Steve leaves behind a company that only he could have built, and his spirit will forever be the foundation of Apple.

– Apple Inc statement upon news of the death of Steve Jobs

What if more than Steve Jobs’ spirit lives forever? What if Apple lives forever? Is this even possible?

I say yes.

As the blogosphere pronounces ‘Apple is Doomed’ at every turn, I can’t help but thinking that we have it wrong. Apple will have its ups and downs, no doubt. It’s just that the more I follow Apple, the more I study Steve Jobs, the more I suspect that while he could not live forever Jobs absolutely believed his creation, Apple, could. Literally.

These are my clues:

Apple University

As the LA Times noted shortly after his death, “Apple University” was a serious focus of the seriously focused Jobs. Think what you will of him personally, but Jobs believed in the rightness of his vision. Apple University was created to inculcate his innumerable qualities in those who would come to run Apple years and decades into the future.

To survive its late founder, Apple and Steve Jobs planned a training program in which company executives will be taught to think like him, in ‘a forum to impart that DNA to future generations.’ Key to this effort is Joel Podolny, former Yale Business School dean.

According to a former Apple executive, speaking anonymously: “No other company has a university charged with probing so deeply into the roots of what makes the company so successful.” Training at Apple University reportedly focuses on what enables a company to create sustained innovation.

If there is one key to serious longevity, it is that: sustained innovation.

Apple Endowment

Jobs was audacious. To enable Apple to live forever, he needed money. Lots of money. Apple has that. Forget about stock buybacks, or Wall Street howls for dividends. Ignore the idea that Jobs and Apple are hoarding cash for acquisitions – keeping their “powder dry” as it were. The nearly hundred fifty billion Apple has amassed has a higher purpose: an Apple endowment.

I believe that Jobs, had he lived longer, would have worked diligently with two groups he no doubt found tiring, Wall Street and Washington, to change the laws so that a substantial portion of Apple’s already substantial cash reserves could be used for an endowment.

Growing up in the area, Jobs no doubt knew of the founding of nearby Stanford University. Via Wikipedia:

With his wife Jane, Stanford founded Leland Stanford Junior University as a memorial for their only child, Leland Stanford, Jr., who died as a teenager of typhoid fever. The Stanfords donated approximately US$40 million (over US$1 billion in 2010 dollars) to develop the university, which held its opening exercises October 1, 1891.

One billion is nice. One hundred billion is better. Harvard’s endowment, for example, the richest of all, is approximately $30 billion. What if Jobs – and he would have made Tim Cook aware of this, I suspect – wanted to have, say, $60 billion of Apple’s money set aside as an endowment?

At $60 billion, if the investment manager of the “Apple Endowment” earned 6.5% a year returns on average, that would deliver approximately $4 billion every year, forever. Apple currently spends about $4 billion a year on R&D. Imagine: Apple research and development funded in perpetuity. Think what the company could achieve ten years from now, a hundred, a thousand. If the future Apple made only enough to pay for its operating expenses, it could still churn out amazing products for your great great great grandchildren.

Business Model Purity

Beyond the money, of course, the more I study Apple the more I admire Jobs’ vision to ensure the durability – the permanence – of Apple. There is a purity to Apple’s business model that is, ironically, so rare in Silicon Valley. Google and Facebook encourage our use of their services, for free, then sell our data to others. Who is the customer? HP, for example, lives off exorbitant printer ink costs. Believe it or not, that is not a sustainable business.

Apple, by contrast, builds great products and prices them accordingly. No tricks, no inducements. Buy them or not. You always know what you are buying, and for how much, and what you are getting for the money. A hundred years from now, for example, I suspect there will be a littany of new business models, some great, some doomed to fail, some beyond our comprehension. Apple’s, however, I am sure will still thrive long after we are all gone.

Saying No

What does HP do anymore? Who are they? What about Cisco? Are they out of the consumer market or back in? Why is there a Google+ and a Google X Phone and a Google Car? There is creation, and then there is creation that moves you forward, sustains you. Jobs was famous for keeping Apple not focused on building great products, but on great products that mattered.

Yes, some of the stuff we never see would no doubt be cool. Yes, some of the top talent — the A players — are more likely to stay at Apple if they have a skunkworks to play in, like Google’s X Labs. Ultimately, however, such activities diminish focus, which alters who you are. No point in living forever if it’s not really you.

Jobs’ words on focus from 1997 still ring true today – and probably will for decades, at least:

People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully. I’m actually as proud of the things we haven’t done as the things I have done. Innovation is saying no to 1,000 things.

Control

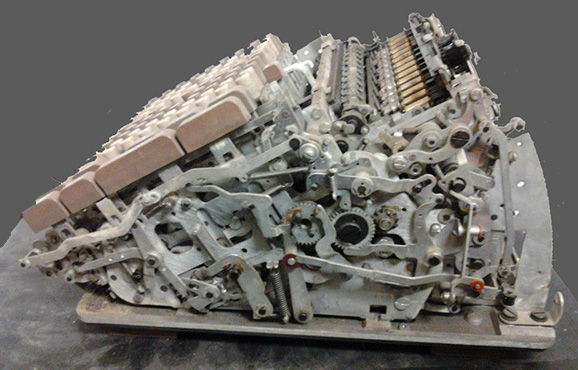

If you follow Apple and/or Steve Jobs, you doubtless know the importance of control: control of core technologies, control of your product development, control of your distribution, control of your brand. So much of Jobs’ control efforts flew directly in the face of accepted wisdom and practice in Silicon Valley: open, sharing, licensing. Jobs would have none of it. He wanted Apple fully in control of its technologies – and its future.

Retail

Apple is (now) lauded for Apple Stores. You may already know they bring in more money per square foot than any other retail chain on the planet. They also ensure that Apple can offer its products directly to customers. Apple, rare in its industry, is not dependent on others for marketing and sales. But I wonder now if there’s an ever greater, longer-lasting benefit to its stores.

Retail is changing, profoundly. Online, mobile, the sharing economy, 3D printing, same-day shipping. With its many stores, Apple are learning, in real-time, not only what their millions of customers think about their latest products, but by being on the front-lines of buying and selling, Apple is learning the future of retail: the integration of real-time, social, online, digital and physical. Not even Amazon possesses this alchemy. Apple Stores should enable Apple to meet the demands of a changing world long into the future.

Here’s To The Crazy Ones

I think of this story from Business Week shortly after Jobs’ passing:

On the day Jobs died, employees numbly walked outside to watch an American flag lowered to half-mast—and then returned to work. Partners who were in town to meet with the company were astonished to learn that appointments would take place as scheduled. “That’s what Steve would have wanted,” an Apple manager explained.

Yes, that’s the way Jobs would have wanted it. He also would want Apple to continue building amazing, magical, revolutionary products in the year 2525. It could happen. It’s crazy, I know, but it’s those crazy ideas that change the world.