Next week should see the announcement of Apple’s latest iPhones and, about ten days later, their availability and the public release of iOS 9. Among other features, one of the interesting things to note is iOS 9 brings a couple more pre-installed apps from Apple over iOS 8. Apple isn’t alone in this – Android, too, has been adding to the range of apps that Google pre-installs on stock devices and Windows on mobile devices is moving in the same direction. Today, I’m going to take a look at what’s been changing and what it signifies.

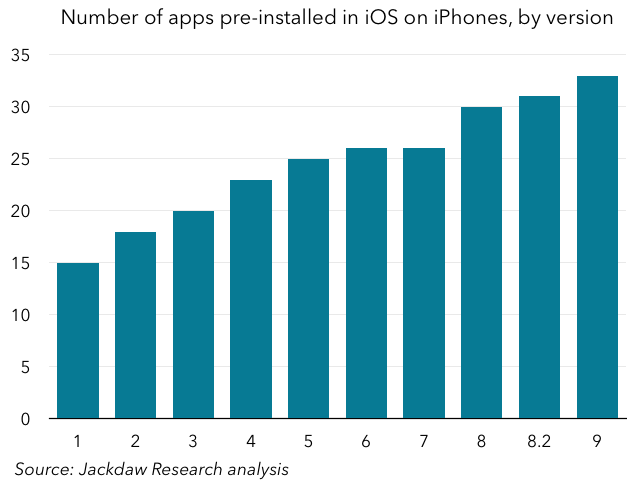

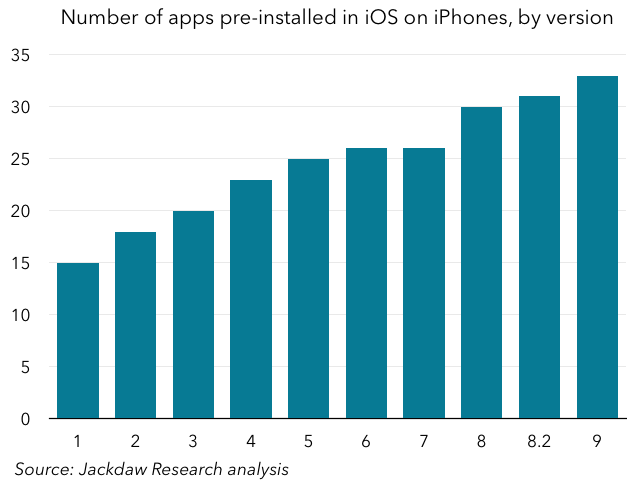

iOS – from 15 to 33 pre-installed apps

iOS – or iPhone OS as it then was – began with just 15 pre-installed apps in its first version. The home screen – then uneditable – had an awkward space on the final row for the first year, an indication of the discipline with which Apple approached the task (it must have been tempting to add another for looks alone). The following year of course, Apple added three more pre-installed apps and the ability to download more from the App Store in iPhone OS 2.0. That story has largely continued over the years since, with only iOS 7 adding no new applications:

Note: it’s actually surprisingly difficult to get an official indication of which apps were pre-installed in different versions of iOS – Apple doesn’t maintain an official page on its website for each version after it’s been replaced and third-party sources often don’t explicitly list them out. In addition, some apps that began as optional installable apps have, over time, become mandatory pre-installed apps. As such, it is possible there are one or more errors in this analysis but the broad trends are accurate.

What has driven this increase over time? There are several broad categories here:

- Splitting functionality into multiple apps – there are several examples here, including the separation of Videos from the iPod app (which happened on the iPhone long after the iPad and iPod Touch); the creation of a separate Contacts app, splitting the functionality of the Phone app; the separation of FaceTime functionality into its own app, along with the separation of Podcasts from iPod/iTunes

- Making previously installable apps pre-installed, including Podcasts, Find my Friends, and Find iPhone, which all debuted as optional apps in the App Store before they became pre-installed in various versions of iOS over the years

- The absorption into the core iOS experience of functionality hitherto provided by third-party apps, including Passbook, the News app, Reminders, iBooks, Voice Memos, and Health

- The rest are a mishmash of items, including the Tips app and Game Center, but also apps driven by new hardware functionality, including the Compass app and the Apple Watch app (driven, not by new functionality in the iPhone, but by new separate hardware).

To my mind, the third of these categories is the most interesting, in that it suggests the category Apple is likeliest to expand in future. Apple has steadily absorbed functionality provided by third-party apps into the first-party experience and it’s a safe bet it will continue to do so. The big question is in which directions Apple will move – many of its new apps have been in the content category, with News, iBooks, and the new Music app (not a new app per se, but certainly new functionality which mirrors that previously only found in third-party apps on iOS) the best examples. An Apple TV service might well be the next big example though, as with Music, it might well find a home within an existing app.

Comparing iOS to Android and Windows Phone

The other thing that’s interesting is to compare iOS to Android and Windows, the other two mainstream smartphone platforms. However, the comparison is tough to make on a direct basis, because Apple’s flavor of iOS is the only version there is, whereas Android and Windows make their way to market on handsets made by OEMs and often sold through carriers, each of which add their own apps.

The latest version of Android, now known by the codename Marshmallow, has 31 pre-installed apps, close to the 33 pre-installed on the iPhone. However, almost no one will use this version of Android, which is only really available on a handful of Nexus devices or by installing ROMs manually on other devices. The vast majority of end users of Android will buy a handset made by an OEM which adds its own apps and a carrier which will layer on several more. As an example, the Galaxy S6 sold by AT&T has at least 50 apps, of which a dozen or more are AT&T apps and services, — many others are Samsung-specific. OEMs using Android have to include those apps which are baked into Android itself and then another 11 or so which are part of the Google Mobile Services package. But in reality, many OEMs substitute their own apps for several of the optional Google apps, or provide duplicates, such as their own browsers alongside Chrome. This quickly swells the total numbers to 40, 50, or even more.

Windows shares some of these characteristics, with OEMs and carriers layering their apps on, too. This has fallen off somewhat in the case of OEM apps on the Microsoft devices compared with the devices made by Nokia before the acquisition, but carriers still add quite a few apps of their own. It’s hard to know what a “stock” Windows 10 experience looks like but, by my calculations, there are around 29 standard apps pre-installed in Windows 10 on smartphones. However, there can be up to a dozen carrier apps added to the version most users will actually see and some OEMs will add their own too.

As such, a “stock” experience on Android or Windows will provide a very similar total number of pre-installed apps to iOS, but the reality is, outside of iOS, that experience won’t be the one most end users actually encounter. Instead, they’ll likely buy devices with a dozen or more additional apps, which may well leave them with around 50% more apps pre-installed than iOS.

What is Google up to?

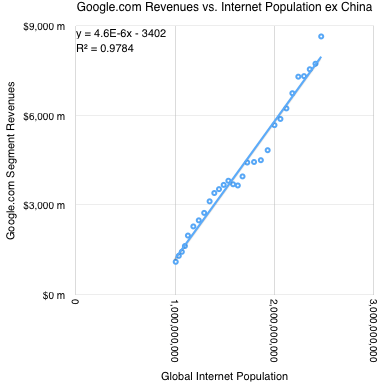

What is Google up to? A great deal of information on Google search opportunity came in a 2012 Federal Trade Commission staff report that was released, sort of, in response to a request by The Wall Street Journal. Sort of because the FTC really did not intend to release the document and what it sent by accident was every other page. (I’m grateful to the efforts of Danny Sullivan of Marketing Land to publish text and comments on the report in a

A great deal of information on Google search opportunity came in a 2012 Federal Trade Commission staff report that was released, sort of, in response to a request by The Wall Street Journal. Sort of because the FTC really did not intend to release the document and what it sent by accident was every other page. (I’m grateful to the efforts of Danny Sullivan of Marketing Land to publish text and comments on the report in a