Very soon, Apple will make its 100th M&A acquisition since it acquired NeXT Computer in 1996. This acquisition was done by then Apple CEO Gil Amelio, and just before he made that acquisition, he asked me about my thoughts about buying this company from Steve Jobs. At the time, because I was helping Mr. Amelio with Apple’s mobile strategy, he and I talked weekly about his goal of reviving Apple. Long time Apple watchers will remember that Gil Amelio was on Apple’s board when the company had lost its way and was over $1 billion in the red. When the board ousted Apple CEO Michael Spindler in 1995, Mr. Amelio was asked by the board to become CEO and try and turn the company back to profitability.

When Gil Amelio told me about the idea of buying NeXT, I have to admit that I was pretty skeptical and was not sure it was a good idea. But as he shared with me how he thought Apple could integrate the NeXT OS into Mac OS and make it even more powerful, he began to win me over. But when the deal was announced, the overall market perception was that the deal made no sense and many were concerned, yet intrigued with the idea that if Steve Jobs got anywhere near Apple, he could find a way to gain more influence on Apple’s future.

Well, history has shown that Mr. Amelio and Apple’s Board’s decision to buy NeXT and bring Steve Jobs back into the company he co-founded was a streak of genius and thanks to Steve Jobs, Apple was put on a fast track to becoming one of the most profitable companies in the world today. The move by Mr. Amelio to buy NeXT set the tone for Apple to become very aggressive with their M&A strategies and given the fact that they have over $240 billion in the bank, they certainly have the money to buy IP and technology companies to bolster their overall hardware, software, and services platform.

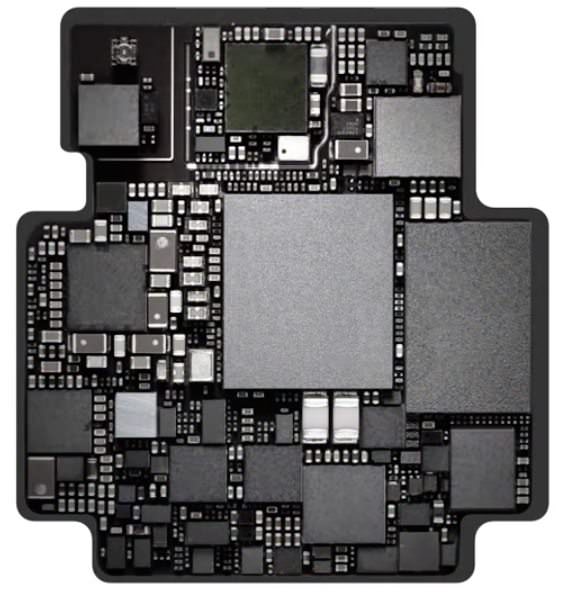

The CB Insights chart below shows the forward path Apple has taken with their M&A activity since 1996 and last weeks’ apparent purchase of Shazam for a reported $400 million is another excellent example of how Apple uses the acquisition of IP and real companies to help them maintain an edge when it comes to innovation.

This does not mean Apple does not innovate from inside the company. Indeed, Apple files hundreds of patents based on internally created IP each year and has shown that they continue to develop new technologies and intellectual property for all of their products and services on a regular basis.

But as the chart above shows, all of the acquisitions shown above are strategic and are used to help bolster their overall IP portfolio in one way or another.

Recently, Apple committed $1 billion towards new types of partnerships and allocated $100 million of that to a joint venture between them and Corning Glass. This investment apparently is to create a new facility in the south that presumably will be used both for R&D and some manufacturing that has not be detailed yet by either company.

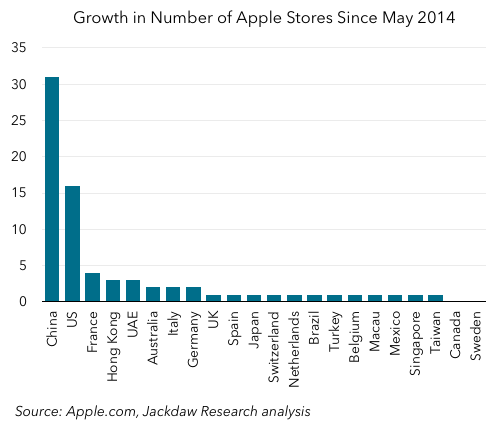

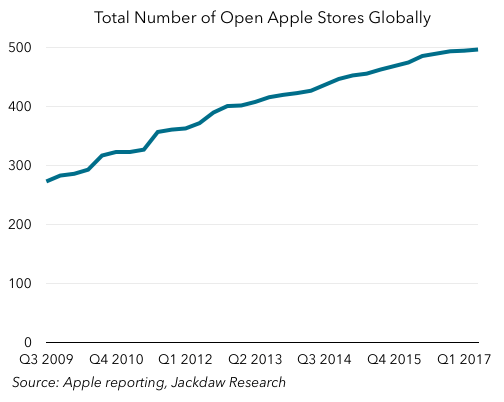

At the same time, we expect Apple to expand their overall M&A activity in the next three years as they seek ways to tie more customers to their ecosystem.

While the need for innovation in hardware and software is always part of their overall strategy, Apple will also probably be aggressive with M&A activity around their services business. One way to look at Apple’s overall approach would be to call it ONE Apple..an environment where hardware, software, and services encompass a total package that Apple’s customers buy into to get the best-integrated experiences within their Digital lifestyle.

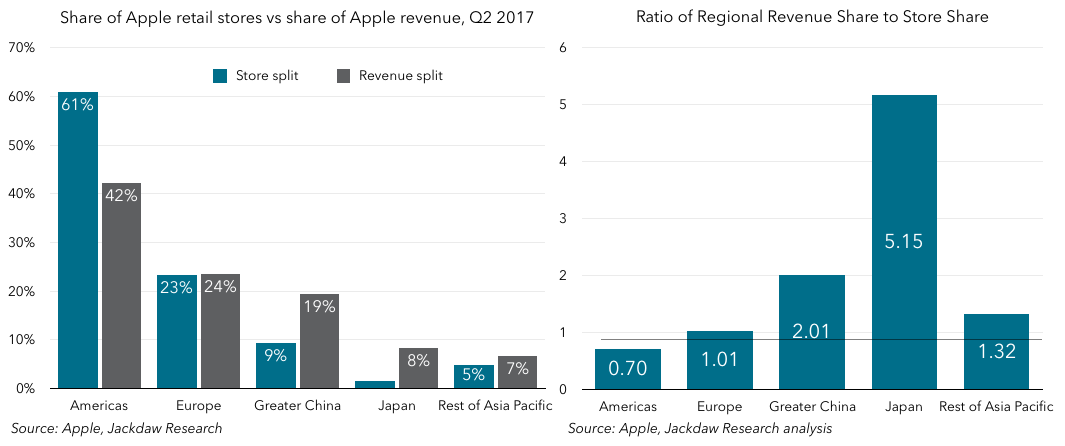

This is becoming more evident with the continuous growth of their services business. Services account for around $30 billion of total revenue and are growing each quarter. This is extremely important for Apple’s future.

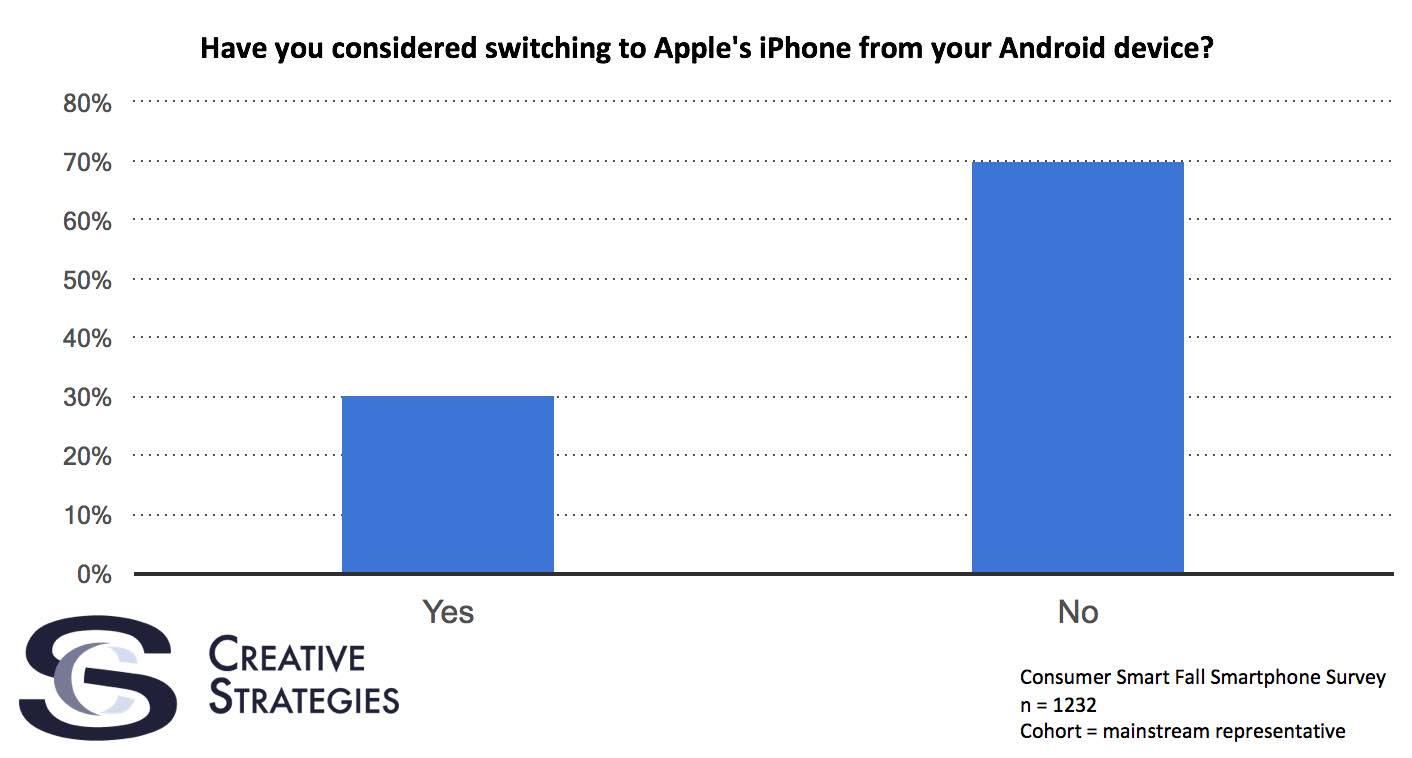

Apple sells about 16 million Mac’s a year, and that number stays pretty constant. And iPhone sales, while still strong and growing, needs more and more content and services if they want to get more switchers and keep current customers in their ecosystem on a continual basis. This in turn helps drive services revenue and on the whole, keeps Apple one of the most profitable companies in the world.

While it is hard to predict what type of mergers and acquisitions are next, we know that Apple is highly interested in AI, Self Driving cars and LIDAR, enhanced voice and text recognition, music and streaming media as well as new ways to strengthen their CPU’s, GPU’s and various radio technologies. I sense that Apple will be particularly aggressive in acquiring AI based IP as this technology will be highly critical for Apple to stay competitive and offer more innovative products and services in the near term. I also believe that Apple will do even have more M&A activity in the next 18 months as Apple will be under even more pressure from Google, Microsoft, and Amazon, especially in the area AI and media services.

Apple’s pile of cash in the bank gives them an excellent position to accelerate their M&A activity, as long as it is strategic for the business. That is why I expect them to be more active in this area in 2018 and early 2019.