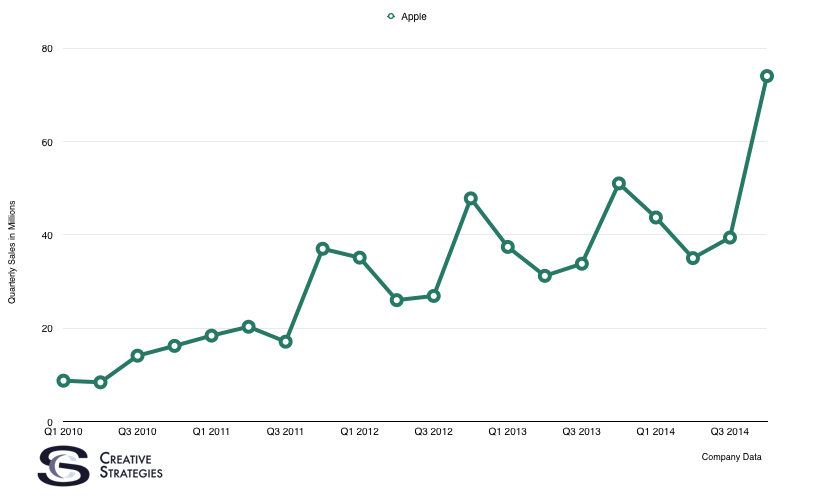

74.5 million iPhones exceeded everyone’s expectations. You can only see that number and feel there remains unprecedented demand for the iPhone. More importantly, demand is not yet satisfied. Apple said only a small percentage (“low teens”) upgraded this cycle. There is still a lot of the iPhone installed base to upgrade in the coming years. What does stand out is how Apple didn’t really lose many customers by not releasing a larger phone sooner. The conventional wisdom was that, by not addressing the larger screen size, Apple would lose customers to Android and have a hard time winning them back. However, what this 74.5m in iPhone sales tells us wad this was not true. Apple didn’t lose customers and, more importantly, they increased their base of new users by anywhere from 15-18m based on my estimates. It’s hard to come away from the data on this quarter and not conclude demand for the iPhone is stronger than ever.

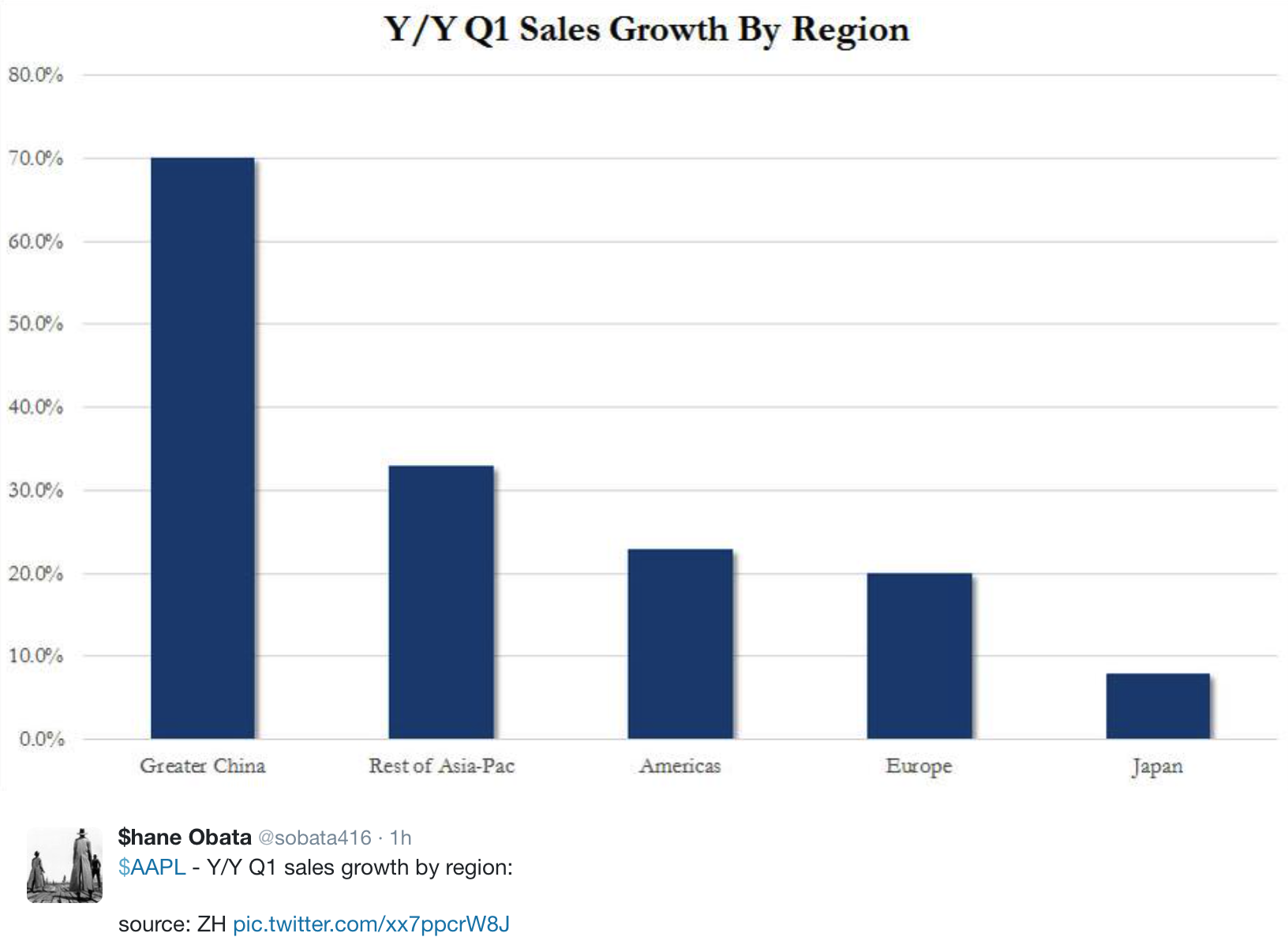

While my estimates for China were high, Luca Maestri, Apple’s senior vice president and Chief Financial Officer, confirmed the US is still the largest iPhone market. But I’m certain I was in the ballpark and they are close. It remains a significant inflection point for Apple with regards to China. With the current quarter containing the Chinese New Year, I expect not only a strong overall quarter for Apple related to iPhones but also in China in general. Apple appears to be guiding 54-55m iPhones for the current quarter and it seems to be the consensus on Wall St. as well. The growth in China remains strong and continues to be a critical market for Apple.

Growth in China can’t be understated. Even if it is not Apple’s largest iPhone market yet, it is the most important market for Apple from a growth standpoint.

The big question on everyone’s mind is, can the growth continue? The strength of the China market with the current quarter including the Chinese New Year, it means Apple will continue to have strong back-to-back quarters. The post holiday lull will be gone as China picks up strong in the first part of the calendar year. With a small percentage of Apple’s base upgrading, it means 2015 should be strong as well. So yes, it appears the growth will continue.

Bullish on iPad?

No disguising iPad numbers. It will certainly remain a narrative in the overall story. But iPad is performing no different than overall tablet trends. It is being treated more like a PC than a smart phone by consumers so refresh rates are longer. Apple has a large installed base of iPad 2s so it seems likely a refresh could be happening. With 50% of customers new to the iPad, Apple continues to add to the base each quarter. All of this is key for the iPad business.

The iPad will be fine. Even between 15-25m a quarter trend lines, it is a healthy business that plays a key role in the Apple ecosystem and product lineup.

One other thing to watch is a potential growing trend of connected and perhaps subsidized tablets. Verizon and AT&T both reported growth in connected tablet sales. Not all of these were iPads but the point is, subsidized tablet sales with connectivity by the carrier is an example of a growing trend that could possibly be a catalyst for the iPad.

Mac as a Growth Story

The Mac grew YoY 14% and I maintain this as a growth story for Apple in 2015. There is share to gain from the Windows OEMs as a part of the enterprise and consumer refresh cycles we expect in 2015. I can see a quarter in 2015 where Mac sales get above 6m but I’m not confident in which one. Regardless, this is a growth line I’ve been anticipating for some time and I expect it to continue into 2015.

The Consumers Everyone Wants

I’ll close on this point. It is becoming overwhelmingly clear that Apple’s near monopoly on the “most profitable” customer base is a huge differentiator for their ecosystem. More importantly, the things they are doing — larger iPhones, Apple Watch, etc., — are all things that increase their grip on the top 20% of customers. What this does is create catalysts for their ecosystem. Apple Pay is a great example of this. With rapid adoption of contactless payments and retail outlets recognizing the benefits of supporting Apple Pay to attract Apple’s valuable customer base, it creates what is, in essence, a network effect. Because Apple’s customers generally are more apt to spend money and are therefore more profitable, they are the type of consumers stores and brands desire to attract. So they will support something like Apple Pay because it drives their end goal.

Similarly, carriers realize these customers are more valuable than Android customers (generally speaking). So carriers push and are willing to be aggressive with iPhones because Apple brings them less risky and more valuable customers. This is the power of what having the most valuable customers does for Apple’s ecosystem.

Stepping back and looking at the big picture, it certainly feels like there are distinct and clear lines between Apple’s customers and Google’s with Android. Two completely different ecosystems in nearly every way. I like this recent tweet from Jean-Louis Gassee.

He is referring to Apple’s market share. But it is a great point. The minority share actually feels like a monopoly in the grand scheme of things.

Ben,

Apple sold 74.5M iPs this qtr and has guided a midpoint of 54.5M for the next.

I’ve read elsewhere that Q2 rev averages about 15% less than Q1.

15% off 74.5M is about 62.5M iPs. Seem likely to me, especially with 5 new Chinese stores and New Year coming.

Apple’s being tricky with this guidance.

I think they are playing it conservative. The China one is going to be huge, for the reasons you mentioned. Plus demand still very high in the West. I could 60m this quarter.