Speculating about the future is not easy. Traditional wisdom looks to technology industry history as our guide. The lessons from this history often shed great insight into the future. However, using this history has its challenges and requires context. But using history as our guide, I think it is very interesting to understand the role services will play in the future.

History as Our Guide

I was at a conference a few years ago and heard a presentation from an early executive at Compaq. He shared that when we look at the history of major segments, such as mainframes, mini computers, and desktops. we observe a familiar pattern. That pattern is related to how value evolves through a segment’s lifecycle. His point was that in the early days of a segment the value starts in hardware. During the hardware stage the innovation in hardware, components, form factors, etc., is the driving value proposition for the buyer. His next point was that once the hardware reaches some level of standardization the value then moves to software.

During the software stage all the value is found in software that takes advantage of the compatible build-up of hardware. In this stage, hardware is largely commoditized and all the value and opportunity is in software. He pointed out that while there was still some value left in the software cycle the next step is when that value shifts to services. Most software during this cycle is designed to take advantage of the services being offered. In essence software as a service becomes the longer-term sticky model.

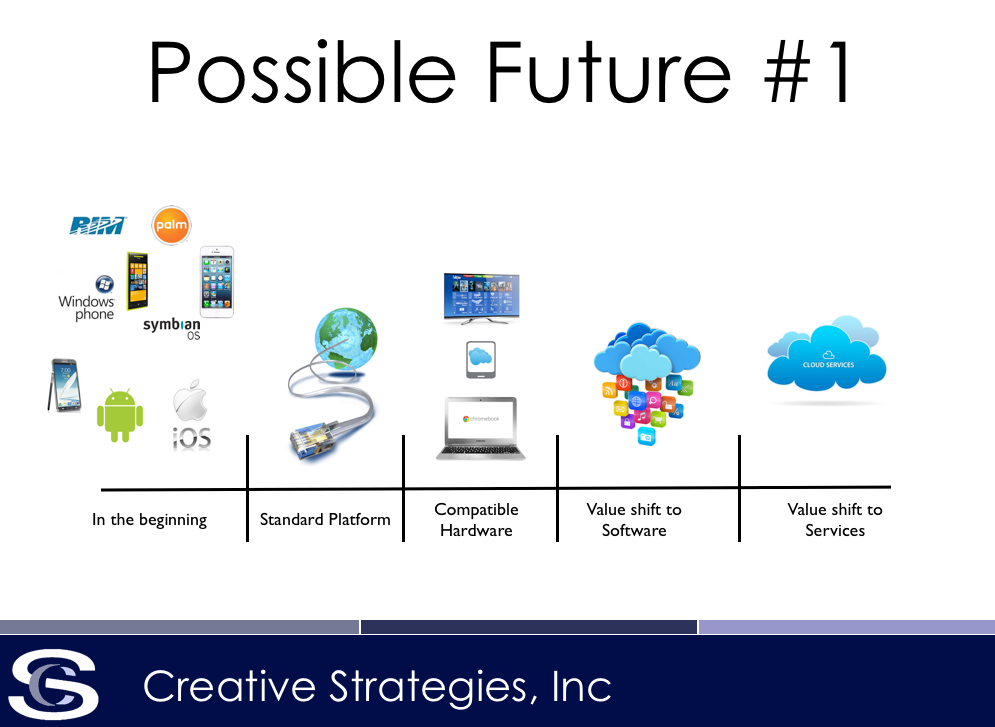

To visualize this cycle as it was in mainframes, minis, and desktops, for example here is the slideshow showing how this happens. Cycle through each slide.

[slider id=’36323′ name=’Value_evolve’ size=’full’]

There is quite a bit of context within our history needed in looking at these slides but the core point is valid. For example, the history in the buildup of hardware may have played out very differently had Compaq’s Rod Canion caved and adopted IBM’s proprietary PS 2 bus architecture. Or perhaps if Gary Kildall would have called IBM back and they used his CP/M OS instead of MS-DOS. But those are stories for a different time.

Using this view of history as our guide, it would suggest that the value cycle related to personal computing is destined to end up in services. Hardware will be commodity and solely exist to run the bulk of compatible software which is just a gateway to a service.

This vision is interesting but I’m not sure it plays out this way. Let me offer two views I have on how this could play out.

Scenario #1

In my first scenario we play out what could happen if the primary view of history, which I outlined above, prevails. This is the view most similar to that embodied today by Google’s Chromebooks and by Larry Ellison’s vision where all computing is cloud-based and hardware is purely thin-client. In this vision the Internet is the platform, not proprietary OS layers.

Here is a slide I created for this scenario using the value shift methodology.

In this view we are still in the ‘beginning’ or the ‘golden era.’ Everything we see happening today with the fragmented platforms, app stores, and services is ‘just the beginning.’ During this stage each platform is evolving on its own related to hardware, software, and services, but will eventually lead to the Internet becoming the platform. This is the pure cloud-based, browser-based computing vision.

What is interesting in this vision is that it is good for software developers but not so good for pure hardware companies. If all hardware simply needs to standardize around web standards, then developers no longer need to write for individual software platforms. Instead all they have to do is create cloud apps that will run on all hardware through a browser or web standards-based operating system.

This vision is at the center of the debate over native apps vs. web apps in our future. This vision seems good for developers because they truly have a universal platform to write software and deliver software to the largest base possible. But it will challenge pure hardware players and force them either more into the software game or services game.

This view, if it does happen, will not happen for quite some time (10 years, at least). I say that because this vision requires that a degree of hardware innovation be exhausted and we are nowhere close to that. It will also require a massive amount of infrastructure related to cloud and wireless networks that are nowhere near where they need to be to support this scenario.

Generally this view favors the strategy of companies like Google and Amazon. It is also the model driving Xaomi’s growth in China. The sheer possibility of this scenario is why companies such Apple, Microsoft, Samsung need to be aggressive about their services strategy.

Scenario #2

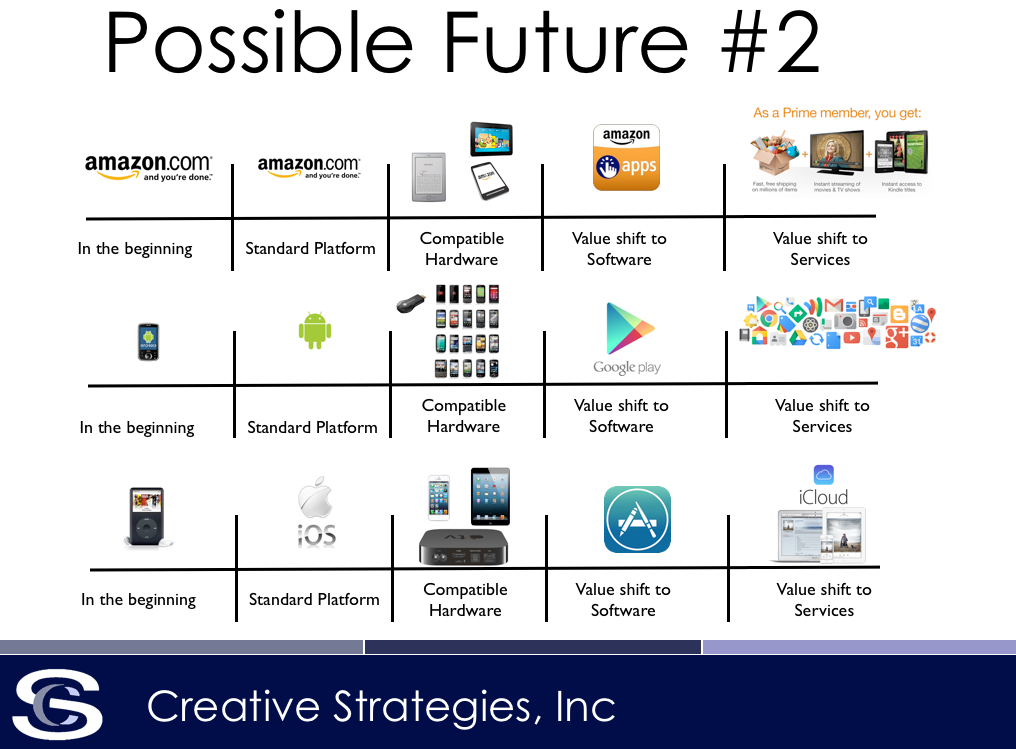

In this scenario the future is a hybrid of the models described above. In this future, there will always be some value in hardware, there will be value in native apps but there will also be a plethora of quality web apps and of course increased value in services. In this view, however, platforms such as iOS, Android, Amazon’s platform, perhaps Windows Phone, or even something else all evolve in parallel down the hardware, software, and services value chain. This view favors a more proprietary ecosystem approach that wins with deeper integration across all three segments.

Thus it may look more like this for the specific players I am pointing out.

In this view the market will sustain a range of approaches and more importantly choice will exist throughout the value cycle. You could argue this scenario benefits the more vertical or integrated players. Google, Microsoft, Amazon, and Apple all have varying degrees of a vertical integration strategies. Each can tightly tune its hardware, its software, and its services to create a differentiated offering in the marketplace. We know from many segments that differentiation to mass market consumers is important.

This does not preclude the more cross-platform services such as Netflix or others from being successful. Only that those companies which offer services on all platforms run the risk of being out-integrated on certain platforms by the vertical player who seeks to offer competing services. The players with a services strategy such as Google, Amazon, Apple, Microsoft, and any else that could do it, have the ability to more tightly integrate their services with their hardware and software. Thus they win with an integrated approach. Integrated approaches are more convenient to mass market consumers, easier to use, and thus will be perceived as valuable (that is, worth paying for).

Conclusion

I can see both these scenarios playing out. In my mind the likelihood of each holds equal weight. Which basically means I’m not sure which will come to pass. If Scenario #1 is more modular, Scenario #2 is more integrated. The point that remains, however, is that any way you look at it we are still only just beginning.

![The Myth of an iPhone Killer [Updated with added chart]](https://techpinions.com/wp-content/uploads/2013/08/Fotolia_53841875_Subscription_Monthly_M.jpg)