This is the last in my series of posts on big technology companies in 2015. From next week on, I’ll be moving on to new topics.

Core user growth

Facebook should see continued growth in its key user metric, monthly active users, in 2015. Growth has slowed a little, as the chart below shows, but it continues to add over 150 million monthly active users year on year and, importantly, a greater and greater percentage of those monthly users are also daily users, which is a key engagement metric for Facebook. Facebook does face some headwinds, since it continues to struggle to win new users and increase engagement, in Asia in particular, and it already has a very high penetration in much of Europe and North America. Core growth, though, will continue at a decent clip in 2015.

Advertising revenue growth

The biggest question facing Facebook’s core revenue in 2015 is the degree to which app-install ads are driving mobile advertising revenue and the extent to which that growth is sustainable. Facebook’s mobile advertising revenue has been growing enormously since it launched but a variety of sources have suggested the bulk of that revenue comes from in-app installs. I’ve written elsewhere about the risk this entails if it’s true. There’s only so much revenue available from app developers, since the app revenue opportunity itself is only so big. Facebook’s response to all this is twofold: first, app-install ads aren’t “the vast majority” of its mobile ad revenue; secondly, app install revenue doesn’t just come from pure app developers but also from big brands like McDonalds who have other reasons for wanting to promote their apps. With this broader addressable market in mind, the ceiling for growth is significantly higher than it would appear, or so Facebook would argue. The question now becomes to what extent we buy these two counterpoints from Facebook and I suspect it will end up having to put more flesh on these bones in 2015 to reassure investors the current rate of mobile advertising growth is sustainable. Of course, it also faces increasing competition from Yahoo, Twitter, Google and others in the app-install ad space, which may hamper growth even if the overall market continues to grow.

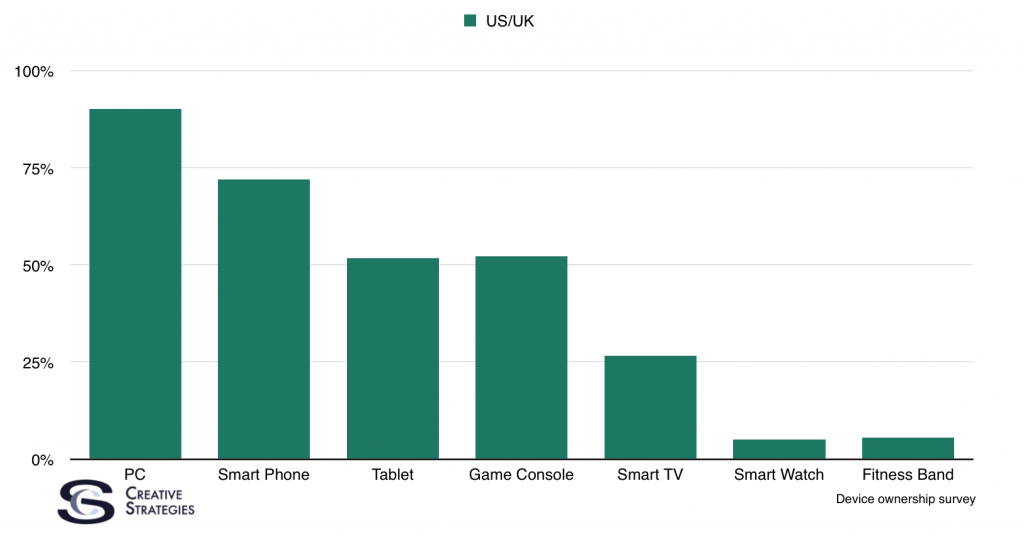

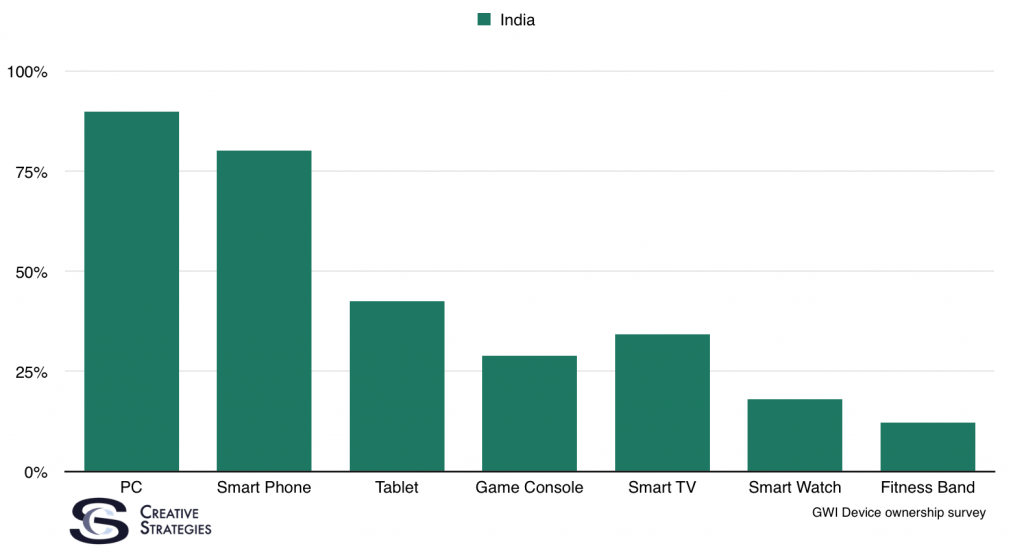

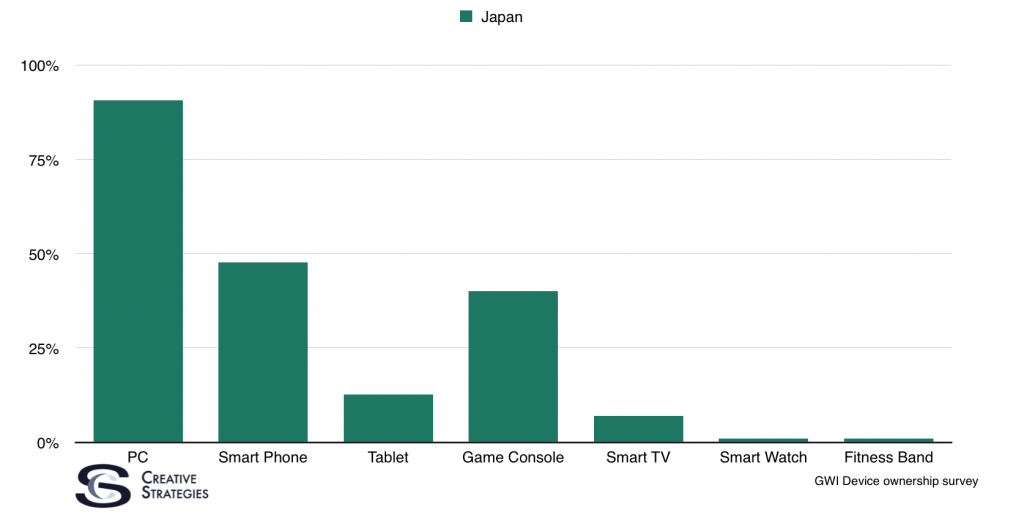

Regardless of the exact source of mobile ad revenue growth, it’s likely the past trends of rapid mobile ad growth and flat desktop ad revenues will continue in 2015. Meaning that mobile revenues will be an ever increasing proportion of the total and will come to dominate Facebook’s revenue by the end of the year. That’s not a bad thing in and of itself, since that’s where the growth is, but it also means Facebook will be increasingly targeting users in emerging markets who have both lower disposable income and attract far less advertising revenue than their counterparts in mature markets. This problem isn’t unique to Facebook – I mentioned it in the context of my Google in 2015 piece too – but it’s something Facebook will increasingly battle going forward. Even as it drives continued user growth, it will struggle to maintain growth in average revenue per user over the long term.

Messaging – Facebook Messenger and WhatsApp

Given these impending threats to Facebook’s core revenue growth, it becomes all the more important it seek out new revenue opportunities elsewhere. Its efforts in messaging are a key part of this picture. However, its two key messaging activities – Facebook Messenger and Whatsapp – will generate very little revenue in 2015 and this is a significant challenge for Facebook in the short to medium term. Though it’s building a variety of new products that will generate significant revenue eventually, most of them are in an investment rather than payoff phase at the present time. Mark Zuckerberg has publicly stated these new businesses won’t generate meaningful revenue anytime soon. However, both products will continue to grow very rapidly in 2015 in terms of users, with WhatsApp filling some of the gaps in regions where Facebook Messenger hasn’t been successful on its own. There are several possible routes to monetization over time, including digital goods, advertising, business accounts and others, and we should start to see signs which way Facebook plans to go in 2015.

Another new product which is slightly further ahead on this roadmap is Instagram, which the company has at least begun to monetize with advertising. But it’s doing so very carefully, with very few ads, carefully curated. The current model sees Kevin Systrom personally overseeing each ad before it goes out, but in 2015 the company will need to start to create a more scalable model. Facebook has begun feeding information about Instagram users’ interests and preferences into the ad targeting system for Instagram, and this is critical for the platform’s future success. But Instagram faces some natural limits in terms of how many ads it can show before users begin to revolt. Already, users have complained about the ads they do see and Instagram will have to manage the tension here carefully.

Oculus

Of course, Facebook’s other big acquisition, aside from WhatsApp, is Oculus VR. In some ways, this will take the longest to pay off. It’s likely we’ll finally see a commercial product in 2015, though pricing and exact availability are still unknown at this point. The Gear VR from Samsung which leverages some of the technology is, of course, already in market, but the core experience, which is tied to PCs rather than smartphones, is the fully-fledged product and will be limited to serious gamers. But the longer term future of Oculus – and Facebook’s plans for it – depend on creating experiences beyond just gaming. Again, in 2015, we’ll hopefully start to see more about what else Oculus can do.

More big acquisitions are still possible

Facebook has made a couple of big acquisitions in the past year and I think it’s still possible they’ll make more. Zuckerberg has shown he’s not afraid to spend Facebook’s stock in this way to secure what he sees as a stake in the future and I don’t doubt he’ll be willing to do it again if the right acquisition comes along. But this is all about securing that future, rather than buying into revenue opportunities for the near term. That’s the key for Facebook in 2015: it’s all about cranking the handle on the core revenue model, particularly mobile advertising, while building the platforms and products that will drive growth three to five years from now. To that extent, Facebook is somewhat similar to Google, which is also investing heavily in projects that won’t pay off for some time. But I think Facebook actually faces fewer short term challenges to its growth than Google does and the next generation of products could begin to be monetized at any time, in contrast to Google’s moonshots.

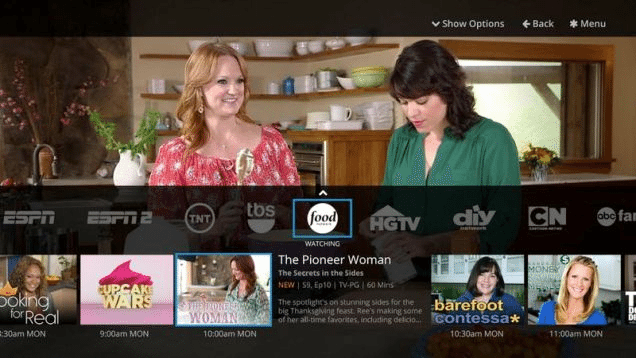

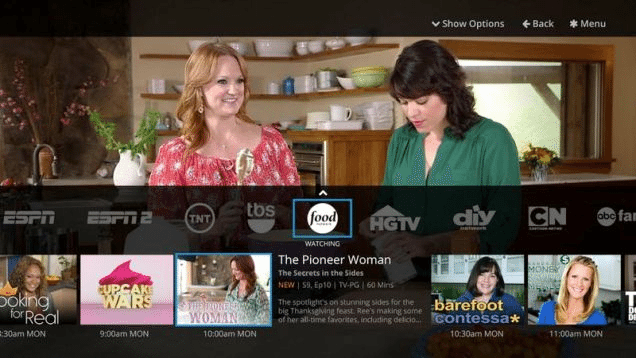

If I were looking for people to break down the force of TV show producers (including sports), broadcasters, and cable carriers, I’d keep a close eye on Charlie Ergen, founder and chairman of DISH Network.

If I were looking for people to break down the force of TV show producers (including sports), broadcasters, and cable carriers, I’d keep a close eye on Charlie Ergen, founder and chairman of DISH Network.

Consumer don’t want ads — they want deals. That is, in essence, what TapSense is offering. When you observe what drives behavior for many consumers today, you’d see it has everything to do with deals. Generally, deals come via email or even postal mail. Retailers have know for decades consumers who opt-in to their programs respond extremely well when offered a deal. This example of a Starbucks deal from TapSense shows the potential.

Consumer don’t want ads — they want deals. That is, in essence, what TapSense is offering. When you observe what drives behavior for many consumers today, you’d see it has everything to do with deals. Generally, deals come via email or even postal mail. Retailers have know for decades consumers who opt-in to their programs respond extremely well when offered a deal. This example of a Starbucks deal from TapSense shows the potential.

A few months ago, as I was slowly recovering from illness, I assumed I would be unable to go to CES. The recovery came, but I found it hard to change my mind. My official excuse was CES would be exhausting, and it would. But it is looking like there will be a distinct shortage of news in Las Vegas next week. While CES still has reason for others, from meeting with manufacturers and vendors to seeing hundreds of obscure Chinese products, I’m still looking for news.

A few months ago, as I was slowly recovering from illness, I assumed I would be unable to go to CES. The recovery came, but I found it hard to change my mind. My official excuse was CES would be exhausting, and it would. But it is looking like there will be a distinct shortage of news in Las Vegas next week. While CES still has reason for others, from meeting with manufacturers and vendors to seeing hundreds of obscure Chinese products, I’m still looking for news.

Jean-Louis Gassée, a veteran executive, investor, and observer of the tech industry, wrote an

Jean-Louis Gassée, a veteran executive, investor, and observer of the tech industry, wrote an