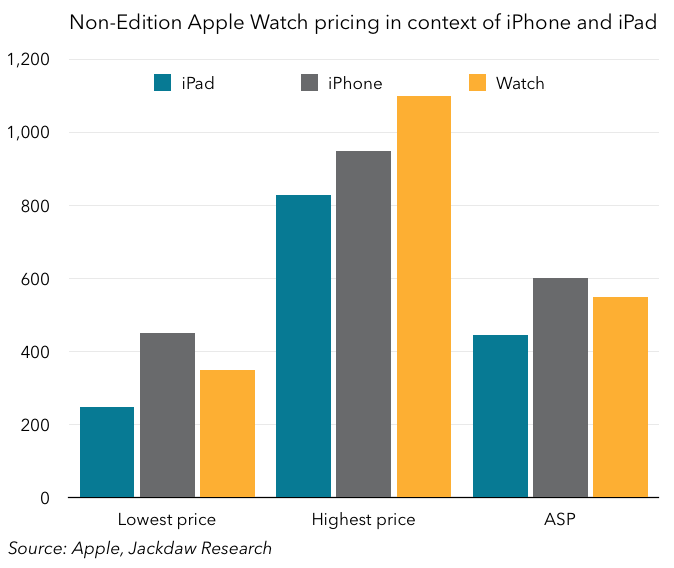

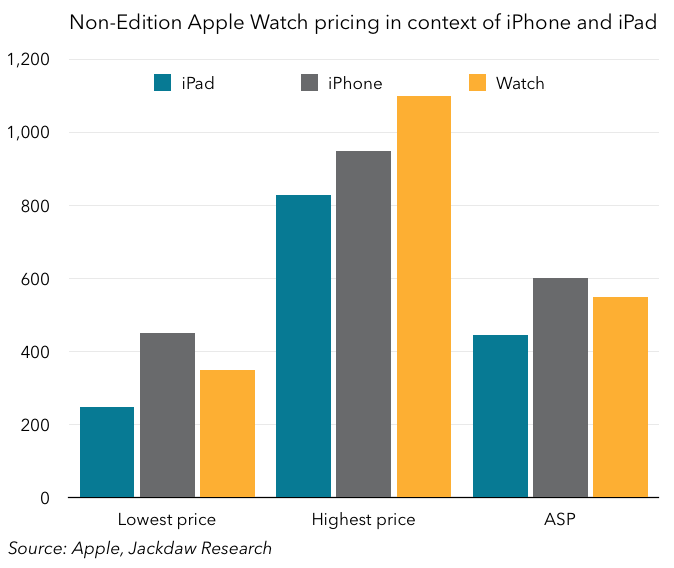

One of the key things out of the Apple event last Monday was how exclusive and far removed from the mainstream the Apple Watch Edition is. The combination of pricing, limited numbers, and limited channels will make this a product very very few people will buy in comparison with the other two versions. It’s important for other reasons and is interesting in its own right, but that’s the subject of a whole other post to be written some other time. What I wanted to focus on here was what the pricing looks like if you strip the Edition out of the equation, specifically in context of the iPhone and iPad. The chart below shows lowest, highest and average selling prices for these three product lines. Obviously, the ASP number for the Apple Watch is an estimate and I have it pegged here at roughly $550 though I’d say anything from $500-700 is entirely feasible and it may well end up being higher than $550:

What you see when you strip out the Edition versions is the Watch sits right around the same range as the other two products. The lowest price is between the lowest iPhone and iPad prices, the highest price is slightly higher than the highest iPhone price and, in my opinion, the ASP will end up right in the same range as the iPhone. The other thing worth bearing in mind is the impact that buying additional bands might have on the ASP of the Watch, which of course Apple won’t be reporting directly, at least for the time being anyway. My ASP above is based on a single band sales model, but of course there will be people who do buy more than one band.

But the point here is the Watch is going to end up priced at a similar level to the iPhone and iPad, which has a couple of implications. Firstly, with regard to affordability, the iPhone has a similar ASP and range of pricing but is, of course, heavily subsidized and/or sold on an installment basis in a number of big markets. As such, affordability for the iPhone at this price range is quite a different question from affordability of Watch at the same price. The iPad has a slightly lower price range, both in terms of high and low and in terms of the likely ASP, but it’s sold to consumers at full price in most cases, which means affordability is in some ways a better fit here for how to think about the Watch.

The reasons for the variability in pricing are quite different for the two existing product lines versus the Watch:

- Specs, specifically storage size and radios (LTE vs. WiFi only) are a major driver of differences in pricing in the iPhone and iPad ranges, but have no impact on the Watch, which has identical specs at all price points, including the Edition. I’d expect this to continue to be the case – as others have pointed out, specs (or “speeds and feeds”) have been entirely absent from Apple’s discussion of the Watch

- Age is the other major driver of differences in pricing within the iPhone and iPad ranges, with older versions commanding a lower price and enabling Apple to take these devices downmarket without sacrificing quality. It’s obviously too early to tell whether the same will happen with the Watch, especially given the existing very large range of price points just with a single year’s model, but it continues to be an effective way to bring the price down

- Materials and finishes the only major driver of Apple Watch price variability, with the aluminum/steel/gold question the major driver, but with materials and finishes in bands an important secondary one. Though iPhones and iPads have hitherto come in different colors, the materials have been the same, so this hasn’t been a driver of price differences. It’ll be interesting to see how this changes going forward – will we see solid gold versions of any other Apple products?

As this brief analysis suggests, the reasons for the price ranges are quite different today but that could easily change over time, with age (though likely not specs) becoming a factor in Apple Watch pricing, and materials becoming a factor in iPhone and iPad pricing. But, in some ways, there’s also a parallel between the materials and finishes driver and the specs driver, in that Apple tends to charge a far greater premium for bumps in both these areas than the underlying cost drivers dictate. In other words, Apple has always charged significantly more for the higher storage iPhones and iPads than the lower storage versions, even though the cost differential is very small, driving higher margins on those devices. Similarly, it’s likely the cost difference between aluminum, steel, and gold doesn’t justify the difference (or even the majority of the difference) in price between those ranges, especially when it comes to the Edition. As such, margins will similarly be higher on the more expensive devices, just as they are with the more expensive iPhones and iPads. In this way, even though the specifics of the drivers of higher price are different, the model could end up being very similar.

I’m intrigued to see what the early sales suggest about how the different versions are selling and what the average selling price ends up being. As I mentioned earlier, we won’t know for quite some time because the numbers will be lumped in with other products in Apple’s reporting. As I’ve said before, I believe in time Apple will likely break these numbers out once they’re big enough to boast about, so hopefully we’ll get more transparency and resulting insight eventually.

This will surely be obvious on Monday when Apple holds its scheduled announcement on the Apple Watch. It is an unusual event since Apple introduced the product in September. The Apple Watch was described and shown off in much detail, including all three designs and two sizes. What Apple has to talk about on March 9 is the apps and services.

This will surely be obvious on Monday when Apple holds its scheduled announcement on the Apple Watch. It is an unusual event since Apple introduced the product in September. The Apple Watch was described and shown off in much detail, including all three designs and two sizes. What Apple has to talk about on March 9 is the apps and services.

The approach is similar to the iPod and the iPhone. Let the competition experiment and make mistakes. Design an exquisite entry that works far better than anything in the market. Grab the market, selling to people who never even considered the competition.

The approach is similar to the iPod and the iPhone. Let the competition experiment and make mistakes. Design an exquisite entry that works far better than anything in the market. Grab the market, selling to people who never even considered the competition. Apple also minimizes design changes. I own a MacBook Air, a MacBook Pro and an iMac. The oldest of these is five years old (the durability, both in terms of performance and usefulness, is another wonder) but you would have to look very hard to find some minor design functions that differ them from current models.

Apple also minimizes design changes. I own a MacBook Air, a MacBook Pro and an iMac. The oldest of these is five years old (the durability, both in terms of performance and usefulness, is another wonder) but you would have to look very hard to find some minor design functions that differ them from current models. Apple’s stores have been brilliant. I remember when Apple opened its first store in Tyson’s Corner Mall, in Washington’s well-off Virginia suburbs in 2001. I was convinced it would be a flop. The store, in the mall’s prime location, was too big and too expensive. No one wanted to schlep a Mac home from a mall (Mac desktops and laptops were all there were).

Apple’s stores have been brilliant. I remember when Apple opened its first store in Tyson’s Corner Mall, in Washington’s well-off Virginia suburbs in 2001. I was convinced it would be a flop. The store, in the mall’s prime location, was too big and too expensive. No one wanted to schlep a Mac home from a mall (Mac desktops and laptops were all there were).

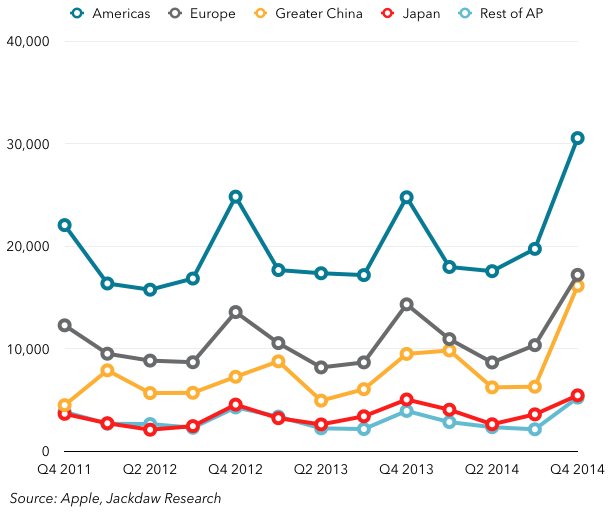

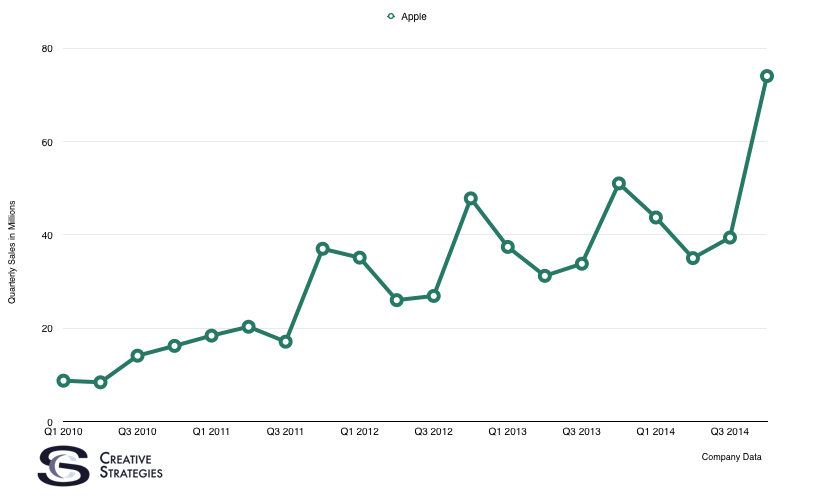

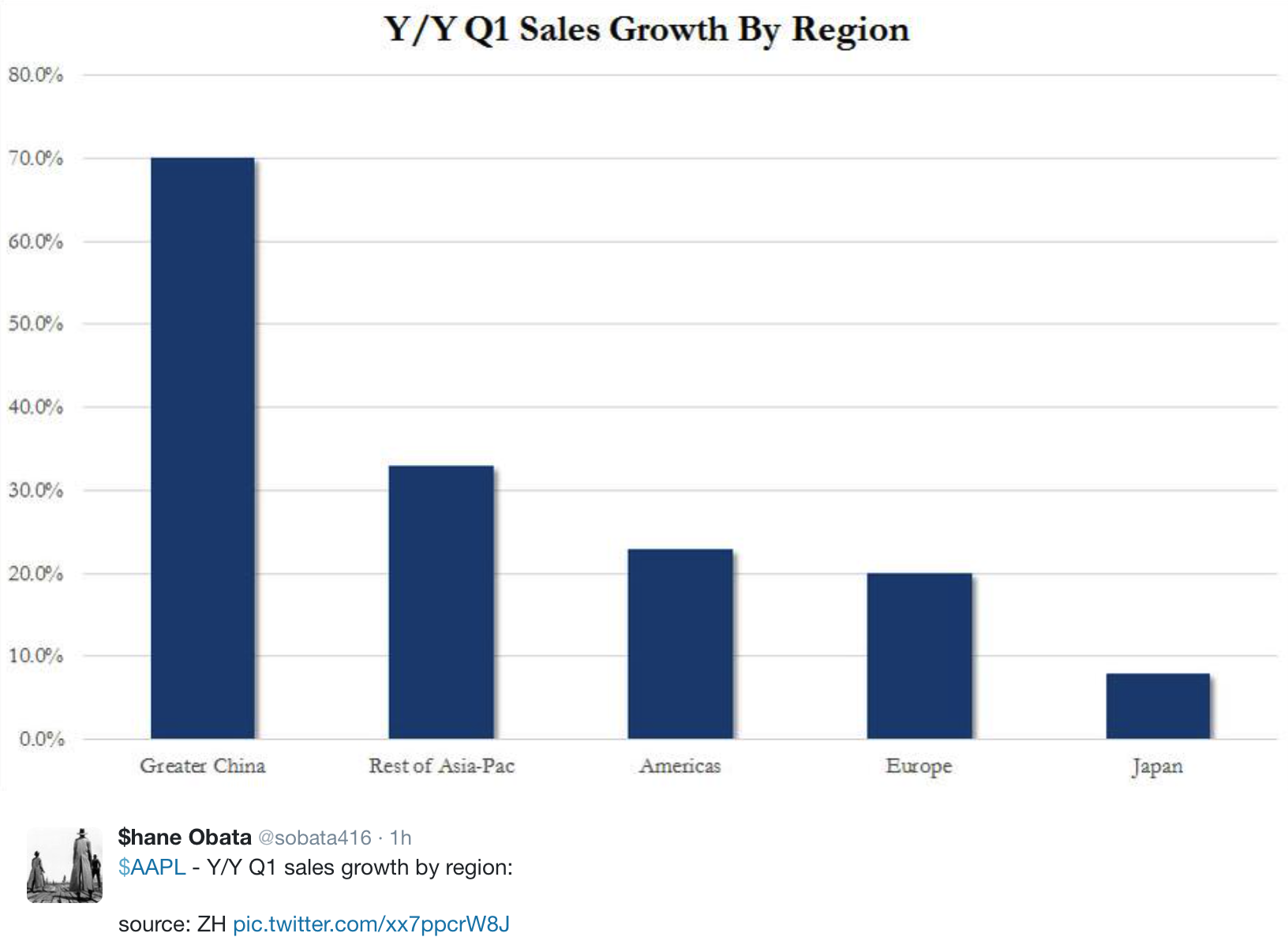

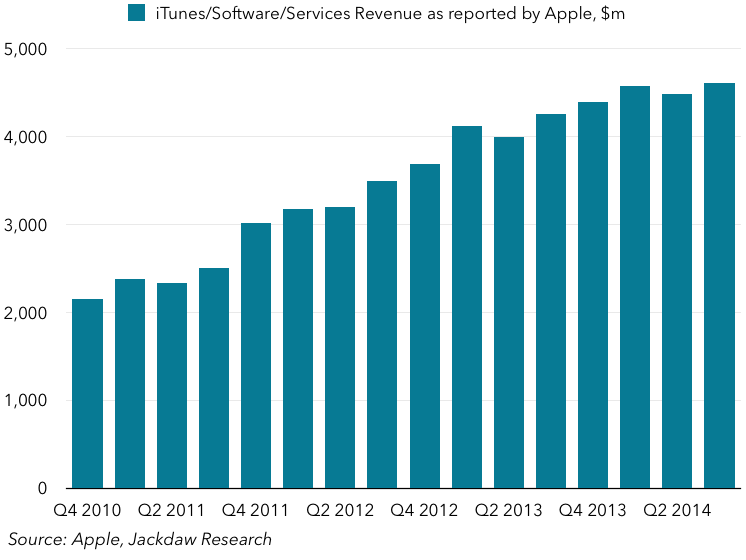

Apple had a big issue with the the first quarter of its fiscal year. True, it’s a problem most companies would love to have, but it’s still a problem: Apple has piled up far more profit than it can figure what to do with.

Apple had a big issue with the the first quarter of its fiscal year. True, it’s a problem most companies would love to have, but it’s still a problem: Apple has piled up far more profit than it can figure what to do with.

Consumer don’t want ads — they want deals. That is, in essence, what TapSense is offering. When you observe what drives behavior for many consumers today, you’d see it has everything to do with deals. Generally, deals come via email or even postal mail. Retailers have know for decades consumers who opt-in to their programs respond extremely well when offered a deal. This example of a Starbucks deal from TapSense shows the potential.

Consumer don’t want ads — they want deals. That is, in essence, what TapSense is offering. When you observe what drives behavior for many consumers today, you’d see it has everything to do with deals. Generally, deals come via email or even postal mail. Retailers have know for decades consumers who opt-in to their programs respond extremely well when offered a deal. This example of a Starbucks deal from TapSense shows the potential.