A few weeks ago, I went to NYC to be at the Windows 10 S launch. Leading up to the event, there had been many rumors floating around about a potential new OS from Microsoft on the horizon aimed at education that would take on Google’s Chrome OS. Various rumors suggested it would be called Windows Cloud or be a “skinny” version of Windows.

Now that Microsoft has unveiled this new OS, we know its official name is Windows 10 S and it is indeed aimed at education markets. However, Microsoft is also seeing interest from some enterprise accounts who like its tighter security. It could be used in deployments where a full version of Windows might be overkill for some workers.

Although this new OS is looked at as a lighter version of Windows and could especially be attractive to schools, I believe Windows 10 S is much more important to Microsoft’s future. In fact, Windows 10 S may actually eventually become the version of Windows used by most people in the coming years. Many people who use Windows 10 now do so because most of the PC apps they use are Windows-based and they need whatever the newest version of Windows is available today.

But if you talk to many IT users and especially consumers, Windows 10 is viewed as a very rich OS but they acknowledge that, in most cases, they probably use less than 30% of Windows’ actual power. On the other hand, there are many professionals in graphics, engineering, finance, government, etc. that are power users and, to them, a full blown version of Windows 10 is important to the work they do day in and day out.

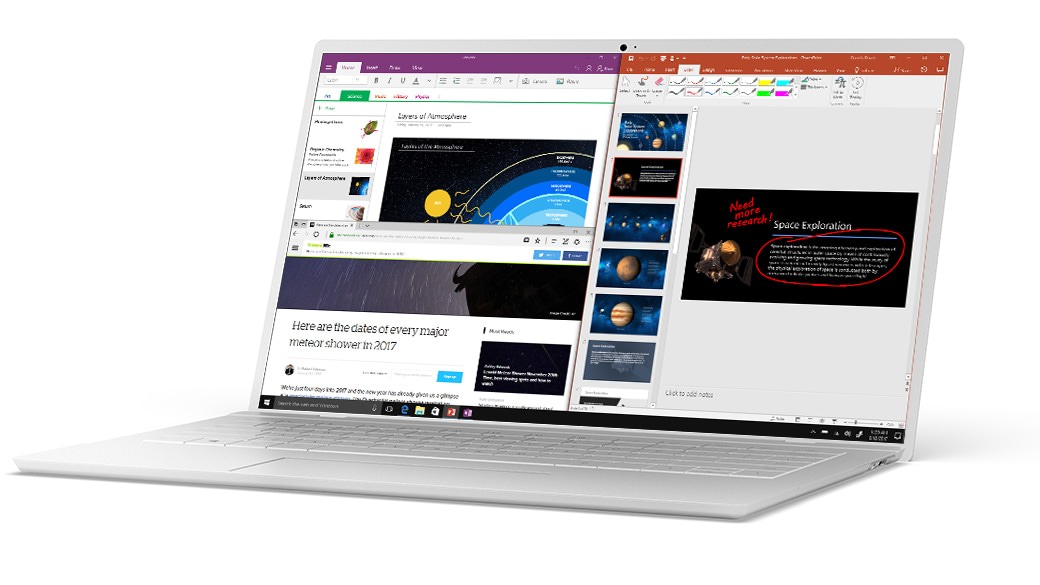

With Windows 10 S, Microsoft introduces a new metaphor for their apps. It has a new type of store that sandboxes these apps and only apps that are vetted can be purchased or downloaded to Windows 10 S. This adds a powerful new level of security compared to the ad hoc access and delivery of millions of Windows apps on the market today. Only apps in this store can run on Windows 10 S along with with web apps that use their Explorer browser.

Sounds familiar? It’s what Apple does with both the Mac and iOS app stores. All of their apps are vetted and sandboxed to increase security and give Apple more control of their ecosystem. The important idea is that, by creating a sandboxed store with only vetted apps, Microsoft can take more control of their app ecosystem and deliver a more secure environment to those who use Windows 10 S. This is one reason Windows 10 S could be more attractive to consumers and many IT customers as well as education.

When I think of Windows 10 S, it is easier for me to understand what this new OS’ goal is by thinking of it in terms of Mac OS and iOS. Today, macOS is really targeted at their power users while OS 10 is targeted at the masses.

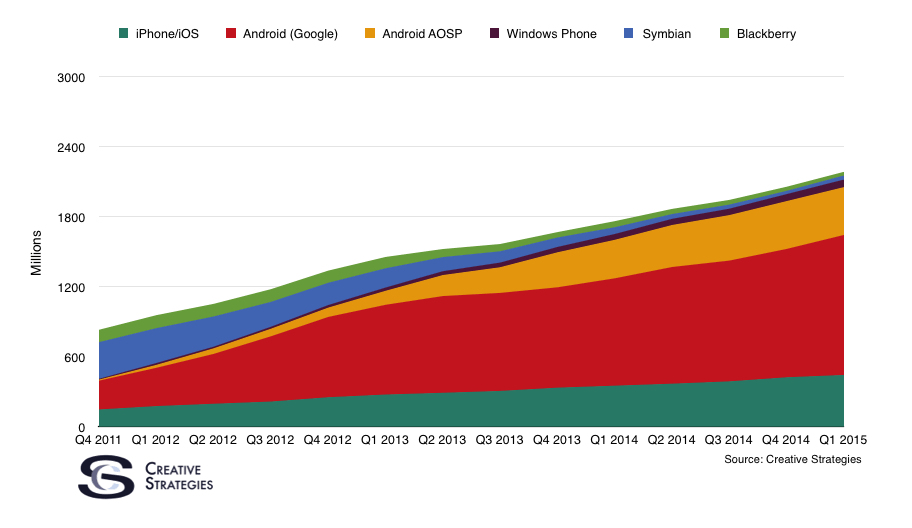

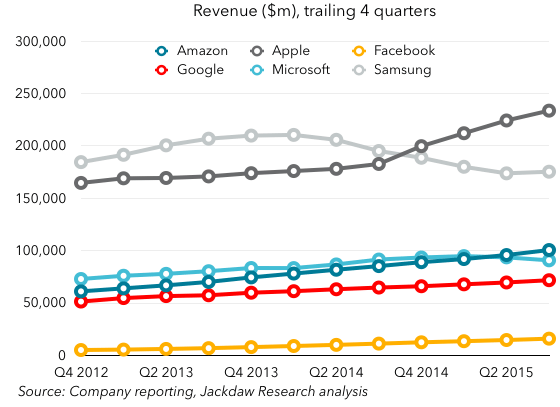

Of course, Apple is still bullish on the Mac and macOS continues to get richer in both features and functions. However, iOS-based devices dwarf Mac sales by a scale of 13X per quarter. In that sense, Apple has already transitioned their core market to iOS and, with the new iPad Pro with keyboard, they are giving users a better option for using iPads for productivity.

Of course, Windows machines used on PC’s are still selling well and the ASPs on Windows hardware has continued to decrease over the last 5 years. But even with lower ASPs, the PC market continues to shrink and we estimate in calendar 2017 vendors will only sell about 275 million PCs compared to Apple selling at least 300+ million iOS devices this year.

To be fair, most of Apple’s iOS device sales are coming from iPhone. iPads represent only about 20% of overall iOS sales. However, Apple sees iOS as their most important OS and is banking on it to drive sales of their smartphones and tablets in the future into every market they compete in around the world.

One key reason for iOS’ existence is that, while it is a powerful OS in its own right, it was designed for a much smaller form factor than a PC. In starting with a small form factor and then introducing larger hardware with the iPad, Apple could scale this OS up and make it even more powerful for use in larger iPads and perhaps even a small laptop of their own in the future. However it uses the same source code as the Mac.

With Microsoft’s Windows 10 OS, Microsoft is doing something I had recommended to the Windows mobile group 12 years ago when I worked on that project for them. At the time, there were two distinct OS camps. One was focused on just Windows and the other was given the charter to create a new mobile OS from scratch. I felt they needed to scale down Windows and use it as the core for Windows mobile but that is not what happened. Besides some political squabbles that kept the two groups apart, I was told the OS core of Windows back then could not be scaled down and used for a mobile OS.

But, over the last 10 years, I am told the Windows base OS has become much more portable and this has made it possible to create a version of Windows that can be used more like a skinny version yet be as powerful a product for many who never need the full power of a robust version of Windows 10.

While the comparison of Windows 10 S to Apple’s iOS is not exactly accurate, it still helps me think about Windows 10 S in terms of its market promise. This is an OS that, with its sandboxed apps, greater security and streamed down Windows OS capabilities, gives Microsoft the type of OS that will be very attractive to education, IT users and, most likely, a larger mass market audience. (BTW, I wonder if Microsoft realizes 10 S is very close to iOS.) And, because it appears to be a more scalable version of Windows, it could be used not only for less expensive PC’s but also new types of Windows hardware including 2-in-1s, tablets, and maybe even smartphones.

Microsoft also makes it possible for a Windows 10 S owner to upgrade to a full version of Windows 10 for about $30. This is not something Apple could do with OS 10 and it will force them to keep the Mac OS and iOS as separate operating systems. But should a Windows 10 S user eventually need more power to handle their workloads, this upgrade path will be very attractive, especially if it is used on a laptop or 2-in-1.

While Windows 10 will dominate the PC landscape for at least the next two to three years, I see Microsoft eventually transitioning their market to Windows 10 S to give their users a more secure OS platform and, more importantly to Microsoft, allow them them to take more control of their ecosystem. In the end, this could benefit both Microsoft and their customers in many ways.

I see Windows 10 S as one of Microsoft’s most important new operating systems for the end of this decade and central to their future well into the next.

It’s hardly a surprise Microsoft has finished off the job of replacing its top managers. The company has been changing leadership considerably for the past year as a big sign of a company finally moving forward well. But it is somewhat striking that, in an industry where changing senior leadership in the biggest companies has been minimal, Microsoft has been mostly promoting the new.

It’s hardly a surprise Microsoft has finished off the job of replacing its top managers. The company has been changing leadership considerably for the past year as a big sign of a company finally moving forward well. But it is somewhat striking that, in an industry where changing senior leadership in the biggest companies has been minimal, Microsoft has been mostly promoting the new.

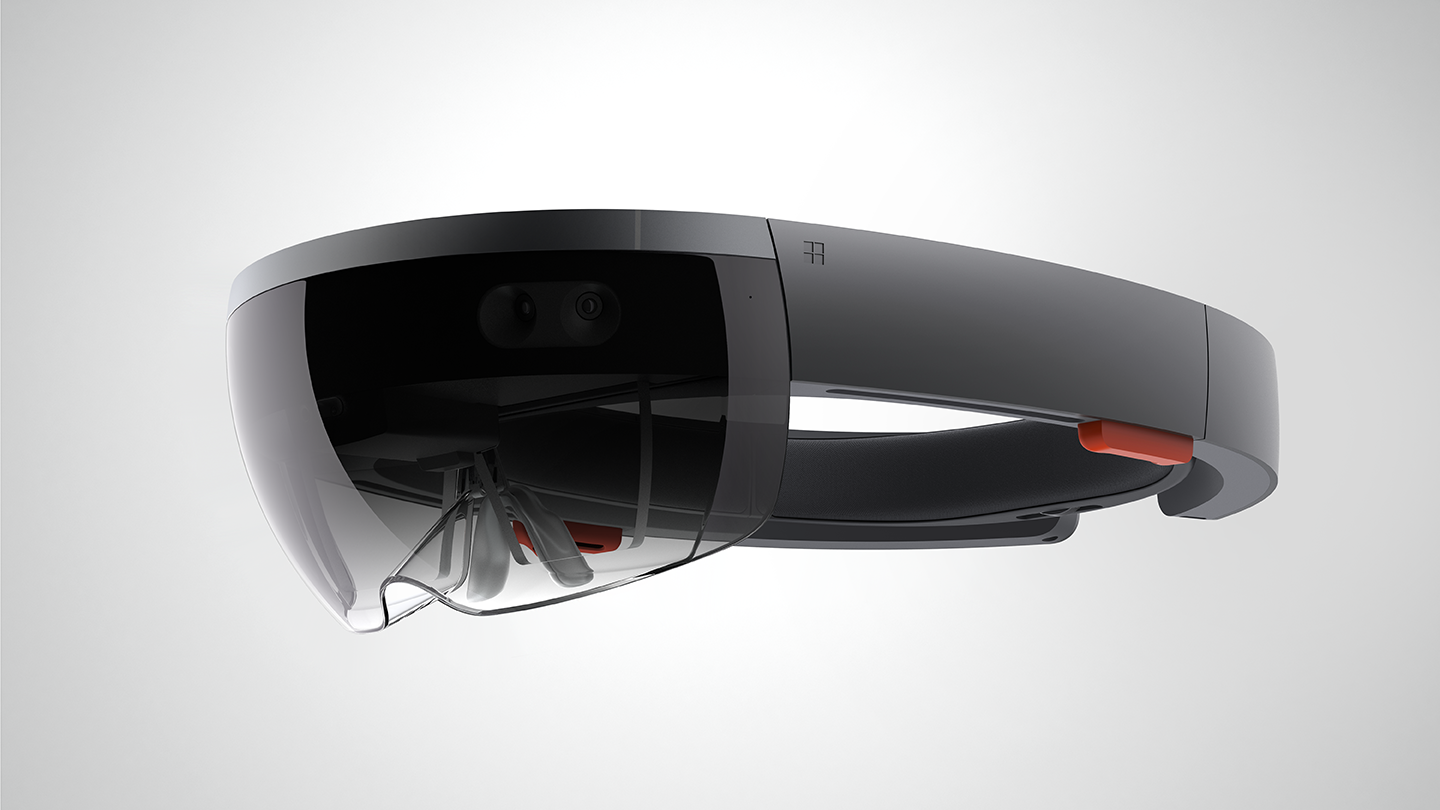

The choice of new executives is part of yet another organization of Microsoft, but one that appears to represent the direction Nadella really wants to go. Windows is hardly going away as a top unit–it remains far too important for that. But Terry Myerson takes charge of a new Windows and Devices Group, combining the key operating system with the devices functions run by Elop. It includes Lumia phones, Surface, Surface Hub, HoloLens, Band, and Xbox. Myerson, a software and engineering specialist, has been with Microsoft when Intersé, his company, was acquired in 1997, and has been a big player in phones and Windows.

The choice of new executives is part of yet another organization of Microsoft, but one that appears to represent the direction Nadella really wants to go. Windows is hardly going away as a top unit–it remains far too important for that. But Terry Myerson takes charge of a new Windows and Devices Group, combining the key operating system with the devices functions run by Elop. It includes Lumia phones, Surface, Surface Hub, HoloLens, Band, and Xbox. Myerson, a software and engineering specialist, has been with Microsoft when Intersé, his company, was acquired in 1997, and has been a big player in phones and Windows.