I’ve been picking up an interesting trend in several Wall St. hedge fund research notes. While not my only evidence, the following articles on Barron’s are two accessible ones many can read:

–Apple: iPhone Demand Upside, Says Morgan Stanley

–Apple: Piper Pounds the Table; Time to Get Ready for an ‘iPhone 7′

For many close watchers of the Apple stock, and any Wall St. stock for that matter, you know Wall St plays a 90-day game. They are making bets on or against the stock that either the company will beat estimates and their willingness to invest or sell depends on, to a degree, their confidence of the amount of a beat or a miss. I play this game with investor clients regularly and continually witness it play out in real time. For Apple, the stock largely moves now on the quarterly opinion of iPhone sales. The grand institutional investor narrative centers on the question of how Apple can keep growing iPhone sales on a YoY basis, with a particular emphasis now on the holiday quarter. It is as though the holiday quarter iPhone sales figure is the barometer for how the YoY growth will fair. Right or wrong, this seems to be a key part of the conversation.

What intrigues me about what I’m reading in a few narratives like the ones linked above is the perceived (by me) attempt to make the narrative less about the holiday quarter and more about the full year. I can’t help but wholly endorse this change, but I hope a number of institutional investors take note. An area of concern is this change by the Apple bulls is because of fears the December quarter shipments may not be what everyone hopes. Currently, Wall St. consensus sits between slightly lower than last year at 73m units all the way up to 78m units. That is the range for the quarter but, to be honest, there will be serious concerns over iPhone growth even if Apple sells 75-76m iPhones. This is where the unnaturally inflated expectations of many investors come into play. You’ll hear me emphasize, just price to iPhone guidance and you won’t get burned. What Apple guides to is my most intriguing number that will be revealed during next week Apple’s earnings call..

Another Big Year

There are several things at play I think make looking at Apple’s YoY growth for iPhones as the correct metric vs. just looking at 90-day cycles.

China: With the US and China markets being Apple’s largest, the US upside is not as high as China’s from a pure growth standpoint. While China is a significant quarterly contributor to iPhone sales, the region’s largest contribution will come in the first calendar quarter due to the Chinese New Year. My estimates for launch weekend contributions from China were in the 3-4 million range and we continue to hear they are on a similar pace as last year. China does have a significant shopping day on Nov 11th called Singles Day, where Chinese consumers who are single treat themselves to a gift. I’d imagine the iPhone will have a great sales day. But even with that, I think China’s largest contribution will come over the Chinese New Year, as the iPhone ranks at the top of gifted items in China. With as big of a market as China, I’d argue if we were going to look at quarters that signal iPhone momentum we need to look at both the calendar Q4 and subsequent Q1 quarter together as a measurement.

Upgrade Plans May Be Out of Whack: The other reason I caution away from focusing on calendar Q4 too heavily, particularly this year, is Apple’s new Upgrade Plan has introduced and interesting wrinkle. In Katy Huberty’s latest note (not public) their in-house research revealed 45% of US consumers across the big four networks responded they would definitely/probably purchase their next iPhone through Apple’s Upgrade Plan. This is very significant if it holds up. I’ve seen two other primary research points on this, both in the 40%-60% range, revealing the same interest level toward Apple’s upgrade plan. To put this into perspective, currently the average percentage of customers who buy from non-carrier stores, including Apple stores, is less than 15%. The wrinkle this provides is the percentage of customers who want to and plan to upgrade their iPhones but are not eligible currently or this quarter is not known. If a consumer is set on waiting until they are eligible so they can purchase through Apple rather than their carrier, then this sale may not happen until after Q4. Even though, under normal circumstances (if Apple’s payment plan didn’t exist), that customer may have upgraded early or, at least, in the December quarter rather than waiting. If a healthy percentage of consumers desiring to upgrade hold-off until they are eligible to buy through Apple, it could very well disrupt this quarter’s iPhone sales number. Should Apple come in closer to or under 74m units in the Dec Q, my theory would be this dynamic played a big role. Which means a few super quarters could be coming in 2016 and it may be hard to know which ones it will be.

Apple will likely report somewhere between 34-40% of their installed base has upgraded during the earnings call next week. With third party research suggesting iPhone loyalty is over 90%, we fully expect the base to upgrade over the course of the next year. I’d bet 80% or more by this time next year.

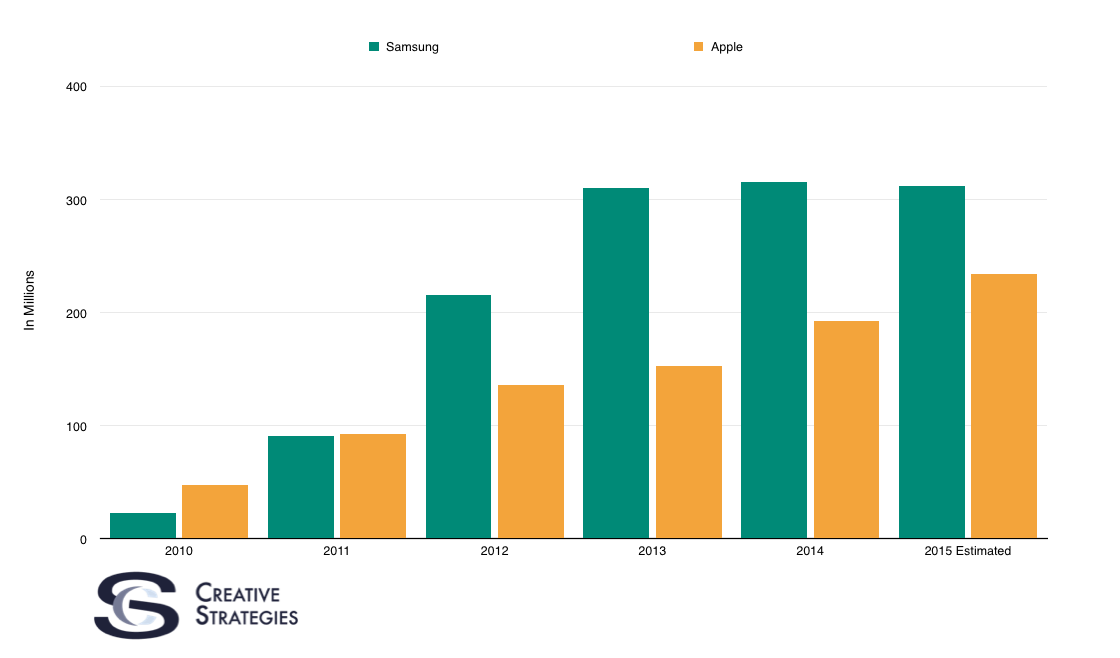

Ultimately, between the installed base upgrade transition and the high levels of switching from Android to iOS in many primary markets we study, I’m not concerned for the annual growth cycle of Apple. Look at the smartphone industry transition to Apple in my chart with historical smartphone sales and my current (always subject to change) estimates for calendar 2015.

I’m modeling:

– Samsung will post its first ever YoY decline in smartphone shipments

– In 2016 Apple will sell more smartphones annually than Samsung, placing Apple squarely as the number one smartphone vendor by sales.

The fundamentals of Apple’s business and the market are making a 90-day game a little more difficult. Savvy investors understand this and be looking for the larger annual narratives to shape their outlook. New market growth, conversions to the upgrade plan, growth in new categories and services revenue, and more leave me confident the revenue growth trends will continue and new hardware and market dynamics will challenge old school templates used to frame Apple’s overall model.

Great post Thank you. I look forward to the continuation.