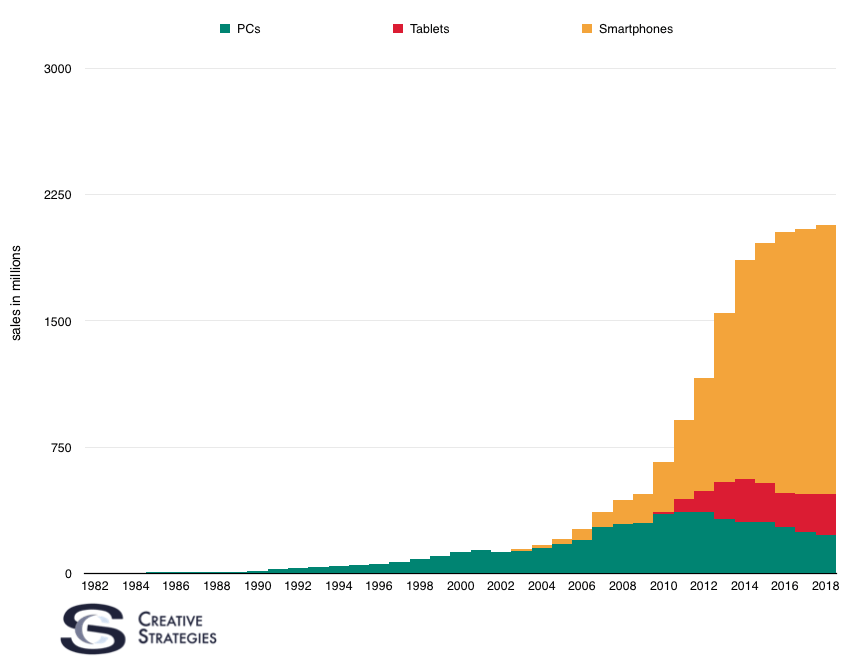

I’ve recently presented at a number of venture capital firms about the next cycle or wave of innovation. An important fundamental observation is to understand that hardware innovations drive software innovations. That software can be local or cloud-based but, the bottom line is, hardware innovation is necessary to move software industries forward. With that in mind, it seems we are nearing the end of the mobile hardware cycle. There are several observations I want to make about this chart.

The chart is depicting the PC, tablet, and smartphone computing cycle we have just gone through. You’ll notice a few things. First, it was big. That should be the obvious one. Second, you notice the smartphone is the largest part of this wave. The smartphone drove an internet-connected computing device into the global mainstream in a way no piece of hardware before it could. You may also notice the S-curve is slowing, which is why it seems we are nearing the end of this particular hardware cycle. But the most interesting observation is how short the wave is. Notice this wave grew inside the span of less than ten years, compared to the early cycle driven largely by desktops and notebooks that steadily grew over 20 years. The large global rollout of computing is a recent phenomena. We still have much to learn as many of the lessons in the first 25 years of computing are no longer applicable in an age where computing has gone where is had not been before.

There are still a few hardware innovations in smartphones to come, like dual lens cameras, which will continue to drive new software innovations. But largely, we are moving from a hardware cycle to a software cycle. This hardware cycle adds roughly another billion consumers to the computing landscape and, between PCs, smartphones, and tablets, we now have roughly two billion people with an internet-connected computing device. During the PC era, our software scale was measured in hundreds of millions but now, thanks to the smartphone, the software industry scale is two billion global consumers and growing.

Companies who can leverage this scale are the ones getting the most attention. Key in that discussion are Facebook and Google. But the hunt is on for other companies who can create a software experience that appeals to billions, not just millions. The list of companies who can achieve software scale in the billions like Facebook may be short but the largest computing base in the history of the industry now exists so anything is possible.

Looking at the type of category which has the best chance at scale, I can narrow it down to a few. From survey data we have, we know the top categories with the most active users are: Social networks, chat/messaging apps, games, maps, photo apps, and music/video. It is likely any app looking for a hundred million user scale and beyond should focus on these categories in order to achieve orders of magnitude of scale greater than other categories offer.

Chasing scale will be one driven by business models. Those apps which are free and make money off of ads or other services will easily acquire the most customers. However, as this new global consumer market for technology software begins to segment, as we are seeing happen right now, there will be lucrative pockets of opportunity where money can be made without achieving massive scale. The temptation for many companies will be to chase active users instead of focusing on their segment and serve it well. Perhaps no better current example exists than Snapchat.

Snapchat is at a crossroads where they can focus on their current base of users under the age of 30, which will get them in the 200m user range but not much more. To get beyond that number, Snapchat will need to adapt their service to appeal to a larger demographic. From the outside looking in, it seems Snapchat is attempting to do this right now. However, there is a risk this will come at the expense of their current users. They may alienate their younger audience as the older demographics get on the service. This is what happened with Facebook as engagement declined significantly with the younger demographic once their parents started using it. They didn’t leave — they just used it less. They moved to apps like Instagram, which Facebook then bought to help retain some engagement with that audience. This is also why Facebook would buy Snapchat if they had the chance.

Owning a profitable segment of the market is valuable but often, due to investment or growth pressure, companies will look to serve a broader demographic and thus begin to underserve the one which helped them get where they are. Whether or not this pursuit will pay off will be the key story line to watch as companies attempt to grow beyond the segments they begin in.

Understanding segmentation is the key to understanding the market. There is no single “market”. There are many markets which make up larger markets. If you don’t understand each pocket or segment of the global consumer market, you don’t actually understand the market beyond the surface. This is why, while difficult, I try to see the forest and the trees at the same time.

So what’s next? Is it VR? Is it further advancements in artificial intelligence? Smart home? Self-driving cars? Or it could be something entirely different and unknown. Whatever it is, it’s likely to come from the foundation of global mobile computing because it is hard to think of any product, one almost every adult on the planet will some day own, that has the scale of the smartphone.

The “smart home” has been a lot of talk without much action, and it could remain like that indefinitely. But AI is a different deal.

The problem with VR is that it’s inherently antisocial unless the owner has bought two headsets, and that seems unlikely.

It is possible that the watch and iPad will eventually provide a better overall computing experience. This also appears to be Tim Cook’s opinion. We could also encounter a future when there is push back on trading privacy for services.

Don’t apps move forward for a big long while after the required hardware has landed, maybe helped by hardware’s incremental progress, but mostly because apps are far from obvious + many need network effects or at least user contributions ? I’m not sure we need new HW platforms right now, we’re probably far from having exhausted what a (possible tweaked) Mobile platform can deliver ? Getting the HW user base built up doesn’t mean the game is ended, but on the contrary that it can now start in earnest ?

I wouldn’t put “dual lens cameras” in a separate category, it’s just a continuation of “better cameras”, I don’t think it’s transformational. “Enough Flash storage” is probably more impactful. As are a full-day battery and bio-IDs (fingerprint, retina scan, voice print).

The scale vs segmentation question is fascinating, especially with the interplay of free (as in beer), ads/tracking/referrals, IAPs, up-front payments, monthly subs… Should the same back-end be dressed up differently for different demos ?

re: Messaging, I’m surprised Ecosystem owners aren’t trying harder to unify the disparate providers into at least a single landing page, which used to be possible (in earlier Windows Phone versions, with cross-network tools à la Trillian on Windows, with XMPP compatibility in a few major networks of yore…). Juggling a handful of IM platforms is a pain !

Interesting points.

I agree that getting the HW user base build up means that it can start in earnest. This does not apply only to hardware, but to everything that can be a platform upon which others can build. Mobile hardware has stabilised and is now ubiquitous. This enables higher layer platforms to now flourish. This is similar to the mid 2000s when PC hardware and broadband Internet stabilised, and created an environment on which Web 2.0 (interactive websites, SNS etc.) could grow.

Right now hardware has stabilised, but also a lot of the software and services have stabilised as well. It is easy for a startup to build upon AWS or Dropbox APIs. Facebook once built its business by allowing apps to run on its platform as a service on top of a service, but mobile came and reset this effort. Instead of Facebook apps, Messaging has provided a new layer that is optimised for mobile, and if this stabilises, we could see a lot of activity upon and above the messaging platforms.

If I understand correctly, Microsoft is also doing work to manage multiple cloud accounts, and this might also be another way to provide a meta-cloud platform (and might also solve your multiple IM platform issue).

As a linear progression from hardware to software to cloud, I would be looking for “the services on top of the cloud” or a “cloud meta-service”. At the same time, from a jobs-to-be-done and follow-the-money perspective, I would be looking at the buckets of spending outside of tech.

Many points to discuss here.

1. PCs

On closer inspection, the PC cycle actually consist of 2 cycles. The first peaks in 2001 and the second in 2011, which actually fits the 10 year span very nicely. The 2001 peak can be attributed to a combination of the adoption of productivity software,, GUIs and the nascent Internet. The second is due to Web 2.0 (the interactive Internet), which gave birth to Wikipedia, Facebook, MySpace, Amazon, online banking, etc. The Digital Hub also plays a role here.

This perspective allows us to accommodate a comeback for tablets, which if the 10 year cycle holds, will peak in mid-2020. The use-cases that will drive this probably already exist, but are still limited in adoption.

2. Buckets of spending

For a typical US or Japanese household with each teenage kid owning a smartphone in addition to the parents, and with a monthly data plan approaching 100 USD per phone, the amount of money that people spend on tech is already huge. VR may be exciting, but I doubt people will spend much money on it if the use cases are limited to what smartphones already do well (entertainment, communication).

The real opportunities for growth in tech are where it diverts the money in other buckets towards tech. Ad-based businesses like Google and Facebook are paid for by advertisers that earn money by what you spend from other buckets. Uber earns money from your household transportation budget. Amazon takes your clothing, home decoration, etc. money.

My point is, tech spending is still a very small segment of total household spending, but it is probably already close to the limit of what we would spend for entertainment and communication alone. For tech to expand, we have to look beyond SNSes, games, AR/VR. We have to look at what people actually spend money on.

Isn’t it premature to ask “So what’s next?”

The paradigm for office pcs stayed relativley static for a decade or longer. Sure, constant improvements, a degree of churn in the players and the apps being used, but the fundamentals of word processing, spreadsheets, etc, as the foundation of the tech economy lasted from 1980 to 1995 without much change in the fundamentals. Then the internet came along and there was a period of frantic scrambling by tech companies to get a stake in the new world of connected computers.

That scramble ended with a lot of firms going bust, and then the paradigm for internet PCs (browser, email, instant messaging) likewise stayed mostly stable for a decade, from 2000 to 2010. The thing to note is that it was fairly obvious throughout that period of scramble what the new paradigm was going to be — it was just that all the scramblers wanted to try to add their harebrained scheme to the mix.

Now we have a new paradigm, of mobile computers that make phone calls and take pictures. And we are in the middle of another frantic scramble. And once again, it seems likely that that this is going to end badly for most of the scramblers. We know what the new paradigm is, we can already see it -messaging, social, and apps to replace some parts of the web.

Asking whats next is to fall for the canard that you can create a new paradigm just by wishing it and scrambling hard enough. With 99% certainty, I can predict that the next big thing isn’t anything that anyone has heard of, that it probably doesn’t exist yet, certainly not in mature form, and that when it does appear, it will take us all by surprise.

This was beautiful Admin. Thank you for your reflections.

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

I think the admin of this site is really working hard for his website, since here every stuff is quality based data.