mail order pharmacy canadianpharm.store

http://indianpharm24.shop/# online shopping pharmacy india indianpharm.store

http://indianpharm24.shop/# mail order pharmacy india indianpharm.store

https://mexicanpharm24.shop/# mexico pharmacies prescription drugs mexicanpharm.shop

77 canadian pharmacy: Canadian pharmacy prices – pharmacy com canada canadianpharm.store

https://canadianpharmlk.com/# legal to buy prescription drugs from canada canadianpharm.store

https://indianpharm24.com/# world pharmacy india indianpharm.store

online pharmacy india online pharmacy usa india online pharmacy indianpharm.store

https://mexicanpharm24.shop/# buying prescription drugs in mexico online mexicanpharm.shop

https://indianpharm24.shop/# top online pharmacy india indianpharm.store

https://mexicanpharm24.com/# mexican pharmaceuticals online mexicanpharm.shop

india pharmacy: india pharmacy – indian pharmacy paypal indianpharm.store

http://mexicanpharm24.com/# reputable mexican pharmacies online mexicanpharm.shop

canadian drugstore online Canadian pharmacy prices canadian pharmacy uk delivery canadianpharm.store

http://canadianpharmlk.shop/# canadian pharmacy 24 com canadianpharm.store

http://canadianpharmlk.com/# canadian drug prices canadianpharm.store

https://canadianpharmlk.shop/# canada drugs online canadianpharm.store

can i purchase generic clomid pills: clomid 50mg price – how to get generic clomid without prescription

amoxicillin 500mg capsule cost: amoxicillin for sinus infection – where can i buy amoxocillin

prednisone 20 mg tablet price: what is prednisone – prednisone 40 mg rx

amoxicillin in india: buy amoxicillin online mexico – where to buy amoxicillin pharmacy

amoxicillin generic: side effects of amoxicillin – where can i buy amoxicillin over the counter uk

prednisone 1 mg tablet: moon face prednisone – prednisone 5mg price

can i buy amoxicillin over the counter in australia: amoxicillin 250 mg price in india – amoxicillin order online

cost of amoxicillin 875 mg: amoxicillin pills 500 mg – how to buy amoxycillin

prednisone 40mg: buy 10 mg prednisone – can you buy prednisone over the counter in usa

where buy cheap clomid now: clomid multiples – where to get clomid now

amoxicillin no prescipion: amoxicillin rash adults – 875 mg amoxicillin cost

where can i get prednisone over the counter: prednisone 20 mg pill – buy prednisone 20mg

can i order generic clomid without insurance: how to get clomid for sale – where buy cheap clomid without rx

can i buy clomid without prescription: clomid constipation – where buy generic clomid prices

where buy generic clomid no prescription: where to buy cheap clomid without prescription – how to get clomid

can i buy prednisone from canada without a script: prednisone 20mg cheap – prednisone brand name canada

where to buy amoxicillin 500mg: amoxicillin 50 mg tablets – amoxicillin 500mg capsules price

amoxicillin pharmacy price: amoxicillin 500 mg dosage for strep throat – amoxicillin cephalexin

ampicillin amoxicillin: amoxicillin 500 mg cost – amoxicillin price without insurance

http://onlinepharmacy.cheap/# reputable online pharmacy no prescription

canadian pharmacy discount coupon: Best online pharmacy – prescription drugs online

best online pharmacy that does not require a prescription in india: no prescription medicine – online pharmacy no prescription

http://edpills.guru/# online ed treatments

canada pharmacy not requiring prescription: Best online pharmacy – best canadian pharmacy no prescription

canada online prescription canadian prescription drugstore review canadian pharmacy online no prescription needed

non prescription medicine pharmacy: canadian online pharmacy – canadian pharmacies not requiring prescription

affordable ed medication: cheap ed medication – ed prescription online

buy prescription drugs online without: pharmacy online no prescription – buying prescription medicine online

http://pharmnoprescription.pro/# buy meds online no prescription

online pharmacy without prescription: online pharmacy delivery – online pharmacy without prescription

online ed meds: cheap ed drugs – ed medications cost

online pharmacy discount code: best online pharmacy – pharmacy coupons

online ed pills п»їed pills online ed treatments online

https://edpills.guru/# get ed meds online

best online pharmacy no prescription: canada online pharmacy – pharmacy without prescription

canadian pharmacy non prescription: medication online without prescription – online pharmacy no prescription needed

buying drugs from canada: legitimate canadian pharmacies – canadian drugs

http://canadianpharm.guru/# ed drugs online from canada

http://indianpharm.shop/# reputable indian pharmacies

purple pharmacy mexico price list: purple pharmacy mexico price list – medication from mexico pharmacy

mail order pharmacy india: indian pharmacy online – Online medicine order

online drugstore no prescription: canadian pharmacy prescription – canada mail order prescriptions

http://indianpharm.shop/# india pharmacy mail order

mexican pharmaceuticals online: pharmacies in mexico that ship to usa – mexico drug stores pharmacies

http://canadianpharm.guru/# onlinepharmaciescanada com

buy medicines online in india: mail order pharmacy india – reputable indian online pharmacy

pharmacy website india: world pharmacy india – Online medicine home delivery

buy medication online with prescription: no prescription drugs – canadian mail order prescriptions

top 10 online pharmacy in india: world pharmacy india – india pharmacy

indianpharmacy com: best india pharmacy – world pharmacy india

https://indianpharm.shop/# online pharmacy india

Online medicine order: reputable indian pharmacies – indian pharmacy paypal

top 10 pharmacies in india: pharmacy website india – buy medicines online in india

online canadian pharmacy no prescription: pills no prescription – buy prescription drugs online without doctor

no prescription canadian pharmacies: how to buy prescriptions from canada safely – online pharmacy no prescription

canadian pharmacy world: best online canadian pharmacy – canadianpharmacymeds

http://mexicanpharm.online/# mexican rx online

buy prescription drugs online without: medicine with no prescription – best online pharmacy that does not require a prescription in india

canadian pharmacy phone number: pet meds without vet prescription canada – legit canadian online pharmacy

mail order prescriptions from canada: prescription from canada – buy prescription drugs online without

no prescription pharmacy online: mexican pharmacy no prescription – canada prescription

top 10 online pharmacy in india: indian pharmacy – legitimate online pharmacies india

pharmacies in mexico that ship to usa: buying prescription drugs in mexico online – buying prescription drugs in mexico

india pharmacy: best online pharmacy india – legitimate online pharmacies india

buying prescription drugs in mexico: mexican mail order pharmacies – п»їbest mexican online pharmacies

https://mexicanpharm.online/# mexican drugstore online

northwest pharmacy canada: canadian drug – safe online pharmacies in canada

best india pharmacy: indianpharmacy com – india pharmacy

mexican mail order pharmacies: buying prescription drugs in mexico online – mexico drug stores pharmacies

canadian pharmacy no prescription needed: canadian mail order prescriptions – order medication without prescription

mexico drug stores pharmacies mexican pharmaceuticals online best online pharmacies in mexico

canadian pharmacy phone number: canada drugstore pharmacy rx – canadian pharmacy world

http://indianpharm.shop/# buy prescription drugs from india

canadian family pharmacy: pharmacy wholesalers canada – canadian pharmacy scam

online pharmacy canada no prescription: canada prescriptions by mail – online pharmacies without prescriptions

can you buy prescription drugs in canada: mexican pharmacy no prescription – buying prescription drugs in canada

mexico online pharmacy prescription drugs: online medication without prescription – pharmacy no prescription

http://pinupgiris.fun/# pin up

http://sweetbonanza.bid/# sweet bonanza oyna

https://aviatoroyna.bid/# aviator oyunu

http://sweetbonanza.bid/# sweet bonanza free spin demo

http://pinupgiris.fun/# pin up 7/24 giris

http://gatesofolympus.auction/# gates of olympus s?rlar?

http://gatesofolympus.auction/# gate of olympus hile

http://pinupgiris.fun/# pin-up bonanza

http://sweetbonanza.bid/# sweet bonanza hilesi

http://sweetbonanza.bid/# sweet bonanza nasil oynanir

http://sweetbonanza.bid/# sweet bonanza demo oyna

http://pinupgiris.fun/# pin-up casino

https://aviatoroyna.bid/# aviator oyunu 50 tl

http://slotsiteleri.guru/# slot bahis siteleri

https://gatesofolympus.auction/# gates of olympus demo turkce oyna

http://sweetbonanza.bid/# sweet bonanza taktik

gates of olympus slot: gates of olympus taktik – gates of olympus taktik

https://slotsiteleri.guru/# deneme bonusu veren siteler

http://pinupgiris.fun/# pin up aviator

https://pinupgiris.fun/# pin-up casino indir

https://aviatoroyna.bid/# aviator giris

https://sweetbonanza.bid/# sweet bonanza yasal site

п»їlegitimate online pharmacies india: Cheapest online pharmacy – pharmacy website india

buying prescription drugs in mexico online: mexican pharmacy – buying from online mexican pharmacy

best online pharmacies in mexico: Online Pharmacies in Mexico – mexican pharmaceuticals online

canadapharmacyonline legit: pills now even cheaper – legitimate canadian online pharmacies

mexican mail order pharmacies: buying prescription drugs in mexico online – buying from online mexican pharmacy

Online medicine home delivery india online pharmacy best india pharmacy

canada rx pharmacy: canadian pharmacy 24 – canadadrugpharmacy com

pharmacy website india indian pharmacy online top 10 pharmacies in india

medicine in mexico pharmacies: cheapest mexico drugs – medicine in mexico pharmacies

india pharmacy: reputable indian online pharmacy – buy medicines online in india

canadian pharmacy ratings: canadian pharmacy 24 – canadian online drugstore

canada drugs online: Large Selection of Medications – canadian pharmacy antibiotics

Online medicine order: reputable indian online pharmacy – buy prescription drugs from india

https://mexicanpharmacy.shop/# buying prescription drugs in mexico online

mexican mail order pharmacies: Online Pharmacies in Mexico – buying from online mexican pharmacy

mexico pharmacy mexico pharmacy mexico drug stores pharmacies

canadian pharmacies compare: Prescription Drugs from Canada – online canadian pharmacy

top online pharmacy india: indian pharmacy delivery – buy prescription drugs from india

indian pharmacy paypal: india online pharmacy – Online medicine order

canadian pharmacy no rx needed: canadian pharmacy meds review – canada online pharmacy

medicine in mexico pharmacies: mexican pharmacy – pharmacies in mexico that ship to usa

indian pharmacy: Cheapest online pharmacy – online shopping pharmacy india

top online pharmacy india Generic Medicine India to USA reputable indian pharmacies

buy medicines online in india: indian pharmacy – reputable indian pharmacies

qiyezp.com

그러나 그가 항해로 돌아올 때마다 그의 심장은… 여전히 두근거렸다.

https://clomidall.com/# can you get generic clomid without insurance

https://clomidall.shop/# buying generic clomid

where can i get zithromax: zithromax azithromycin – generic zithromax azithromycin

http://amoxilall.shop/# amoxicillin 500mg

http://amoxilall.com/# prescription for amoxicillin

https://zithromaxall.shop/# zithromax coupon

https://amoxilall.com/# amoxicillin 200 mg tablet

https://zithromaxall.com/# zithromax coupon

https://amoxilall.com/# generic amoxicillin over the counter

can you buy zithromax over the counter: how to get zithromax online – zithromax azithromycin

http://clomidall.com/# can i order cheap clomid for sale

https://prednisoneall.com/# can i buy prednisone online without a prescription

http://zithromaxall.com/# generic zithromax azithromycin

buy kamagra online usa: kamagra best price – Kamagra 100mg