As we head into the new year, I want to embark on a series of posts outlining the key opportunities and challenges facing some of the big names in tech. I’ll continue this over the next few weeks. Given the wave of negativity surrounding Apple at the moment, I thought looking at the key opportunities and challenges the company faces would be a good place to start.

Opportunity

iPhone 8 Super Cycle – Especially in China

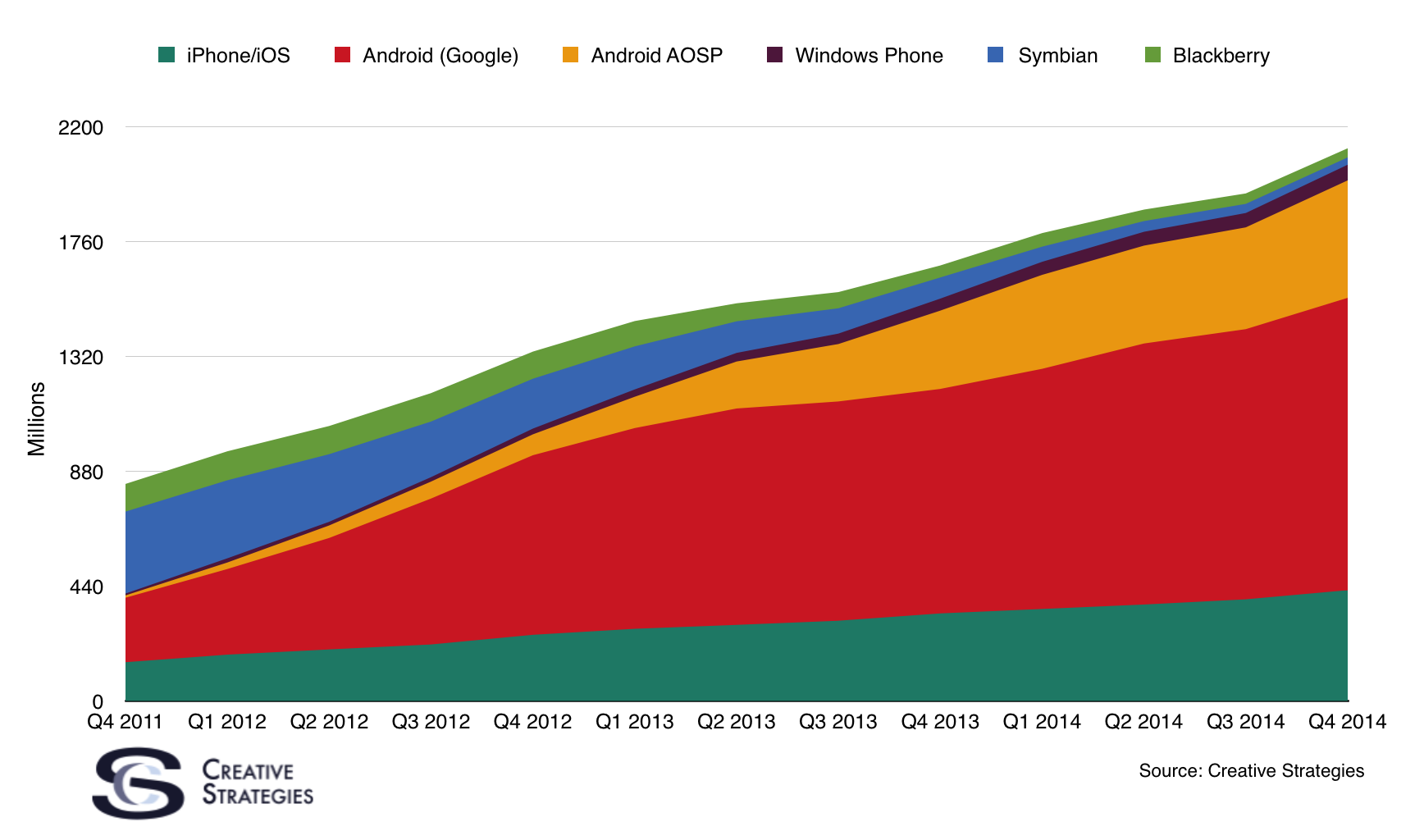

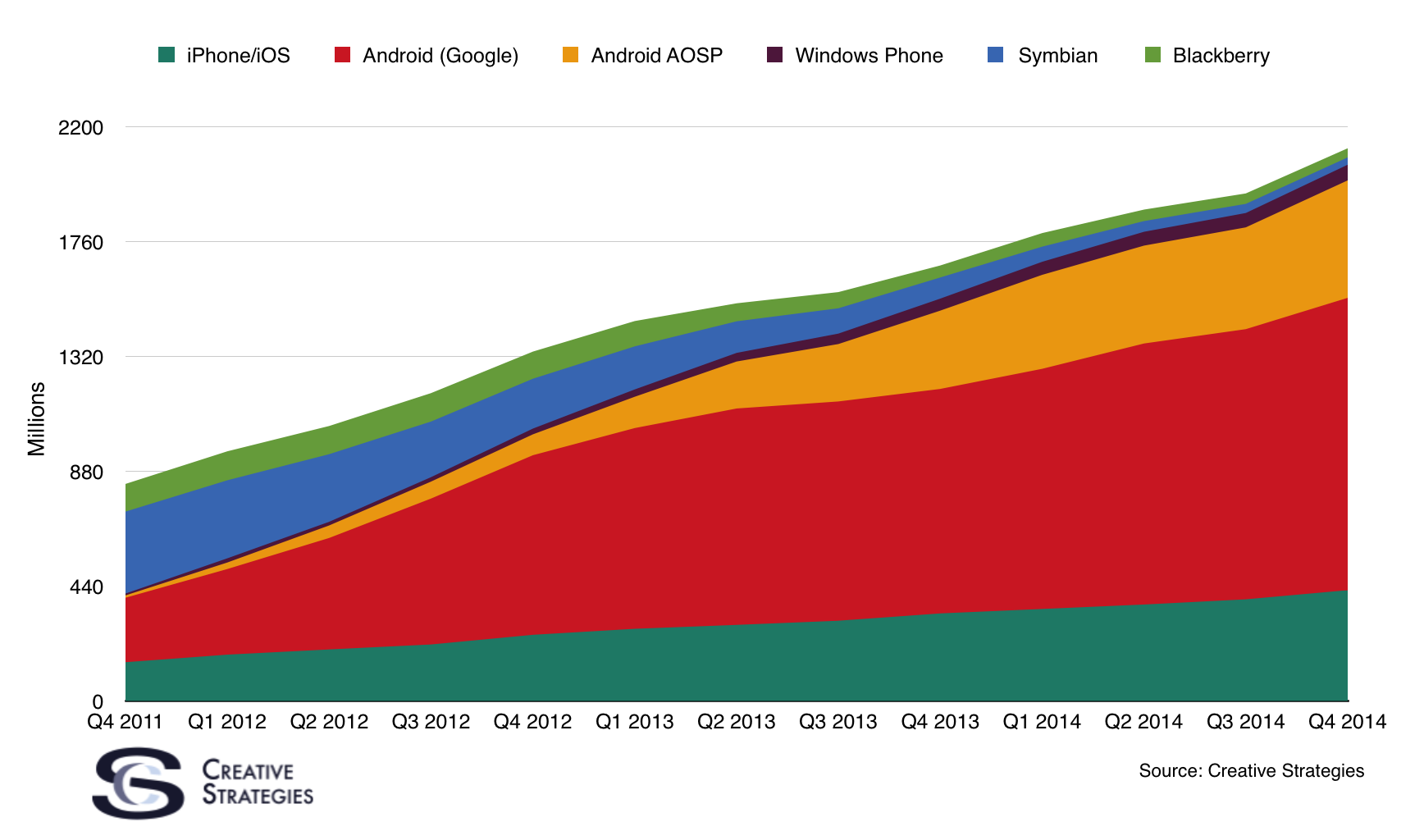

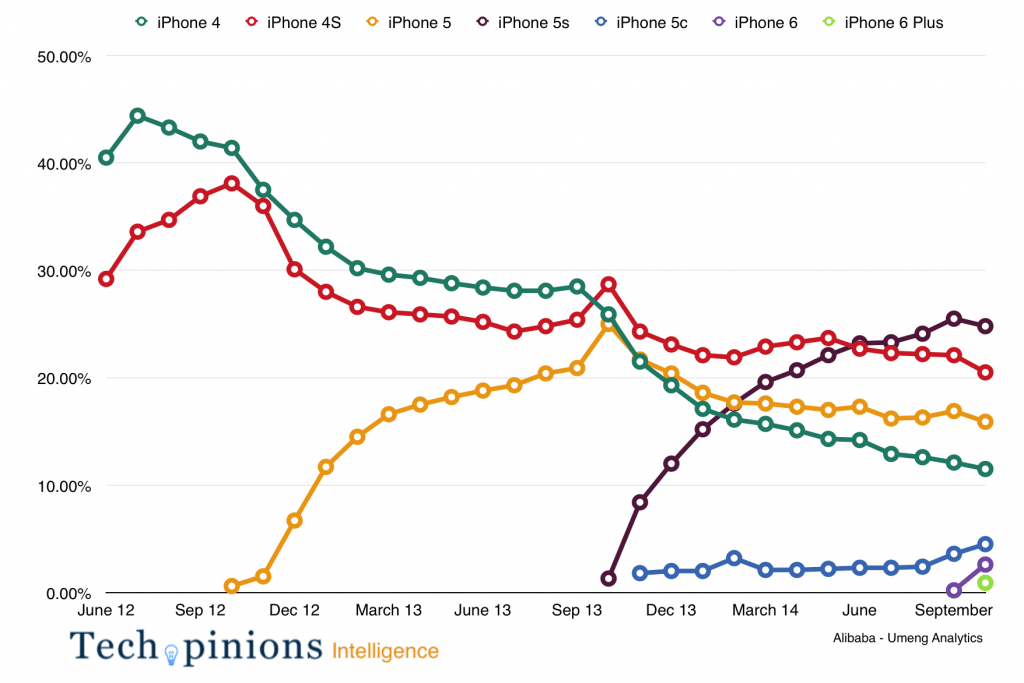

Our research indicated that, in developed markets in the West (in particular the US market), we would see a stronger than anticipated upgrade cycle. All the evidence in post-Q4 sales we have seen validates our research. With this research and data in hand, we modeled different scenarios going into 2017 with the iPhone 8 super cycle in mind. The last super cycle came with a form factor change from the 5s to the 6 and 6 Plus. Consensus thinking is the next major form factor change could be another such catalyst.

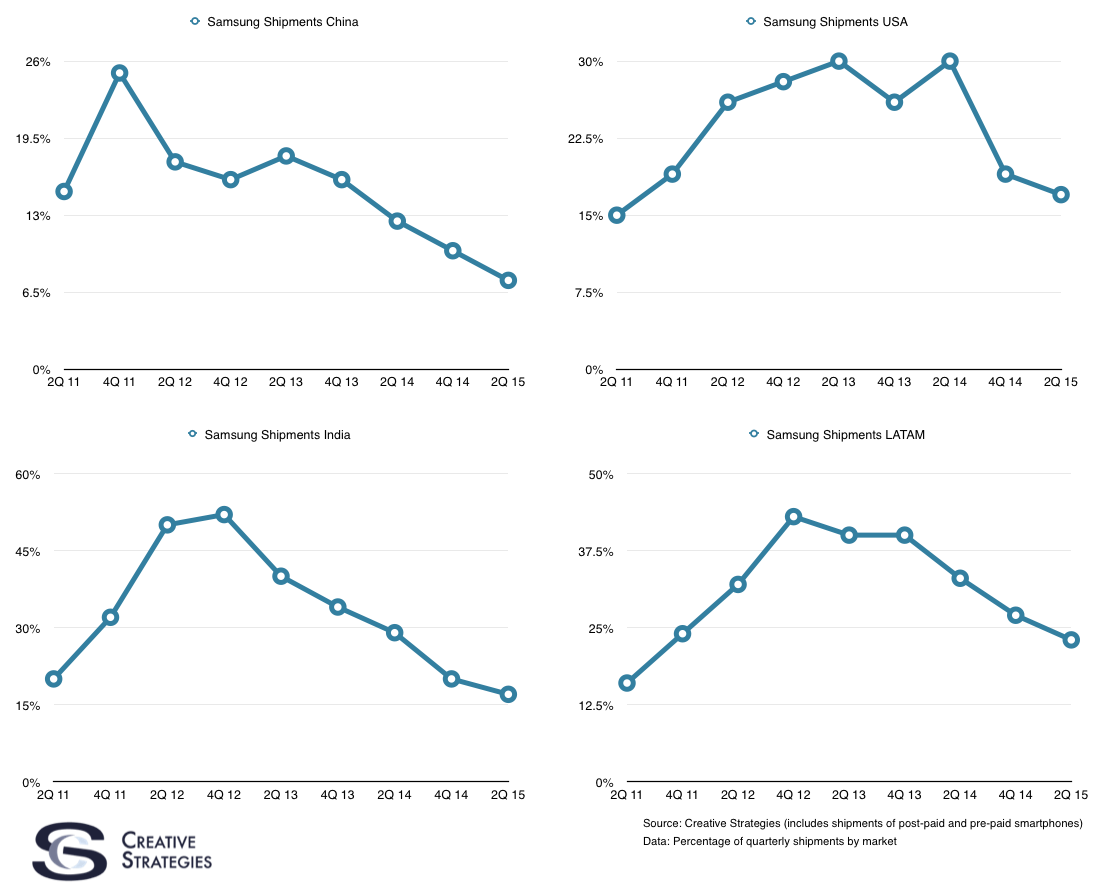

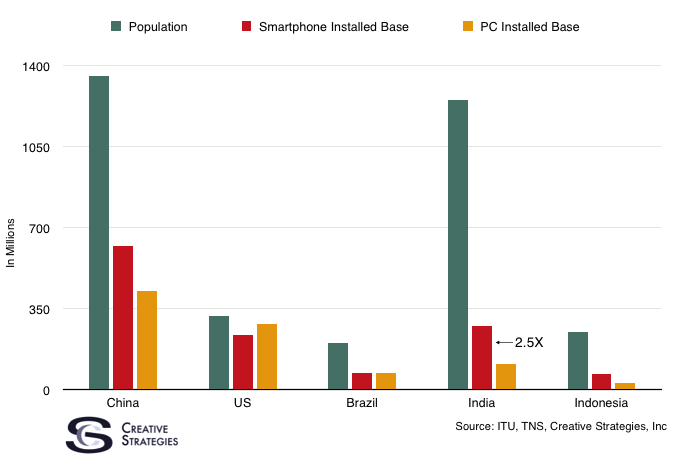

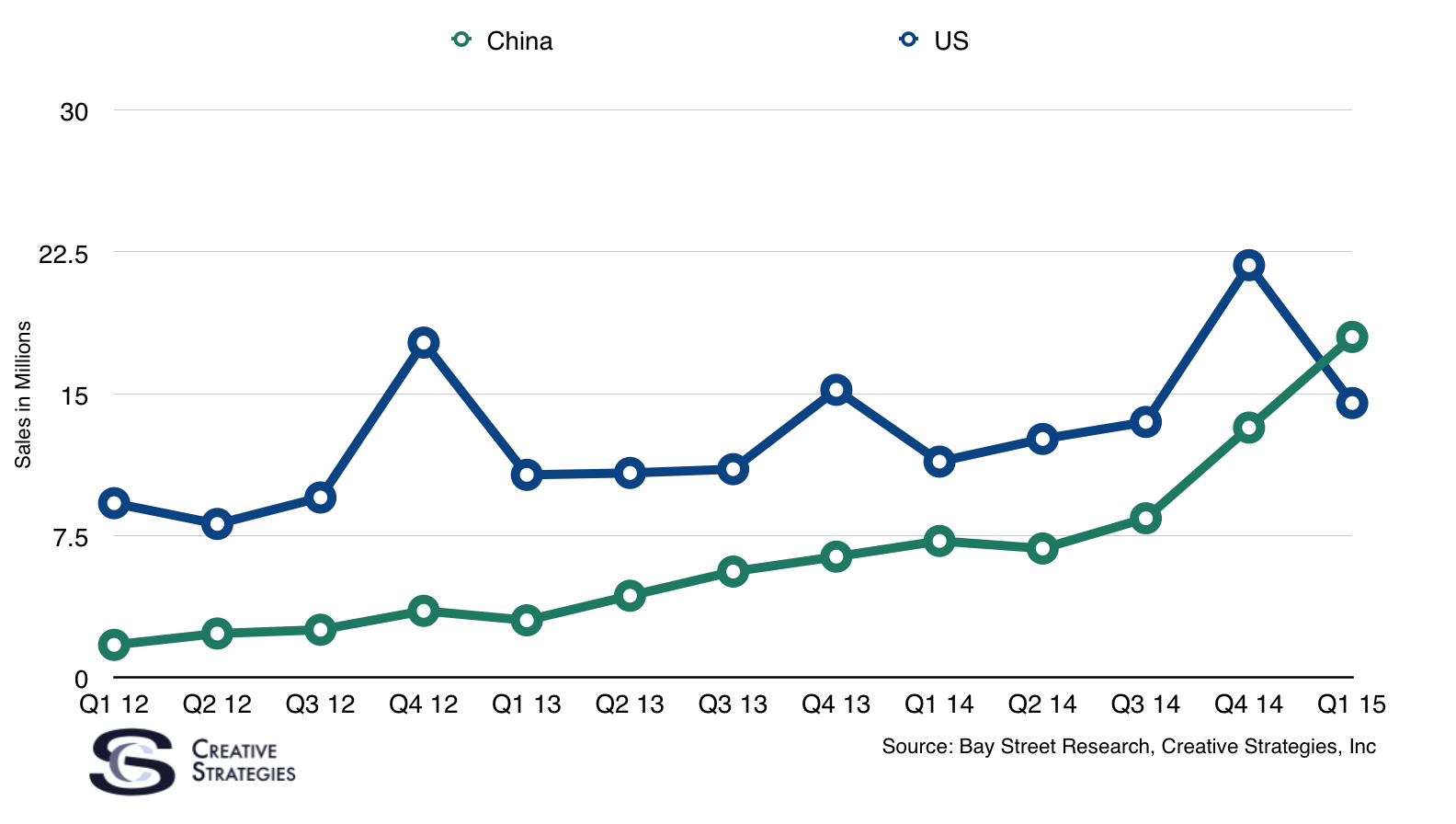

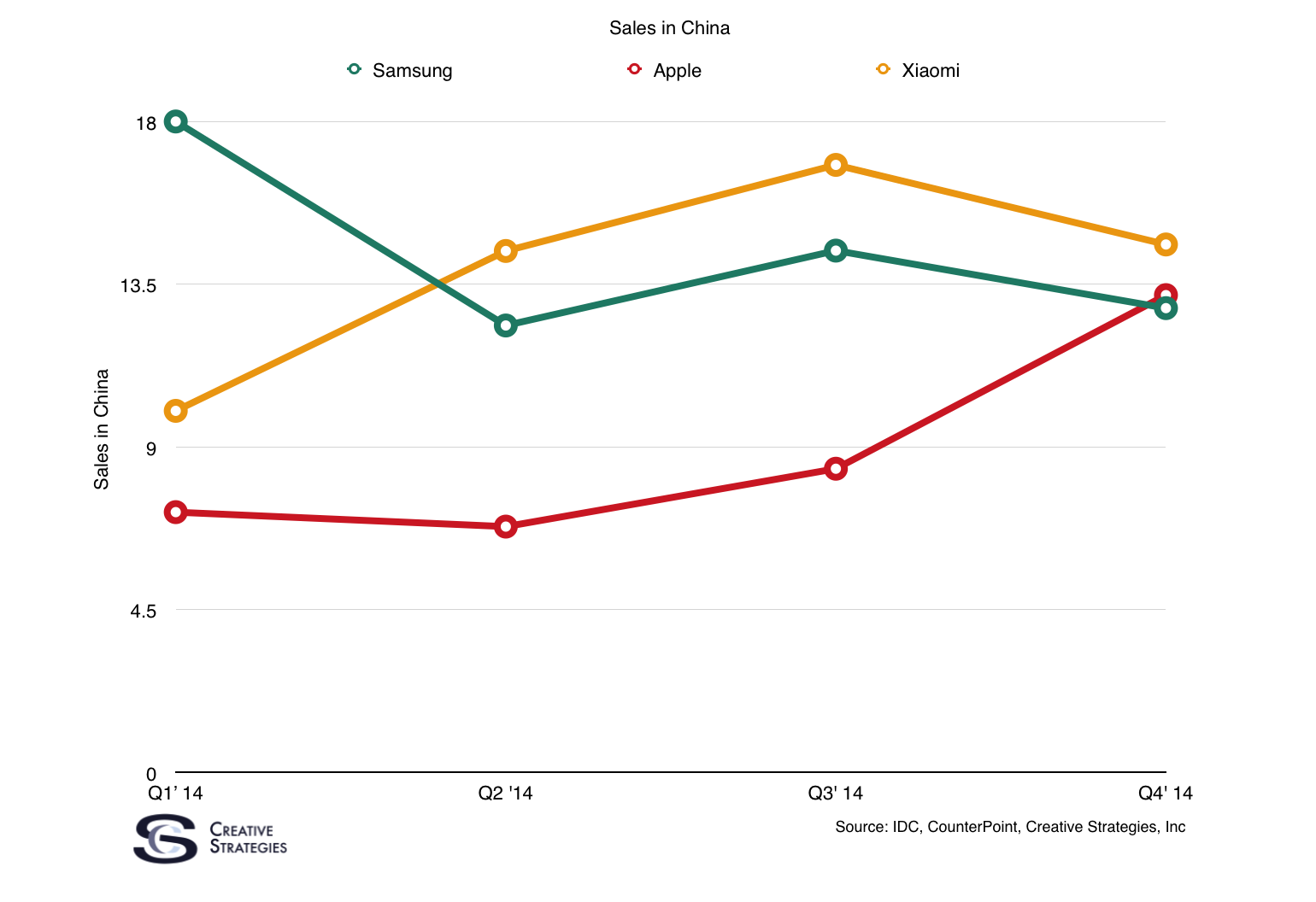

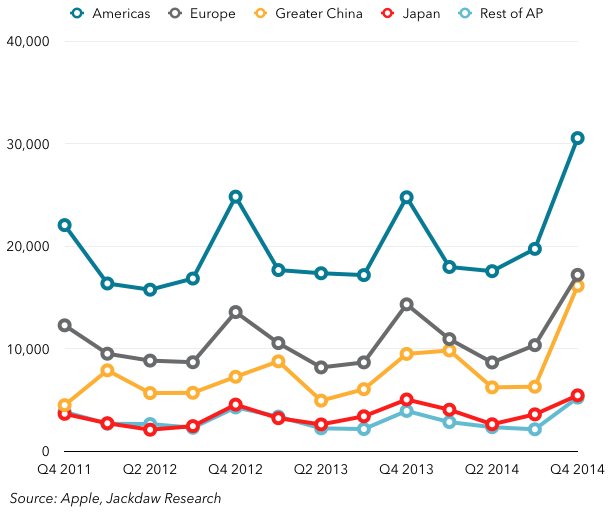

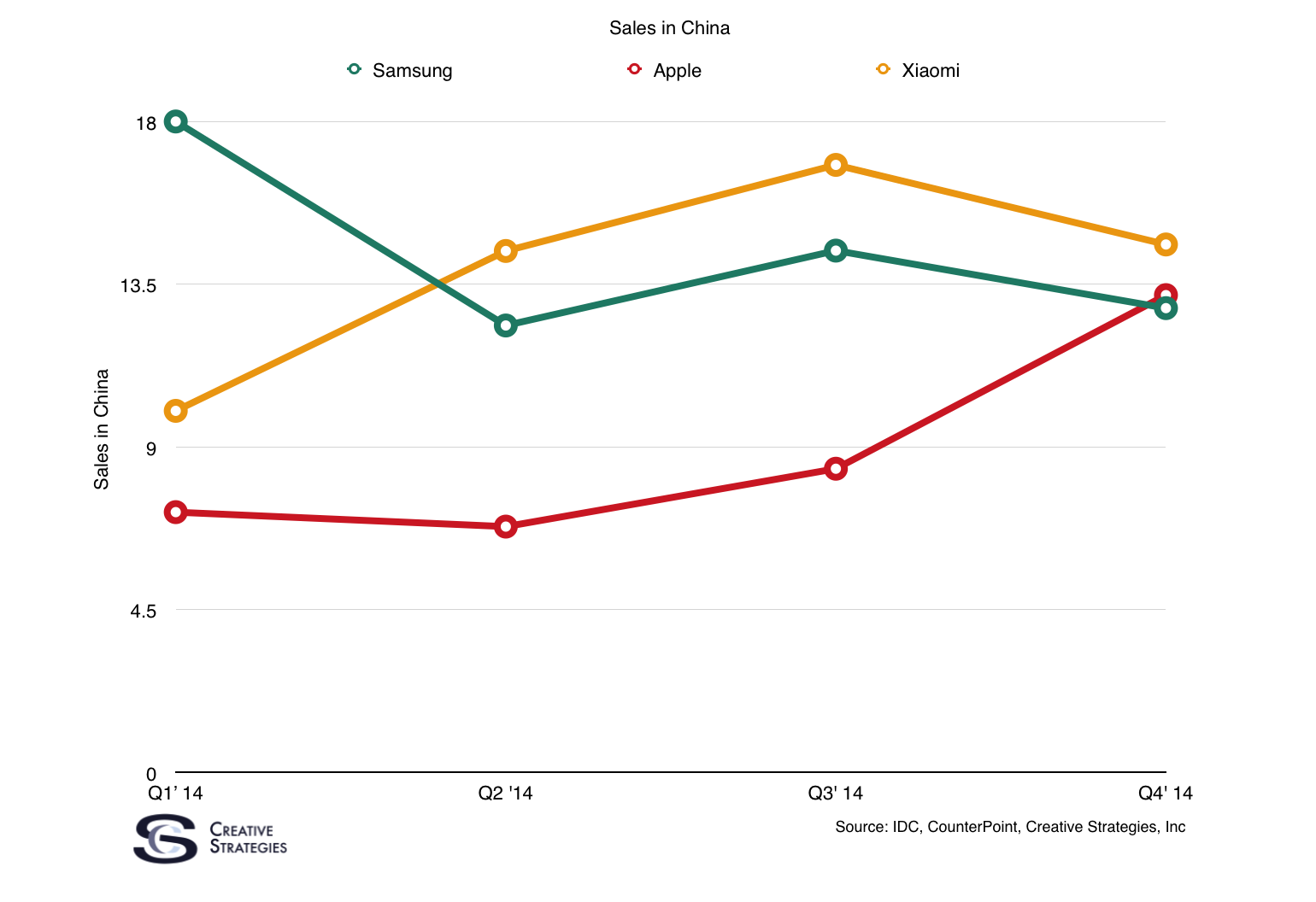

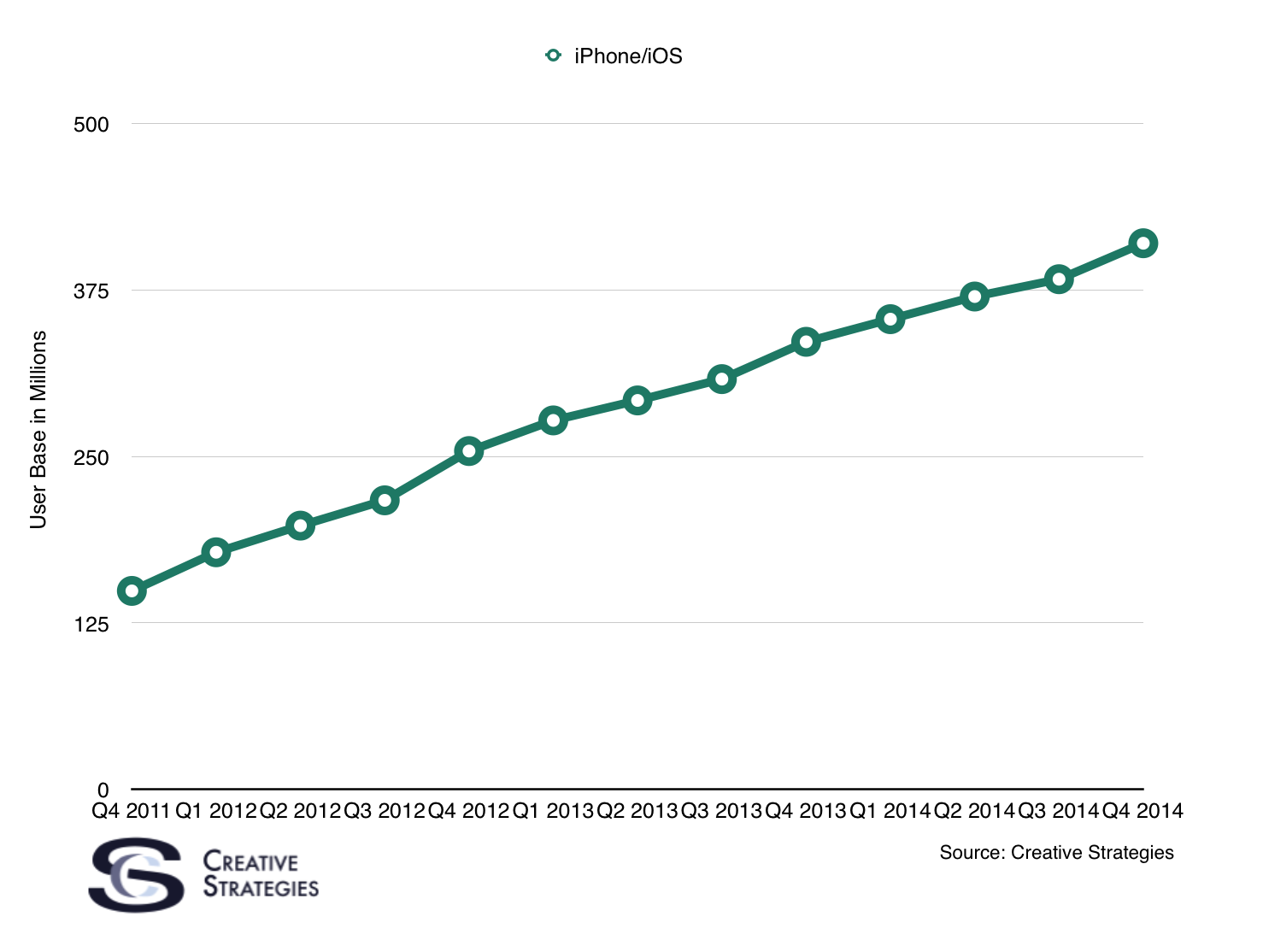

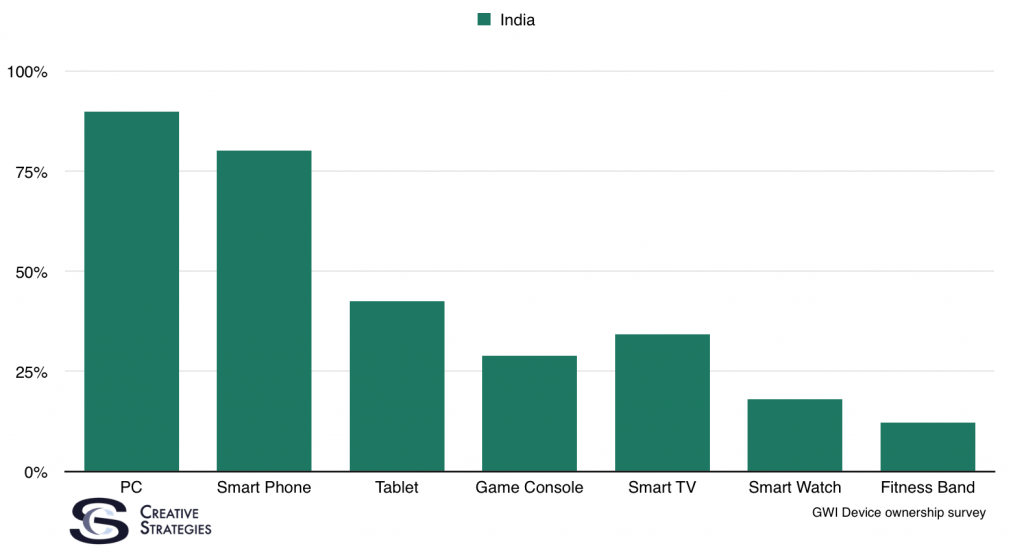

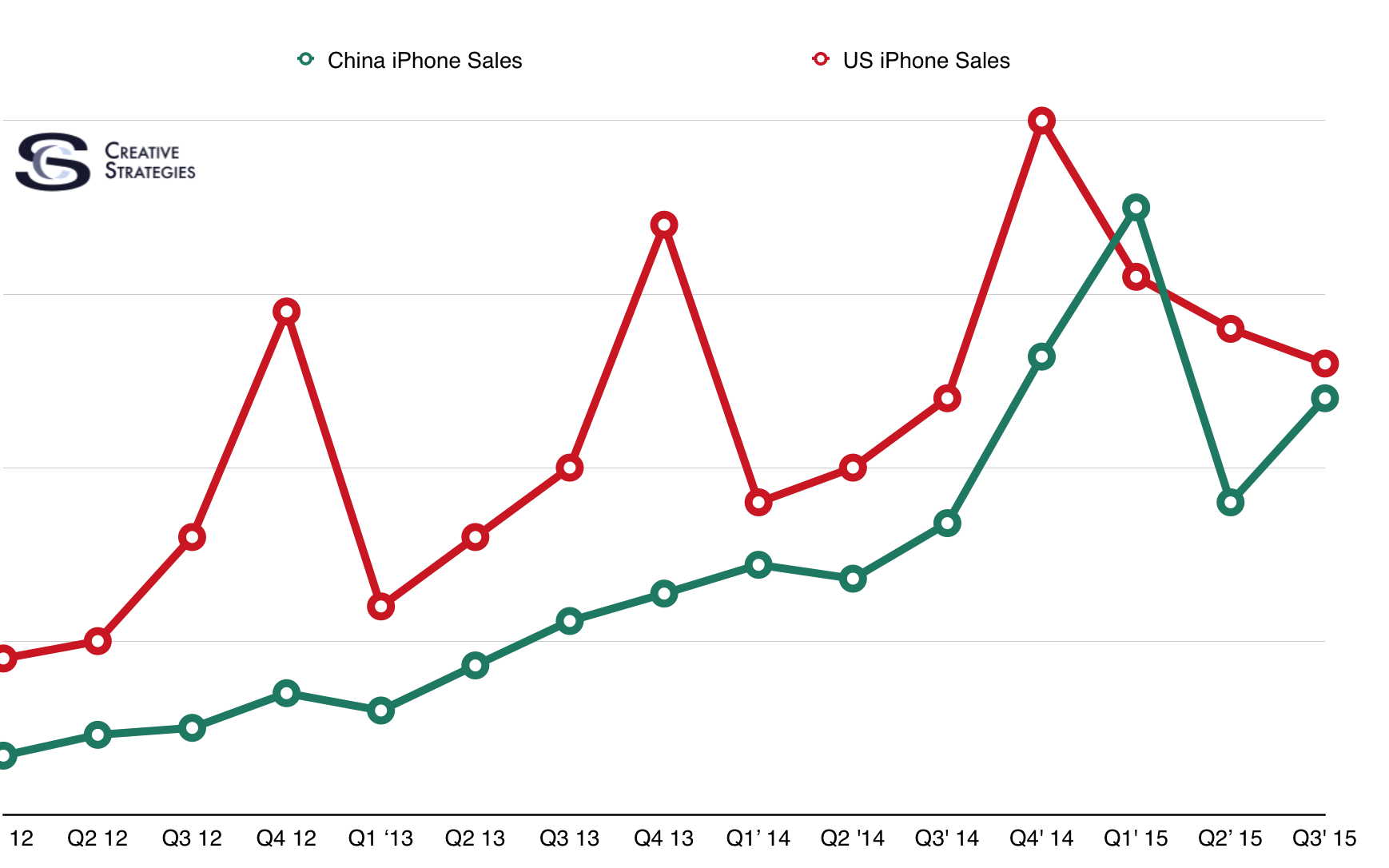

Remember, Apple’s two largest markets by installed base of iPhones is the US and China. These markets combined make up nearly half of the global iPhone installed base. When these markets move, iPhone sales spike. Notably, China has a larger iPhone installed base than the US and it is altogether possible a massive refresh cycle in China alone would spur a super cycle-like sales quarter. And we do believe there is significant pent up demand in China at the moment as a huge chunk of iPhone owners are waiting for something big to come in the iPhone 8.

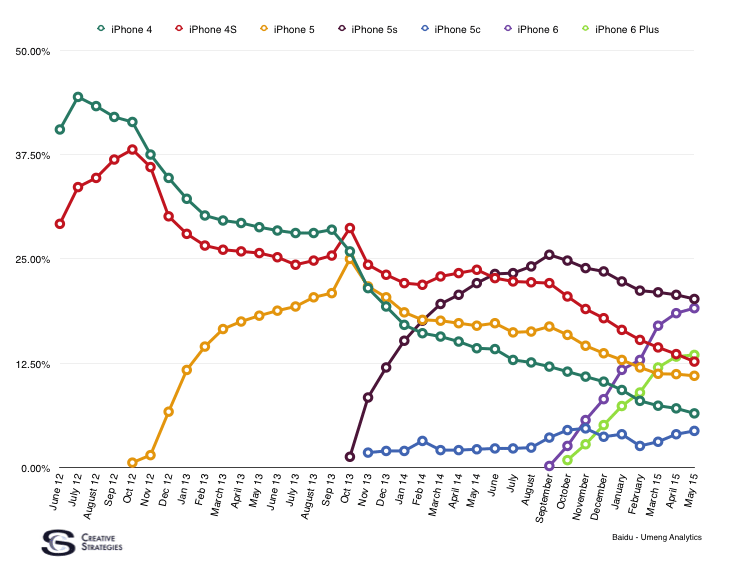

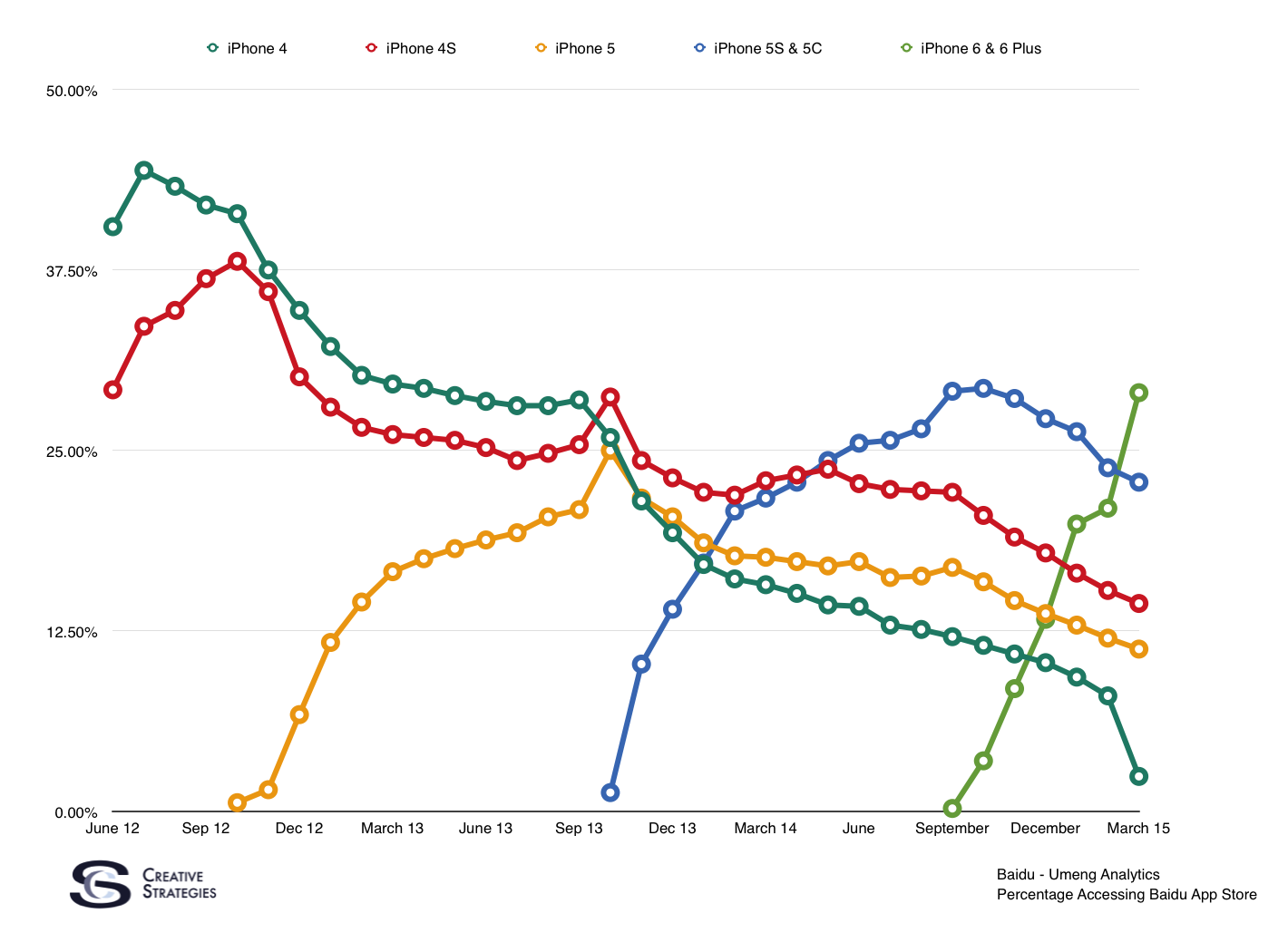

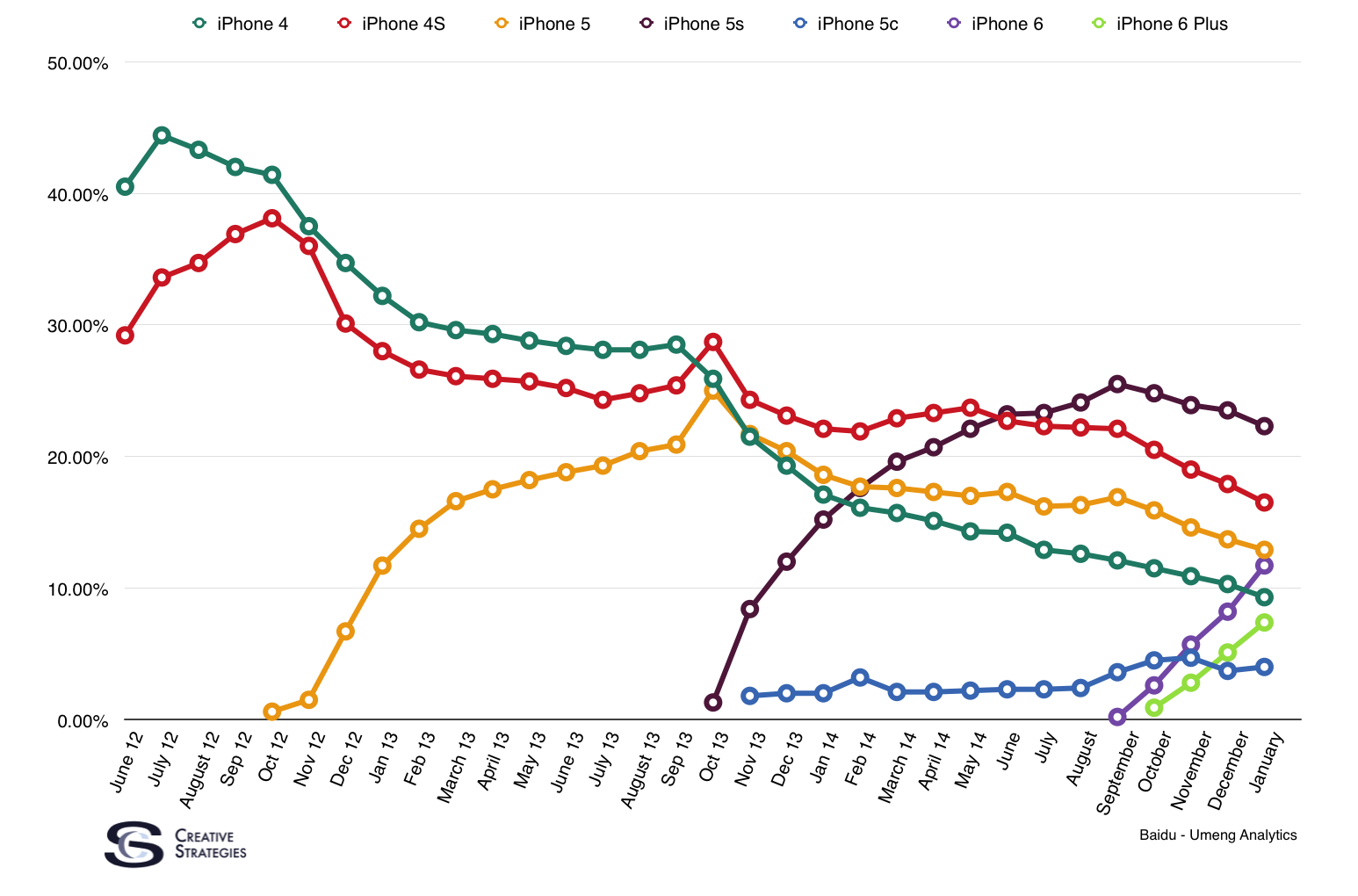

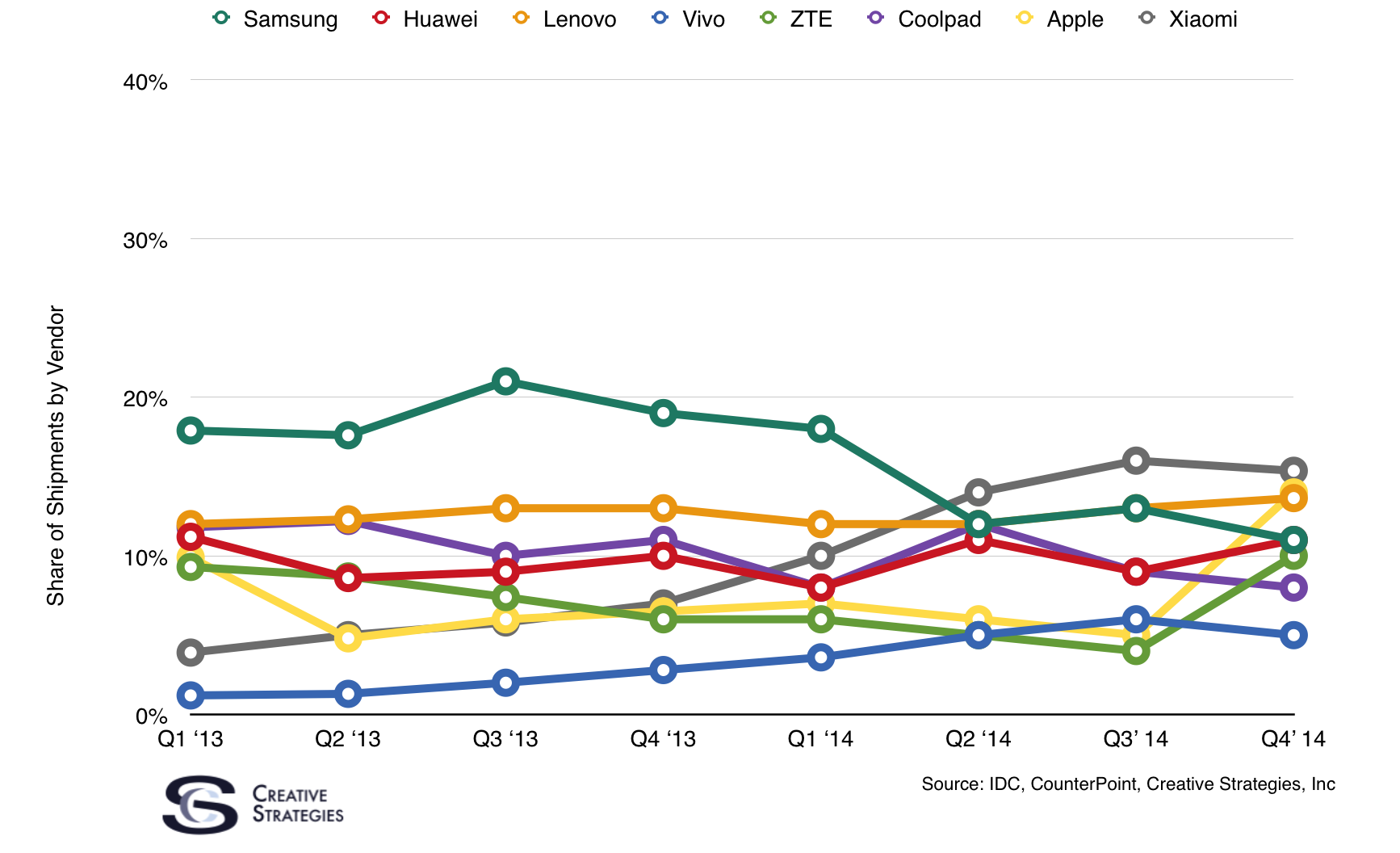

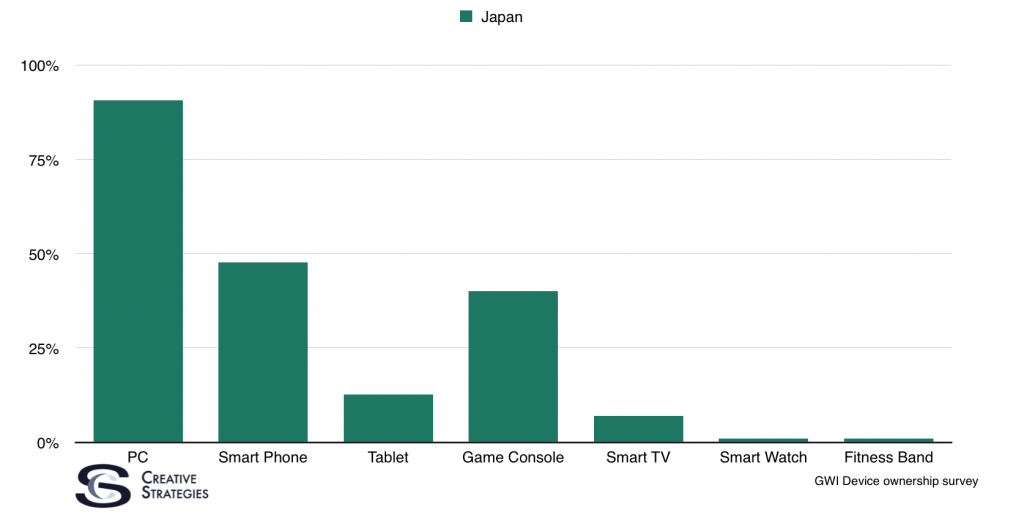

Just looking at the data, Chinese consumers have been holding onto their iPhones longer and longer each year. A good chunk of the Chinese consumer base who jumped into the iPhone family with a 6/6 Plus is still holding onto their devices. The replacement cycle of iPhones went up around 10% from 2015 to 2016 and there is significant evidence Chinese consumers are holding onto their iPhones longer. Per my chart below from active device data in China, we are seeing, for the first time, a mix shift toward the 7 Plus and the reasons have given us a key insight into the Chinese consumer mindset regarding Apple. They will buy whatever is perceived as a significant innovation. It appears the camera in the 7 Plus was enough to cause a mix shift. Which leads me to believe a big form factor change, the addition of OLED, wireless charging, etc., will cause a huge sales cycle in China. Should these things come in the iPhone 8, expect Apple’s sales from China to be significant.

Not to downplay the iPhone 8 opportunity at a global level but we believe the biggest opportunity awaiting Apple in 2017 is the Chinese market with the iPhone 8.

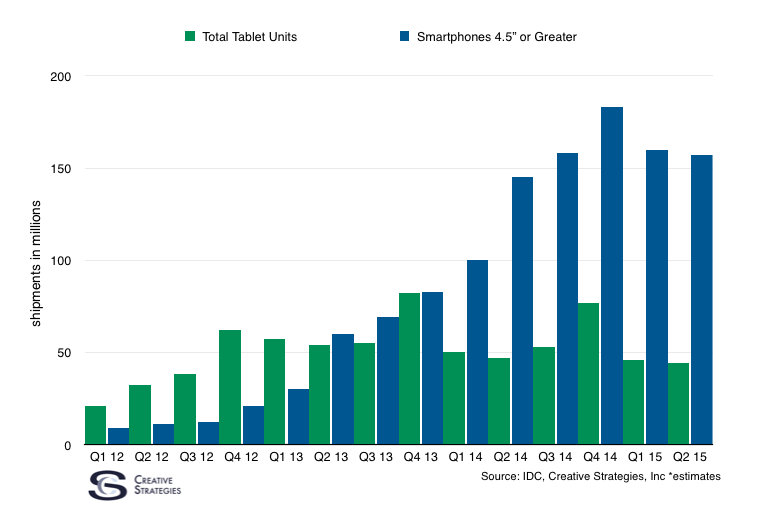

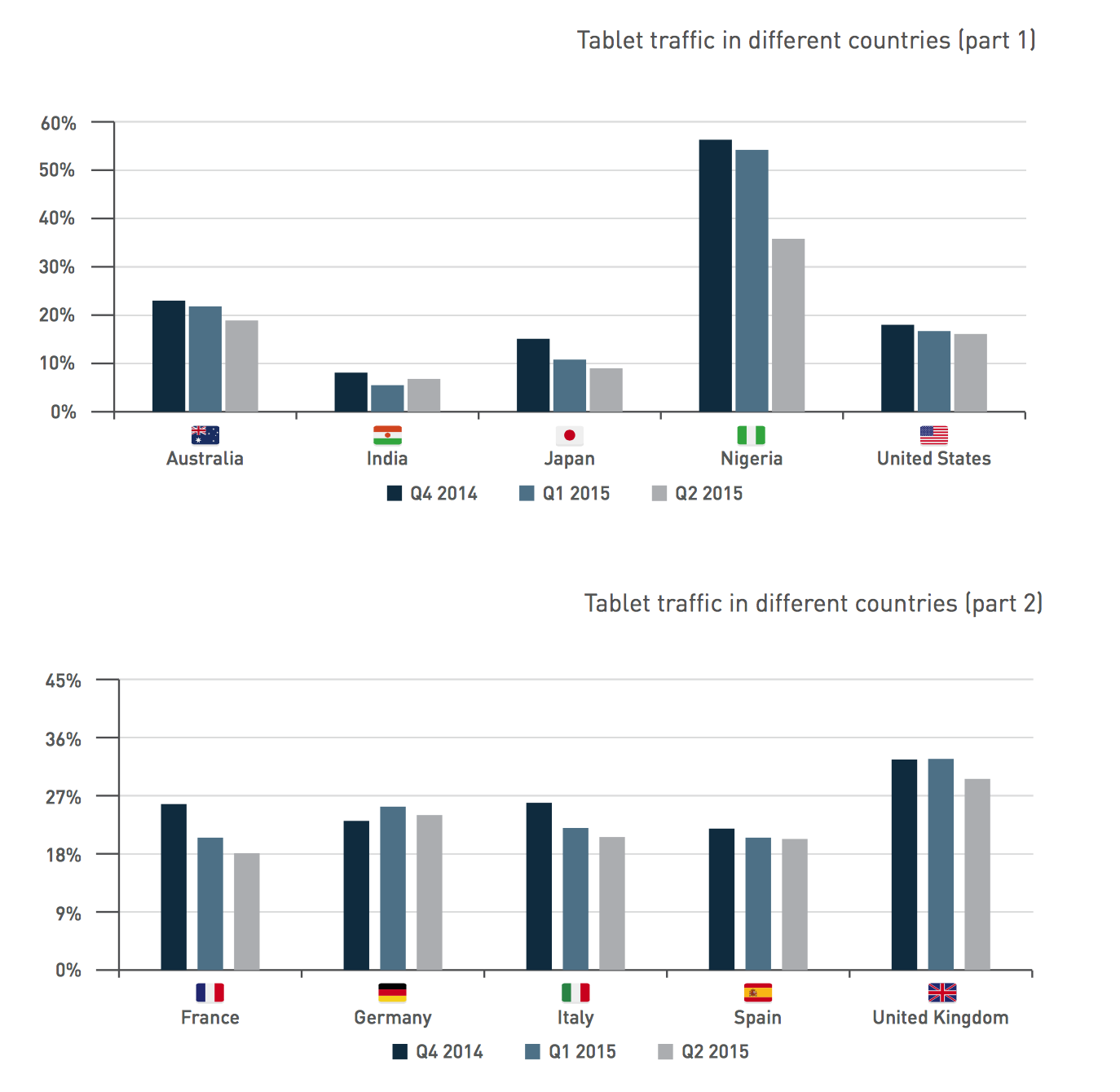

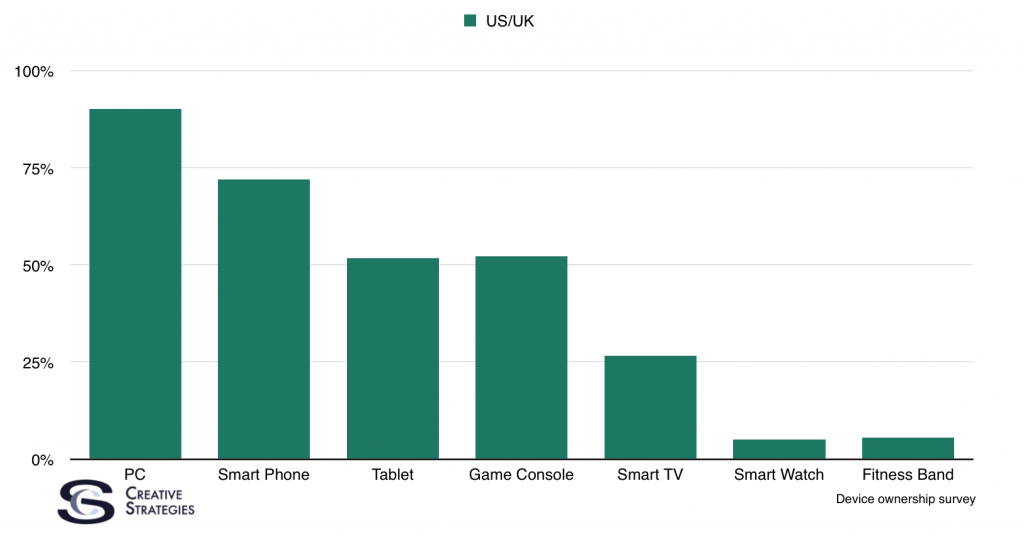

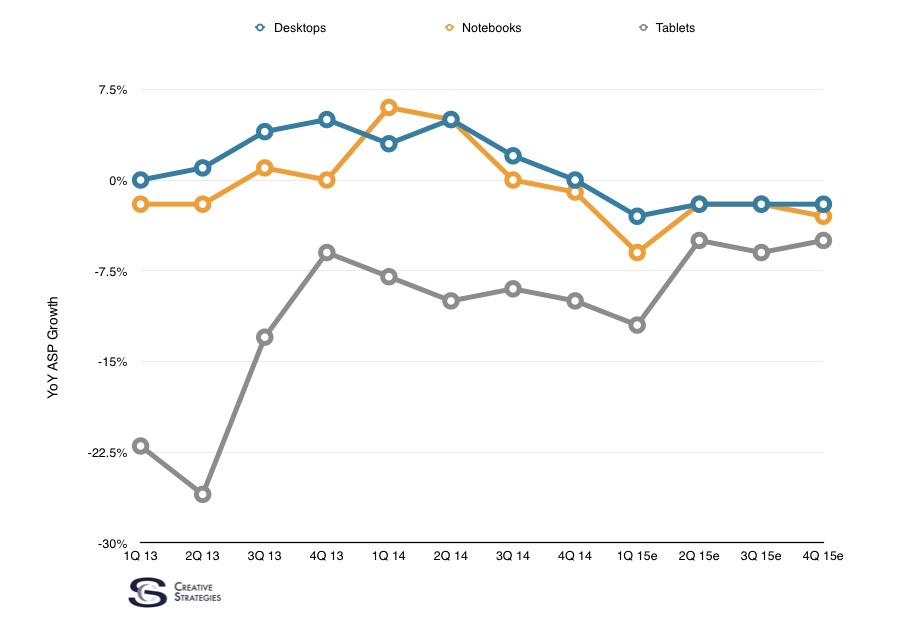

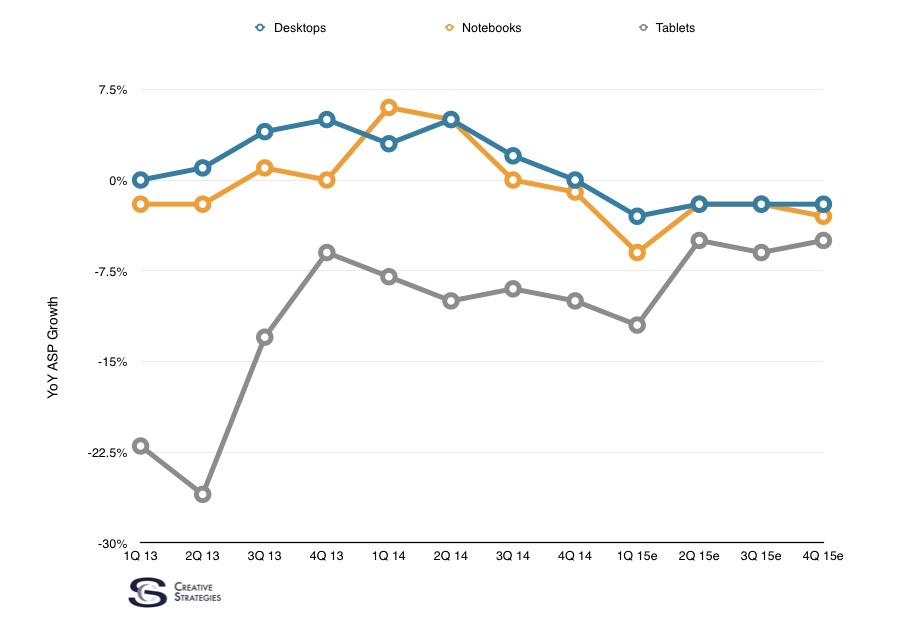

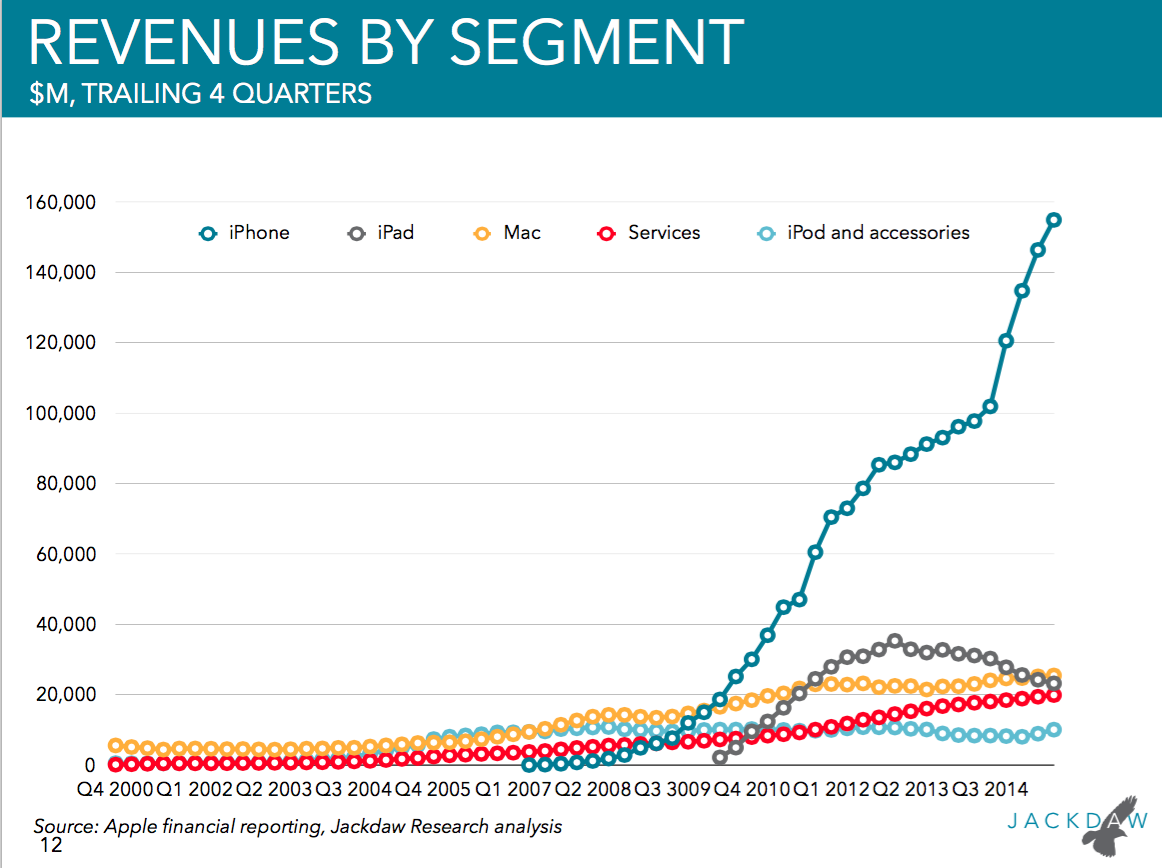

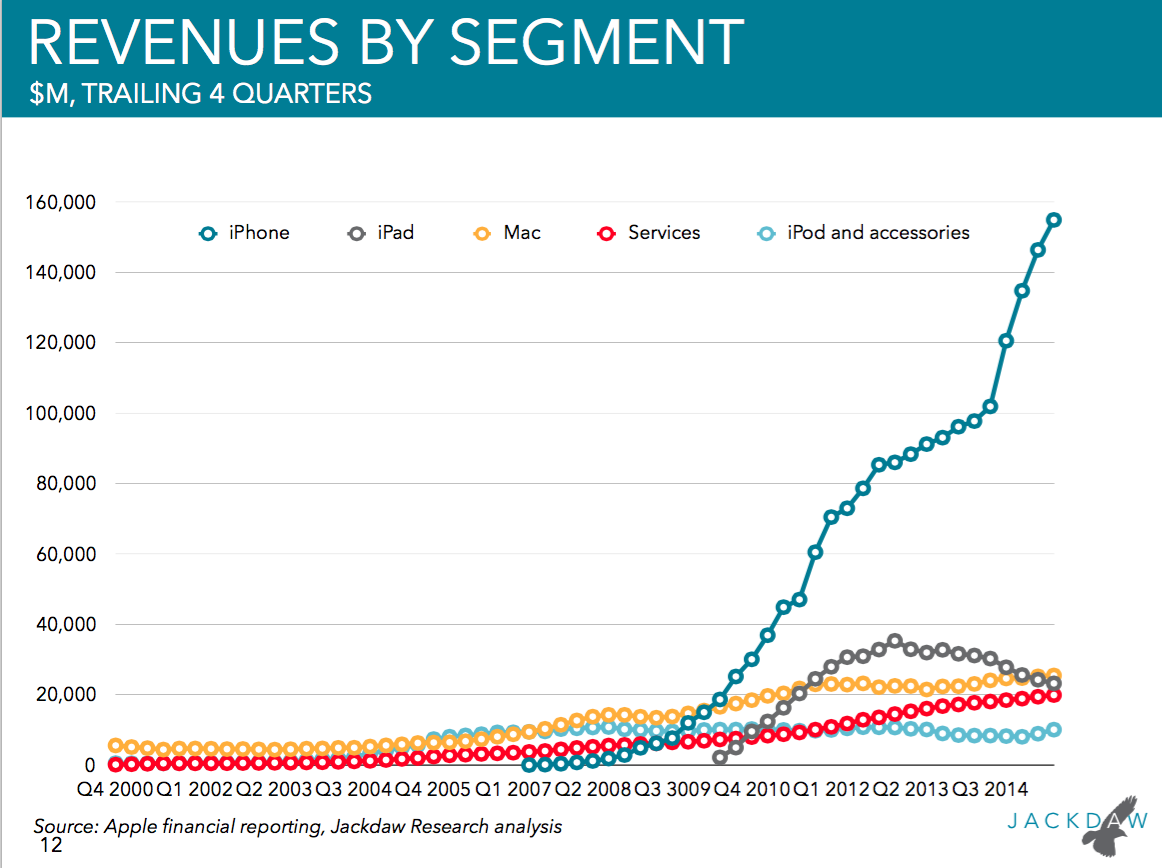

iPad Continuing to eat into PC replacement sales

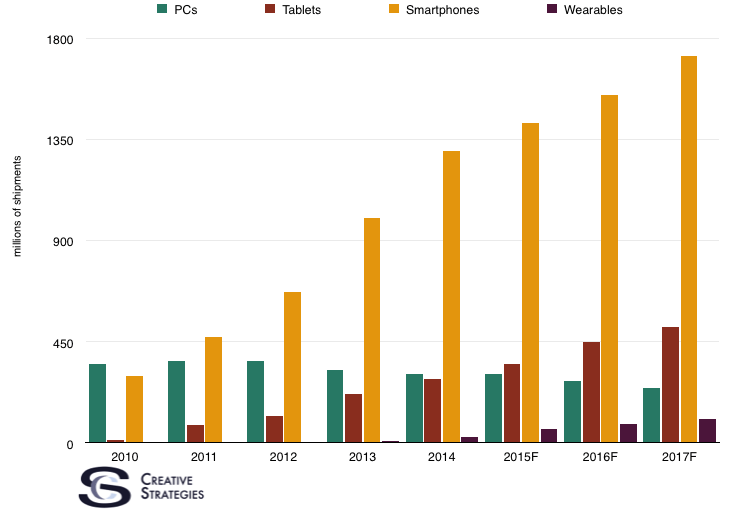

Articles came out, post-CES, claiming the PC is interesting again. These articles are not wrong. However, with as much press the PC is getting and even with as many interesting innovations coming to PCs from all vendors, our firm and many others are still anticipating -6% to -8% (with a bear case of -10%) decline in the category in 2017. Those forecasts take into account all the interesting things coming to PCs.

I am still bullish on iPad. Call me stubborn but I am. I maintain all these wonderful innovations coming to PCs still over serve the mainstream consumer’s needs. Yet, I acknowledge the mainstream consumer still wants/needs more than their smartphone for many tasks which fall into the productivity and creativity department. We believe, as consumers get more comfortable around viewing the iPad as a PC (notebook/desktop) replacement, the iPad becomes an attractive platform for them to choose for these tasks.

We have been counting sales of iPads as part of the PC category for years and now many other analyst firms are doing the same. Which means, should the iPad hit the opportunity with consumers we believe it is being positioned for, we will see Apple’s share of the PC market grow dramatically in 2017 or possibly 2018.

With Apple’s move to make the iPad more directly compete with PCs, we expect their iPad products in 2017 to continue to take aim at mainstream consumers considering a new laptop will consider the iPad instead. This is, I believe, the ultimate opportunity for the iPad.

Siri – Voice Assistants

Siri is, for Apple, both an opportunity and a challenge. I’ll focus on the opportunity here. Siri remains a strategically important factor in my analysis. It is the one major feature I believe will deepen consumer loyalty to Apple in perhaps unprecedented ways, which is saying something, given Apple’s customer loyalty today. Siri has the opportunity to become your ultimate helper. We use the word “assistant” but that seems too vague. Siri has the potential to become something closer to your secretary or your concierge. The true helper that helps you get things done, manage your life, learn new things, and more in even better ways than you do today. This is the upside and Apple understands this. As they did with last year at WWDC, I expect more advanced Siri APIs to show up this June at the developer event. As Apple gives third parties more hooks to use Siri and better serve the customers of their service, apps, and more, I think we will see Siri gain the trust of Apple customers. But that trust is not quite there yet, which is the root of the challenge.

Challenges

HomeKit

In all honesty, HomeKit support is less further along than I anticipated. A key part of my analysis related to Apple revolves around them having one of the most desired, profitable, and important customer bases in the world. This reality has afforded them a number of structural advantages. Specifically, a robust third party software ecosystem creating unique, proprietary, and vastly better quality apps on iOS than on other smartphone platforms. A key assumption around HomeKit and smart connected appliances from third parties leveraged this viewpoint to conclude hardware companies would integrate HomeKit because they want to target customers who have money to spend on their products. This, however, is not happening at the pace I and many others expected. In fact, many of these vendors who used to be, or should clearly need to be Apple partners with HomeKit, are specifically not embracing HomeKit and instead supporting Google Home and Amazon Echo/Alexa.

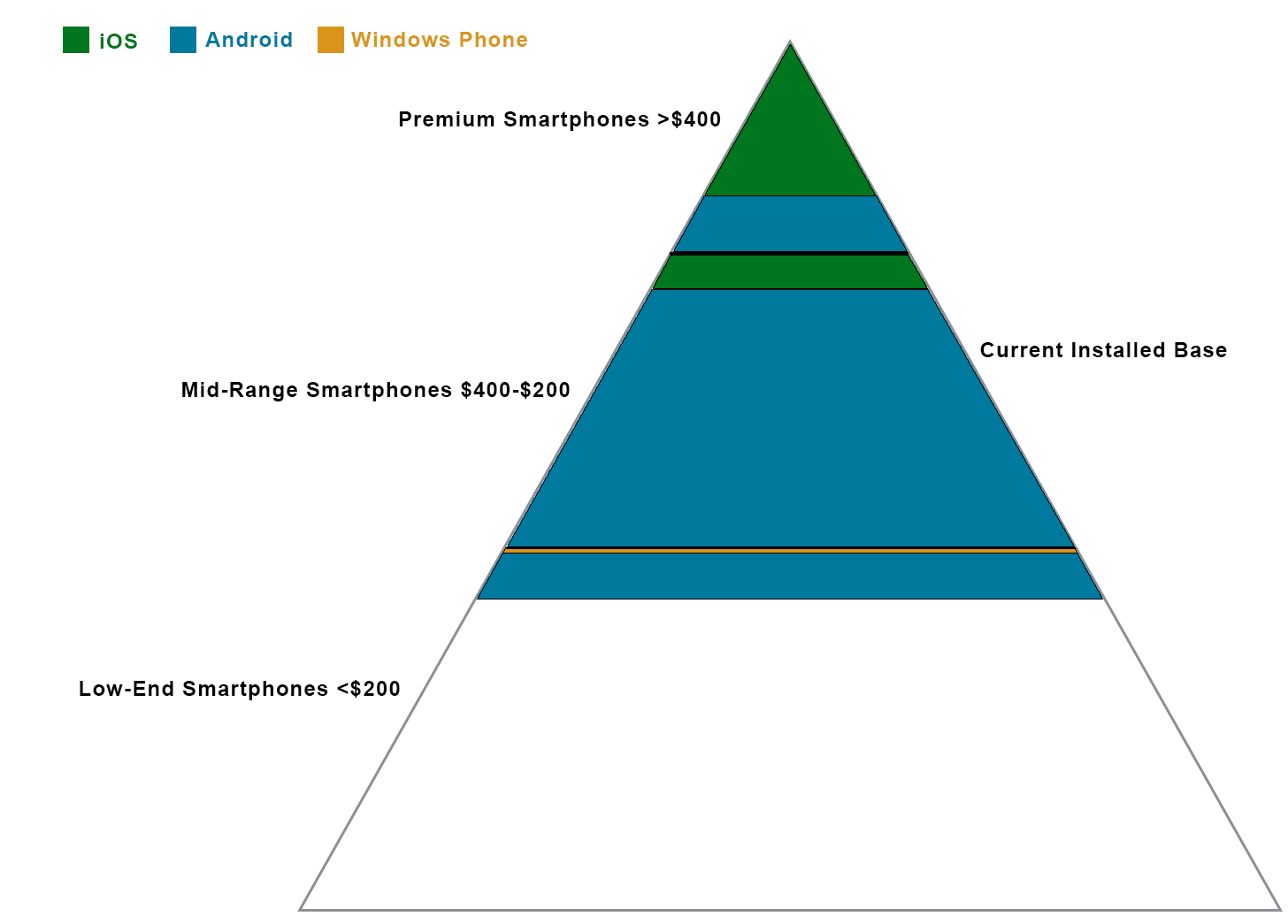

All of this feels counter to logic. There are more iPhones in the market than Google Home or Amazon Echo by orders of magnitude. Yet the biggest names selling appliances, connected hardware for the home, etc., are not embracing HomeKit. This is troubling. Part of the issue relates to Apple’s requirements to be HomeKit capable which includes a hardware chip and participation in a particular security/privacy policy. Both things are good, since security and privacy will be essential to move the smart home into the mainstream. But, at the moment, it seems like vendors are not embracing HomeKit at the rate they are other ecosystems and Apple needs to work to change that trend.

We have a really long way to go in this space but these vendors don’t write their own software or manage their own cloud systems. This is where Amazon is seizing this opportunity and it will be interesting to see how they battle or support Apple with their own development of Alexa. I consider Amazon’s structural advantages in these areas to be a challenge for Apple.

Siri’s Challenges – Building Trust

During a round of qualitative interviews with about a dozen average consumers I spent time talking to, I heard the words “Siri is stupid” more times than I expected. Siri remains, by far, the most used voice assistant in the global market today but I’m not sure Siri has completely earned the trust of its users. Several folks in our interviews said they use Siri for some things like setting timers, reminders, etc. but then use Google voice search (via the app or web) when they need to find something out. There is no question Google search is better and I fear the main use case for voice assistants being a web search is not leaving the best first impression of Siri with its users.

As I noted in my article on AirPods, the criticism of Siri not always understanding you, or missing what you are saying, were greatly diminished with the AirPods thanks to better background noise cancellation and beam forming mics able to pick up my voice clearly. Even if we acknowledge some of the issues with Siri are not necessarily related to the backend technology but the microphone, or internet connections or some other variable, we can’t ignore that consumers see this as a failing and blame Apple or Siri and then are led to believe it isn’t good or doesn’t work as it should. It is the sentiment around consumers trusting Siri which is my biggest concern with the technology. I’m not sure consumers’ first impressions with Siri are what Apple wants or hoped for and it may be a case where having it in beta and putting it into consumers’ hands too early was a worse idea than waiting until it was absolutely ready. Only time will tell.

As we study this space over the next year, a major focus will be about sentiment and trust of these assistants. We want to learn which ones they tend to depend on more than others or in which situations than others, to get a better picture of how this may play out. But, right now, from data of customer satisfaction we have from a previous study, it seems the Amazon Echo and has higher customer satisfaction than Siri which gives Amazon the early edge in setting a better first impression.

I am not counting Apple out, not even close, but I do think some of the more negative first impressions Apple has had with Siri simply mean they have to work that much harder to establish trust and confidence that Siri is the assistant most worthy to add value to consumers’ lives.

All in all, Apple remains incredibly well positioned in many areas currently relevant as well as ones which will be relevant in the future. That does not mean they are not up against perhaps, more challenges than in previous years. It will make 2017 an interesting test for the company and their current leadership.

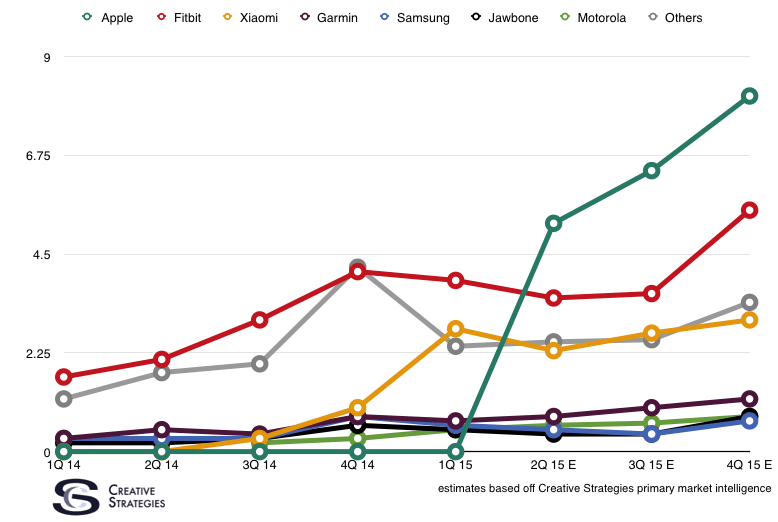

(Forgive me for not revealing the Y-Axis as the hard data is for our institutional clients)

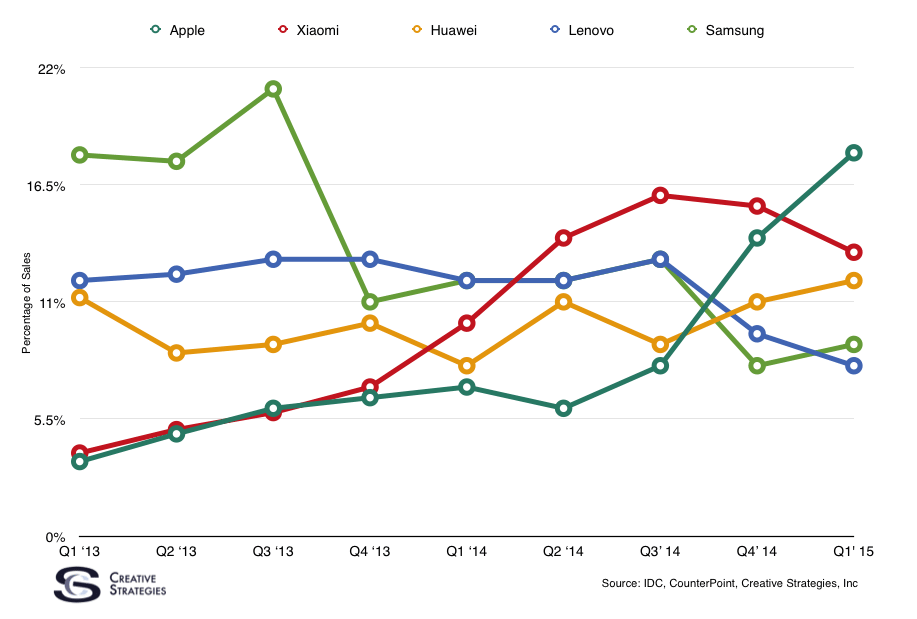

(Forgive me for not revealing the Y-Axis as the hard data is for our institutional clients)