I have a very long history when it comes to being involved with laptop designs. In 1984, as part of my consulting work with IBM, I was asked to be part of the team that worked on their first laptop. The core design team was based in Austin in those days but for months this team and another in Atlanta would go to IBM’s Boca Raton facility where they would work on the original design of this forerunner of their ThinkPad line. At least twice a month, I would fly to Boca Raton to meet with them, review the work and give input from a mobile researcher and user standpoint.

Since our research had a strong mobile user focus, I also got involved with laptop research design work with many of the PC clone companies back then and got to see up close how portable computers evolved from sewing machine-styled designs to the clamshell form factors we still have today. However, I have been surprised that, given that clamshells came into the market in 1985 via the original Panasonic laptop, clamshells are still the dominant mobile computing form factor.

The good news is that, over time, the screens have gotten better and now are touch sensitive, their battery life is longer, there are more storage options and they are lighter and thinner. But they are still clamshells. Not that this is bad. This form factor has proven to work well but I believe there at least needs to be more innovation applied to this design if it is to remain the dominant one for mobile productivity.

Of course, Microsoft could argue their Surface has broken the mold of the clamshells and represents an important innovation in portable computing. But all it really is is a large tablet with a keyboard. Together, it is still clamshell-like in its overall design. A few weeks back, I wrote a piece that talked about how Lenovo’s Yogabook was an example of a radical design with two screens and provided a greater level of versatility in portable computing. I have also been talking to some OEMs who have suggested they are working hard to go beyond the clamshell designs and make their mobile devices more powerful and more versatile as well.

While I am excited that OEMs are trying to break the clamshell mold and create some new portable computing designs for the future, I am pretty sure the clamshell is not going away soon. If true, then we need more innovation in this form factor.

One of the more practical innovations I have seen recently comes from HP in a new laptop they have that has a virtual privacy screen. If you are working on a laptop on a plane or in areas where people are sitting right next to you, it is good to have a privacy screen on your laptop so that only you can see what is on your display. Privacy screens you can place over a display have been around for decades but HP has a unique hardware and software solution that, at a touch of a button, gives the display a privacy filter. This is a brilliant idea and I wish all laptop makers would add something like this to their laptops.

Another important innovation comes through next-generation cameras such as Intel’s Real Sense camera appearing in some high-end laptops today. This adds 360-degree images to the mobile experience and, over time, could become an important vehicle for user created content for AR and VR.

I also see innovation coming through Microsoft’s Hello and its link to advanced biometrics. Biometrics can help deliver another level of security to a laptop design and add multiple levels of authentication through iris scanning and next-gen fingerprint readers. In this day and age, where local information on a laptop needs even greater protections, biometrics is an important advance in keeping our laptops more secure.

There is also some interesting work going on in eye tracking and, with the addition of Cortana on Windows and Siri on Macs, voice adds another dimension to the navigational functions in laptops.

One last innovation to mention is waterproof keyboards. Dumping coffee or soda on a keyboard happens more often than one would think and unprotected keyboards get fried when this happens. Lenovo and others have introduced various models with waterproof keyboards and I think this should be a default feature on all laptops.

These new technologies are a good way to innovate on a clamshell platform but I would like to see even greater innovation, including the addition of VR and AR within these PC operating systems. While I actually hope someone comes up with a really radical design in laptops, clamshell portable PCs will be here for at least another decade, I hope the vendors who make these mobile computers never stop innovating.

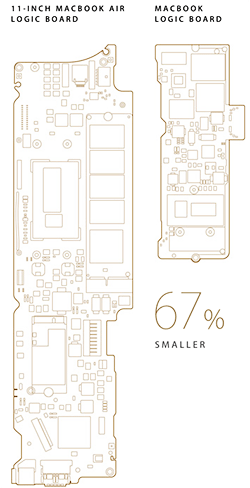

The motherboard is stunningly tiny, even in comparison to the MacBook Air. Until iFixit gets a chance to tear one down, we won’t know how Apple has revised the choice and design of components to achieve this miniaturization, but it is impressive.

The motherboard is stunningly tiny, even in comparison to the MacBook Air. Until iFixit gets a chance to tear one down, we won’t know how Apple has revised the choice and design of components to achieve this miniaturization, but it is impressive.