The market for smart connected devices is changing and it’s doing so at a rate that’s even faster than most people realize. In the process, the whole conception of what computing is, where it happens and even what means is changing and evolving.

Let me put it another way. This year, my firm TECHnalysis Research predicts that the 2014 shipments of large smartphones (those with screens 5” and larger—commonly called “phablets” but perhaps better coined “mobile connected devices”) will far outsell both small tablets (those with under 8” screens) and even notebook PCs. Specifically, we are forecasting that worldwide phablet unit shipments will reach approximately 240 million in 2014 versus 173 million notebooks and 158 million small tablets. That’s a seismic shift that will have profound implications on branded device vendors, component suppliers, ecosystems, applications and app development, and even regional influence. We’re going to see an increasing influence on mobile operating systems, developing markets and computing devices that fit into your pants pocket or small purse.

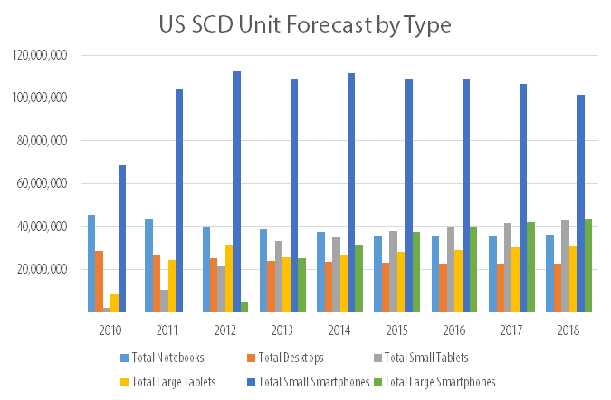

In the US, the story isn’t quite as dramatic, as large smartphones have been a little bit slower to reach mass appeal, but even by 2015 we expect large smartphones to outship notebooks in the US by a margin of 37.5 million to 35.9 million and by 2017 we expect them these mobile connected devices to outsell small tablets in the US (41.9 million versus 41.5 million).

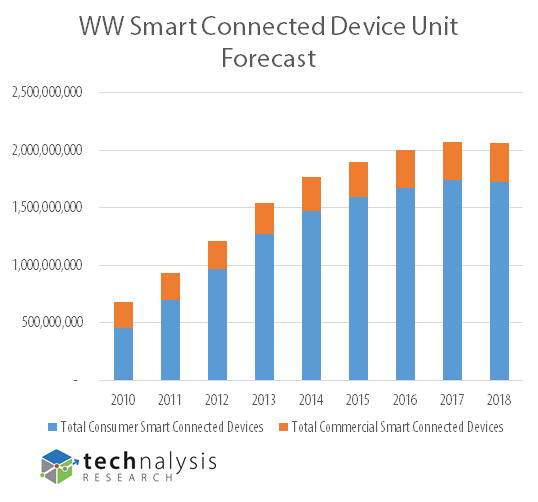

The charts below show our view of the entire smart connected devices market (the combination of PCs, tablets and smartphones—it’s a term I coined while at IDC), split by the six key subcategories: notebook PCs, desktop PCs, small tablets (under 8”), large tablets (8”+), small smartphones (under 5”) and large smartphones (5”+). The top graph shows the WW numbers and the second one shows the US numbers.

In addition to the major transitions in device influence show by these graphs, one of the other key takeaways is that the total smart connected devices market is starting to stabilize and show much more modest growth, especially in the US. The fact is the market for these device categories are all starting to saturate, as people hold onto their devices longer and the need to upgrade is reduced. PCs were the first to suffer this fate, but we believe it will move over to tablets and even smartphones by the end of the 5-year forecast period—again, especially in the US.

As a result, the only way vendors can continue to grow within these categories is to steal share from one another. We believe this is one of the many reasons Apple is likely to enter the large smartphone market later this year. Demand for these devices is particularly strong in the regions where the company wants to grow and even in the US, it will be necessary to help them maintain their share.

The device industry has been on a treadmill of seemingly never-ending growth for decades, but we believe that era of unimpeded growth will be coming to an end by the end of this decade. Of course, many device vendors, ecosystem providers and supply chain partners will transition over to wearable technology and other yet-to-be-discovered product categories in the interim in order to compensate for this change. However, this maturation of core computing devices into a more mature, slower growth industry is bound to bring with it some other unexpected changes that promised to keep this space an exciting and interesting one to watch.

If you’re interested in seeing the highlights of the new TECHnalysis Research forecast document (which covers significantly more than I could cover in a single column), you can download a free copy at www.technalysisresearch.com/sample_research.html.

“That’s a seismic shift”

Come on: large smartphones are mobile phones and the mobile phone market is a LOT bigger than the computer market and always was. There is no seismic shift there, only a re-balancing of the large smartphones and small tablets markets where they overlap (mostly as portable video/TV devices).

Moreover, at some point, if you add the phone feature to a small tablet it becomes a (very) large smartphone: the point is that in the 6-7″ display size range, large smartphones and small tablets are mostly the same and it is meaningless to consider them as belonging to different markets.

I think that you have a market for small devices you can take with you every time, everywhere, with voice capability and a market for bigger mobile devices mostly aimed at content consumption and “real work”. In the first market, you have small smartphones and probably soon “smart watches” (wrist devices). In the second market, large smartphones, tablets and laptops.

Those markets are indeed evolving quickly currently because large smartphones and small tablets are quite young segments and there is still no smart watch available. But within a few years, the mobile device market will mature and then there will be a place for everything from smart watches to big laptops. Only companies which do not cover all segments are in trouble (mostly traditional laptops manufacturers such as DELL or HP) while other companies will just re-balance their portfolio.

Nothing seismic there: only the natural evolution of several converging markets.

Well said. Bob has written before about phablets, if I’m remembering correctly. In a previous comment thread we tried to nail down what sales of phablets actually were (not shipments or projections, *sales*) and the consensus was that phablet sales are quite small right now.

Samsung and others make so much marketing for flagship big Galaxy S and Note devices that many consider such device as being the norm which is indeed by far not the case.

Phablets are definitely over hyped (I guess because Apple does not have a big iPhone yet and thus it is an easy way to be “better than the iPhone”): while there is for sure a significant market for “small phablets” (5″), I think the huge 6″ smartphones are just a fad or a very small niche.

Actually, according to my research as well as that of other firms, the worldwide phablet sales in 2013 were over 150 million units (I pegged them around 164 million), with only 15% of those being in the US. That’s far from small….

My argument is based on the principle that large smartphones are not mobile phones, but mobile computing devices and therefore their growth past smaller tablets and notebooks does represent a major shift. Application developers want to create solutions for the largest markets they can and, based on these market transitions, I think you will see shifts in where, how and for what devices innovative applications get developed.

Plus, the evolution of these devices also adds to the increasing number of compute devices that people have with them and along with that comes the need for services that tie people’s data and devices together, regardless of platform. This too, I believe, will lead to large shifts in the balance of power and influence across the tech industry.

Ah, but the iPhone is and always was a mobile computer and iOS is already a robust (and growing) computing platform.

Not that I am paying all that much attention, but the only evidence of companion apps I’ve seen is for TV and usually only supplied by the local affiliate with some minor forays for program specific work. I am not convinced (but could be) that it will be all that big a deal. It all sounds convenient, even, informative, but I think, particularly with TV, it adds complexity to a generally accepted and expected simple process. Beyond hash tags and Twitter, I don’t think people are all that interested. Maybe different in more vertical markets, especially with the new chips where Cook thinks it is about to explode. But what do I know?

I’ve _wanted_, not necessarily companion apps per se, but, apps on my iPad that extended or even added functionality from my desktop productivity apps. But that does not seem to be a high priority for developers. Not sure why.

Joe

Joe, my notion of companion apps is actually directly in line with what you describe in your last paragraph and I too am a bit surprised we haven’t seen more of them. However, I also think that’s a reflection of the fact that people are just getting used to this idea of getting their devices to work together and so it’s taking a while for them to come up the right kinds of ideas. I am convinced, however, that longer term we will start many of those kind of extended functionality companion applications.

CAD (I’ve mentioned before) could do well with this, especially with BOM features or even just allowing minor editing with a tablet for onsite work, but It seems all they can do to focus on the PC app. You would think for a minimum of $2000 a seat, something else could be accomplishable.

Joe

Bechtel is doing some interesting stuff on site with iPads. I think there’s a profile on Apple’s website.

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is valuable and everything. Nevertheless imagine if you added some great pictures or video clips to give your posts more, “pop”! Your content is excellent but with images and videos, this website could definitely be one of the greatest in its field. Very good blog!

Wow that was odd. I just wrote an very long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say excellent blog!

Whoa! This blog looks exactly like my old one! It’s on a entirely different topic but it has pretty much the same page layout and design. Wonderful choice of colors!

delta 8 wax for sale

it’s awesome article. I look forward to the continuation.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

There is definately a lot to find out about this subject. I like all the points you made

I appreciate you sharing this blog.Really looking forward to read more. Really Great.

Hey very interesting blog!

you are truly a just right webmaster. The site loading velocity is amazing.

It sort of feels that you are doing any distinctive trick.

Furthermore, The contents are masterwork. you have performed a excellent task in this

topic!

I have learn some good stuff here. Definitely worth bookmarking for revisiting.

I wonder how so much effort you place to create this type of wonderful informative website.

Hello there I am so happy I found your weblog, I really found you

by accident, while I was searching on Bing for something else, Nonetheless I am here now and would just

like to say many thanks for a marvelous post and a all round interesting

blog (I also love the theme/design), I don’t have time to read it all at the minute but I

have saved it and also added your RSS feeds, so when I have time I will be back to read more,

Please do keep up the great b.

Hi, i think that i saw you visited my weblog so i came to

“return the favor”.I’m trying to find things to enhance my website!I suppose its ok to use some of your ideas!!

Hi there, yup this piece of writing is genuinely good and I have learned lot of

things from it on the topic of blogging. thanks.

I loved as much as you’ll receive carried out right here.

The sketch is tasteful, your authored subject matter stylish.

nonetheless, you command get got an impatience over that you wish be delivering the following.

unwell unquestionably come further formerly again as

exactly the same nearly very often inside case you shield this hike.

Hi there would you mind stating which blog platform you’re working with?

I’m going to start my own blog soon but I’m having a hard time

selecting between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different then most blogs and I’m looking for something unique.

P.S My apologies for getting off-topic but I had to ask!

fantastic issues altogether, you simply won a brand

new reader. What might you suggest in regards to your post that you made some days

ago? Any positive?

That is very attention-grabbing, You are an excessively professional blogger.

I have joined your rss feed and sit up for looking for extra of your excellent post.

Additionally, I’ve shared your site in my social networks

I always used to read piece of writing in news papers but

now as I am a user of web so from now I am using net for posts, thanks to web.

Hi mates, how is the whole thing, and what you would like to say about this post,

in my view its genuinely remarkable for me.

What a material of un-ambiguity and preserveness of valuable

experience regarding unpredicted feelings.

I’m gone to tell my little brother, that he should also pay a quick visit this blog on regular basis to get updated from most recent

information.

There is certainly a lot to know about this subject. I like all the points you have

made.

Everything is very open with a precise clarification of the issues.

It was really informative. Your website is very useful.

Many thanks for sharing!

Can you tell us more about this? I’d want to find out some additional information.

Woah! I’m really digging the template/theme of this website.

It’s simple, yet effective. A lot of times it’s challenging to get

that “perfect balance” between user friendliness and visual appearance.

I must say you have done a very good job with this. Additionally, the blog loads extremely fast for me on Chrome.

Exceptional Blog!

Keep this going please, great job!

Right away I am ready to do my breakfast, afterward having my breakfast coming yet again to read further news.

Spot on with this write-up, I seriously believe this website needs far more attention. I’ll

probably be returning to see more, thanks for

the information!

Thank you for the good writeup. It in reality was a

enjoyment account it. Look complicated to more delivered agreeable from

you! However, how can we communicate?

Thank you ever so for you blog. Really looking forward to read more.

My website: порно бесплатно

Muchos Gracias for your article.Really thank you! Cool.

My website: учитель и ученица порно

Ponto IPTV a melhor programacao de canais IPTV do Brasil, filmes, series, futebol

My website: вылизывает анус

I got what you intend,bookmarked, very decent website.

My website: порно девушки 18 лет

A round of applause for your article. Much thanks again.

My website: секс видео толпой

I read this post completely on the topic of the comparison of most up-to-date

and earlier technologies, it’s remarkable article.

Hi there, all is going nicely here and ofcourse every one is sharing facts, that’s actually good, keep up

writing. https://fordero.shop

A round of applause for your article. Much thanks again.

My website: страпонесса трахает

Thank you ever so for you blog. Really looking forward to read more.

My website: полизать писю

This post is actually a good one it helps new

web visitors, who are wishing in favor of blogging.

Can you write more about it? Your articles are always helpful to me. Thank you!

I got what you intend,bookmarked, very decent website.

My website: Домашнее порно зрелых

Respect to post author, some fantastic information

My website: порно толстых старушек

I reckon something truly special in this website.

My website: порно нд

I’m extremely pleased to discover this website. I wanted to thank you for ones time just for this fantastic read!

My website: Молодые азиатки

I’m extremely pleased to discover this website. I wanted to thank you for ones time just for this fantastic read!

My website: межрассовое порно

hello!,I really like your writing so a lot! share we be in contact extra about your article on AOL?

I need an expert in this space to unravel my problem.

May be that’s you! Having a look forward to peer you.

Thank you ever so for you blog. Really looking forward to read more.

My website: порно брат выебал сестру

I reckon something truly special in this website.

My website: порно а анал

Thanks for sharing, this is a fantastic blog post.Really thank you! Much obliged.

My website: частное домашнее порно зрелых

A round of applause for your article. Much thanks again.

My website: кончил на ножки

Muchos Gracias for your article.Really thank you! Cool.

My website: порнуха трансвеститов

Wohh precisely what I was searching for, regards for putting up.

My website: порно нарезки

Very descriptive post, I liked that bit. Will there

be a part 2?

Wow, awesome blog structure! How lengthy have you been running

a blog for? you made running a blog glance easy. The full look of your web site is excellent, as smartly as the content material!

Readers might find parallels in their own lives, reflecting on instances where personal values influenced major decisions. This example highlights the complexity of value-based decision-making and invites readers to consider how they navigate the interplay between different values in their own journeys.

Hello! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted keywords but

I’m not seeing very good results. If you know of any please share.

Thanks! You can read similar article here: Najlepszy sklep

Terrific post however I was wanting to know if you could write a litte more on this subject?

I’d be very grateful if you could elaborate a little bit further.

Thanks!

Hello there! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Many thanks! You can read similar art

here: Link Building

WOW just what I was looking for. Came here by searching for

кітап нано жұмыс істемейді