(This article was originally posted for our Tech.pinions subscribers on Nov 12, 2015. We are reposting it today to give you a sense of the type of content we are providing to subscribers. We encourage you to visit this link to subscribe.)

It’s not something I talk about often, but I was right in the middle of the Netbook debacle. The Netbook category was an accident. It was not Intel’s intention to have a small, not very powerful, yet cheap “PC” enter the marketplace. Asus took a chip Intel wasn’t positioning for a clamshell form factor and made a tiny PC that ran Linux. While initial sales of this product were not large, other OEMs caught on and wanted to ship Windows on it. Both Intel and Microsoft thought this was a good idea to get new hardware onto the landscape but both of them prefaced this thinking with the caveat that these machines could not be “full powered” PCs. Meaning it needed to be clear they could not do everything a full powered PC can do.

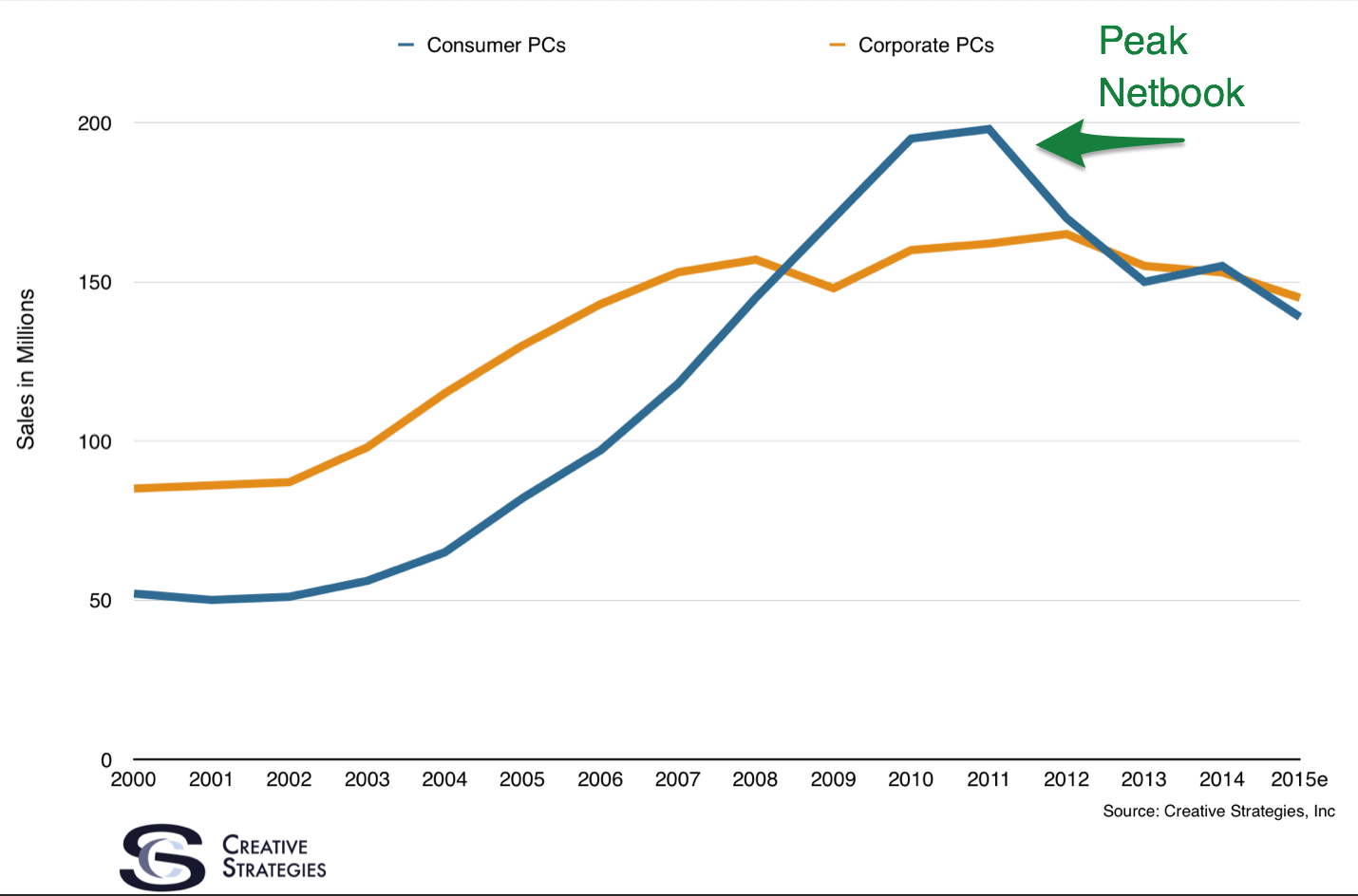

From the outset I told both companies, in my analysis notes to them, this was a bad idea. It would uncover the dirty secret that most consumers do not do very much with their PCs. My firm had just done some dedicated research on PC behavior in consumer markets and the data we discovered at the time gave us the insight that consumers, on average, use five pieces of software regularly on their PCs and none of them were CPU intensive tasks. My fear was these machines would be viewed as good enough for most mass market consumers and threaten the PC category as a whole with steep ASP declines. No one believed me. Sure enough, the chips got a little better on Netbooks, enough to watch good quality videos without skipping, for example. Microsoft eased up and let more of the capabilities of Windows on the hardware and boom, 40m devices at its peak of PCs under $200.

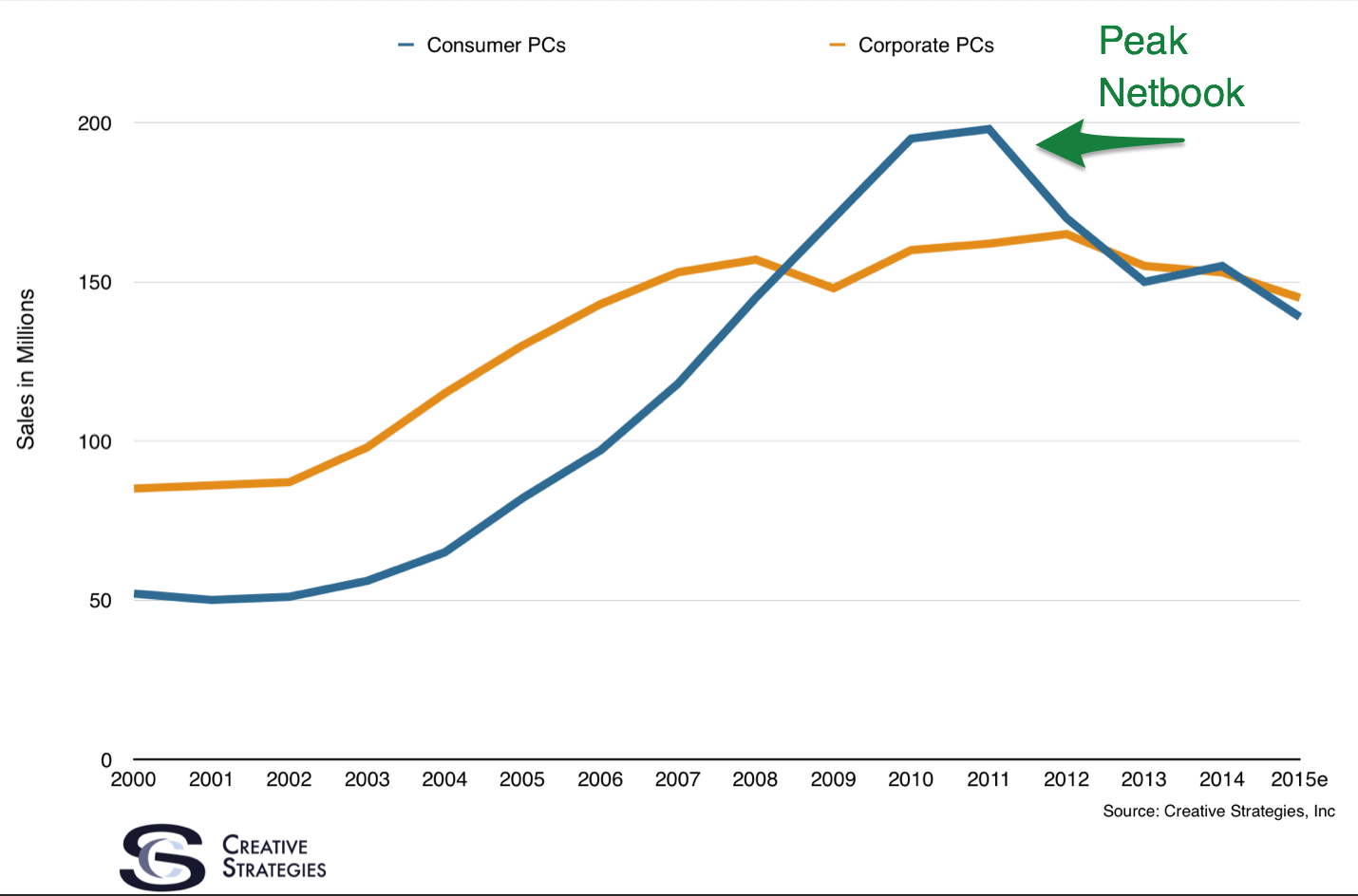

To add some perspective here, note on this chart of PC sales sliced by consumer and enterprise PC sales, the peak year for consumer PC sales also was the same year Netbooks peaked.

Microsoft and Intel reacted quickly to this, with the help of some smart guidance, and brought this back under control and essentially killing the category. But what the Netbook fiasco did was let the cat out of the bag — consumers are not pushing the limits of their PCs. They are doing simple things like watching movies, browsing the web, checking email, messaging friends, etc. They aren’t creating the next major novel, they aren’t exporting cells from Excel. They aren’t making a two hour Hollywood motion picture. Their needs are simple and the Netbook, an underpowered, small, cheap, internet connected, clamshell PC was good enough for them.

I tell you this because it applies to how I think about the positioning of the iPad Pro and the Surface Pro 4. No, I don’t think either of those products are anything like the Netbook. Quite the contrary. However, both represent the needs of and an opportunity for two different markets. The Surface brings all the things a hard-core, technologically literate PC user needs in an ultraportable form factor. You can do everything a tech literate can and push the boundaries with computing tasks those users want. You can plug it into an external monitor and do even more. The Surface is a PC and exists as a form factor option for those who know how to use and drive a PC like a pro. But remember what I said about the Netbook. That PC user, who can drive a PC like a pro, is not the mass market. Not even close. That’s where I’ve always felt the iPad comes in.

The iPad is certainly more powerful than a Netbook and the software much more capable than ever it was on a Netbook. However, a central question I was wrestling with during the brief Netbook era was, why are consumers not doing more with their PCs? Even those who had a top of the line notebook or desktop in that era were still only using a small fraction of its capabilities. What I uncovered was they simply didn’t know how. The PC was too complex, too burdensome, they were afraid of breaking it then having to spend hours on support trying to fix it. For many consumers we studied and surveyed at the time, they did not have positive things to say, generally, about their PC experience.

Then, the smartphone hit the scene. The harsh reality is mainstream consumers do more with their smartphones to utilize their max capabilities today than they ever did with their PCs, then and now. I think this is a tragedy. Not because of all the things they do with their smartphone and not a PC, but because humans are capable of so much more with digital tools and creativity. Yet most don’t engage in it. Hardware and software companies need to give consumers the tools to easily, and I stress easily, use these tools to their maximum potential. Desktop operating systems, like Windows and OS X, are for the professionals. Mobile operating systems are for the masses. The promise of something like the iPad and the iPad Pro, and even where Android can go on tablets, or laptops, or even desktops, is to empower the masses to do MORE than they can on their smartphones with a computing paradigm that focuses on simplicity but still yields sophisticated results.