The tablet market is easily the most fascinatingly diverse consumer electronics category I have ever studied. If you have read my commentary on tablets, it is the unique form and function of the product that allows it to be so nuanced. Both the smartphone and the tablet are relatively small pieces of glass. Both are brought to life by their software. However ,with smartphones, we see more clear consistency in application. We don’t see the rich segmentation in smartphones we are seeing in tablets. The tablet is a blank piece of glass that can take on many general computing use cases and unlike the smartphone which has a focus, the tablet can be many things to many people. This, at a root level, is why I believe so many people misunderstand the tablet category.

Without question, the tablet saw explosive initial growth. This was driven primarily by Apple and benefited from a latent PC refresh cycle. Looking back, there are certain market dynamics which contributed to the tablet category allowing it to be rapidly adopted. I would argue those dynamics have changed and, if the tablet was released for the first time in 2014, the product would not have the same initial ramp up. That in no way means the tablet category is dead or, more importantly, not a viable category. It simply highlights the tablet market is still not fully mature.

Coming Back Down to Earth

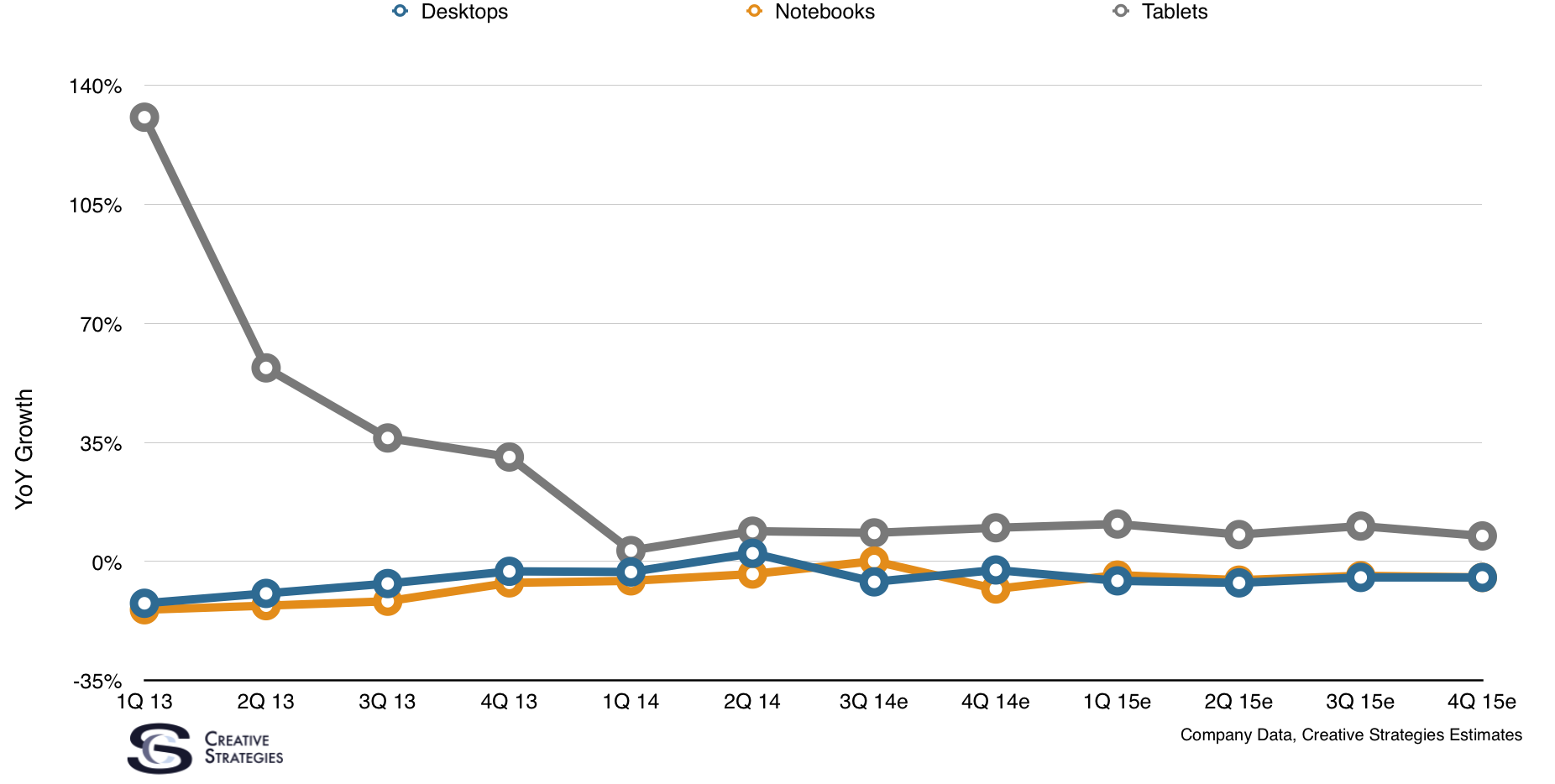

Many of the charts I’ll be showing are a part of a much larger and in depth PC/Tablet Report I’m publishing through my industry analyst firm Creative Strategies. I’ve broken a few of these charts out to give a high level view of the tablet market.

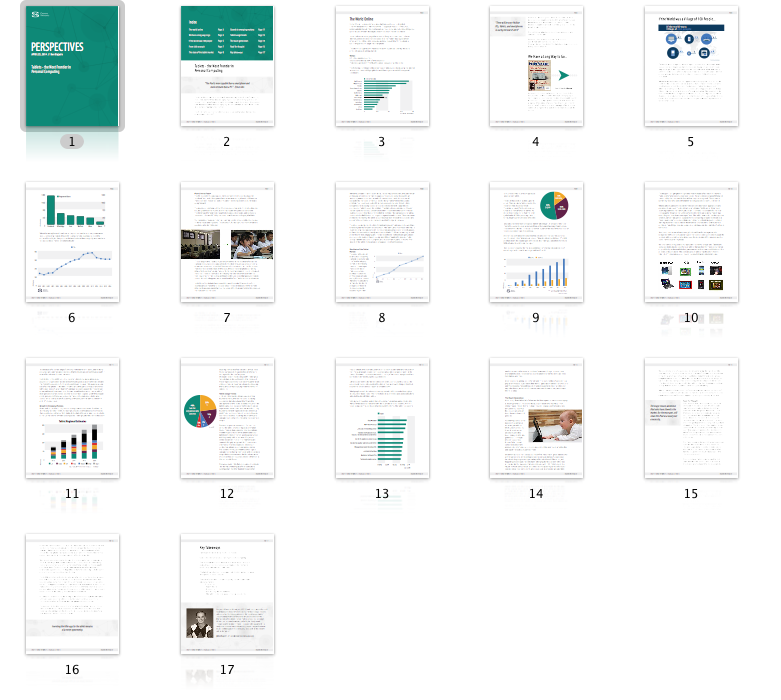

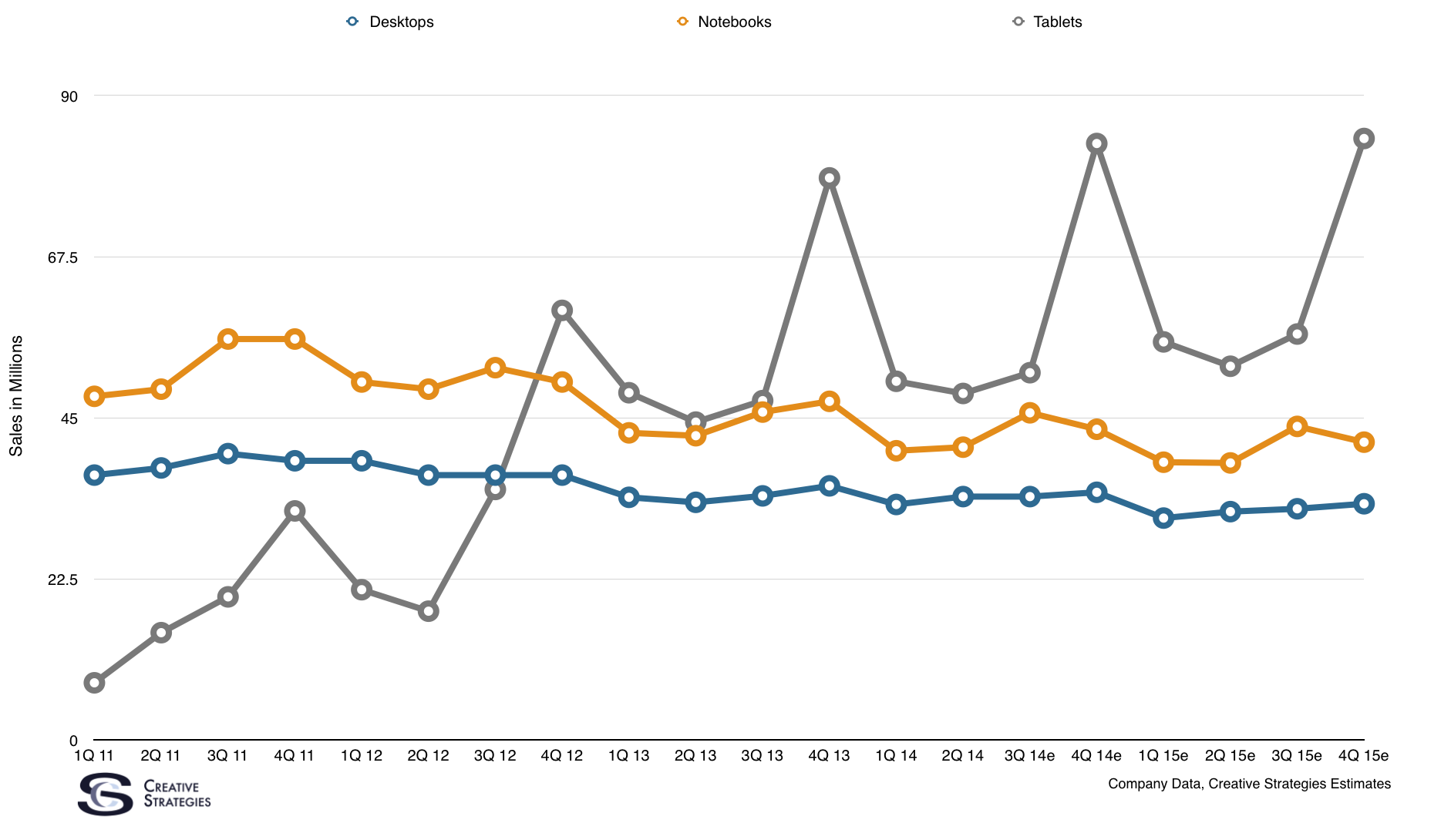

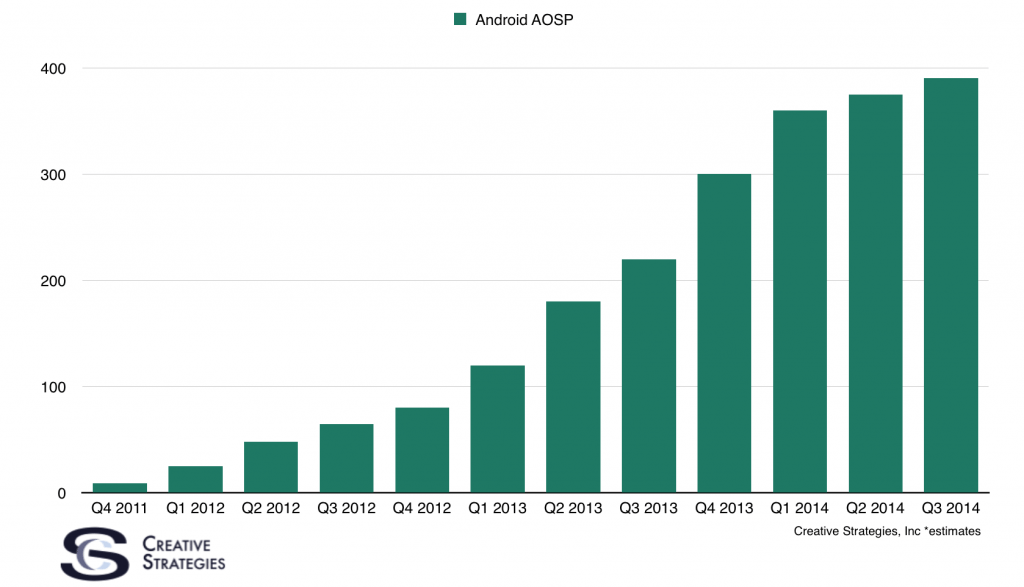

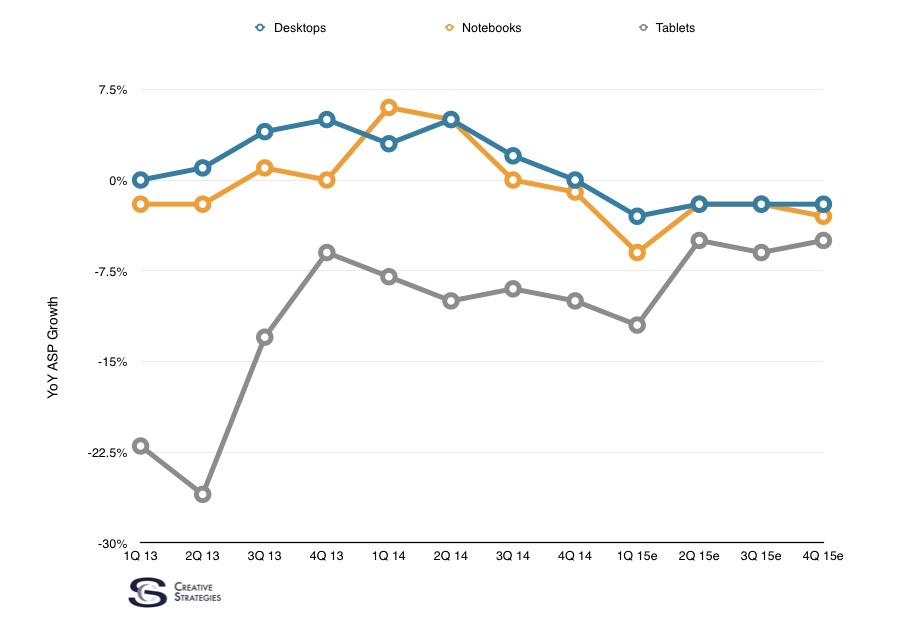

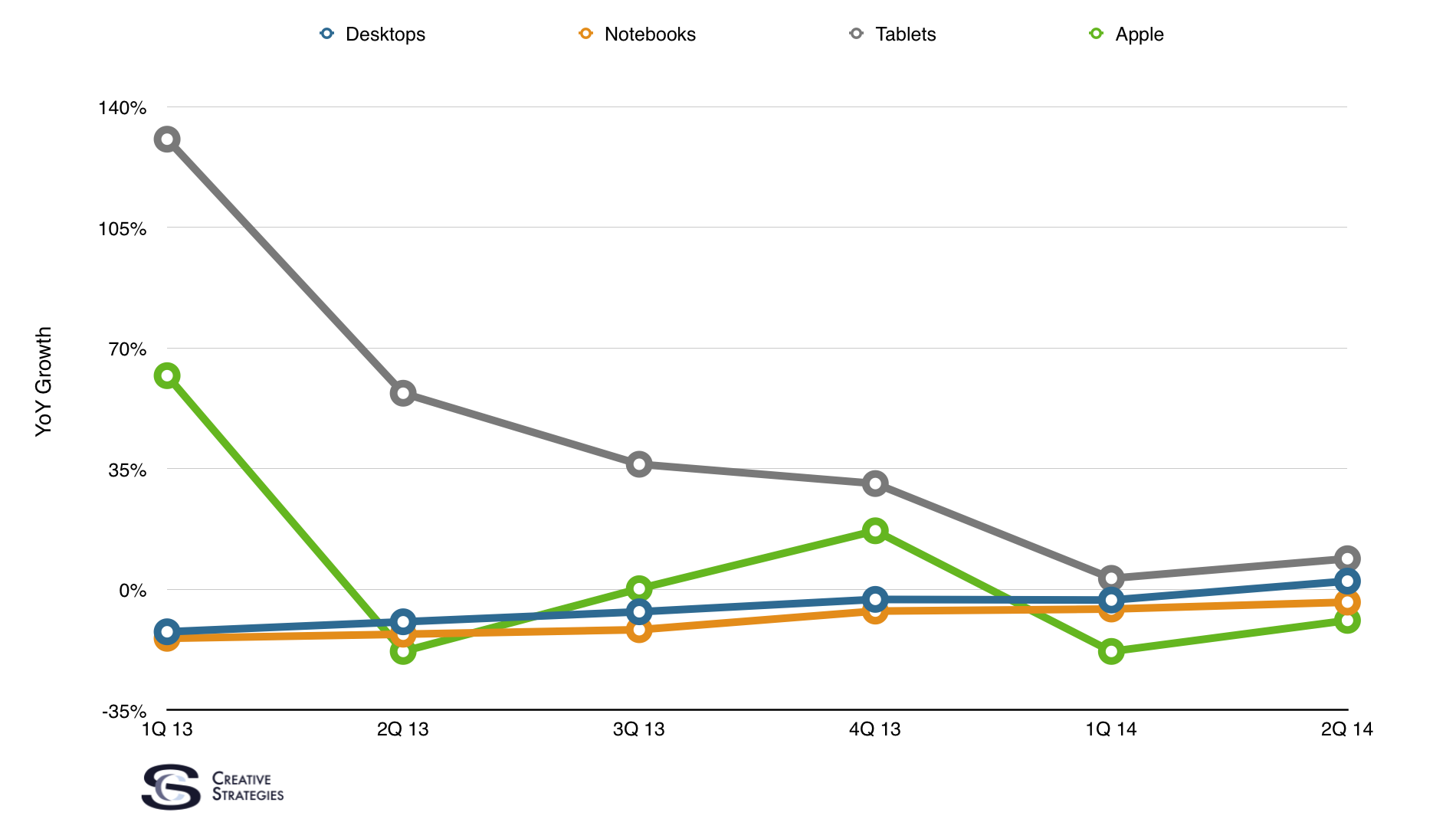

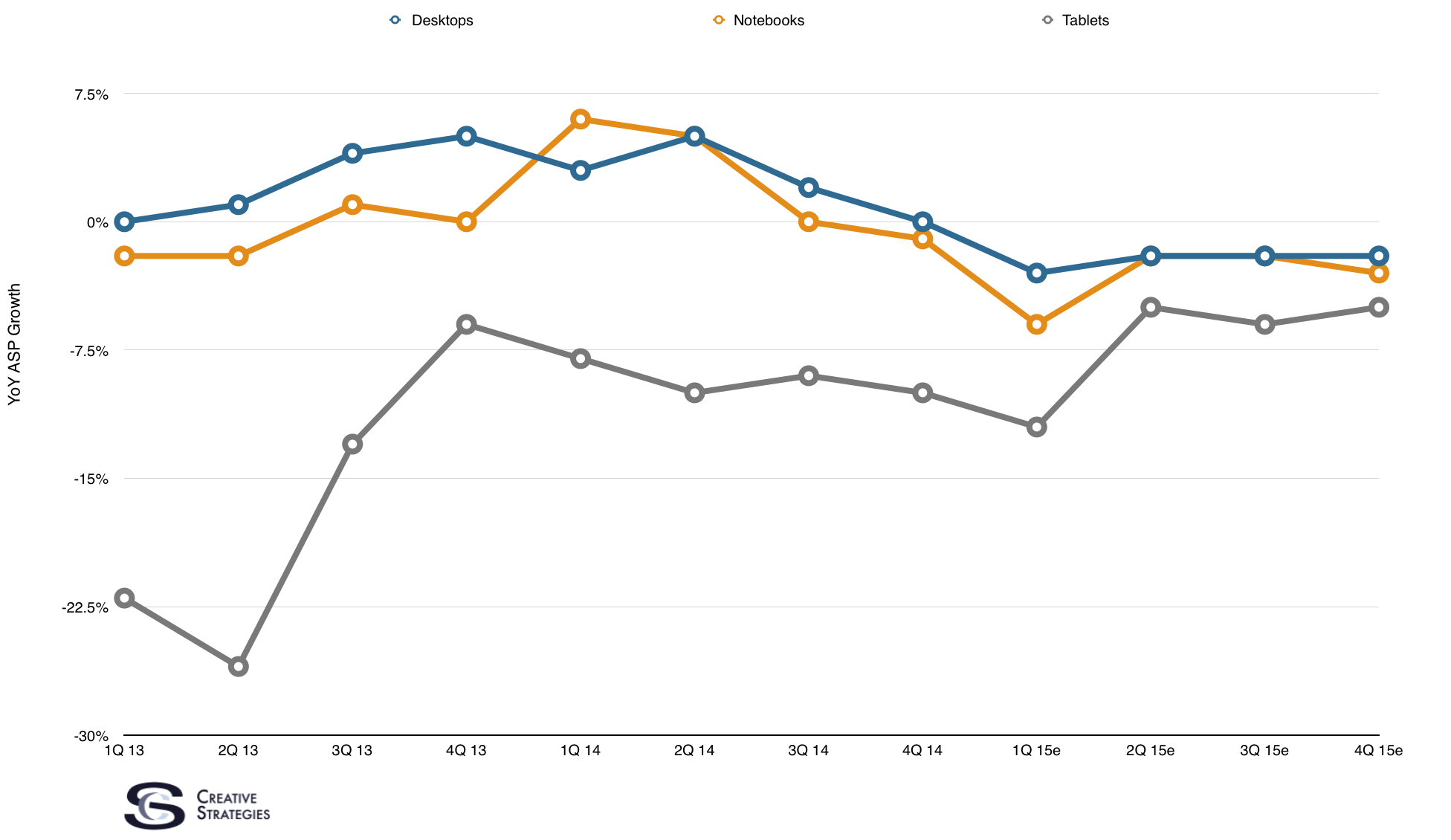

As you can see, YoY growth of tablets has come back down to earth. For nearly a year, the tablet was experiencing anywhere from 120%-220% growth YoY in certain markets. YoY growth prior to Q1 2013 remained high — 70% up to 135% depending on the quarter. But after Q1 2013, the growth normalized and as you can see, the tablet category is now performing similar to desktops and notebooks.

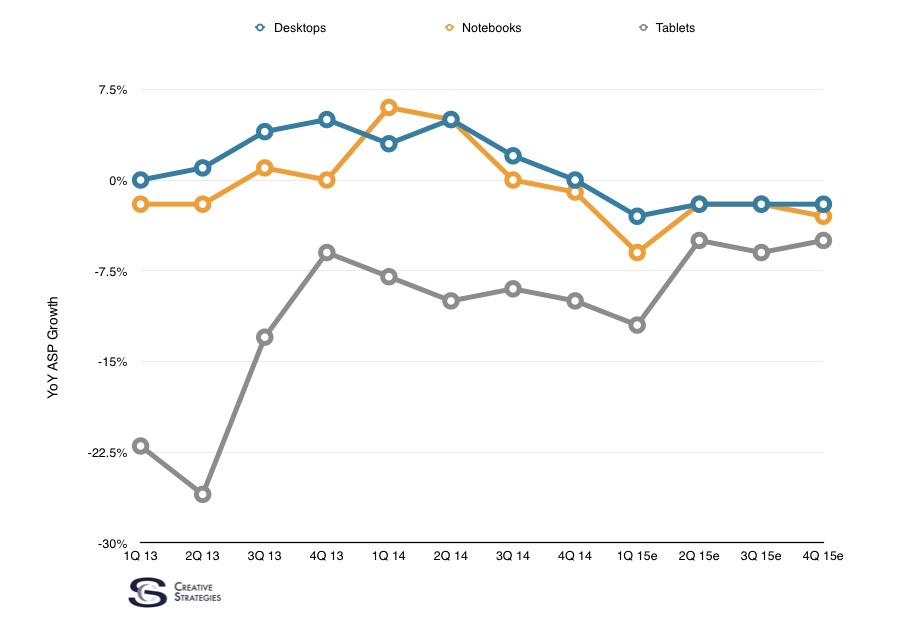

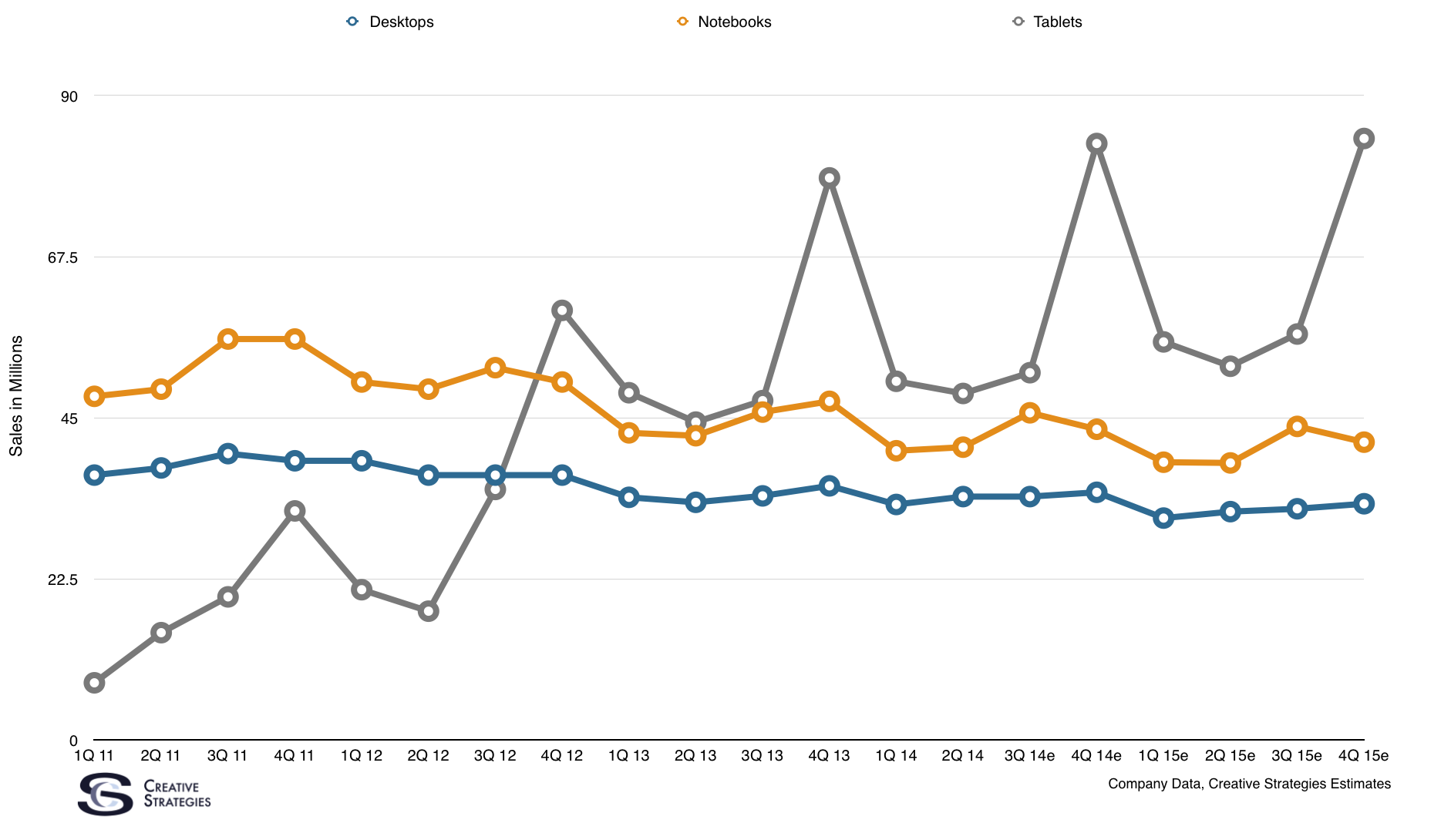

I’ve included in this chart my estimates for the next few quarters and into 2015. These of course are still subject to revision should we see any major trends which cause us to revise. But as of now, we believe the tablet will still remain in slightly positive, but low, growth territory, where notebooks and desktops remain slightly off going forward. The one caveat to the tablet line could be the effect of large phones on tablet growth. This is the one factor that could cause the tablet line to move closer to the notebook and desktop line.

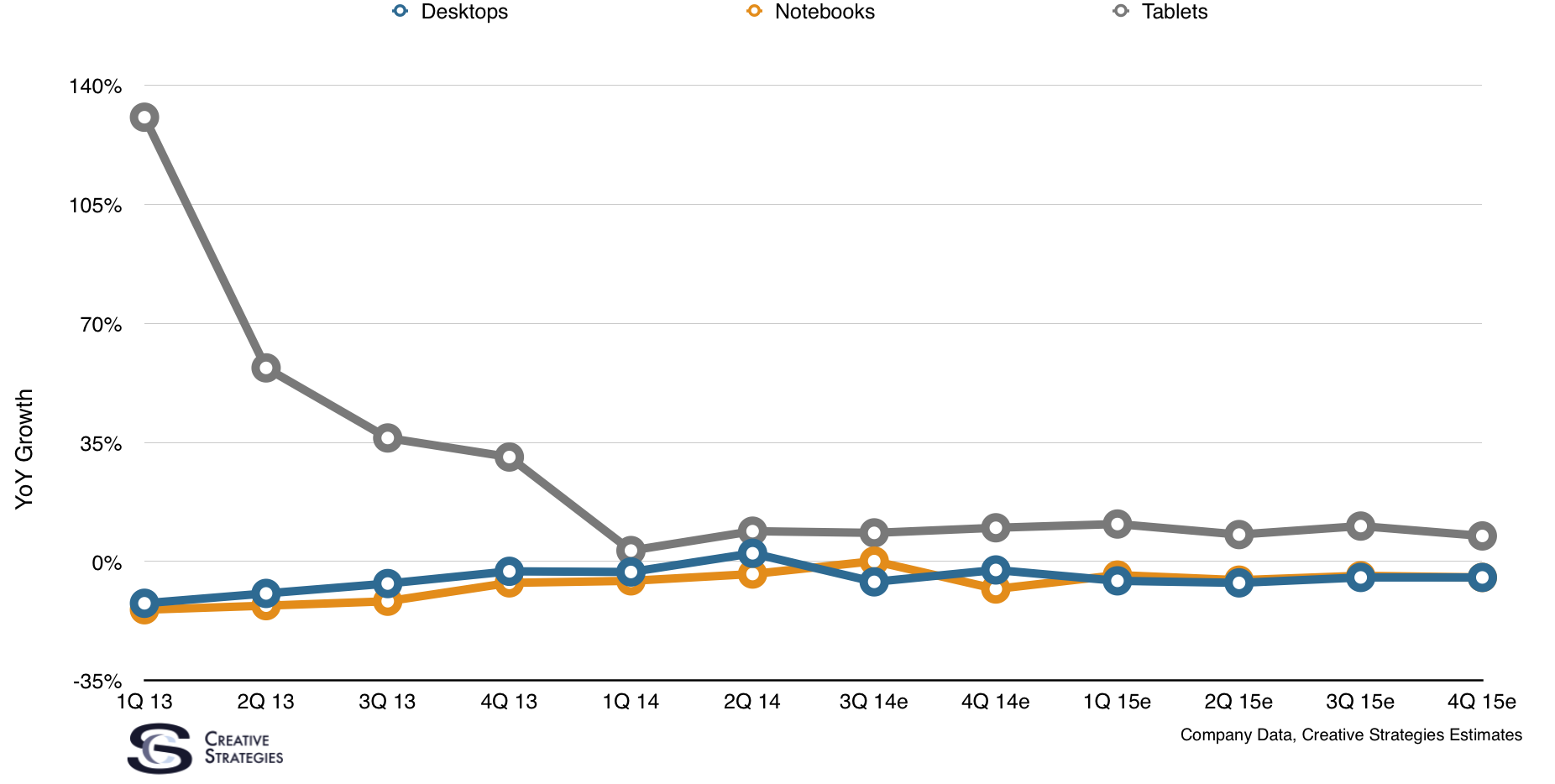

Another interesting way to slice the same chart is to add Apple’s YoY growth of iPads. I’ve done that in this chart and you can see the impact iPad sales have on the tablet market as a whole.

Tablets vs. Notebooks

A key discussion point for those of us who analyze both the tablet and PC market is what impact tablets are having on PCs? There is little evidence to suggest tablets are replacing PCs but that they are more of an extension to them. Perhaps a good way to understand the tablet vs. the notebook is to think in terms of computer literacy. To use a notebook one has to be PC literate. Users need to know their way around a desktop OS, mouse, and keyboard. Not every person on the planet is computer literate. However, thanks to smartphones, many are touch computing and touch OS literate. This is why the tablet running a mobile OS provides greater upside in our view.

The notebook form factor has taken the mobile PC as far as it can go. At this point, if you need a notebook for your day job, student life, or any other use case, you know it. Therefore, we believe the notebook addressable market is tapped out. However, the tablet represents a form and function of a device that can bring a “computer” to those who did not use one before either in their life or work place. For example, corporate field workers are being given tablets to replace walking around with clip boards on the job site. Tablets, as a work opportunity, bring computing to field workers who did not use a computer in their day job. For these workers, the notebook was simply not mobile enough. Tablets are filling those holes.

We also believe the tablet represents an opportunity for first time PC owners. Those who are not computer literate but looking for more capabilities than their smartphone offers. It is within this view we continue to watch tablets as a category.

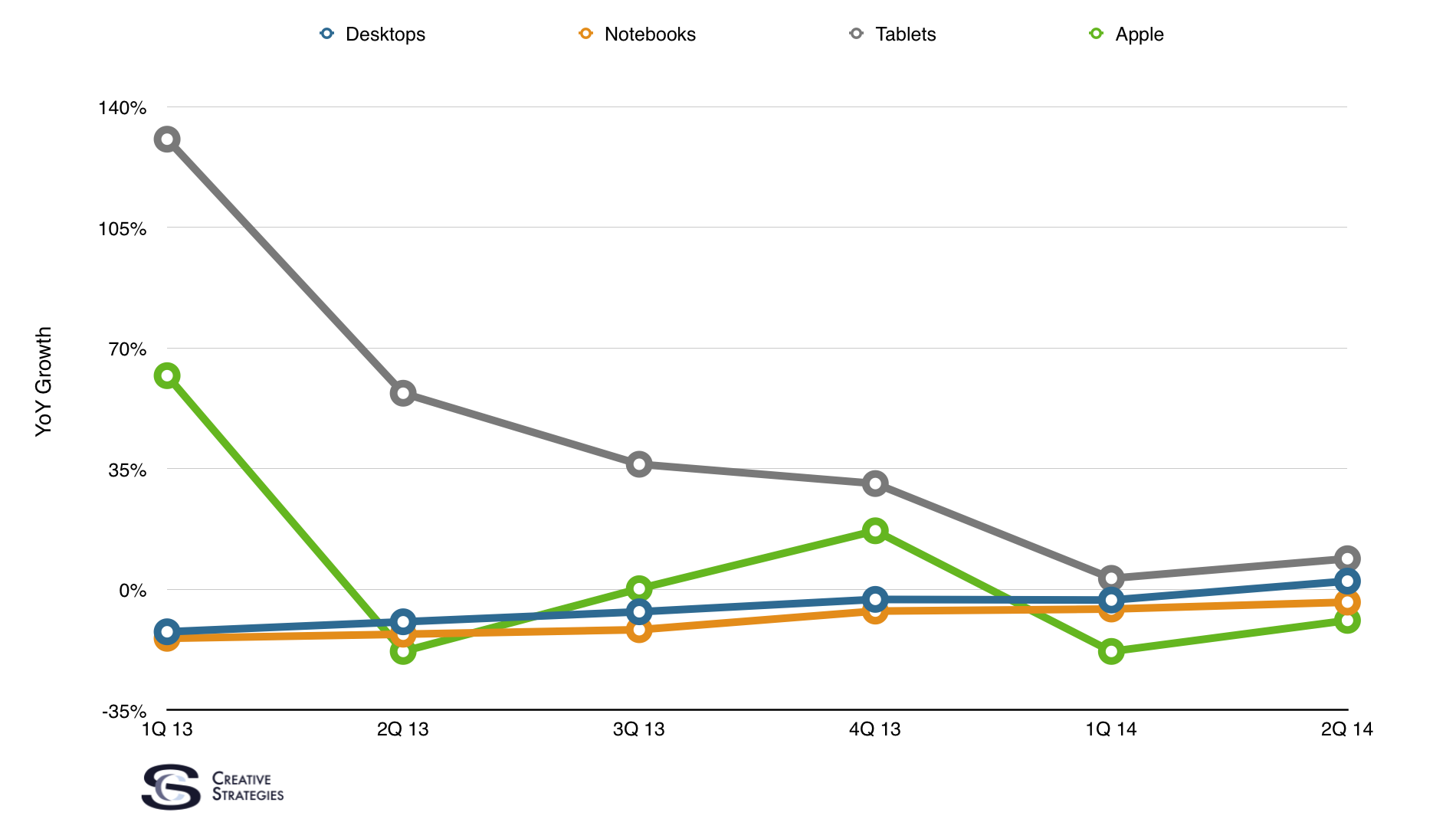

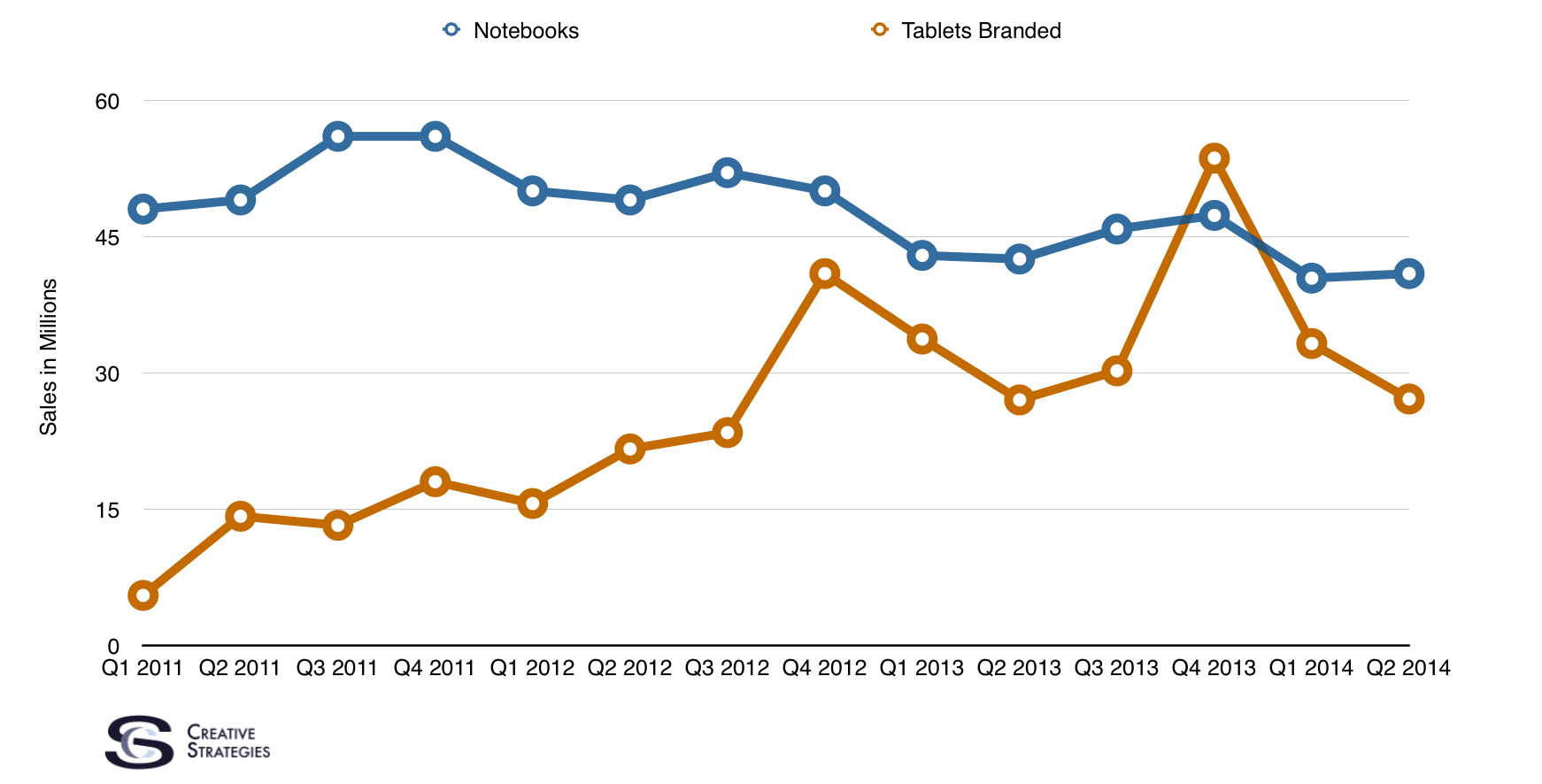

The last point to make on this topic is not all tablets are created equal. If we count tablets that are not branded and being sold sub-$80 in many emerging markets, we can probably argue the tablet market may be larger than the PC market. But when we only look at branded tablets from PC or mobile companies, we see the tablet market may be shaped more like the notebook market than the entire PC category.

Here I charted only branded tablets from companies like Apple, Samsung, Lenovo, Asus, etc. You can see the tablet category is comparable to the notebook category when we attempt, as best we can, to compare apples to apples.

Seasonality

While I try to point out there is some comparison to be made to the notebook and branded tablet market, there is one area the tablet category is quite different than the PC market. Tablets, including branded tablets by the vendors I mentioned above, are more seasonal purchases. Part of this has to do with the more consumer focused play of tablets for now, but also their pricing. PCs maintained a fairly high ASP for most of their life. Even now the ASP of PCs is still over $600 while the ASP of the tablet category is just over $300.

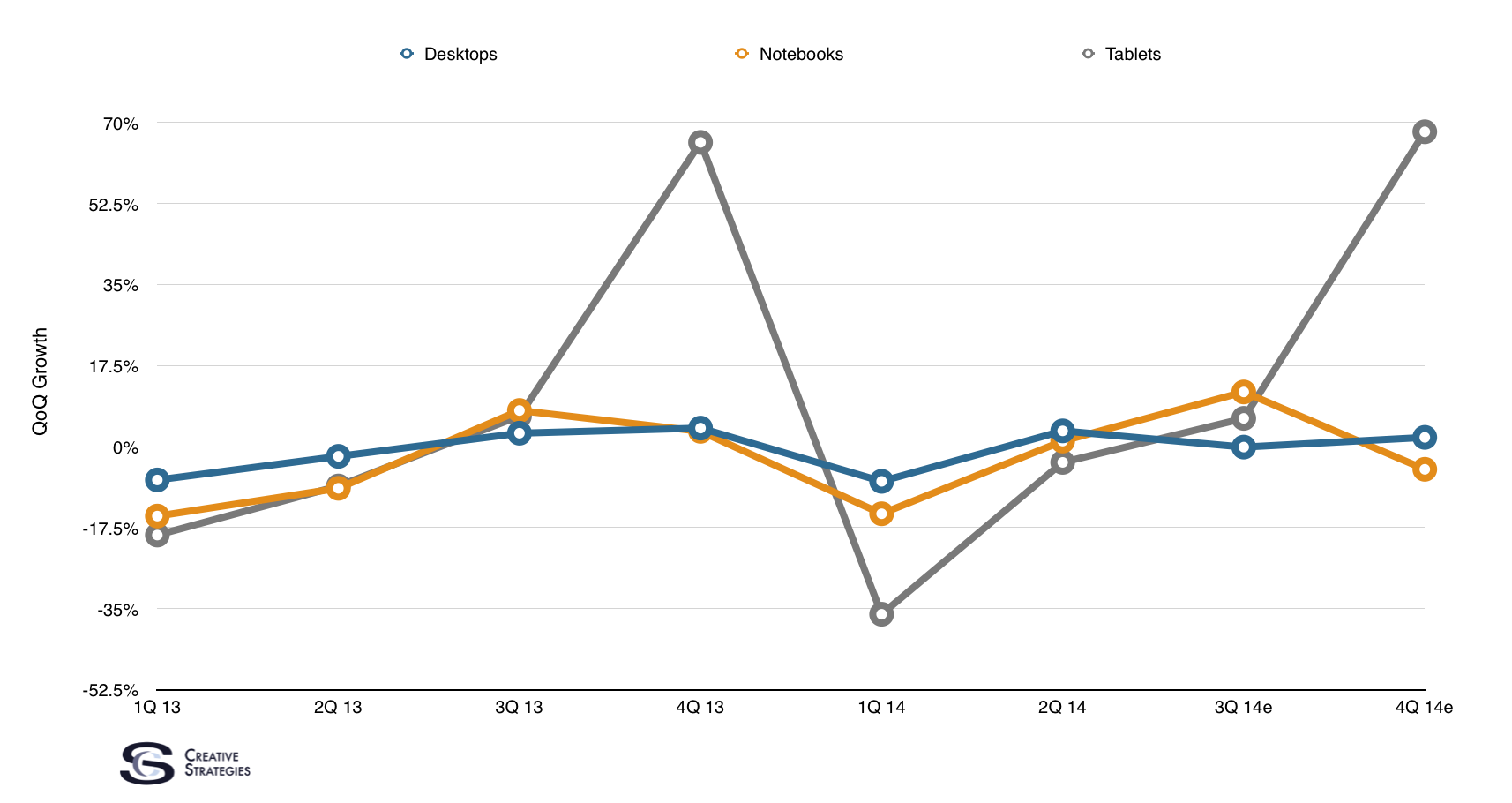

As you can see from this chart, the seasonality of tablets is more dramatic than any other class of PC.

Note, the chart looking forward includes my estimates subject to revision depending on the trends we see.

Tablets, in essence, operate similarly to both the notebook and the smartphone. The smartphone category also experiences dramatic seasonality purchases in the calendar Q4, although we are seeing smartphone seasonality slow down as the global audience comes online.

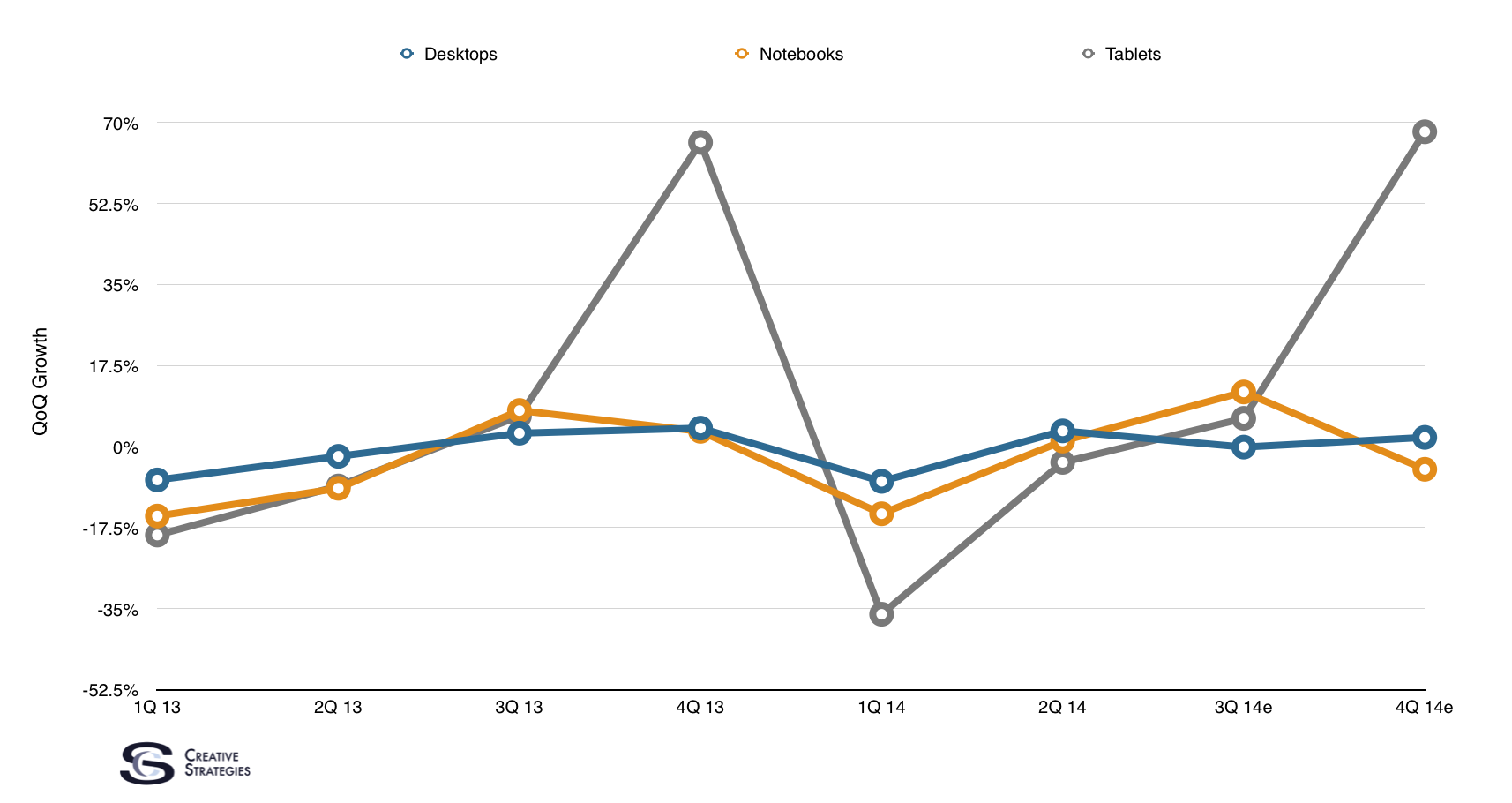

The seasonality of tablets is also visualized when we look at QoQ growth since Q1 2013. While YoY growth, charted earlier, smoothes the tablet line, QoQ growth highlights the seasonality of that growth.

From a marketing standpoint, this chart tells us tablet marketing is best spent in calendar Q4. Bottom line, I don’t see the seasonality of the tablet category going away any time soon.

ASP

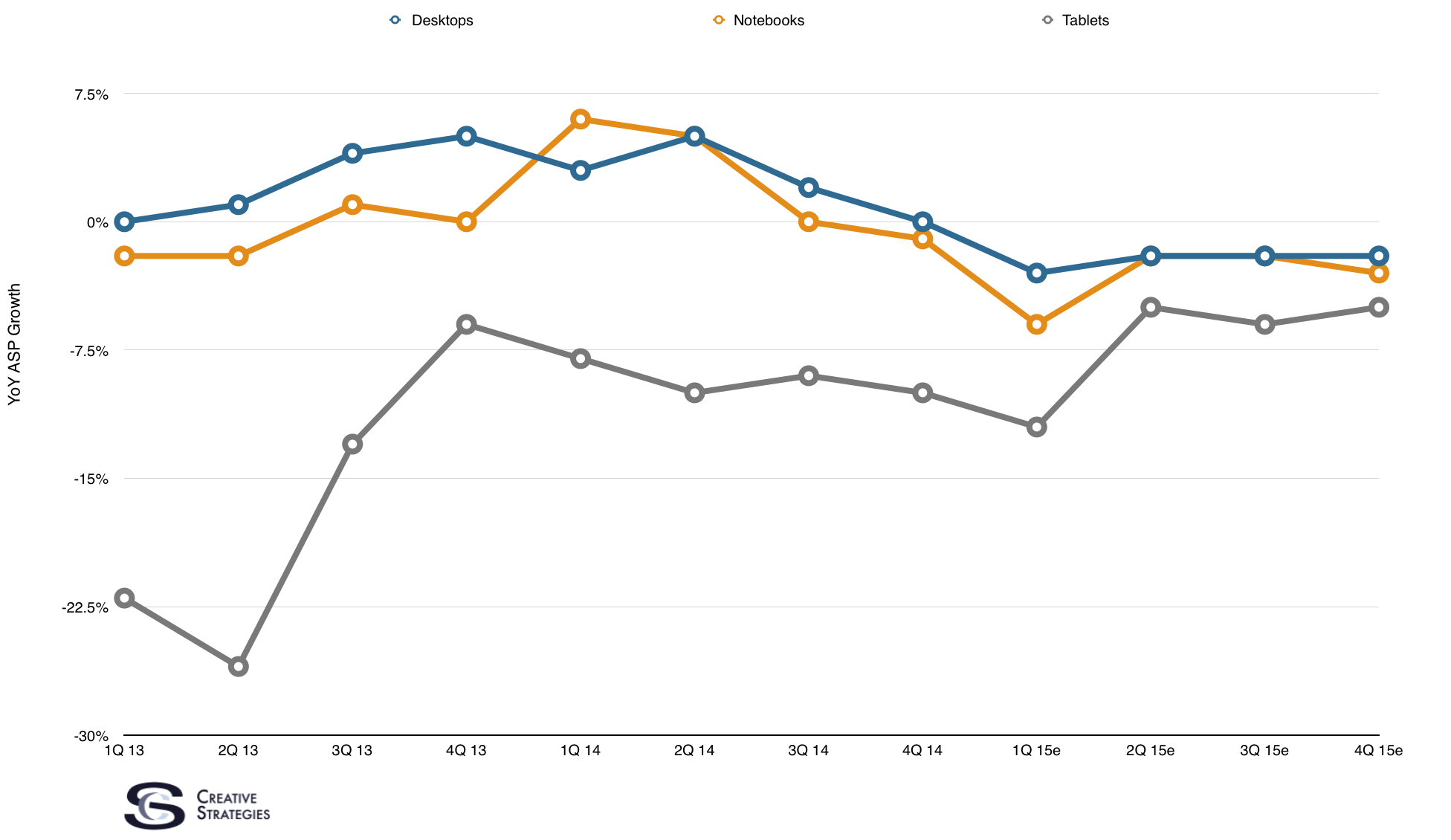

I talk a lot about the the white box tablet market. These are non-branded tablets coming from the China tech manufacturing ecosystem and selling for less than $80 on average. Knowing that, when we plot the ASP YoY growth of tablets, it shows how dramatic both the low cost Android push and the white box tablet market have had on tablet ASPs.

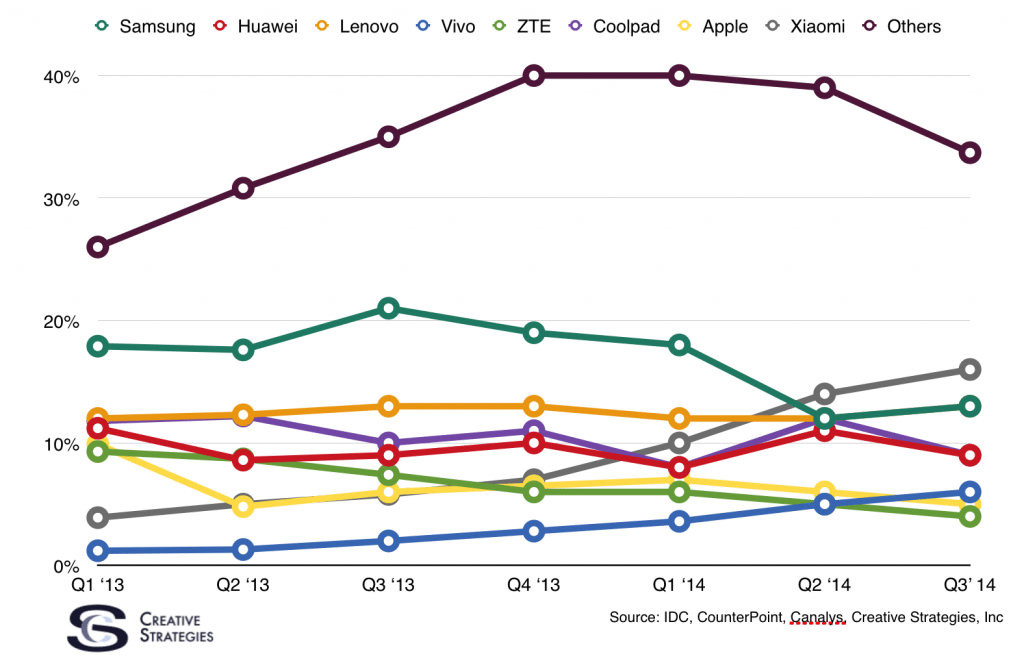

As you can see, the tablet market as a whole has been a troublesome one to really make money at for nearly all but Apple. Vendors like Samsung would move many as a promotion through the carrier channel with the purchase of another Samsung smartphone. Other than those two, no one really sells tablets in any meaningful volume.

As we look at ASPs going forward, the line is still trending down. One caveat on tablets would be if we see fewer branded tablets on the market as certain companies get out of the market due to lack of volume or monetization. In which case, the tablet market would be driven by Apple and white-box as far as volume goes.

Conclusion

As many of my charts highlight, much of the key growth in tablets appears to have slowed and, in some cases, disappeared entirely. Revisiting the question of whether or not the tablet category is as large as the PC category seems like a re-kindled debate. From what I see right now the answer is both yes and no. If we combine all tablet sales, including those low cost white box tablets from the China tech manufacturers, then I can see how we sell more tablets than PCs worldwide annually (not necessarily quarterly). However, since not all tablets are created equal, this may not be a metric worth spending more time on.

Comparing branded tablets like the iPad for example, and tracking them against notebook sales does seem like a valid metric worth tracking. But, as a few of my charts point out, it is questionable whether the branded tablet category is bigger than that of PCs. Rather, it seems it is more similar in terms of volume to notebooks than the entire PC category. Given its form factor and use case, this makes sense.

As we track tablet sales and try to articulate the bigger picture of how they fit into computing as well as the broader consumer electronics picture, we strive to look at ways the tablet is extending computing in meaningful ways to those who were not true “computer users” before. We know nearly everyone on the planet will have a smartphone. We have reasonable assumptions the smartphone is not the only computing product they will own. We have strong doubts, based on the point of computer literacy, that the notebook or desktop will be the first computer of choice for current smartphone-only customer. We believe, for this market, the tablet represents the most interesting opportunity as the first large screen computer of choice.

What cannot be overstated in this discussion is the meaningful impact of bringing computers to the masses. It should not matter the shape or manner, only that we deliver on that promise. Each form factor — the desktop, notebook, tablet, and smartphone — will play a role in bringing computing and the internet to the masses. Some form factors will be more affordable than others. Some more capable. Some more portable. No matter their size, shape, or capabilities, we are seeing computing advance in ways we never could have before thanks to the many shapes a personal computer can take in the 21st century.

Jean-Louis Gassée, a veteran executive, investor, and observer of the tech industry, wrote an accurate and depressing account on the position of once high-flying Intel. Like Microsoft, Intel was unable to to keep up with a rapidly changing world where the kings of PCs were being overrun by small, lightweight, mobile equipment.

Jean-Louis Gassée, a veteran executive, investor, and observer of the tech industry, wrote an accurate and depressing account on the position of once high-flying Intel. Like Microsoft, Intel was unable to to keep up with a rapidly changing world where the kings of PCs were being overrun by small, lightweight, mobile equipment.

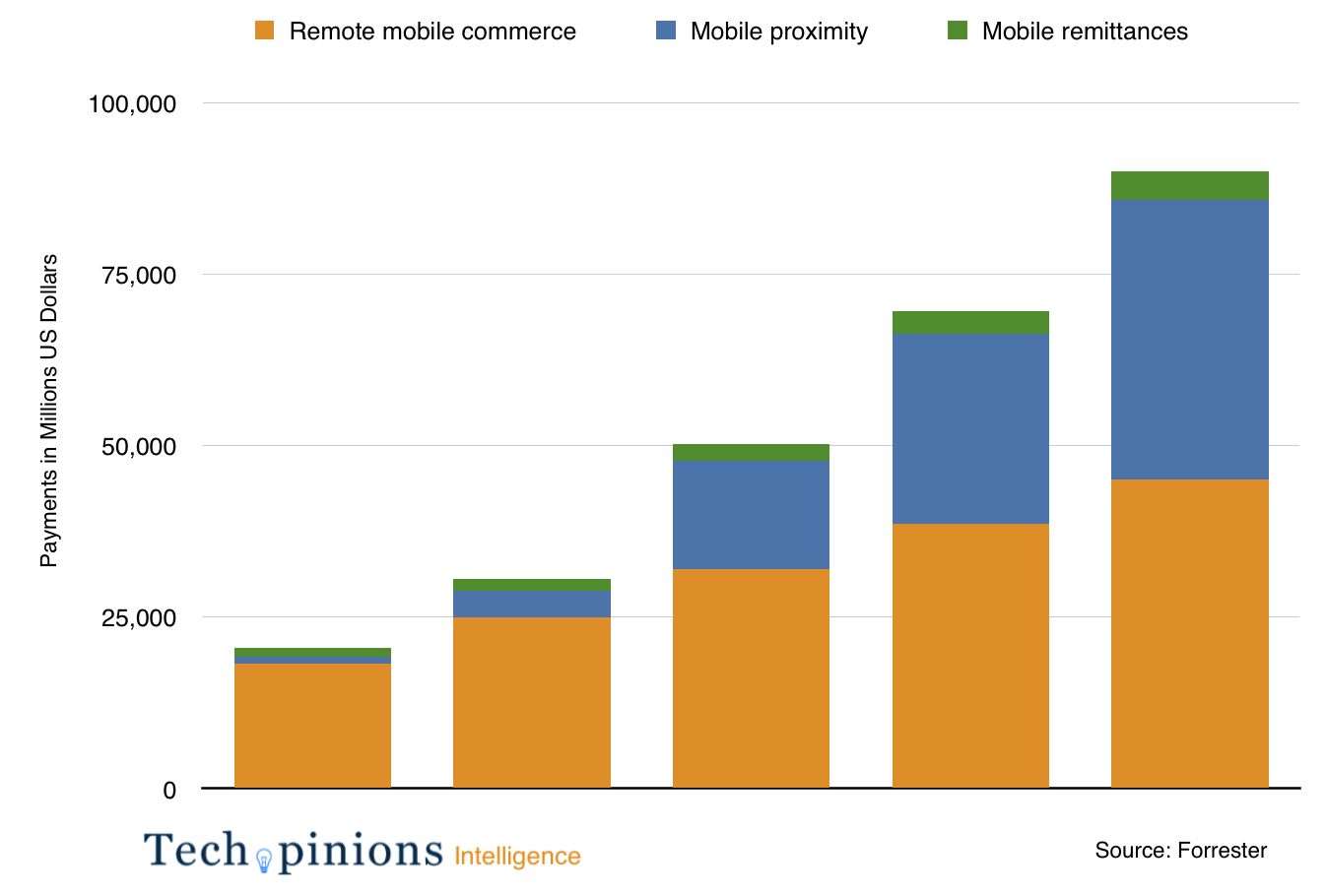

Having recently been at an analyst event with many of the Forrester, IDC, and Gartner analysts, we discussed mobile payments and there was a consensus we are on the cusp of the market developing and developing rapidly.

Having recently been at an analyst event with many of the Forrester, IDC, and Gartner analysts, we discussed mobile payments and there was a consensus we are on the cusp of the market developing and developing rapidly.