In the spirit of full non-disclosure, the # 1 reason I did not go to MWC was I was invited to speak at a conference in Maui. I accepted that engagement rather than spend four days walking MWC’s aisles in Barcelona, jostling among 90,000 people who all want to get close to new slabs of glass being showcased at this event. I also was promised some free time to sit on the beach and contemplate the universe. The option of this peace and quiet overruled any potential pull towards Barcelona. Don’t get me wrong, I love Barcelona the city, but MWC’s draw paled in comparison to Maui.

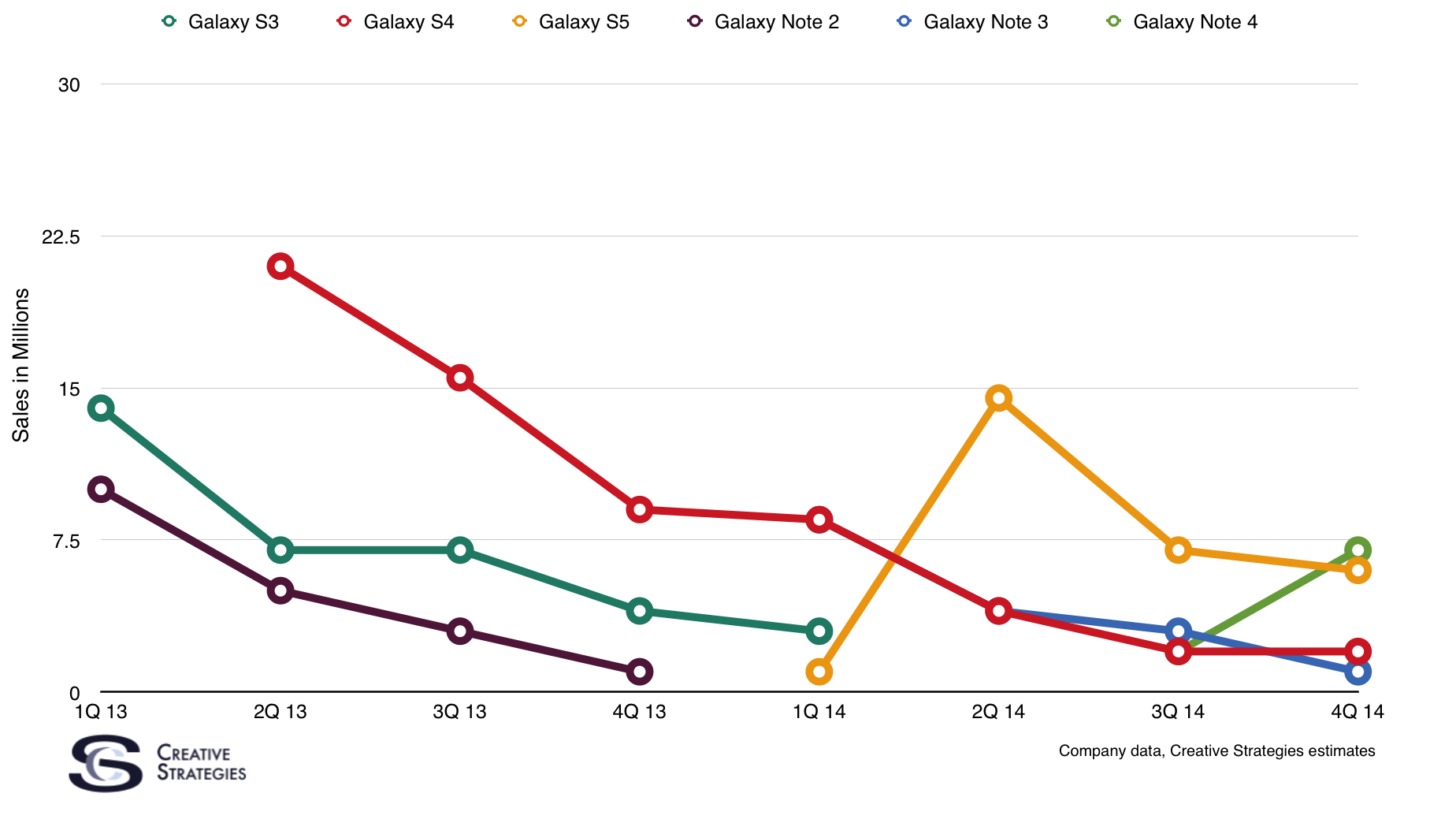

The second reason is I get to see most of the top smartphones being announced at the show in the privacy of hotel suites in the US and get one on one time with company execs in these settings. By the time Samsung unveiled their new Galaxy 6 devices, I already had a week to drool over the Galaxy Edge and try to put some analysis around its potential impact in the market. The Galaxy Edge was the best new smartphone announced at the show and it clearly puts Samsung back into the premium smartphone market and should help people forget the Galaxy S5 that flopped last year.

However, even if I had not had the Maui opportunity I would have bypassed MWC for another major reason. As my colleague Bob O’Donnell posted on Tuesday, the show was basically hardware specific. Besides the Galaxy Edge, there was very little innovation in devices at this show. I encourage you to read Bob’s first hand observations and analysis as he brings up one of the big things I think threatens the long term viability of MWC — the show is hardware-centric with very little innovation. After a while, all you are looking at are pieces of glass in various shapes and sizes all doing the same basic thing.

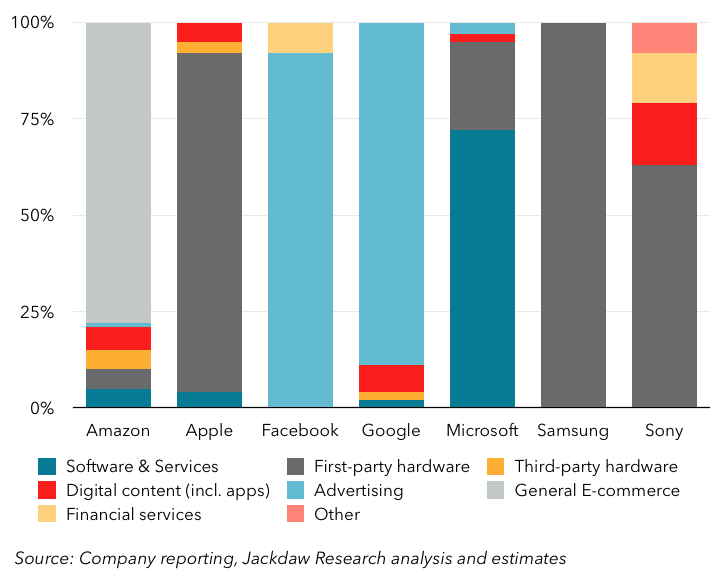

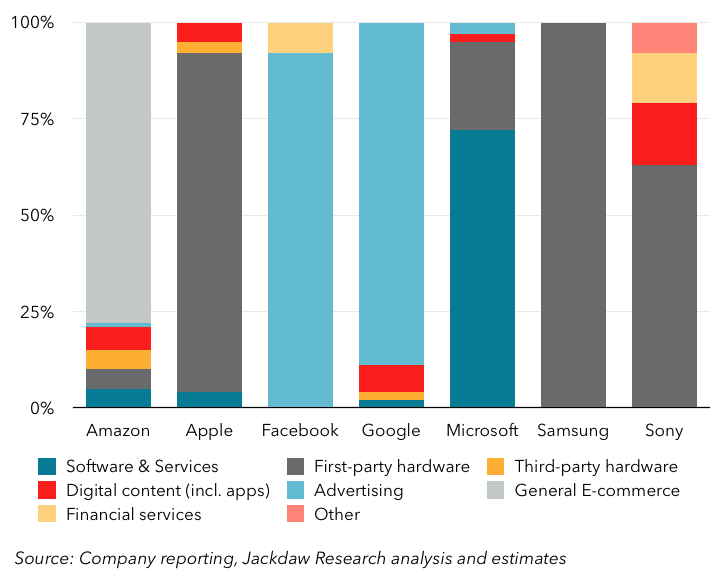

The other real problem about this show is the real trend is not in hardware but in software and services. Many of my friends who went to the show told me that finding anything interesting and innovative in software and services was pretty much a lost cause at this year’s MWC. This is very troubling to me. If you look at Apple’s success, software and services combined into an ecosystem has been critical to their growth and profitably.

The same goes for Xaomi in China. They have their own stores, music services, video services, etc., and are innovating a lot around software. We see this from Micro Max in India, Cherry Mobile in the Philippines, and many other countries where they are innovating with software — especially eCommerce services. The bottom line is Samsung, Huawei, HTC, and many others have all launched products but the focus on the user experience, software, and ecosystem is almost completely absent.

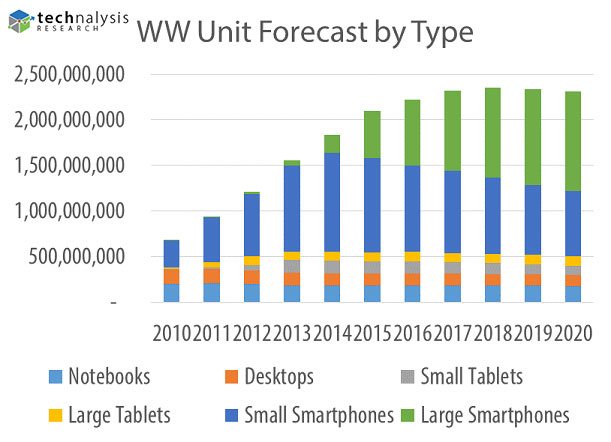

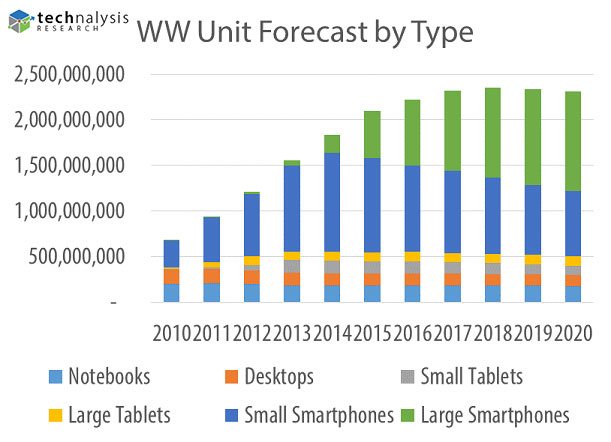

As Bob O’Donnell points out, at the user interface level we need to see new ways to interact with these devices including things like gestures, more tactile devices and better UI experiences. The event must show off how various countries are innovating in software and services, especially at the local level if it wants to keep the interest of thousands of people trekking to Barcelona year after year. I just can’t see how a hardware focused show can grow if it just keeps showing us the same thing over and over with minimal tweeks to their designs and not showcase where the real innovation in software and services are headed, especially in emerging markets where all the growth will be the coming years.

The approach is similar to the iPod and the iPhone. Let the competition experiment and make mistakes. Design an exquisite entry that works far better than anything in the market. Grab the market, selling to people who never even considered the competition.

The approach is similar to the iPod and the iPhone. Let the competition experiment and make mistakes. Design an exquisite entry that works far better than anything in the market. Grab the market, selling to people who never even considered the competition. Apple also minimizes design changes. I own a MacBook Air, a MacBook Pro and an iMac. The oldest of these is five years old (the durability, both in terms of performance and usefulness, is another wonder) but you would have to look very hard to find some minor design functions that differ them from current models.

Apple also minimizes design changes. I own a MacBook Air, a MacBook Pro and an iMac. The oldest of these is five years old (the durability, both in terms of performance and usefulness, is another wonder) but you would have to look very hard to find some minor design functions that differ them from current models. Apple’s stores have been brilliant. I remember when Apple opened its first store in Tyson’s Corner Mall, in Washington’s well-off Virginia suburbs in 2001. I was convinced it would be a flop. The store, in the mall’s prime location, was too big and too expensive. No one wanted to schlep a Mac home from a mall (Mac desktops and laptops were all there were).

Apple’s stores have been brilliant. I remember when Apple opened its first store in Tyson’s Corner Mall, in Washington’s well-off Virginia suburbs in 2001. I was convinced it would be a flop. The store, in the mall’s prime location, was too big and too expensive. No one wanted to schlep a Mac home from a mall (Mac desktops and laptops were all there were).

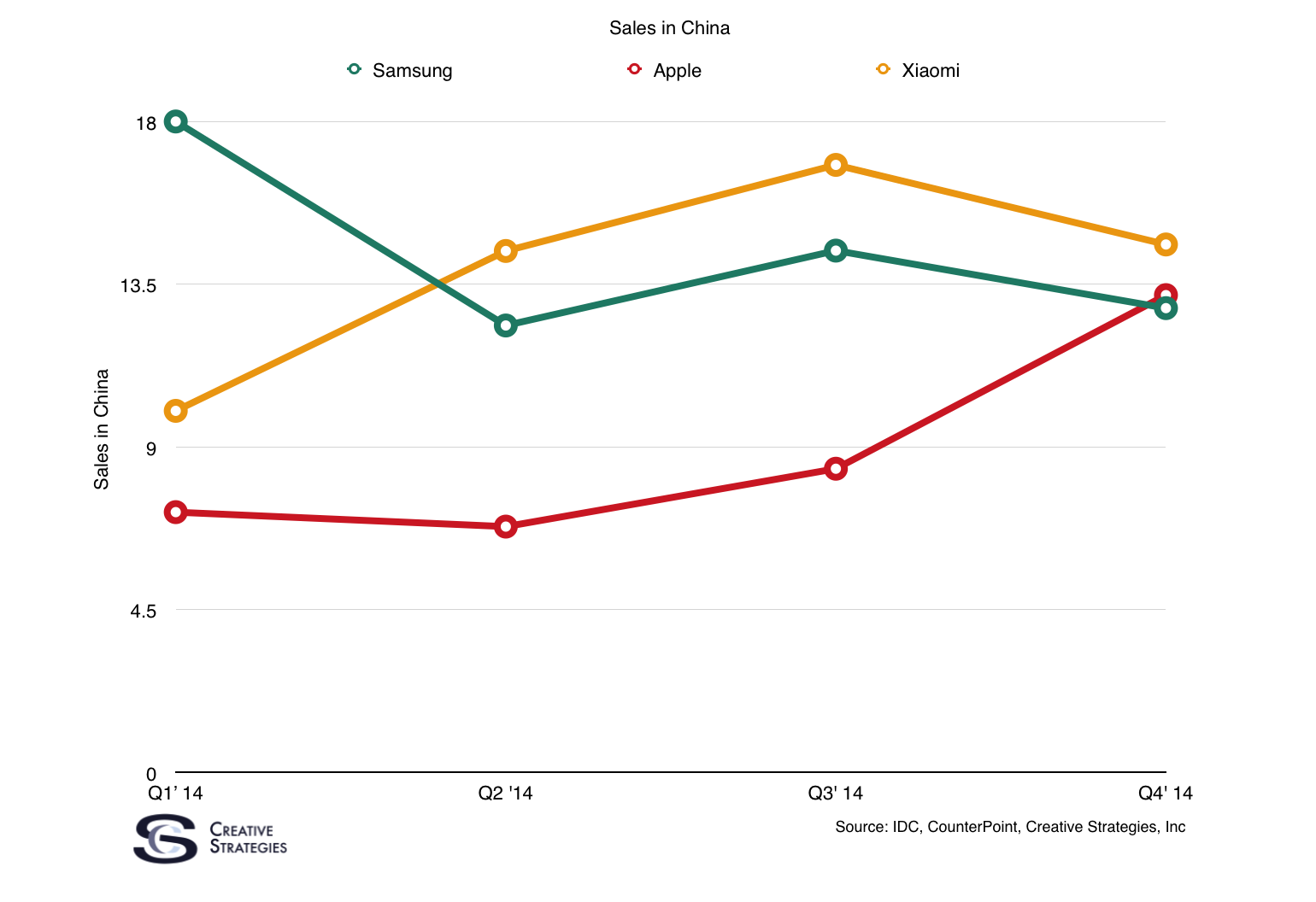

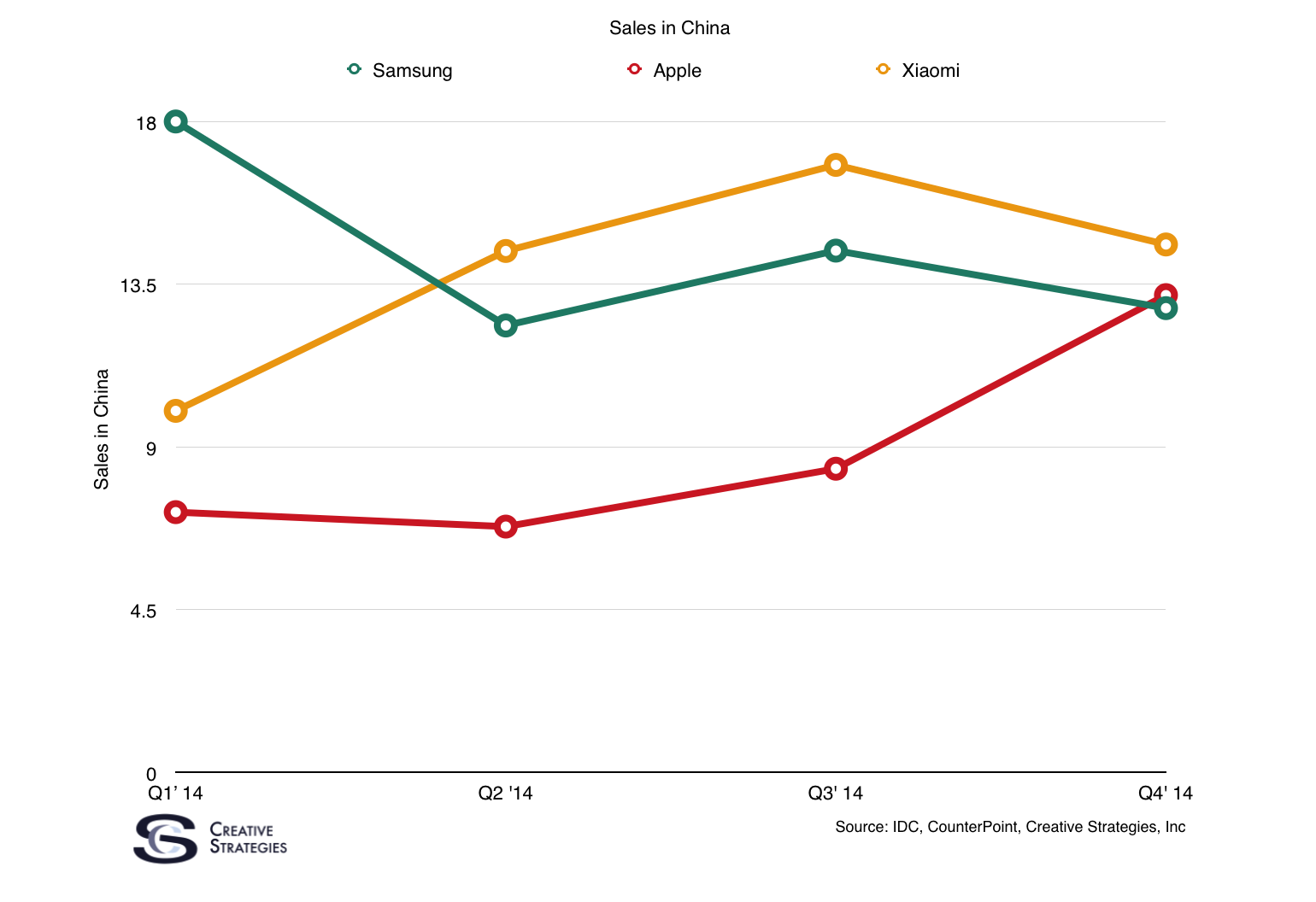

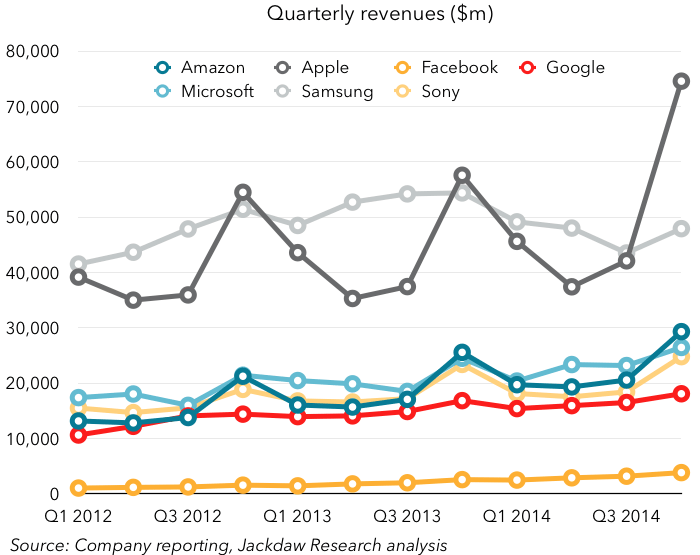

For most of these large Android vendors, growth rates from Q3 to Q4 this year were significantly worse than Q3 to Q4 rates last year. Lenovo (excluding Motorola) and Xiaomi were particularly badly hit, with most of their shipments in China, but Samsung and LG also saw quarter on quarter declines. Among vendors, only Huawei and Sony managed to weather the iPhone’s impact. At Samsung of course, there are longer term challenges at play but, for most of these vendors, the iPhone accounts for a substantial portion of the impact.

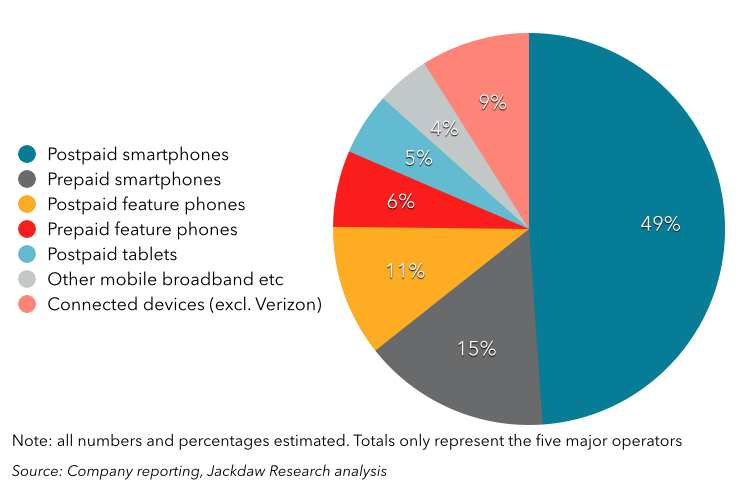

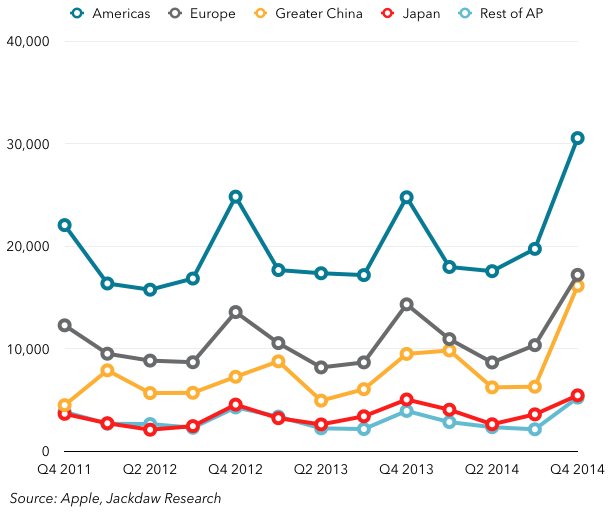

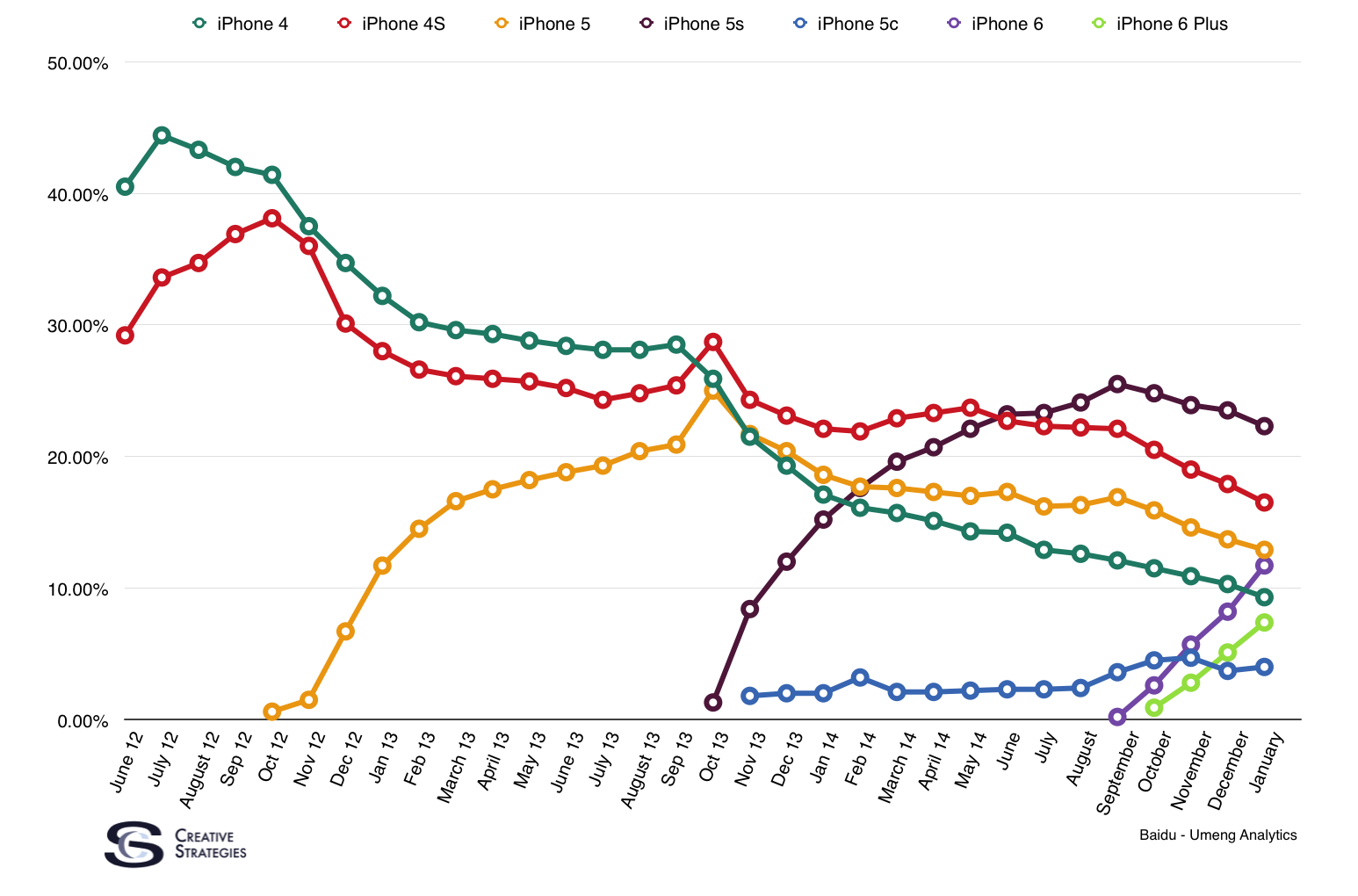

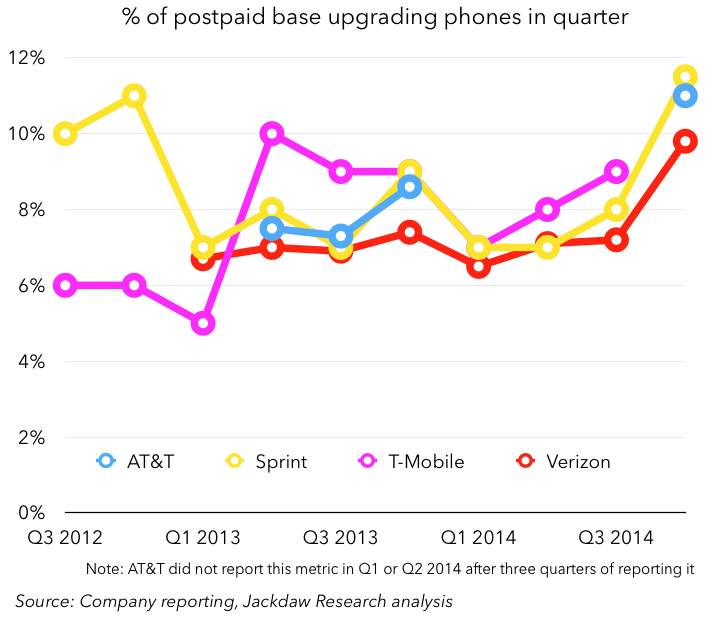

For most of these large Android vendors, growth rates from Q3 to Q4 this year were significantly worse than Q3 to Q4 rates last year. Lenovo (excluding Motorola) and Xiaomi were particularly badly hit, with most of their shipments in China, but Samsung and LG also saw quarter on quarter declines. Among vendors, only Huawei and Sony managed to weather the iPhone’s impact. At Samsung of course, there are longer term challenges at play but, for most of these vendors, the iPhone accounts for a substantial portion of the impact. All three of the big carriers have reported a higher percentage of upgrades than in any quarter in the past three years and I would expect T-Mobile to join them. Several factors play into this. The iPhone 6 and 6 Plus obviously drove a big iPhone upgrade cycle, but another major factor was the move to installment-based billing. There’s been quite some debate about whether this new model will stimulate or slow smartphone sales, but this quarter it was a huge factor for all carriers and they all sold tons of smartphones as a result. In Q4 alone, the four big carriers likely sold almost 40 million smartphones between them. Despite this upgrade behavior, however, the vast majority of the subscribers these carriers added in the quarter were not new smartphone lines, but tablets and “connected devices” (machine to machine subscriptions, e-readers and the like).

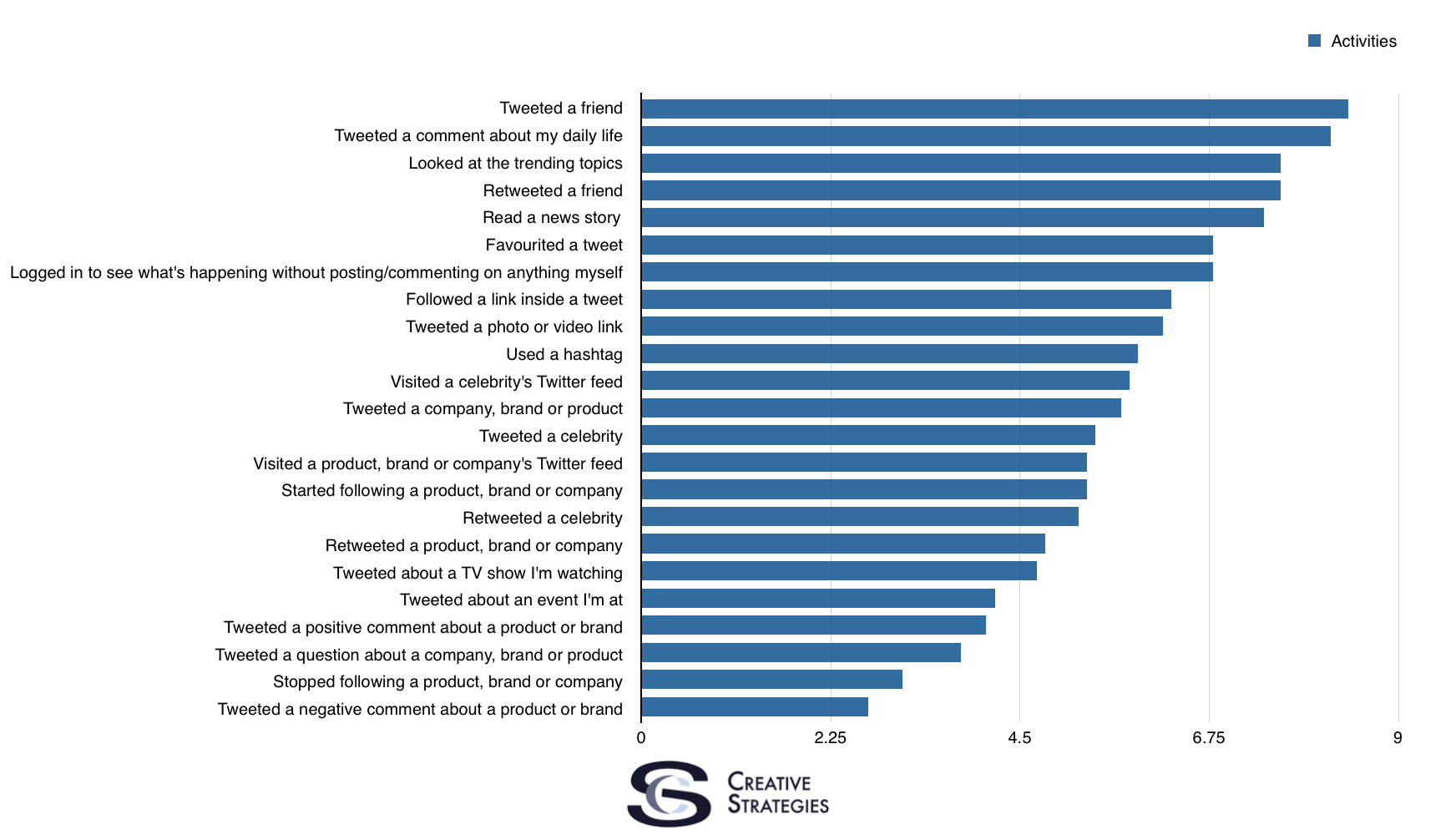

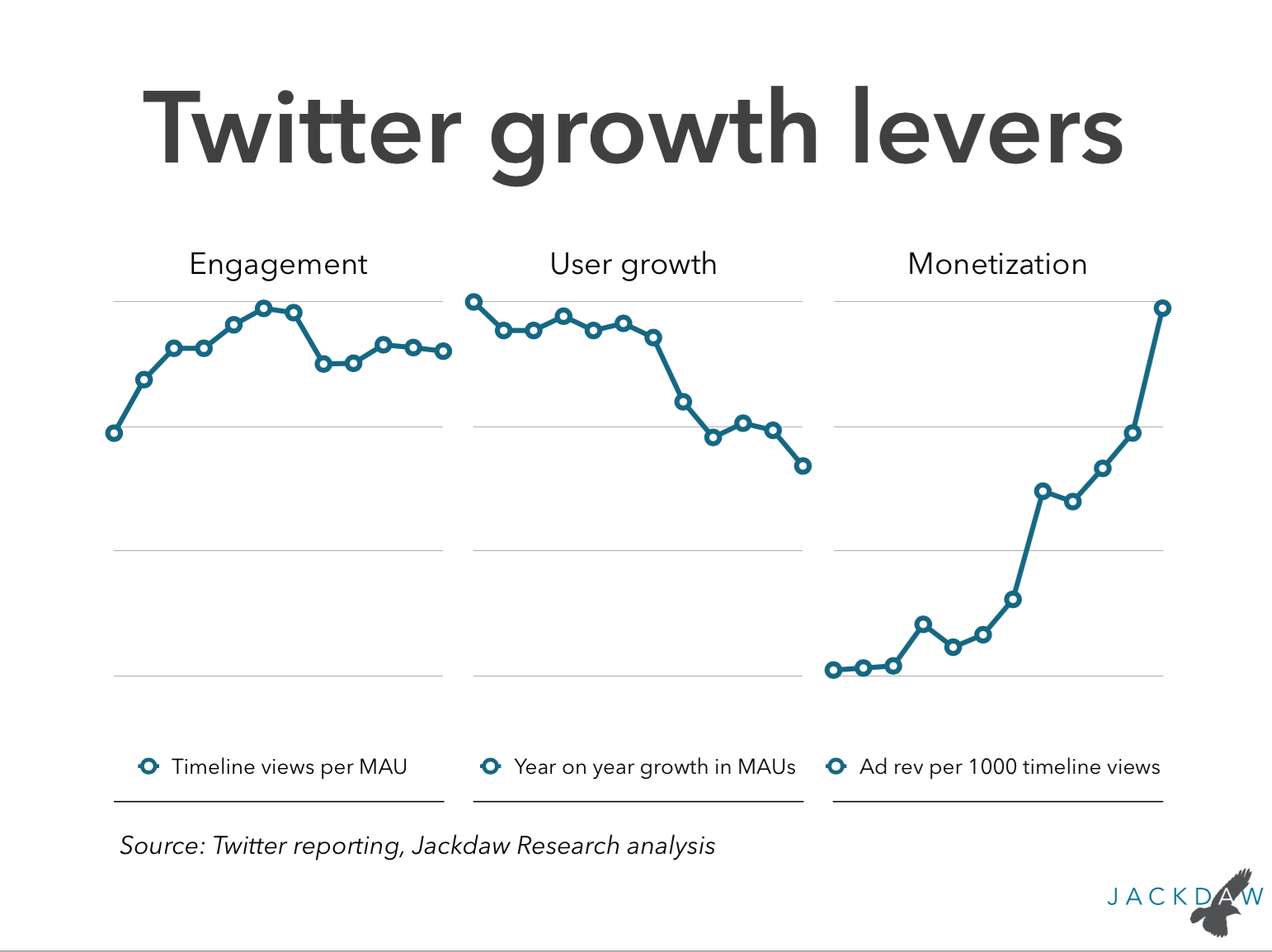

All three of the big carriers have reported a higher percentage of upgrades than in any quarter in the past three years and I would expect T-Mobile to join them. Several factors play into this. The iPhone 6 and 6 Plus obviously drove a big iPhone upgrade cycle, but another major factor was the move to installment-based billing. There’s been quite some debate about whether this new model will stimulate or slow smartphone sales, but this quarter it was a huge factor for all carriers and they all sold tons of smartphones as a result. In Q4 alone, the four big carriers likely sold almost 40 million smartphones between them. Despite this upgrade behavior, however, the vast majority of the subscribers these carriers added in the quarter were not new smartphone lines, but tablets and “connected devices” (machine to machine subscriptions, e-readers and the like). Meanwhile, Twitter reported just 230 million mobile MAUs, a number that has barely moved since last quarter (its overall MAU number didn’t grow by much either). These numbers just reinforce the difference in scale and breadth of appeal for Twitter and Facebook in their core products. But this doesn’t tell the whole story. Facebook’s entire product is private and based on being logged in to an account. But Twitter’s product is inherently public. So much of the exposure most people get to Twitter is not through the core service itself but through embedded tweets, hashtags on TV, and so on. Twitter is at a crossroads in terms of its user growth: it clearly believes it can get MAU growth going again, but even if it does, it’s simply not going to be on a trajectory to reach Facebook (or Google) scale. But Twitter’s management seems to believe it can capture another kind of audience that isn’t logged in (and may not even have an account). It already attracts a pretty significant audience this way but it makes almost no effort to monetize it yet. That’s the next challenge for Twitter.

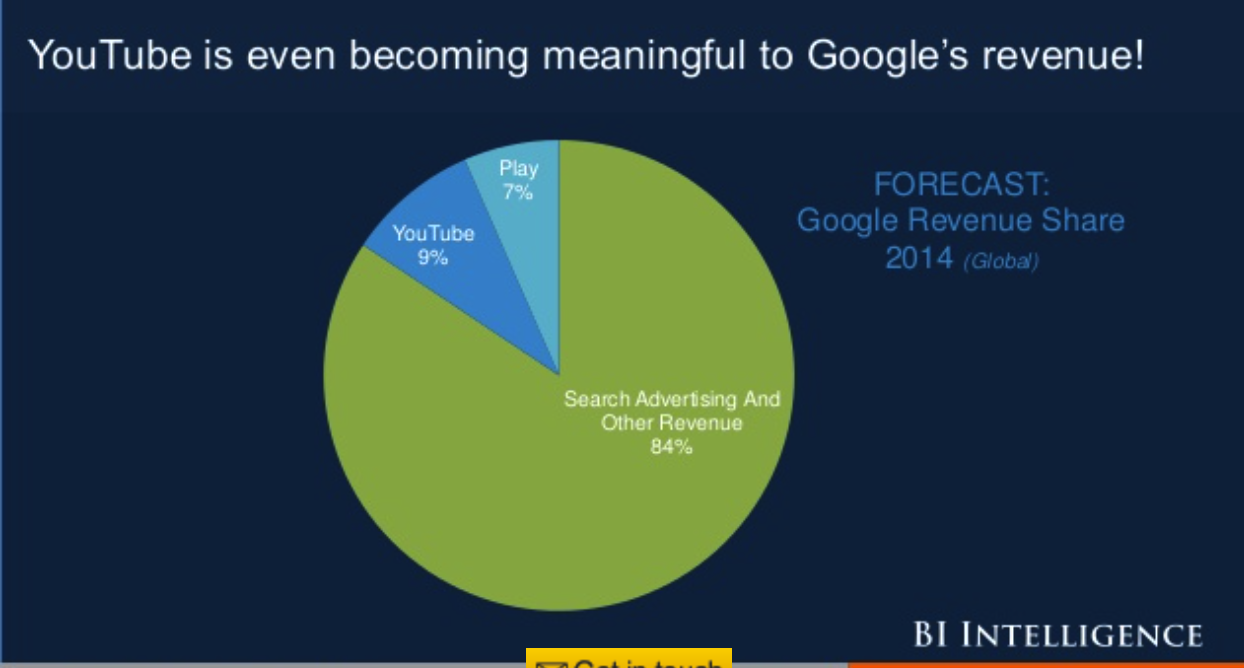

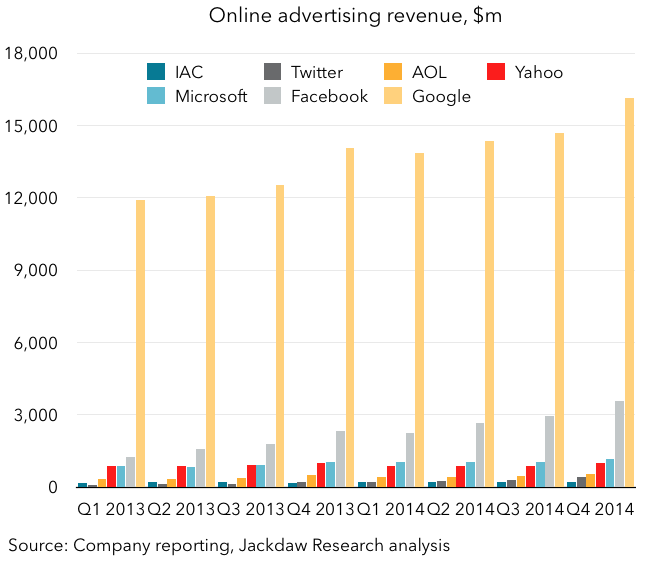

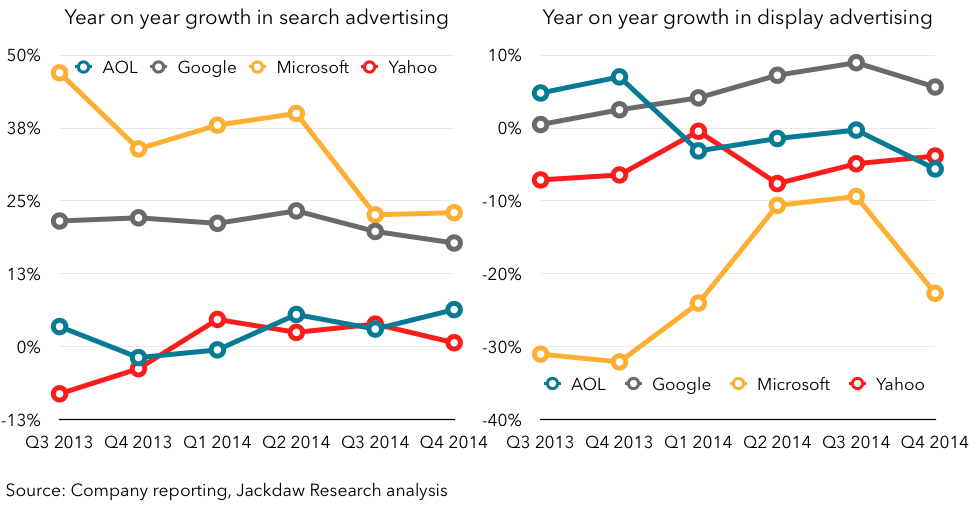

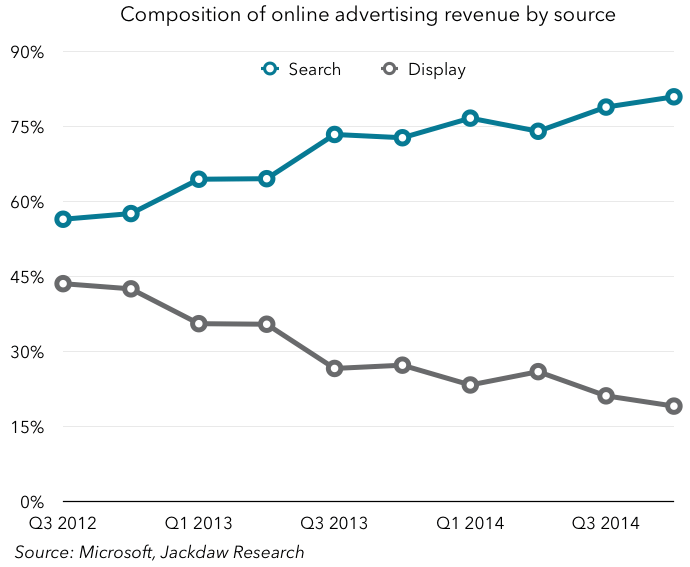

Meanwhile, Twitter reported just 230 million mobile MAUs, a number that has barely moved since last quarter (its overall MAU number didn’t grow by much either). These numbers just reinforce the difference in scale and breadth of appeal for Twitter and Facebook in their core products. But this doesn’t tell the whole story. Facebook’s entire product is private and based on being logged in to an account. But Twitter’s product is inherently public. So much of the exposure most people get to Twitter is not through the core service itself but through embedded tweets, hashtags on TV, and so on. Twitter is at a crossroads in terms of its user growth: it clearly believes it can get MAU growth going again, but even if it does, it’s simply not going to be on a trajectory to reach Facebook (or Google) scale. But Twitter’s management seems to believe it can capture another kind of audience that isn’t logged in (and may not even have an account). It already attracts a pretty significant audience this way but it makes almost no effort to monetize it yet. That’s the next challenge for Twitter. This illustrates the divergence nicely, because this is happening across major companies that play in the advertising space, whether Google, Yahoo, IAC, AOL or whoever. Display ad prices are falling, clicks aren’t growing as fast, and the business is generally performing much worse than other forms of online advertising. Meanwhile, search continues to be a very lucrative business for those who offer it, notably Google (though even there, there are signs of challenges). But the other major growth areas are native advertising, whether at Facebook or Twitter or news sites such as Buzzfeed, and video advertising, which is obviously already a huge business at YouTube, but is also increasingly important at Facebook, which now reports 3 billion views a day. Of course, Twitter and Snapchat both recently announced video products both for users and advertisers, and Instagram has tweaked its video product too. Video will be increasingly important for these companies in generating ad revenue, especially as non-native display advertising continues to suffer.

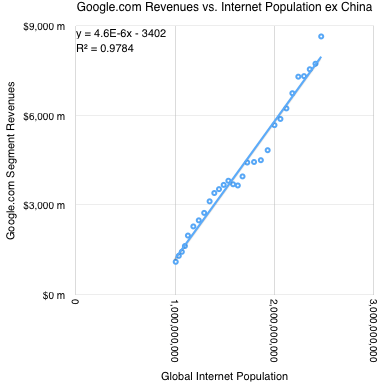

This illustrates the divergence nicely, because this is happening across major companies that play in the advertising space, whether Google, Yahoo, IAC, AOL or whoever. Display ad prices are falling, clicks aren’t growing as fast, and the business is generally performing much worse than other forms of online advertising. Meanwhile, search continues to be a very lucrative business for those who offer it, notably Google (though even there, there are signs of challenges). But the other major growth areas are native advertising, whether at Facebook or Twitter or news sites such as Buzzfeed, and video advertising, which is obviously already a huge business at YouTube, but is also increasingly important at Facebook, which now reports 3 billion views a day. Of course, Twitter and Snapchat both recently announced video products both for users and advertisers, and Instagram has tweaked its video product too. Video will be increasingly important for these companies in generating ad revenue, especially as non-native display advertising continues to suffer.