One of the more interesting things I’ve been observing in our global research is how the success of varying business models is differing in certain regions as it relates to the consumer internet. What has stood out to me in particular is how free services subsidized by ads do not seem to work well in markets like China and India. Jenny Lee, from GGV Capital, mentioned this point in particular in an interview recently.

Chinese companies prefer the subscription model, virtual currency/items, commerce model versus a pure ad-based model. Most people do not consume ads online, especially on mobile. – Jenny Lee

An original early theory of this observation was related to the economy of a particular region. Those economies that were wealthier, or even healthier, tended to be ones which supported a business model of free services subsidized by ads. The theory was, since consumers in those economies spend more and as a result, were more attractive to present with advertising. However, even as China has grown significantly in purchasing power, we still don’t see free-with-advertising business models succeeding there. Rather, transaction-based business models are working well in China.

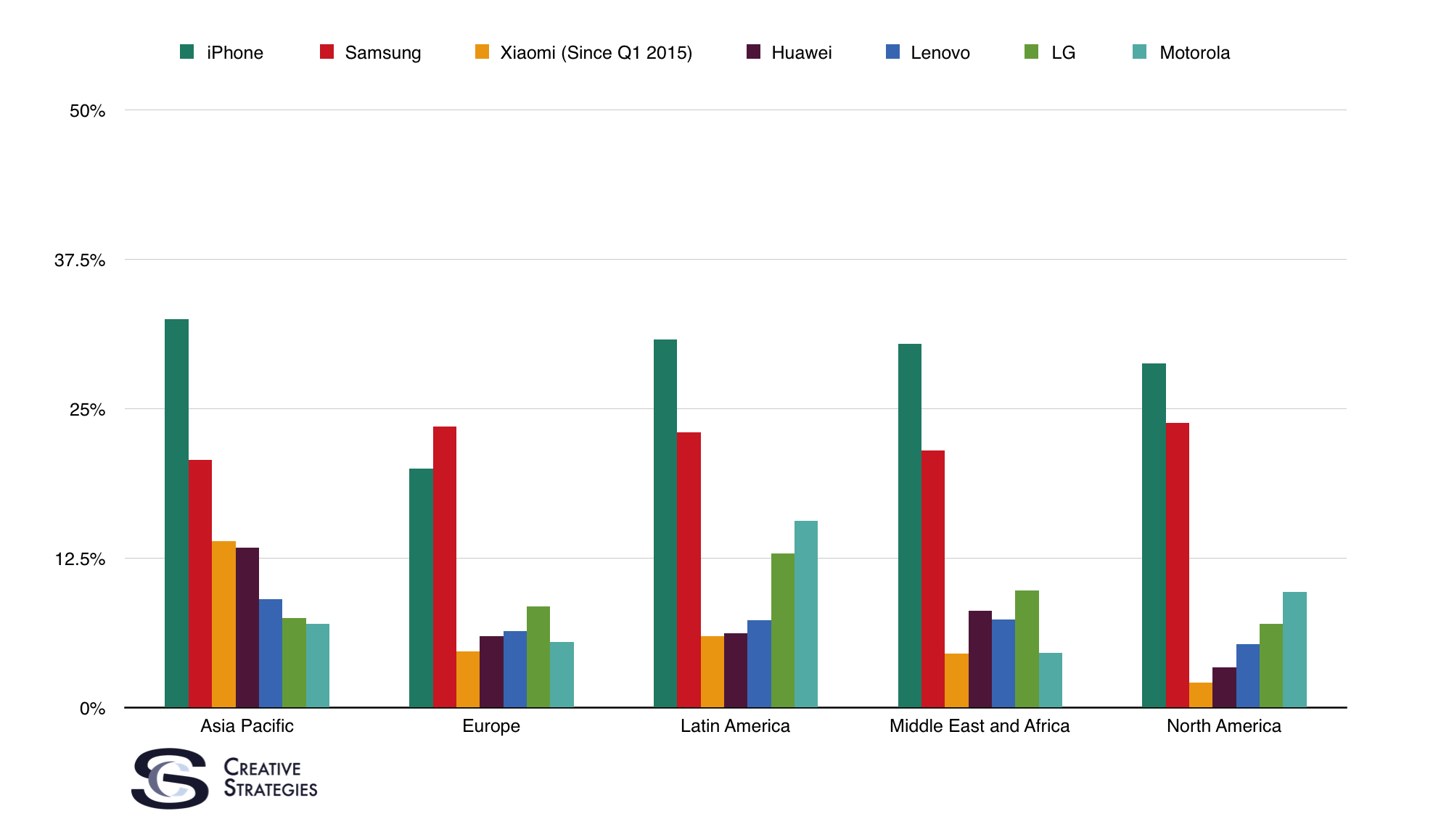

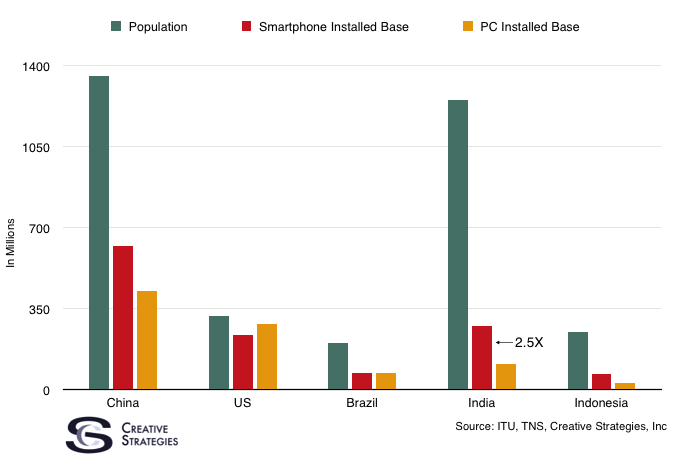

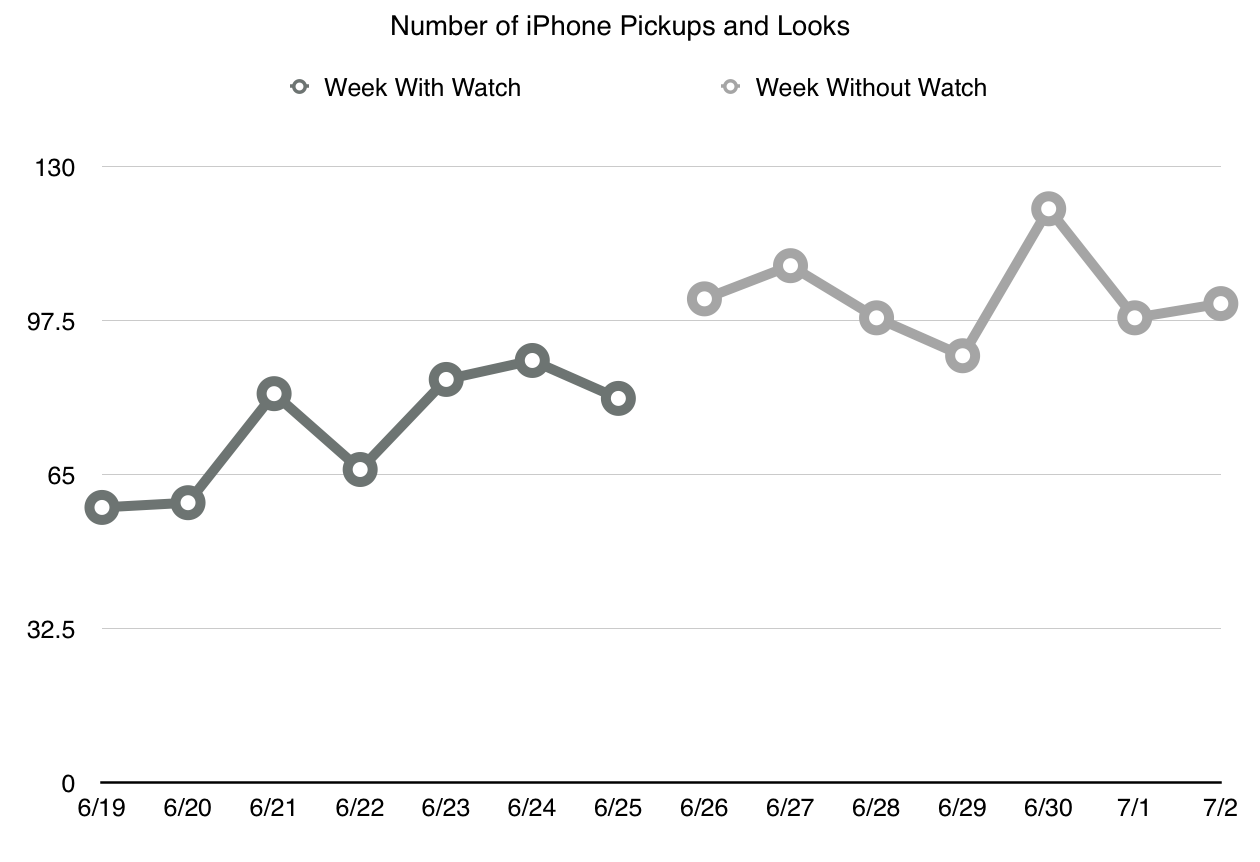

Similarly in India, the free-with-ads business model is struggling. While Facebook is not in China, perhaps this slide from Facebook’s Q2 2015 earnings visualizes well the point I am making.

Facebook’s services may very well touch more humans every day than Google’s. It makes them a decent bellwether to analyze this business model at a global level. If Facebook’s global ARPU numbers look like this, you can imagine Google’s, Twitter’s, and many other free services subsidized by ads have similar regional ARPUs. Just to put a stamp on this point, note Facebook’s ARPU in Asia-Pacific and, while Facebook is not directly in China, WeChat’s ARPU is estimated to be around $7. WeChat has succeeded at encouraging ARPU to around the same as Facebook in the US & Canada, with a very different business model and in a market where free-with-ad business models are challenged.

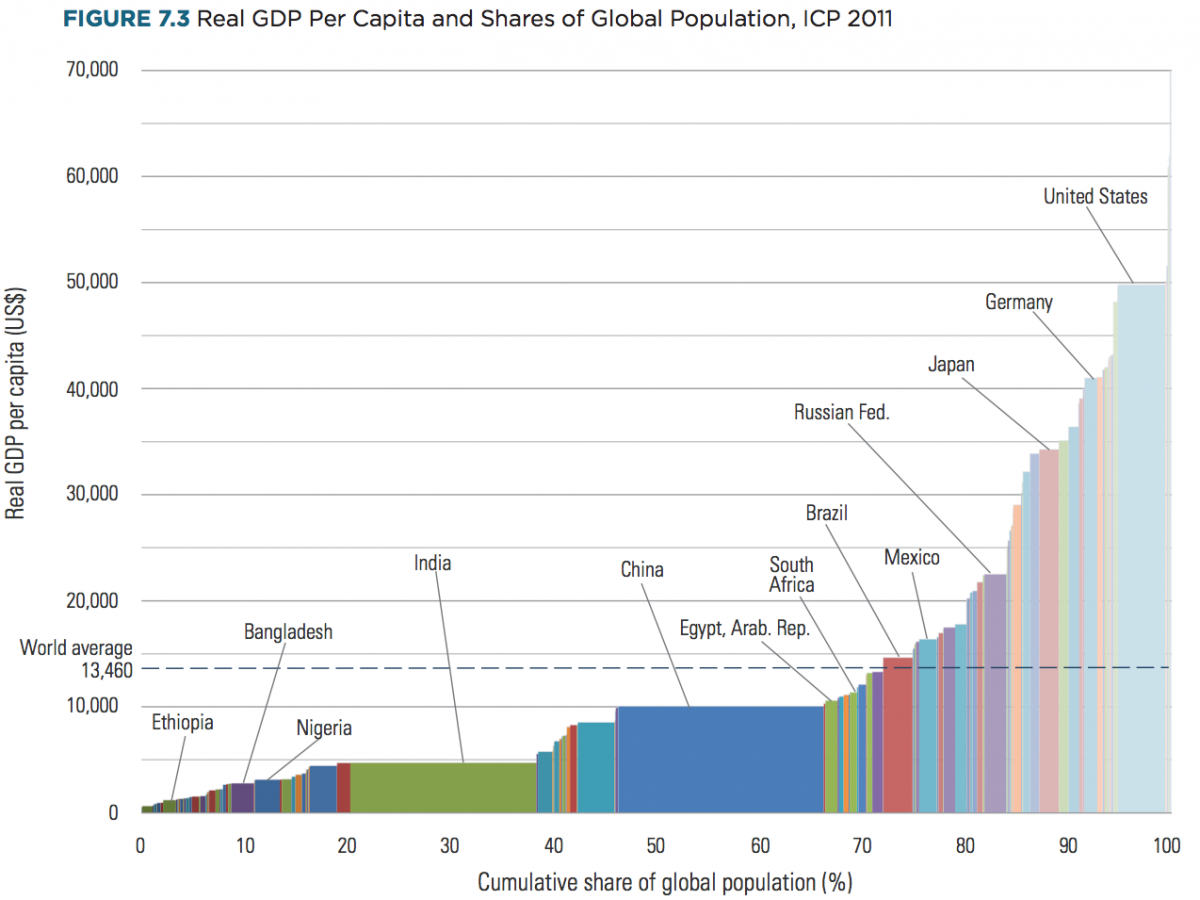

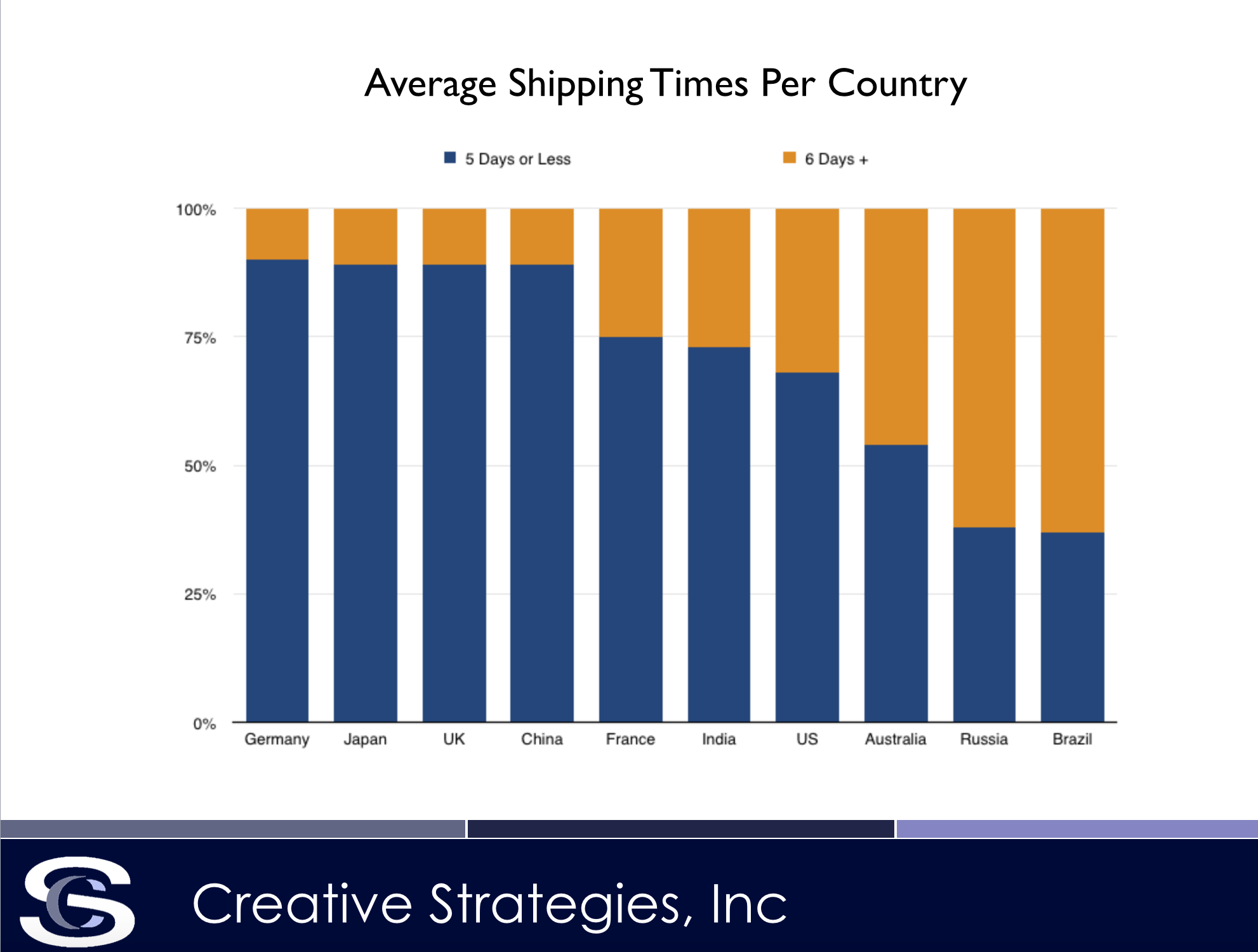

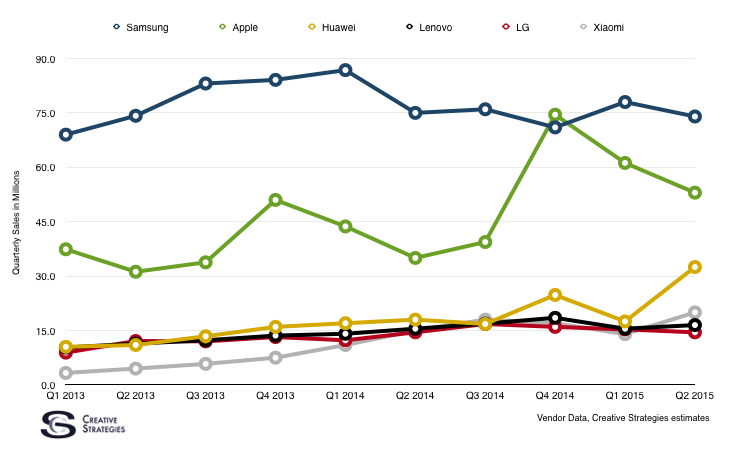

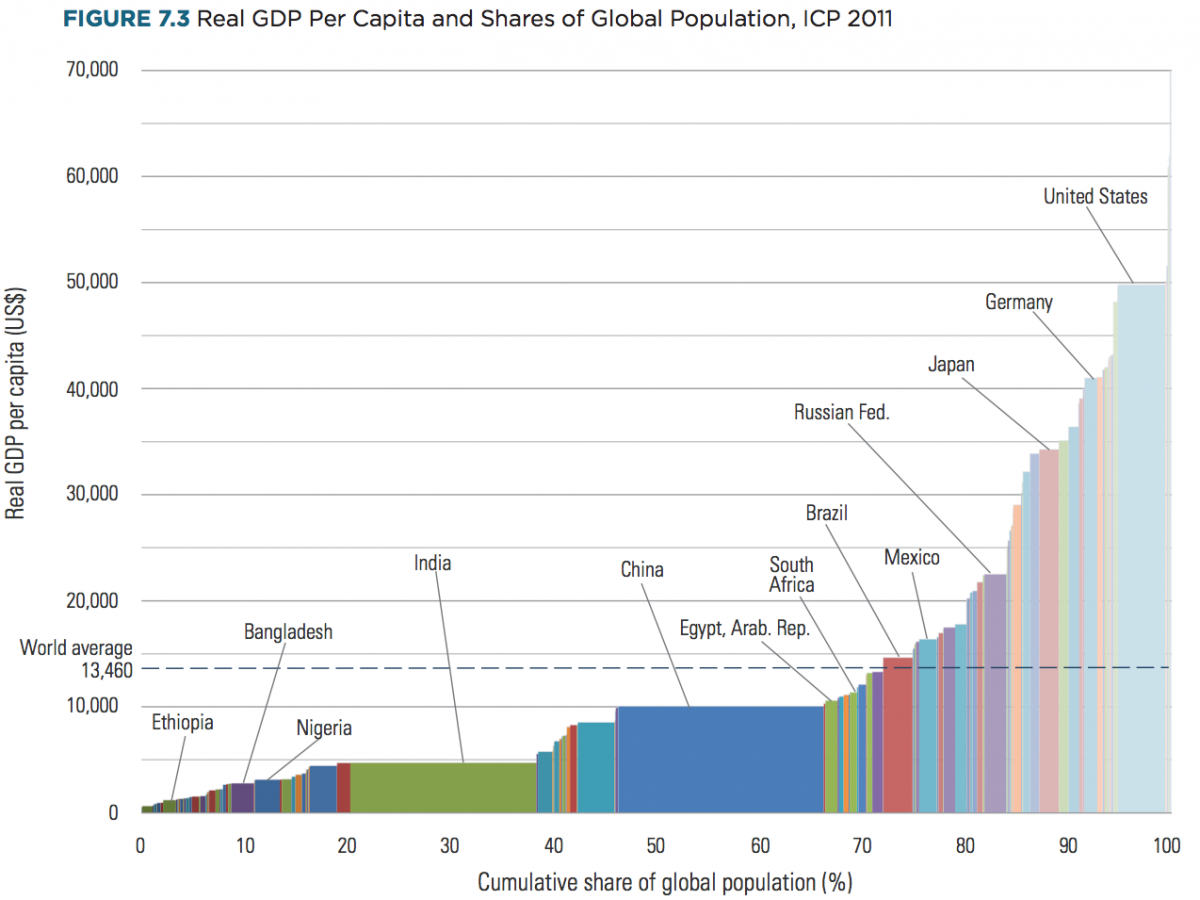

Now, about how the state of each economy may play into this dynamic. This is a chart I like on the subject to highlight where many economies are, relative to each other.

Although this chart is from 2011, I looked at the most recent (2014) data from the World Bank and the IMF and not a great deal has changed. Based on the point I’ve made, you could argue free-with-advertising based models work better in countries to the far right of the graph vs. those well below the line–at least for the time being. Which, if true, makes for the follow-up observation that most of those countries have a mature and saturated consumer internet. All the growth in users and new business opportunities is going to come from countries with less developed economies, purchasing power, and many other fundamentals that impact this particular business model. This is a key element to why we see transaction-based business models finding more success in the East.

If it plays out this way, then to grow, many companies with free-with-advertising business models will need to evolve to include more transactions as well. Perhaps this is why Twitter, Pinterest, and even Facebook, are trying to encourage more purchasing by adding buy or other action buttons to encourage a transaction of some kind in order to collect a share of the transaction. The mantra for many companies facing slowing revenue growth is to maximize ARPU of existing customers. This is where much of the evolution of these free-with-advertising services is likely to evolve.

While these are current and distinct observations, the story is not over. Something important has not happened yet which may alter the thesis on these business models. Mobile commerce is not the dominant internet transaction model yet. When this happens, and it will, not only will we see country by country e-commerce statistics rise, we may see extremely active shoppers ready and willing to be incentivized to purchase. I’m convinced mobile commerce will be the catalyst to drive overall e-commerce to new heights. With this will come the opportunity to be even more targeted with purchase interests. Whether this manifests itself by way of traditional or new types of advertising we do not yet know. However, while there is a clear separation of Eastern and Western market business models today, we may see some converge going forward as each market learns from the other.