Last quarter, the Wristly team and I set out to run the first ever Apple Watch customer satisfaction report. Our first survey returned a customer satisfaction level of 97%, which, for a first generation product, is quite impressive. While there were some concerns about bias in our panel because it was an opt-in panel of Apple Watch owners, the reality is all ownership panels are opt-in. This early in the Apple Watch adoption cycle, one can only run a customer satisfaction survey after building up a panel of owners, as Wristly did. So concerns about the panel are moot in my mind. However, we decided to see what customer satisfaction is now that a healthy portion of our existing panel has owned the watch for even longer. We found some interesting results.

1. Customer satisfaction remains high at 96%. Our initial report posted customer satisfaction at 97% and we have more than doubled the panel, which accounts for the 1% drop which is statistically insignificant given the extremely low margin of error (Less than 1%) from with a panel of our size. We consider the sustained high customer satisfaction rate to be encouraging.

2. When we looked at the responses from those in our panel who participated in our first customer satisfaction survey or indicated they received their Apple Watch in the April-May-June quarter, we discovered something interesting. Those who owned the watch since April had the highest overall satisfaction rating. When just looking at satisfaction by month of Apple Watch acquisition, those who purchased the Watch in April also had the highest number of people who selected “very satisfied” out of any other month in which the Watch was acquired. Our interpretation of this is clear — those who owned the watch the longest seemed to become more satisfied over time.

3. Non-techies still love the watch the most. The insight we discovered in our last survey held true even as we doubled the size of our panel. Customer satisfaction for the Apple Watch ranked highest among those consumers who were admittedly not techies or worked in an industry other than tech. Some highlights I thought were most interesting:

- The highest number of those who said they were “very satisfied” also said they worked outside of the tech industry. 71% of this group said they were very satisfied and, in total, this demographic had a satisfaction rating of 98% as compared to those who work in the tech industry where 63% marked “very satisfied” and a total satisfaction rating of 95%.

- The data got even more interesting when we evaluated the satisfaction ratings by reason for purchasing the Apple Watch. Here I’m focusing on making points on those who ranked “very satisfied” and the total satisfaction rating. Those who bought the watch to be used as a watch had the highest number of respondents who checked “very satisfied”. The highest total satisfaction level, both at 98%, came from those who bought the watch for the notification capabilities and to be more active. The lowest satisfaction rating, a total of 93%, came from those who stated their sole purpose for buying was to evaluate it for tech or business. This group also had the highest level of respondents who checked “somewhat dissatisfied”. Again emphasizing the point I’ve made before that those who are looking to scrutinize and evaluate the watch have a different opinion of it than those who bought it for specific features they valued, such as for health and fitness.

- The age demographic with the highest total satisfaction level was the 18-24-year-old group with a total satisfaction rating of 98%. While the age demographic with the highest number of “very satisfied” owners is the 55+ demographic. While the highest total satisfaction rating came from men, more women checked the “very satisfied” box than men. Lastly, the only demographic who checked the “very dissatisfied” box was women.

Our ability to segment satisfaction ratings by occupation, age, and purchase intention is extremely helpful for us to understand the nuances of a product like the Apple Watch over a broad range of consumers. The shift of percentage of respondents who moved from “somewhat satisfied” to “very satisfied” is perhaps the most significant data point in my mind. This is in stark contrast to other wearable products where third party data confirms the product ends up in a drawer after six months to a year.

Prospects Going Forward

Based on satisfaction ratings, it is clear the Apple Watch is not a flop, nor will it be, since usage and behavior trends over time are quite encouraging. We know those who bought it love it. But what about interest in Apple Watch by those who don’t own one? Here I also have some research to share.

From my own primary research of iPhone owners, when asked if they were interested in buying a wearable (i.e. Fitbit, Apple Watch, Jawbone, etc.) this holiday season, 52% said no and 48% said yes. When asked which wearable they are most interested in, 39% said the Apple Watch, 37% said a Fitbit product, 8% said Jawbone, and 5% said Garmin. The key takeaway is the Apple Watch and Fitbit are the most dominant brands when it comes to interest in purchasing by iPhone owners worldwide. When it comes to the potential upside for Apple to gain existing Fitbit owners, the statistic that those who purchased it for its fitness capabilities had the highest total satisfaction levels is important. Compare that data with this analysis by our own Jan Dawson on Fitbit abandonment rates as analyzed from their own S-1.

The number bounces around at about 50%, rising or falling a little over time but remaining remarkably constant. In one sense, that’s obviously fairly bad news – in addition to the fact that very few Fitbit buyers purchase a second device, it would appear that half of those who bought one stop using it after a period of time.

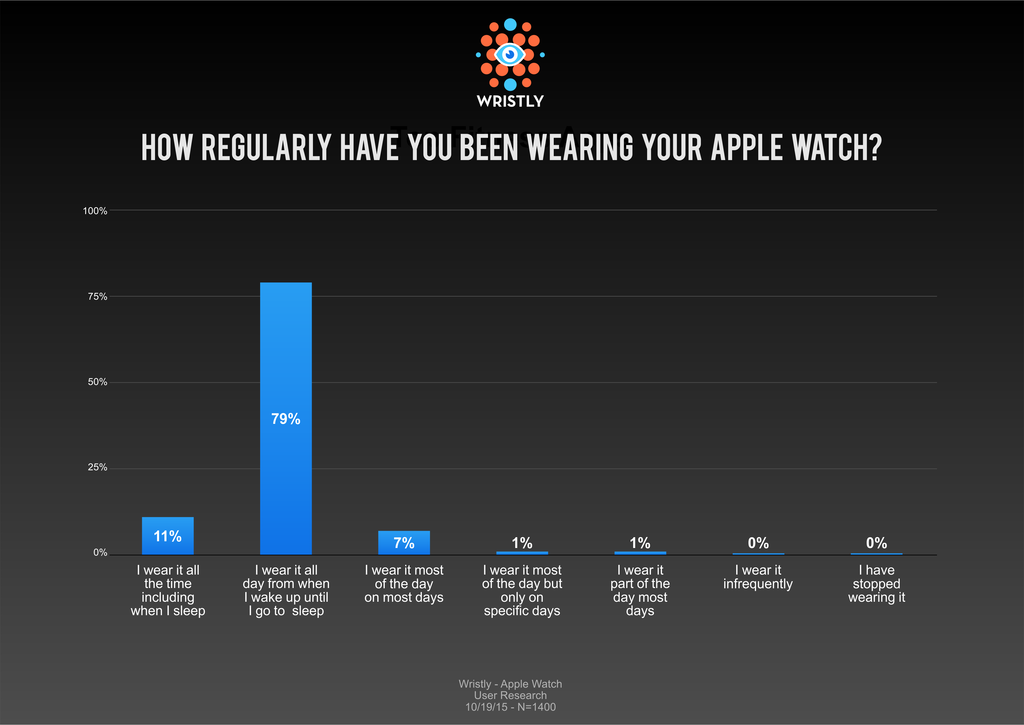

Comparing this point to our own Wristly data of continued usage.

Even those who got the watch in the earliest cycles of April-May are still wearing it today. In fact, the largest group that say they still wear it all day, every day are those who got it in April. During my analysis of wearables, dating back to well before Apple announced and released the Watch, I pounded on the point that the vast majority of research surrounding the category and all the existing players was that consumer response indicated they saw little to no value in the product. That trend is roughly in line today with all but the Apple Watch. The hard data is from my own research and from Wristly’s as well. It makes it hard to not conclude that, at least for now, the Apple Watch remains in a category by itself.

I’m ditched Nike, Polar, and Fitbit twice. Watch has stuck. Which surprises me because I really liked the idea of conventional watches paired with unobtrusive fitness bands. I just found none of them really worked.

Apple’s secret sauce, for me, seems to be differentiating between active calories and passive.

About 31% of our panel said they did the same. They abandoned their prior health and fitness band for the Apple Watch and aren’t looking back. Thanks for sharing.

Elon Musk was the most recent to say that the Apple Watch is kind of nice but not compelling. (Granted, he was walking back prior comments when you said that, so who knows what he really thinks.)

I think there are two conflicting factors here. Enough consumers do you not yet want such a product to make it a huge seller. But there is a certain inevitability to it. Time keeping devices evolved from building sized clock towers to grandfather clocks to wall clocks to pocket watches and then to the wrist. Computing devices have followed a similar evolution: smaller and more personal. Stock analysts and market watchers can complain that the device is not yet compelling, but if you are an engineer, you’re just going to make things smaller and faster and more personal. Inevitable is the only word I can think of that applies.

I have heard folks say that Apple should’ve waited a little bit longer for the category to mature. But they were definitely in a damned if they do, damned if they wait situation

Seriously… You’re sitting on massive piles of cash and you have an industrial design team that you have the upmost faith in… What would you do?

Be that as it may… The category is going to happen, whether consumers are ready for it or not. You just can’t ask engineers not to design something it’s just sitting there waiting to be designed.

Whether consumers flock to it or not is a question for the experts. But it seems obvious that if the category is personal and well designed, then Apple will be the major player

Since recovering from major surgery this month I’ve added three new apps to my watch. One for tracking my diabetes readings, another for medicine reminders at the appropriate times, and of course, sleep tracker has had a major update and is now tracking movement through the night too.

It’s very unusual for a device I bought to do a certain set of tasks be able to pivot and adapt to a whole new use case. Although I must confess that while I was trapped in a hospital bed I did ignore those time to stand notifications…

May I offer two keen suggestion-tips for your COMPLICATIONS settings?

1). A new app called Just Press Record puts a handy voice memo/iCloud based record mic button on your Watch face screen.

2). Set up your most-watched stock on top of your list of “stocks”. You will get an up- or down-trade arrow and price quotation each time your Watch face screen is activated.

Thanks for the tip on Just Press Record!

“From my own primary research of iPhone owners…”. Can you please clarify who exactly and how you surveyed to get these numbers? That matters a great deal in getting anything even remotely resembling meaningful numbers as far as the general audience goes.

Also,

“54% said no and 48% said yes.” 54+48=102.

It was a broad research panel of iPhone owners about their interest in wearables. I have all the cohort data and cohort analysis but we reserve that for clients.

Also fixed to 52% which. Looked at an earlier sample not the final for results. Apologize.

I understand and thanks for sharing as much as you did. Still, if you could say anything more about the survey group that would be great.

Owners of an iPhone, global base.. Good balance of age, income, gender, work (inside and outside of tech), etc.

I to am very satisfied with my Apple Watch as it does make me exercise more than before. That was the main purpose for my purchase. I had a cheap step sleep tracker but having to pair it with my iPhone or iPad manually meant that I stopped using it when I upgraded from an iPhone 4 to 6 as the new phone counted elevation as well as steps. The Apple Watch ability to measure calories burned is the main reason for my purchase. The rest is just added bonuses.

Ben if you had asked ME, the satisfaction rate would have held steady at 97%! Thanks for the interesting summary. Getting curious what AppleWatch 2 (or will it be AppleWatch “S”?) will be like other than thinner with longer battery life. And will there be a resale market as with iPhones and iPads?

For the reason that the admin of this site is working no uncertainty very quickly it will be renowned due to its quality contents.

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic.

Hey There. I discovered your weblog the use of msn. That is an extremely

neatly written article. I’ll make sure to bookmark it and return to

read extra of your helpful information. Thank you for the post.

I will definitely comeback.

Awesome blog! Do you have any tips for aspiring writers?

I’m hoping to start my own site soon but I’m a little lost on everything.

Would you advise starting with a free platform like WordPress or go for a

paid option? There are so many choices out there that I’m completely overwhelmed ..

Any recommendations? Appreciate it!

What’s Going down i’m new to this, I stumbled upon this I’ve found It absolutely

useful and it has helped me out loads. I’m hoping to contribute

& help other customers like its helped me.

Great job.

I am really impressed with your writing skills and also with the layout on your

weblog. Is this a paid theme or did you customize

it yourself? Either way keep up the excellent quality writing,

it is rare to see a nice blog like this one today.

Admiring the commitment you put into your site and in depth information you provide.

It’s great to come across a blog every once in a while that isn’t the same out of date rehashed material.

Wonderful read! I’ve saved your site and I’m adding your RSS feeds to my Google

account.

Pretty section of content. I just stumbled upon your blog and in accession capital to

assert that I acquire actually enjoyed account your blog posts.

Any way I will be subscribing to your feeds and even I

achievement you access consistently quickly.

Hello, Neat post. There’s an issue with your web site in internet explorer, would

test this? IE still is the marketplace leader and a big section of other folks will pass over your great writing because of this problem.

If you wish for to take a great deal from this article then you have to apply such methods to your won webpage.