Apple’s strategy for the smart home has been one of the areas I’ve been most critical. Mostly out of frustration when I see Amazon and Google flooding the market with options for smart home control centers. At Apple’s fall launch event yesterday, their smart home strategy becomes more clear and quite differentiated.

For as far behind as Apple has seemed in the home, the caveat in our analysis was always that Apple owned the pocket more than Amazon, and even Google to a degree. I always felt if Apple could better leverage its end computing devices, mainly the one you have with you at all times, they could catch up quickly. I use these words catch up somewhat lightly because, in Apple’s mind, they were never behind, but that’s a different story.

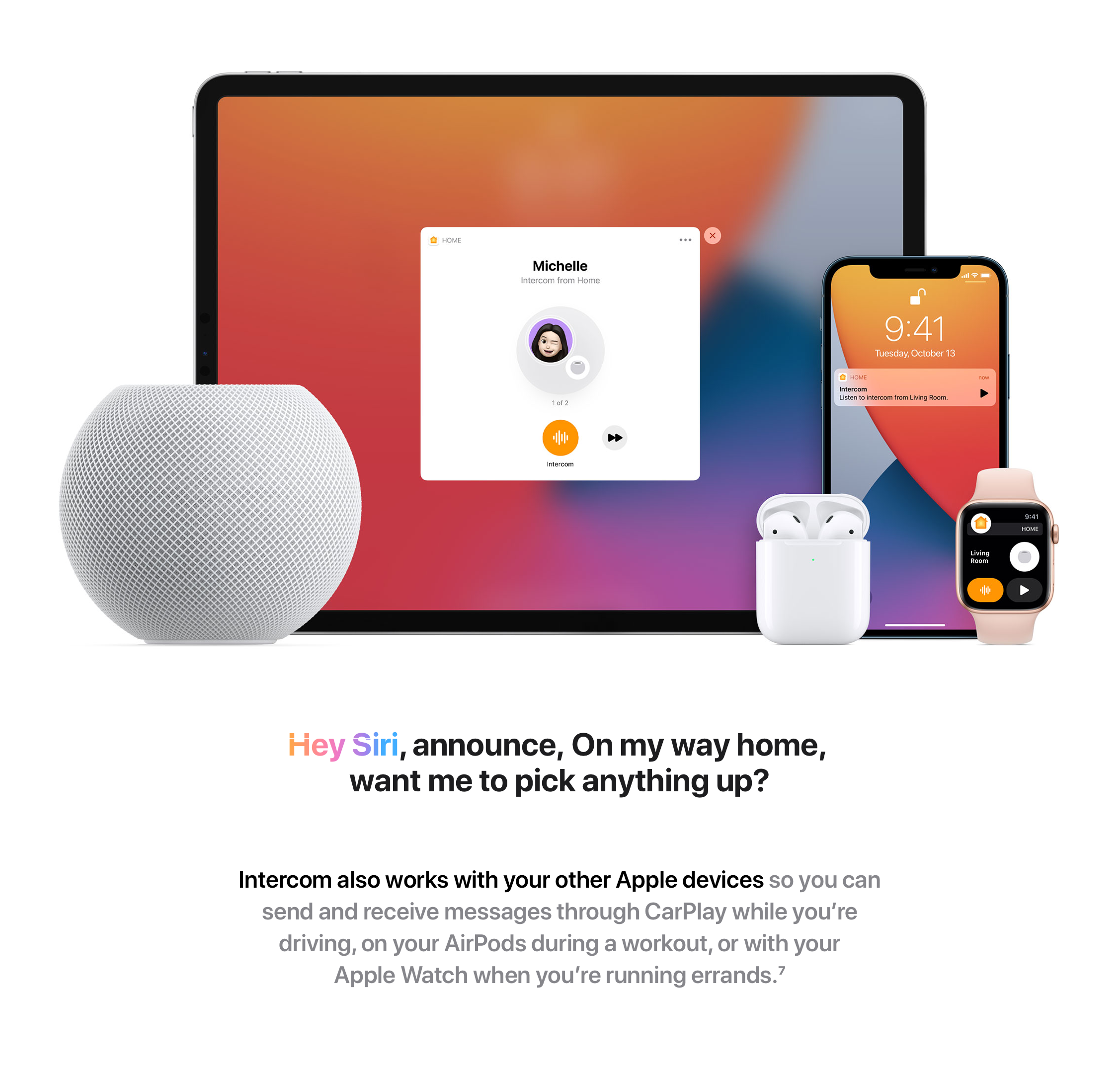

The broader picture Apple painted was how much stronger their HomePod + all other devices strategy could come together now that a $99 HomePod is an option, and you can have one in many rooms of your house. Where this story came together was with Apple’s Intercom feature, where when you want to send a message to your family, it can play on not just the HomePod/HomePod mini in the house but any device, including AirPods.

This image demonstrates Apple’s ability to leverage the numerous other devices in the home and outside the home and glue them together with the presence of a smart speaker. What this highlights again is Apple’s ability to integrate and how a solution can cleanly tie together the more devices you own. Many of the voice assistant products from Amazon and Google feel more like island experiences where the device does what it does, and that’s it. Largely that is because Amazon and Google may have an Echo in a room in the house, but they don’t own all the other common endpoints most consumers care about used daily.

The elephant in the room for this strategy is, of course, Siri. And while I admit Siri is still weak in many of the areas where Alexa and Google Assistant are strong, the more consistent parts of the Siri experience that do shine are the ones where you don’t have to talk to Siri.

Overall, Apple’s positioning of Siri was telling. While I blatantly disagree with calling Siri a world-class assistant as they did, Siri is, for now, a mostly competent assistant for what it is designed for. Apple gave examples of Siri in use cases I’ll bucket as automation, facts, and anticipation.

For automation, I’ve long argued that is all people do with smart assistants mostly anyway. Things like to set the alarm, play music, set a timer, or simply turn off a light. All you are doing is using your voice to complete an action you would have otherwise had to use your fingers for. This is easily the dominant use case for voice assistants today, and Siri is competent here.

Facts had traditionally been Siri’s weakness, and even study after study we did on how people use smart assistants, we did not find facts or general information to be a top use case for any assistant other than Google’s. While it is nice Apple added more facts to Siri’s knowledge base, it is unclear to me if there is much value here for Apple/Siri.

Anticipation is the most interesting category for me. This is where Apple owning the pocket of its customer can reveal the most value in Siri. And most interestingly, the best examples of this today show up in situations where you don’t talk to Siri. Siri suggestions in things like contacts, mail, apps, and others are looking at behavior and attempting to limit steps you need to take to get to the desired action. These are the powerful areas where Apple can press on their advantage of owning the pocket and do more than Amazon can and Google to a degree.

We are beginning to see more of Apple’s home category start to take shape. When they created a subcategory for home out of “other” from a revenue standpoint is indicated they had more products and services than just HomePod in the pipeline. The smart speaker market is a relatively large one with estimates of the current installed base being ~280m smart speakers worldwide. Amazon having the largest chunk of that, and an interesting question is how loyal will current iPhone owners are also Echo owners be to the product when they see more of the ecosystem value and price of HomePod mini. A study we did months after HomePod was released showed price as the major barrier for people to purchase one and the vast majority (54% of people saying they would be very interested in a lower-priced HomePod mini. A note I read from Morgan Stanely indicated the lower-priced HomePod Mini increases Apple’s total addressable market by ~4x.

The lack of Spotify could be an interesting problem for Apple, although I do hope Apple works with Spotify to support the service as it will greatly aid in the value proposition. Other areas to watch are ways Apple can tie HomePod nicely into Apple TV and perhaps even with things like AppleTV+ with unique audio experiences. Another angle for Apple to drive up HomePod’s base is to offer the Mini as a bundle with other hardware via promotions.

Ultimately $99 is a much more aggressive price for the Mini and a key strategy for the home for Apple in my opinion, and HomePod Mini should help Apple gain ground against Amazon and Google and lay a deeper foundation for Apple’s ecosystem.

Hi this is somewhat of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding expertise so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

Unquestionably imagine that which you said.Your favorite reason appeared to be on the net the easiest factor totake into accout Greens Of Bliss CBD Oil – http://www.atomy123.com -.I say to you, I definitely get irked whilst people consider issues that theyjust don’t recognise about. You controlled to hit the nail upon the highest and also defined out the whole thing without having side-effects , people could takea signal. Will probably be back to get more. Thanks!

What i do not understood is if truth be told how you arenot actually a lot more smartly-liked than you might benow. You are so intelligent. You know therefore significantly in termsof this subject, made me in my opinion imagine it from numerousvarious angles. Its like men and women don’t seem to be interested until it is one thing to accomplish with Lady gaga!Your own stuffs nice. All the time maintain itup!

Nice blog here! Also your web site loads up very fast! What host are you using? Can I get your affiliate link to your host? I wish my site loaded up as fast as yours lol

This article is a gem. I’ve bookmarked it for future reference. Thanks for the valuable insights!

Hello just wanted to give you a quick heads up. The text in your article seem to be running off the screen in Internet explorer. I’m not sure if this is a formatting issue or something to do with internet browser compatibility but I figured I’d post to let you know. The layout look great though! Hope you get the issue solved soon. Cheers

Thank you, I have just been searching for info about this subject for ages and yours is the greatest I’ve discovered so far. But, what about the conclusion? Are you sure about the source?

czy delta 8 thc jest legalne w polsce

Hi, I think your blog might be having browser compatibility issues. When I look at your website in Ie, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, awesome blog!

Hey are using WordPress for your site platform? I’m new to the blog world but I’m trying to get started and create my own. Do you require any html coding knowledge to make your own blog? Any help would be greatly appreciated!

Very nice blog post. I definitely love this site. Stick with it! .

Thank you for great article. I look forward to the continuation.

This was beautiful Admin. Thank you for your reflections.

Chat with a horny model now – they are online and want your company!

I like this blog very much, Its a real nice berth to read and incur info .

I don’t even know the way I finished up right here, however I assumed this publish used to be good. I do not understand who you might be however definitely you are going to a well-known blogger in case you aren’t already 😉 Cheers!

he blog was how do i say it… relevant, finally something that helped me. Thanks

Valuable info. Lucky me I found your web site by accident, and I am shocked why this accident did not happened earlier! I bookmarked it.

Very good written article. It will be supportive to anyone who usess it, as well as yours truly :). Keep up the good work – i will definitely read more posts.

It is truly a great and useful piece of info. I’m satisfied that you just shared this useful info with us. Please stay us informed like this. Thank you for sharing.

As a Newbie, I am permanently exploring online for articles that can aid me. Thank you

I do agree with all of the ideas you’ve presented in your post. They’re really convincing and will certainly work. Still, the posts are very short for newbies. Could you please extend them a bit from next time? Thanks for the post.

Thanks on your marvelous posting! I certainly enjoyed reading it, you may be a great author.I will ensure that I bookmark your blog and will often come back later on. I want to encourage one to continue your great posts, have a nice morning!

I like this, but I do have a question. Do you mind answering?

I think other web-site proprietors should take this site as an model, very clean and wonderful user friendly style and design, let alone the content. You’re an expert in this topic!

Sweet site, super design, rattling clean and apply pleasant.

Would you be fascinated about exchanging hyperlinks?

What’s Going down i’m new to this, I stumbled upon this I’ve found It positively helpful and it has aided me out loads. I am hoping to contribute & assist different customers like its aided me. Great job.

Hello There. I found your blog using msn. This is a very well written article. I’ll be sure to bookmark it and return to read more of your useful information. Thanks for the post. I will certainly return.

I¦ll right away snatch your rss feed as I can’t find your e-mail subscription hyperlink or e-newsletter service. Do you have any? Please let me realize so that I may subscribe. Thanks.

We are a group of volunteers and opening a new scheme in our community. Your web site offered us with valuable information to work on. You have done an impressive job and our entire community will be thankful to you.

Spot on with this write-up, I really suppose this website needs rather more consideration. I’ll in all probability be once more to learn far more, thanks for that info.

Do you have a spam issue on this site; I also am a blogger, and I was wanting to know your situation; we have created some nice procedures and we are looking to trade methods with others, why not shoot me an email if interested.

Excellent blog here! Also your web site loads up very fast! What host are you using? Can I get your affiliate link to your host? I wish my website loaded up as fast as yours lol

Lovely just what I was searching for.Thanks to the author for taking his time on this one.

Thank you for another informative website. Where else could I get that kind of info written in such an ideal way? I have a project that I am just now working on, and I have been on the look out for such info.

https://ivermectin.store/# stromectol uk buy

http://indianpharm.store/# indian pharmacy paypal indianpharm.store

https://canadianpharm.store/# canada drugs reviews canadianpharm.store

family pharmacy online: canadian discount online pharmacy – medicine from canada with no prescriptions

canadian pharmacy online canada: cheapest canadian pharmacy – canadian prescription drugs

https://certifiedpharmacymexico.pro/# mexico pharmacy

mexico pharmacies prescription drugs mexico pharmacy medicine in mexico pharmacies

https://mexicoph24.life/# mexico drug stores pharmacies

http://canadaph24.pro/# canadian pharmacies that deliver to the us

http://canadaph24.pro/# best canadian pharmacy to buy from

http://canadaph24.pro/# canadian discount pharmacy

https://canadaph24.pro/# cheap canadian pharmacy

mexican drugstore online: mexican pharmacy – mexican pharmaceuticals online

Hey, I think your website might be having browser compatibility issues. When I look at your blog site in Opera, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, excellent blog!

Way cool, some valid points! I appreciate you making this article available, the rest of the site is also high quality. Have a fun.

I have been surfing online more than 3 hours lately, but I by no means found any interesting article like yours. It is pretty price sufficient for me. In my view, if all site owners and bloggers made excellent content material as you did, the internet can be much more helpful than ever before.

Good write-up, I’m regular visitor of one’s website, maintain up the excellent operate, and It’s going to be a regular visitor for a long time.

It is perfect time to make some plans for the future and it’s time to be happy. I’ve read this post and if I could I wish to suggest you few interesting things or suggestions. Perhaps you can write next articles referring to this article. I desire to read more things about it!

There’s noticeably a bundle to learn about this. I assume you made sure nice factors in options also.

Would you be fascinated with exchanging hyperlinks?

Somebody essentially help to make seriously posts I would state. This is the very first time I frequented your website page and thus far? I surprised with the research you made to make this particular publish extraordinary. Magnificent job!

I very pleased to find this site on bing, just what I was searching for : D too saved to favorites.

I got what you intend, regards for putting up.Woh I am thankful to find this website through google.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Hey very cool site!! Man .. Excellent .. Amazing .. I will bookmark your site and take the feeds also…I’m happy to find numerous useful info here in the post, we need develop more techniques in this regard, thanks for sharing. . . . . .

you are in reality a good webmaster. The web site loading velocity is amazing. It sort of feels that you are doing any unique trick. Furthermore, The contents are masterwork. you have performed a great activity on this subject!

I needed to draft you this tiny word just to say thank you the moment again on the great secrets you have documented here. This has been quite seriously open-handed with you to present easily just what a lot of people could have offered for an electronic book to make some profit for their own end, and in particular seeing that you could have tried it in the event you considered necessary. The pointers as well worked to be the easy way to fully grasp that other people online have the same dreams just like my very own to grasp more on the subject of this condition. I’m certain there are numerous more pleasant situations in the future for individuals that view your website.

I got what you mean , regards for putting up.Woh I am happy to find this website through google.

Wow! This can be one particular of the most helpful blogs We’ve ever arrive across on this subject. Actually Magnificent. I’m also an expert in this topic therefore I can understand your effort.

Its such as you learn my thoughts! You seem to understand a lot approximately this, such as you wrote the e-book in it or something. I think that you simply can do with a few percent to power the message house a little bit, however other than that, this is wonderful blog. A fantastic read. I’ll definitely be back.

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

Well I sincerely enjoyed studying it. This information offered by you is very practical for good planning.

Thank you so much for providing individuals with an extremely marvellous possiblity to check tips from here. It’s always very superb and jam-packed with amusement for me personally and my office acquaintances to search your web site particularly 3 times every week to read through the newest issues you will have. And of course, I am also at all times amazed concerning the special tips you give. Certain 2 points in this posting are unquestionably the very best we’ve had.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is fundamental and all. Nevertheless just imagine if you added some great graphics or video clips to give your posts more, “pop”! Your content is excellent but with pics and videos, this website could definitely be one of the best in its field. Awesome blog!

Pretty great post. I just stumbled upon your weblog and wished to mention that I have really enjoyed surfing around your blog posts. In any case I will be subscribing in your rss feed and I hope you write again soon!

Thanks for the sensible critique. Me & my neighbor were just preparing to do a little research on this. We got a grab a book from our local library but I think I learned more from this post. I am very glad to see such great info being shared freely out there.

Lovely just what I was looking for.Thanks to the author for taking his time on this one.

whoah this blog is great i like studying your posts. Stay up the good work! You know, a lot of individuals are searching round for this information, you could aid them greatly.

I always was interested in this subject and stock still am, thankyou for posting.

Great beat ! I wish to apprentice even as you amend your site, how can i subscribe for a weblog website? The account aided me a applicable deal. I have been a little bit familiar of this your broadcast offered bright transparent concept

I haven’t checked in here for some time since I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂

Real superb information can be found on blog. “Compassion for myself is the most powerful healer of them all.” by Theodore Isaac Rubin.

I like this post, enjoyed this one appreciate it for posting.

I like the valuable information you provide in your articles. I will bookmark your blog and check again here frequently. I am quite sure I’ll learn a lot of new stuff right here! Best of luck for the next!

I’m not sure where you are getting your information, but great topic. I needs to spend some time learning much more or understanding more. Thanks for excellent info I was looking for this info for my mission.

Thank you, I have just been searching for information approximately this subject for a while and yours is the best I have discovered till now. However, what concerning the bottom line? Are you sure about the source?

I simply couldn’t go away your website before suggesting that I actually enjoyed the standard information an individual provide in your guests? Is going to be again continuously to check out new posts

I am often to blogging and i really admire your content. The article has really peaks my interest. I’m going to bookmark your web site and hold checking for brand new information.

But wanna comment that you have a very nice internet site, I love the style it actually stands out.

I couldn’t resist commenting

Heya i’m for the first time here. I came across this board and I find It truly useful & it helped me out much. I hope to give something back and help others like you helped me.

I have been surfing online greater than three hours these days, but I never found any attention-grabbing article like yours. It?¦s pretty value enough for me. In my view, if all webmasters and bloggers made excellent content material as you did, the internet shall be much more useful than ever before.

Hola! Sé que esto está un poco fuera de tema, pero me preguntaba si sabías dónde podría obtener un complemento captcha para mi formulario de comentarios. estoy usando t¿La misma plataforma de blogs que la tuya y tengo dificultad para encontrar una? ¡Muchas gracias!

As I website possessor I think the subject matter here is very wonderful, thanks for your efforts.

We’re a group of volunteers and starting a new scheme in our community. Your site provided us with valuable info to work on. You’ve done an impressive job and our entire community will be grateful to you.

Hi! I’ve been reading your web site for some time now and finally got the courage to go ahead and give you a shout out from Atascocita Tx! Just wanted to say keep up the fantastic work!

Excellent site. Plenty of useful information here. I¦m sending it to some pals ans also sharing in delicious. And certainly, thank you for your sweat!

Your style is so unique compared to many other people. Thank you for publishing when you have the opportunity,Guess I will just make this bookmarked.2

Virtually all of the things you point out is astonishingly legitimate and it makes me wonder the reason why I had not looked at this in this light previously. Your piece truly did switch the light on for me personally as far as this specific issue goes. Nevertheless at this time there is one particular issue I am not necessarily too cozy with so whilst I try to reconcile that with the actual core idea of your position, let me see just what the rest of your visitors have to say.Very well done.

Hello there, You’ve performed a fantastic job. I will certainly digg it and for my part recommend to my friends. I’m confident they’ll be benefited from this web site.

You made some first rate points there. I looked on the internet for the problem and located most individuals will go together with with your website.

It’s in reality a nice and helpful piece of information. I am happy that you simply shared this useful information with us. Please stay us up to date like this. Thank you for sharing.

Hi there! Someone in my Facebook group shared this site with us so I came to look it over. I’m definitely enjoying the information. I’m book-marking and will be tweeting this to my followers! Wonderful blog and fantastic style and design.

I do not even know the way I finished up right here, however I assumed this put up used to be good. I don’t know who you’re but certainly you’re going to a famous blogger should you aren’t already 😉 Cheers!

I like this web blog very much, Its a really nice situation to read and obtain info .

I’m impressed, I need to say. Really rarely do I encounter a blog that’s both educative and entertaining, and let me inform you, you have hit the nail on the head. Your concept is outstanding; the problem is one thing that not enough persons are talking intelligently about. I’m very completely satisfied that I stumbled throughout this in my search for something relating to this.

Hey there this is somewhat of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding experience so I wanted to get guidance from someone with experience. Any help would be greatly appreciated!

I am really loving the theme/design of your weblog. Do you ever run into any web browser compatibility issues? A small number of my blog audience have complained about my blog not operating correctly in Explorer but looks great in Firefox. Do you have any suggestions to help fix this problem?

Very good written article. It will be useful to everyone who employess it, including yours truly :). Keep doing what you are doing – for sure i will check out more posts.

I’m really loving the theme/design of your blog. Do you ever run into any browser compatibility problems? A few of my blog readers have complained about my site not working correctly in Explorer but looks great in Safari. Do you have any recommendations to help fix this issue?

As a Newbie, I am constantly searching online for articles that can benefit me. Thank you

Hi my loved one! I want to say that this post is awesome, nice written and come with approximately all important infos. I would like to see more posts like this.

Some truly wonderful info , Sword lily I noticed this.

Just wish to say your article is as astonishing. The clarity in your post is simply great and i could assume you’re an expert on this subject. Well with your permission allow me to grab your RSS feed to keep updated with forthcoming post. Thanks a million and please keep up the rewarding work.

whoah this blog is great i love studying your articles. Keep up the great paintings! You recognize, many people are hunting round for this information, you could help them greatly.

Thanks, I’ve just been searching for information about this subject for a long time and yours is the best I have found out so far. However, what concerning the conclusion? Are you positive about the supply?

Hello! I know this is kinda off topic but I’d figured I’d ask. Would you be interested in trading links or maybe guest authoring a blog article or vice-versa? My website covers a lot of the same topics as yours and I believe we could greatly benefit from each other. If you might be interested feel free to shoot me an e-mail. I look forward to hearing from you! Excellent blog by the way!

I am lucky that I found this blog, precisely the right information that I was searching for! .

It’s in reality a nice and helpful piece of info. I’m satisfied that you just shared this useful information with us. Please stay us up to date like this. Thanks for sharing.

Yesterday, while I was at work, my cousin stole my iPad and tested to see if it can survive a 30 foot drop, just so she can be a youtube sensation. My apple ipad is now destroyed and she has 83 views. I know this is totally off topic but I had to share it with someone!

As I website possessor I believe the content material here is rattling wonderful , appreciate it for your efforts. You should keep it up forever! Best of luck.

http://withoutprescription.guru/# best non prescription ed pills

Appreciate it for this post, I am a big fan of this internet site would like to continue updated.

WONDERFUL Post.thanks for share..extra wait .. …

Undeniably believe that which you said. Your favorite justification appeared to be on the internet the easiest thing to be aware of.

I say to you, I definitely get annoyed while people consider worries that they just don’t know

about. You managed to hit the nail upon the top and also defined

out the whole thing without having side effect , people can take a signal.

Will likely be back to get more. Thanks

You are a very capable person!

Hello there, You’ve done an incredible job. I will certainly digg it and personally suggest

to my friends. I am confident they will be benefited from this site.

male ed drugs: impotence pills – best ed medication

You are my breathing in, I possess few blogs and infrequently run out from to post : (.

Hello, Neat post. There’s an issue along with your site in internet explorer, may check thisK IE still is the marketplace leader and a good part of other people will omit your fantastic writing due to this problem.

My partner and I stumbled over here different web page and thought I should check things out. I like what I see so now i am following you. Look forward to exploring your web page for a second time.

generic doxycycline: doxycycline 100mg online – generic doxycycline

great issues altogether, you just gained a logo new reader. What could you recommend about your post that you simply made a few days in the past? Any sure?

I have fun with, result in I discovered just what I was having a look for. You’ve ended my 4 day long hunt! God Bless you man. Have a nice day. Bye

mexican pharmaceuticals online: mexican pharmaceuticals online – pharmacies in mexico that ship to usa

Thanks for all your efforts that you have put in this. very interesting info .

Hi there all, here every one is sharing such experience, therefore it’s

nice to read this web site, and I used to pay a quick visit this website every

day.

An outstanding share! I’ve just forwarded this onto a coworker

who was conducting a little research on this. And he actually bought me breakfast due to

the fact that I discovered it for him… lol. So allow me to reword this….

Thank YOU for the meal!! But yeah, thanx for spending time

to discuss this issue here on your web site.

What i don’t understood is in reality how you’re no longer actually much more neatly-appreciated than you might be right now. You are very intelligent. You already know therefore significantly on the subject of this matter, made me in my opinion believe it from numerous numerous angles. Its like women and men are not fascinated except it?¦s one thing to do with Woman gaga! Your own stuffs outstanding. All the time care for it up!

F*ckin¦ awesome issues here. I am very happy to peer your post. Thanks a lot and i am having a look ahead to touch you. Will you kindly drop me a e-mail?

prescription drugs online: buy prescription drugs without doctor – buy cheap prescription drugs online

cost propecia for sale: buying propecia tablets – cost of generic propecia tablets

Excellent site. A lot of useful info here. I¦m sending it to some buddies ans additionally sharing in delicious. And obviously, thank you to your effort!

Great post however I was wanting to know if you could write a litte more on this subject? I’d be very thankful if you could elaborate a little bit more. Thank you!

Kamagra Oral Jelly: cheap kamagra – Kamagra Oral Jelly

drugs for ed erectile dysfunction medicines cheapest ed pills

What’s up, yes this post is truly good and I have learned lot of things from it about blogging.

thanks.

tadalafil generic over the counter: tadalafil tablets price in india – buy generic tadalafil online

https://tadalafil.trade/# buy tadalafil online paypal

best treatment for ed: treatments for ed – pills for erection

sildenafil 100 canada sildenafil 25 mg mexico generic sildenafil without a prescription

I visited a lot of website but I believe this one has got something special in it in it

Hello, i think that i saw you visited my website so i

came to “return the favor”.I am trying to find things to enhance my web site!I suppose its ok

to use a few of your ideas!!

This web page is really a walk-by means of for the entire information you wanted about this and didn’t know who to ask. Glimpse right here, and also you’ll undoubtedly discover it.

An intriguing discussion is worth comment. I do believe that you need to

publish more about this subject, it might not be a taboo matter but generally

people don’t talk about such subjects. To the next! Best wishes!!

Levitra 10 mg best price Buy Vardenafil 20mg online Levitra 20 mg for sale

Cheap Levitra online: buy Levitra over the counter – Buy Vardenafil 20mg

Hello my family member! I wish to say that this article is amazing, great written and include almost all important infos. I would like to see more posts like this.

tadalafil tablets 10 mg online: tadalafil 10mg coupon – where can i buy tadalafil

http://levitra.icu/# Levitra generic best price

sildenafil oral jelly 100mg kamagra Kamagra Oral Jelly buy kamagra online usa

Buy Vardenafil online Buy Vardenafil online Levitra 20 mg for sale

Levitra generic best price: Levitra tablet price – Vardenafil buy online

Levitra online pharmacy: Levitra 20 mg for sale – Buy Vardenafil 20mg online

http://amoxicillin.best/# buy amoxicillin 500mg uk

zithromax azithromycin: zithromax antibiotic – zithromax tablets for sale

amoxicillin online canada: buying amoxicillin online – amoxicillin 200 mg tablet

http://lisinopril.auction/# lisinopril 20mg discount

amoxicillin 500 mg tablet: buy amoxil – amoxicillin 800 mg price

zestril 2.5 mg tablets: Lisinopril 10 mg Tablet buy online – buy lisinopril 10 mg

http://azithromycin.bar/# buy cheap zithromax online

Perfect piece of work you have done, this internet site is really cool with great information.

ciprofloxacin generic: Buy ciprofloxacin 500 mg online – buy cipro online

buy amoxicillin 500mg usa: cheap amoxicillin – amoxicillin 250 mg price in india

https://lisinopril.auction/# zestril over the counter

doxycycline 50 mg: Buy doxycycline hyclate – online doxycycline

http://amoxicillin.best/# amoxicillin online no prescription

online lisinopril: buy lisinopril online – prinivil 5mg tablet

I absolutely love your blog and find a lot of your post’s to be just what I’m looking for. can you offer guest writers to write content for yourself? I wouldn’t mind writing a post or elaborating on most of the subjects you write concerning here. Again, awesome blog!

http://azithromycin.bar/# zithromax 500 without prescription

doxycycline price comparison: buy doxycycline over the counter – doxycycline tablets where to buy

http://buydrugsonline.top/# best canadian pharmacies

I think this internet site contains very excellent written content articles.

canadian drug stores: canadianpharmacymeds com – canadian world pharmacy

pharmacy in canada trust canadian pharmacy pharmacy canadian

Utterly written articles, Really enjoyed looking through.

http://ordermedicationonline.pro/# offshore online pharmacies

buying prescription drugs in mexico: best online pharmacy – mexican rx online

https://indiapharmacy.site/# india pharmacy

canada pharmacy: international online pharmacy – canadian pharmacy

I am glad to be one of the visitants on this great site (:, appreciate it for putting up.

canadian online drugs trust canadian pharmacy canadian pharmacy king reviews

The very core of your writing while sounding agreeable initially, did not really work properly with me personally after some time. Somewhere throughout the sentences you actually managed to make me a believer unfortunately just for a short while. I still have a problem with your leaps in assumptions and one would do well to help fill in all those breaks. In the event you can accomplish that, I could undoubtedly be amazed.

https://wellbutrin.rest/# how to get brand name wellbutrin cheap

Paxlovid over the counter: Paxlovid over the counter – п»їpaxlovid

I really appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again

https://wellbutrin.rest/# wellbutrin brand price

can i get generic clomid without dr prescription: clomid best price – can i buy cheap clomid

https://clomid.club/# buying cheap clomid without dr prescription

п»їpaxlovid: paxlovid club – paxlovid covid

whoah this blog is excellent i like reading your posts. Stay up the great work! You already know, lots of individuals are hunting round for this information, you could aid them greatly.

The CBD SEO Intermediation delivers top-notch services for businesses in the thriving CBD industry. With a strategic nearer to Search Appliance Optimization (SEO), they cbd seo company dominate in enhancing online visibility and driving consistent traffic. Their mastery lies in tailoring SEO strategies specifically in the interest of CBD companies, navigating the unexcelled challenges of this niche market. Middle of comprehensive keyword delve into, content optimization, and link-building tactics, they effectively upwards search rankings, ensuring clients experience inaccurate amidst competition. Their side’s pledge to staying updated with industry trends and search motor algorithms ensures a dynamic and effective approach. The CBD SEO Agency’s commitment to transparency and patient communication fosters keeping and reliability. All-embracing, their specialized services pander to to the noticeable needs of CBD businesses, making them a valuable associate in navigating the digital aspect within this competitive market.

paxlovid pharmacy https://paxlovid.club/# paxlovid for sale

I like what you guys are up too. Such intelligent work and reporting! Keep up the superb works guys I?ve incorporated you guys to my blogroll. I think it’ll improve the value of my web site 🙂

http://wellbutrin.rest/# wellbutrin 65mg

buy gabapentin online: neurontin 300 mg cap – purchase neurontin canada

http://clomid.club/# cost of generic clomid without prescription

generic neurontin 600 mg: buy gabapentin – neurontin 214

https://wellbutrin.rest/# average cost of wellbutrin

how can i get cheap clomid no prescription: clomid best price – can you buy cheap clomid no prescription

http://paxlovid.club/# paxlovid india

farmacia online migliore: avanafil prezzo – farmacie online affidabili

farmacie online sicure farmacia online spedizione gratuita comprare farmaci online all’estero

farmacie online affidabili: avanafil prezzo in farmacia – farmaci senza ricetta elenco

https://tadalafilit.store/# п»їfarmacia online migliore

viagra naturale in farmacia senza ricetta: viagra online siti sicuri – pillole per erezioni fortissime

comprare farmaci online all’estero: comprare avanafil senza ricetta – farmacia online senza ricetta

farmacia online: farmacia online miglior prezzo – farmacia online migliore

comprare farmaci online all’estero Farmacie a milano che vendono cialis senza ricetta farmacie online autorizzate elenco

acquistare farmaci senza ricetta: cialis generico – farmacie on line spedizione gratuita

https://kamagrait.club/# acquisto farmaci con ricetta

farmacia online migliore: farmacia online spedizione gratuita – farmacie on line spedizione gratuita

top farmacia online: farmacia online – farmaci senza ricetta elenco

farmacia online più conveniente: kamagra – farmacia online migliore

farmacia online piГ№ conveniente avanafil spedra comprare farmaci online con ricetta

cialis farmacia senza ricetta: sildenafil 100mg prezzo – farmacia senza ricetta recensioni

farmacia online miglior prezzo: kamagra gel prezzo – farmacia online miglior prezzo

farmacia online senza ricetta: kamagra gel prezzo – farmacia online migliore

comprare farmaci online all’estero: farmacia online miglior prezzo – farmaci senza ricetta elenco

http://tadalafilit.store/# acquistare farmaci senza ricetta

acquistare farmaci senza ricetta: kamagra oral jelly consegna 24 ore – comprare farmaci online all’estero

top farmacia online: farmacia online più conveniente – farmacie online sicure

farmacia online miglior prezzo kamagra oral jelly farmacie online sicure

acquisto farmaci con ricetta: farmacia online spedizione gratuita – comprare farmaci online con ricetta

Hi my loved one! I want to say that this article is amazing, great written and include approximately all significant infos. I would like to look extra posts like this .

farmacia online più conveniente: avanafil prezzo – comprare farmaci online all’estero

farmacia online migliore: Tadalafil generico – acquistare farmaci senza ricetta

I loved as much as you will receive carried out right here.

The sketch is attractive, your authored material stylish. nonetheless,

you command get bought an shakiness over that you wish be delivering

the following. unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike.

acquistare farmaci senza ricetta: farmacia online miglior prezzo – farmaci senza ricetta elenco

You actually make it seem so easy with your presentation but I find this matter to be actually something that I think I would never understand. It seems too complicated and extremely broad for me. I am looking forward for your next post, I will try to get the hang of it!

acquistare farmaci senza ricetta cialis prezzo farmaci senza ricetta elenco

farmacie on line spedizione gratuita: farmacia online – acquistare farmaci senza ricetta

farmacie on line spedizione gratuita: avanafil prezzo in farmacia – acquisto farmaci con ricetta

farmacie online sicure: comprare avanafil senza ricetta – acquisto farmaci con ricetta

https://avanafilit.icu/# acquistare farmaci senza ricetta

comprare farmaci online con ricetta: farmacia online miglior prezzo – comprare farmaci online all’estero

farmacie online affidabili farmacia online spedizione gratuita farmacie online affidabili

farmacia online più conveniente: farmacia online più conveniente – farmacia online miglior prezzo

I gave sleep cbd gummies a strive quest of the first patch, and I’m amazed! They tasted great and provided a wisdom of calmness and relaxation. My stress melted away, and I slept control superiors too. These gummies are a game-changer representing me, and I highly propound them to anyone seeking natural ictus assuagement and better sleep.

farmacie online autorizzate elenco: avanafil spedra – farmacie on line spedizione gratuita

farmacie online sicure: kamagra gold – acquisto farmaci con ricetta

comprare farmaci online con ricetta: kamagra gel prezzo – farmacie online affidabili

miglior sito dove acquistare viagra: viagra prezzo – cialis farmacia senza ricetta

le migliori pillole per l’erezione sildenafil 100mg prezzo viagra consegna in 24 ore pagamento alla consegna

http://avanafilit.icu/# farmacia online piГ№ conveniente

acquistare farmaci senza ricetta: kamagra – comprare farmaci online con ricetta

http://sildenafilo.store/# viagra online gibraltar

se puede comprar sildenafil sin receta: comprar viagra en espana – venta de viagra a domicilio

https://kamagraes.site/# farmacia online 24 horas

https://farmacia.best/# farmacias baratas online envГo gratis

http://kamagraes.site/# farmacia envÃos internacionales

http://farmacia.best/# farmacia barata

http://sildenafilo.store/# viagra para mujeres

farmacia barata: Precio Cialis 20 Mg – farmacia barata

http://sildenafilo.store/# sildenafilo 50 mg precio sin receta

https://farmacia.best/# farmacia online internacional

http://vardenafilo.icu/# farmacia online envÃo gratis

https://farmacia.best/# farmacia online envÃo gratis

http://sildenafilo.store/# viagra para hombre precio farmacias similares

Great post. I am facing a couple of these problems.

http://vardenafilo.icu/# farmacia online madrid

п»їfarmacia online: comprar cialis online seguro – farmacia barata

http://vardenafilo.icu/# farmacias online baratas

https://kamagraes.site/# farmacias online baratas

farmacias baratas online envГo gratis: farmacia online internacional – farmacia barata

https://sildenafilo.store/# sildenafilo cinfa sin receta

https://farmacia.best/# farmacia online barata

http://sildenafilo.store/# sildenafilo cinfa 100 mg precio farmacia

https://farmacia.best/# farmacias baratas online envÃo gratis

http://tadalafilo.pro/# farmacia 24h

https://farmacia.best/# farmacia online internacional

farmacias online baratas: comprar cialis original – farmacia online envГo gratis

http://farmacia.best/# farmacia barata

https://farmacia.best/# farmacia online envÃo gratis

http://farmacia.best/# farmacias online baratas

https://sildenafilo.store/# comprar viagra contrareembolso 48 horas

https://sildenafilo.store/# viagra online cerca de malaga

Super-Duper blog! I am loving it!! Will come back again. I am bookmarking your feeds also.

sildenafilo 50 mg comprar online: comprar viagra contrareembolso 48 horas – viagra online cerca de bilbao

http://tadalafilo.pro/# farmacias baratas online envÃo gratis

http://vardenafilo.icu/# farmacia online internacional

https://kamagraes.site/# farmacias online seguras en espaГ±a

http://sildenafilo.store/# comprar viagra online en andorra

farmacia barata: farmacia online envio gratis murcia – п»їfarmacia online

http://vardenafilo.icu/# farmacia online 24 horas

https://vardenafilo.icu/# farmacia online 24 horas

http://sildenafilo.store/# venta de viagra a domicilio

http://farmacia.best/# farmacias online seguras en españa

Good day very cool website!! Man .. Beautiful .. Superb .. I will bookmark your blog and take the feeds alsoKI’m satisfied to search out so many useful information right here within the submit, we need work out more techniques in this regard, thanks for sharing. . . . . .

http://tadalafilo.pro/# farmacia online

http://tadalafilo.pro/# farmacias online seguras

farmacia online 24 horas Levitra sin receta farmacia 24h

http://sildenafilo.store/# sildenafilo cinfa 100 mg precio farmacia

http://farmacia.best/# farmacias online seguras

farmacia 24h: vardenafilo sin receta – farmacia barata

I’ll immediately clutch your rss feed as I can not find your email subscription link or e-newsletter service. Do you’ve any? Kindly let me realize so that I may just subscribe. Thanks.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

http://farmacia.best/# farmacia online madrid

Wonderful web site. A lot of helpful info here. I¦m sending it to some pals ans also sharing in delicious. And obviously, thank you in your effort!

http://vardenafilo.icu/# farmacia barata

https://kamagrafr.icu/# Pharmacie en ligne livraison rapide

farmacia online internacional: Precio Levitra En Farmacia – farmacias online seguras

https://viagrasansordonnance.store/# Viagra homme prix en pharmacie sans ordonnance

Pharmacie en ligne livraison 24h: acheter kamagra site fiable – Pharmacie en ligne pas cher

http://kamagrafr.icu/# pharmacie ouverte 24/24

Heya i’m for the first time here. I found this board and I find It really useful & it helped me out much. I hope to give something back and aid others like you helped me.

https://cialissansordonnance.pro/# Acheter médicaments sans ordonnance sur internet

Saya suka google

I got what you intend, thankyou for putting up.Woh I am delighted to find this website through google.

http://pharmacieenligne.guru/# pharmacie ouverte

farmacia online envГo gratis: kamagra – farmacias baratas online envГo gratis

https://kamagrafr.icu/# Pharmacie en ligne livraison 24h

acheter medicament a l etranger sans ordonnance: pharmacie en ligne sans ordonnance – Pharmacie en ligne livraison 24h

Wohh exactly what I was searching for, regards for posting.

https://pharmacieenligne.guru/# pharmacie ouverte 24/24

http://pharmacieenligne.guru/# Pharmacie en ligne fiable

Hello! I know this is kinda off topic but I’d figured I’d ask. Would you be interested in exchanging links or maybe guest authoring a blog post or vice-versa? My site covers a lot of the same subjects as yours and I think we could greatly benefit from each other. If you happen to be interested feel free to send me an email. I look forward to hearing from you! Fantastic blog by the way!

https://cialissansordonnance.pro/# Pharmacie en ligne pas cher

п»їfarmacia online: farmacias baratas online envio gratis – farmacia online madrid

https://viagrasansordonnance.store/# Viagra pas cher paris

I’m in attraction with the cbd products and natural face toner! The serum gave my epidermis a youthful support, and the lip balm kept my lips hydrated all day. Knowing I’m using moral, bona fide products makes me desire great. These are in the present climate my must-haves for a unorthodox and nourished look!

pharmacie ouverte 24/24: pharmacie en ligne pas cher – Pharmacie en ligne France

http://viagrasansordonnance.store/# Viagra Pfizer sans ordonnance

http://kamagrafr.icu/# Pharmacie en ligne livraison rapide

https://cialissansordonnance.pro/# pharmacie ouverte

I have read several just right stuff here. Certainly value bookmarking for revisiting. I surprise how much attempt you set to create the sort of magnificent informative website.

https://pharmacieenligne.guru/# Pharmacie en ligne livraison 24h

Viagra sans ordonnance 24h suisse: Viagra en france livraison rapide – Sildenafil teva 100 mg sans ordonnance

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

https://kamagrafr.icu/# Pharmacie en ligne France

Very interesting topic, appreciate it for putting up.

http://cialissansordonnance.pro/# acheter médicaments à l’étranger

farmacia online madrid: comprar cialis online seguro – farmacia online barata

https://cialissansordonnance.pro/# Acheter médicaments sans ordonnance sur internet

https://levitrafr.life/# Pharmacie en ligne sans ordonnance

Обзор игрового сайта Вулкан Platinum и зеркала Вулкан Платинум. Тысячи видеослотов, 100 бонус на первый депозит и ежедневные розыгрыши с призами ждут вас.

Sildenafil Preis viagra tabletten Viagra Generika kaufen Deutschland

https://potenzmittel.men/# versandapotheke

internet apotheke cialis rezeptfreie kaufen online apotheke deutschland

http://viagrakaufen.store/# Viagra Apotheke rezeptpflichtig

You can certainly see your expertise in the work you write. The sector hopes for even more passionate writers like you who are not afraid to mention how they believe. All the time follow your heart.

I have been absent for some time, but now I remember why I used to love this website. Thanks , I will try and check back more often. How frequently you update your site?

internet apotheke cialis preise online apotheke gГјnstig

Greetings from Ohio! I’m bored at work so I decided to check

out your blog on my iphone during lunch break. I enjoy

the information you provide here and can’t wait to take a look when I get home.

I’m shocked at how fast your blog loaded on my mobile ..

I’m not even using WIFI, just 3G .. Anyways,

wonderful site!

gГјnstige online apotheke: online apotheke gunstig – online apotheke preisvergleich

https://potenzmittel.men/# gГјnstige online apotheke

online apotheke preisvergleich kamagra oral jelly kaufen gГјnstige online apotheke

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

One more thing. It’s my opinion that there are a lot of travel insurance internet sites of trustworthy companies that permit you to enter your holiday details to get you the estimates. You can also purchase the actual international travel insurance policy on the internet by using your own credit card. All that you should do should be to enter your own travel information and you can start to see the plans side-by-side. You only need to find the program that suits your finances and needs and then use your credit card to buy them. Travel insurance online is a good way to check for a trustworthy company for international travel insurance. Thanks for revealing your ideas.

https://apotheke.company/# online apotheke preisvergleich

online apotheke deutschland potenzmittel kaufen online-apotheken

online-apotheken: online apotheke rezeptfrei – online apotheke versandkostenfrei

You have observed very interesting details! ps decent web site.

My husband and i got ecstatic when Michael could deal with his reports with the ideas he received out of your weblog. It’s not at all simplistic to just always be giving freely guidelines which usually the others might have been trying to sell. And now we see we’ve got the website owner to appreciate for that. The entire illustrations you have made, the easy web site navigation, the relationships your site assist to create – it’s many excellent, and it’s assisting our son and us reason why this issue is satisfying, which is certainly very serious. Thank you for the whole thing!

buying prescription drugs in mexico medication from mexico pharmacy buying from online mexican pharmacy

Some truly interesting info , well written and loosely user genial.

buying prescription drugs in mexico online reputable mexican pharmacies online mexico drug stores pharmacies

Good day very cool site!! Man .. Beautiful .. Wonderful .. I will bookmark your website and take the feeds additionally?KI’m satisfied to search out so many helpful info here within the submit, we want work out more techniques in this regard, thank you for sharing. . . . . .

http://mexicanpharmacy.cheap/# reputable mexican pharmacies online

buying from online mexican pharmacy п»їbest mexican online pharmacies reputable mexican pharmacies online

mexican drugstore online mexico drug stores pharmacies mexico drug stores pharmacies

buying from online mexican pharmacy buying prescription drugs in mexico online mexican border pharmacies shipping to usa

п»їbest mexican online pharmacies mexican drugstore online п»їbest mexican online pharmacies

mexico drug stores pharmacies mexico drug stores pharmacies reputable mexican pharmacies online

medication from mexico pharmacy mexican pharmacy buying prescription drugs in mexico

http://mexicanpharmacy.cheap/# pharmacies in mexico that ship to usa

Hello. fantastic job. I did not imagine this. This is a fantastic story. Thanks!

I would like to express appreciation to the writer just for rescuing me from this situation. Because of looking throughout the search engines and obtaining opinions which are not powerful, I was thinking my life was well over. Living minus the strategies to the difficulties you have solved as a result of your write-up is a crucial case, and those which may have in a wrong way damaged my career if I had not encountered your blog post. The talents and kindness in controlling all the things was vital. I’m not sure what I would have done if I had not come across such a solution like this. I’m able to now look ahead to my future. Thanks for your time so much for this skilled and amazing guide. I won’t be reluctant to refer your web site to anyone who needs and wants direction on this subject matter.

I’ve learn a few good stuff here. Definitely worth bookmarking for revisiting. I surprise how so much attempt you set to make such a excellent informative web site.

п»їbest mexican online pharmacies buying prescription drugs in mexico mexican online pharmacies prescription drugs

https://mexicanpharmacy.cheap/# mexico drug stores pharmacies

The subsequent time I learn a blog, I hope that it doesnt disappoint me as a lot as this one. I imply, I do know it was my option to read, but I truly thought youd have one thing fascinating to say. All I hear is a bunch of whining about something that you would fix in the event you werent too busy on the lookout for attention.

mexican online pharmacies prescription drugs best online pharmacies in mexico п»їbest mexican online pharmacies

mexican rx online buying prescription drugs in mexico online mexican online pharmacies prescription drugs

What i do not realize is actually how you’re not actually much more well-liked than you may be right now. You are very intelligent. You realize thus significantly relating to this subject, produced me personally consider it from so many varied angles. Its like women and men aren’t fascinated unless it is one thing to accomplish with Lady gaga! Your own stuffs nice. Always maintain it up!

reputable mexican pharmacies online pharmacies in mexico that ship to usa mexican drugstore online

May I have your authorization to add this content to my dataset? I want to mention that I’m collecting this data for my personal hobby as a data scientist, and rest assured, I’ll be citing the source in all circumstances. Here my campus page at Kampus Terbaik Thanks! ID : CMT-ONSBRZKQF37UE2VWCI

mexican drugstore online mexican border pharmacies shipping to usa best online pharmacies in mexico

http://mexicanpharmacy.cheap/# purple pharmacy mexico price list

mexican pharmacy mexican rx online mexican border pharmacies shipping to usa

mexican mail order pharmacies best mexican online pharmacies medication from mexico pharmacy

mexican drugstore online mexico drug stores pharmacies mexican mail order pharmacies

I got what you mean , regards for posting.Woh I am delighted to find this website through google.

http://canadapharmacy.guru/# canada pharmacy online legit canadapharmacy.guru

best canadian pharmacy online canadian pharmacy antibiotics – pharmacy canadian superstore canadiandrugs.tech

I think this is among the most vital info for me. And i am glad reading your article. But want to remark on few general things, The site style is ideal, the articles is really great : D. Good job, cheers

world pharmacy india buy medicines online in india world pharmacy india indiapharmacy.guru

Great work! This is the type of info that should be shared around the web. Shame on the search engines for not positioning this post higher! Come on over and visit my site . Thanks =)

Thank you for sharing excellent informations. Your website is so cool. I am impressed by the details that you have on this site. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my friend, ROCK! I found just the info I already searched everywhere and just couldn’t come across. What a perfect web-site.

http://edpills.tech/# ed drugs list edpills.tech

thecanadianpharmacy canadian pharmacy no scripts – the canadian pharmacy canadiandrugs.tech

https://indiapharmacy.guru/# top 10 online pharmacy in india indiapharmacy.guru

http://canadiandrugs.tech/# safe canadian pharmacies canadiandrugs.tech

http://mexicanpharmacy.company/# medication from mexico pharmacy mexicanpharmacy.company

https://edpills.tech/# generic ed pills edpills.tech

http://indiapharmacy.guru/# indian pharmacy indiapharmacy.guru

best ed pill best otc ed pills medicine for erectile edpills.tech

https://indiapharmacy.guru/# online shopping pharmacy india indiapharmacy.guru

http://indiapharmacy.guru/# top 10 online pharmacy in india indiapharmacy.guru

canadian pharmacy ltd my canadian pharmacy reviews – canadian pharmacy checker canadiandrugs.tech

http://canadiandrugs.tech/# safe canadian pharmacy canadiandrugs.tech

https://canadiandrugs.tech/# canadian pharmacy sarasota canadiandrugs.tech

https://edpills.tech/# male ed drugs edpills.tech

http://edpills.tech/# treatment of ed edpills.tech

https://edpills.tech/# buying ed pills online edpills.tech

https://canadiandrugs.tech/# buy prescription drugs from canada cheap canadiandrugs.tech

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

canadian pharmacy reviews maple leaf pharmacy in canada – canadian valley pharmacy canadiandrugs.tech

https://canadiandrugs.tech/# canadian pharmacy antibiotics canadiandrugs.tech

http://mexicanpharmacy.company/# buying prescription drugs in mexico online mexicanpharmacy.company

world pharmacy india world pharmacy india online shopping pharmacy india indiapharmacy.guru

http://indiapharmacy.guru/# indian pharmacies safe indiapharmacy.guru

http://edpills.tech/# best over the counter ed pills edpills.tech

https://edpills.tech/# ed dysfunction treatment edpills.tech

https://indiapharmacy.guru/# indianpharmacy com indiapharmacy.guru

https://indiapharmacy.guru/# top online pharmacy india indiapharmacy.guru

best canadian pharmacy online canadian pharmacy meds reviews – recommended canadian pharmacies canadiandrugs.tech

buy prescription drugs from india indian pharmacies safe online shopping pharmacy india indiapharmacy.guru

http://canadiandrugs.tech/# my canadian pharmacy rx canadiandrugs.tech

https://edpills.tech/# male ed pills edpills.tech

I really like your writing style, wonderful information, thanks for posting :D. “In every affair consider what precedes and what follows, and then undertake it.” by Epictetus.

http://edpills.tech/# best ed treatment pills edpills.tech

https://canadapharmacy.guru/# the canadian pharmacy canadapharmacy.guru

http://canadiandrugs.tech/# canada discount pharmacy canadiandrugs.tech

https://canadiandrugs.tech/# buy prescription drugs from canada cheap canadiandrugs.tech

erectile dysfunction medications ed dysfunction treatment pills erectile dysfunction edpills.tech

Some genuinely select blog posts on this site, saved to favorites.

https://indiapharmacy.guru/# buy medicines online in india indiapharmacy.guru

canada drug pharmacy cheap canadian pharmacy online – canadian family pharmacy canadiandrugs.tech

http://edpills.tech/# buy erection pills edpills.tech

http://canadiandrugs.tech/# canadian neighbor pharmacy canadiandrugs.tech

http://canadiandrugs.tech/# canada discount pharmacy canadiandrugs.tech

I got good info from your blog

buy cipro without rx cipro ciprofloxacin generic price

paxlovid price: paxlovid buy – paxlovid pharmacy

https://paxlovid.win/# paxlovid generic

get clomid now: cost cheap clomid without dr prescription – where can i get cheap clomid

paxlovid buy: paxlovid india – paxlovid buy

Great wordpress blog here.. It’s hard to find quality writing like yours these days. I really appreciate people like you! take care

A few things i have usually told individuals is that when looking for a good on-line electronics shop, there are a few variables that you have to factor in. First and foremost, you want to make sure to get a reputable and in addition, reliable retailer that has obtained great reviews and rankings from other customers and industry professionals. This will make sure that you are dealing with a well-known store that can offer good assistance and aid to the patrons. Thank you for sharing your thinking on this website.

can you buy cheap clomid without prescription: how can i get generic clomid without prescription – can i purchase clomid now

generic prednisone for sale online order prednisone prednisone 5mg over the counter

where can i buy clomid without insurance: where can i buy clomid no prescription – where can i buy generic clomid pill

cipro generic: ciprofloxacin 500mg buy online – ciprofloxacin order online

Nice post. I was checking constantly this blog and I’m

impressed! Extremely helpful information specifically the final section 🙂 I deal with

such information much. I used to be looking for this particular information for a long

time. Thank you and best of luck.

cipro generic: buy cipro online without prescription – buy cipro cheap

can i buy amoxicillin online: amoxicillin 500mg capsule cost – amoxicillin 500mg capsules uk

https://prednisone.bid/# prednisone 7.5 mg

buy cipro online canada: antibiotics cipro – buy cipro online canada

cipro antibiotics cipro buy cipro online canada

Great article! That is the kind of info that are supposed

to be shared across the web. Disgrace on the search engines for no longer positioning this publish upper!

Come on over and discuss with my site . Thank you =)

Thanks , I’ve recently been looking for information approximately this topic for a while and yours is the

greatest I’ve discovered so far. However, what about the bottom line?

Are you positive in regards to the supply?

paxlovid pill: paxlovid buy – paxlovid pill

ciprofloxacin order online: cipro 500mg best prices – ciprofloxacin generic price

amoxicillin price without insurance: amoxicillin without a doctors prescription – can you buy amoxicillin uk

buy cipro cheap: buy cipro cheap – antibiotics cipro

can you buy generic clomid without a prescription: where can i get clomid without rx – where to get generic clomid without prescription

online prednisone 5mg prednisone 1 mg for sale prednisone online for sale

amoxicillin 30 capsules price: buy amoxicillin online without prescription – amoxicillin buy no prescription

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

prednisone price south africa: prednisone nz – prednisone cost in india

bookmarked!!, I love your web site!

https://amoxil.icu/# medicine amoxicillin 500

buy cipro: buy cipro – ciprofloxacin generic

Paxlovid over the counter: paxlovid cost without insurance – paxlovid pill

paxlovid cost without insurance paxlovid pharmacy п»їpaxlovid

ロボット セックス シリコーンTPEで作られたダッチワイフの蓄積のようにあなたの人生を始めて、あなたの人生にこれらの熱と魅惑的な女性を含む治療を評価する機会を得てください。

At this time it looks like BlogEngine is the preferred blogging platform out there right now. (from what I’ve read) Is that what you are using on your blog?

can i get generic clomid without a prescription: where to buy cheap clomid prices – where to buy cheap clomid without prescription

You are a very bright individual!

amoxicillin 500mg without prescription: amoxicillin 500mg no prescription – amoxicillin for sale

Generally I don’t read post on blogs, but I would like to say that this write-up very forced me to try and do it! Your writing style has been amazed me. Thanks, quite nice post.

paxlovid cost without insurance Paxlovid over the counter paxlovid india

Hey very cool web site!! Guy .. Beautiful .. Amazing .. I’ll bookmark your blog and take the feeds alsoKI am satisfied to search out numerous useful info right here within the put up, we want develop more strategies in this regard, thanks for sharing. . . . . .

amoxicillin 500mg: amoxicillin capsule 500mg price – can you buy amoxicillin over the counter canada

where to get generic clomid price can i buy clomid without prescription cost of cheap clomid tablets

amoxicillin online no prescription amoxicillin 500mg capsule buy online amoxicillin without a prescription

generic amoxicillin online: ampicillin amoxicillin – amoxicillin 500 mg cost

ciprofloxacin 500 mg tablet price: ciprofloxacin generic price – buy cipro online canada

Very interesting points you have observed, thankyou for posting.

Valuable information. Lucky me I found your web site by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.

https://ciprofloxacin.life/# ciprofloxacin generic price

As soon as I noticed this internet site I went on reddit to share some of the love with them.

buy prednisone online australia: cheapest prednisone no prescription – prednisone 20 mg prices

I have been absent for some time, but now I remember why I used to love this website. Thanks, I will try and check back more often. How frequently you update your website?

cost of generic clomid pills cost generic clomid without dr prescription – can you get generic clomid prices

https://amoxil.icu/# amoxicillin 250 mg capsule

https://amoxil.icu/# amoxicillin for sale

how can i get clomid without rx: cost generic clomid pill – cheap clomid without rx

I have recently started a website, the info you provide on this web site has helped me tremendously. Thank you for all of your time & work.

I will right away snatch your rss feed as I can not find your e-mail subscription hyperlink or e-newsletter service. Do you have any? Kindly permit me recognize in order that I could subscribe. Thanks.

This is really interesting, You’re a very skilled blogger. I have joined your feed and stay up for seeking extra of your magnificent post. Also, I have shared your web site in my social networks!

Wow, marvelous blog format! How long have you been running a blog for? you make blogging look easy. The overall glance of your site is fantastic, as smartly as the content!

http://zithromaxbestprice.icu/# buy zithromax online with mastercard

zithromax prescription online buy zithromax online australia where to get zithromax

cost for 40 mg lisinopril: lisinopril generic – lisinopril 20 mg prices

buy zithromax online fast shipping: generic zithromax online paypal – zithromax canadian pharmacy

https://zithromaxbestprice.icu/# zithromax order online uk

http://cytotec.icu/# buy misoprostol over the counter

doxycycline mono: doxycycline without prescription – doxycycline hyclate

online doxycycline: doxycycline hyc – buy doxycycline online 270 tabs

https://lisinoprilbestprice.store/# buy zestril online

buy generic doxycycline: buy cheap doxycycline online – buy doxycycline monohydrate

doxycycline vibramycin doxycycline hyc doxycycline tablets

zithromax capsules australia: can i buy zithromax online – where can i buy zithromax capsules

http://cytotec.icu/# buy cytotec over the counter

https://zithromaxbestprice.icu/# zithromax tablets for sale

buy cytotec over the counter: buy cytotec – cytotec pills buy online

lisinopril cost 40 mg: cost of lisinopril 10 mg – lisinopril 10 mg prices

http://nolvadex.fun/# how to get nolvadex

generic zithromax medicine: zithromax buy – buy cheap generic zithromax

tamoxifen citrate pct tamoxifen cost nolvadex half life

tamoxifen therapy: nolvadex online – how to lose weight on tamoxifen

https://zithromaxbestprice.icu/# buy zithromax 1000 mg online

VidaCalm is an all-natural blend of herbs and plant extracts that treat tinnitus and help you live a peaceful life.

http://lisinoprilbestprice.store/# lisinopril 20 mg 12.5 mg

cytotec abortion pill: buy cytotec pills online cheap – cytotec buy online usa

http://doxycyclinebestprice.pro/# where to get doxycycline

tamoxifen rash tamoxifen medication nolvadex side effects

can you buy zithromax online: buy zithromax 1000 mg online – can you buy zithromax online

lisinopril 10 mg for sale: lisinopril medication otc – lisinopril rx coupon

LeanFlux is a natural supplement that claims to increase brown adipose tissue (BAT) levels and burn fat and calories.

https://indiapharm.llc/# india pharmacy indiapharm.llc

best india pharmacy: India Post sending medicines to USA – best online pharmacy india indiapharm.llc

https://mexicopharm.com/# buying from online mexican pharmacy mexicopharm.com

Excellent post. I was checking continuously this blog and I’m impressed! Very useful info specifically the last part 🙂 I care for such info a lot. I was looking for this particular info for a very long time. Thank you and good luck.

onlinepharmaciescanada com: Pharmacies in Canada that ship to the US – canadian pharmacy scam canadapharm.life

purple pharmacy mexico price list: Mexico pharmacy online – purple pharmacy mexico price list mexicopharm.com

Leanotox is one of the world’s most unique products designed to promote optimal weight and balance blood sugar levels while curbing your appetite,detoxifying and boosting metabolism.

http://mexicopharm.com/# best online pharmacies in mexico mexicopharm.com

legitimate canadian online pharmacies: Pharmacies in Canada that ship to the US – canada ed drugs canadapharm.life

Puralean is an all-natural dietary supplement designed to support boosted fat-burning rates, energy levels, and metabolism by targeting healthy liver function.

PowerBite is a natural tooth and gum support formula that will eliminate your dental problems, allowing you to live a healthy lifestyle.

mexican online pharmacies prescription drugs Medicines Mexico purple pharmacy mexico price list mexicopharm.com

Sugar Defender is the #1 rated blood sugar formula with an advanced blend of 24 proven ingredients that support healthy glucose levels and natural weight loss.

Illuderma is a groundbreaking skincare serum with a unique formulation that sets itself apart in the realm of beauty and skin health. What makes this serum distinct is its composition of 16 powerful natural ingredients.

india online pharmacy: Online India pharmacy – Online medicine order indiapharm.llc

buying from online mexican pharmacy: Mexico pharmacy online – purple pharmacy mexico price list mexicopharm.com

https://indiapharm.llc/# mail order pharmacy india indiapharm.llc

https://mexicopharm.com/# mexican mail order pharmacies mexicopharm.com

DentaTonic™ is formulated to support lactoperoxidase levels in saliva, which is important for maintaining oral health. This enzyme is associated with defending teeth and gums from bacteria that could lead to dental issues.

ordering drugs from canada: Canadian pharmacy best prices – best canadian pharmacy canadapharm.life

mexico pharmacy: mexican pharmacy – mexican mail order pharmacies mexicopharm.com

By taking two capsules of Abdomax daily, you can purportedly relieve gut health problems more effectively than any diet or medication. The supplement also claims to lower blood sugar, lower blood pressure, and provide other targeted health benefits.

https://canadapharm.life/# drugs from canada canadapharm.life

Fast Lean Pro is a natural dietary aid designed to boost weight loss. Fast Lean Pro powder supplement claims to harness the benefits of intermittent fasting, promoting cellular renewal and healthy metabolism.

BioVanish a weight management solution that’s transforming the approach to healthy living. In a world where weight loss often feels like an uphill battle, BioVanish offers a refreshing and effective alternative. This innovative supplement harnesses the power of natural ingredients to support optimal weight management.

Keratone is 100% natural formula, non invasive, and helps remove fungal build-up in your toe, improve circulation in capillaries so you can easily and effortlessly break free from toenail fungus.

LeanBliss™ is a natural weight loss supplement that has gained immense popularity due to its safe and innovative approach towards weight loss and support for healthy blood sugar.

top 10 online pharmacy in india: indian pharmacy to usa – buy medicines online in india indiapharm.llc

purple pharmacy mexico price list Best pharmacy in Mexico mexico drug stores pharmacies mexicopharm.com

http://mexicopharm.com/# mexico pharmacies prescription drugs mexicopharm.com

Wild Stallion Pro is a natural male enhancement supplement designed to improve various aspects of male

canadianpharmacyworld com: Canadian online pharmacy – canada rx pharmacy canadapharm.life

mexican pharmaceuticals online: mexico drug stores pharmacies – mexican border pharmacies shipping to usa mexicopharm.com

Folixine is a enhancement that regrows hair from the follicles by nourishing the scalp. It helps in strengthening hairs from roots.

indian pharmacy: Online India pharmacy – mail order pharmacy india indiapharm.llc

Nice post. I was checking constantly this blog and I am impressed! Very helpful info specially the last part 🙂 I care for such info a lot. I was seeking this certain info for a very long time. Thank you and best of luck.

Protoflow is a prostate health supplement featuring a blend of plant extracts, vitamins, minerals, fruit extracts, and more.

https://indiapharm.llc/# п»їlegitimate online pharmacies india indiapharm.llc

india pharmacy: Online medicine home delivery – indian pharmacies safe indiapharm.llc

Embrace the power of Red Boost™ and unlock a renewed sense of vitality and confidence in your intimate experiences. effects. It is produced under the most strict and precise conditions.

http://indiapharm.llc/# reputable indian pharmacies indiapharm.llc

Zoracel is an extraordinary oral care product designed to promote healthy teeth and gums, provide long-lasting fresh breath, support immune health, and care for the ear, nose, and throat.

Some truly interesting points you have written.Aided me a lot, just what I was searching for : D.

ordering drugs from canada: Canada pharmacy online – pharmacy wholesalers canada canadapharm.life

https://mexicopharm.com/# mexican pharmacy mexicopharm.com

buy medicines online in india: Medicines from India to USA online – online pharmacy india indiapharm.llc

LeanBiome is designed to support healthy weight loss. Formulated through the latest Ivy League research and backed by real-world results, it’s your partner on the path to a healthier you.

medicine erectile dysfunction: buy ed drugs online – erectile dysfunction drugs

http://sildenafildelivery.pro/# sildenafil 20 mg brand name

https://kamagradelivery.pro/# Kamagra Oral Jelly

super kamagra: Kamagra 100mg price – Kamagra tablets

https://sildenafildelivery.pro/# sildenafil online

top erection pills: ed medication online – over the counter erectile dysfunction pills

https://sildenafildelivery.pro/# sildenafil 200mg price

buy Kamagra kamagra oral jelly sildenafil oral jelly 100mg kamagra

buy tadalafil 20mg price in india: tadalafil without a doctor prescription – medicine tadalafil tablets

tadalafil for sale from india: tadalafil without a doctor prescription – tadalafil 30

http://levitradelivery.pro/# Vardenafil online prescription

http://kamagradelivery.pro/# Kamagra 100mg price

buy online sildenafil: cheap sildenafil – buy sildenafil in usa

http://edpillsdelivery.pro/# ed pill

Kamagra tablets: buy kamagra – buy Kamagra