This week’s launch of Android Wear 2.0 and several new smartwatches designed to showcase the new operating system is a useful reminder of the state of the overall smartwatch market, which appears to have struggled outside of the Apple Watch. But it also serves as a useful prompt to consider the general state of the wearables market, which was supposed to be the hot thing just a few years ago but seems to be fizzling now. What is the true state of that market and where will it go from here?

Still Grading Smartwatches on a Curve

It’s illuminating to go back roughly two and a half years to mid-2014, when I wrote a piece about smartwatches being graded on a curve. Most of the smartwatches on offer then were poorly designed, had limited functionality and, consequently, sold in very small numbers. Yet they were generally given pretty decent ratings by the major gadget blogs anyway. At that point, smartwatches really weren’t selling and the reasons were fairly obvious.

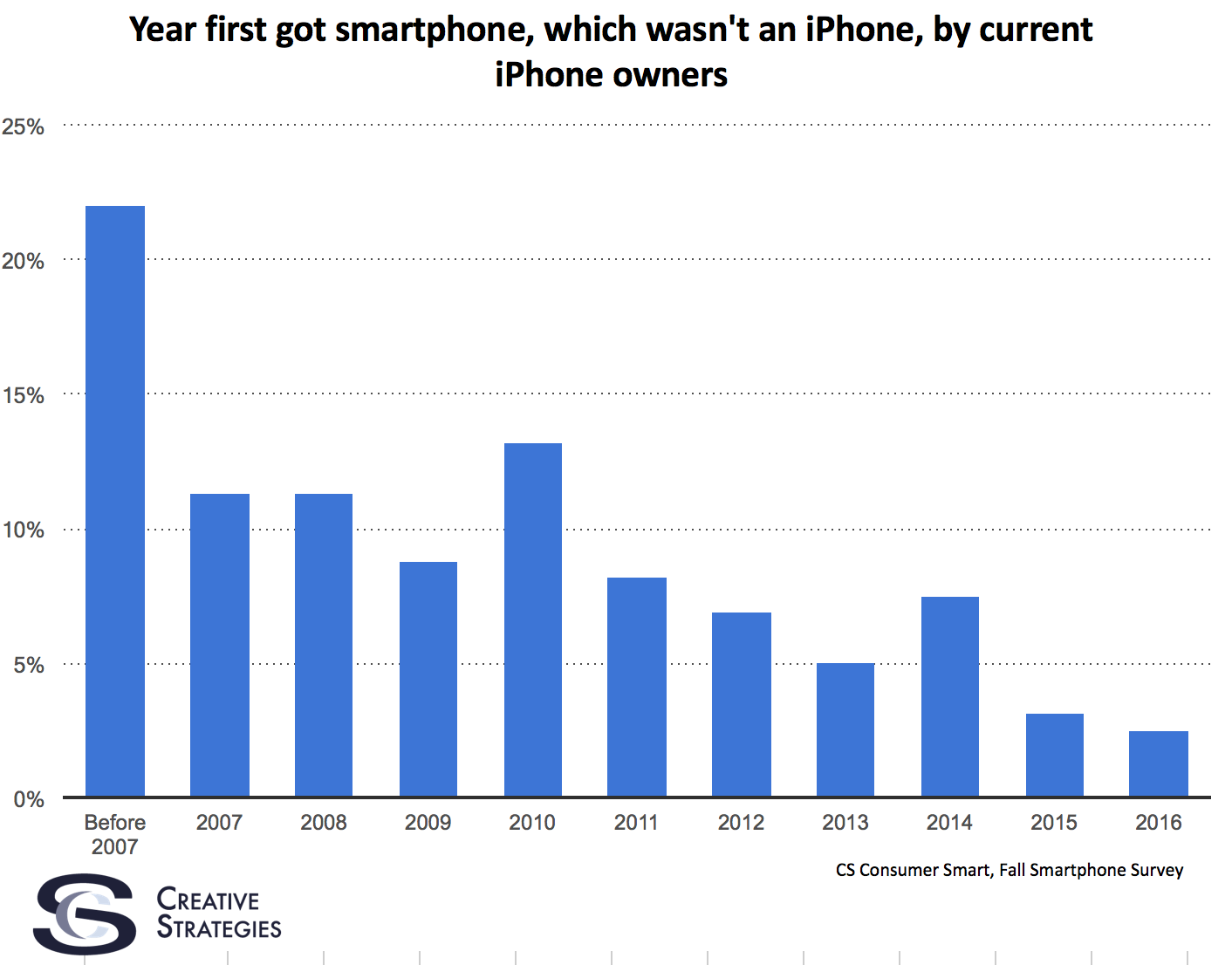

Then along came the Apple Watch, instantly selling in much larger numbers than other smartwatches, taking half or more of the unit shipments and the vast majority of the revenues, as well as jumping into the top ranks of all watchmakers by revenue in its first year. I and a number of others had thought Apple’s entry would prompt Google and its OEM partners to up their game and compete more effectively, much as smartphone vendors did following the launch of the iPhone and tablet vendors did following the iPad launch but that hasn’t really happened. Android Wear continues to account for only a small minority of total smartwatch shipments and actually shrank last year. Samsung and Fitbit have taken the second and third slots in the market, mostly without help from Android Wear.

This week’s announcements tweak some of the software facets but they also continue the bombardment of new features which is often characteristic of the Android approach – throw as many radios and other features into the device as possible and don’t worry about the effect on battery life or form factor. What results is a pair of watches from LG which offer either massive bulk and all the features except decent battery life or a slimmer profile but none of the new hardware features. Meanwhile, other Android Wear pioneers like Motorola are sitting this round out.

What we have today is not so much a smartwatch market but three distinct markets with three dominant players:

- The Apple Watch, which really exists in a niche of its own as a premium fashion device and focuses on health and fitness tracking but also does notifications and glanceable information well

- dedicated fitness trackers, a market increasingly dominated by Fitbit in most western markets

- Samsung’s various wearables, many of which are bundled and/or heavily discounted with a smartphone purchase and therefore thrive on a different business model from the rest.

Everyone else basically falls into the cracks between those three markets, falling short of the products offered by the three companies that dominate them — that includes Android Wear.

The Broader Wearables Market has Fallen Short

If you were to go back just a few years, you’d have heard about wearables at every industry conference and seen lots of ambitious forecasts for the category – I found one from 2104 which predicted well over 100 million unit shipments in 2016 including five million smart glasses, 11 million wearable headsets, 15 million wearable cameras, 38 million fitness trackers, and 46 million smartwatches. But, of course, the market was nowhere near that in 2016. There were perhaps half that many smartwatches sold, almost that many fitness trackers, maybe five million VR headsets, and almost no smart glasses.

Why has the broader wearables category not taken off as predicted? Ultimately, it comes down to the fact excitement for the category was driven almost entirely by vendors of gear and components and not at all by the market. The jobs to be done by these new wearables were far from clear and the offerings in the market did a poor job convincing anyone they were worth having. Smartwatches have largely failed because they have borrowed the use case of the smartphone without explaining why performing those tasks was better on a smaller, less powerful device.

The exceptions – those wearable categories that have performed well – are those which have articulated a use case and executed on it effectively. Arguably, the single biggest use case has been fitness tracking. Even the Apple Watch, which does much more, has been most compelling as a fitness tracker and that was reflected in last year’s fall event, which focused on these features more than anything else. But Apple isn’t just making glorified Fitbits – it has also recognized that, when it comes to a watch, people want the device to perform one of the other jobs a watch does for them: look good on the wrist with a variety of outfits. That means a premium device with premium materials and a variety of options for the finish, colors, and so on. Apple has fleshed out the value proposition with additional features like some of the best notification management on a smartwatch and good use of the rectangular screen with complications.

Where Future Growth Might Come From

Having said that, the market served by fitness trackers and premium fitness-centric digital watches is still relatively small. This was never going to be a smartphone-sized market but it’s a heck of a long way from a tablet-sized market at this point and it doesn’t seem to be growing very much. This raises the question of whether it can ever be any bigger and whether there are other categories of wearables that could still find success.

I still believe the smartwatch has potential beyond its current incarnation but I don’t think the technology is ready yet. One of LG’s new watches, and a number of existing ones, feature 3G or LTE connectivity that allows them to operate independently of a phone but the tradeoffs are much like those in early LTE smartphones – they drain the battery and add bulk for relatively little additional value. That will change as the technology matures and becomes both smaller and more battery efficient. The ongoing miniaturization enabled by smartphones will continue to drive other technologies to perform better at smaller sizes and smartwatch CPUs will become more powerful and battery efficient as well. As that happens, we could see more compelling app models on smartwatches, which could finally lead to the kind of innovation that helped smartphones take off and which has been largely missing in the smartwatch space so far.

Until then, though, the most promising wearables categories are those which extend the functionality of the smartphone in some way. Some time ago, I wrote about the fact the smartphone would be increasingly extended in various ways as input and output methods and processing tasks were outsourced to other devices and services. Smartwatches are an example of this, putting input and output permanently out in the open on the wrist rather than buried in a pocket and providing new ways to see notifications, trigger voice assistants, follow navigation directions, and even carry on phone calls. But this extension needn’t stop with smartwatches – the next generation of audio technologies will further extend the smartphone into the ears, providing both audio feedback and input via built-in microphones. If you own an Apple Watch and AirPods today, you can keep your iPhone in your pocket much more, relying on visual feedback on the Watch and audio feedback and input via the AirPods exclusively for some tasks. We’ll see a lot more of this.

When it comes to visual interfaces, augmented and virtual reality have quite a bit of promise but, for today, are mostly occasional-use technologies rather than true wearables, used throughout the day in the way smartwatches are. Virtual reality allows for a much more immersive display than a smartphone ever could and, if headsets weren’t so bulky, they’d make for an interesting way to carry room-scale displays with you everywhere you go as another extension of the smartphone. Augmented reality, especially in a form factor resembling normal glasses, has great promise too, but we’re likely several years from that future as well.

Again, those wearable categories that succeed will do so by solving real pain points or providing real additional value, not by merely sticking a set of smartphone-based components into a new form factor and slapping a logo on it. That approach has characterized too much of what we’ve seen in the wearables category so far and it won’t work any better in the future than it has in the past. But it’s going to be a slow build to meaningful numbers in all these categories, not a massive explosion along the lines of what we’ve seen in previous categories.