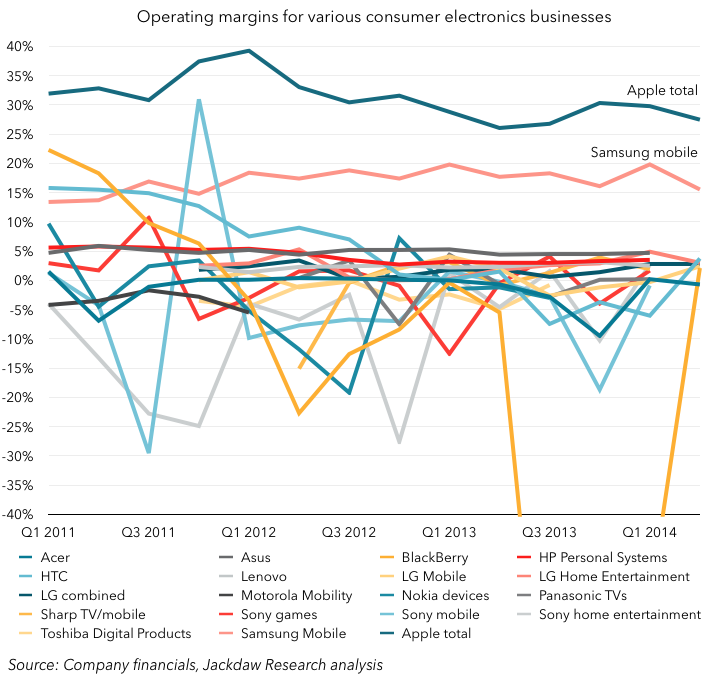

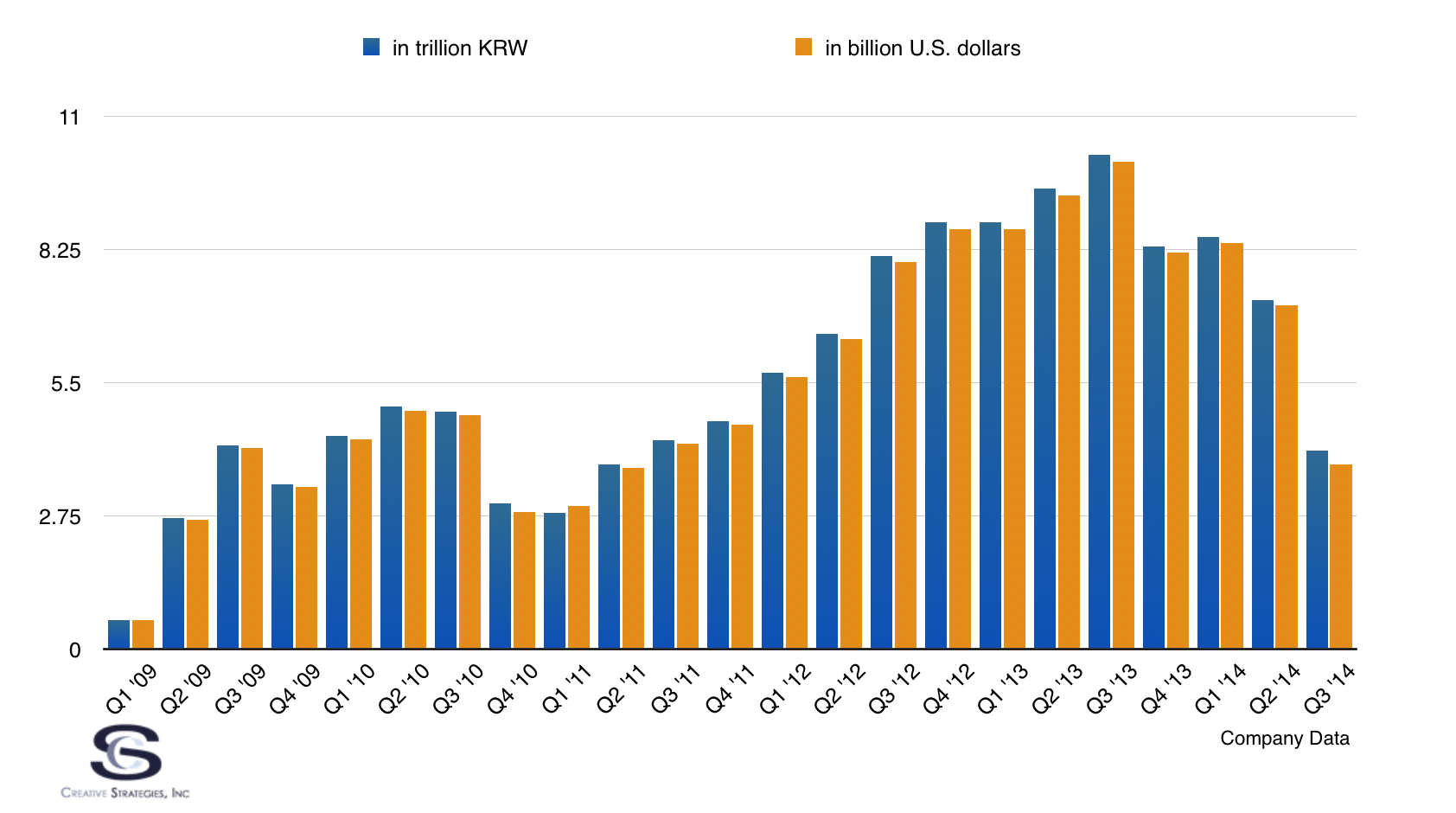

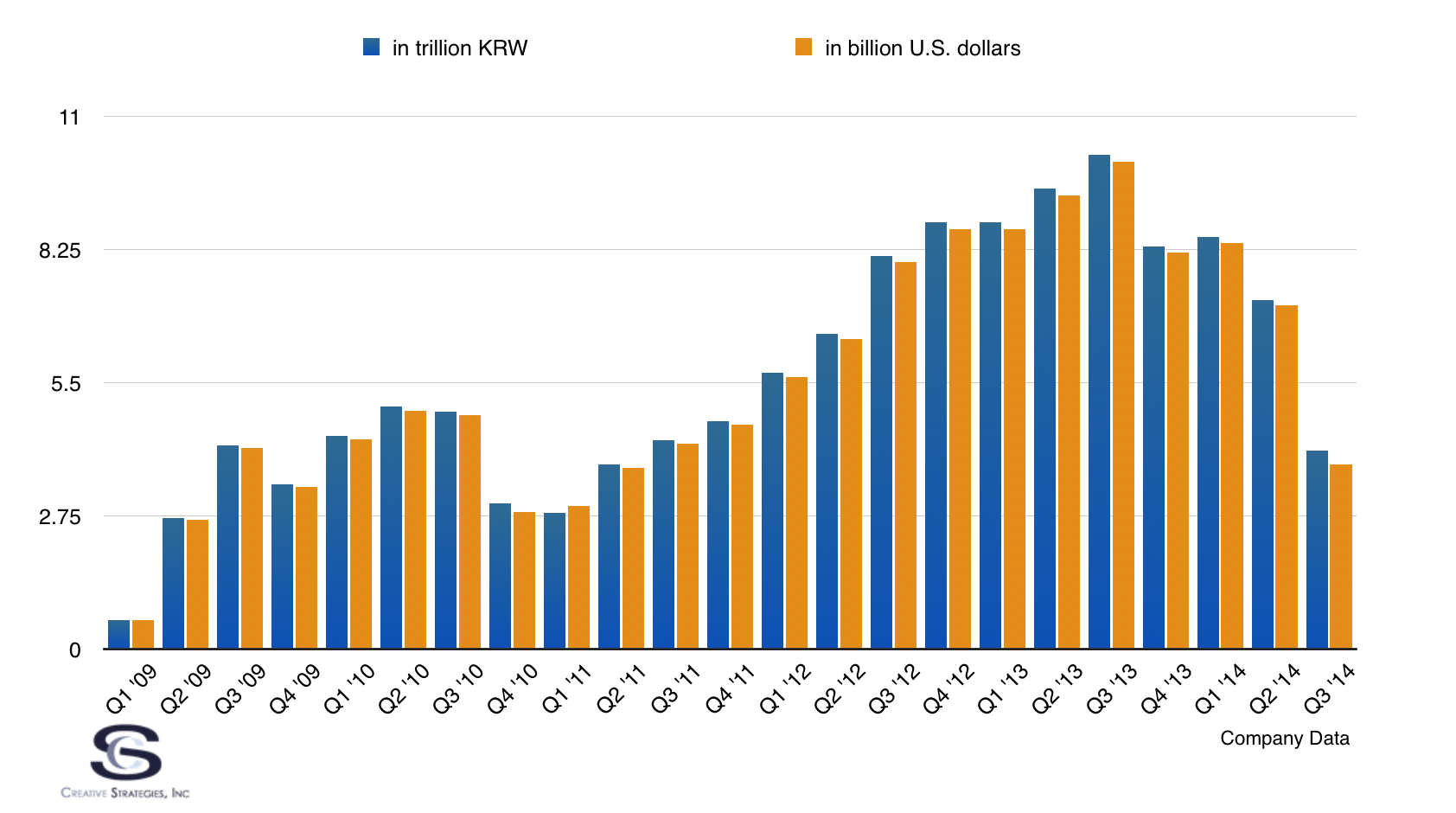

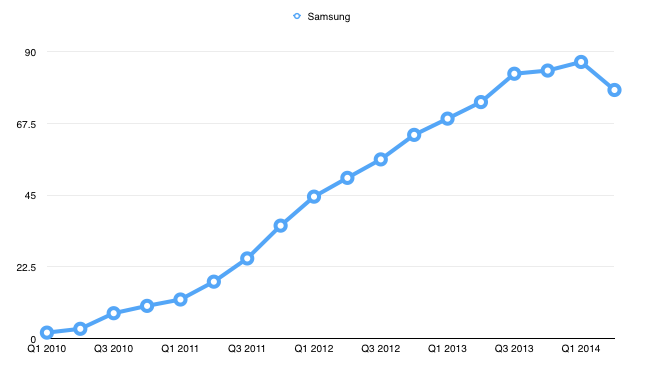

Yesterday, Samsung issued a Q3 2014 guidance update stating they will miss expectations. The report says profit is down nearly 60%. For many of us, this was entirely expected. If this estimate holds up, Samsung’s operating profit chart looks like this:

For me, the only surprise is so many people are surprised at Samsung’s troubles. Samsung themselves knew this was a possibility over two years ago. I had a long meeting with Samsung’s Chief Strategy Officer and his entire staff more than two years ago on this very subject. I outlined in detail what happens when you don’t have sustainable differentiation. Through the years I’ve written quite a bit and documented how I thought this would play out for Samsung. For this article I want to highlight the lessons learned and the key takeaways all hardware providers, but specifically those who ship someone else’s software like Windows, Windows Phone, Android, etc., must learn from Samsung’s cautionary tale.

The Root of the Problem

Ultimately, Samsung’s challenges occurred due to a lack of sustainable differentiation. Samsung has a number of differentiating factors like scale, time to market, marketing prowess and budget. However, none of them were sustainable. By shipping someone else’s software and relying on someone else’s services, Samsung is only a hardware company. What their struggles point out is companies looking to profit from hardware will only struggle when they ship someone else’s software and rely on someone else’s services.

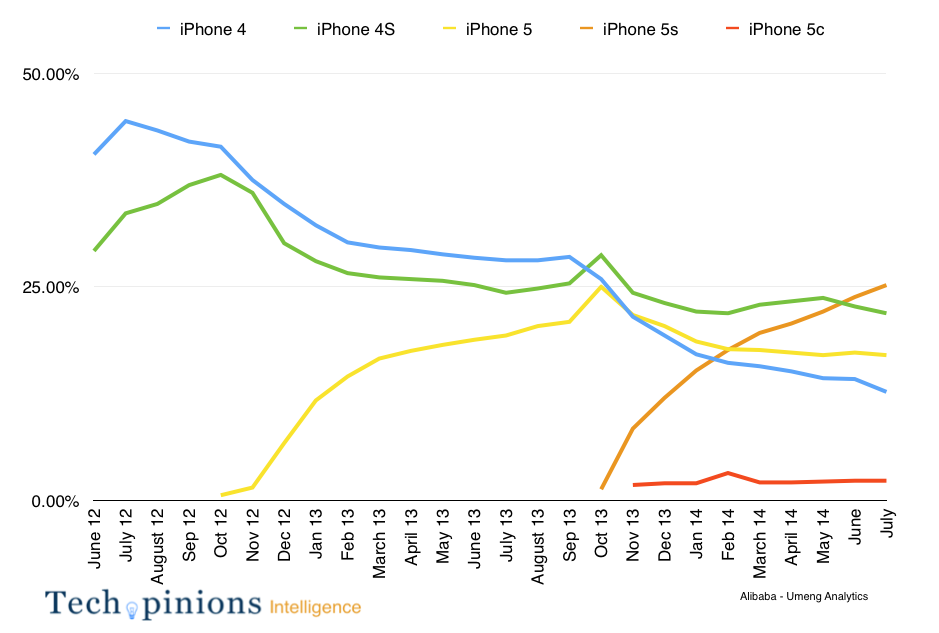

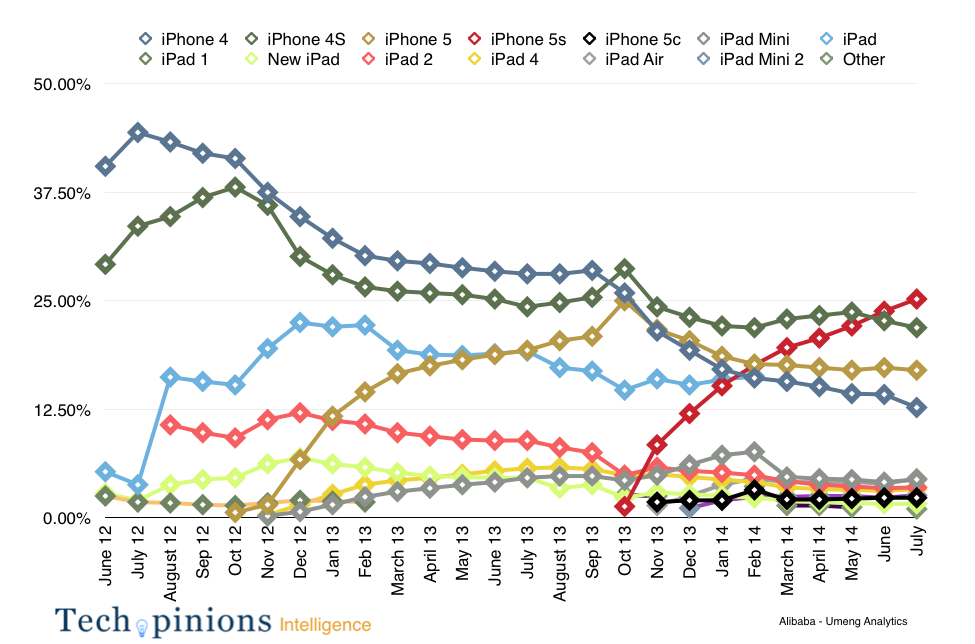

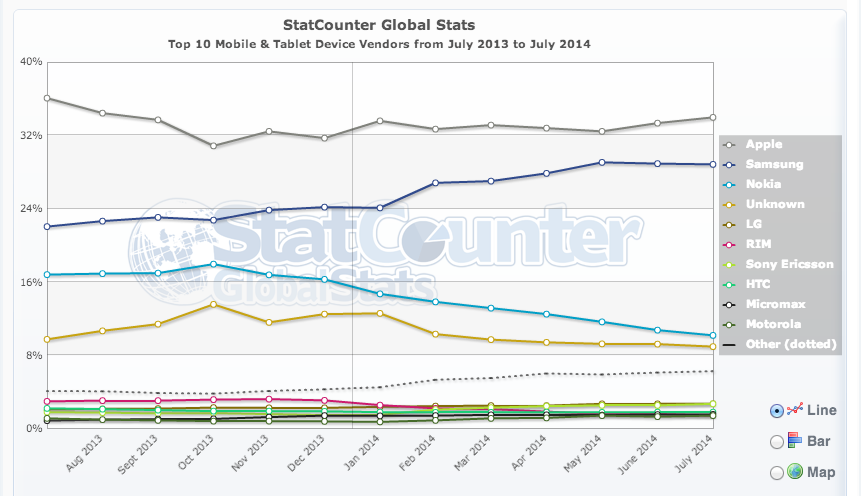

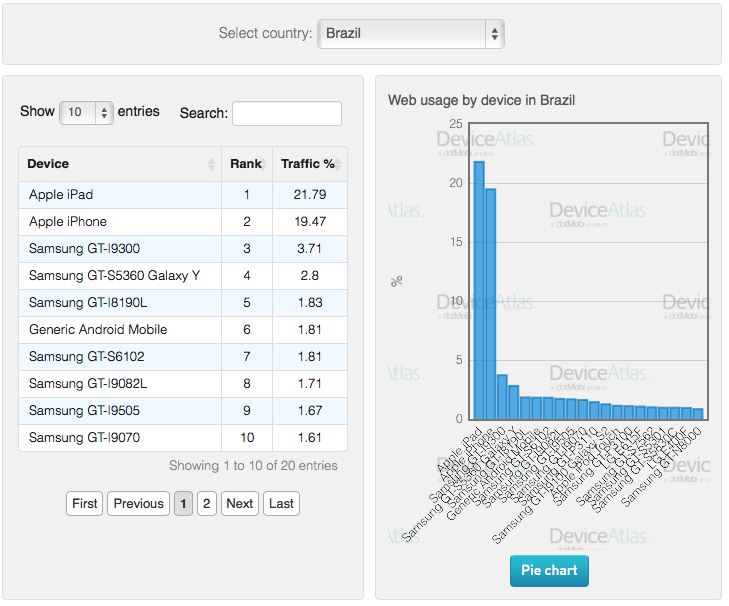

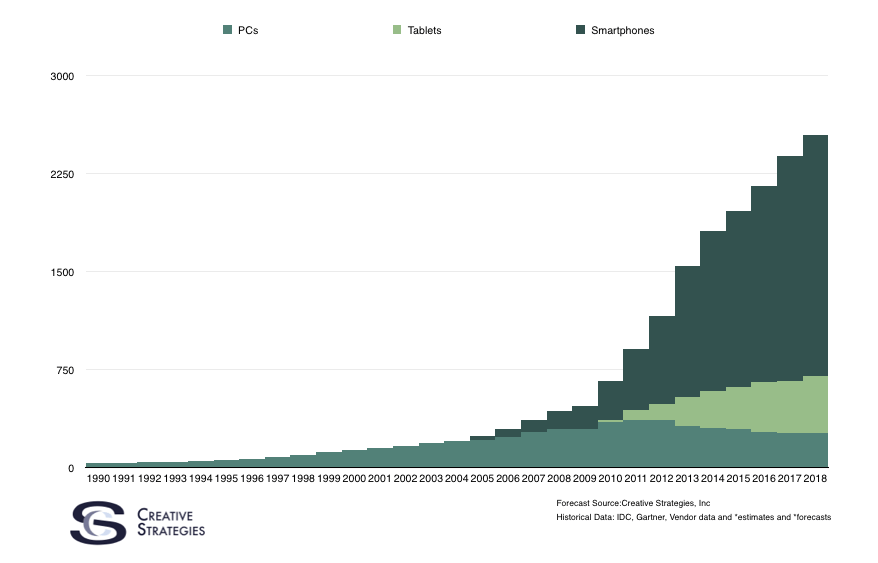

There was a time not too long ago when a successful strategy could be found in hardware alone. This was true both of PCs and smartphones for example. Prior to a category getting crowded, and while there is still category defining innovation, value can still be found and profited from with hardware. But once innovation slows down and hardware gets “good enough”, competitors who can also ship the same software as you can now begin undercutting your pricing. This is what is happening to Samsung as companies like Xiaomi, Huawei in China, and Micromax in India are eating into Samsung’s smartphone market share.

Integrated vs. Modular

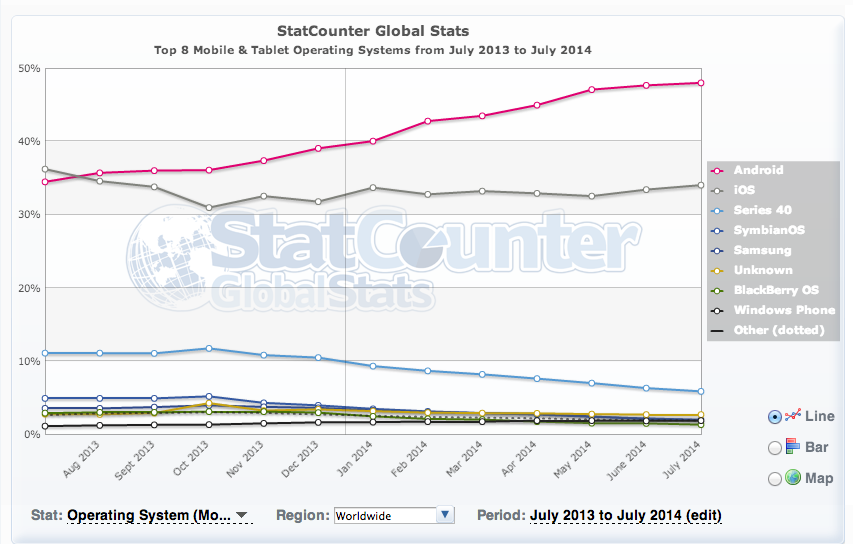

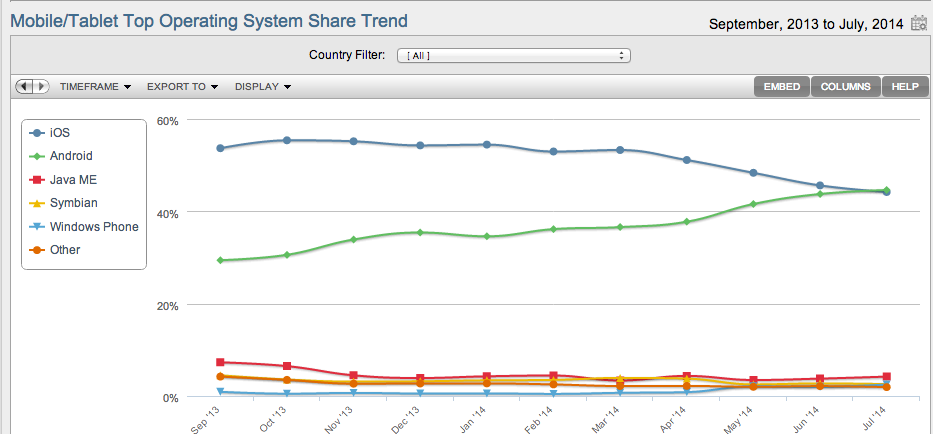

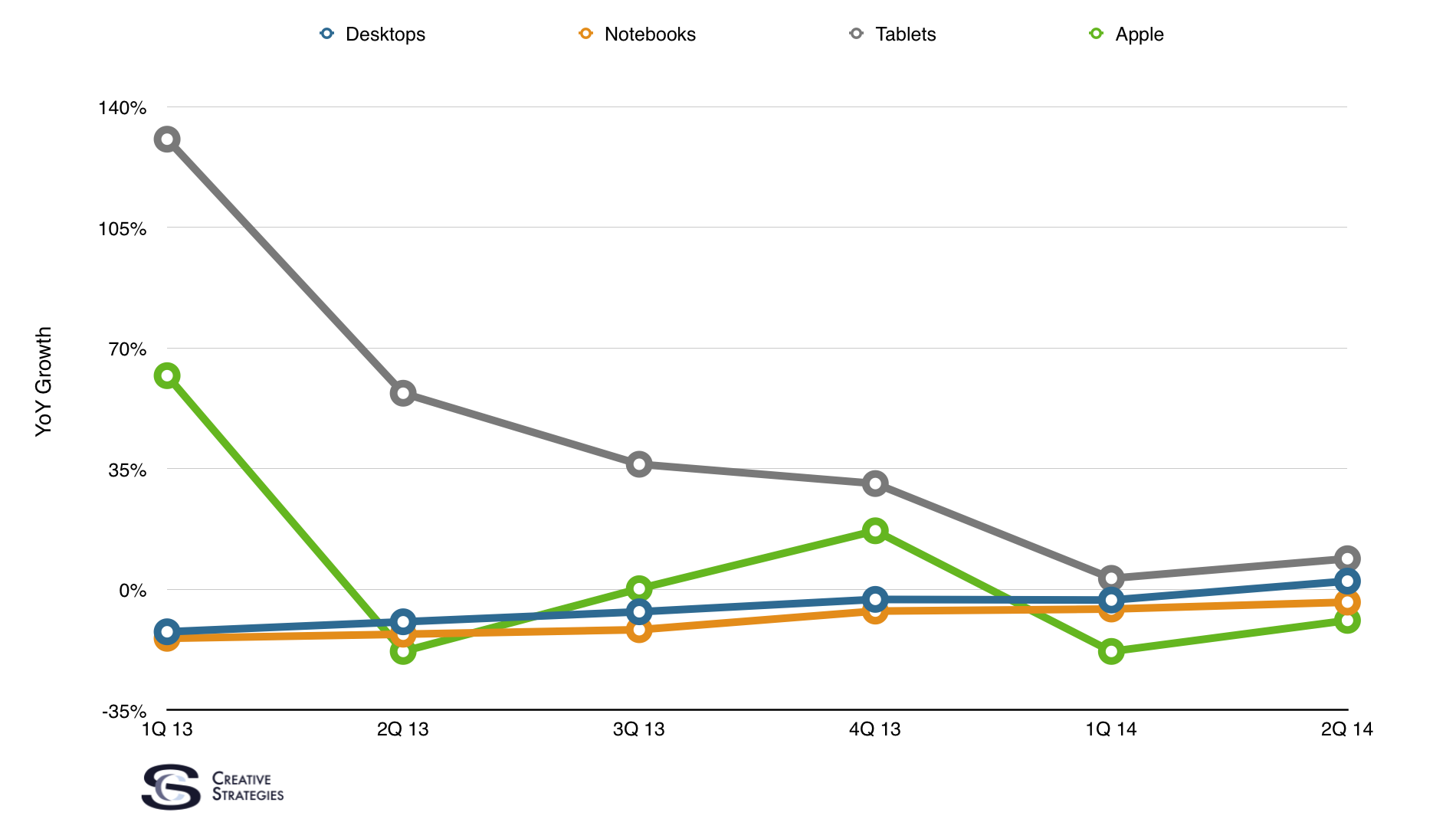

Those who did not see Samsung’s problems coming had a weak understanding of the dynamics of integrated and modular systems within the technology industry. At an even deeper level, many have a weak understanding of disruption within the dynamics of integrated and modular systems. In a modular ecosystem, a company like Samsung provides the hardware and Google provides the software. Apple is an integrated player. They make the hardware but also make the software. Apple does not depend on someone else to make the software for their hardware, nor do they give their software for others to use. As Ben Thompson says, “Apple has a monopoly on iOS.” This is a central point. Because Apple has a monopoly on iOS their product is differentiated. Apple’s iPhone stands out not just at a hardware level but at a software level. When consumers see iOS, they realize what they get with iOS they cannot get elsewhere. When consumers look at Samsung devices, they see an OS they can get on any other hardware. Therefore the purchasing decision nearly always comes down to price.

In modular ecosystems, the various hardware players all shipping the same software create what I like to call “the sea of sameness”. Outside of a few hardware differences everything looks the same. When everything looks the same, you are only as good as your lowest priced competitor.

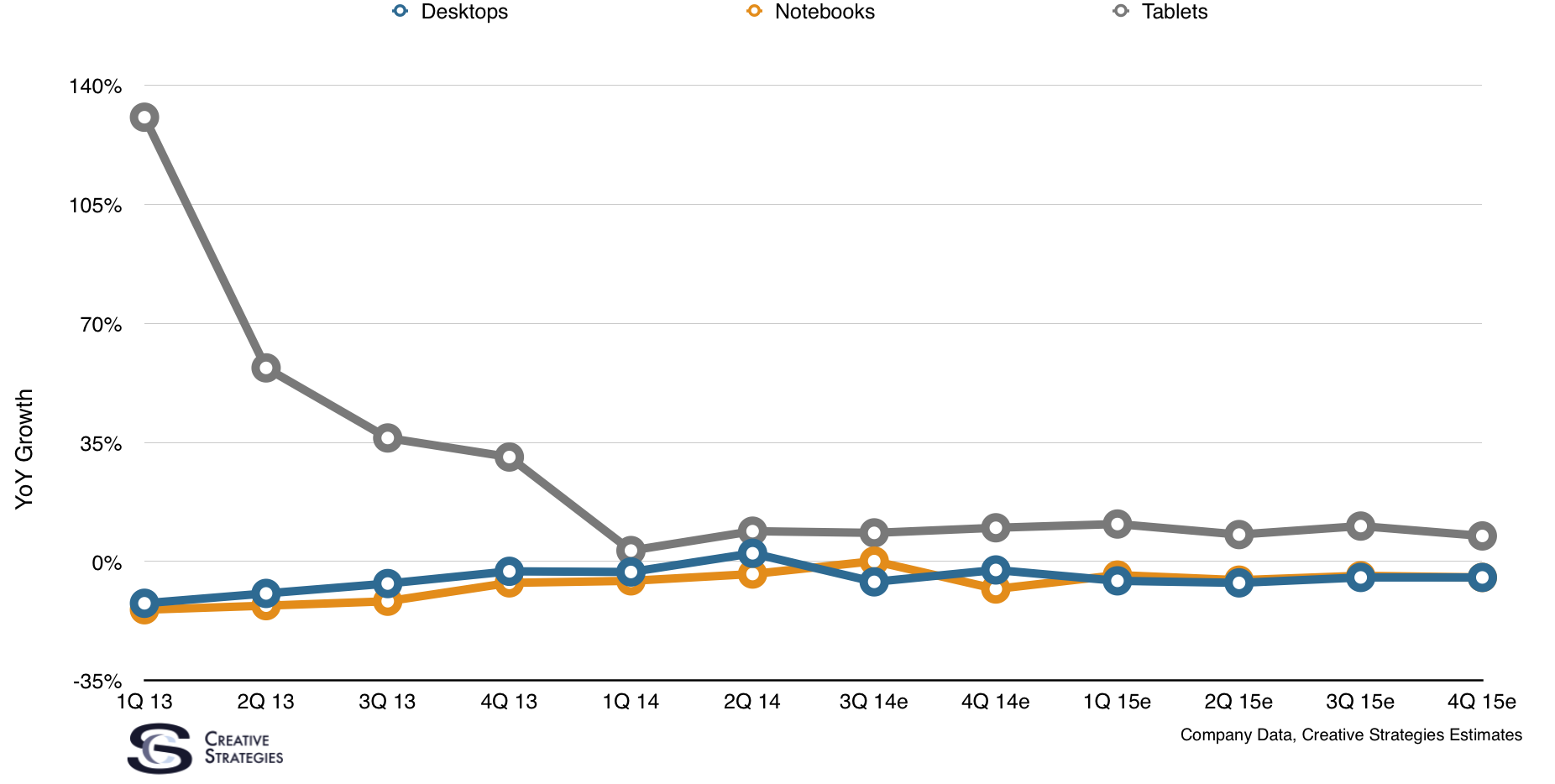

Hardware companies, especially those who are modular and ship someone else’s software, have to learn that attempting to profit from hardware alone is not a sustainable strategy. This is true of PCs, tablets, and smartphones. This is why PC vendors like Dell, HP, and Lenovo focus on using the hardware as a means to a larger enterprise services strategy. In a modular world, hardware is a means to monetize services when all the dust settles.

Classic Disruption

What essentially is happening is Samsung is being disrupted in the classical sense according to the theory. I’d argue in certain markets, like pure consumer ones, disruption theory is more predictable and consistent in modular environments. I argued in this Insider post that Apple is immune to disruption thanks to their more integrated approach which is sustainable in large global consumer tech markets. Apple has yet to have to change their business model, whereas Samsung is actively shifting away from premium and changing their strategy to ensure the scale the fundamentals of their company require.

The lesson for all hardware OEMs making PCs and smartphones is to begin planning for a future where hardware becomes a means to an end and to sell a broader set of services. Competition is going to come from all angles and I expect even more “services first” companies, like telco’s or even TV services companies. Ultimately, companies like Xiaomi and Amazon who employ a services first strategy and hardware as a means to monetize those services, may be the future of the OEM model in modular markets.

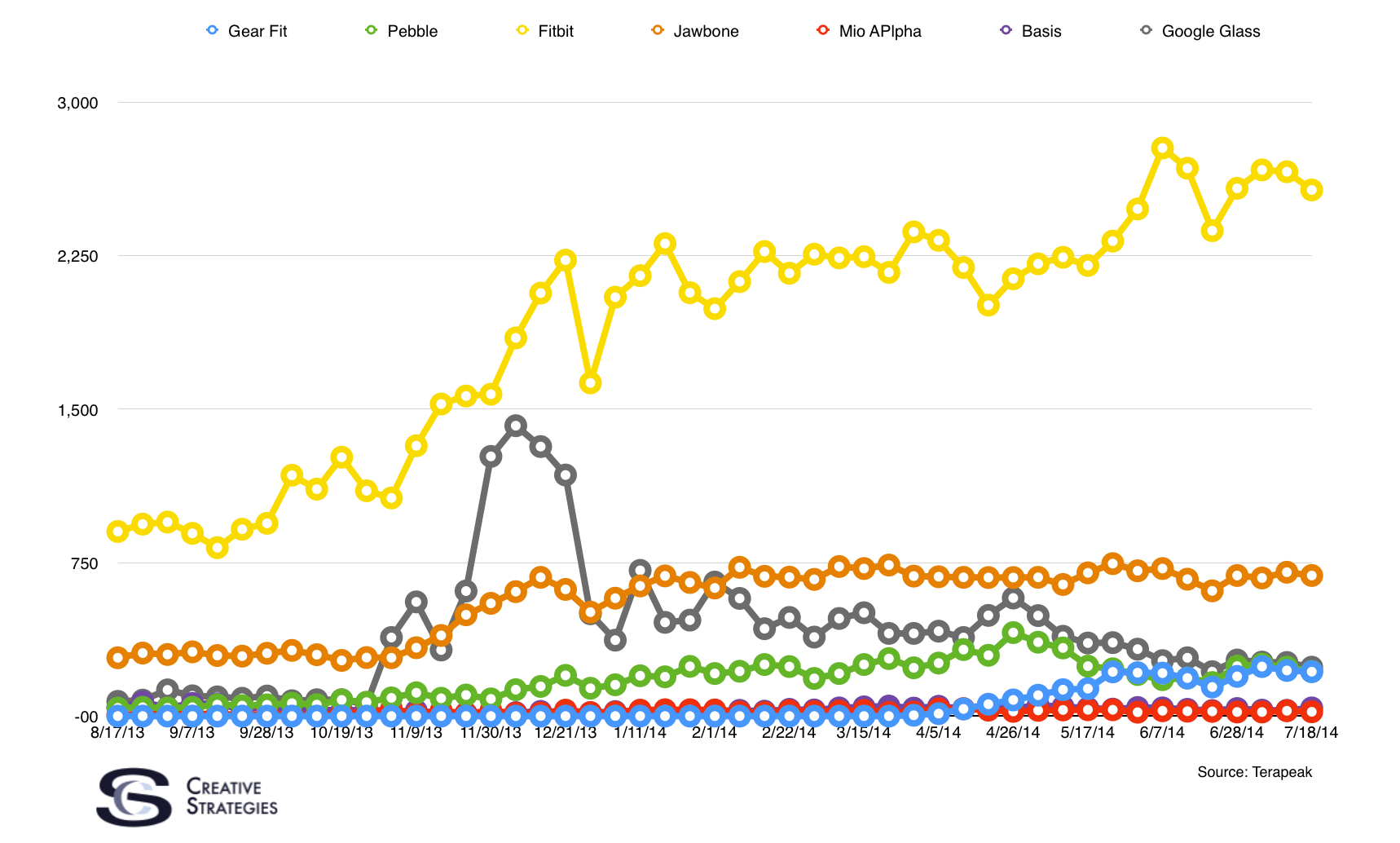

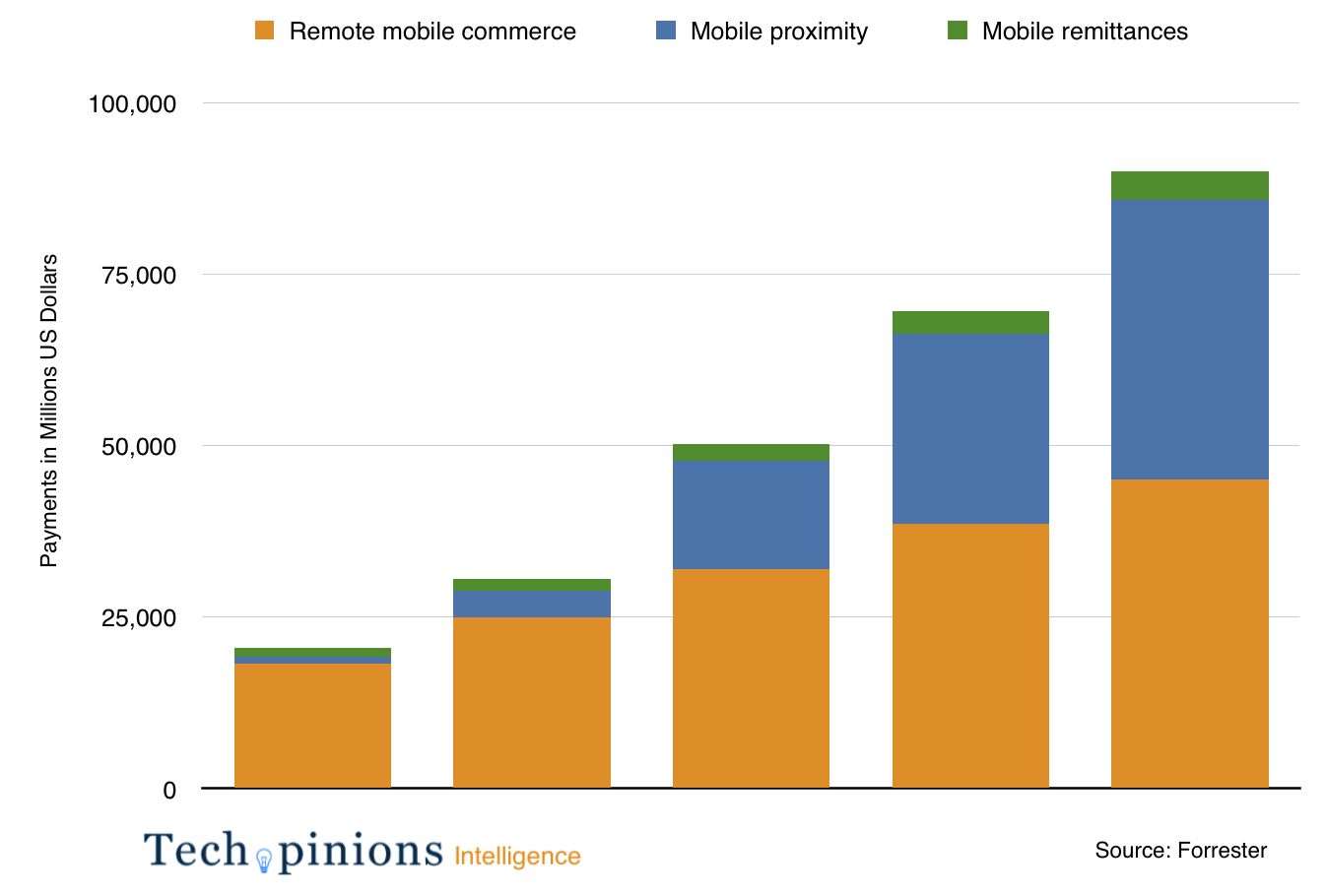

Having recently been at an analyst event with many of the Forrester, IDC, and Gartner analysts, we discussed mobile payments and there was a consensus we are on the cusp of the market developing and developing rapidly.

Having recently been at an analyst event with many of the Forrester, IDC, and Gartner analysts, we discussed mobile payments and there was a consensus we are on the cusp of the market developing and developing rapidly.