TL;DR version: It’s their A-series processors. However, I’ll lay out many of the reasons why this single component may be the source of Apple’s most significant competitive advantage.

In 2008, The year Apple bought P.A. Semiconductor, I was working with a company specializing in semiconductor industry IP licensing. The CEO became a good friend and he was a long-time exec in Motorola’s chipset business back in the day. Suffice to say, our meeting shortly after the news dropped was an interesting one. One of the key parts of this discussion was centered around how the strategy by semiconductor companies is to differentiate their chips by their designs. Meaning, how they put together the entire solution either onto a single chip or with many chips (co-processors) working together. Each vendor selling chips to others, generally, had a custom design and solution. What the smart semiconductor insiders knew with this acquisition of P.A Semiconductor was Apple was going to start designing their own chips. However, unlike others in the competitive chipset design business (Intel, Qualcomm, Nvidia, Broadcom, and a few others), Apple would not be designing these chips to sell to others but exclusively for their own devices and operating systems.

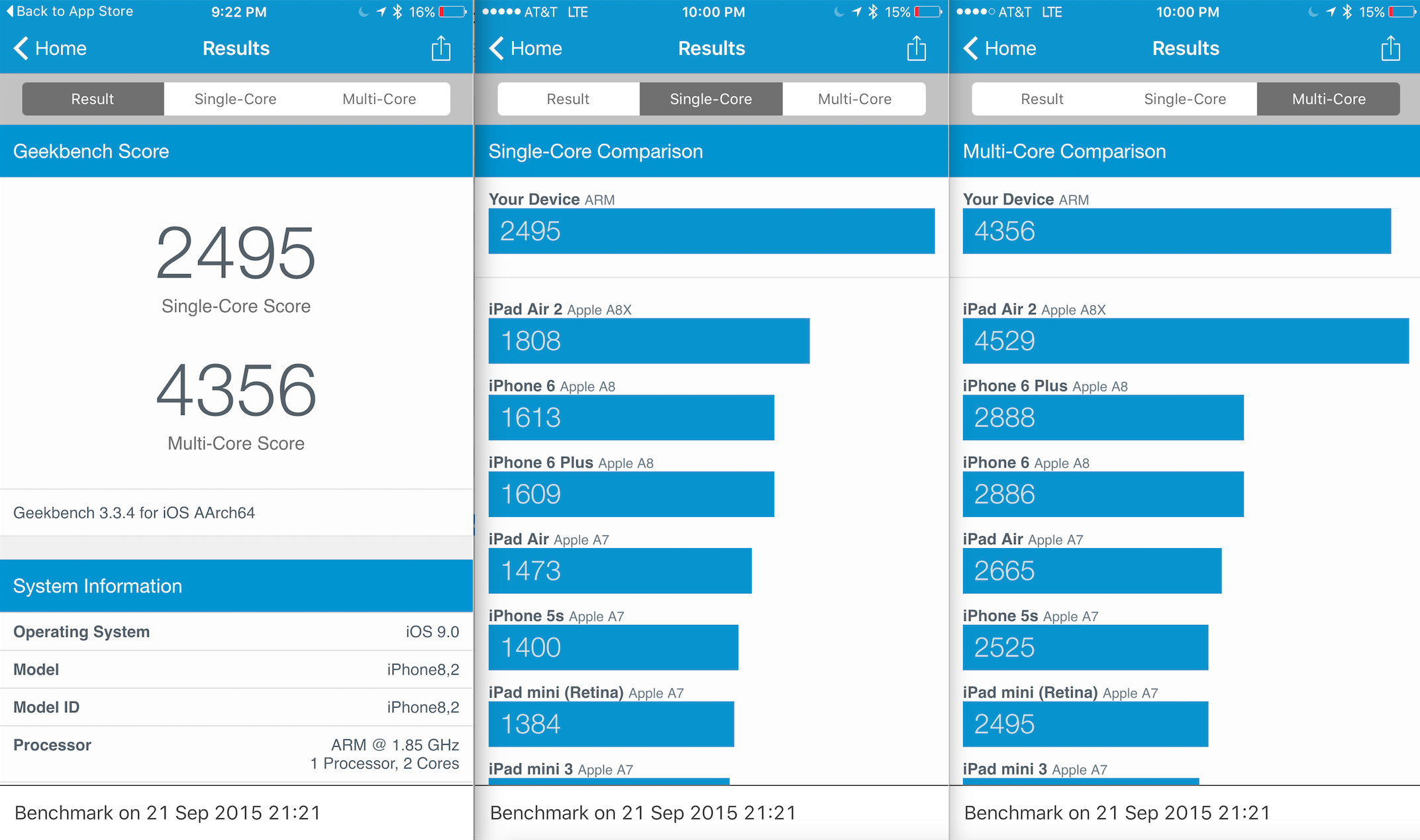

As I’ve studied the semiconductor industry for over 15 years now and the nuances between each chipset designer are fascinating. The way each one designs their chips to solve market problems and compete against other vendors is unique and creative. But all of these vendors have to design into their SoC or entire chipset solution the broadest of solutions in order to capture as many different parts of the market as possible. So a vendor like Qualcomm will design their architecture and then tailor it for different parts of the market. The initial design is broad, yet its applications can be made more specific. The same is true with Intel. They must cover the broad market with their solutions. Apple, on the other hand, does not, meaning every bit of their engineering resources, architecture designs, and nuances in optimization have a single purpose — to make iOS the most sophisticated, capable, and powerful mobile operating system on the market. Apple has been acquiring some of the best chipset designers in the world and they are tasked with making the most powerful and battery-efficient designs in the industry. These designs are exclusive to iOS while, at the same time, being competitive with the broader market chipset vendors as well. Without being a semiconductor industry insider, it is hard to internalize just how big of a deal the A-series processor design is in the grand scheme of things.

Prior to designing their own chips, Apple’s vertical hardware and software intergration stood apart because they could tune the software to the hardware, which contained many parts of the puzzle they did not own, and make specific software optomizations to accompany that hardware. This has only extended to a much deeper level now that they can tune/design the CPU/GPU and many other parts, like display drivers, motion processors, image sensors, and a host of other critical things, into the design and optimizations of other hardware and, most importantly, the software.

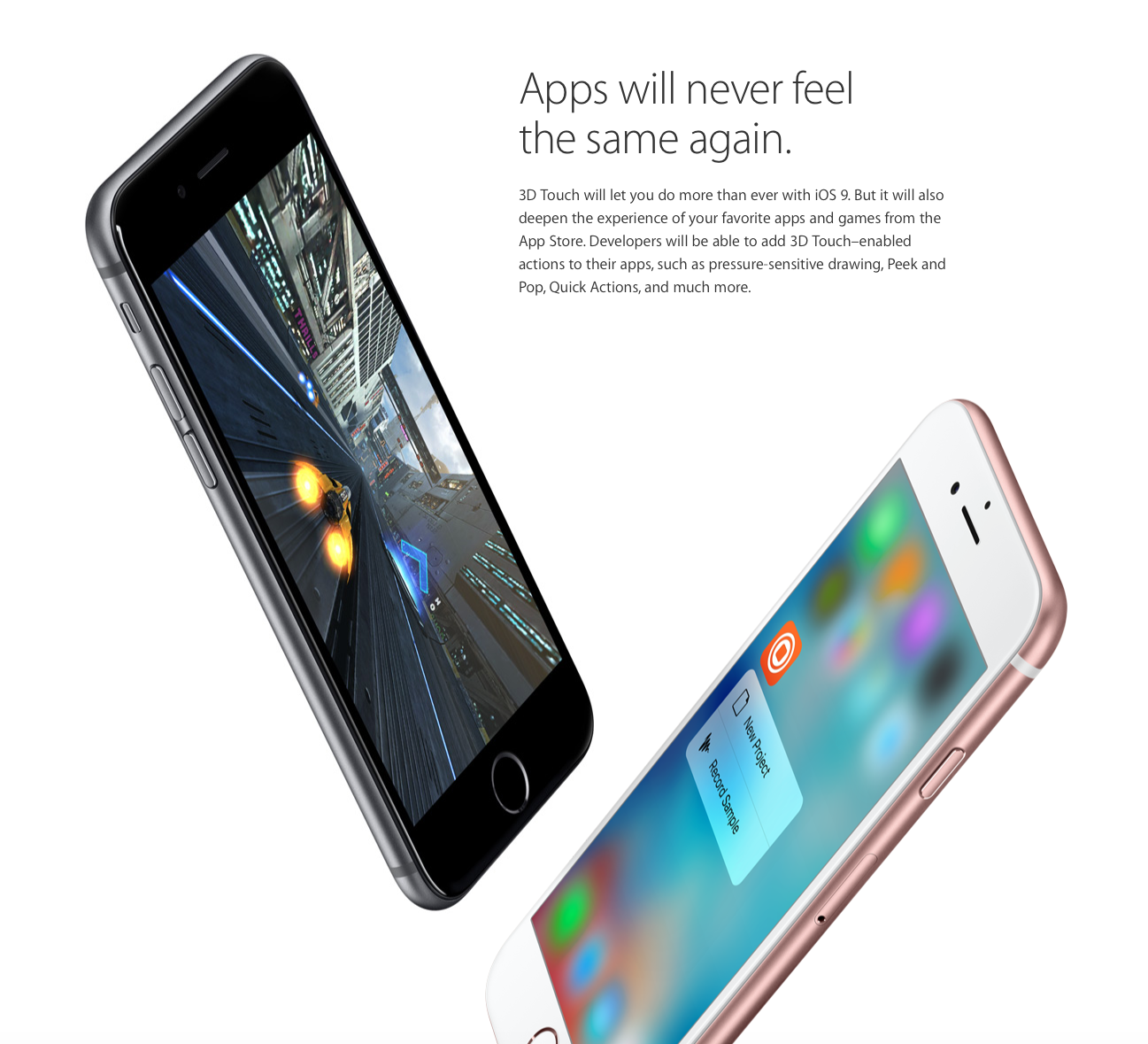

The results of Apple owning so many of the key components is not just the visual performance in terms of speed or graphics, but how fast Touch ID is, for example. Or their superior protection by being able to do hardware level security integrated into the chipset via the secure enclave, and locking in safeguards at the SoC level. So overall superior performance, security, and new software capabilities like 3D touch, are just a few of the things Apple can do to integrate and differentiate on their platforms. There are more to list and more will come, but there are two key points I’d like to draw out.

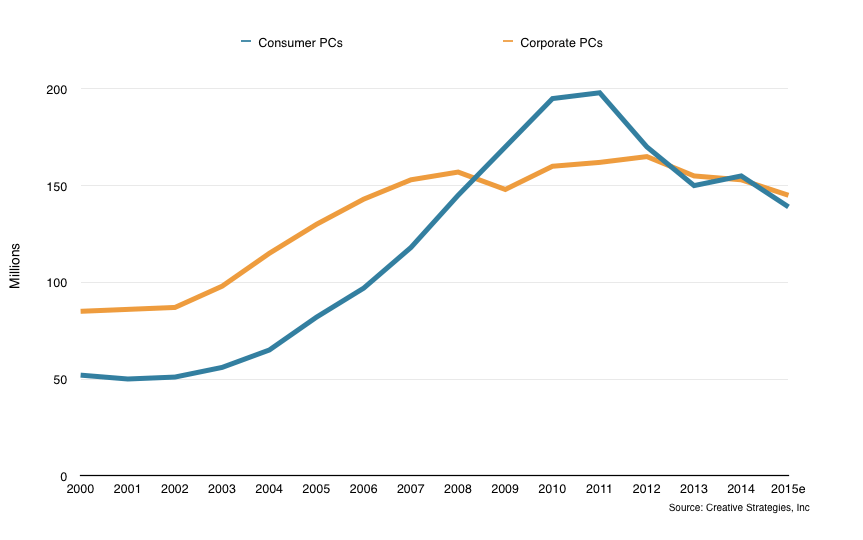

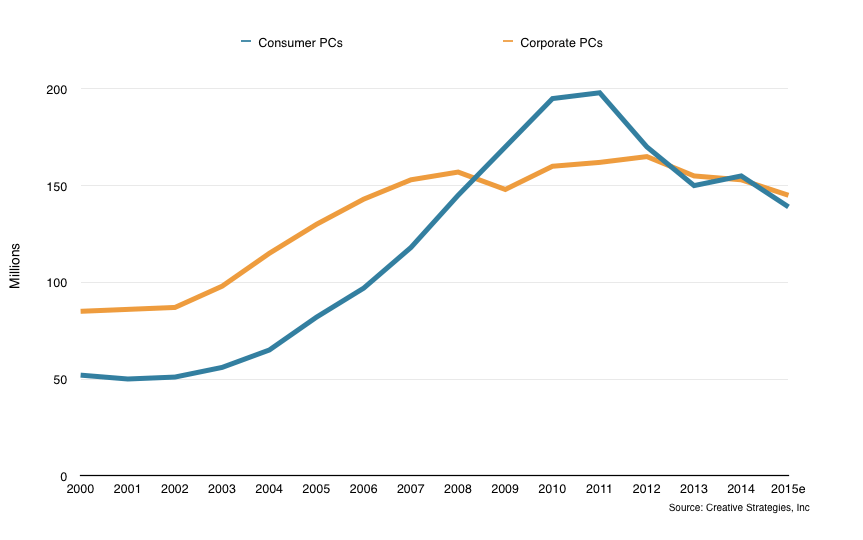

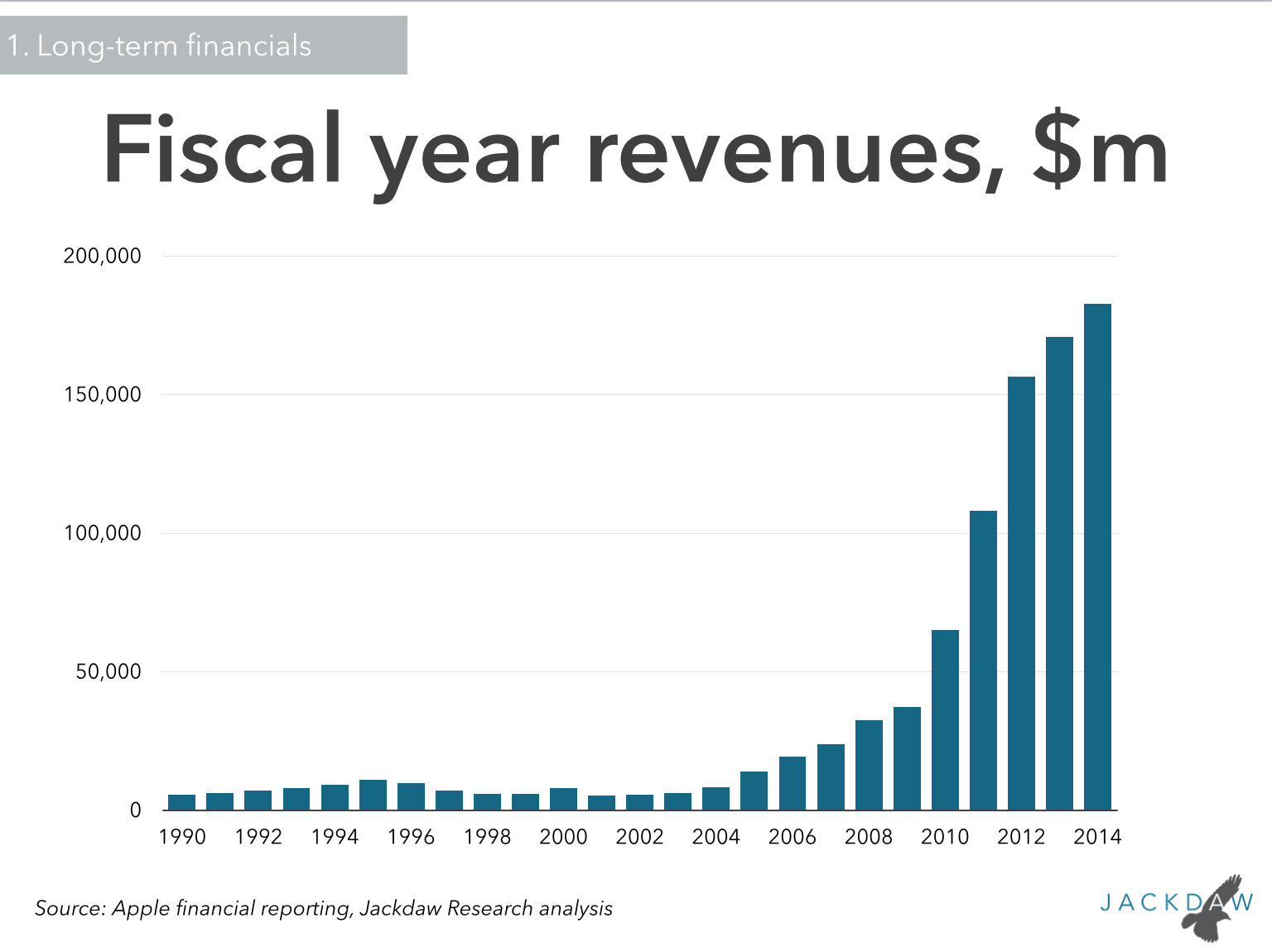

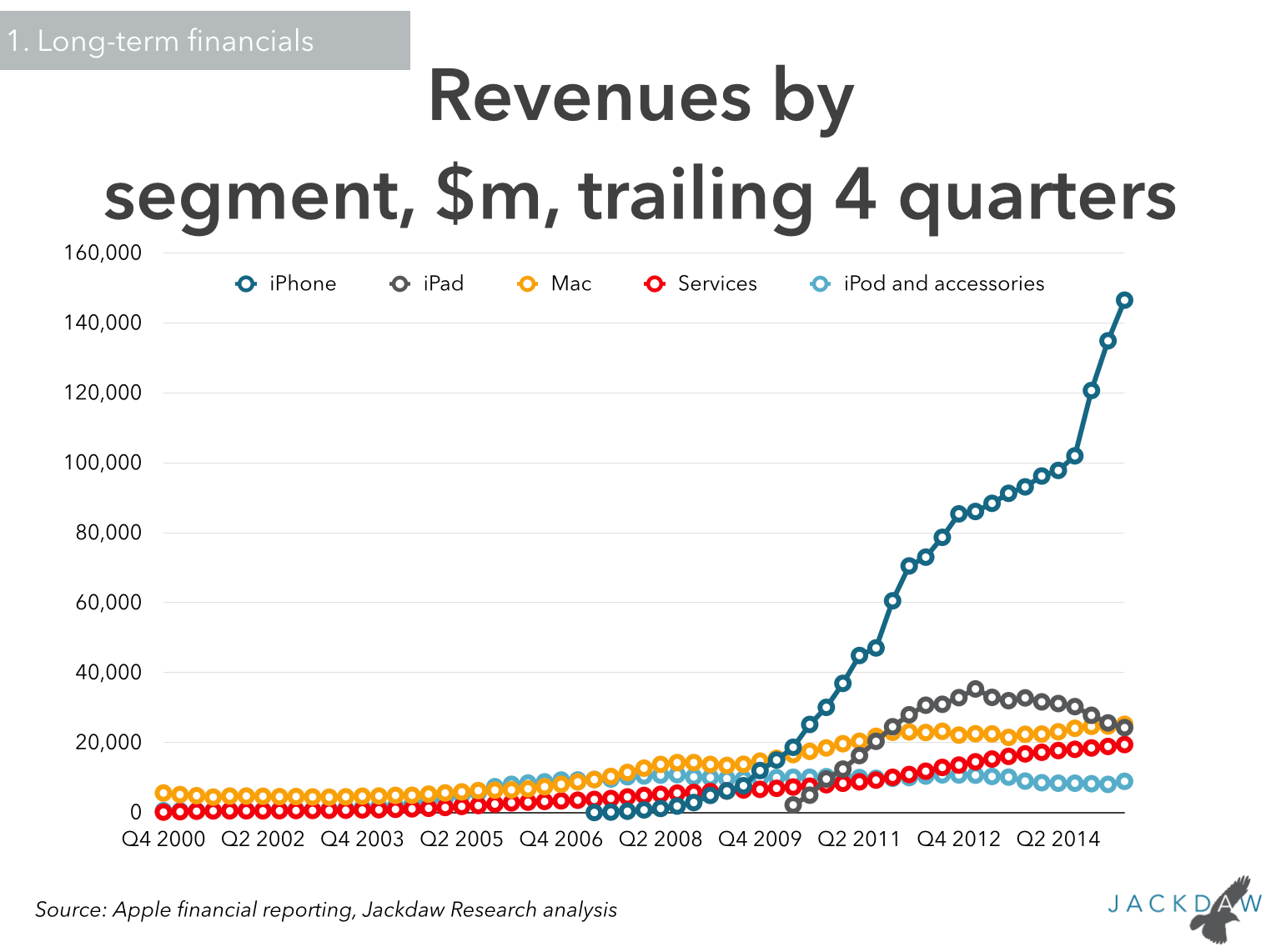

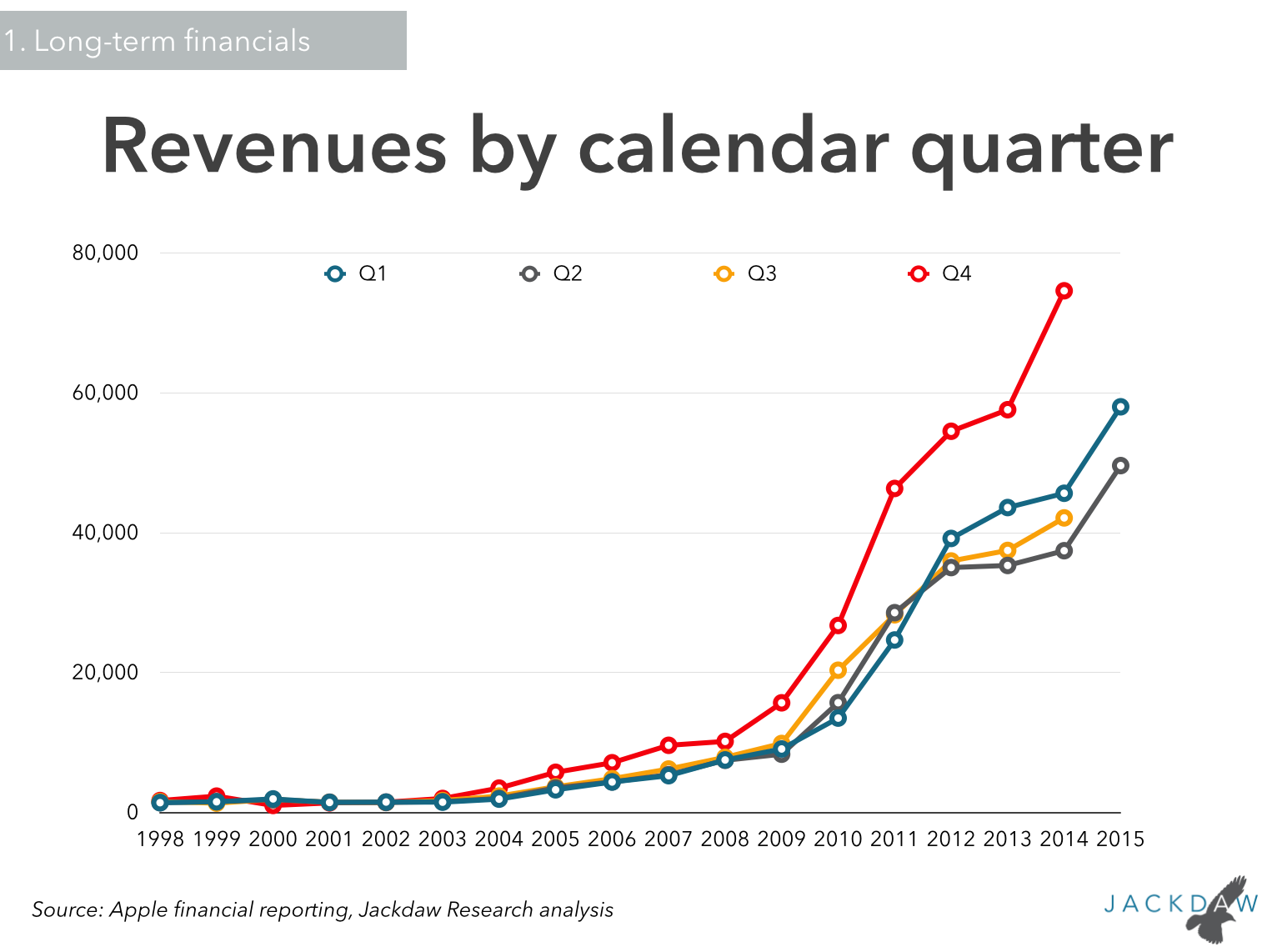

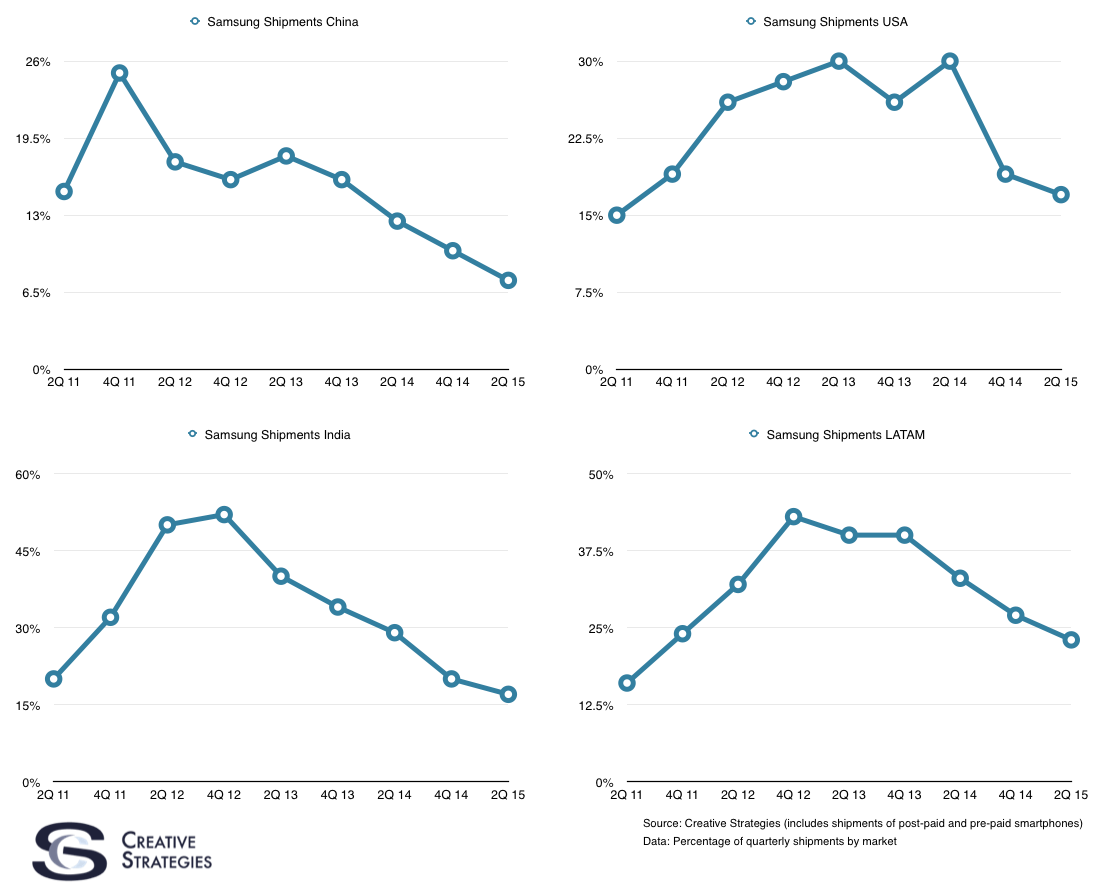

Other companies will be very slow to catch up. No vendor has quite nailed Touch ID the same way Apple has in terms of reliability and accuracy. The new Samsung devices I’ve tried are close, but experts have told me there are security concerns. They got one part close but not the other key ingredient. The real observation to be made here is what Apple has done to the premium hardware sector in smartphones, PCs, tablets, etc., in that it is mostly non-existent. In nearly every computing category Apple competes in — tablets, PCs, and smartphones — they own between 75% and 90% of the premium category. The impact of this reality is other vendors who compete in these spaces will find it more difficult to justify investments in leading edge components (even if they exist) because they won’t sell enough in volume. Samsung as an example, will lead in things like curved glass or other features which they own the supply chain for, but their ROI on those components won’t come from their handset business but from other companies. They key question here is, are there other customers for high end components other than Apple? If there are not, then even Samsung’s latest will be delayed due to lack of customers willing to pay premiums for curved glass or other things they focus on. And with the coming near-impossibility to sell an Android handset for more than $500, I do not forsee any other hardware vendors out there able to buy premium components en mass and commercialize them at the high-end where they must be due to their price.

Apple Suppler Leverage. Once Apple becomes the main customer for all high-end innovations, they acquire the upper hand in supplier and supply chain negotiations. Take this latest move to dual-source the A9 from Samsung and TSMC. Samsung is on 14nm and TSMC was on 16nm. Samsung had the capacity to make all of Apple’s chips but Apple chose to dual-source to not only keep their suppliers honest, but to give business to TSMC so they can use the money to invest in their next process node at 10nm. TSMC has prioritized Apple to the point of aggravating other very well known semiconductor companies, causing delays for others to get their latest chips to market. Should TSMC make the jump to 10nm and the process is mature, Apple would be the only customer for it, as they are the only ones who can afford to pay the premium. This gives Apple a great deal of leverage. This is just one example of many I hear from my contacts in the supply chain where Apple has the upper hand.

When I put all this together, what stands out to me is, in this race, Apple is sprinting and everyone else is walking. Others in the market may get there but Apple will get there first. The markets they compete in really are theirs to lose and owning all the key parts of the hardware and software and increasingly, services chain, means it’s hard to see how they lose it any time soon.