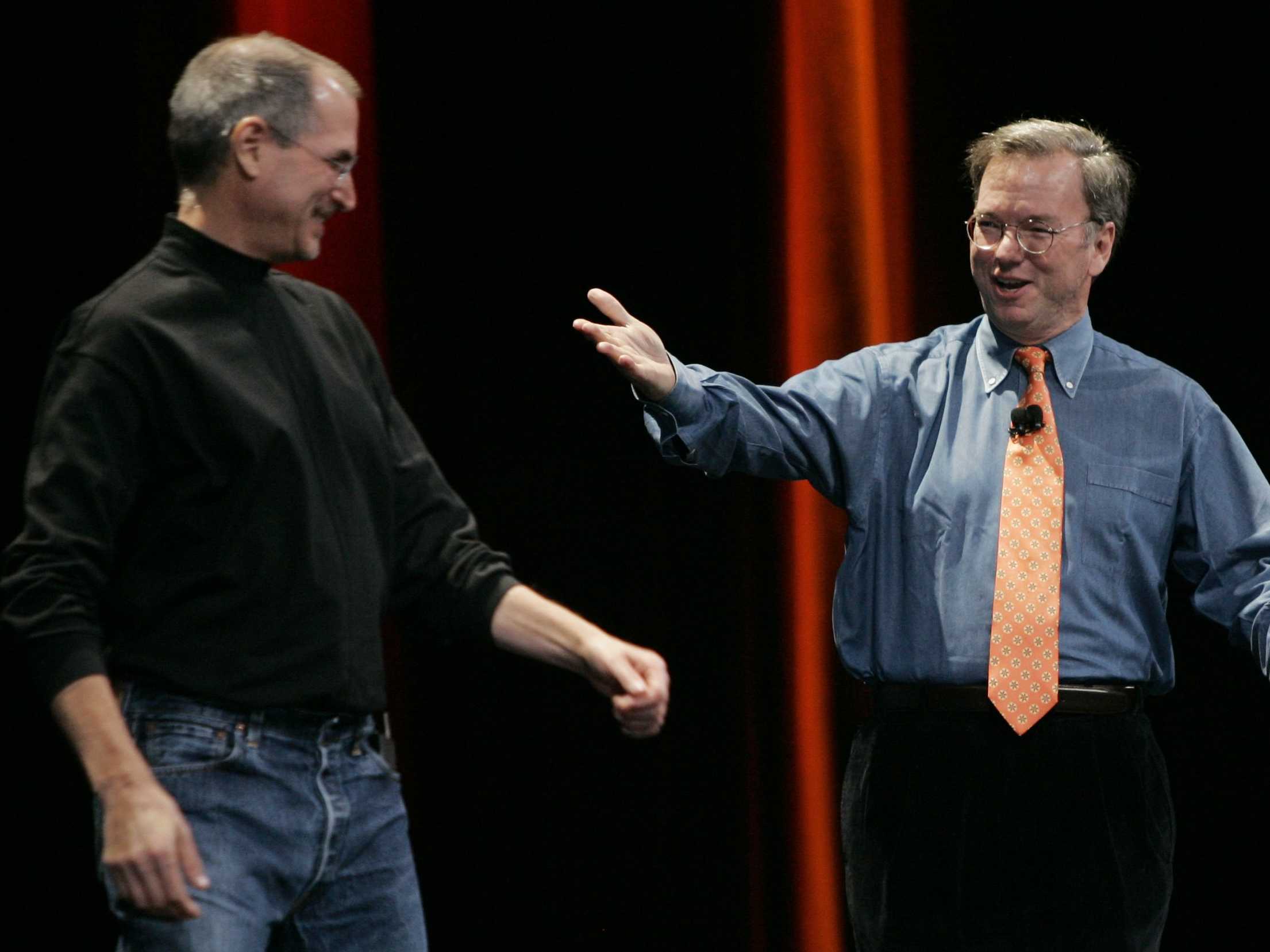

Arguably, Apple and Google are the largest, richest, most powerful, most influential technology companies on the planet. Across many markets their products, services and technologies directly compete with one another. Yet, in countless endeavors, each benefits the other, enabling both to earn more, reach more, do more, grow ever larger, their creations touching nearly all of us.

Which begs the question: which company creates more good in this world? Apple or Google?

Unknowable?

I think the question a valid one. Despite their many similarities, the companies have profoundly divergent strategies when it comes to the development, release and spread of technology. Seeking the answer to this question might help us better understand how we should construct future tech companies, offer insights into what we should value most and whose methods we should help foster.

Pay To Play

As both Apple and Google continue to extend their reach deeper into our lives, the more obvious differences between the two begin to peel away. Once, Apple was hardware and Google was software. Now, both are mobile devices, cloud computing, entertainment, maps, apps, payments, productivity, music, messaging and — even if poorly — social media. We have to look deeper.

Start with pricing. Apple, whose products no one is required to purchase, is regularly blasted for ‘premium’ pricing. Google, whose products are mostly free, generates no such acrimony.

Is it better to demand customers pay for a product, to enter into a covenant where value is promised at a specific price, as Apple requires? Or is offering services for free the superior model? Certainly free seems better, but the price of free in today’s world is constant advertising, payment of which is continuous mining of our personal data. Does the Google way — pulling off tiny pieces of ourselves, bit by bit, moment by moment, and then selling these off to an unknowable coterie of people and businesses — better serve humanity?

I want to be in favor of free, but in its current form, the price of free seems too steep for me. For the rest of the world, I think in pricing Google trumps Apple, whether I wish it so or not.

No Product Before Its Time

Another core difference: product development and release.

Is it better to release products only when they are ready, as Apple does, or as soon as they reach sanctioned beta stage, as Google does, allowing anyone to experiment with their creation, make it better, expand its reach? Again, this seems to favor Google.

While we wait for the next insanely great product from Apple, a hyperfast-moving Google is — right now — helping us understand the pitfalls and benefits of driverless cars. Google Glass is forcing us to consider our views on personal privacy in public spaces and it must be acknowledged, pushing the technical boundaries and design limits of wearable technologies.

Google is meeting with city leaders, exploring methods to offer cheaper, radically faster broadband. They are unleashing ‘balloons‘ to bring the Internet to all points of the world. Push, push, push, now, now, now. The Google Way seems more right for our world.

Meanwhile, Apple…what, exactly? An iWatch likely few can afford once its finally released?

Tim Cook recently tweeted:

“Remembering Steve on his birthday: ‘Details matter, it’s worth waiting to get it right.'”

Is this true? Is this best for the 7+ billion of us on the planet? To wait?

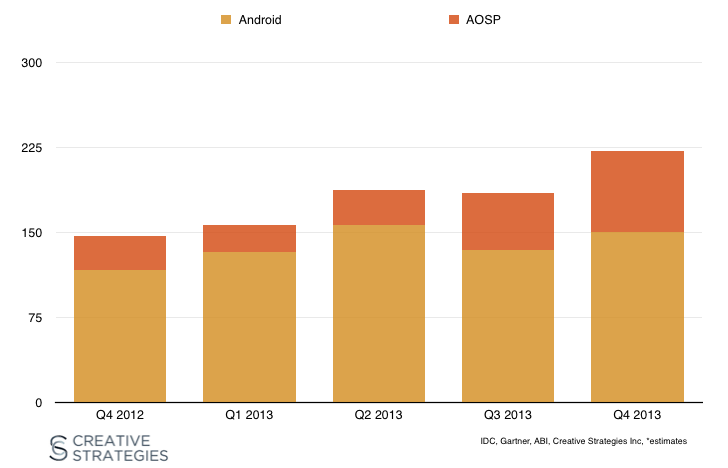

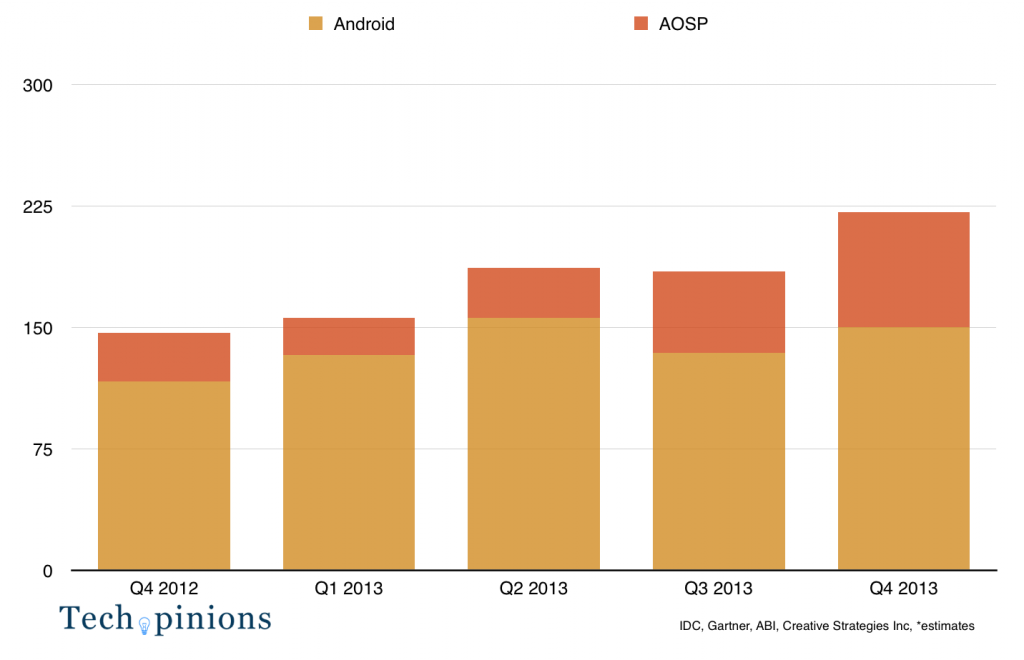

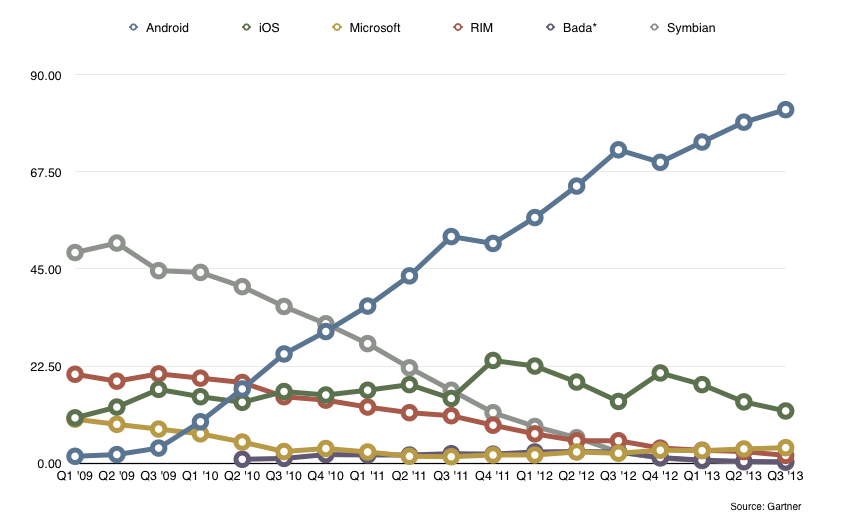

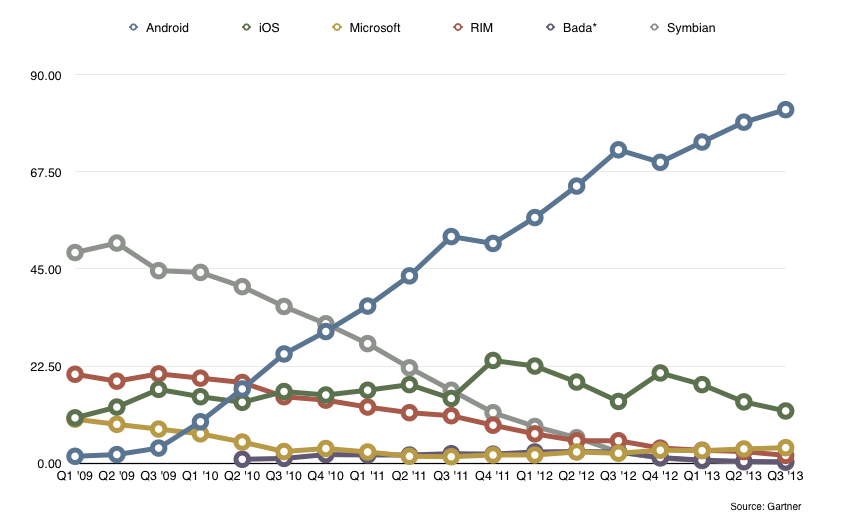

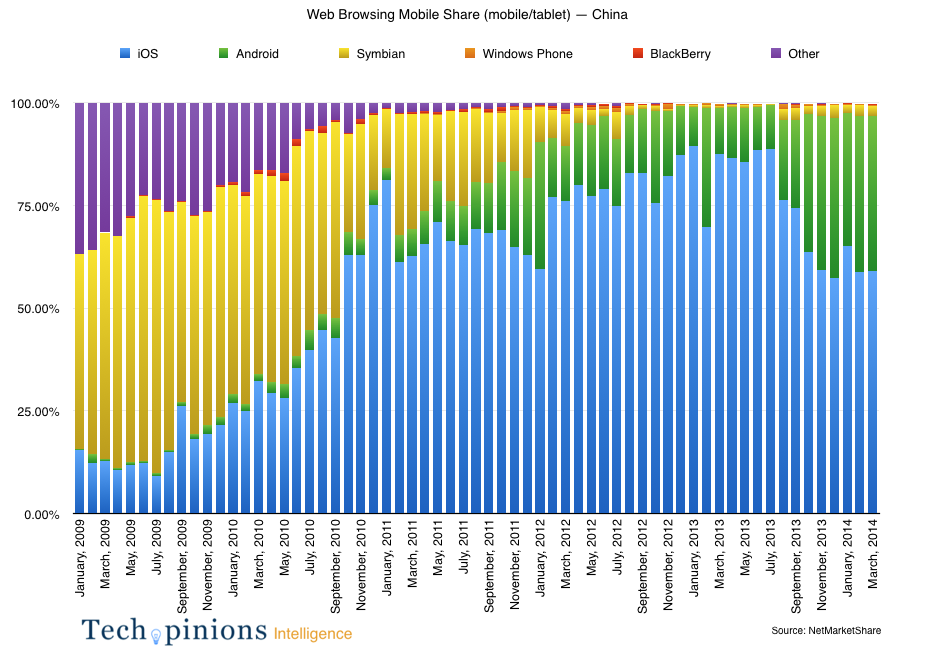

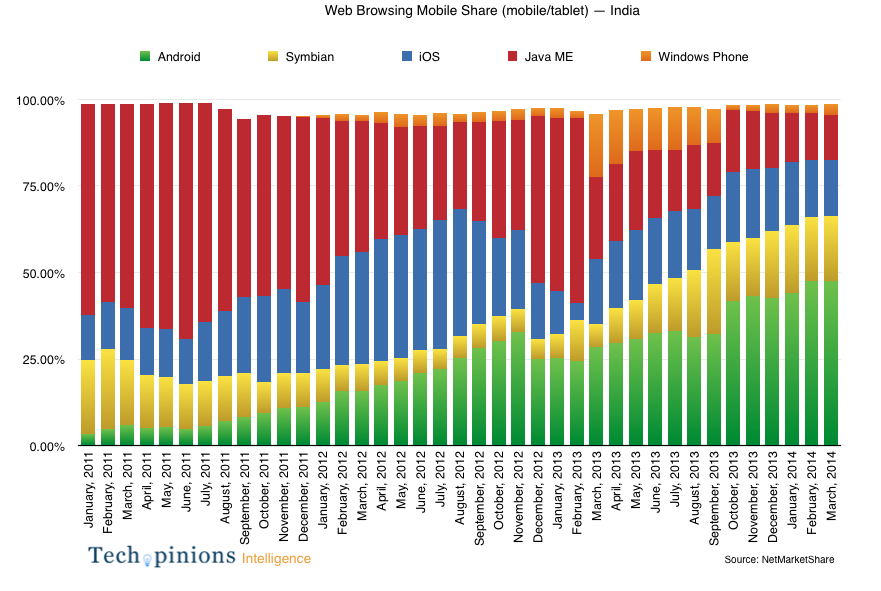

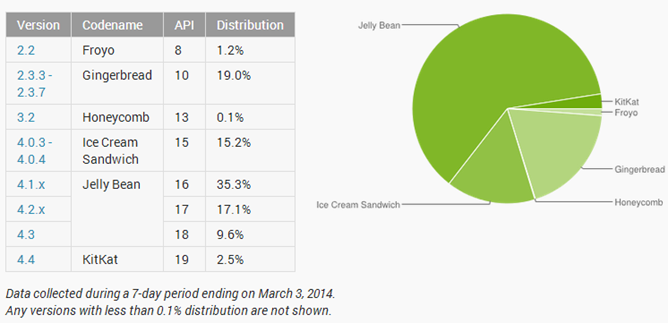

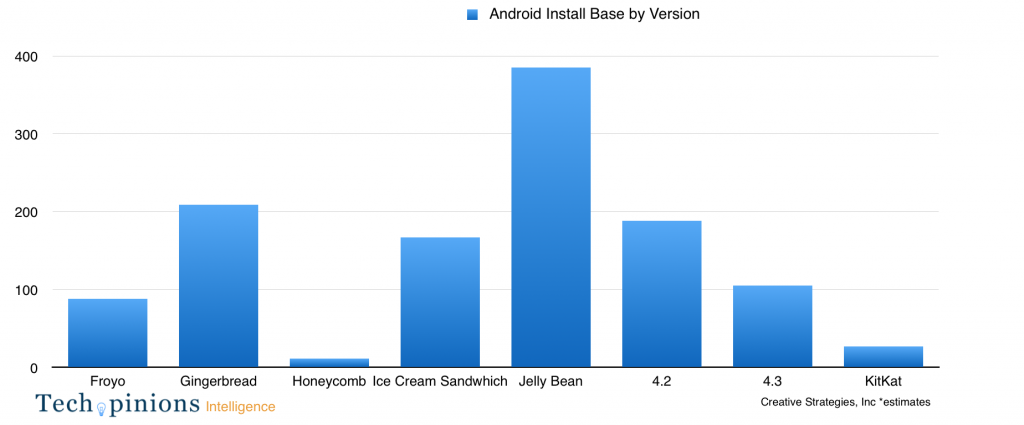

Consider Android. Android is now the most widely used operating system in the world in part because Google unleashed it, for free, even while its business model remained in flux, and without waiting for agreement from potential stakeholders like Java’s Oracle. Nor was it perfect, by any stretch. Our gain.

We are rapidly connecting with one another, linking to astoundingly low-cost information resources whose total value is nearly incalculable, thanks in large part to this essentially free, freely available and extraordinarily robust mobile operating system. Humanity has been aided by Android, clearly.

Step back. Did Apple’s deliberate plodding make all this possible?

Look at an Android device pre-iPhone: it is an evolutionary dead-end. Think of all the apps, services, knowledge, entertainment and productivity we garner from all the phones that came only after Apple and the iPhone cleared the way. Consider the rather glaring limitations of Android, pre-iPhone. Had Apple launched iPhone before it was ready, before all the “details” were just right, the entire smartphone industry, now over a billion users strong, may have taken a completely different path – and died on the vine.

Might the same thing happen in wearables — likely the next iteration of the ongoing personal computing revolution? As wearable technologies abound in type and quantity, we await Apple’s entry.

Yet it may be wearables can only achieve their fullest potential for improving our health, our fitness, our connectedness to our minds and bodies only after the details are exactly right. That is, only after Apple clears a broad, lasting path just as they did with Mac (PCs), iPhone (smartphones), and iPad (tablets).

We have significant evidence Apple’s entry into a category has disproportionately, even radically re-shaped all that came before and all that follows. Perhaps we are better served in our analysis if instead of viewing Apple as sitting atop the ‘high end’ or ‘premium’ segment of a market, we acknowledge their products as a sort of official start, or a big bang of a new product category, unleashing and enabling the full potential of such technologies.

Thus, it may be that Apple better serves humanity even as their products are viewed by many as the tools of the wealthy. Apple made possible the very revolutions Google has seized upon. I think when it comes to the development, creation and release of products, Apple does humanity better.

Origin Myths

While I harbor suspicions regarding some of Google’s actions, I deeply admire their speed and scale, along with their willingness to try, to fail, to push. Google’s fast, expansive focus seems much more aligned with our nature and certainly more aligned with our times. Google’s beliefs include:

- fast is better than slow

- democracy on the web works, and

- great just isn’t good enough

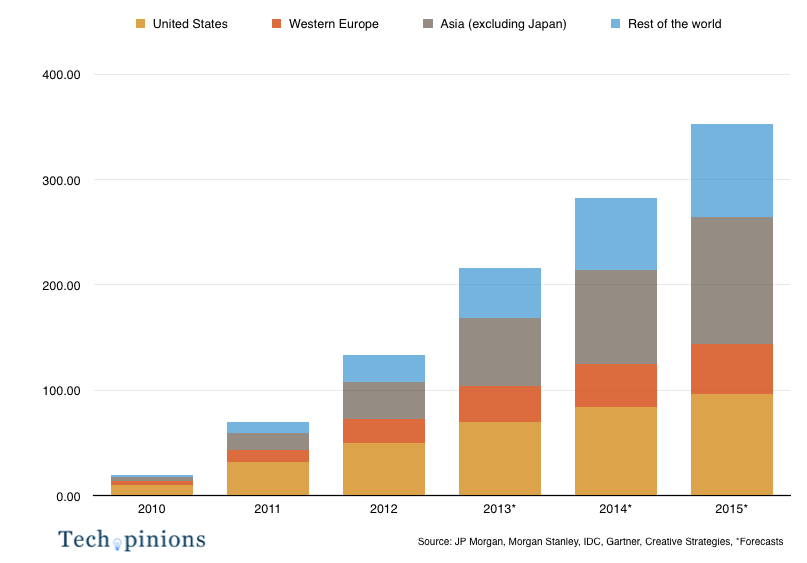

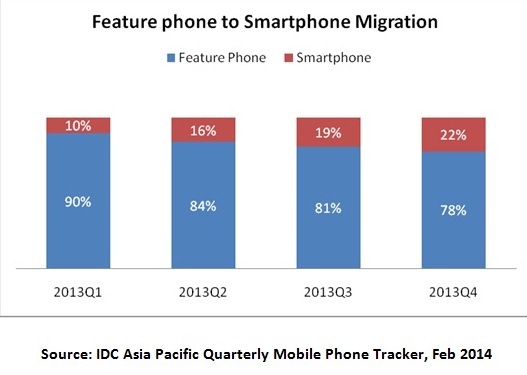

Thanks in part to such beliefs we most likely will have faster broadband, more bandwidth, radically cheaper smartphones connecting the world, tablets everywhere, a nearly infinitely scalable and mobile-optimized real-time web, all manner of affordable information and content, search, driverless cars, and whatever else Google is cooking up in its labs or scouting for acquisition.

That’s a substantial list.

It took Google for us to have YouTube, free maps, real-time-anywhere search, and the ability to live our lives within a fully digital realm. Yes, this comes at the creeping and rising cost of advertising everywhere and aggressively lobbied laws that do not necessarily favor our privacy interests. Almost seems fair.

Apple’s mission, by contrast, is shockingly prosaic:

Apple designs Macs, the best personal computers in the world, along with OS X, iLife, iWork and professional software. Apple leads the digital music revolution with its iPods and iTunes online store. Apple has reinvented the mobile phone with its revolutionary iPhone and App Store, and is defining the future of mobile media and computing devices with iPad.

That’s it? No move fast and break things? No do no evil? Not even a computer in every purse?

In vision and purpose, I say Google bests Apple.

I suspect that despite their overlapping business interests, core differences between the companies are inextricably linked back to their founding — the mad, beautiful and deceptively detailed vision of computing borne inside the mind of Steve Jobs, versus the youthful, audacious and limitless grandiosity of Page and Brin.

Apple and Google are a mere five miles from one another, yet the difference in their work and world views appears an impassable chasm. I do not know who does more for humanity. I am greatly proud, nonetheless, that these two giants of innovation are American-born, American-led, and are both, separately and together, creating a better world.

Anyone who follow Apple closely knows that they are a bundle of paradoxes. One of the most baffling of these is that Apple has literally tens of billions in excess cash but seems always to be chronically short of critical software engineers.

Anyone who follow Apple closely knows that they are a bundle of paradoxes. One of the most baffling of these is that Apple has literally tens of billions in excess cash but seems always to be chronically short of critical software engineers.