Expect mobile payments and mobile commerce to be a landmark trend in 2016. All the stars are aligning for the commerce landscape to dramatically change and mobile commerce will be the catalyst.

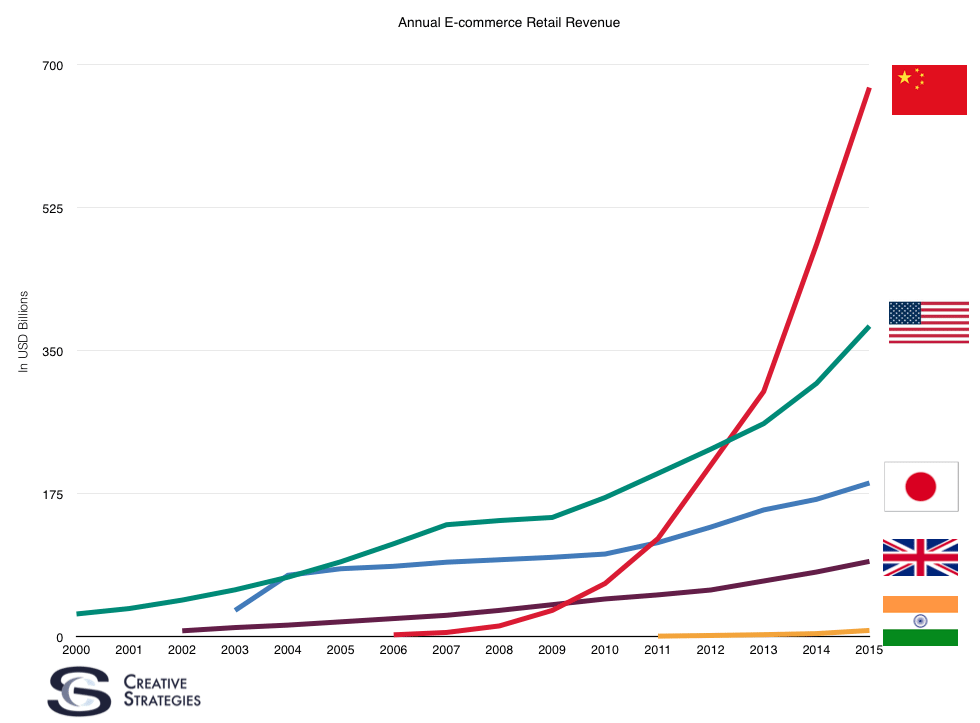

Here is a chart looking at e-commerce sales annually by country.

If you have been following China, it won’t be a surprise that e-commerce is larger there than in the US. What does get missed in this observation is how it was the smartphone that caused China’s e-commerce sales to take-off.

When we look at China, their active (monthly) online shopper base is only about 150m more than the active shopping base of the US. Which suggests the number of e-commerce transactions each month per Chinese shopper is more than that of a US online shopper.

China has several things I believe make e-commerce more fluid, thus directionally impacting the volume of e-commerce transactions. The first are platforms like WeChat or Alibaba, which offers practically everything people buy or need regularly. From a vast array of products, groceries, restaurant meals, and host of services, nearly everything is available online. Second is a seamless mobile wallet. Alipay, for example, controls over 80% of digital transactions in China and is the standard for online payments. The huge selection of nearly everything and seamless integration with a payment mechanism eliminates all friction.

This fundamental groundwork in China has led them to become the largest e-commerce market in the world. The forecast for mobile only e-commerce transactions in China for 2015 will be, in total, more than the total e-commerce transactions from both PC and mobile in the United States.

It is possible to get small glimpses of the changing landscape in the US during the holiday season. In a recent report from Google we learn:

54% of all holiday shoppers say that they plan to shop on their smartphones in spare moments throughout the day, like walking or commuting.1 These shorter mobile sessions that occur throughout the day are visible in the data: shoppers now spend 7% less time in each mobile session, yet smartphones’ share of online purchases has gone up 64% over the last year. The days of “look on mobile but buy on the laptop” are changing: 30% of all online shopping purchases now happen on mobile phones.

Shopping-related searches on mobile have grown more than 120% year-over-year.5 Consumers are using their smartphones in all parts of the shopping process―starting with inspiration, then on through research and purchase.

Further research from GPShpper I acquired at a mobile money conference highlighted the following top responses for using a smartphone in a physical retailer’s store during the shopping experience.

How Will You Use Your Smartphone In Store During Holiday Shopping?

- 54% Research Products

- 46% Compare Prices in Store

- 31% Seek additional product info

- 22% Purchase products in app

Which retail store app features will you use while in same retail store?

- 49% Mobile coupons

- 46% Customer reviews

- 37% Loyalty account

- 21% Inventory status

The foundation in the US and many other markets is there by way of consumer behavior. The next step is to eliminate friction for transactions. This is where the EMV shifts chaos will benefit the adoption of NFC transactions like Apple Pay and Android Pay. Our research discovered that only 29% of US smartphone owners have used their phone to make a contactless payment through something like Apple Pay or Android Pay. Drilling down further, we found out that only 20% of iPhone owners to 9% of Android owners have engaged in such a transaction in the US. This is encouraging but still low in the grand scheme of retail purchasing. However, all signs are pointing upward.

Merchants need to market their acceptance of Apple Pay and Android Pay much better than they do today by making it clear where it is accepted. Many retailers I spoke to at this conference indicated this was the plan. Market education is still necessary. Over 60% of people surveyed said they were still uncomfortable with the security of storing all their credit cards in their smartphones. But this is all just part of the transition. Mobile payments will begin to change the face of commerce and open up new opportunities for retailers, banks, and financial services.

Globally, the trend to watch is how the smartphone, tied to a financial service, can play a massive role in financial inclusion to billions of people yet to get a bank account or credit. Instead of giving them plastic cards, we give them smartphones. Over time, we will look back at the smartphone as the mechanism for the largest effort of global financial inclusion we have ever seen.

This is just the beginning.

Thank you for great information. I look forward to the continuation.